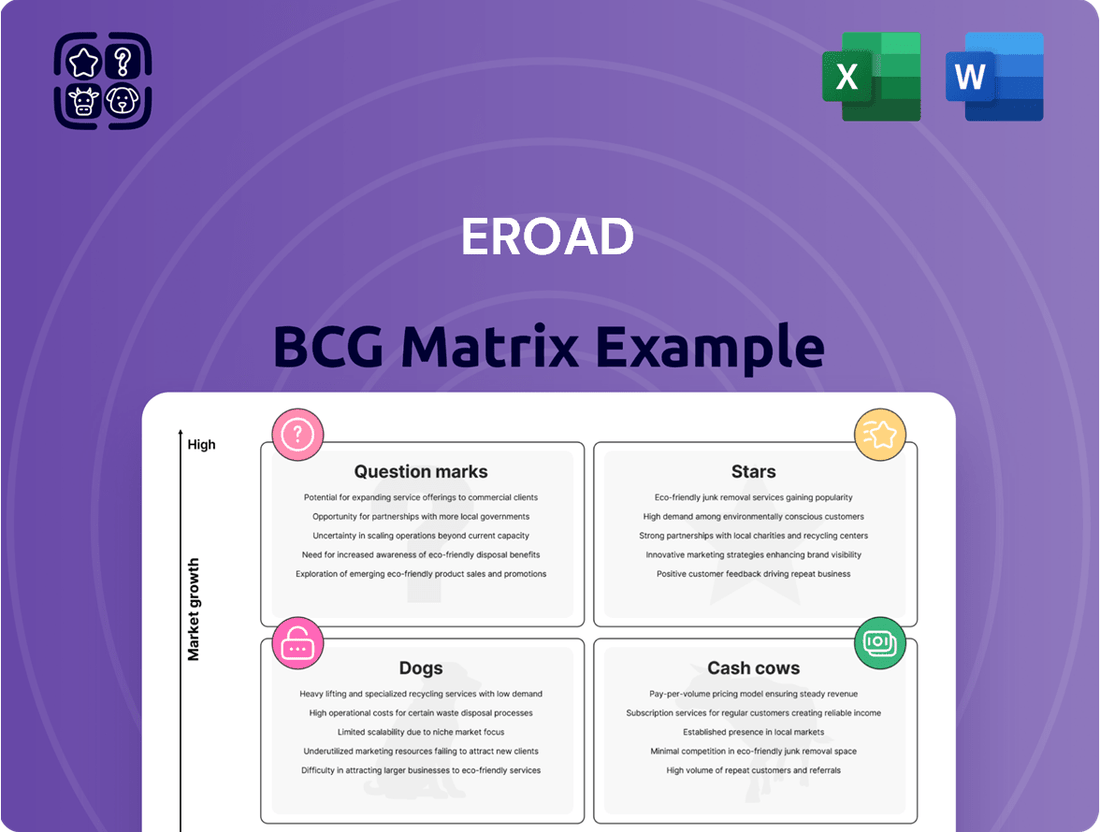

EROAD Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EROAD Bundle

Unlock the strategic potential of EROAD's product portfolio with our comprehensive BCG Matrix analysis. See where EROAD's offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and gain a clear understanding of their market share and growth potential. Purchase the full report for actionable insights and a strategic roadmap to optimize EROAD's success.

Stars

The AI-powered Clarity Edge Dashcams from EROAD are a prime example of a Star in the BCG Matrix. This innovative product is designed for high growth and targets a significant market opportunity, estimated to be in the billions in North America.

This advanced dashcam enhances driver safety by providing real-time monitoring of driver behavior and road conditions. Its proactive safety features directly address the growing industry demand for intelligent driver assistance systems and video telematics, positioning it for continued expansion.

EROAD's ongoing enhancements to its MyEROAD and Core360 platforms, including automated unidentified driving event reviews and improved IFTA reporting, demonstrate a clear commitment to growth. These updates are crucial for maintaining competitiveness and expanding the software's usefulness, directly addressing customer demands for greater efficiency and compliance. For instance, by streamlining IFTA reporting, EROAD helps fleets reduce administrative burdens, a significant factor for businesses operating across multiple jurisdictions.

The integration of video telematics into Core360 is a strategic move that significantly boosts its market appeal within the rapidly evolving software sector. This feature provides valuable insights into driver behavior and operational safety, a critical need for modern fleet management. In 2024, the demand for integrated video solutions in fleet management software saw a substantial increase, with many companies prioritizing safety and accountability.

EROAD's North American enterprise solutions are a key growth driver, reflecting a strategic push to capture larger fleet customers in this vital market. This focus is underscored by significant investment and a clear opportunity for scaled expansion.

The company's success in securing and growing these large accounts is evident, with a recent example being the renewal of a major enterprise customer contract covering 6,000 units. This achievement highlights EROAD's capability to penetrate and expand within the high-potential North American fleet sector.

Sustainability and EV Solutions

EROAD's Sustainability and EV Solutions are positioned as a potential Star in the BCG Matrix. The development and rollout of initiatives like the Sustainability Module and emissions calculators directly address the burgeoning market demand for environmental compliance and corporate ESG targets.

The transportation sector's accelerated move towards decarbonization and the increasing adoption of electric vehicles (EVs) create a fertile ground for EROAD's expansion in this area. This strategic focus allows EROAD to capitalize on the growing market segment dedicated to minimizing environmental impact.

- Market Growth: Global investment in sustainable transportation is projected to reach trillions by 2030, driven by regulatory pressures and consumer demand.

- Regulatory Tailwinds: Stricter emissions standards globally, such as those being implemented across the EU and North America in 2024, directly boost the need for solutions like EROAD's emissions calculators.

- Corporate ESG Focus: In 2024, over 90% of S&P 500 companies report on ESG metrics, highlighting the corporate imperative for tools that track and improve environmental performance.

- EV Adoption: EV sales continued their upward trajectory in 2024, with projections indicating a significant increase in the total number of EVs on the road by 2025, necessitating specialized fleet management solutions.

Strategic Partnerships for Market Reach

Strategic partnerships are key for EROAD to broaden its market reach. Collaborations, such as the one with Geotab for the Etrack Locate product, allow EROAD to tap into new, rapidly expanding areas like light commercial fleets.

These alliances leverage established players to introduce novel solutions, effectively widening EROAD's potential customer base. This approach facilitates growth and market penetration, reducing the need for EROAD to develop every new market solution entirely on its own.

- Geotab Partnership: EROAD's collaboration with Geotab for Etrack Locate targets the light commercial vehicle segment.

- Market Expansion: This strategy allows EROAD to access high-growth segments without solely relying on internal development.

- Diversification: Partnerships help diversify EROAD's addressable market by offering integrated solutions.

EROAD's AI-powered Clarity Edge Dashcams and its expanding Sustainability and EV Solutions are prime examples of Stars in the BCG Matrix. These offerings benefit from high market growth and EROAD's strategic investments, such as partnerships and platform enhancements, to capture significant market share.

The company's focus on North American enterprise solutions, exemplified by a major contract renewal for 6,000 units, demonstrates successful penetration into a high-potential sector. Similarly, the push into sustainability and EV management taps into a market driven by regulatory tailwinds and corporate ESG priorities, with global sustainable transportation investment projected to reach trillions by 2030.

EROAD's strategic partnerships, like the one with Geotab for Etrack Locate, further solidify its Star position by enabling access to new, rapidly expanding segments such as light commercial fleets. This collaborative approach allows EROAD to offer integrated solutions, broadening its addressable market and capitalizing on the increasing adoption of EVs and stricter emissions standards in 2024.

| Product/Solution | BCG Category | Market Growth Driver | EROAD's Strategy | Key Data Point (2024/2025 Projection) |

|---|---|---|---|---|

| Clarity Edge Dashcams | Star | Increased demand for driver safety and video telematics | Product innovation, platform integration (Core360) | North American market opportunity in billions |

| Sustainability & EV Solutions | Star | Decarbonization, ESG focus, EV adoption | New module development, emissions calculators | Over 90% of S&P 500 companies report ESG metrics (2024) |

| North American Enterprise Solutions | Star | Large fleet adoption of telematics | Focus on large accounts, scaled expansion | Renewal of contract for 6,000 units |

| Etrack Locate (via Geotab partnership) | Star | Growth in light commercial vehicle segment | Strategic partnerships, market access | Targets high-growth segments without sole internal development |

What is included in the product

This BCG Matrix overview analyzes EROAD's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

EROAD's BCG Matrix offers a clear, one-page overview of its business units, relieving the pain of complex strategic analysis.

Cash Cows

EROAD's electronic Road User Charging (eRUC) system in New Zealand is a prime example of a Cash Cow. It dominates a mature market, consistently generating substantial revenue.

For fiscal year 2025, EROAD captured 56% of all heavy vehicle Road User Charges in New Zealand. This significant market share underscores the system's stability and EROAD's entrenched position.

The eRUC system provides predictable, high-margin cash flows. Because the market is established and regulatory compliance is a necessity, ongoing investment in marketing or product development is minimal.

EROAD's core Electronic Logging Device (ELD) and Hours of Service (HOS) compliance solutions, especially in North America, are its cash cows. These foundational offerings generate a consistent stream of recurring revenue.

While the broader telematics market continues to expand, the basic compliance segment is quite mature. This maturity allows EROAD to capitalize on its established strong reputation and certified devices within this segment.

These essential solutions for commercial fleets are widely adopted, contributing significantly to EROAD's free cash flow. For instance, as of early 2024, EROAD reported a strong customer base for its compliance services, underscoring their dependable revenue generation.

EROAD's established fleet tracking and telematics platform serves as a definitive Cash Cow. This core offering, providing essential real-time data and tracking for a substantial customer base, consistently generates predictable annual recurring revenue (ARR) through subscriptions. In 2024, EROAD reported that its fleet management solutions, including telematics, are utilized by a significant portion of its customer base, demonstrating high asset retention and a strong revenue stream.

Heavy Vehicle Distance Capture and Reporting

EROAD's heavy vehicle distance capture and reporting service functions as a robust cash cow within its business model. This core offering, essential for road user charging and effective fleet management, provides a consistent and predictable revenue stream. Its importance is amplified by its role in regulatory compliance and enhancing operational efficiency for trucking companies, especially in markets like New Zealand where EROAD has a strong foothold.

The enduring demand for accurate distance tracking and reporting, coupled with EROAD's established infrastructure, solidifies this service as a reliable cash generator. For instance, in 2024, the ongoing need for compliance with road user charges, which directly utilize this data, ensures continued revenue. The company's significant market share in key regions further underpins the stability of this income source.

Key aspects contributing to its cash cow status include:

- Regulatory Necessity: The service is mandated for compliance in many jurisdictions, creating a captive customer base.

- Operational Efficiency: Fleet operators rely on this data for cost management and route optimization, driving ongoing adoption.

- Market Dominance: EROAD's strong presence in markets like New Zealand ensures consistent revenue from a large installed base.

- Recurring Revenue Model: The subscription-based nature of the service provides predictable and stable income.

Standardized Regulatory Compliance Tools

Beyond their core electronic logging device (ELD) and road usage charge (RUC) offerings, EROAD’s comprehensive suite of standardized regulatory compliance tools for fleet operations acts as a consistent cash generator. These vital tools streamline the often-complex processes of reporting and adhering to diverse transport regulations, significantly easing the administrative load for their clientele. For instance, EROAD's compliance solutions help fleets manage hours of service (HOS) tracking, vehicle inspection reports, and fuel tax reporting, all critical for operational legality.

The persistent and evolving nature of regulatory requirements across the transportation sector guarantees a stable and predictable revenue stream for EROAD. This recurring income is derived from a broad customer base, encompassing both commercial trucking companies and government entities, all of whom depend on these tools to maintain compliance and avoid penalties. In 2024, the increasing complexity of international transport regulations, such as those related to emissions and driver fatigue, further solidified the demand for such dependable compliance solutions.

- Stable Revenue: The inherent necessity of regulatory adherence ensures a predictable and recurring income for EROAD's compliance tools.

- Broad Customer Base: EROAD serves a wide array of commercial and government operators, diversifying its revenue sources.

- Reduced Burden: These tools simplify complex reporting, saving customers time and resources.

- Market Demand: Evolving and complex regulations in 2024 continue to drive strong demand for compliance solutions.

EROAD's established fleet tracking and telematics platform is a definitive Cash Cow, consistently generating predictable annual recurring revenue (ARR) through subscriptions from a substantial customer base. This core offering, providing essential real-time data and tracking, saw significant utilization in 2024, highlighting strong asset retention and a dependable revenue stream.

The company's heavy vehicle distance capture and reporting service also functions as a robust cash cow. Essential for road user charging and fleet management, it provides a consistent revenue stream, amplified by its role in regulatory compliance and operational efficiency, particularly in markets like New Zealand where EROAD holds a strong position.

EROAD's standardized regulatory compliance tools for fleet operations, including ELD and RUC solutions, act as consistent cash generators. These vital tools streamline complex reporting processes, ensuring operational legality for clients and providing a stable, predictable revenue stream driven by the persistent need for regulatory adherence in the transportation sector.

| EROAD Product/Service | BCG Category | Key Characteristics | 2024 Data/Insights |

|---|---|---|---|

| eRUC System (New Zealand) | Cash Cow | Mature market dominance, high revenue generation, minimal new investment needed. | 56% market share of heavy vehicle Road User Charges in New Zealand. |

| Core ELD & HOS Compliance (North America) | Cash Cow | Foundational offerings, consistent recurring revenue, established reputation. | Strong customer base for compliance services, underscoring dependable revenue. |

| Fleet Tracking & Telematics | Cash Cow | Essential real-time data, significant customer base, predictable ARR. | High asset retention and strong revenue stream from fleet management solutions. |

| Distance Capture & Reporting | Cash Cow | Essential for RUC and fleet management, consistent revenue, regulatory importance. | Continued revenue due to ongoing need for compliance with road user charges. |

| Standardized Regulatory Compliance Tools | Cash Cow | Streamlines reporting, broad customer base, stable recurring income. | Increasing demand due to growing complexity of international transport regulations. |

What You’re Viewing Is Included

EROAD BCG Matrix

The EROAD BCG Matrix preview you're examining is the identical, complete document you'll receive upon purchase, ensuring no hidden surprises or altered content. This professionally crafted report, ready for immediate application, will be delivered directly to you, allowing for seamless integration into your strategic planning processes. You can confidently rely on this preview as a true representation of the high-quality, analysis-ready EROAD BCG Matrix that will be yours to utilize without delay.

Dogs

EROAD's legacy 2G/3G hardware units are firmly in the Dogs category of the BCG Matrix. These older units are becoming obsolete as telecommunication providers in Australia and New Zealand shut down their 2G and 3G networks. This forces EROAD into significant capital expenditure to manage an ongoing 4G upgrade program for these devices.

These aging hardware units represent a cash drain for EROAD, as they require substantial investment for upgrades without generating new revenue streams or contributing to future growth. The cost and effort associated with transitioning these units highlight a product segment that is in a clear decline, consuming resources rather than creating value.

In segments where basic telematics functionality has become highly commoditized, EROAD might face challenges with low market share and growth, making these offerings question marks or even dogs in the BCG matrix. Intense price competition from numerous providers means these services generate minimal profit margins and struggle to differentiate. For instance, in 2024, the telematics market saw continued pressure on pricing for core features like GPS tracking and basic driver behavior monitoring, with average revenue per vehicle (ARPV) for such services declining in competitive regions.

Non-Strategic, Underperforming Niche Products in EROAD's portfolio represent offerings that haven't resonated with the market or integrated well. These typically exhibit low market share and contribute minimally to the company's revenue and growth trajectory. For instance, if a specific telematics feature designed for a very narrow industry segment saw less than 5% adoption among EROAD's customer base in 2024, it would fit this category.

Continued investment in these underperforming niches risks diminishing returns and could divert resources from more promising areas. EROAD's 2024 financial reports might highlight specific product lines with declining revenue or negative growth rates, signaling potential candidates for discontinuation. The strategic decision here often leans towards divesting or phasing out these products to streamline operations and focus on core, high-potential offerings.

Hardware Sales Without SaaS Attachment

Hardware sales without a SaaS attachment would be considered a Dog in EROAD's BCG Matrix. This scenario occurs when EROAD sells its hardware units but fails to secure the accompanying long-term software-as-a-service subscriptions.

These isolated hardware transactions generate low-margin, one-time revenue, which is unsustainable in the competitive hardware landscape. EROAD's core strategy relies on the high-value, recurring revenue generated by its SaaS platform, making hardware-only sales a deviation from its desired business model.

- Low Profitability: Hardware margins are typically thin, especially when competing against numerous providers.

- Non-Recurring Revenue: Unlike SaaS, hardware sales do not foster ongoing customer relationships or predictable income streams.

- Strategic Mismatch: This segment fails to contribute to EROAD's goal of building a robust, recurring revenue base.

- Market Saturation: The hardware market itself is often crowded, making it difficult to achieve significant market share or premium pricing without a value-added service.

Unsuccessful Pilot Programs or Unscaled Ventures

Unsuccessful pilot programs or ventures that don't scale into full commercial operations represent a significant drain on resources. These initiatives, despite initial investment, fail to capture market share or generate profitable growth. EROAD's strategic emphasis on advancing late-stage pilots highlights a proactive approach to mitigating the risks associated with such ventures.

These unscaled ventures are essentially cash traps, consuming capital and management attention without delivering a return. For instance, a pilot program for a new telematics service might show initial promise but falter due to integration challenges or insufficient market demand. If such a program doesn't transition to a broader rollout, the invested funds, including R&D and marketing, are lost. EROAD's reported focus on converting pilots suggests they are actively working to avoid this outcome, aiming to ensure that promising early-stage projects mature into revenue-generating products.

- Resource Drain: Unscaled ventures consume cash and effort without generating revenue or market share.

- Opportunity Cost: Resources tied up in failed pilots could have been allocated to more successful ventures.

- EROAD's Strategy: The company prioritizes converting late-stage pilots to avoid the 'dog' category.

- Example: A pilot for a new fleet management feature that doesn't gain traction or scale represents a 'dog' if not successfully commercialized.

EROAD's legacy 2G/3G hardware units are firmly in the Dogs category of the BCG Matrix. These older units are becoming obsolete as telecommunication providers in Australia and New Zealand shut down their 2G and 3G networks, forcing EROAD into significant capital expenditure for a 4G upgrade program. These aging devices represent a cash drain, requiring substantial investment without generating new revenue or contributing to future growth.

Hardware sales without a Software-as-a-Service (SaaS) attachment are also considered Dogs. These generate low-margin, one-time revenue, which is unsustainable and a strategic mismatch for EROAD's reliance on recurring SaaS revenue. In 2024, the telematics market continued to see pricing pressure on core features, impacting profitability for hardware-centric offerings.

Unsuccessful pilot programs that do not scale represent a drain on resources, consuming capital without delivering returns. For instance, a pilot for a new fleet management feature that fails to gain traction or scale would be a 'dog' if not successfully commercialized. EROAD's focus on converting late-stage pilots aims to mitigate this risk.

| Category | Characteristics | EROAD Example | 2024 Market Trend Impact | Strategic Consideration |

|---|---|---|---|---|

| Dogs | Low market share, low growth, negative cash flow | 2G/3G hardware units, hardware-only sales, unscaled pilot programs | Network shutdowns (2G/3G), commoditization of basic telematics, pricing pressure | Divest, phase out, or invest strategically for transition |

Question Marks

The EROAD Nav application, introduced in 2024, aims to revolutionize truck navigation with specialized routing and live traffic information. Despite its innovative approach to a critical fleet management need, its market penetration and user adoption are still nascent, classifying it as a Question Mark in the BCG matrix.

EROAD's investment in EROAD Nav is substantial, with a focus on expanding its capabilities and marketing reach. The company recognizes that to elevate this product from its current Question Mark status to a Star, considerable resources must be allocated to solidify its market position and drive widespread adoption among its target audience.

EROAD's expansion of its Core360 platform to include specialized industry verticals like cold chain logistics and construction positions these as Question Marks within the BCG Matrix. These sectors present significant growth opportunities, as demonstrated by the global cold chain market projected to reach $714.3 billion by 2027, and the construction industry's ongoing digital transformation. EROAD's success here hinges on developing highly tailored telematics solutions that address the unique operational challenges of these industries.

Capturing market share in these specific niches will require substantial investment in product development and targeted marketing strategies. For instance, the construction sector alone accounted for approximately 13% of global GDP in 2023, highlighting the economic importance and potential for telematics adoption. EROAD must demonstrate clear value propositions, such as enhanced asset tracking, compliance management, and operational efficiency, to gain traction against established or emerging competitors.

EROAD's ventures into advanced data insights and analytics services, developed through collaborations with research partners for economic forecasting and risk analysis, represent a Question Mark on the BCG Matrix. While the data analytics sector is experiencing robust growth, the market penetration of EROAD's advanced offerings beyond core fleet management is likely still in its nascent stages.

These sophisticated services necessitate substantial investment in both product development and consumer education to achieve widespread adoption and solidify market positioning. For instance, in 2024, the global business analytics market was projected to reach over $111 billion, indicating a significant opportunity but also highlighting the competitive landscape EROAD must navigate.

Solutions for Emerging Electric Vehicle (EV) Fleets

EROAD's strategic positioning for electric vehicle (EV) uptake highlights a significant future growth opportunity, likely placing its EV-related solutions in the question marks quadrant of the BCG Matrix. This means they are in a growing market but may have a smaller market share currently. Continued investment in specialized EV fleet management features, such as real-time battery health monitoring and integrated charging infrastructure data, will be essential to capitalize on this expanding sector.

The global EV market is experiencing robust growth, with projections indicating continued expansion. For instance, by the end of 2024, it's anticipated that over 30% of new vehicle sales in some key markets will be electric. EROAD's focus on developing advanced telematics for EV fleets, including optimized charging schedules and route planning that considers charging availability, positions them to capture a larger share of this burgeoning market.

- Investment in EV-Specific Features: EROAD's commitment to developing and enhancing features like battery performance analytics and charging station management software is critical for future market penetration.

- Market Growth Potential: The accelerating adoption of EVs globally presents a substantial opportunity for EROAD to expand its customer base and revenue streams within this segment.

- Strategic Partnerships: Collaborating with charging infrastructure providers and EV manufacturers could further solidify EROAD's position and accelerate its growth in the EV fleet management space.

- Data-Driven Optimization: Leveraging telematics data to provide actionable insights on EV operational efficiency, such as optimizing charging patterns to reduce electricity costs, will be a key differentiator.

Expansion into New Geographic Sub-segments (e.g., Light Commercial)

EROAD's strategic move into light commercial vehicle (LCV) segments, such as the Geotab partnership for Etrack Locate, places this area firmly in the Question Mark quadrant of the BCG Matrix. While the LCV market offers significant growth potential, EROAD is currently establishing its foothold, suggesting a relatively low market share.

This expansion requires substantial investment to build brand awareness and develop specialized offerings catering to LCV fleet needs. Success hinges on EROAD's ability to effectively penetrate this market, potentially transforming it into a Star performer.

- Market Growth: The LCV sector is experiencing robust expansion, driven by e-commerce and last-mile delivery services.

- Market Share: EROAD is in the early stages of building its presence in the LCV segment.

- Investment Needs: Significant capital is required for sales, marketing, and product development to capture market share.

- Potential: With strategic execution, this segment could evolve into a high-growth, high-market-share Star.

EROAD's EROAD Nav application, launched in 2024, targets specialized truck navigation with live traffic data. Despite its innovative approach, its market penetration is still developing, classifying it as a Question Mark. Significant investment is needed to grow its market share and transition it into a Star performer.

The expansion of EROAD's Core360 platform into specialized sectors like cold chain logistics and construction also represents Question Marks. These markets, with the global cold chain valued at $714.3 billion by 2027 and construction contributing significantly to global GDP, offer growth but require tailored telematics solutions.

Advanced data analytics and EV fleet management solutions are further Question Marks for EROAD. The business analytics market exceeded $111 billion in 2024, and EV sales are rapidly increasing, with over 30% of new sales in some key markets being electric by the end of 2024. EROAD's success in these areas depends on substantial investment and strategic positioning.

EROAD's entry into the Light Commercial Vehicle (LCV) market, exemplified by the Geotab partnership, positions this segment as a Question Mark. The LCV sector is growing, driven by e-commerce, but EROAD is still building its presence, necessitating investment in brand awareness and specialized offerings.

| Product/Service | BCG Quadrant | Market Growth | Market Share | Investment Focus |

| EROAD Nav | Question Mark | High | Low | Market Penetration, User Adoption |

| Core360 (Cold Chain, Construction) | Question Mark | High | Low | Tailored Solutions, Market Entry |

| Advanced Data Insights | Question Mark | High | Low | Product Development, Consumer Education |

| EV Fleet Management | Question Mark | Very High | Low | Specialized Features, Partnerships |

| LCV Segment | Question Mark | High | Low | Brand Awareness, Product Development |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including EROAD's financial reports, industry growth rates, and competitor analysis, to accurately position each business unit.