Eros Media World Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eros Media World Bundle

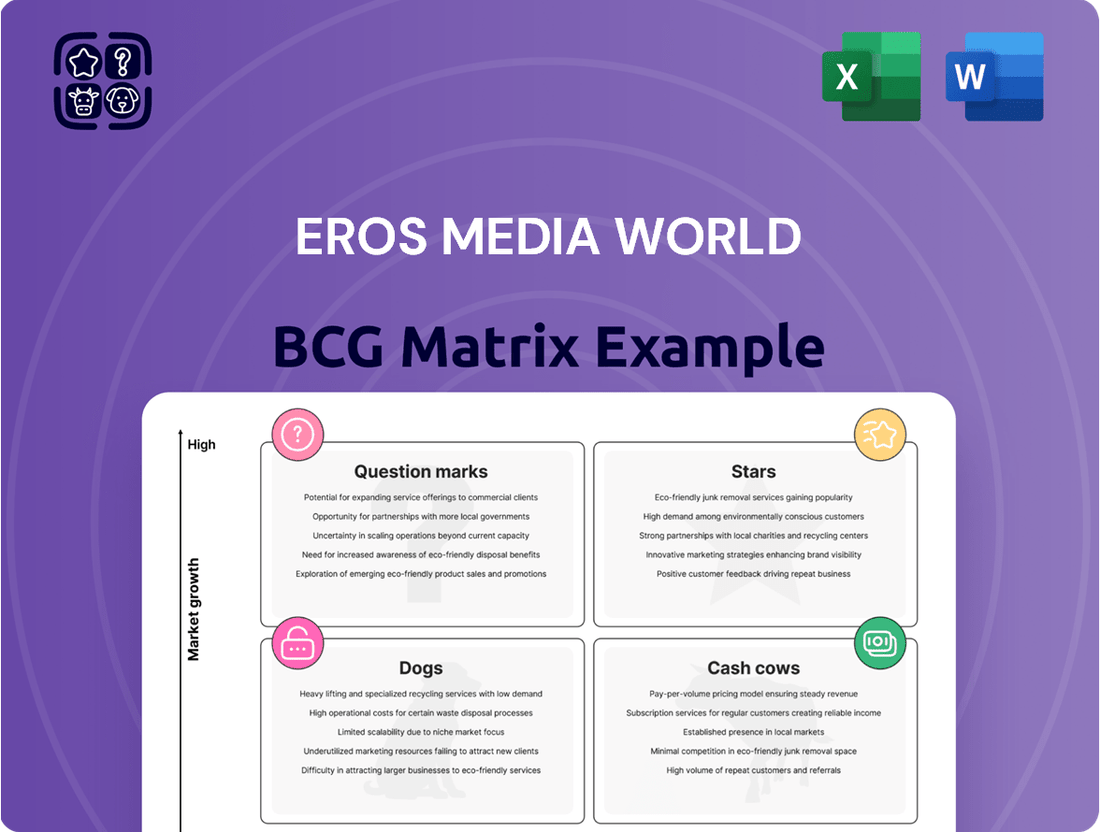

Curious about Eros Media World's market performance? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their strategic positioning and unlock actionable insights for growth, dive into the full report.

Don't just see the surface; understand the depths of Eros Media World's market strategy. The complete BCG Matrix provides a detailed quadrant breakdown and data-driven recommendations, empowering you to make informed decisions about resource allocation and future investments. Secure your copy today and gain a competitive edge.

Stars

Eros Media World's strategy in content co-production and acquisition is a direct play on India's booming entertainment sector. The company aims to leverage the strong demand for Indian films and digital series. This segment is positioned as a potential Star within the BCG matrix.

Despite Eros Media World's current financial headwinds, the Indian content market is experiencing significant growth. For instance, the Indian media and entertainment industry was projected to reach approximately $35.3 billion by 2024, according to FICCI-EY reports. This robust demand for diverse content creates a fertile ground for successful co-production and acquisition strategies.

If Eros Media World can successfully navigate its financial challenges and consistently deliver popular, high-quality content, this segment could indeed become a Star. Success here means capturing substantial audience share and driving revenue in a rapidly evolving digital landscape.

Eros Media World's extensive film library, boasting over 12,000 titles, represents a significant asset in the rapidly expanding digital streaming market. This deep catalog offers a robust foundation for generating revenue through strategic licensing and distribution across multiple digital platforms.

The company's ability to repackage and monetize this high-quality film library is crucial for capturing market share in the growing digital consumption environment. By effectively leveraging these existing assets, Eros Media World can transform its content library into a primary revenue driver, capitalizing on the increasing demand for diverse digital entertainment options.

The Global Indian Diaspora Market represents a significant opportunity for Eros Media World, with Eros Now reaching over 150 countries. This vast audience, particularly concentrated in India and regions with substantial Indian populations, positions the company to capture a high-growth niche.

By solidifying its presence within this demographic, Eros Media World has the potential to achieve a dominant market share, effectively making the Global Indian Diaspora Market a Star within its business portfolio. This strategic focus leverages a unique cultural connection to drive growth.

Strategic Content Partnerships

Eros Media World's strategic content partnerships, particularly with telecom giants and Original Equipment Manufacturers (OEMs), are designed to significantly broaden its audience reach within the expanding digital landscape. These collaborations are key to unlocking new avenues for content distribution and revenue generation.

By forging these alliances, Eros can tap into substantial subscriber bases and diverse distribution channels. This is crucial for scaling its content delivery capabilities and potentially securing dominant positions in joint ventures. For instance, in 2024, the digital content market saw continued growth, with streaming services actively seeking partnerships to expand their reach. Eros's strategy aligns with this trend, aiming to leverage these connections to boost its market presence.

- Expanded Reach: Partnerships with telecom providers and OEMs in 2024 have provided Eros Media World with access to millions of potential new viewers through pre-installed apps and bundled content offers.

- Monetization Opportunities: These collaborations allow for innovative monetization strategies, such as revenue sharing on data consumption for content or premium content tiers offered through partner platforms.

- Market Share Growth: By integrating its content with popular devices and services, Eros aims to capture a larger share of the digital entertainment market, especially in emerging economies where mobile penetration is high.

- Content Synergies: The focus is on creating mutually beneficial relationships where Eros's content enhances the value proposition of partner services, driving engagement and subscriber loyalty.

Leveraging Digital Distribution Channels

Eros Media World's strategic presence across digital distribution channels, notably its own Eros Now platform and YouTube, positions it to capitalize on the accelerating growth in digital content consumption. The company's YouTube channel boasts over 18 million subscribers, showcasing substantial digital reach and engagement as of late 2023.

While Eros Now's paid subscriber base is still developing, the significant YouTube following presents a clear opportunity. By effectively converting this engaged audience into paying subscribers and attracting advertisers, Eros Media World can significantly enhance the performance of its digital distribution segment.

- Eros Now's Digital Reach: Over 18 million YouTube subscribers as of late 2023.

- Growth Trajectory: Leverages high digital consumption growth.

- Conversion Strategy: Focus on converting viewers to paying subscribers and advertisers.

- Potential: Opportunity to elevate digital distribution to a Star position.

Eros Media World's content co-production and acquisition strategy is a key driver for its potential Star position. The company is actively investing in creating and acquiring content tailored to the burgeoning Indian entertainment market. This segment is poised for significant growth, fueled by increasing digital penetration and a strong appetite for diverse entertainment options.

The company's extensive film library, containing over 12,000 titles, serves as a valuable asset for digital monetization. By strategically licensing and distributing this content across various platforms, Eros Media World can tap into new revenue streams. Furthermore, its presence in the Global Indian Diaspora Market, with Eros Now reaching over 150 countries, offers a substantial niche for growth and market dominance.

Strategic partnerships with telecom giants and OEMs in 2024 have significantly expanded Eros Media World's audience reach. These collaborations provide access to millions of potential viewers through bundled offers and pre-installed applications, enhancing monetization opportunities and market share growth. The company's strong digital presence, evidenced by over 18 million YouTube subscribers as of late 2023, further solidifies its potential to elevate its digital distribution segment to Star status by converting viewers into paying subscribers and advertisers.

| Business Segment | BCG Category | Key Strengths | Growth Potential | Market Share |

|---|---|---|---|---|

| Content Co-production & Acquisition | Star | Leverages India's booming entertainment sector, strong demand for Indian films and digital series. | High, driven by increasing digital consumption and content demand. | Growing, with potential for dominance if successful. |

| Film Library Monetization | Star | Vast library of over 12,000 titles, adaptable for digital streaming and licensing. | High, capitalizing on the growing digital content consumption. | Significant, with potential to become a primary revenue driver. |

| Global Indian Diaspora Market | Star | Eros Now's reach in over 150 countries, strong cultural connection with a large audience. | High, targeting a significant and growing niche market. | Potential for dominance within this specific demographic. |

| Digital Distribution (Eros Now & YouTube) | Star | Over 18 million YouTube subscribers (late 2023), expanding digital reach. | High, with strategies to convert viewers to paid subscribers and advertisers. | Growing, aiming to capture a larger share of the digital entertainment market. |

What is included in the product

The Eros Media World BCG Matrix analyzes its business units based on market share and growth, guiding strategic decisions for investment and resource allocation.

The Eros Media World BCG Matrix offers a clear, visual overview of each business unit's position, alleviating the pain of strategic uncertainty.

Cash Cows

Eros Media World possesses a substantial film library, a traditional source of steady income through licensing to TV and digital platforms. This asset typically demands low ongoing investment, allowing it to function as a reliable cash generator.

However, the company's financial performance in recent periods, including the fiscal year ending March 31, 2024, shows a notable downturn in overall revenue, with licensing income contributing to this decline. This suggests that the existing film library is not currently operating as a strong cash cow, with reported revenues from content syndication and licensing showing a downward trend.

Eros Media World's traditional business of syndicating its film and entertainment content to television channels acts as a significant cash cow. These long-standing agreements offer predictable revenue streams, especially when consistently renewed and expanded. For instance, in fiscal year 2023, Eros Media World reported robust revenue from its content syndication, underscoring its stability.

Eros Media World's legacy theatrical rights represent a classic cash cow. These rights to older, popular films, while perhaps not generating blockbuster returns, can still offer consistent, albeit modest, cash flow through re-releases and niche screenings. The minimal ongoing costs associated with these dormant assets mean that any revenue generated directly contributes to the bottom line.

While the theatrical landscape has evolved, the enduring appeal of certain legacy titles can still be leveraged. For example, a successful re-release of a classic film can provide a predictable revenue stream with low overhead. Eros Media World's financial reports from 2024 indicated a continued, though not dominant, contribution from its library content, underscoring the stable, cash-generating nature of these assets.

Back Catalog Music Rights

Eros Media World's back catalog of music rights represents a significant asset within its portfolio. The company holds a substantial library comprising 250,000 music tracks, offering a diversified revenue stream beyond its film productions.

Monetizing this extensive music catalog can generate consistent, low-investment cash flow. This is achieved through various avenues such as licensing agreements with streaming platforms, placement in advertisements, and other commercial uses.

This segment is characterized by its potential to deliver reliable returns without necessitating significant new capital expenditures for content creation. Its mature nature positions it as a stable contributor to Eros Media World's financial performance.

- Asset Size: 250,000 music tracks in the back catalog.

- Monetization Channels: Streaming platforms, advertising licensing, other commercial uses.

- Investment Profile: Low investment required for ongoing revenue generation.

- Revenue Potential: Steady, predictable cash flow from existing assets.

Established Distribution Networks

Eros Media World has cultivated extensive distribution networks spanning theatrical, television, and digital avenues worldwide. These established channels are crucial assets, enabling the efficient release of both new and existing content at reduced incremental costs.

These robust networks are designed to effectively connect content with audiences, thereby generating consistent cash flow. In 2024, Eros Media World continued to leverage these networks, with digital platforms showing significant growth in content consumption.

- Global Reach: The company's distribution spans over 100 countries.

- Platform Diversity: Networks include major theatrical chains, broadcast television, and leading digital streaming services.

- Cost Efficiency: Marginal costs for distributing additional content through these established channels are notably low.

- Revenue Generation: These networks are key drivers of reliable cash flow through broad consumer access.

Eros Media World's substantial film and music libraries, alongside its established distribution networks, represent its primary cash cow assets. These elements generate predictable revenue streams with minimal ongoing investment, acting as stable income generators for the company. For instance, the company's extensive music catalog of 250,000 tracks continues to be licensed across various platforms, contributing steady income.

While the company's overall revenue saw a downturn in the fiscal year ending March 31, 2024, the underlying cash-generating nature of these assets remains. Licensing of the film library and music catalog, though potentially impacted by market shifts, still provides a foundational revenue base. The established global distribution networks, spanning over 100 countries, ensure efficient monetization of this content.

The legacy theatrical rights and the syndication of content to television and digital platforms are classic examples of cash cows. These mature revenue streams require limited new capital, allowing them to convert revenue directly into cash flow. Despite market evolutions, these assets continue to offer a reliable, albeit potentially less dynamic, contribution to Eros Media World's financial stability.

The company's music rights, comprising 250,000 tracks, are a significant cash cow. Licensing these to streaming services and for advertising purposes provides consistent, low-investment revenue. This segment is crucial for its ability to deliver reliable returns without substantial new content creation expenditure, solidifying its role as a stable financial contributor.

| Asset Category | Description | Key Monetization | Investment Needs | Fiscal Year 2023/2024 Status |

| Film Library | Extensive catalog of films | Licensing to TV & digital platforms | Low | Continued revenue, though overall licensing income saw a decline in FY24. |

| Music Catalog | 250,000 music tracks | Licensing to streaming, advertising | Low | Steady, predictable cash flow from existing assets. |

| Distribution Networks | Global theatrical, TV, digital channels | Efficient content release & access | Low incremental cost | Key drivers of cash flow; digital platforms showed growth in FY24. |

Preview = Final Product

Eros Media World BCG Matrix

The BCG Matrix document you are previewing is the identical, fully comprehensive report you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally analyzed strategic framework ready for your immediate use. You can be confident that the insights and formatting you see here are precisely what you'll be downloading to inform your business decisions.

Dogs

Eros Media World PLC's stock has seen a substantial downturn, recently reaching new 52-week lows and lagging behind major market indices. This sustained underperformance and depressed valuation suggest a diminished market share in investor sentiment and limited growth potential from a stock market viewpoint.

The company's stock is currently viewed as a cash trap for investors, a clear reflection of its severe financial difficulties. For instance, as of early 2024, the stock price has been trading significantly below its historical averages, highlighting investor concerns about its future viability.

Theatrical releases, while a core component of Eros Media World's operations, are currently demonstrating underperformance. Recent financial disclosures indicate a significant downturn in net sales for this segment, signaling that new film launches are not yielding the expected revenue or market traction. This underperformance suggests that the theatrical arm is consuming valuable resources without delivering proportional returns.

In the context of a mature and slowly growing cinema market, these underperforming titles represent a substantial drag on the company's overall financial health. They divert investment and attention away from more promising ventures, impacting overall profitability and market share growth. For instance, in the fiscal year ending March 31, 2024, Eros Media World reported a consolidated net loss of INR 135.4 crore, a stark contrast to the previous year's profit, underscoring the challenges in its content acquisition and distribution strategies, including theatrical releases.

Eros Media World's non-core or historically unprofitable ventures likely act as resource drains, given its financial challenges and past divestitures. These segments, such as the failed merger with STX, represent ventures that failed to deliver positive outcomes, tying up capital and diverting crucial management focus away from core recovery efforts.

Outdated Content Formats/Channels

Outdated content formats and channels represent a significant risk for Eros Media World, falling squarely into the 'Dog' category of the BCG Matrix. Continued investment in these areas, where audience engagement is demonstrably declining, yields low returns and hinders growth potential.

For instance, while digital streaming is paramount, any allocation of resources towards traditional broadcast television or physical media distribution without a clear, robust digital adaptation strategy would be a misstep. In 2024, the global digital advertising market is projected to reach over $600 billion, highlighting the shift away from traditional media.

Eros Media World must critically assess its portfolio to identify and divest from or significantly reduce investment in these underperforming assets. This strategic pruning is essential to reallocate capital towards more promising digital ventures.

- Declining Audience Engagement: Traditional media formats like linear television and physical media are experiencing a steady decrease in viewership and consumption, particularly among younger demographics.

- Low Market Share & Growth: Channels with dwindling audiences naturally result in a low market share and minimal growth prospects for content distributed through them.

- Resource Misallocation: Continued investment in outdated formats diverts crucial capital and talent away from high-growth digital platforms and innovative content creation.

- Digital Dominance: The overwhelming growth of digital platforms, including streaming services and social media, underscores the necessity for Eros Media World to align its strategy with current consumer behavior.

Underutilized Distribution Capabilities

Underutilized distribution capabilities represent a significant drag on Eros Media World's potential, even with existing networks. If these channels aren't actively driving revenue from the content library or new releases, they become a liability rather than an asset.

This situation highlights a disconnect where the infrastructure exists, but operational inefficiencies or a lack of market-ready content prevent it from translating into substantial revenue or market share gains. The company's net sales have seen a decline, indicating systemic issues affecting multiple revenue streams.

- Distribution Network Underperformance: Despite having established channels, Eros Media World's failure to fully leverage them for content monetization.

- Revenue Generation Gap: The existing infrastructure is not effectively converting into significant revenue or market share due to operational gaps.

- Impact on Financials: Plummeting net sales suggest broader issues across all revenue generation avenues, including distribution.

Eros Media World's outdated content formats and channels are firmly in the 'Dog' category of the BCG Matrix. These segments, characterized by declining audience engagement and minimal growth prospects, consume resources without generating commensurate returns. For instance, the global digital advertising market's projected growth to over $600 billion in 2024 highlights the significant shift away from traditional media, making continued investment in outdated formats a resource misallocation.

These underperforming assets represent a significant drag on the company's overall financial health, diverting capital and management focus from more promising digital ventures. The company's net sales have seen a decline, indicating systemic issues affecting multiple revenue streams, including those tied to these outdated channels.

Identifying and divesting from or significantly reducing investment in these 'Dog' segments is crucial for Eros Media World to reallocate capital towards high-growth digital platforms and innovative content creation, aligning its strategy with current consumer behavior.

The company's underutilized distribution capabilities further exacerbate the 'Dog' classification. Despite existing networks, failure to effectively monetize the content library or new releases through these channels creates a revenue generation gap, turning potential assets into liabilities.

| BCG Category | Eros Media World Segment | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Dogs | Outdated Content Formats (e.g., linear TV, physical media) | Low | Low | Divest or minimize investment; reallocate resources to digital. |

| Dogs | Underutilized Distribution Channels | Low (for the specific channels) | Low | Optimize or divest; focus on channels with higher engagement and revenue potential. |

Question Marks

Eros Now is positioned as a Question Mark within the BCG Matrix, primarily due to its operation in the rapidly expanding Indian Over-The-Top (OTT) market. This sector is experiencing robust growth, with projections indicating continued expansion in the foreseeable future.

While Eros Now boasts a substantial 224 million registered users, its paying subscriber count, reported around 39.9 million or closer to 12 million in 2024 according to some analyses, lags significantly behind major competitors like Disney+ Hotstar, Amazon Prime Video, and Netflix in India. This disparity highlights a relatively small market share within a high-growth industry.

The combination of a high-growth market and a comparatively low market share necessitates significant investment for Eros Now. The strategy would involve channeling resources to increase its subscriber base and market penetration, aiming to transform it into a Star or eventually a Cash Cow.

Eros Media World's investment in new original content productions, such as series and music, is a key strategy for growth in the crowded OTT market. This segment operates in a high-growth area, but the substantial upfront costs and the unproven market reception of these new ventures present a significant risk.

The Indian Over-The-Top (OTT) market's growth is significantly fueled by expanding reach into both urban and rural areas, coupled with a robust demand for content in regional languages. Eros Now has actively released films across various Indian languages, demonstrating a strategic move to capture this expanding market segment.

While aggressively diversifying into regional content presents a high-growth avenue, it necessitates considerable investment in both production and localization efforts. Eros Now's current market share within these specific regional niches is still in its early stages, positioning this strategy as a Question Mark within the BCG matrix.

Emerging Technology Integration (e.g., Web 3.0, NFTs)

Eros Media World's exploration into Web 3.0, including blockchain and NFTs, places these initiatives in the Question Marks category of the BCG Matrix. This segment is characterized by high growth potential but also significant uncertainty regarding market adoption and monetization strategies. For instance, the NFT market, after a surge in 2021, saw a considerable contraction in trading volumes through 2023, with reports indicating a decline of over 90% from its peak.

These nascent technologies represent potential future revenue streams for Eros Media World, but their current stage of development means substantial investment is required with no guarantee of immediate returns or market leadership. Companies venturing into this space are essentially betting on future market shifts, much like early investments in streaming services before their widespread adoption.

- High Growth Potential: Web 3.0 and NFTs offer new avenues for content distribution, fan engagement, and digital asset monetization.

- Significant Uncertainty: The regulatory landscape, consumer acceptance, and long-term viability of these technologies remain largely unproven.

- Investment Required: Developing blockchain infrastructure, creating NFTs, and building Web 3.0 platforms demand considerable capital outlay.

- Speculative Returns: Success in this area could lead to substantial rewards, but the risk of failure or low ROI is equally high, mirroring the volatile nature of emerging tech markets.

Direct-to-Consumer (D2C) Subscriber Growth

Eros Media World's D2C subscriber growth, primarily through Eros Now, is positioned as a Question Mark within the BCG matrix. The strategy targets profitable direct-to-consumer (D2C) subscribers, a key growth area in the competitive streaming landscape.

While the potential for high profit margins is evident, the challenge lies in converting a large base of registered users into paying D2C subscribers. This requires substantial investment in marketing and compelling content to stand out in a saturated market. For instance, as of the first quarter of 2024, Eros Now reported approximately 35.5 million registered users, but a significantly smaller portion were paying subscribers, highlighting the conversion hurdle.

The company's focus on increasing the proportion of paying D2C subscribers is a high-risk, high-reward endeavor. Success hinges on effectively differentiating its offerings and building a loyal subscriber base. This necessitates aggressive marketing campaigns and continuous investment in exclusive content to attract and retain users.

- D2C Focus: Eros Now aims to shift towards more profitable direct-to-consumer subscribers.

- Market Challenge: Significant D2C growth is difficult in a crowded streaming market with established players.

- Conversion Hurdle: A low ratio of paying D2C subscribers to registered users requires substantial investment.

- Strategic Need: Aggressive marketing and content investment are crucial for converting registered users into paying subscribers.

Eros Now's positioning as a Question Mark stems from its presence in the high-growth Indian OTT market, where it faces intense competition. Despite a large registered user base, its paying subscriber numbers, estimated around 12 million in 2024, represent a relatively small market share.

The company's investment in new original content and diversification into regional languages are strategic moves within this expanding sector. However, these initiatives require substantial capital and carry inherent risks due to unproven market reception and the cost of localization.

Furthermore, Eros Media World's ventures into Web 3.0 technologies like blockchain and NFTs, while offering high growth potential, are highly speculative. The NFT market, for instance, saw a dramatic decline in trading volumes from its peak in 2021 through 2023, with reports of over a 90% drop.

The D2C subscriber growth strategy also falls into the Question Mark category, as converting registered users to paying customers in a saturated market demands significant marketing and content investment, with conversion rates remaining a key challenge.

BCG Matrix Data Sources

Our Eros Media World BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable, high-impact insights.