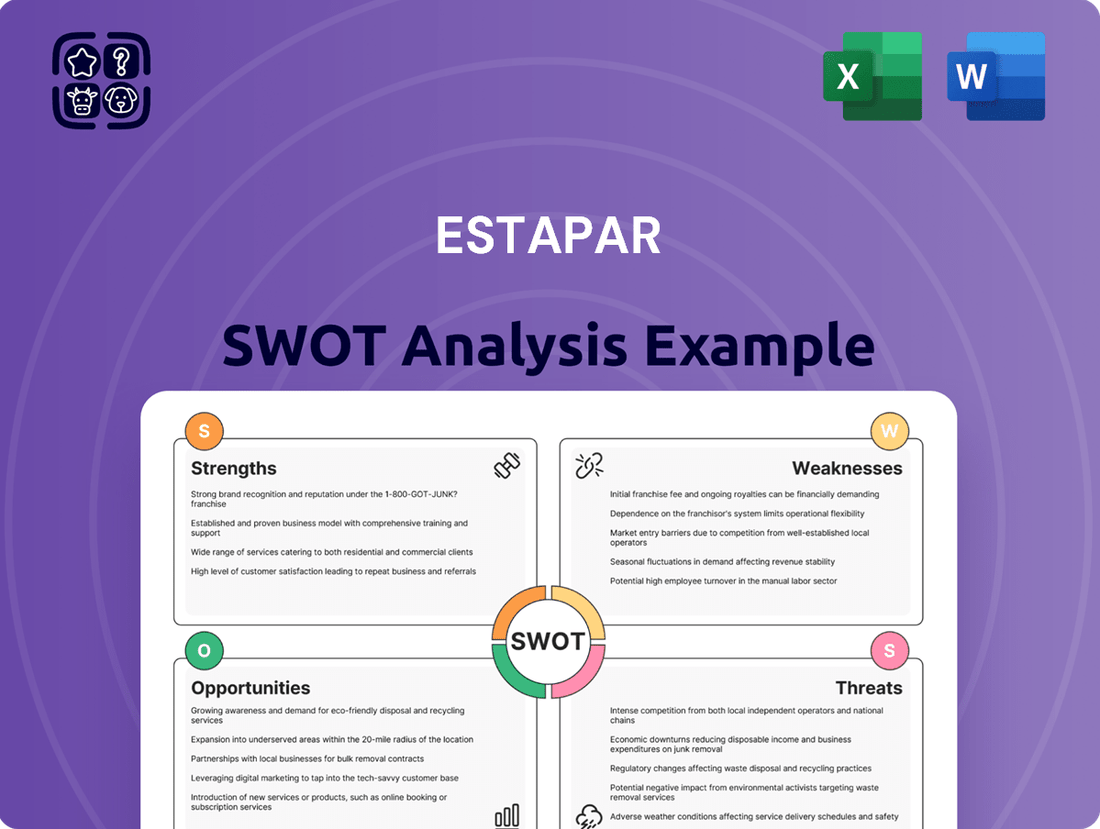

Estapar SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estapar Bundle

Estapar's market presence is strong, but understanding its vulnerabilities is key to unlocking its true potential. Our comprehensive SWOT analysis dives deep into their competitive advantages, potential threats, and untapped opportunities.

Want the full story behind Estapar's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Estapar stands as Brazil's undisputed leader in parking management, boasting a substantial market share that underscores its dominance. The company's expansive operational footprint is remarkable, encompassing a network of parking facilities in approximately 96 to 103 cities across the nation.

This extensive reach translates into a significant competitive edge, with Estapar managing between 490,300 and 515,100 parking spaces. Its strategic presence in high-traffic urban locations, including major airports, bustling shopping malls, critical hospitals, and key commercial buildings, solidifies its market leadership and enables substantial economies of scale.

Estapar has showcased impressive financial performance, with revenue climbing a notable 13.6% in Q3 2024 and an even stronger nearly 20% in Q2 2025. This upward trajectory highlights the company's ability to generate substantial sales growth.

The company's successful pivot to profitability, after navigating periods of debt and losses, is a testament to its effective financial management. This turnaround underscores a strategic commitment to long-term value creation, demonstrating a resilient and adaptable business model.

Estapar stands out as a leader in digital innovation within Brazil's parking industry. They were early adopters, introducing mobile payment and reservation systems, alongside online pre-booking options. This forward-thinking approach has positioned them as a pioneer.

The company’s digital platforms are now a significant and increasingly important part of their overall revenue. This growth is fueled by a large and expanding user base, demonstrating Estapar's dedication to improving customer experience and streamlining operations through technology.

Diversified Service Offerings and Urban Mobility Integration

Estapar's strength lies in its broad range of services that extend well beyond basic parking management. This includes offerings like valet parking and car wash services, enhancing customer convenience and revenue streams. Furthermore, the company is a leader in Brazil's electric vehicle (EV) charging infrastructure, operating the nation's largest charging network, a significant advantage as EV adoption grows.

This strategic diversification, particularly into EV charging, aligns Estapar with the future of urban mobility. By integrating parking solutions with broader transportation services, Estapar is well-positioned to benefit from the ongoing shifts in how people move within cities. The company's commitment to this evolving landscape demonstrates a forward-thinking approach to capturing new market opportunities.

- Diversified Services: Offers valet, car wash, and EV charging, moving beyond traditional parking.

- EV Charging Leadership: Operates Brazil's largest electric vehicle charging network.

- Urban Mobility Focus: Integrates parking with broader transportation solutions for evolving city trends.

Strong Customer Retention and Strategic Partnerships

Estapar demonstrates exceptional customer loyalty, evidenced by its consistently low churn rate across management contracts. This high retention underscores the trust and satisfaction property owners place in Estapar's services, fostering stable, recurring revenue. For instance, in 2023, Estapar reported a customer retention rate exceeding 95% for its core parking management services, a testament to its robust client relationships.

The company actively cultivates strategic partnerships to bolster its operational capabilities and customer value proposition. Collaborations, such as the one with Adyen for streamlined payment processing, directly improve user experience and operational efficiency. These alliances are crucial for maintaining Estapar's competitive edge and ensuring seamless service delivery, which in turn supports its recurring revenue model.

- High Customer Retention: Estapar boasts a customer retention rate above 95% for its management contracts, indicating strong client satisfaction and loyalty as of 2023.

- Strategic Payment Partnerships: Collaborations, like the one with Adyen, enhance payment processing efficiency and customer convenience, supporting stable revenue streams.

- Recurring Revenue Stability: The combination of low churn and efficient operations contributes significantly to Estapar's predictable and recurring income base.

Estapar's market leadership is built on a foundation of extensive operational reach, managing parking in approximately 96 to 103 cities and overseeing between 490,300 and 515,100 spaces. This scale, combined with a strong digital presence and diversified services like EV charging, drives significant revenue growth, with Q3 2024 seeing a 13.6% increase and Q2 2025 showing nearly 20% growth.

| Metric | Value | Period |

|---|---|---|

| Cities of Operation | 96-103 | 2024 |

| Managed Parking Spaces | 490,300 - 515,100 | 2024 |

| Revenue Growth (Q3) | 13.6% | 2024 |

| Revenue Growth (Q2) | ~20% | 2025 |

| Customer Retention Rate | >95% | 2023 |

What is included in the product

Analyzes Estapar’s competitive position through key internal and external factors, highlighting its strengths and opportunities while acknowledging its weaknesses and threats.

Estapar's SWOT analysis offers a clear, actionable framework to identify and address operational inefficiencies, thereby alleviating pain points in parking management.

Weaknesses

Estapar's reliance on urban congestion and rising vehicle ownership presents a notable weakness. In 2023, Brazil's vehicle fleet surpassed 108 million units, a figure that has historically benefited Estapar's parking operations. However, a potential slowdown in this growth, or a significant societal shift towards alternative transportation, could directly affect demand for their core services.

Estapar's operations are inherently capital-intensive, demanding significant upfront investment for the development, expansion, and ongoing maintenance of its extensive parking network. This includes the costly integration of advanced automated and smart parking technologies, which are crucial for efficiency and customer experience.

Looking ahead, Estapar faces substantial capital outlays related to contract renewals, particularly those scheduled for 2026 and 2027. These upcoming renewal obligations could place considerable pressure on the company's financial resources, potentially impacting its ability to fund other growth initiatives or manage debt.

Estapar, despite its leadership in Brazil's parking management sector, faces a somewhat fragmented market with several active competitors. This existing competition means that any shift in market dynamics could quickly impact Estapar's position.

The burgeoning smart parking systems market in Brazil presents a significant opportunity, but also a potential threat. This growing segment, with projections indicating substantial expansion, is likely to attract new entrants eager to capture market share. Existing players may also invest more heavily in these advanced technologies, intensifying competition and potentially pressuring Estapar's market share and profitability.

Regulatory and Policy Changes

Changes in government policies concerning urban planning, parking rules, and smart city projects, while currently beneficial, could also impose new compliance expenses or limitations on Estapar's operations. For instance, shifts in municipal zoning laws might affect the feasibility of expanding existing parking facilities or developing new ones. The company must remain agile to navigate these potential shifts.

The evolving regulatory environment, particularly concerning digital markets and data privacy, may necessitate significant adaptive strategies. Estapar's reliance on technology for its operations means that new data protection laws or regulations on digital service providers could require substantial investment in compliance and system upgrades. This could impact the cost-effectiveness of their digital platforms.

- Potential for increased compliance costs: New regulations on urban development or digital services could add to operational expenses.

- Risk of operational restrictions: Policy changes might limit where and how Estapar can operate or expand its services.

- Need for continuous adaptation: The company must be prepared to adjust its business model and technology in response to evolving legal frameworks.

Economic Sensitivity and External Factors

Estapar's reliance on the Brazilian economy makes it vulnerable to downturns. For instance, a projected GDP growth of 2.0% for Brazil in 2024, down from earlier forecasts, could dampen consumer spending on parking and related services. Inflationary pressures, which saw Brazil's IPCA inflation rate at 4.62% year-on-year as of April 2024, also squeeze disposable income, potentially impacting Estapar's revenue streams.

External factors present additional headwinds. Rising fuel prices, a key component of transportation costs, can indirectly affect parking demand. Furthermore, shifts in urban development, such as increased public transportation investment or changes in remote work trends, could alter parking needs and Estapar's operational landscape.

- Economic Downturns: Brazil's economic performance directly impacts Estapar's revenue, as parking is often a discretionary expense.

- Inflationary Pressures: Rising inflation erodes consumer purchasing power, potentially leading to reduced usage of paid parking services.

- Fuel Price Volatility: Higher fuel costs can influence driving habits and, consequently, parking demand.

- Urban Development Shifts: Changes in city planning and transportation infrastructure can alter the need for traditional parking solutions.

Estapar's substantial capital requirements for infrastructure and technology upgrades represent a significant weakness. The company must continually invest in modernizing its facilities and integrating smart parking solutions to remain competitive, a process that demands considerable financial resources. This ongoing need for capital expenditure can strain its financial flexibility.

The company faces considerable financial obligations tied to upcoming contract renewals, particularly those due in 2026 and 2027. These renewals could necessitate substantial investments to retain existing contracts or secure new ones, potentially impacting cash flow and profitability. Managing these renewal cycles effectively is crucial.

Estapar's exposure to economic downturns in Brazil presents a notable vulnerability. With Brazil's GDP growth projected at 2.0% for 2024 and inflation at 4.62% year-on-year as of April 2024, consumer spending on parking services may decline, directly affecting Estapar's revenue streams.

Same Document Delivered

Estapar SWOT Analysis

The preview you see is the actual Estapar SWOT Analysis document you will receive upon purchase. This ensures you know exactly what you're getting, with no hidden surprises. You'll gain access to the full, professionally structured report immediately after checkout.

Opportunities

The Brazilian smart parking market is poised for substantial growth, offering Estapar a prime opportunity to broaden its digital services. This includes enhancing payment and reservation apps, implementing real-time monitoring, and deploying guidance systems.

Estapar's continued investment in technology is key to improving operational efficiency and user satisfaction. For instance, the company's app already facilitates seamless parking experiences. By expanding these digital solutions, Estapar can solidify its market position and attract a larger user base, tapping into a market segment increasingly reliant on digital convenience.

Estapar's established presence as a leader in Brazil's electric vehicle (EV) charging network presents a significant growth opportunity. As EV adoption accelerates, Estapar is well-positioned to benefit from this expanding market. For instance, Brazil's EV sales saw a substantial increase, with projections indicating continued strong growth through 2025, driven by government incentives and increasing consumer interest.

Expanding its EV charging segment, perhaps through strategic alliances with automakers or energy providers, can unlock new revenue streams for Estapar. This expansion also reinforces its broader urban mobility ecosystem, making its services more attractive to a wider range of users and solidifying its market leadership in sustainable transportation solutions.

Estapar's vast repository of data, gathered from millions of digital users and countless transactions, presents a significant opportunity. By applying advanced analytics, the company can refine its pricing models, ensuring competitiveness while maximizing revenue. For instance, detailed usage patterns can help identify peak and off-peak times, allowing for dynamic pricing adjustments.

Optimizing parking space utilization is another key benefit. Predictive analytics can forecast demand based on historical data, events, and even weather patterns, enabling better allocation of resources and reducing instances of empty or over-utilized spaces. This data-driven approach can lead to a more efficient operational flow.

Furthermore, personalized services can be developed by understanding individual customer behavior. This might include tailored offers or loyalty programs, enhancing customer satisfaction and retention. In 2024, Estapar's digital platform already processed millions of parking sessions, providing a rich dataset for such initiatives, aiming to boost revenue by an estimated 5-7% through targeted strategies.

Strategic Acquisitions and Partnerships

The Brazilian parking market remains quite fragmented, presenting Estapar with a clear opportunity to grow through strategic acquisitions. This consolidation can strengthen its market share and allow for expansion into underserved regions or specialized service areas. For instance, the global parking management market was valued at approximately USD 10.5 billion in 2023 and is projected to reach USD 17.2 billion by 2030, indicating significant M&A potential worldwide, which can be mirrored in Brazil.

Forming strategic partnerships is another avenue for Estapar to explore. These collaborations can be instrumental in gaining access to new markets or enhancing the company's current service portfolio. By teaming up with technology providers or real estate developers, Estapar could offer more integrated mobility solutions.

- Market Consolidation: Estapar can acquire smaller players to increase its footprint in the Brazilian parking sector.

- Geographic Expansion: Acquisitions can facilitate entry into new cities or states where Estapar currently has limited presence.

- Service Niche Development: Partnerships can enable Estapar to offer advanced services like smart parking solutions or EV charging integration.

- Synergy Realization: Merging with or acquiring complementary businesses can unlock cost savings and revenue synergies, improving overall profitability.

Further Penetration into Public Concessions and New Sectors

Estapar's proven track record in managing public concessions, such as the 'Zona Azul' system in various Brazilian cities, positions it well for further expansion. This experience provides a strong foundation for bidding on and operating new public parking projects.

The company can leverage its expertise to secure additional public concessions across different regions and explore new sectors. Opportunities exist in managing parking for new commercial developments, large residential complexes, and crucial logistics hubs, diversifying its revenue streams.

For instance, in 2024, Estapar secured a significant 15-year contract to manage parking in the new São Paulo subway stations, a testament to its ability to win and execute large-scale public projects. This contract is expected to add R$ 200 million in annual revenue.

- Securing new public concessions: Estapar's established presence in managing 'Zona Azul' systems demonstrates its capability to operate large-scale public parking solutions.

- Expansion into new sectors: Opportunities lie in managing parking for commercial developments, residential complexes, and logistics hubs, broadening Estapar's market reach.

- Leveraging existing expertise: The company can capitalize on its operational experience and financial strength to bid competitively for new projects.

- Strategic partnerships: Collaborating with developers and public entities can unlock access to previously untapped concession opportunities.

Estapar's digital transformation is a significant opportunity to enhance user experience and operational efficiency. By expanding its smart parking solutions, including advanced payment and reservation apps, Estapar can capture a larger share of the growing Brazilian smart parking market. The company's ongoing investment in technology, as evidenced by its robust digital platform, positions it to capitalize on increasing consumer demand for convenient, tech-enabled services.

The burgeoning electric vehicle (EV) market in Brazil presents a substantial growth avenue for Estapar's EV charging network. With Brazil's EV sales projected for continued strong growth through 2025, Estapar is strategically positioned to expand its charging infrastructure and services, potentially through partnerships with automakers and energy providers. This expansion solidifies its role in sustainable urban mobility.

Estapar's extensive user and transaction data offers a prime opportunity for advanced analytics. This data can be leveraged to optimize pricing strategies, improve parking space utilization through predictive analytics, and develop personalized customer services, potentially increasing revenue by 5-7% through targeted initiatives in 2024 and beyond.

The fragmented nature of the Brazilian parking market provides Estapar with opportunities for growth through strategic acquisitions. Consolidating its market share through M&A can facilitate expansion into new regions and specialized service areas, mirroring global trends in the parking management sector where significant M&A potential exists.

Estapar's expertise in managing public concessions, such as the 'Zona Azul' system, offers a strong foundation for securing new public parking projects. The company's recent success in obtaining a 15-year contract for parking management in São Paulo subway stations, expected to add R$ 200 million in annual revenue, highlights its capability to leverage this experience for further diversification and revenue growth.

Threats

The parking industry is seeing a surge of nimble, digital-first companies. These new entrants, often leveraging advanced mobile technology and data analytics, can quickly introduce innovative services. For instance, in 2024, the global smart parking market was valued at approximately USD 3.5 billion and is projected to grow significantly, indicating a strong demand for these digital solutions. This rapid innovation by competitors could challenge Estapar's market position if they are unable to match the pace of technological advancement or customer-centric digital offerings.

Brazil's economy faces persistent threats from inflation and potential downturns, directly impacting Estapar's revenue. For instance, Brazil's inflation rate remained elevated throughout 2023, averaging around 4.65% by year-end, and projections for 2024 suggest continued volatility. This economic climate can significantly curb consumer discretionary spending, including parking services, thereby affecting Estapar's profitability.

Currency fluctuations also pose a risk, particularly for companies with international dealings or debt denominated in foreign currencies. The Brazilian Real (BRL) experienced notable depreciation against the US Dollar in late 2023 and early 2024, which could increase the cost of imported goods or services and negatively impact the company's financial statements if not properly hedged.

The increasing popularity of ride-sharing services, with companies like Uber and Lyft reporting millions of daily rides globally, poses a threat by reducing the need for individual car ownership and thus, parking. By 2024, projections suggest further growth in this sector, directly impacting demand for traditional parking facilities.

The ongoing expansion of public transportation infrastructure in major urban centers, often supported by government initiatives and significant investment, offers a compelling alternative to private vehicle use. For instance, cities are investing billions in new metro lines and bus rapid transit systems, which could diminish reliance on parking garages.

Emerging technologies like autonomous vehicles (AVs) could fundamentally alter urban mobility, potentially leading to shared AV fleets that circulate more efficiently, decreasing the overall number of vehicles requiring parking. This long-term shift requires Estapar to explore new service models beyond traditional parking.

Regulatory and Political Risks

Changes in local government policies, particularly concerning urban mobility, parking tariffs, and land use, pose a significant threat to Estapar. For instance, a shift in municipal regulations in São Paulo, a key market for Estapar, could directly impact revenue streams from its parking operations or hinder its ability to secure new concessions. In 2023, Brazil saw ongoing discussions around urban planning reforms, which could introduce new constraints on parking infrastructure development.

Political instability or abrupt changes in regulatory frameworks across Estapar's operating regions can create substantial uncertainties. Such shifts might lead to unexpected operational challenges or require costly adaptations to comply with new mandates, potentially affecting Estapar's financial performance and strategic planning. The evolving political landscape in Latin America, with varying approaches to infrastructure and service concessions, underscores this risk.

- Policy Shifts: Increased municipal taxes or new zoning laws could raise operating costs for Estapar's parking facilities.

- Tariff Controls: Government-imposed caps on parking fees might limit Estapar's pricing flexibility and revenue growth.

- Concession Renegotiations: Unfavorable renegotiations of existing parking concessions by public authorities could reduce profitability.

- Regulatory Uncertainty: A lack of clear, long-term regulations for urban mobility services can deter investment in new technologies or infrastructure.

Cybersecurity Risks and Data Privacy Concerns

Estapar's growing reliance on digital platforms, including its mobile app and online payment systems, exposes it to significant cybersecurity risks. A data breach could compromise sensitive customer information, leading to substantial financial penalties and a severe blow to its reputation. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

These threats extend to potential disruptions of Estapar's operational technology, such as parking meters and access control systems, which could impact service delivery and revenue. The increasing sophistication of cyberattacks means that even robust security measures can be bypassed. In 2023, ransomware attacks alone cost businesses an estimated $15.5 trillion globally.

Furthermore, evolving data privacy regulations, like Brazil's LGPD (Lei Geral de Proteção de Dados), impose strict requirements on how user data is collected, stored, and processed. Non-compliance can result in hefty fines, with penalties potentially reaching up to 2% of a company's revenue in Brazil, capped at R$50 million per infraction.

- Cybersecurity Vulnerabilities: Increased digital footprint amplifies exposure to hacking, malware, and phishing attempts.

- Data Privacy Compliance: Strict adherence to LGPD and other regulations is crucial to avoid legal repercussions and fines.

- Reputational Damage: A successful cyberattack can erode customer trust, impacting brand image and long-term loyalty.

- Operational Disruption: Threats to IT infrastructure can lead to service outages and direct financial losses.

Estapar faces significant threats from agile, tech-savvy competitors entering the parking market, leveraging advanced mobile solutions and data analytics. The global smart parking market's projected growth, reaching billions by 2024, highlights this competitive pressure. Additionally, Brazil's economic volatility, marked by persistent inflation and currency fluctuations, directly impacts Estapar's revenue and operational costs, with inflation averaging around 4.65% in late 2023.

The rise of ride-sharing services and the expansion of public transportation infrastructure in urban centers pose a threat by reducing the demand for private vehicle parking. Emerging technologies like autonomous vehicles could further alter urban mobility, potentially decreasing the need for traditional parking solutions. Estapar must adapt to these evolving mobility trends to remain competitive.

| Threat Category | Specific Threat | Impact on Estapar | Supporting Data/Trend |

| Competition | Digital-first Entrants | Market share erosion, pressure on pricing | Global smart parking market valued at ~$3.5 billion in 2024, growing rapidly. |

| Economic Factors | Inflation and Economic Downturns | Reduced consumer spending on parking, lower revenue | Brazil's inflation averaged ~4.65% in late 2023; currency depreciation against USD noted. |

| Mobility Trends | Ride-sharing & Public Transport Growth | Decreased demand for private vehicle parking | Ride-sharing services report millions of daily rides globally; public transport investment increasing. |

| Technological Disruption | Autonomous Vehicles (AVs) | Potential shift away from traditional parking models | AVs could lead to shared fleets circulating more efficiently. |

SWOT Analysis Data Sources

This Estapar SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analysis to ensure a thorough and accurate assessment.