Estapar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estapar Bundle

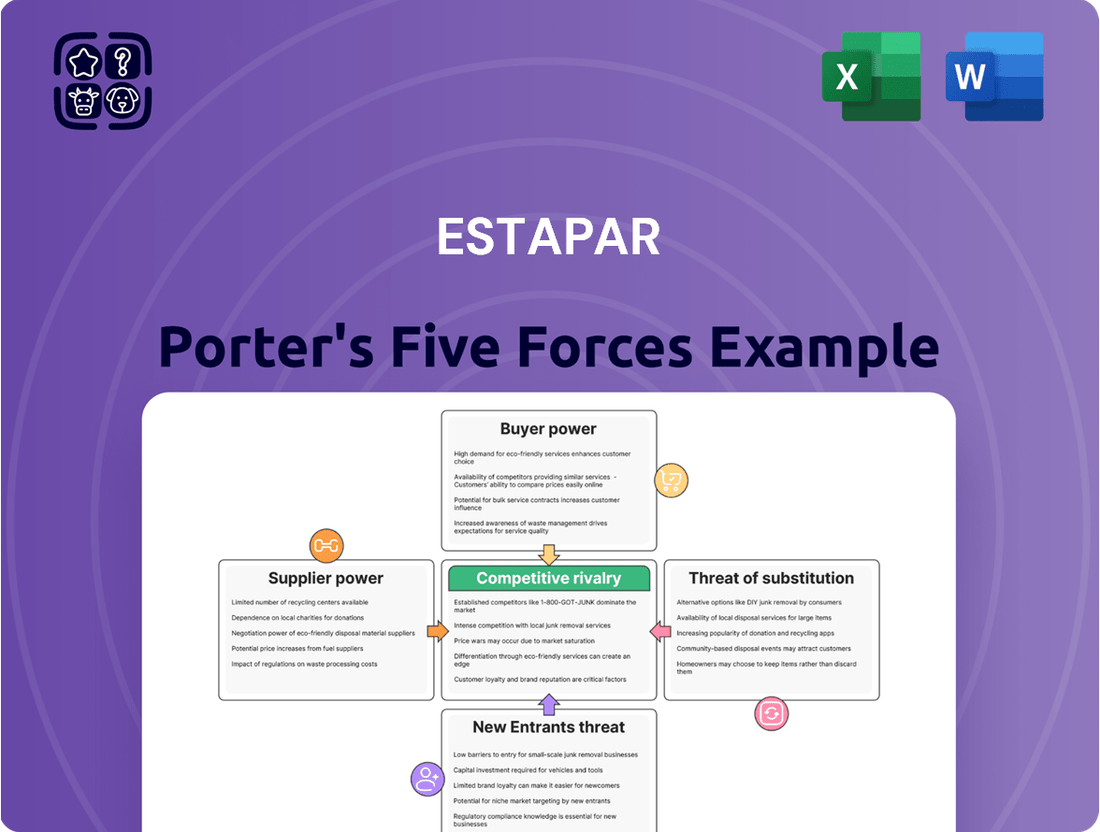

Estapar's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the threat of new entrants entering the parking sector. Understanding these dynamics is crucial for any business operating within or looking to enter this market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Estapar’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Estapar's dependence on prime locations, like those found at airports and major shopping centers, significantly bolsters supplier power. These high-traffic areas are crucial for Estapar's business model.

The limited availability of such strategically positioned real estate means property owners hold considerable sway. For Estapar, finding comparable alternative sites is challenging and costly.

In 2024, urban land values in major Brazilian cities, where Estapar primarily operates, continued to see appreciation, reflecting the ongoing demand for prime commercial real estate. This scarcity directly translates to stronger bargaining power for the owners of these valuable locations.

Estapar's significant investment in digital parking solutions, such as payment and reservation apps and smart parking systems, creates a reliance on technology providers. This dependence means suppliers of these specialized hardware, software, and maintenance services can wield considerable bargaining power.

This power is amplified if these technology solutions are proprietary or necessitate complex integration, making it expensive and disruptive for Estapar to switch vendors. For instance, in 2024, companies in the smart city infrastructure sector, which includes parking technology, saw continued demand, with some specialized providers experiencing revenue growth exceeding 15% as cities invest in modernization.

While automation can handle some parking functions, Estapar still relies on a significant workforce for management, security, maintenance, and valet services. In 2024, the Brazilian labor market experienced continued tightness in certain sectors, potentially impacting wage negotiations for these roles.

If specialized skills are needed for advanced facility management or if labor unions gain strength within Estapar's operational areas, employees could exert greater bargaining power. This could translate into increased wage demands or create operational disruptions if staffing levels are compromised.

Financing and capital providers

Estapar's need for substantial capital for expansion and infrastructure development, including new operations and technological advancements, directly impacts the bargaining power of financing and capital providers. In the current economic climate of 2024, characterized by persistent inflation and elevated interest rates, lenders and investors wield considerable influence.

This leverage allows them to dictate terms, affecting the cost and accessibility of funds crucial for Estapar's growth strategies. For instance, a company like Estapar, seeking to fund a new parking facility, might face higher borrowing costs if capital markets are tight.

- Capital Requirements: Estapar's expansion plans necessitate significant financial investment.

- Influence of Interest Rates: Higher interest rates in 2024 increase borrowing costs for Estapar.

- Investor Leverage: Lenders and investors can negotiate more favorable terms due to capital demand.

- Economic Uncertainty: Periods of economic doubt amplify the power of capital providers.

Infrastructure and equipment vendors

Infrastructure and equipment vendors, supplying items like parking barriers, payment machines, and surveillance systems, hold a degree of bargaining power. Although some of these components can be seen as commodities, specialized technology or lengthy maintenance agreements can foster reliance, especially for Estapar's widespread operations.

For instance, the global market for parking management systems, which includes payment and barrier technology, was valued at approximately USD 4.5 billion in 2023 and is projected to grow. Vendors offering advanced, integrated solutions or those with established service networks for critical uptime can leverage this position.

- Specialized Technology: Vendors providing unique or patented parking access control or payment processing technology can command higher prices due to limited alternatives.

- Maintenance Contracts: Long-term, comprehensive maintenance agreements for essential equipment like automated barriers and digital payment terminals can lock in suppliers and create switching costs for Estapar.

- Scale of Deployment: For Estapar's extensive network, the sheer volume of equipment required means that suppliers capable of meeting these demands at scale might negotiate more favorable terms.

- Vendor Concentration: If the market for a particular type of critical infrastructure, such as advanced security surveillance, is dominated by a few key players, their bargaining power increases significantly.

The bargaining power of suppliers for Estapar is notably influenced by the concentration of prime real estate locations, where limited availability grants property owners significant leverage. This is further amplified by Estapar's reliance on specialized technology providers for digital parking solutions, where proprietary systems and integration complexities create high switching costs. Furthermore, the need for capital in 2024, amidst a backdrop of elevated interest rates and economic uncertainty, strengthens the position of lenders and investors. Finally, while some infrastructure components are commoditized, specialized equipment and comprehensive maintenance contracts can empower vendors.

| Supplier Type | Key Factors Influencing Power | Impact on Estapar | 2024 Context/Data Point |

|---|---|---|---|

| Real Estate Owners (Prime Locations) | Scarcity of high-traffic sites | Higher rental costs, limited expansion options | Urban land values in Brazil appreciated in 2024. |

| Technology Providers (Digital Parking) | Proprietary solutions, integration complexity | Dependency, high switching costs | Smart city infrastructure sector saw demand growth in 2024. |

| Capital Providers (Lenders/Investors) | Capital demand, economic conditions | Higher borrowing costs, stricter terms | Elevated interest rates in 2024 increased borrowing costs. |

| Infrastructure/Equipment Vendors | Specialized technology, maintenance contracts | Potential for price increases, reliance on critical uptime | Global parking management systems market projected to grow. |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape surrounding Estapar, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Estapar's Porter's Five Forces Analysis provides a visual, interactive dashboard to quickly identify and address competitive threats, simplifying complex market dynamics for strategic advantage.

Customers Bargaining Power

The bargaining power of individual customers for parking services, like those provided by Estapar, is generally low due to the highly fragmented nature of the customer base. While there are many individual drivers, their collective impact is diluted, especially when Estapar offers convenient and strategically located parking options in major urban areas.

Switching costs for individual drivers are typically minimal if alternative parking is easily accessible. However, Estapar's extensive network in key city centers often makes its locations more attractive than minor price variations, particularly for short-term parking needs where convenience is paramount. For instance, in 2024, Estapar operated over 400 parking facilities across Brazil, serving millions of vehicles annually, underscoring its market presence and the convenience it offers to a dispersed customer base.

Estapar's core business heavily relies on managing parking for major institutional clients, including airports, shopping malls, hospitals, and large commercial buildings.

These clients are significant because they offer substantial, long-term contracts. Their considerable bargaining power stems from the sheer volume of business they represent and their ability to negotiate favorable terms. They can also solicit competitive bids from other parking management companies or even explore managing their parking facilities internally, putting pressure on Estapar to maintain competitive pricing and service levels.

While users can technically switch parking apps, Estapar's digital platform exhibits considerable stickiness. With nearly eight million users by the end of 2023, the sheer volume of transactions processed through their app suggests a strong user base that isn't easily swayed.

The integration of services, such as finding available parking, payment, and even loyalty rewards within a single app, significantly reduces the friction for users to switch. This convenience, coupled with a broad network of Estapar-managed parking locations accessible via the app, further solidifies customer loyalty and discourages frequent platform hopping.

Price sensitivity varies by segment

Customer price sensitivity is a key factor in Estapar's operations, and it's not uniform across the board. For instance, daily commuters who use parking facilities regularly are often more attuned to price fluctuations, looking for the most cost-effective options. In contrast, individuals parking at airports or hospitals might place a higher value on convenience and guaranteed availability, making them less sensitive to small price variations. This difference is crucial for Estapar's strategy.

Estapar leverages this understanding by implementing segmented pricing. By analyzing demand and customer behavior in different locations and for various parking durations, they can tailor their pricing models. This approach allows them to capture value from less price-sensitive segments while remaining competitive for those who are more budget-conscious. For example, Estapar might offer premium pricing for prime airport spots with guaranteed availability, while providing discounted monthly passes for regular commuters in less central locations.

- Daily commuters often exhibit higher price sensitivity.

- Airport and hospital visitors may prioritize convenience over minor price differences.

- Estapar's strategy involves segmenting pricing based on location, duration, and customer type.

- This segmentation helps manage varying customer price sensitivities effectively.

Importance of parking service to customer experience

For many customers, especially in busy urban environments or at entertainment venues, parking is more than just a place to leave their car; it's a significant part of their overall experience. A hassle-free parking process, from easy entry and exit to clear signage and secure facilities, directly impacts how a customer feels about their visit. This integral role gives Estapar a strong hand in negotiations.

By offering a superior parking service, Estapar becomes a vital part of their clients' value proposition. This means businesses that rely on foot traffic, like shopping malls or event centers, see good parking as essential to customer satisfaction. When parking is a positive contributor to the overall experience, customers are less likely to switch to a competitor solely based on small price differences, thereby reducing the bargaining power of those customers who might otherwise demand lower fees.

In 2024, for instance, customer satisfaction scores for venues with well-managed parking often saw a noticeable uplift compared to those with less efficient systems. Studies indicate that a poor parking experience can deter up to 15% of potential visitors, highlighting its importance. This underscores Estapar's ability to command favorable terms because they provide a service that directly enhances their clients' customer retention and revenue.

- Parking as a Key Customer Touchpoint: The parking experience is often the first and last interaction a customer has with a venue.

- Impact on Overall Satisfaction: Positive parking experiences correlate with higher customer satisfaction, directly benefiting the venue's reputation.

- Reduced Price Sensitivity: Customers are often willing to pay more for convenient and secure parking, diminishing their bargaining power on price alone.

- Estapar's Value Proposition: Estapar's efficient and secure parking solutions contribute significantly to their clients' ability to attract and retain customers.

The bargaining power of individual customers for parking services, like those provided by Estapar, is generally low due to the highly fragmented nature of the customer base. While there are many individual drivers, their collective impact is diluted, especially when Estapar offers convenient and strategically located parking options in major urban areas.

Switching costs for individual drivers are typically minimal if alternative parking is easily accessible. However, Estapar's extensive network in key city centers often makes its locations more attractive than minor price variations, particularly for short-term parking needs where convenience is paramount. For instance, in 2024, Estapar operated over 400 parking facilities across Brazil, serving millions of vehicles annually, underscoring its market presence and the convenience it offers to a dispersed customer base.

Customer price sensitivity is a key factor in Estapar's operations, and it's not uniform across the board. Daily commuters who use parking facilities regularly are often more attuned to price fluctuations, looking for the most cost-effective options. In contrast, individuals parking at airports or hospitals might place a higher value on convenience and guaranteed availability, making them less sensitive to small price variations. Estapar leverages this understanding by implementing segmented pricing, allowing them to capture value from less price-sensitive segments while remaining competitive for those who are more budget-conscious.

Preview the Actual Deliverable

Estapar Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This detailed Porter's Five Forces analysis of Estapar provides a comprehensive overview of the competitive landscape, including bargaining power of buyers and suppliers, threat of new entrants and substitutes, and industry rivalry. You’re previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

The Brazilian parking services market is quite dynamic, featuring over 14 companies vying for dominance. This includes major international players like Indigo, alongside a multitude of smaller, localized operators. Estapar, while a leader, faces this crowded landscape.

This intense competition means companies like Estapar must constantly strive for efficiency and innovation to keep their edge. The sheer number of players, all operating within a market that’s seeing growth, naturally escalates the rivalry, pushing for better service and pricing strategies to attract and retain customers.

The Brazilian parking management market is booming, with smart parking solutions expected to see a compound annual growth rate of 24.8% between 2024 and 2030. This rapid expansion, fueled by increasing urbanization and more cars on the road, is a magnet for new players and existing companies alike.

As more businesses enter this lucrative space, the rivalry among them intensifies. Companies are competing fiercely to capture a larger slice of this growing market, leading to increased marketing efforts and potentially more aggressive pricing strategies.

Estapar's competitive rivalry is significantly shaped by its differentiation strategy, leveraging both technology and scale. The company operates an extensive network, encompassing 789 sites across 103 cities, which provides a substantial barrier to entry for smaller competitors. This vast operational footprint, combined with a deep well of expertise in managing concessions, allows Estapar to offer a more integrated and reliable service.

Technological advancements are another key differentiator for Estapar. The company has invested in digital platforms that enhance customer experience and operational efficiency. Furthermore, its early adoption and expansion of electric vehicle (EV) charging solutions position it ahead of rivals who are still developing these capabilities. These innovations not only attract environmentally conscious consumers but also create new revenue streams.

The combination of scale and technological innovation makes it challenging for rivals to compete solely on price. Competitors are compelled to make significant investments in replicating Estapar's infrastructure and technological offerings, thereby increasing the overall cost of competition in the sector. This dynamic forces a strategic response from rivals, pushing them to either specialize in niche markets or undertake substantial capital outlays to keep pace.

Acquisition and consolidation activities

Estapar's competitive rivalry is significantly shaped by its acquisition and consolidation strategy. The company has actively pursued mergers and acquisitions, notably acquiring Serbet and Zul Digital. These moves are clear indicators of a strategy focused on consolidating market share and integrating services that complement its existing offerings.

This approach to mergers and acquisitions (M&A) directly reflects the highly competitive landscape in which Estapar operates. Companies are increasingly looking to grow through inorganic means to bolster their market standing and achieve greater economies of scale.

- Market Consolidation: Estapar's acquisitions, like Serbet and Zul Digital, are designed to increase its footprint and market share in a fragmented industry.

- Strategic Growth: These M&A activities are a key driver for Estapar's growth, allowing it to expand its service portfolio and geographic reach.

- Competitive Response: The pursuit of consolidation suggests that Estapar is responding to or proactively engaging with competitive pressures by seeking to become a larger, more dominant player.

Contractual relationships and churn rates

Estapar's competitive landscape is significantly shaped by its strong contractual relationships, which result in remarkably low client churn. In the second quarter of 2025, the company reported an exceptionally low churn rate of just 0.04%. This high client retention underscores the stability and longevity of its agreements with institutional clients.

These enduring contractual ties serve as a formidable barrier for competitors looking to dislodge Estapar from its established positions. The difficulty in acquiring these secured contracts reinforces Estapar's market stability and its dominant presence. However, the upcoming renewal periods for these contracts present a potential area where competitive pressures could intensify.

- Client Retention: Estapar's Q2 2025 churn rate of 0.04% highlights exceptional client loyalty.

- Contractual Strength: Long-term contracts with institutional clients create a robust market moat.

- Competitive Barrier: High retention makes it difficult for rivals to gain market share through contract poaching.

- Future Challenges: Upcoming contract renewals represent key points where competitive rivalry may increase.

The competitive rivalry in the Brazilian parking market is fierce, with Estapar operating in a dynamic environment alongside numerous domestic and international players. This intense competition necessitates continuous innovation and efficiency improvements to maintain market leadership.

The market's rapid growth, projected at a 24.8% CAGR for smart parking solutions between 2024 and 2030, attracts new entrants, further escalating rivalry. Estapar leverages its extensive network of 789 sites across 103 cities and technological advancements, including EV charging, to differentiate itself and create barriers to entry for smaller competitors.

Estapar's strategy of market consolidation through acquisitions, such as Serbet and Zul Digital, aims to bolster its market share and achieve economies of scale, directly responding to competitive pressures. Furthermore, its exceptionally low client churn rate of 0.04% in Q2 2025, due to strong contractual relationships, creates a significant competitive moat, though contract renewals present future challenges.

| Key Competitive Factors | Estapar's Position | Impact on Rivalry |

| Number of Competitors | Over 14 major players, plus smaller operators | High rivalry, driving price and service innovation |

| Market Growth (Smart Parking) | 24.8% CAGR (2024-2030) | Attracts new entrants, intensifying competition |

| Operational Scale | 789 sites in 103 cities | Creates barrier to entry, forces rivals to invest heavily |

| Client Retention (Q2 2025) | 0.04% churn rate | Reduces opportunities for rivals to gain clients; contract renewals are key battlegrounds |

| Acquisition Strategy | Acquired Serbet and Zul Digital | Consolidates market share, increases competitive pressure on remaining players |

SSubstitutes Threaten

The increasing adoption of public transportation in Brazilian cities poses a significant threat to parking services. As urban centers expand and governments invest in better transit systems, more people are opting for buses, subways, and trains. This trend directly impacts the demand for parking, especially in downtown areas where commuters previously relied on private vehicles.

For instance, São Paulo, a major economic hub, has seen continued investment in its metro and train lines. In 2023, the São Paulo Metro system transported over 1.5 billion passengers, a substantial increase from previous years, indicating a growing reliance on public transit for daily commutes. This shift means fewer individuals will require parking spaces, directly affecting revenue streams for parking operators like Estapar.

The rise of ride-sharing and car-sharing services presents a significant threat of substitutes for traditional parking providers like Estapar. Platforms such as Uber and 99, along with car-sharing initiatives, are increasingly making personal vehicle ownership and the associated parking needs less essential, particularly in densely populated urban areas.

These mobility alternatives offer convenience and cost-effectiveness for many users, directly siphoning demand away from parking facilities. For instance, a 2024 report indicated that ride-sharing services in major Brazilian cities now account for a substantial portion of daily urban travel, reducing the reliance on private cars and, consequently, the need for long-term or even short-term parking.

Urban planning initiatives in Brazil, particularly smart city projects, are actively encouraging alternatives to private car use. For instance, São Paulo has been expanding its Ciclofaixa network, with over 600 kilometers of dedicated bike lanes in operation as of early 2024, making cycling a more viable option for daily commutes.

These efforts, including the creation of more pedestrian-friendly zones and investments in public transport integration, can directly impact the demand for parking services. As more citizens adopt cycling or walking for shorter trips, the need for traditional parking solutions in urban centers may see a gradual decline, presenting a threat of substitution for parking providers like Estapar.

Remote work trends impact on commuter parking

The increasing adoption of remote and hybrid work models poses a significant threat of substitution for traditional commuter parking services. As more companies embrace flexible work arrangements, the demand for daily and monthly parking passes in urban business districts is likely to decrease. For instance, a 2024 survey indicated that 62% of US companies plan to maintain hybrid work policies, directly impacting the need for office-based parking.

This shift means fewer cars will be parked in commercial areas on a regular basis. Businesses that rely heavily on parking revenue, like Estapar, face a potential reduction in their customer base as employees opt to work from home or use alternative transportation methods. The long-term viability of large parking facilities in city centers could be challenged if this trend continues to solidify.

- Reduced Demand: The sustained trend of remote and hybrid work directly cuts into the need for daily commuter parking.

- Long-Term Contracts Threatened: Businesses may see a decline in demand for long-term parking contracts in business districts.

- Workforce Shift: A substantial portion of the workforce continuing to work from home diminishes the necessity for traditional office parking.

- Market Impact: Companies heavily reliant on parking revenue, such as Estapar, face a direct threat to their business model.

Emergence of new urban mobility solutions

The rise of new urban mobility solutions poses a significant threat of substitutes for traditional parking services. Beyond established options like public transit and ride-sharing, the landscape is rapidly evolving. For instance, in 2024, cities worldwide saw continued expansion in micro-mobility services, with electric scooter and bike-sharing schemes becoming increasingly prevalent. These alternatives offer convenient, often cheaper, point-to-point travel within urban centers.

The long-term implications are substantial. As autonomous vehicle fleets mature and integrate into urban transportation networks, they could further disrupt demand for parking. Imagine a future where shared autonomous vehicles drop off passengers and then proceed to their next pickup or designated charging/storage locations, bypassing the need for individual parking spaces. This shift could fundamentally alter how people navigate cities, directly impacting the need for Estapar’s core services.

- Micro-mobility growth: E-scooter and bike-sharing services continue to expand their reach in major metropolitan areas, offering alternatives to car ownership and parking.

- Autonomous vehicle potential: Advancements in self-driving technology suggest a future where vehicles may operate with less reliance on traditional parking infrastructure.

- Changing urban travel patterns: These new mobility options can lead to reduced reliance on personal vehicles, thereby decreasing demand for parking facilities.

- Cost-effectiveness: For many urban commuters, micro-mobility and shared services offer a more economical transportation solution compared to the combined costs of car ownership, fuel, insurance, and parking.

The threat of substitutes for parking services is substantial, driven by evolving urban mobility trends and changing consumer behaviors. As public transportation, ride-sharing, and micro-mobility options become more accessible and appealing, the demand for traditional parking diminishes.

The increasing adoption of remote and hybrid work models further reduces the need for daily commuter parking, impacting long-term contracts. For instance, a 2024 survey revealed that 62% of US companies planned to maintain hybrid work policies, a trend mirrored globally, directly affecting parking revenue streams.

New urban mobility solutions like e-scooters and bike-sharing schemes are expanding, offering cost-effective point-to-point travel. Furthermore, advancements in autonomous vehicle technology suggest a future where vehicles may operate with less reliance on fixed parking spaces, presenting a long-term challenge to parking infrastructure.

| Trend | Impact on Parking Demand | Supporting Data (2023-2024) |

| Public Transportation Growth | Decreased reliance on private cars, reducing parking needs. | São Paulo Metro transported over 1.5 billion passengers in 2023. |

| Ride-Sharing & Car-Sharing | Directly siphons demand from parking facilities. | Ride-sharing services account for a substantial portion of daily urban travel in major Brazilian cities. |

| Remote/Hybrid Work | Reduced demand for daily commuter parking. | 62% of US companies planned to maintain hybrid work policies in 2024. |

| Micro-mobility Expansion | Offers convenient, cheaper alternatives for short trips. | Continued expansion of e-scooter and bike-sharing schemes globally in 2024. |

| Autonomous Vehicles | Potential for reduced need for individual parking spaces. | Ongoing advancements in self-driving technology. |

Entrants Threaten

Entering the parking management sector, particularly at Estapar's operational level, demands considerable capital. This includes funds for acquiring or leasing strategic locations, constructing necessary infrastructure, and implementing sophisticated parking technology systems. For instance, developing a single large-scale parking facility can easily run into millions of dollars in construction and technology costs.

These substantial upfront financial requirements act as a significant deterrent for prospective new competitors. The need for extensive capital outlay and a prolonged commitment to recouping investments makes the industry less accessible to smaller players or those without robust financial backing, thereby reducing the immediate threat of new entrants.

Established players like Estapar have secured long-term contracts and concessions for highly desirable locations such as major airports and shopping malls. For instance, Estapar's significant presence in São Paulo's Zona Azul system, a prime urban parking area, represents a substantial barrier to entry.

New entrants face immense difficulty in acquiring similar lucrative sites, as these opportunities are typically tied up in complex, long-term agreements. This exclusivity, often involving substantial upfront investment and navigating intricate regulatory frameworks, effectively locks out potential competitors from the most profitable segments of the market.

Regulatory hurdles and complex licensing requirements significantly impede new entrants in the parking industry. Operating parking facilities, particularly those involving public concessions, demands adherence to a labyrinth of municipal and state regulations, securing diverse permits, and complying with urban planning policies. For instance, in 2024, obtaining a new parking concession in major Brazilian cities often involves lengthy approval processes that can span over a year, deterring smaller or less capitalized competitors.

Brand recognition and established customer relationships

Estapar's long-standing presence, established in 1981, has cultivated significant brand recognition and deep-seated customer relationships within Brazil's parking sector. This history translates into a substantial competitive advantage, making it difficult for new entrants to quickly gain traction. For instance, securing contracts with major airports or shopping malls, which Estapar has a proven track record with, requires a level of trust and established operational capacity that newcomers often lack.

Newcomers face the daunting task of replicating Estapar's reputation and loyalty. Building the necessary trust and a solid track record to compete for substantial contracts or attract a large customer base would necessitate considerable investment in marketing and a lengthy period of demonstrating reliability. This brand equity acts as a significant deterrent, as potential rivals must overcome not only operational hurdles but also the established preference of consumers and institutional clients.

- Brand Recognition: Estapar's brand is widely recognized across Brazil, a result of decades of operation and consistent service delivery.

- Customer Loyalty: Established relationships with key institutional clients, such as large commercial property owners and event venues, create a sticky customer base.

- Barriers to Entry: New entrants would need to invest heavily in marketing and demonstrate a similar level of reliability and service quality to challenge Estapar's market position.

- Market Trust: The trust Estapar has built over the years is a critical asset that new competitors would find challenging and time-consuming to replicate.

Technological and operational expertise requirements

The modern parking industry requires significant technological and operational expertise. New entrants must invest heavily in sophisticated systems like digital payment platforms, smart parking guidance, and data analytics to even begin competing. For instance, by the end of 2023, Estapar reported that its digital platforms handled a substantial portion of its transactions, showcasing the critical nature of these capabilities.

Estapar's established leadership in automation and mobile payment solutions creates a formidable barrier. New companies entering the market would need to replicate or surpass this level of technological integration and operational efficiency. This includes developing robust mobile applications and backend systems capable of managing complex payment processing and customer data.

- Technological Investment: New entrants face high upfront costs for developing or acquiring advanced parking management software and hardware.

- Operational Efficiency: Achieving Estapar's level of operational streamlining requires significant investment in training and process optimization.

- Data Analytics Capability: The ability to leverage data for revenue optimization and customer insights is a key differentiator that new players must develop.

The parking sector, especially for a company like Estapar, presents substantial capital requirements for new entrants. These include the costs of acquiring or leasing prime locations, building infrastructure, and implementing advanced parking technologies, with large-scale facility development easily costing millions in 2024.

These high initial investments act as a significant barrier, making the industry less accessible to smaller or less-funded competitors. The need for extensive capital and a long payback period deters many potential new players.

Estapar's established long-term contracts for desirable locations, such as major airports and shopping centers, create another hurdle. For instance, securing a concession for a prime urban parking area, like São Paulo's Zona Azul, involves navigating complex, long-term agreements that are difficult for newcomers to replicate.

Regulatory complexities and licensing further impede new entrants. Obtaining necessary permits and adhering to urban planning policies, especially for public concessions, can involve lengthy approval processes, sometimes extending over a year in major Brazilian cities as of 2024, which discourages less capitalized competitors.

The threat of new entrants is moderate due to these significant barriers. While the industry offers growth potential, the substantial capital investment, established contracts, regulatory hurdles, strong brand loyalty, and technological sophistication required to compete effectively with incumbents like Estapar limit the ease with which new companies can enter and gain market share.

Porter's Five Forces Analysis Data Sources

Our Estapar Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Estapar's official financial statements, investor relations materials, and relevant regulatory filings.

We supplement this with industry-specific reports from reputable market research firms and economic data from government sources to capture the broader competitive landscape.