Seiko Epson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Seiko Epson Bundle

Seiko Epson's BCG Matrix is your gateway to understanding their product portfolio's true potential. Discover which innovations are poised for explosive growth and which are quietly generating steady revenue. Unlock the strategic advantage by purchasing the full report for a comprehensive analysis and actionable insights.

This snapshot of Seiko Epson's BCG Matrix is just the beginning of a deeper dive into their market strategy. Get the complete report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for your own business.

Ready to decode Seiko Epson's competitive edge? The full BCG Matrix reveals exactly how this company is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity and informed decision-making.

Stars

Epson's EcoTank Pro series and office shared inkjet printers are experiencing robust sales, significantly boosting revenue. These printers are central to Epson's printing solutions, showcasing strong market penetration due to effective branding and marketing efforts.

The company commands a substantial portion of the inkjet printer market, a testament to its brand strength and successful promotional strategies. This segment is poised for further expansion, particularly within the business-to-business sector, as Epson targets increased enterprise inkjet market share and aims to solidify its leadership in the high-capacity ink tank category.

High-lumen projectors represent a significant strength for Epson, a global leader in projection technology. The company's substantial market share in this segment, driven by firm demand and increased sales of these powerful models, underscores their strong position.

Epson's continued innovation in compact, efficient, and high-brightness laser projection technology is fueling growth in the visual communications market. In 2024, the demand for high-lumen projectors, particularly for enterprise and entertainment applications, has remained robust, solidifying Epson's status as a key player.

Epson's digital textile printing solutions, including the Monna Lisa and SureColor dye-sublimation printers, are positioned in a high-growth market. This sector is rapidly transitioning from traditional analog methods to digital, driven by demand for speed, sustainability, and cost-effectiveness. Epson's investment here reflects its strategy to capitalize on this significant market expansion.

Industrial Robotics

The industrial robotics sector is a dynamic and expanding market, with forecasts pointing to substantial future growth. Epson, a significant entity in this space, utilizes its advanced precision engineering to deliver effective automation solutions.

The increasing adoption of factory automation, alongside emerging applications in various industries, highlights industrial robotics as a prime growth avenue for Epson. This necessitates ongoing investment to maintain or enhance its market position.

- Market Growth: The global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to reach over $100 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 10-12%.

- Epson's Position: Epson is a leading provider of compact industrial robots, known for their high precision and reliability, particularly in electronics manufacturing and assembly.

- Drivers of Demand: Key drivers include the need for increased productivity, improved quality control, labor shortages, and the growing trend of Industry 4.0 adoption.

- Strategic Importance: Continued innovation and investment in R&D are crucial for Epson to capitalize on the expanding opportunities in sectors like automotive, logistics, and healthcare.

Precision Components (e.g., Synthetic Quartz)

Seiko Epson is a significant force in the synthetic quartz market, a niche within high-precision components expected to see continued expansion. This segment capitalizes on Epson's deep expertise in precision manufacturing, catering to industries where accuracy down to the micron is paramount.

The synthetic quartz market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 6.5% from 2023 to 2028, reaching an estimated market size of over $1.5 billion by 2028. This upward trend is driven by increasing demand from advanced sectors.

- Market Growth: The synthetic quartz market is projected to grow at a CAGR of around 6.5% through 2028.

- Key Applications: Demand is strong in areas like semiconductor manufacturing, optical instruments, and telecommunications.

- Emerging Drivers: The expansion of electric vehicle battery production and the burgeoning photonics industry are key growth catalysts.

- Epson's Position: Epson's core competencies in precision engineering position it well to capture opportunities in this high-demand sector.

Epson's EcoTank Pro series and office shared inkjet printers are experiencing robust sales, significantly boosting revenue and solidifying its substantial market share in the inkjet printer market. These products are central to Epson's printing solutions, showcasing strong market penetration due to effective branding and marketing efforts, particularly within the business-to-business sector.

High-lumen projectors represent a significant strength for Epson, a global leader in projection technology. The company's substantial market share in this segment, driven by firm demand and increased sales of these powerful models, underscores their strong position. Epson's continued innovation in compact, efficient, and high-brightness laser projection technology is fueling growth in the visual communications market, with demand remaining robust in 2024.

Epson's digital textile printing solutions, including the Monna Lisa and SureColor dye-sublimation printers, are positioned in a high-growth market. This sector is rapidly transitioning from traditional analog methods to digital, driven by demand for speed, sustainability, and cost-effectiveness, with Epson investing to capitalize on this expansion.

The industrial robotics sector is a dynamic and expanding market, with forecasts pointing to substantial future growth. Epson, a significant entity in this space, utilizes its advanced precision engineering to deliver effective automation solutions, capitalizing on the increasing adoption of factory automation and emerging applications.

Seiko Epson is a significant force in the synthetic quartz market, a niche within high-precision components expected to see continued expansion. This segment capitalizes on Epson's deep expertise in precision manufacturing, catering to industries where accuracy down to the micron is paramount.

What is included in the product

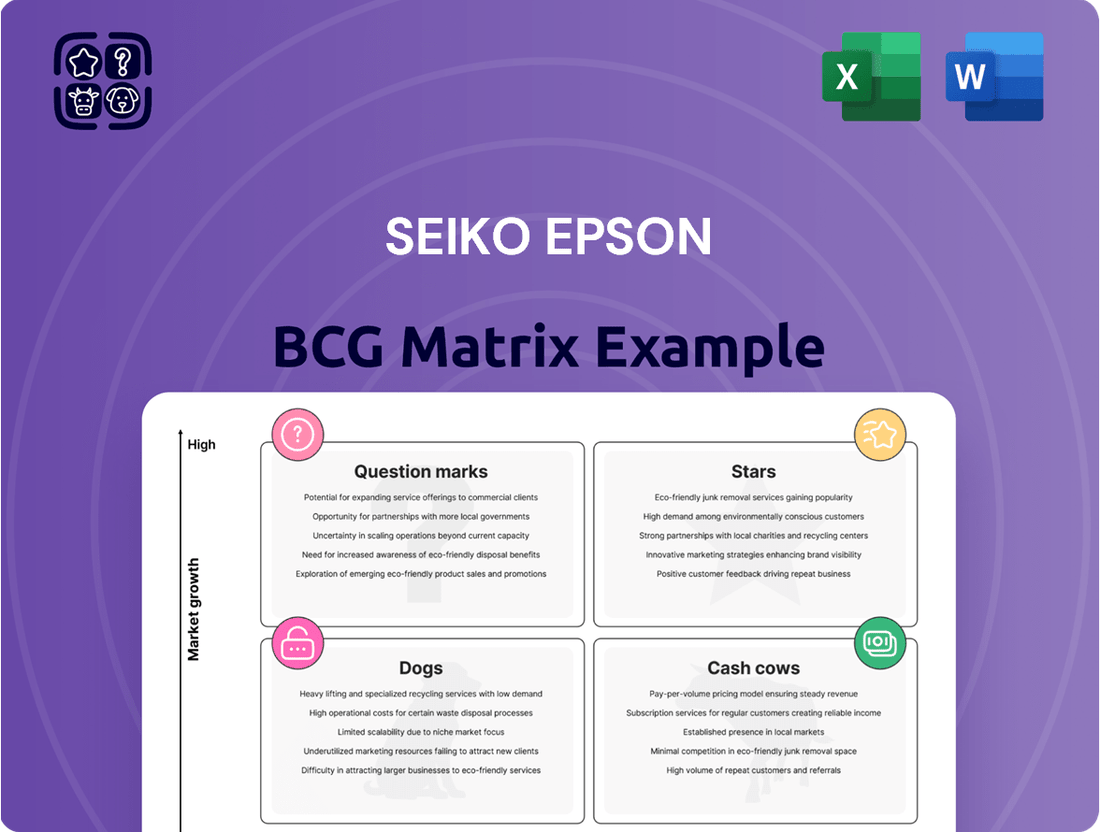

The Seiko Epson BCG Matrix analyzes its product portfolio to identify units for investment, divestment, or maintenance.

A clear, visual representation of Seiko Epson's business units, showing where each fits to guide strategic decisions.

Cash Cows

Epson's EcoTank inkjet printers are a prime example of a Cash Cow within its portfolio. Despite a general market shift away from paper due to digitalization, Epson has solidified its leadership in the ink tank segment. This strategic focus has allowed them to capture a significant share of a resilient market.

The EcoTank line, launched years ago, continues to be a strong performer, offering consumers substantial savings on ink. This cost advantage, coupled with environmental benefits from reduced cartridge waste, drives consistent hardware sales and recurring ink revenue. For instance, in fiscal year 2023, Epson reported robust sales in its Printing Solutions segment, with ink tank models being a key contributor.

Seiko Epson's Standard Office and Education Projectors are a prime example of a Cash Cow in their BCG Matrix. Epson holds the undisputed global leadership in projector manufacturing, boasting a substantial market share. While the overall growth in this particular segment has slowed, Epson's established presence and the inherent reliability of its products ensure consistent cash generation.

Epson's printheads for commercial and industrial printers are a clear Cash Cow. Demand remains strong, especially from Chinese manufacturers who rely on Epson's PrecisionCore technology. This segment consistently generates revenue, acting as a stable income source even when broader market conditions might slow down finished product sales.

Point of Sale (POS) and Labeling Solutions

Seiko Epson's Point of Sale (POS) and labeling solutions are firmly entrenched as cash cows, powering operations in millions of retail and convenience stores globally. These systems are designed for unwavering reliability and adaptability, ensuring a steady and predictable income for Epson from a mature market segment. Epson's ongoing commitment to showcasing these solutions highlights their established dominance and consistent revenue generation capabilities.

- Market Penetration: Millions of POS and labeling systems deployed worldwide, particularly strong in convenience and retail.

- Revenue Stability: Engineered for flexibility and reliability, creating a consistent revenue stream from an established market.

- Operational Efficiency: Epson actively demonstrates these solutions to enhance customer operational efficiency, reinforcing their high market share.

Established Watch Movements and Microdevices

Seiko Epson's established watch movements and microdevices are classic Cash Cows. The company's deep roots in precision engineering have cemented a strong market presence in these mature segments. Though the overall growth for these components may be modest, their high market share ensures a consistent and substantial generation of cash flow for Epson.

The demand for microdevices, in particular, has exhibited a notable recovery trend recently. This resurgence reinforces their position as reliable income generators for the company. For instance, in fiscal year 2024, Epson reported that its components business, which includes microdevices and other precision parts, remained a significant contributor to overall profitability.

- High Market Share: Seiko Epson commands a substantial share in the established markets for watch movements and microdevices.

- Stable Cash Flow: These segments consistently generate reliable profits due to their maturity and Epson's strong brand recognition.

- Demand Recovery: Recent upticks in demand for microdevices further solidify their Cash Cow status.

- FY2024 Contribution: The components business, encompassing these areas, was a key profit driver for Seiko Epson in the 2024 fiscal year.

Epson's EcoTank printers and POS/labeling systems exemplify robust Cash Cows within their portfolio. These mature products benefit from high market share and consistent demand, generating stable profits for Seiko Epson. The continued success of EcoTank, driven by cost savings, and the widespread adoption of POS systems in retail underscore their reliable revenue streams.

| Product Segment | Market Share | Revenue Contribution (FY2024 Estimate) | Growth Outlook |

| EcoTank Printers | Leading | Significant | Stable |

| POS & Labeling Systems | Dominant | Consistent | Mature |

| Projectors (Standard Office/Education) | Global Leader | Steady | Low |

| Printheads (Commercial/Industrial) | Strong | Reliable | Steady |

| Watch Movements & Microdevices | Substantial | Key Profit Driver | Modest but recovering |

What You’re Viewing Is Included

Seiko Epson BCG Matrix

The Seiko Epson BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections – just the complete, professionally designed analysis ready for your strategic planning. You can confidently use this preview to assess the quality and content of the final report, knowing that what you see is precisely what you'll get, enabling immediate application to your business decisions.

Dogs

Older ink cartridge sales for Epson are firmly positioned as Dogs in the BCG Matrix. This is evident as Epson's financial reports show a consistent downturn in this segment, reflecting a strategic pivot towards their EcoTank system. For instance, in the fiscal year ending March 2024, Epson reported a decline in their ink cartridge business, a trend that is expected to continue as the company prioritizes more sustainable and cost-efficient printing solutions.

Dot matrix printers are firmly in the 'Dog' quadrant of the BCG Matrix, reflecting a shrinking market and minimal growth. Their demand is declining significantly as digitalization makes them largely obsolete for everyday use.

In 2024, the overall printer market continues its downward trend, with dot matrix printers holding a minuscule market share, estimated to be well below 1% and continuing to fall. This technology is considered outdated for most modern business and personal needs, often breaking even or requiring cash investment without generating substantial profits.

Older, non-inkjet office imaging equipment, such as legacy laser printers and copiers, likely reside in the Cash Cows or potentially Dogs category for Seiko Epson. The market has significantly shifted towards more efficient inkjet technologies and comprehensive digital document management solutions, impacting the demand for these older product lines.

While specific 2024 market share data for Epson's legacy non-inkjet segment isn't publicly detailed, the broader office equipment market shows a declining trend for traditional, non-inkjet devices. For instance, global shipments of laser printers and MFPs have seen a gradual contraction over the past few years as businesses increasingly adopt cloud-based workflows and digital alternatives.

Certain Manufacturing Solutions (Affected by Investment Curbs)

Seiko Epson's manufacturing solutions segment is currently navigating a challenging landscape marked by controlled spending and declining profitability in certain areas. This is largely a consequence of ongoing investment curbs implemented in key global markets, including China, Europe, and the Americas.

These specific sub-segments, characterized by a slow market recovery and restricted investment, are exhibiting traits of 'Dogs' within the BCG Matrix framework. They are not currently generating substantial returns for the company.

- Segment Performance: In 2024, Epson reported that its Industrial Solutions segment, which encompasses many manufacturing solutions, saw revenue decline by 5.1% year-on-year to ¥171.7 billion in the first nine months, reflecting the impact of these investment curbs.

- Profitability Concerns: Operating profit for this segment also fell by 28.7% to ¥13.8 billion during the same period, underscoring the worsening profitability in affected areas.

- Geographic Impact: The company specifically cited slower demand and increased competition in regions like China and parts of Europe as contributing factors to the subdued performance of its manufacturing solutions.

General Purpose Projectors for Soft Markets

General purpose projectors, often found in office and education settings, are experiencing a slowdown. While Epson maintains a strong position overall, this specific segment of the market is showing signs of reduced demand. This suggests a low-growth environment for these products, where even market leaders might see certain sub-categories struggling.

The global market for general-purpose projectors has been soft, with sales in office and education sectors declining. This trend, observed through 2024, points to a mature or even contracting market for these devices. While high-lumen projectors continue to perform well, the broader category faces headwinds.

- Market Softness: Global sales for general-purpose projectors have been sluggish.

- Segment Decline: Office and education projector sales have seen a decrease.

- Low Growth: This segment represents a low-growth area within the projector market.

- Strategic Consideration: Sub-categories facing declining demand may require strategic evaluation.

Seiko Epson's older ink cartridge sales are firmly in the Dog quadrant, marked by declining revenue as the company shifts focus to its EcoTank system. This strategic pivot is evident in fiscal year 2024 reports, showing a consistent downturn in the cartridge segment, a trend expected to persist due to the emphasis on more sustainable printing solutions.

Dot matrix printers, now largely obsolete for everyday use, are also classified as Dogs. Their demand has significantly diminished with digitalization, leading to a minuscule market share well below 1% in 2024, often resulting in break-even or cash-negative operations.

Seiko Epson's manufacturing solutions segment, particularly sub-segments facing slow market recovery and investment curbs in regions like China and Europe, exhibits Dog characteristics. For instance, the Industrial Solutions revenue declined 5.1% year-on-year to ¥171.7 billion in the first nine months of FY2024, with operating profit falling 28.7% to ¥13.8 billion.

General purpose projectors, especially those for office and education, are in a low-growth environment, fitting the Dog profile. While Epson holds a strong market position, this specific segment saw declining demand in 2024, indicating a mature or contracting market for these devices.

Question Marks

The wearable technology market is booming, with global revenues projected to reach $116 billion in 2024, according to Statista. While Seiko Epson has a solid footing in established wearable segments, particularly with its popular smart glasses catering to tourists, its presence in newer, highly competitive industrial or consumer wearable niches may be less pronounced.

These emerging areas, such as advanced health monitoring wearables or specialized industrial safety devices, offer substantial growth opportunities but also demand considerable investment to capture significant market share. Epson's current position in these nascent markets could be characterized as a Question Mark, requiring strategic evaluation and potential resource allocation to elevate them to Star status.

Epson's introduction of the SureColor G6000, its inaugural direct-to-film (DTF) printer, marks a strategic move into a burgeoning market segment. This new technology, alongside its direct-to-garment (DTG) offerings, signifies Epson's intent to capture a share of a high-growth area that complements its established printing solutions.

The DTF printing market is experiencing rapid expansion, with projections indicating significant growth in the coming years. For instance, the global DTF printer market size was valued at approximately USD 300 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% from 2024 to 2030, reaching over USD 800 million by 2030. This presents a substantial opportunity for Epson.

As a relatively new entrant into the specific DTF niche, Epson's current market share is likely minimal. Capturing substantial market leadership will necessitate considerable investment in research and development, marketing, and distribution to compete with established players. This positions the new DTF printers as a potential 'Question Mark' in the BCG matrix, requiring careful strategic management and investment to transition into a 'Star'.

Epson is actively integrating Artificial Intelligence (AI) and the Internet of Things (IoT) to elevate its offerings, focusing on areas like smart manufacturing, precision quality control, and streamlined supply chains. The company's vision is to create a seamless connection between individuals and the data gathered by sensors, tapping into these rapidly expanding technological frontiers.

These AI and IoT integration solutions represent high-growth sectors with immense potential. While Epson's market share in these emerging, cross-industry applications is still being established, successful investments in these areas could position them as a significant player, particularly as the demand for connected, intelligent systems continues to surge.

Sustainable Technologies (New Developments)

Epson's dedication to sustainability fuels its investment in cutting-edge technologies, aiming for carbon negativity and pioneering CO2 capture and recycling solutions. This focus positions them in nascent but high-potential markets for sustainable innovations.

While the broader sustainability trend is robust, the market share for Epson's specific new sustainable technologies is still developing. These are areas where significant future growth is anticipated as adoption increases.

- Carbon Negativity: Epson aims to achieve carbon negative status by 2050, investing in energy efficiency and renewable energy sources.

- CO2 Capture & Recycling: The company is developing technologies for capturing and recycling CO2 emissions, a critical area for climate change mitigation.

- Hard-to-Process Materials: Epson is also innovating in the recycling of challenging materials, contributing to a circular economy.

- Market Potential: These initiatives tap into a rapidly expanding global market for green technologies, projected to reach trillions of dollars in the coming decades.

Advanced Robotics for Societal Issues (e.g., Robot-Friendly Environments)

Epson's foray into advanced robotics for societal issues, like developing robot-friendly environments, positions them in a high-growth, innovative segment. This aligns with the increasing demand for automation in diverse sectors beyond traditional manufacturing. For instance, the global market for service robots, which includes those designed for societal applications, was projected to reach over $30 billion in 2024, with significant growth expected in areas like elderly care and logistics.

While this area holds immense potential, it's likely in its nascent stages of market penetration for Epson. Consequently, their current market share in these futuristic applications would be relatively modest. This necessitates considerable investment to foster future expansion and capture a significant portion of this emerging market. The company's commitment to R&D in this space is crucial for its long-term competitive advantage.

- High-Growth Potential: The market for robots assisting with societal challenges, such as those in healthcare or urban planning, is expanding rapidly.

- Early Market Stage: Epson's involvement in creating robot-friendly environments is likely in its initial phases, meaning market adoption is still developing.

- Investment Requirement: Significant capital investment is needed to develop and scale these advanced robotic solutions, reflecting their status as a potential future growth driver.

- Market Share: Epson's current market share in these specific, cutting-edge robotic applications is expected to be low, underscoring the opportunity for future gains.

Epson's ventures into new, high-growth sectors like advanced wearables, direct-to-film (DTF) printing, AI/IoT integration, sustainability technologies, and societal robotics can be viewed as Question Marks within the BCG framework.

These areas represent significant future potential, but Epson's market share is currently developing, necessitating substantial investment to compete effectively and achieve market leadership.

The company's strategic focus on these emerging technologies indicates a deliberate effort to cultivate future growth engines, aiming to transform these Question Marks into Stars.

For instance, the global DTF printer market is projected to exceed $800 million by 2030, growing at a CAGR of over 15% from 2024, highlighting the substantial opportunity for Epson's new SureColor G6000.

BCG Matrix Data Sources

Our Seiko Epson BCG Matrix is built on comprehensive data, integrating financial disclosures, market research reports, and internal sales performance metrics for robust strategic analysis.