Etteplan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Etteplan Bundle

Uncover the strategic positioning of Etteplan's product portfolio with this insightful BCG Matrix preview. See which offerings are poised for growth and which require careful management. Ready to transform this understanding into actionable growth strategies?

Purchase the full Etteplan BCG Matrix for a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with data-driven recommendations and a clear roadmap for optimizing your investments and product development.

Stars

Etteplan's 'Transformation with AI' strategy for 2025-2027 highlights AI-powered service solutions as a central pillar, with a target of 35% of revenue from these offerings by 2027. This aggressive push into AI signifies a high-growth market where Etteplan is positioning itself for substantial market share gains.

The company's commitment is evident in its significant investments in developing novel AI-driven solutions and improving current ones. This strategic emphasis on AI integration firmly places these advanced service offerings in the Star category, poised for considerable future expansion and value creation.

Etteplan's strategic move to acquire Novacon Powertrain GmbH in January 2025 significantly bolsters its presence in the burgeoning e-mobility sector. This acquisition, adding 180 skilled personnel, directly targets the high-growth potential of automotive powertrain development and e-mobility solutions.

By integrating Novacon's specialized expertise, Etteplan is poised to enhance its capabilities in a rapidly transforming industry. The company's commitment to this area signals a strong belief in the market's future growth and Etteplan's ambition to be a leader in e-mobility innovation.

Etteplan's strategic acquisition of AFFRA AB in May 2024 significantly bolsters its position in the advanced software testing sector, especially within the critical Hardware in the Loop (HIL) testing domain. This move targets a high-growth niche vital for industries like automotive and transport.

HIL testing is indispensable for ensuring the efficiency and safety of complex software and hardware integrations, a demand that continues to surge across modern technological landscapes. In 2023, the global HIL testing market was valued at approximately USD 2.2 billion, with projections indicating substantial growth driven by the increasing complexity of automotive electronics and autonomous driving systems.

This acquisition not only diversifies Etteplan's service portfolio but also amplifies its expertise in a technically demanding and expanding market segment, reinforcing its competitive edge.

Growth in Chinese Market

The Chinese market presents a compelling growth opportunity for Etteplan, as evidenced by a significant increase in hours sold during the first quarter of 2025. Specifically, from January to March, Etteplan saw a 21.9% rise in hours delivered within China.

This robust performance underscores China's status as a high-growth region where Etteplan is effectively capturing market share. Continued strategic investment and focus are crucial to solidify its position as a Star in the BCG matrix, capitalizing on the strong regional demand.

- Market Growth: 21.9% increase in hours sold in China (Q1 2025).

- Strategic Importance: China is identified as a high-growth region for Etteplan.

- Future Outlook: Continued investment can solidify its Star position.

Defense Industry Engagements

Investments in the defense industry have remained robust for Etteplan, even as the broader market faced uncertainty through 2024 and into Q1 2025. This sector continues to be a significant growth area for the company, driven by consistent demand for its specialized engineering and technical services. Etteplan's active participation in defense projects underscores its strong market position within this vital industry.

The defense sector represents a high-growth opportunity for Etteplan, showcasing sustained demand for its engineering expertise. This continued engagement highlights the company's ability to navigate market fluctuations while capitalizing on the sector's inherent growth trajectory.

- Defense Sector Growth: Etteplan has experienced sustained growth in its defense industry engagements, reflecting a strong market demand for its services.

- Market Resilience: The company's performance in the defense sector remained strong throughout 2024 and Q1 2025, demonstrating resilience amidst broader economic uncertainties.

- Strategic Importance: Etteplan's continued investment and focus on defense projects indicate a strategic commitment to this high-growth market segment.

- Market Share: The consistent demand for Etteplan's engineering and technical services suggests a significant and potentially growing market share within the defense industry vertical.

Stars in Etteplan's BCG matrix represent business units or offerings with high market share in high-growth markets. These are the company's prime growth engines, demanding significant investment to maintain their leading position and capitalize on expanding opportunities.

Etteplan's AI-powered service solutions are a prime example, targeting a market projected for substantial expansion. Similarly, the company's strategic focus on e-mobility, bolstered by acquisitions like Novacon Powertrain GmbH, positions it within a rapidly growing sector.

The company's strong performance in the Chinese market, marked by a 21.9% increase in hours sold in Q1 2025, and its sustained growth in the defense industry further solidify its Star status in these respective segments.

| Business Unit/Offering | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|

| AI-Powered Service Solutions | High | Growing | Investment in development, aggressive market penetration |

| E-Mobility Solutions | High | Emerging/Growing | Acquisitions, enhancing specialized expertise |

| China Market Operations | High | Increasing | Continued strategic investment, capitalizing on demand |

| Defense Industry Services | High | Strong/Sustained | Continued participation in projects, leveraging expertise |

What is included in the product

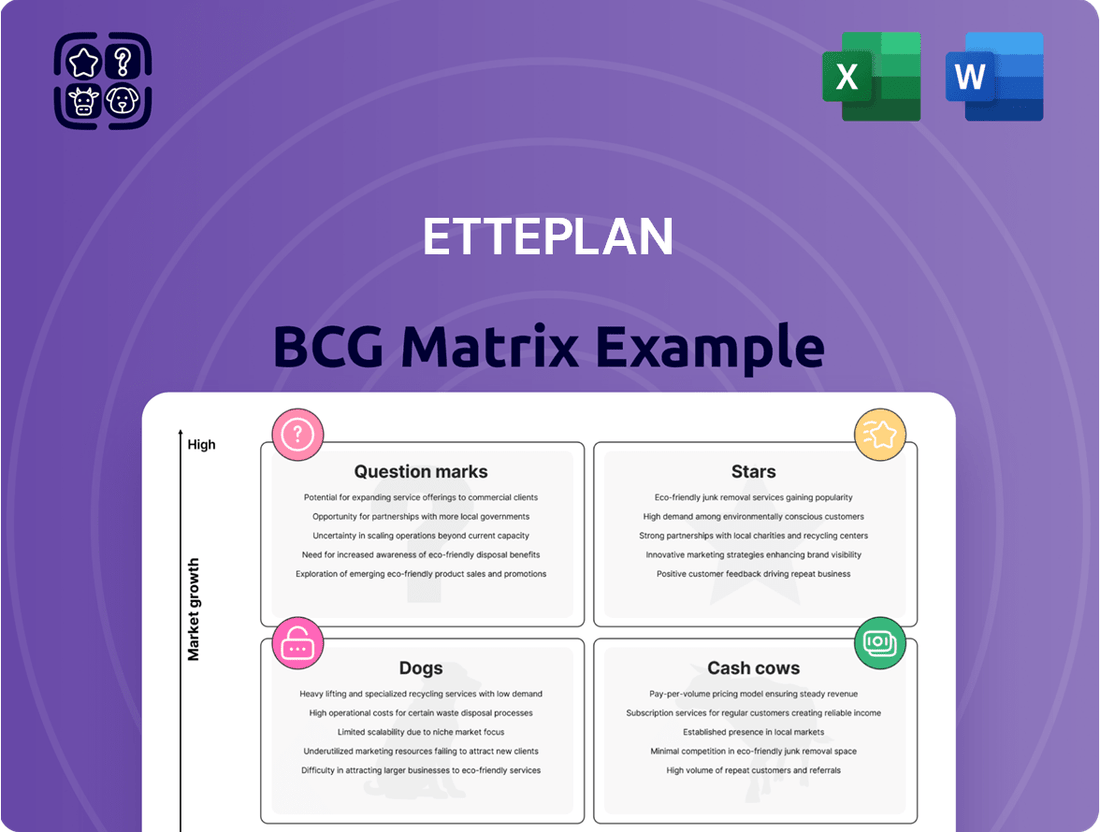

The Etteplan BCG Matrix analyzes a company's portfolio by product or business unit, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic guidance on resource allocation, highlighting which units to invest in, hold, or divest for optimal growth and profitability.

A clear visual roadmap for strategic resource allocation, simplifying complex portfolio decisions.

Cash Cows

Etteplan's core industrial engineering services likely function as a cash cow within its BCG matrix. This segment typically operates in a mature market where Etteplan commands a significant market share, generating consistent and robust cash flow.

These services are foundational to Etteplan's business, offering stable revenue streams. Despite potentially modest overall market growth, this established area remains a dependable source of profitability for the company.

Etteplan's deep-rooted expertise and strong client relationships in industrial engineering solidify its dominant position and ensure its continued financial strength in this segment. For instance, in 2024, industrial engineering and automation services contributed significantly to Etteplan's revenue, reflecting the stability of this sector.

Etteplan's established managed services model is a prime example of a Cash Cow within the BCG Matrix. The company is targeting 75% of its revenue from managed services by 2027, a significant increase from the 65% achieved in 2024. This strategic focus on taking comprehensive control of customer projects generates predictable, recurring revenue in a market that is already well-established.

This model's strength lies in its ability to provide stable income, meaning Etteplan can rely on consistent cash generation. Consequently, the need for substantial promotional investments to acquire new business is reduced, further solidifying its position as a reliable profit center.

Etteplan's traditional technical documentation solutions, encompassing manuals, spare parts information, and digital distribution systems, represent a cornerstone of their business. This segment benefits from a long-standing market presence and a reputation for delivering accurate and compliant content.

Despite a noted weakness in the broader Technical Communication and Data Solutions area in Q1 2025, the established technical documentation services are anticipated to continue functioning as reliable cash cows. The consistent demand for these essential services in mature industries provides a stable revenue stream.

In 2024, the demand for comprehensive technical documentation remained robust, driven by regulatory requirements and the need for efficient product support across various sectors. Etteplan's expertise in navigating these complexities ensures continued client engagement and consistent cash flow generation from these core offerings.

Mature Software and Embedded Solutions

The Software and Embedded Solutions segment, while experiencing a soft market in 2023, demonstrated a notable profitability rebound by year-end. This recovery signals resilience within a mature market segment.

Etteplan's deep-rooted expertise spans software and embedded system development across diverse industries like industrial automation, medical devices, and consumer electronics. This broad application base solidifies its market position.

This established business, especially its work with long-term clients and ongoing projects, serves as a consistent generator of cash flow. For instance, in 2023, Etteplan's revenue from its Technology Services segment, which includes software and embedded solutions, was €235.6 million, contributing significantly to the company's overall financial stability.

The reliable income from these mature offerings is crucial, as it provides the financial foundation to strategically invest in and nurture newer, higher-growth business areas within Etteplan's portfolio.

- Mature Market Resilience: Despite a weak 2023 market, Etteplan's Software and Embedded Solutions showed improved profitability by year-end.

- Industry Breadth: Etteplan's extensive experience covers industrial, medical, and consumer sectors, showcasing broad applicability.

- Stable Cash Flow Generation: Long-term client relationships and recurring projects in this segment provide dependable revenue streams.

- Strategic Investment Funding: Profits from these mature offerings enable investment in Etteplan's growth-oriented ventures.

Energy Industry Projects

Energy industry projects represent a significant Cash Cow for Etteplan. Investment in this sector has been steady, showcasing a reliable demand for Etteplan's expertise. This stability translates into consistent revenue streams, bolstering the company's financial health.

Etteplan's participation in renewable energy heat storage projects highlights its presence in a mature but dependable market. While growth might not be explosive, these projects offer a predictable and ongoing source of business.

- Stable Revenue: The energy sector provides a predictable income for Etteplan, acting as a reliable cash generator.

- Mature Market: Etteplan operates within an established energy market, ensuring consistent project flow.

- Renewable Focus: Involvement in heat storage projects diversifies their energy offerings within a stable segment.

Etteplan's managed services, particularly in areas like industrial automation and the energy sector, function as significant cash cows. The company's strategic aim to derive 75% of its revenue from managed services by 2027, up from 65% in 2024, underscores the stability and predictability of this revenue model. This focus on comprehensive project control in mature markets generates consistent cash flow with reduced need for extensive new business acquisition.

The company's traditional technical documentation services also represent a reliable cash cow. Despite some market softness in Q1 2025 for broader technical communication, the core demand for manuals and spare parts information remains strong, driven by regulatory needs and product support requirements. This segment benefits from Etteplan's established market presence and reputation for accuracy.

Software and embedded solutions, while facing market challenges in 2023, demonstrated a profitable rebound by year-end. This segment, with its broad application across industrial, medical, and consumer electronics, generates stable cash flow through long-term client relationships and ongoing projects, contributing €235.6 million to Etteplan's Technology Services revenue in 2023.

Energy industry projects, especially in renewable heat storage, serve as a dependable cash cow. The steady investment and consistent demand in this mature market provide predictable revenue streams, reinforcing Etteplan's financial health and enabling strategic investments in growth areas.

What You’re Viewing Is Included

Etteplan BCG Matrix

The Etteplan BCG Matrix preview you're examining is the identical, fully formatted report you will receive upon purchase. This means no watermarks or placeholder content; it's the complete strategic tool ready for your immediate use. You can confidently use this preview as a direct representation of the professional-grade analysis you'll acquire, enabling swift integration into your business planning and decision-making processes.

Dogs

The Technical Communication and Data Solutions segment showed weakness in the first quarter of 2025, partly due to one-off costs and adjustments. This indicates that some specific areas within this service line are struggling with slow growth and possibly a diminished market position.

These underperforming sub-segments might be what we call cash traps. They demand substantial investment and resources but don't deliver proportionate returns. This situation could stem from outdated operational methods or a decrease in customer interest for particular services offered.

Legacy Software Development Projects, in the context of the Etteplan BCG Matrix, often represent the 'Dogs' quadrant. In a weak market situation, such as the very few new software and application engineering projects initiated in Q1 2025, these legacy projects are particularly vulnerable. The Software and Embedded Solutions segment's struggles in 2023 further highlight this, indicating that older, less innovative software development or those linked to declining industries are likely underperforming.

These legacy projects typically exhibit low growth prospects and can become resource drains, offering minimal contribution to market share or profitability. For instance, if a company relies heavily on software for a product line that has seen declining consumer interest, the associated development projects would fit this 'Dog' profile, requiring careful management to avoid further financial strain.

Etteplan's Q1 2025 report pointed to a challenging European market, with Finland and Germany showing particular weakness. This stems from heightened geopolitical tensions and ongoing trade wars, leading to a more cautious business environment. In these regions, customers are exhibiting slower decision-making processes, and many planned investment projects are being delayed or even scrapped altogether.

These struggling European operations are a significant concern. They directly contribute to a downturn in Etteplan's organic revenue growth and are negatively impacting overall profitability. Essentially, these markets are acting as a drain on company resources, diverting attention and capital that could be better utilized elsewhere.

Non-strategic Service Offerings

As Etteplan sharpens its focus on AI and key growth sectors, services that don't fit this new direction or struggle with technological advancements can become non-strategic. These are offerings with weak market pull or where Etteplan doesn't hold a strong competitive position, resulting in low market share and limited growth potential. In 2024, Etteplan continued to assess its portfolio, with a notable emphasis on integrating AI capabilities across its service lines.

These non-strategic services might represent areas where Etteplan faces declining demand or intense competition without a clear differentiator. For instance, if a particular legacy engineering service saw a revenue decline of over 15% in early 2024 due to shifts in client needs towards digital solutions, it would likely be flagged for review. Such offerings might require divestment or a significant overhaul to align with the company's forward-looking strategy.

- Limited Market Demand: Services with declining customer interest or niche applications that don't align with Etteplan's AI-centric strategy.

- Lack of Competitive Edge: Offerings where Etteplan's market share is low and competitors have a stronger technological or market presence.

- Resource Misallocation: Services that divert resources and attention from higher-growth, strategic areas like AI-driven engineering.

- Potential for Divestment/Restructuring: These offerings may need to be sold off or fundamentally changed to fit the evolving business model.

Inefficient Organic Growth Areas

Despite overall revenue growth in 2024, largely driven by acquisitions, Etteplan saw its organic revenue decline. This trend continued into Q1 2025, highlighting a struggle to expand from its core business.

Segments experiencing stagnant or negative organic revenue growth, even with continued investment, can be categorized as inefficient organic growth areas. These are the parts of the business that aren't independently expanding their market presence in slower-growing markets.

- Organic Revenue Decline: Etteplan's organic revenue decreased in 2024 and Q1 2025.

- Acquisition Dependence: Total revenue growth was primarily supported by acquisitions, not internal expansion.

- Stagnant Segments: Areas with flat or negative organic growth are inefficient.

- Market Share Challenges: These segments struggle to gain market share without external support.

Dogs in the Etteplan BCG Matrix represent business areas with low market share in slow-growing industries. These segments often require significant investment for minimal returns, acting as cash drains. For Etteplan, legacy software development and underperforming technical communication services exemplify these 'Dogs'.

These areas struggle with limited market demand and a lack of competitive edge, potentially leading to resource misallocation. Given Etteplan's focus on AI and growth sectors, these non-strategic offerings might face divestment or restructuring to align with the company's forward-looking strategy, especially considering the challenging European market in early 2025.

Etteplan's organic revenue decline in 2024 and Q1 2025, despite acquisition-driven growth, highlights the presence of these stagnant segments. For example, a 15% revenue decline in a legacy engineering service in early 2024 due to shifting client needs towards digital solutions would fit this 'Dog' profile.

The company's strategic assessment in 2024, with an emphasis on integrating AI, likely flagged these underperforming areas. The Q1 2025 report's indication of weakness in Finland and Germany due to geopolitical tensions further underscores the vulnerability of these low-growth segments.

| Segment/Area | BCG Category | Market Trend | Etteplan's Position | Financial Impact |

|---|---|---|---|---|

| Legacy Software Development | Dog | Slow Growth/Declining | Low Market Share | Resource Drain |

| Technical Communication & Data Solutions (Underperforming Sub-segments) | Dog | Weakening Market | Diminished Market Position | Potential Cash Trap |

| Struggling European Operations (e.g., Germany, Finland) | Dog (in context of slow growth) | Challenging/Cautious Business Environment | Impacted Market Share | Negative Organic Revenue Growth, Profitability Strain |

Question Marks

Etteplan's new AI-driven service offerings, in their nascent stages, are positioned as Question Marks in the BCG matrix. While the overall AI market is experiencing robust growth, estimated to reach over $200 billion globally by 2024, these specific services are still building traction and have a relatively low market share.

These offerings represent high-potential opportunities within a rapidly expanding sector, driven by the increasing demand for intelligent automation and data analytics. However, their current low market penetration necessitates substantial investment in research, development, and market penetration strategies to capitalize on this growth potential.

The objective is to nurture these Question Marks, channeling resources to enhance their capabilities and visibility, with the aim of transforming them into Stars. Success in this phase will depend on Etteplan's ability to effectively demonstrate the value proposition of its AI solutions and secure early adopters in the competitive landscape.

Etteplan provides crucial support for sustainability reporting, particularly in navigating the complexities of the Corporate Sustainability Reporting Directive (CSRD) and European Sustainability Reporting Standards (ESRS). This service directly addresses the escalating demand for transparent and standardized environmental, social, and governance (ESG) disclosures.

The market for sustainability reporting services is experiencing rapid expansion, driven by stringent new regulations and a heightened corporate focus on ESG performance. For instance, by the end of 2024, it is estimated that over 50,000 companies across the EU will be subject to CSRD requirements, highlighting the significant growth potential in this sector.

As a relatively nascent offering for many companies, including potentially Etteplan, establishing a robust market share in sustainability reporting support will require considerable investment. This is to build brand recognition, develop specialized expertise, and secure early client wins in a competitive and evolving landscape.

Etteplan, building on its Novacon Powertrain acquisition, is strategically eyeing emerging niche automotive sectors. These include advanced autonomous driving software development and specialized electric vehicle (EV) component engineering, areas poised for significant growth but demanding substantial upfront investment and expertise cultivation.

The company's expansion into these nascent fields, while promising high returns, faces headwinds from current market uncertainties. Customer investment decisions in the broader automotive landscape are cautious, potentially slowing the rapid scaling of these high-potential ventures for Etteplan.

Emerging Digital Transformation Consulting

Emerging Digital Transformation Consulting, as a component of Etteplan's strategic portfolio, represents a dynamic area focused on guiding businesses through their digital evolution. This segment encompasses the entire lifecycle of digitalization, from initial concept and requirement gathering to the actual development and deployment of digital solutions, leveraging Etteplan's extensive software and digitalization expertise.

While the broader digitalization market is experiencing robust growth, specific niche areas within emerging digital transformation consulting may currently hold a smaller market share. Etteplan's strategic positioning in these nascent fields signifies a commitment to innovation and future market leadership, necessitating substantial investment to cultivate unique capabilities and achieve scalable growth.

- Market Potential: The global digital transformation market was valued at approximately $767 billion in 2023 and is projected to reach over $2.0 trillion by 2030, indicating a significant growth trajectory for services like those offered by Etteplan.

- Investment Focus: Etteplan's investment in emerging digital transformation consulting areas is designed to build a competitive advantage in high-demand, future-oriented services.

- Capability Development: The company is actively developing new competencies to address evolving client needs in areas such as AI-driven process automation and advanced data analytics implementation.

- Strategic Growth: By targeting new client segments and expanding its service offerings in emerging digital transformation, Etteplan aims to capture a larger share of this expanding market.

Developing Global Delivery Capabilities (e.g., BJIT)

Etteplan’s 2024 acquisition of a minority stake in BJIT, a leading IT consulting firm in Bangladesh, positions it to leverage cost-effective global talent and expand its service offerings. This strategic move is designed to enhance Etteplan's delivery capabilities and tap into new markets, though the successful integration and scaling of these operations remain a key challenge.

The integration of BJIT into Etteplan's global delivery network represents a classic Question Mark in the BCG matrix. While the potential for growth and cost savings is significant, the actual realization of these benefits hinges on effective management and strategic execution. For instance, Bangladesh's IT sector has seen substantial growth, with the export of IT services projected to reach $10 billion by 2025, indicating a fertile ground for expansion.

- Global Expansion: Etteplan's investment in BJIT aims to build a robust global delivery model, offering clients a wider range of services and competitive pricing.

- Integration Challenge: Successfully merging BJIT's operations and culture with Etteplan's existing structure is crucial for unlocking the full potential of this acquisition.

- Market Potential: Bangladesh's IT market is rapidly expanding, offering opportunities for Etteplan to gain market share and increase profitability through its new partnership.

- Strategic Execution: Significant investment and careful planning are required to manage the complexities of global operations and translate BJIT's capabilities into tangible business growth for Etteplan.

Question Marks represent Etteplan's emerging AI-driven services, sustainability reporting support, niche automotive ventures, digital transformation consulting, and the recent acquisition of a stake in BJIT. These areas exhibit high growth potential within expanding markets, but currently hold a low market share.

Significant investment in research, development, and market penetration is crucial for these Question Marks to mature into Stars. Etteplan must effectively demonstrate their value proposition and secure early adoption to navigate competitive landscapes and capitalize on market opportunities.

The success of these ventures hinges on strategic execution, capability development, and overcoming integration challenges, particularly in the context of global expansion and evolving client needs.

| Etteplan Business Area | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| AI-driven Services | Question Mark | High | Low | High |

| Sustainability Reporting Support | Question Mark | High | Low | High |

| Niche Automotive Sectors | Question Mark | High | Low | High |

| Emerging Digital Transformation Consulting | Question Mark | High | Low | High |

| BJIT Acquisition (Global Delivery) | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.