Eros Media World Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eros Media World Bundle

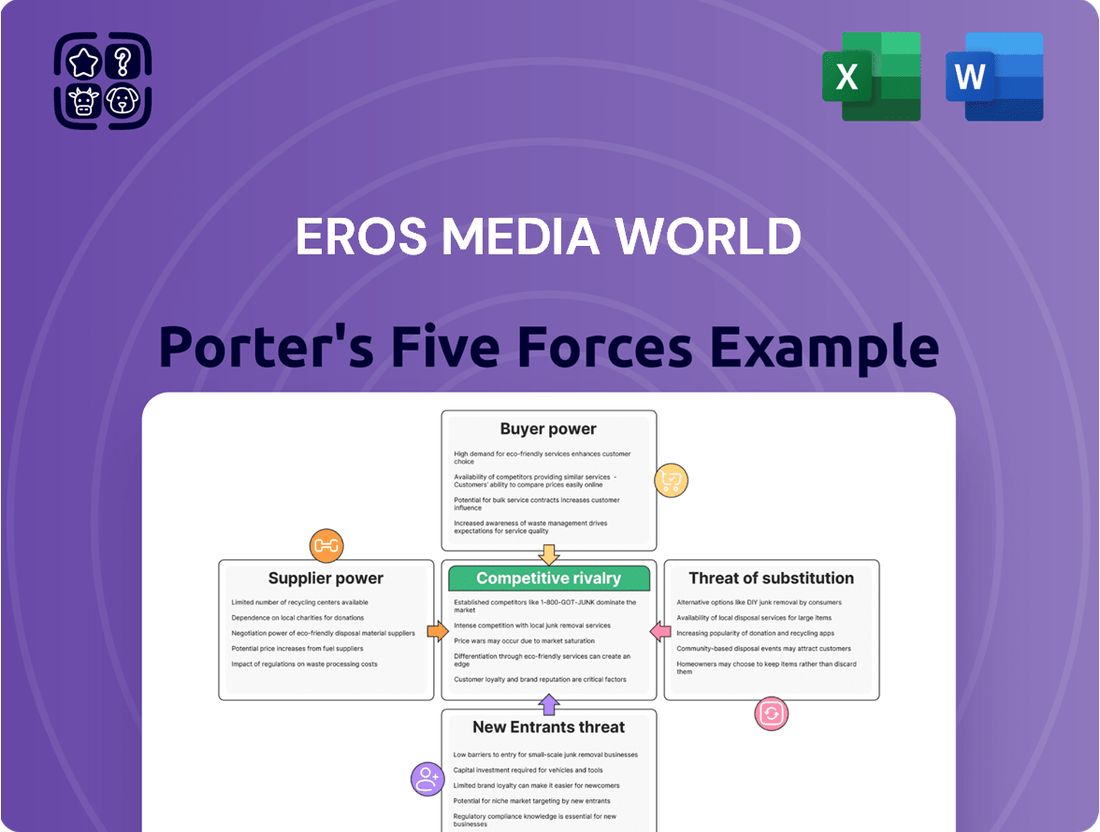

Eros Media World faces a dynamic entertainment landscape, with intense rivalry among established players and emerging digital platforms. Understanding the bargaining power of buyers and the threat of substitutes is crucial for navigating this competitive arena.

The full Porter's Five Forces Analysis reveals the real forces shaping Eros Media World’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of content creators and talent within the Indian film industry is substantial, particularly for established actors, directors, and music composers. This leverage stems from the high demand for their skills and the limited pool of truly A-list individuals. Eros Media World, like other production houses, must navigate these relationships carefully to secure desirable talent for their projects.

Securing exclusive content or top-tier talent for Eros Media World's films and streaming services hinges on successful negotiations with these creative powerhouses and their associated production entities. The intense competition for unique stories and star power can significantly escalate acquisition costs, directly impacting the company's bottom line.

In 2023, the Indian entertainment industry saw a significant rise in talent fees, with top actors commanding upwards of INR 100 crore per film. This trend underscores the considerable bargaining power held by key creative individuals, forcing companies like Eros Media World to allocate a larger portion of their budgets towards talent acquisition.

Eros Media World's reliance on independent production houses for co-productions and acquisitions means these suppliers can hold significant sway. Those with a history of box office hits or exclusive, sought-after content can negotiate better deals, potentially increasing Eros's costs.

While the market has many independent producers, the power of any single one is amplified if they dominate a niche genre or possess exclusive access to a major star. This fragmentation, however, generally limits the bargaining leverage of most individual suppliers unless they offer something truly unique or essential.

Suppliers of streaming technology, cloud services, content delivery networks (CDNs), and cybersecurity are vital for Eros Media World's operations. Major tech players often dominate these sectors, but the specialized nature of certain services and the expense associated with migrating to new platforms can grant these suppliers a moderate level of bargaining power.

For instance, a significant portion of cloud infrastructure costs can be tied to specific providers. In 2024, the global cloud computing market was valued at over $600 billion, with major players like Amazon Web Services, Microsoft Azure, and Google Cloud holding substantial market share, indicating their leverage.

Music Rights Holders

Music rights holders, including music labels and composers, hold significant bargaining power within the Indian media landscape. Music is a crucial element in Indian films and digital content, positioning these suppliers as key providers of essential intellectual property. Their ability to license popular music for films and streaming platforms means they can negotiate favorable terms, potentially increasing royalty payments and overall content production costs for companies like Eros Media World.

The leverage of music rights holders is amplified by the demand for popular and established music catalogs. In 2023, the Indian music industry continued its robust growth, with streaming services dominating revenue. This trend underscores the value of readily available, high-quality music content, allowing rights holders to command higher licensing fees. For instance, the increasing per-stream royalty rates negotiated by major labels directly impact the profitability of content creators.

- High Demand for Music Content: Music is a vital component of Indian films and digital streaming, making music rights holders indispensable suppliers.

- Catalog Strength: Possessing extensive and popular music catalogs grants music labels and composers considerable leverage in licensing negotiations.

- Increased Production Costs: Strong bargaining power can translate into higher royalty payments, directly escalating content production expenses for media companies.

- Industry Growth: The continued expansion of the Indian music industry, particularly through streaming, reinforces the financial clout of music rights holders.

Marketing and Distribution Channels

While Eros Media World operates its own distribution and streaming services, external entities like marketing agencies, cinema chains, and satellite TV providers can function as suppliers of audience reach. Their capacity to control access and visibility, especially for films shown in theaters or broadcast via syndication, gives them a degree of bargaining leverage. For example, in 2024, the average cost for a prime-time television advertising slot in India could range significantly, impacting the supplier's influence on promotional reach.

The bargaining power of these suppliers is tied to their ability to secure favorable terms for prime advertising slots or extensive promotional campaigns. In 2024, the Indian media and entertainment industry saw continued growth, with digital advertising spend projected to increase by approximately 15-20%, indicating a dynamic market where negotiation for visibility remains crucial for companies like Eros Media World.

- Supplier Influence: External marketing agencies, cinema chains, and satellite TV providers offer critical audience reach.

- Negotiation Leverage: Their control over audience access and visibility grants them bargaining power.

- Market Dynamics (2024): The growing digital advertising spend in India highlights the importance of securing favorable terms for promotion.

- Strategic Importance: Negotiating advantageous terms for prime slots and widespread promotion is vital for maximizing visibility.

The bargaining power of suppliers for Eros Media World, particularly content creators and talent, is significant due to the high demand and limited availability of A-list individuals in the Indian film industry. This leverage is further amplified by the increasing talent fees, with top actors commanding substantial sums, as seen in 2023 where fees could exceed INR 100 crore per film.

Independent production houses that possess exclusive, sought-after content or a strong track record of box office success can negotiate more favorable terms, potentially increasing Eros Media World's costs. Similarly, music rights holders wield considerable power due to the critical role of music in Indian entertainment and the robust growth of the music industry, especially through streaming, which has driven up licensing fees.

Suppliers of essential technology, such as cloud services and CDNs, also hold moderate bargaining power, especially major tech players dominating the market. The global cloud computing market, valued at over $600 billion in 2024, illustrates the significant market share and leverage held by key providers, making migration costly for companies like Eros Media World.

External entities providing audience reach, like marketing agencies and cinema chains, possess bargaining leverage through their control over visibility and access. The dynamic Indian media market, with digital advertising spend projected to grow by 15-20% in 2024, underscores the importance of securing advantageous promotional terms.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Eros Media World | 2023/2024 Data Point |

|---|---|---|---|

| Content Creators & Talent | High demand, limited A-list pool, strong negotiation skills | Increased talent acquisition costs | Top actor fees > INR 100 crore (2023) |

| Independent Production Houses | Exclusive content, box office success, niche dominance | Higher acquisition costs, potential for better deal terms | N/A (Qualitative assessment) |

| Music Rights Holders | Essential role of music, strong catalog, streaming growth | Higher licensing fees, increased production expenses | Robust growth in Indian music industry revenue (2023) |

| Technology Providers (Cloud, CDN) | Market dominance, specialized services, high switching costs | Significant cloud infrastructure costs, moderate leverage | Global cloud market > $600 billion (2024) |

| Audience Reach Providers (Marketing, Cinemas) | Control over visibility, prime advertising slots | Negotiation for promotional terms, impact on reach | Digital ad spend growth ~15-20% (2024 projection) |

What is included in the product

This analysis unpacks the competitive forces impacting Eros Media World, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the media industry.

Instantly identify and quantify competitive pressures, allowing for targeted strategies to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Individual subscribers to Eros Now possess a moderate to high degree of bargaining power. This is largely due to the crowded streaming market, where consumers have a plethora of alternative platforms to choose from, each offering a unique content mix. For instance, in 2024, the global video streaming market was valued at over $100 billion, highlighting the intense competition Eros Now faces.

Consumers can readily switch between services based on factors like the breadth of their content library, subscription pricing, and the overall user experience. This ease of switching makes Eros Media World particularly attentive to its subscription fees and the perceived value of its content. A key driver for subscriber retention is the availability of exclusive content that competitors do not offer.

The bargaining power of theatrical audiences is significant, as individual moviegoers ultimately decide which films succeed at the box office. Factors like critical reviews, peer recommendations, and the draw of star talent heavily influence their choices, giving them substantial leverage. In 2023, the global box office revenue reached approximately $26 billion, a substantial increase from previous years, demonstrating the audience's collective power to drive demand for compelling content.

Television channels, particularly major networks with substantial audience reach, wield considerable bargaining power when acquiring syndication rights for Eros Media World's extensive film library. Their ability to negotiate favorable licensing fees is directly influenced by factors such as projected viewership, the exclusivity of content, and the specific demand for particular film titles.

The pricing power of these broadcasters is closely tied to the perceived popularity and current relevance of Eros Media World's content. For instance, in 2024, the average cost for a major network to license a popular Bollywood film for a single broadcast slot can range from $50,000 to $250,000, depending on the film's age and star power.

International Distributors/Aggregators

International distributors and aggregators are crucial for Eros Media World's global reach, acting as significant customers in markets outside India. Their extensive distribution networks and established market presence grant them substantial bargaining power when negotiating content licensing deals. For instance, major international streaming platforms often command favorable terms due to their ability to reach millions of viewers, directly impacting Eros Media World's international revenue streams.

These powerful intermediaries can dictate terms based on their market access and the volume of content they acquire. Eros Media World's success in maximizing revenue from these territories is directly tied to its capacity to negotiate advantageous licensing agreements with these key players.

- Market Access: International distributors possess established channels and relationships with local broadcasters and platforms, giving them significant leverage.

- Negotiating Power: Their ability to aggregate content from multiple sources strengthens their position in licensing negotiations with content creators like Eros Media World.

- Revenue Dependence: Eros Media World relies on these distributors to monetize its content internationally, making them key customers whose terms can heavily influence profitability.

- Platform Dominance: The rise of global streaming giants means a few dominant players hold considerable sway over content acquisition and licensing fees.

Advertisers (on AVOD models)

Advertisers hold significant sway in an AVOD model, as they can easily shift their spending to competing platforms that offer better reach or more targeted demographics. For Eros Media World, securing and retaining advertisers hinges on demonstrating robust viewership and audience engagement metrics. For instance, in 2024, the global digital advertising market reached an estimated $600 billion, highlighting the intense competition for ad dollars. Eros Now would need to provide compelling data on its subscriber base and viewing habits to command favorable advertising rates.

The bargaining power of advertisers is amplified by the availability of alternative platforms and the potential for audience fragmentation. Advertisers can leverage this by demanding lower ad rates or more favorable placement if Eros Media World's viewership isn't meeting their expectations. In 2024, streaming services reported varying CPM (Cost Per Mille) rates, with some AVOD platforms seeing CPMs ranging from $5 to $15, depending on audience quality and platform demand. Eros Media World's ability to attract and retain advertisers will directly influence its revenue streams.

- Advertisers can easily switch between AVOD platforms based on audience reach and demographic targeting.

- Strong viewership and engagement metrics are crucial for Eros Media World to attract and retain advertisers.

- The global digital advertising market's size in 2024, estimated at $600 billion, underscores the competitive landscape for ad revenue.

- Eros Media World must offer compelling data to negotiate favorable advertising rates, with AVOD CPMs varying significantly in 2024.

Individual subscribers to Eros Now hold considerable bargaining power due to the vast array of streaming options available. In 2024, the global video streaming market exceeded $100 billion, indicating intense competition where consumers can easily switch services based on price and content. This power is further amplified by the availability of exclusive content, a key factor in subscriber retention.

The bargaining power of theatrical audiences is significant, as their choices directly impact box office success. Factors like reviews and star power influence their decisions, with global box office revenue reaching approximately $26 billion in 2023, showcasing audience collective leverage.

Television channels and international distributors also wield substantial bargaining power. Their ability to negotiate favorable licensing fees for Eros Media World's content is influenced by projected viewership and market access. For instance, in 2024, licensing a popular Bollywood film for a single broadcast could range from $50,000 to $250,000.

Advertisers in the AVOD model can shift spending to competing platforms, giving them leverage. Eros Media World must demonstrate strong viewership to secure favorable ad rates, especially in a global digital advertising market valued at $600 billion in 2024, where AVOD CPMs in 2024 varied between $5 and $15.

Full Version Awaits

Eros Media World Porter's Five Forces Analysis

This preview displays the complete Eros Media World Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally compiled strategic tool.

Rivalry Among Competitors

Eros Media World contends with formidable rivals such as Yash Raj Films and Dharma Productions, alongside global entertainment giants with substantial Indian footprints. These competitors fiercely battle for top talent, valuable content rights, and prime distribution networks, all aiming to capture a significant share of India's booming film industry.

The competitive landscape in India's film sector is characterized by intense bidding wars for promising projects and aggressive, high-spending marketing campaigns. For instance, in 2023, the Indian box office saw a significant rebound, with gross collections estimated to have surpassed INR 12,000 crore, highlighting the high stakes involved in capturing audience attention.

The competitive rivalry from global streaming giants like Netflix, Amazon Prime Video, and Disney+ Hotstar is a major force impacting Eros Media World. These behemoths, with their vast financial resources, are aggressively expanding their reach and content offerings, directly challenging Eros Now's market share. For instance, Netflix alone reported over 270 million paid subscribers globally as of the first quarter of 2024, showcasing its immense scale.

This intense competition forces Eros Media World to constantly innovate and differentiate its content strategy. The global players offer a diverse mix of international hits and localized content, compelling Eros Now to focus on the quality and exclusivity of its South Asian library to stand out. Their aggressive content acquisition and production budgets, often in the billions of dollars annually, set a high bar that smaller players must navigate carefully.

The sheer volume of content produced by these global giants also affects Eros Media World's ability to secure desirable content and talent. Their strategic investments in original programming and exclusive licensing deals can significantly impact Eros Now's content pipeline and its capacity to attract and retain subscribers in a crowded marketplace.

India's vibrant linguistic diversity fuels a robust competitive landscape for regional content producers and platforms. These entities, deeply attuned to local cultural nuances and audience preferences, present a substantial challenge to pan-Indian content providers like Eros Media World.

For instance, the South Indian film industries, particularly Tamil and Telugu cinema, consistently outperform Hindi cinema at the box office, demonstrating the power of regional appeal. In 2023, films like Jailer (Tamil) and RRR (Telugu) achieved massive global success, underscoring the significant market share regional content commands. This trend is further amplified by the rise of localized streaming services that cater specifically to these linguistic pockets, offering content that resonates more profoundly than one-size-fits-all approaches.

Eros Media World must therefore strategically develop and distribute content that not only appeals to a broad audience but also demonstrates a keen understanding and respect for India's varied linguistic and cultural segments to effectively compete.

Television Channels and Cable Providers

Traditional television channels and cable providers continue to exert significant competitive pressure, particularly in semi-urban and rural markets where linear TV viewing remains prevalent. These established players offer a consistent flow of content, including films and series, often packaged at a perceived lower cost through cable bundles. Eros Media World must contend for viewer attention and advertising revenue against these deeply rooted media outlets.

In 2024, the linear TV advertising market, while evolving, still represents a substantial portion of media spend. For instance, while digital advertising continues its ascent, traditional TV advertising revenue in India, a key market for Eros Media World, was projected to grow by around 8-10% in 2024, indicating sustained advertiser interest in reaching broad audiences through this medium.

- Linear TV Dominance: Traditional channels maintain strong viewership in non-metro areas, making them formidable rivals.

- Bundled Value Proposition: Cable packages offer perceived cost-effectiveness, drawing audiences away from standalone streaming options.

- Advertising Competition: Eros Media World vies for advertising budgets against established broadcasters with large, consistent reach.

Piracy and Unregulated Content

Content piracy, both online and offline, acts as a potent form of competitive rivalry by providing unauthorized free access to films and shows. This illicit distribution directly siphons off potential revenue streams that would otherwise benefit Eros Media World from theatrical releases, subscriptions, and syndication deals.

While not a direct competitor in the traditional sense, piracy significantly impacts market share and revenue. For instance, reports from 2024 indicate that the global digital piracy market continues to be a substantial drain on the creative industries, with billions of dollars in lost revenue annually.

Eros Media World, like other players in the industry, must allocate resources towards robust anti-piracy strategies. These investments are crucial for safeguarding intellectual property and mitigating the financial damage caused by unauthorized content distribution.

- Erosion of Revenue: Piracy directly undermines sales and subscription models.

- Market Share Dilution: Free, unauthorized content attracts viewers away from legitimate platforms.

- Increased Costs: Investment in anti-piracy technology and legal action adds to operational expenses.

- Brand Perception: Widespread piracy can impact the perceived value of licensed content.

Eros Media World faces intense competition from domestic production houses like Yash Raj Films and Dharma Productions, as well as global streaming giants such as Netflix and Amazon Prime Video. These rivals actively compete for talent, content rights, and distribution channels, driving up costs and fragmenting market share. The Indian box office saw robust recovery in 2023, exceeding INR 12,000 crore, underscoring the high stakes in this competitive arena.

Regional content producers, particularly from South Indian cinema, also pose a significant challenge, with films like Jailer and RRR achieving major success in 2023. Traditional television channels continue to hold sway, especially in non-metro areas, with linear TV advertising projected to grow by 8-10% in 2024. Furthermore, content piracy remains a persistent threat, costing the industry billions annually.

| Competitor Type | Key Players | Impact on Eros Media World | 2023/2024 Data Point |

|---|---|---|---|

| Domestic Studios | Yash Raj Films, Dharma Productions | Talent acquisition, content rights competition | Indian Box Office > INR 12,000 crore |

| Global Streamers | Netflix, Amazon Prime Video | Subscriber acquisition, content spending wars | Netflix global subscribers > 270 million (Q1 2024) |

| Regional Content | Tamil, Telugu film industries | Market share diversion, localized appeal | Jailer (Tamil), RRR (Telugu) major successes |

| Linear TV | Traditional broadcasters | Audience retention, advertising revenue competition | Linear TV ad revenue projected 8-10% growth (2024) |

| Piracy | Unauthorized distribution | Revenue loss, market share dilution | Global piracy costs billions annually |

SSubstitutes Threaten

Consumers have an overwhelming number of digital entertainment choices, from social media scrolling and online gaming to user-generated content on platforms like TikTok and YouTube, and the growing popularity of podcasts. These diverse options directly vie for consumers' limited leisure time and attention, potentially drawing engagement away from Eros Media World's traditional film and streaming offerings.

The sheer accessibility of these substitutes presents a significant challenge. For instance, in 2024, the global online gaming market was projected to reach hundreds of billions of dollars, demonstrating a massive allocation of consumer entertainment budgets and time towards non-film/series content. Similarly, the continued growth of short-form video platforms indicates a shift in viewing habits that Eros Media World must consider.

Live entertainment like concerts and sporting events directly competes with Eros Media World's offerings by capturing consumer leisure time and discretionary spending. For instance, the global live music industry was projected to reach over $10 billion in 2024, demonstrating a significant draw for consumers seeking unique experiences.

Theatrical plays and other cultural performances also present a substitute by offering immersive, in-person entertainment that can be more appealing than at-home viewing for certain demographics. This competition necessitates Eros Media World to emphasize the convenience, accessibility, and unique value proposition of its digital content to retain audience engagement.

Despite the digital revolution, traditional media like linear TV, radio, and print still hold sway, especially with older demographics. For instance, in 2024, linear TV viewership, while declining, still represented a substantial portion of overall video consumption in many markets, diverting advertising budgets. This persistence means they remain viable substitutes for digital entertainment and news, impacting Eros Media World's audience capture and revenue streams.

Home Video and Physical Media

While the trend is clearly towards digital, the market for physical media like DVDs and Blu-rays, along with transactional video-on-demand (TVOD) or electronic sell-through (EST), still presents a substitute for subscription streaming services like Eros Now and even cinema attendance. Consumers who value ownership, have unreliable internet, or prefer a tangible product might still choose these formats.

This persistent, albeit shrinking, demand means that Eros Media World must consider these alternatives when evaluating its market position. For instance, while streaming dominates, a segment of the audience might still purchase physical copies of popular films, bypassing subscription models entirely.

- Physical media sales, though declining, still represent a portion of consumer spending on entertainment content.

- Limited internet access or a preference for ownership are key drivers for consumers choosing physical media or transactional digital purchases.

- The threat of substitutes from physical media is diminishing but remains relevant for specific content genres or audience segments.

- Eros Media World's strategy needs to acknowledge this continued, albeit niche, demand for non-subscription-based content consumption.

Reading and Educational Content

The rise of books, e-books, and online courses presents a significant threat of substitutes for entertainment companies like Eros Media World. These alternatives cater to individuals seeking intellectual stimulation or skill development, directly competing for leisure time. For instance, the global e-book market was valued at approximately $17.9 billion in 2023 and is projected to grow, indicating a substantial alternative to traditional media consumption.

These educational substitutes consume discretionary time that audiences might otherwise allocate to watching films or series. As of 2024, the online learning market is booming, with platforms like Coursera and Udemy reporting millions of active users, demonstrating a strong preference for self-improvement content. Eros Media World must therefore ensure its entertainment offerings are compelling enough to capture audience attention against these enriching and often more productive alternatives.

- Books and E-books: Valued at nearly $18 billion globally in 2023, offering intellectual engagement.

- Online Courses: Platforms like Coursera and Udemy boast millions of users in 2024, competing for leisure time.

- Time Allocation: Leisure hours are finite, and educational content directly competes with entertainment consumption.

- Content Competitiveness: Eros Media World needs to maintain high engagement levels to be chosen over self-improvement alternatives.

The threat of substitutes for Eros Media World is substantial, encompassing a wide array of entertainment and leisure activities. Consumers have an abundance of choices, from social media and online gaming to live events and even educational pursuits like online courses, all vying for limited leisure time and discretionary spending. The sheer volume and accessibility of these alternatives mean Eros Media World must continuously innovate and offer compelling content to retain audience engagement.

The global online gaming market, projected to reach hundreds of billions of dollars in 2024, highlights a significant diversion of consumer attention and budget away from traditional film and series. Similarly, the live music industry, expected to exceed $10 billion in 2024, offers a powerful experiential substitute. Even the persistent, though shrinking, market for physical media and transactional digital purchases represents a segment of consumers bypassing subscription models entirely.

The rise of e-books, valued at nearly $18 billion globally in 2023, and the booming online learning market, with platforms like Coursera reporting millions of users in 2024, further underscore this competitive landscape. These substitutes cater to intellectual stimulation and self-improvement, directly competing for leisure hours that could otherwise be spent on Eros Media World's offerings.

| Substitute Category | 2023/2024 Data Point | Implication for Eros Media World |

|---|---|---|

| Online Gaming | Projected to reach hundreds of billions USD (2024) | Significant diversion of time and budget from film/series. |

| Live Music | Projected to exceed $10 billion USD (2024) | Captures discretionary spending and desire for unique experiences. |

| E-books | Valued at ~$17.9 billion USD (2023) | Competes for leisure time with intellectual engagement. |

| Online Learning | Millions of active users on platforms like Coursera/Udemy (2024) | Attracts time for self-improvement, away from entertainment. |

| Physical Media/TVOD | Still represents a portion of consumer spending | Offers alternative ownership models, bypassing subscriptions. |

Entrants Threaten

Entering the Indian film and digital content arena demands significant financial outlay for acquiring, co-producing, and marketing movies and shows. Newcomers must invest heavily in a strong content library to draw in subscribers or cinema-goers, presenting a substantial financial hurdle.

For instance, major content acquisition deals in 2024 for blockbuster films can run into hundreds of crores of rupees. This high initial investment acts as a powerful deterrent for many aspiring new entrants, limiting the competitive landscape.

Eros Media World, like its competitors, benefits from deeply entrenched brand loyalty and robust distribution channels across theatrical releases, television syndication, and its proprietary streaming service. Newcomers face a significant challenge in replicating this established market presence, necessitating substantial investment in marketing and a considerable timeframe to cultivate a comparable audience reach. Overcoming ingrained consumer preferences for familiar brands and viewing habits presents a formidable barrier to entry.

Newcomers face significant hurdles in securing top-tier creative talent, such as actors, directors, and writers, as well as establishing a robust pipeline of compelling content. Established media companies often leverage deep-rooted relationships and exclusive contracts, creating a formidable barrier for emerging players seeking to attract sought-after talent and projects.

In 2024, the competition for A-list talent intensified, with major studios and streaming platforms investing heavily in talent acquisition. For instance, major streaming services reportedly spent billions on content and talent acquisition in 2024, making it exceptionally difficult for new entrants to secure the necessary resources and creative powerhouses to compete effectively.

Regulatory Hurdles and Censorship

The Indian media and entertainment sector faces significant regulatory complexities, including stringent censorship boards and evolving content guidelines. New players must meticulously understand and adhere to these local rules, which can introduce substantial operational challenges and prolonged launch timelines.

Navigating this intricate regulatory environment represents a considerable barrier to entry. For instance, the Broadcast Audience Research Council (BARC) India, which sets viewership measurement standards, necessitates compliance from all broadcasters. Failure to meet these benchmarks, such as those related to data reporting accuracy, can lead to penalties and reputational damage.

- Regulatory Compliance Costs: New entrants must allocate resources for legal counsel and compliance officers to manage licensing and content approval processes.

- Content Guidelines: Adherence to guidelines set by bodies like the Central Board of Film Certification (CBFC) impacts production and distribution strategies.

- Data Reporting Standards: Compliance with BARC India’s measurement standards is crucial for advertising revenue.

- Policy Changes: The dynamic nature of government policies, such as those related to foreign direct investment in media, can create uncertainty for potential entrants.

Technological Infrastructure and Scalability

The threat of new entrants in the digital media space, particularly for platforms like Eros Media World, is significantly influenced by the high cost and complexity of technological infrastructure. Building and maintaining a robust streaming platform requires substantial investment in sophisticated technology for content delivery, data analytics, and user experience. For instance, major streaming services often spend billions annually on technology and content acquisition, a figure that new players must contend with.

New entrants would need to develop or acquire advanced capabilities in areas such as content encoding, adaptive bitrate streaming, and content management systems. This technological barrier is further amplified by the need for scalability to support millions of concurrent users, a feat demanding significant capital and specialized expertise. The ongoing evolution of streaming technology, including the push towards higher resolutions and immersive experiences, necessitates continuous investment, making it a formidable hurdle for newcomers.

- High Infrastructure Costs: Significant capital is required for servers, content delivery networks (CDNs), and software development.

- Technological Expertise: Access to specialized talent in areas like AI for content recommendation and cybersecurity is crucial.

- Scalability Demands: The ability to rapidly scale operations to accommodate a growing user base is a key challenge.

The threat of new entrants remains moderate for Eros Media World. While the Indian media landscape is attractive, substantial capital investment is required for content acquisition and production, with major film deals in 2024 costing hundreds of crores. Established players like Eros benefit from strong brand loyalty and extensive distribution networks, making it difficult for newcomers to gain comparable market share without significant marketing investment and time.

Securing top creative talent is another significant barrier, as major studios and streaming platforms invested billions in talent and content acquisition in 2024, creating intense competition for sought-after artists. Furthermore, navigating India's complex regulatory environment, including compliance with bodies like BARC India for viewership standards, adds operational challenges and costs for new players.

The technological infrastructure for digital media also presents a high barrier. Building scalable streaming platforms requires substantial investment in sophisticated technology and specialized expertise, with ongoing evolution demanding continuous capital outlay. These combined factors, including high initial costs, established brand power, talent acquisition challenges, regulatory hurdles, and technological demands, collectively moderate the threat of new entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eros Media World is built upon a foundation of robust data, including the company's annual reports, SEC filings, and industry-specific market research from firms like Statista and IBISWorld. We also incorporate insights from financial analyst reports and news from reputable business publications to provide a comprehensive view of the competitive landscape.