EROAD Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EROAD Bundle

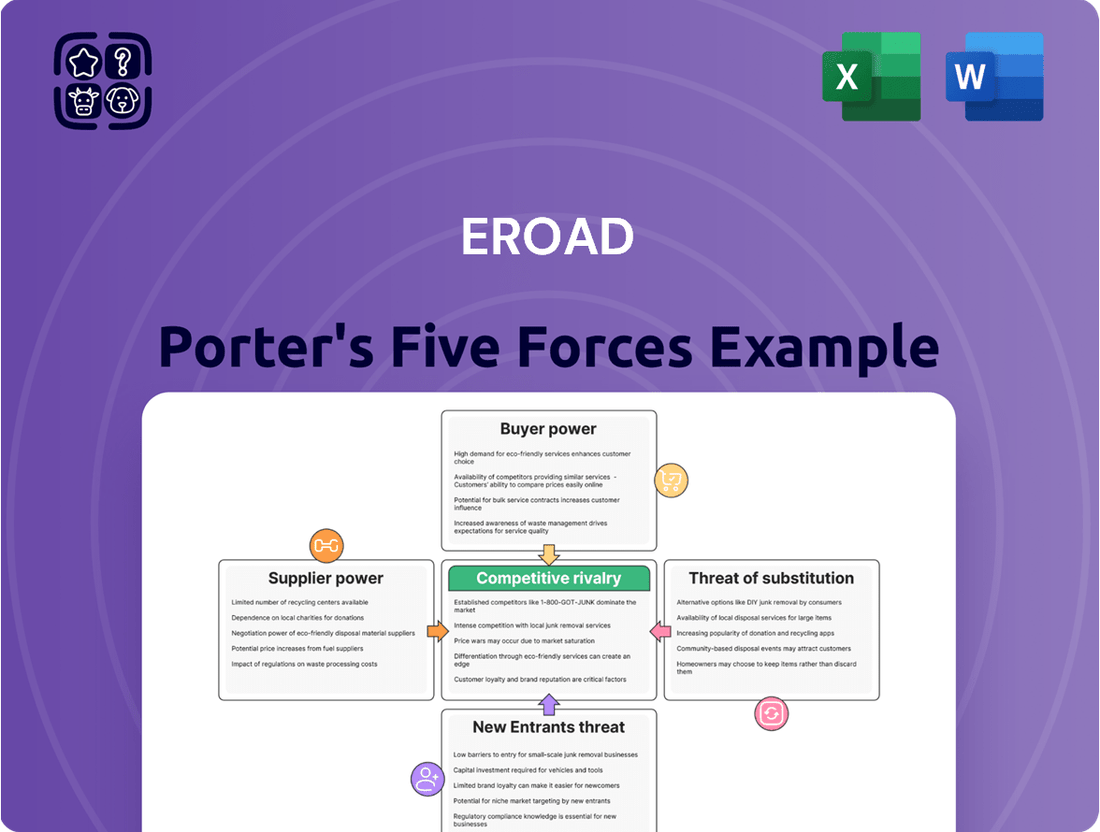

Understanding EROAD's competitive landscape is crucial for any industry player. Our Porter's Five Forces analysis dissects the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within EROAD's market. This comprehensive framework reveals the underlying forces shaping EROAD's strategic environment.

Unlock the full Porter's Five Forces Analysis to explore EROAD’s competitive dynamics, market pressures, and strategic advantages in detail. Gain actionable insights to drive smarter decision-making and stay ahead of the curve.

Suppliers Bargaining Power

EROAD's reliance on hardware and component suppliers, particularly contract manufacturers in Indonesia, the Philippines, and Vietnam, grants these suppliers significant bargaining power. The cost, quality, and delivery schedules of EROAD's telematics devices are directly impacted by these relationships.

For instance, disruptions in the global electronics supply chain, which were particularly acute in 2022 and continued to pose challenges into 2023, underscore the vulnerability of companies like EROAD to supplier leverage. These disruptions can lead to increased component costs and production delays.

EROAD's strategic exploration of relocating production and adjusting pricing demonstrates a proactive approach to managing this supplier power, aiming to build greater resilience and control over its hardware supply chain.

Telecommunications and connectivity providers hold significant bargaining power over EROAD. The company's core telematics solutions rely entirely on cellular networks for real-time data transmission, making these providers essential partners. This dependence means EROAD must adhere to the terms and pricing set by telcos, directly impacting operational expenses.

The ongoing shutdown of 2G and 3G networks by telcos in Australia and New Zealand presents a clear example of this power. EROAD is compelled to undertake substantial hardware upgrade programs, with a completion target of December 2025, to ensure continued service. This situation underscores how telcos can dictate EROAD's investment cycles and service continuity through their network infrastructure decisions.

Suppliers of essential software, cloud infrastructure, and cutting-edge technologies like AI and IoT modules hold considerable sway over EROAD's platform. Their specialized knowledge and unique tech can grant them significant leverage, especially as the fleet management sector increasingly adopts AI for predictive maintenance and advanced telematics.

Data and Mapping Service Providers

The bargaining power of data and mapping service providers for EROAD is a significant factor. Access to accurate, real-time mapping data and traffic information is fundamental to EROAD's core offerings in navigation and fleet management. The quality and pricing of these essential data feeds, typically sourced from specialized third-party vendors, directly influence EROAD's product capabilities and the overall cost of its services. For instance, in 2024, the global market for location-based services, which includes mapping data, was projected to reach hundreds of billions of dollars, indicating the substantial value and potential leverage held by major data providers.

These partnerships are crucial for improving user experience and optimizing route planning, which are key differentiators for EROAD. Should a key data provider significantly increase its prices or reduce the quality of its service, EROAD would face challenges in maintaining its competitive edge. The reliance on a limited number of high-quality data suppliers could therefore translate into higher operational costs or necessitate investment in developing proprietary data solutions.

- Critical Data Dependency: EROAD's navigation and fleet management solutions rely heavily on the continuous availability of accurate mapping and traffic data.

- Third-Party Sourcing: These essential data services are often procured from specialized external providers, making EROAD susceptible to their pricing and quality control.

- Market Value of Data: The global location-based services market, a key indicator of data provider value, is substantial, suggesting significant leverage for these suppliers.

- Impact on Service Delivery: Fluctuations in data quality or cost directly affect EROAD's product features, user experience, and overall service delivery efficiency.

Specialized Sensor and Camera Manufacturers

The bargaining power of specialized sensor and camera manufacturers is a significant factor for EROAD. As the industry increasingly integrates AI dashcams and other Internet of Things (IoT) sensors for enhanced driver safety and vehicle monitoring, EROAD's reliance on these component providers grows. Suppliers possessing unique, patented, or hard-to-replicate technologies can exert considerable influence.

- Unique Technology: Suppliers with proprietary AI algorithms or advanced sensor capabilities can command higher prices or dictate terms, impacting EROAD's cost structure and product development timelines.

- Limited Alternatives: If few manufacturers offer comparable specialized components, EROAD has fewer options, strengthening the suppliers' negotiating position.

- Impact on Innovation: The ability of these suppliers to innovate and provide cutting-edge features directly affects EROAD's capacity to maintain a competitive edge in the rapidly evolving telematics market.

- Supply Chain Dependence: EROAD's dependence on these specialized inputs means that disruptions or price increases from these suppliers can have a direct and substantial impact on EROAD's operations and profitability.

EROAD's reliance on contract manufacturers, particularly in Southeast Asia, for its telematics hardware means these suppliers hold considerable sway. Their ability to control costs, quality, and delivery schedules directly impacts EROAD's product availability and pricing. The ongoing global electronics supply chain challenges, which persisted into 2023, highlight this vulnerability, potentially leading to increased component costs and production delays.

Telecommunications and connectivity providers wield significant bargaining power over EROAD, as its core telematics solutions depend entirely on cellular networks for real-time data. This reliance forces EROAD to accept terms and pricing from telcos, directly affecting operational expenses. For instance, the planned shutdown of 2G and 3G networks by telcos in Australia and New Zealand by December 2025 necessitates EROAD's investment in hardware upgrades, demonstrating how telcos can dictate EROAD's expenditure and service continuity.

Suppliers of critical data, such as mapping and traffic information, possess substantial leverage over EROAD. These services are fundamental to EROAD's navigation and fleet management offerings. The global location-based services market, valued in the hundreds of billions of dollars in 2024, underscores the significant value and potential influence of these data providers. Any increase in their pricing or decrease in service quality could directly impact EROAD's competitive edge and operational costs.

Specialized sensor and camera manufacturers, especially those with unique AI dashcam or IoT technologies, also exert considerable bargaining power. As the telematics market increasingly adopts advanced safety features, EROAD's dependence on these suppliers for cutting-edge components grows. Limited alternatives for proprietary technologies can lead to higher prices and influence EROAD's product development timelines and innovation capabilities.

What is included in the product

This analysis unpacks the competitive forces shaping EROAD's operating environment, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the telematics sector.

Effortlessly identify and quantify competitive pressures, allowing for proactive strategy adjustments to mitigate threats.

Customers Bargaining Power

Large enterprise fleets wield considerable bargaining power, primarily due to the sheer volume of units they operate and their potential for long-term commitments, which translates into significant revenue for EROAD. These clients expect more than just basic compliance; they demand sophisticated, customized solutions that demonstrably boost safety, productivity, and overall operational efficiency, compelling EROAD to invest heavily in continuous innovation and prove a clear return on investment.

Small and medium-sized businesses (SMBs), while individually possessing less sway than larger corporations, wield considerable collective influence. Their purchasing choices are frequently swayed by price and user-friendliness, a dynamic EROAD addresses by offering more economical options for light commercial vehicles through collaborations, such as their partnership with Geotab. This market segment's varied requirements necessitate adaptable and budget-friendly solutions.

A substantial part of EROAD's customer base is compelled to use their services due to regulatory mandates, like electronic logging device (ELD) rules and road user charges (RUC). Even though compliance is non-negotiable, customers can still select from various providers, which gives them leverage to influence pricing and the quality of the compliance solutions offered.

This customer segment, driven by mandatory regulations, holds significant bargaining power. They can shop around for the best value, pushing EROAD to maintain competitive pricing and continuously improve its compliance features to retain market share.

EROAD's strong position in New Zealand's RUC system, where they serve a large portion of the market, highlights their ability to meet these specific, compliance-driven customer needs effectively. For instance, in 2023, EROAD reported that its New Zealand operations were a significant contributor to its revenue, underscoring the importance of this regulatory-driven segment.

Customers Seeking Advanced Analytics and AI Integration

Customers are increasingly demanding advanced analytics and AI integration in fleet management solutions. This shift means they expect predictive maintenance, optimized routes, and improved driver safety powered by artificial intelligence. As of early 2024, a significant portion of fleet operators are actively evaluating or implementing AI-driven technologies, driving up expectations for data-driven insights and measurable operational improvements. This elevated demand empowers customers to select providers who offer these cutting-edge capabilities.

- Demand for AI: Fleet managers are prioritizing AI for predictive maintenance, route optimization, and safety enhancements.

- Data-Driven Expectations: Customers expect advanced features and actionable insights to improve efficiency.

- Provider Choice: The ability to deliver measurable operational improvements through technology influences customer purchasing decisions.

Customers Focused on ROI and Cost Efficiency

Customers, irrespective of their scale, are fundamentally driven by the pursuit of a favorable return on investment (ROI) from their telematics solutions. This translates to a constant demand for demonstrable benefits such as minimized fuel expenditure, bolstered safety records, and elevated operational effectiveness. For instance, in 2024, many fleet operators reported fuel savings of up to 10% after implementing advanced telematics, directly impacting their ROI calculations.

The leverage customers possess stems from their capacity to shift to alternative providers or opt for different solutions if EROAD's offerings fail to deliver concrete cost reductions or performance enhancements. This inherent substitutability amplifies their bargaining power, compelling EROAD to continually demonstrate value. The competitive telematics market in 2024 saw several new entrants offering lower-cost alternatives, putting pressure on established players.

- Customer Focus on ROI: All customers prioritize a positive return on investment from telematics, seeking savings in fuel, safety, and efficiency.

- Switching Power: Customers can switch providers if EROAD's solutions don't offer tangible cost savings or performance improvements.

- EROAD's Value Proposition: EROAD's commitment to increasing Average Revenue Per User (ARPU) and generating free cash flow underscores its dedication to delivering customer value and mitigating this bargaining power.

Customers, particularly large fleets, hold significant bargaining power due to their substantial order volumes and potential for long-term contracts. Their demand for customized, data-driven solutions with demonstrable ROI, such as fuel savings of up to 10% reported by many operators in 2024, forces EROAD to continually innovate and prove its value proposition.

Even smaller businesses collectively exert influence by prioritizing price and ease of use, prompting EROAD to offer more accessible options. Furthermore, regulatory mandates, like ELD and RUC compliance, while ensuring a baseline demand, still allow customers to choose providers, thereby influencing pricing and service quality. EROAD's strong market share in New Zealand's RUC system, a key revenue driver in 2023, showcases its ability to cater to these compliance-focused needs.

| Customer Segment | Bargaining Power Factors | EROAD's Response/Considerations |

|---|---|---|

| Large Enterprise Fleets | High volume, long-term commitment potential, demand for advanced analytics and AI, need for proven ROI. | Customized solutions, continuous innovation, focus on demonstrating efficiency gains. |

| Small and Medium Businesses (SMBs) | Price sensitivity, demand for user-friendliness, collective influence. | Economical options, partnerships for broader reach. |

| Mandate-Driven Users (ELD/RUC) | Regulatory necessity, ability to switch providers, focus on compliance features and cost-effectiveness. | Competitive pricing, high-quality compliance solutions, leveraging market position (e.g., NZ RUC). |

Preview Before You Purchase

EROAD Porter's Five Forces Analysis

This preview displays the complete EROAD Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within the telematics and fleet management industry. You are seeing the exact, professionally formatted document that will be instantly available for download upon purchase. This comprehensive analysis will equip you with critical insights into the forces shaping EROAD's market, enabling informed strategic decision-making.

Rivalry Among Competitors

The global telematics and fleet management market is incredibly dynamic and spread out, featuring a wide array of companies from big international ones to smaller, specialized regional outfits. This intense competition is driven by fast-paced technological progress, such as the integration of AI, IoT, and electric vehicles, which continuously reshapes the competitive environment.

Providers are under constant pressure to innovate to stay relevant and hold onto their market share. For instance, as of early 2024, the market is seeing significant investment in AI-powered predictive maintenance and route optimization, with companies like Geotab reporting over 3 million connected vehicles on their platform, highlighting the scale of adoption and the need for advanced solutions.

EROAD operates in a crowded market, facing competition from specialized telematics providers like Geotab and Verizon Telematics, alongside automotive manufacturers increasingly integrating telematics into their vehicles. Technology giants also pose a threat with their broader IoT and logistics platforms.

These competitors leverage diverse strengths, from Geotab's extensive global network to the deep vehicle integration offered by OEMs, and the advanced data analytics of tech behemoths. EROAD's strategic alliance with Geotab, for instance, aims to enhance its product portfolio and competitive standing in this dynamic environment.

While EROAD emphasizes its enterprise-grade solutions and value-added services, the market still sees intense price-based competition, especially for light commercial vehicles and essential compliance tools. Competitors often present more budget-friendly options, compelling EROAD to carefully balance its premium features with competitive pricing. This pressure to manage costs and boost efficiency within EROAD is a direct consequence of this ongoing price rivalry.

Innovation and Feature Differentiation

Competitive rivalry in the telematics and fleet management sector, where EROAD operates, is intensely driven by innovation and the ability to differentiate products through advanced features, user experience, and integration capabilities.

Companies are constantly introducing new products, such as AI-powered dashcams and enhanced navigation applications, to maintain a competitive edge. This relentless pursuit of advancement means that staying ahead requires a continuous investment in research and development.

The race to integrate cutting-edge technologies like artificial intelligence and predictive analytics is a key battleground, forcing all players to adapt quickly. For instance, in 2023, the global fleet management market was valued at approximately USD 28.5 billion, with a significant portion of that growth attributed to technological advancements and the demand for sophisticated telematics solutions.

- Technological Integration: The ability to seamlessly integrate new technologies like AI and IoT is crucial for differentiation.

- Product Development Cycles: Rapid product development and feature updates are essential to counter competitor advancements.

- User Experience Focus: Enhancing the user interface and overall experience of telematics platforms is a key competitive differentiator.

- R&D Investment: Companies are increasing R&D spending to develop next-generation features, with some reporting R&D expenditure representing over 10% of their revenue.

Customer Retention and Ecosystem Lock-in

EROAD focuses on keeping customers by providing excellent service and adding value, making it hard for them to leave. This strategy helps them stand out against competitors.

Their impressive customer retention rate of 92.8% in the first half of fiscal year 2025 highlights their success. This high retention is crucial for managing competition and minimizing customer loss.

- High Customer Retention: EROAD achieved a 92.8% customer retention rate in H1 FY25.

- Ecosystem Lock-in: The company aims to increase the number of products customers use, creating a sticky ecosystem.

- Reduced Churn: Strong retention and ecosystem development directly combat competitive threats and reduce customer churn.

Competitive rivalry in the telematics and fleet management sector is fierce, driven by rapid technological advancements and a crowded market. EROAD faces competition from established players like Geotab and Verizon Telematics, as well as automotive manufacturers integrating telematics directly into vehicles and large technology firms offering broader IoT solutions.

Companies differentiate themselves through advanced features, user experience, and integration capabilities, leading to continuous innovation and investment in R&D. For instance, the global fleet management market was valued at approximately USD 28.5 billion in 2023, with growth fueled by these technological leaps.

EROAD's strategy to combat intense competition includes focusing on high customer retention, evidenced by its 92.8% rate in H1 FY25, and building a sticky ecosystem by encouraging customers to use multiple products, thereby reducing churn.

| Competitor | Key Strengths | EROAD's Counter-Strategy |

|---|---|---|

| Geotab | Extensive global network, large connected vehicle base (over 3 million in early 2024) | Strategic alliance for enhanced product portfolio |

| Verizon Telematics | Strong brand recognition, integrated connectivity solutions | Focus on enterprise-grade solutions and value-added services |

| OEMs (Automotive Manufacturers) | Deep vehicle integration, direct access to vehicle data | Emphasis on specialized telematics features and customer service |

| Tech Giants (e.g., Google, Amazon) | Broad IoT and logistics platforms, advanced data analytics | Targeting specific fleet management needs, high customer retention |

SSubstitutes Threaten

While regulations like the ELD mandate have pushed many fleets away from traditional paper logs, manual and paper-based systems still linger as a substitute. These older methods, however, cannot match the real-time data, efficiency, and advanced analytics provided by digital platforms like EROAD. For instance, in 2024, many smaller or less technologically advanced fleets might still rely on manual entry for certain aspects of their operations, but the inherent inefficiencies and compliance risks make them a weak substitute for integrated digital solutions.

Less sophisticated, lower-cost GPS tracking devices and basic telematics solutions can act as substitutes for EROAD's comprehensive platform. These simpler alternatives primarily offer location data and may appeal to fleets with minimal compliance requirements or basic management needs.

For instance, a small trucking company needing only to track vehicle locations might find a standalone GPS unit, costing perhaps $50-$100 per device, a more budget-friendly option compared to EROAD's integrated system. While these substitutes lack EROAD's advanced features like Hours of Service (HOS) compliance or detailed fuel monitoring, they fulfill a more rudimentary need for fleet visibility.

Large transportation firms with robust IT departments may opt to build their own fleet management systems, integrating custom hardware. This offers unparalleled control and personalization, but demands significant upfront capital, continuous upkeep expenses, and in-house technical skills that many businesses find more economical to outsource.

Alternative Transportation Methods and Logistics Solutions

The threat of substitutes for EROAD's fleet management solutions is present, particularly as alternative transportation methods and logistics models evolve. Increased reliance on third-party logistics (3PL) providers, for instance, could mean that the end-user company is not directly managing a fleet, thus reducing their need for EROAD's core telematics. Furthermore, advancements in public transportation infrastructure or the emergence of autonomous last-mile delivery systems might bypass the need for traditional fleet telematics entirely.

However, these shifts often integrate telematics at a different layer within the broader supply chain. For example, a 3PL provider would likely still utilize telematics for their own fleet operations, potentially creating a different customer segment for EROAD. The adoption of autonomous delivery, while potentially reducing the need for driver-focused telematics, will likely still require sophisticated tracking and management systems, which EROAD could adapt to provide.

- 3PL Market Growth: The global 3PL market was valued at approximately $1.1 trillion in 2023 and is projected to grow steadily, indicating a significant portion of logistics being outsourced.

- Autonomous Delivery Investment: Significant investments are being made in autonomous vehicle technology for logistics, with projections suggesting a substantial market share in last-mile delivery by the late 2020s.

- Telematics Integration: Even with outsourcing or automation, the need for data-driven insights into vehicle performance, location, and efficiency remains, suggesting telematics will continue to be a crucial component, albeit potentially integrated differently.

OEM-Embedded Telematics Systems

Automakers are embedding telematics directly into new vehicles, a trend that poses a threat of substitution for aftermarket providers like EROAD. For instance, in 2024, a significant percentage of new commercial vehicles are expected to feature advanced connectivity and data services as standard. This factory-installed integration could diminish the demand for third-party telematics if Original Equipment Manufacturers (OEMs) deliver robust, all-inclusive packages that satisfy fleet operators' needs.

While partnerships between telematics companies and OEMs, such as Geotab's collaborations, can mitigate this threat, the increasing sophistication of OEM-embedded systems presents a long-term strategic challenge. If these integrated solutions offer competitive pricing and a comprehensive feature set, they could directly substitute the value proposition of standalone telematics providers, potentially impacting market share and revenue streams for companies relying on aftermarket installations.

The growing adoption rate of connected vehicles, with projections indicating over 90% of new passenger cars sold globally in 2025 will have some form of telematics, underscores the significance of this substitution threat. Fleet managers may find it more convenient and cost-effective to utilize the OEM's integrated system rather than adding a separate third-party solution, especially if the embedded telematics cover essential fleet management functions.

- OEM Integration: Automotive manufacturers are increasingly building telematics into vehicles from the factory.

- Market Shift: This could reduce demand for aftermarket telematics if OEM offerings are compelling.

- Competitive Landscape: Robust OEM services may substitute the need for third-party solutions.

- Strategic Consideration: This trend requires long-term strategic planning for telematics providers.

Manual and paper-based logging systems, though inefficient, persist as a substitute, especially for smaller fleets in 2024. However, they lack the real-time data and compliance advantages of digital solutions like EROAD. Similarly, basic GPS trackers offer rudimentary location services at a lower cost, appealing to fleets with minimal needs, but they don't provide the comprehensive features EROAD offers.

The threat of substitutes for EROAD's fleet management solutions is multifaceted. While manual logs and basic GPS trackers offer lower-cost alternatives, they fundamentally lack the integrated compliance, efficiency, and advanced analytics that EROAD provides. For instance, in 2024, many smaller operators might still use paper logs, but the inherent risks and inefficiencies make them a weak substitute. Furthermore, the rise of third-party logistics (3PL) providers, a market valued at over $1.1 trillion in 2023, means some end-users may outsource fleet management entirely, reducing their direct need for telematics.

Automakers embedding telematics directly into new vehicles present a significant substitution threat. By 2025, over 90% of new passenger cars globally are expected to have some form of telematics. If Original Equipment Manufacturers (OEMs) offer robust, cost-effective, factory-installed packages, they could diminish the demand for aftermarket solutions like EROAD, especially if these integrated systems cover essential fleet management functions.

Entrants Threaten

Developing and manufacturing advanced telematics hardware and sophisticated software platforms demands significant upfront capital. This includes substantial investment in research and development, state-of-the-art production facilities, and the acquisition or creation of intellectual property. For instance, companies entering the connected vehicle space often face R&D costs that can run into tens of millions of dollars annually.

This considerable financial barrier effectively deters many potential new entrants. Established players like EROAD have already navigated these initial hurdles, building extensive infrastructure and diverse product portfolios. Their existing scale and market presence make it incredibly difficult for newcomers to achieve competitive pricing and product parity without a similar level of financial commitment.

The transportation sector faces significant hurdles for newcomers due to stringent regulations. For instance, the Electronic Logging Device (ELD) mandate in the United States and Road User Charges (RUC) in New Zealand require substantial understanding and adherence to complex rules.

New entrants must invest heavily in acquiring the necessary expertise, obtaining certifications, and continuously updating their systems to remain compliant with evolving regulations. This ongoing commitment to regulatory adherence presents a considerable barrier to entry.

EROAD's deep-rooted expertise in navigating these regulatory complexities and offering solutions that are inherently compliance-driven establishes a robust defense against potential new competitors seeking to enter the market.

The threat of new entrants is significantly lowered by EROAD's strong brand recognition and deep-seated customer trust. With over 250,000 connected units as of early 2024 and consistently high customer retention rates, EROAD has cultivated a loyal customer base. New companies entering the market must overcome the considerable hurdle of establishing credibility and proving their reliability to customers who are hesitant to switch critical operational systems.

Economies of Scale and Network Effects

Established players like EROAD enjoy significant cost advantages due to economies of scale. This allows them to negotiate better prices for hardware, invest more in software innovation, and offer more comprehensive customer support, making it difficult for newcomers to match their pricing and service levels. For instance, in 2024, EROAD's continued expansion in its key markets likely further solidified these scale efficiencies.

Network effects are a substantial barrier for new entrants. As EROAD's user base grows, the platform becomes more valuable for all participants, particularly through data aggregation and shared insights. This creates a virtuous cycle where more users attract more users, leaving new competitors with a smaller, less attractive network to build upon.

- Economies of Scale: EROAD benefits from bulk purchasing of hardware and streamlined operational costs due to its size.

- Network Effects: A larger installed base enhances the value of EROAD's platform for all users, creating a barrier to entry.

- Data Advantage: EROAD's extensive vehicle data, collected over years, fuels superior analytics and product development, a resource difficult for new entrants to replicate quickly.

Access to Distribution Channels and Talent

New companies entering the telematics and fleet management sector face substantial hurdles in establishing robust sales, marketing, and support infrastructure across diverse markets like New Zealand, Australia, and North America. This extensive network development requires significant capital and time investment.

Securing and retaining top-tier talent in specialized fields such as telematics, the Internet of Things (IoT), artificial intelligence (AI), and advanced fleet management is a constant battle. The demand for these skills often outstrips supply, driving up recruitment costs and retention challenges.

EROAD's established distribution channels and strong organizational framework offer a distinct advantage. For instance, EROAD's presence in Australia, a key market, has been built over years, facilitating easier market penetration and access to a skilled workforce compared to a newcomer.

- Distribution Network: EROAD has developed extensive sales and service networks across its operating regions, which are costly and time-consuming for new entrants to replicate.

- Talent Acquisition: Competition for specialized talent in telematics and AI is fierce; EROAD's existing employer brand and established teams provide an edge in attracting and retaining skilled professionals.

- Market Penetration: EROAD's long-standing customer relationships and brand recognition in markets like New Zealand, where it holds a significant market share, create barriers to entry for new competitors.

The threat of new entrants in the telematics and fleet management sector is considerably low for EROAD. This is primarily due to the substantial capital investment required for R&D, manufacturing, and regulatory compliance, creating a high barrier to entry. Furthermore, EROAD's established brand loyalty, economies of scale, and network effects create a strong competitive moat that makes it difficult for newcomers to gain traction. The company's existing infrastructure and expertise in navigating complex regulations also serve as significant deterrents.

| Barrier Type | Description | Impact on New Entrants | EROAD Advantage |

|---|---|---|---|

| Capital Requirements | High R&D, manufacturing, and IP costs. | Significant financial hurdle. | Established infrastructure and funding. |

| Regulatory Compliance | Complex ELD/RUC mandates. | Requires specialized knowledge and ongoing investment. | Deep expertise and compliance-focused solutions. |

| Brand Recognition & Trust | Customer loyalty and preference. | Difficult to gain credibility. | Over 250,000 connected units (early 2024), high retention. |

| Economies of Scale | Lower unit costs and better supplier terms. | Inability to match pricing and service. | Continued market expansion (2024) enhances efficiencies. |

| Network Effects | Increased platform value with more users. | Smaller, less attractive network for new entrants. | Growing user base enhances data aggregation and insights. |

| Distribution & Talent | Building sales, marketing, and support networks; acquiring specialized talent. | Costly and time-consuming to replicate. | Established channels (e.g., Australia) and skilled workforce. |

Porter's Five Forces Analysis Data Sources

Our EROAD Porter's Five Forces analysis leverages data from industry-specific market research, company annual reports, and regulatory filings to provide a comprehensive view of the competitive landscape.