Enhabit Home Health & Hospice PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enhabit Home Health & Hospice Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Enhabit Home Health & Hospice's trajectory. Our expertly crafted PESTLE analysis provides a comprehensive overview of these external influences, empowering you to anticipate challenges and capitalize on opportunities. Gain a significant competitive advantage by understanding the full external landscape. Download the complete PESTLE analysis now for actionable intelligence.

Political factors

Changes in federal and state healthcare policies significantly shape Enhabit's operations. For instance, shifts in Medicare reimbursement rates, a primary revenue source, directly affect profitability. In 2024, the Centers for Medicare & Medicaid Services (CMS) proposed a 0.8% payment rate reduction for home health agencies, highlighting the constant need for adaptation.

New healthcare acts or reforms, such as those impacting patient eligibility or service delivery models, can alter Enhabit's market reach and operational costs. The ongoing focus on value-based care initiatives, for example, encourages providers to deliver higher quality outcomes, potentially influencing how Enhabit structures its service offerings and performance metrics.

Adapting to evolving regulations concerning telehealth, staffing ratios, and quality reporting is paramount for Enhabit's compliance and financial health. These adjustments ensure the company remains competitive and legally sound within the dynamic healthcare landscape.

Government decisions on reimbursement rates, especially from Medicare and Medicaid, are a major political influence on Enhabit. For instance, the Centers for Medicare & Medicaid Services (CMS) proposed a 2.1% increase for Medicare payments to home health agencies in 2024, a slight but important adjustment impacting revenue streams.

Changes in these rates, or a move towards value-based care and bundled payment models, directly affect Enhabit's profitability and its capacity for growth and service enhancement. The shift to these new models aims to reward quality outcomes over the volume of services provided.

Industry associations actively lobby policymakers to influence these crucial funding decisions. Their advocacy can shape legislation and regulations that ultimately determine the financial landscape for home health and hospice providers like Enhabit.

Government agencies like the Centers for Medicare & Medicaid Services (CMS) and state health departments exert significant regulatory oversight on home health and hospice providers. Enhabit faces a substantial compliance burden due to this scrutiny, particularly concerning quality metrics, fraud prevention, and patient safety.

Increased enforcement trends, driven by political emphasis on healthcare accountability, can compel Enhabit to make considerable investments in compliance infrastructure and staff training. For instance, CMS's focus on value-based care and potential penalties for non-compliance directly influence operational costs and strategic planning for companies like Enhabit.

Public Health Initiatives and Preparedness

Government-backed public health campaigns, such as those focused on chronic disease management or pandemic preparedness, directly influence the demand for home health services. For instance, initiatives promoting aging in place or supporting post-hospitalization recovery at home can boost Enhabit's patient volume. The Centers for Medicare & Medicaid Services (CMS) continues to be a significant payer, with Medicare fee-for-service spending projected to reach $529 billion in 2024, underscoring the importance of policy shifts affecting reimbursement for home health services.

Policies designed to shift care from institutional settings to home-based environments present a clear opportunity for Enhabit. The COVID-19 pandemic highlighted the critical role of home health, leading to increased focus on telehealth and remote patient monitoring capabilities, areas where Enhabit can leverage technology to expand its reach and efficiency. In 2023, the home health sector saw continued emphasis on value-based care models, which reward providers for quality outcomes rather than volume, aligning with Enhabit's strategic goals.

Conversely, public health emergencies can also pose operational challenges. During a pandemic, for example, resource allocation might shift, potentially impacting staffing availability or increasing the cost of personal protective equipment (PPE). Enhabit's ability to adapt its service delivery model, ensuring patient and staff safety while maintaining service continuity, is crucial. The ongoing evolution of healthcare regulations, including potential changes to staffing ratios or infection control protocols, requires constant vigilance and strategic adjustment.

- Government Funding: CMS reimbursement rates for home health services are subject to annual adjustments, with a projected net payment rate increase of 2.4% for Medicare-certified home health agencies in 2024.

- Pandemic Response: Public health declarations can trigger emergency waivers or policy changes that affect service delivery, such as expanded telehealth allowances for home health providers.

- Chronic Disease Management: Government programs aimed at managing conditions like diabetes or heart failure often encourage home-based care, directly benefiting providers like Enhabit.

Political Stability and Healthcare Spending

Political stability is a cornerstone for sectors like home health and hospice. In the United States, the prevailing political climate significantly shapes healthcare policy, directly impacting reimbursement rates and regulatory frameworks for providers like Enhabit. A government that champions expanded healthcare access often translates to more favorable conditions for in-home care services, as these are seen as cost-effective alternatives to institutional settings.

The stance of the current administration and Congress on healthcare spending is a critical factor. For instance, discussions around Medicare and Medicaid funding levels, which are primary revenue sources for home health agencies, directly influence the financial health of companies like Enhabit. Changes in these funding streams, whether through legislative action or administrative policy shifts, can create either opportunities for growth or headwinds for the industry.

- Healthcare Spending Trends: In 2024, projections indicate continued growth in overall healthcare spending, with a particular focus on value-based care models that often favor home-based services.

- Policy Initiatives: Federal and state initiatives aimed at increasing access to home health services, such as those proposed in recent legislative sessions, could bolster Enhabit's market position.

- Regulatory Environment: Shifts in regulations concerning staffing, patient care standards, and payment models can significantly affect operational costs and revenue for home health providers.

- Political Party Platforms: The healthcare platforms of major political parties, particularly their emphasis on Medicare Advantage and traditional Medicare, directly influence the reimbursement landscape for Enhabit's services.

Government reimbursement rates, particularly from Medicare and Medicaid, are a significant political factor for Enhabit. For example, the Centers for Medicare & Medicaid Services (CMS) finalized a 0.8% payment rate reduction for home health agencies in 2024, a change that directly impacts revenue. Policy shifts towards value-based care also influence how Enhabit structures its services to meet quality outcome expectations.

Government initiatives promoting aging in place and chronic disease management at home create demand for Enhabit's services. The US Department of Health and Human Services continues to support programs that encourage home-based care as a cost-effective alternative to institutional settings. Political advocacy by industry associations also plays a crucial role in shaping legislation and regulations affecting providers.

Regulatory oversight from agencies like CMS and state health departments imposes a compliance burden on Enhabit, particularly regarding quality metrics and patient safety. Increased enforcement of healthcare accountability measures can necessitate significant investments in compliance infrastructure. The political emphasis on value-based care and potential penalties for non-compliance directly affects operational costs and strategic planning.

| Policy Area | 2024 Impact/Projection | Enhabit Relevance |

|---|---|---|

| Medicare Reimbursement Rates | Proposed 0.8% reduction for home health agencies (CMS final rule) | Directly affects revenue and profitability. |

| Value-Based Care Initiatives | Continued emphasis on rewarding quality outcomes | Requires adaptation of service delivery and performance metrics. |

| Healthcare Spending | Projected growth in overall healthcare spending, focus on home-based care | Indicates potential for increased demand and market opportunities. |

What is included in the product

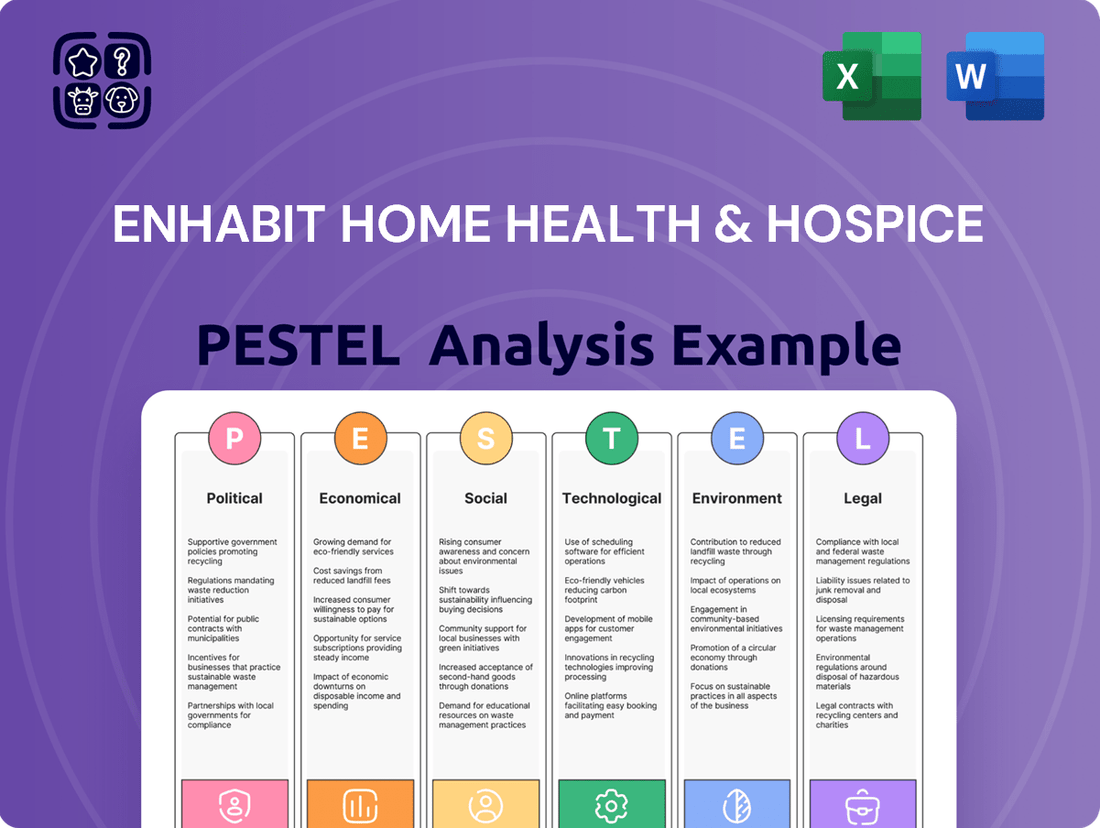

This PESTLE analysis examines the external macro-environmental factors impacting Enhabit Home Health & Hospice, covering political, economic, social, technological, environmental, and legal influences.

It provides actionable insights into how these forces create opportunities and threats for the company's strategic planning and growth.

This PESTLE analysis for Enhabit Home Health & Hospice provides a clear, concise overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

It offers a visually segmented breakdown by PESTEL categories, enabling quick interpretation and identification of key opportunities and threats, thus alleviating the pain of information overload.

Economic factors

National healthcare expenditure is a critical economic driver for home health and hospice. In 2023, U.S. healthcare spending reached an estimated $4.7 trillion, a 6.1% increase from the previous year, according to CMS projections. This upward trend in overall healthcare costs creates a strong economic rationale for shifting care from costly hospitals to home-based settings, directly benefiting companies like Enhabit Home Health & Hospice.

The increasing cost of inpatient care, projected to continue its ascent, makes home health a more attractive and cost-effective alternative. For instance, Medicare’s average payment for a day in a skilled nursing facility can be significantly higher than for home health services. This economic pressure on the broader healthcare system is a tailwind for Enhabit's service model.

However, economic downturns can impact government funding for healthcare programs. If the economy slows significantly, leading to reduced tax revenues, there's a potential for tighter budgets affecting Medicare and Medicaid reimbursement rates, which are crucial for Enhabit's revenue streams. This fiscal constraint could temper the growth in demand for outsourced home healthcare services.

Inflationary pressures are a significant concern for Enhabit, particularly impacting the cost of essential resources. Skilled nursing and therapy labor, a cornerstone of their service delivery, has seen considerable wage inflation in the healthcare sector. This, combined with rising prices for medical supplies and increased transportation expenses due to fuel costs, directly squeezes Enhabit's operating margins.

For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for healthcare practitioners and technical occupations increased by approximately 4.5% year-over-year through early 2024. If Enhabit cannot secure commensurate increases in reimbursement rates or achieve substantial operational efficiencies, these rising costs pose a direct threat to profitability and financial stability.

The economic supply and demand for healthcare professionals, particularly registered nurses, licensed practical nurses, and therapists, significantly influence Enhabit's capacity to deliver services. For instance, a report from the U.S. Bureau of Labor Statistics in 2024 projects a 6% growth for registered nurses from 2022 to 2032, a rate slower than the average for all occupations, underscoring potential ongoing demand pressure.

Widespread healthcare workforce shortages can escalate recruitment and retention expenses, directly impacting Enhabit's operational costs and its ability to maintain service levels and quality of care. The average registered nurse salary in the US was around $86,070 in 2024, with demand driving this figure higher in many regions.

Economic incentives, such as competitive compensation packages and student loan forgiveness programs, alongside robust educational pipelines for these critical professions, are vital for addressing these shortages and ensuring Enhabit's long-term staffing stability.

Reimbursement Rate Viability

The viability of reimbursement rates from Medicare and private insurers is a critical economic factor for Enhabit Home Health & Hospice. Changes in these rates directly impact revenue and profitability, especially as operational costs, including labor and supplies, continue to rise. For instance, Medicare's proposed payment rates for home health agencies in 2024 indicated a potential decrease, highlighting the sensitivity of the business model to policy shifts.

Strategic planning must consider the ongoing shift from fee-for-service to value-based payment models. While value-based care aims to reward quality outcomes, the transition can introduce financial uncertainty. Enhabit's ability to adapt and thrive in these evolving reimbursement structures will be key to its long-term economic success.

- Medicare Reimbursement: In 2024, the Centers for Medicare & Medicaid Services (CMS) proposed a 0.8% payment rate increase for home health agencies, a figure that may not fully offset rising costs.

- Private Payer Mix: The proportion of revenue derived from private insurers, whose rates can vary significantly, influences overall financial stability.

- Operational Cost Inflation: Rising wages for skilled nursing staff and increased supply costs directly pressure the margin between reimbursement and expenses.

- Value-Based Purchasing: The potential adoption and success of value-based payment models, which reward quality and efficiency, will shape future revenue streams.

Consumer Disposable Income and Insurance Coverage

While government programs and private insurance are primary payers for home health and hospice, consumer disposable income plays a subtle role. As of Q1 2024, real disposable income in the U.S. saw a modest increase, suggesting a potential for individuals to afford services not fully reimbursed by insurance, like enhanced comfort care or specialized therapy. Higher employment rates, which were around 62.7% for the working-age population in early 2024, also contribute to this indirectly by bolstering overall economic confidence and the ability to cover out-of-pocket expenses.

The direct impact of disposable income on Enhabit's core services is limited, as Medicare and Medicare Advantage are the dominant reimbursement sources. However, increased disposable income can influence patient choices regarding supplemental services or private-pay options. For instance, families with greater financial flexibility might opt for additional in-home support or specialized palliative care services that go beyond standard Medicare coverage, potentially boosting revenue for providers like Enhabit.

- Consumer Spending Power: Real disposable income growth in early 2024 provides a buffer for out-of-pocket healthcare expenses.

- Employment Stability: A robust employment landscape (62.7% working-age population employment in Q1 2024) supports household financial stability.

- Supplemental Service Demand: Higher disposable income can increase demand for non-covered, value-added services in home health and hospice.

- Indirect Economic Influence: Overall economic health, reflected in disposable income and employment, indirectly supports the sector's operational capacity and patient access.

The economic landscape significantly shapes Enhabit's operational environment, with healthcare expenditure trends and reimbursement policies being paramount. Rising healthcare costs, projected to continue, create a favorable economic climate for home-based care, positioning Enhabit as a cost-effective alternative to inpatient settings. However, economic downturns and inflationary pressures, particularly on labor and supplies, directly impact profit margins, necessitating careful financial management and strategic adjustments to reimbursement rates.

| Economic Factor | 2023/2024 Data Point | Implication for Enhabit |

| National Healthcare Expenditure | $4.7 trillion (2023, 6.1% increase) | Supports shift to cost-effective home care. |

| Healthcare Labor Cost Inflation | ~4.5% increase in avg. hourly earnings (early 2024) | Pressures operating margins; requires rate adjustments. |

| Medicare Reimbursement (Proposed) | 0.8% increase (2024) | May not fully offset rising operational costs. |

| Real Disposable Income | Modest increase (Q1 2024) | Supports demand for supplemental/private-pay services. |

Preview the Actual Deliverable

Enhabit Home Health & Hospice PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Enhabit Home Health & Hospice covers political, economic, social, technological, legal, and environmental factors impacting their operations. Dive into a detailed examination of the external forces shaping their strategic landscape.

Sociological factors

The United States is experiencing a significant demographic shift with a growing elderly population. In 2023, individuals aged 65 and over represented over 17% of the total population, a figure projected to climb steadily. This trend directly translates to increased demand for home health and hospice services.

As people age, the likelihood of developing chronic diseases like heart disease, diabetes, and Alzheimer's increases. Data from the Centers for Disease Control and Prevention (CDC) indicates that approximately 6 in 10 adults in the U.S. have a chronic disease, and 4 in 10 have two or more. These conditions often necessitate continuous medical attention and support, making in-home care a preferred and often more cost-effective option compared to institutional settings.

This societal evolution, characterized by both an expanding senior demographic and a higher prevalence of chronic illnesses, serves as a fundamental growth driver for companies like Enhabit, which specialize in providing essential in-home healthcare solutions.

A significant societal trend is the strong preference among older adults to age in place, meaning they wish to remain in their own homes and communities rather than move to assisted living facilities or nursing homes. This desire for comfort, familiarity, and independence is a major sociological factor driving demand for home health and hospice services.

Enhabit Home Health & Hospice is well-positioned to capitalize on this trend. For instance, a 2023 AARP survey indicated that 77% of adults aged 50 and older want to stay in their own homes for as long as possible. This aligns perfectly with Enhabit's core service offering, directly addressing a widespread societal preference.

Societal shifts are significantly impacting the demand for home healthcare. Smaller family sizes and the geographical scattering of relatives mean fewer individuals are available to provide informal care. Furthermore, with more women participating in the workforce, the traditional pool of family caregivers is shrinking.

This reduction in informal support directly translates to a greater need for professional services. For instance, in 2024, the number of Americans aged 65 and older is projected to reach over 56 million, a substantial segment often requiring assistance. This growing demographic, coupled with fewer family caregivers, creates a robust market opportunity for companies like Enhabit Home Health & Hospice.

Health Literacy and Awareness of Home Care Benefits

Rising health literacy is a significant sociological driver for Enhabit Home Health & Hospice. As more individuals and families understand the advantages of receiving medical care and support in their own homes, demand for these services naturally increases. This growing awareness means patients are more likely to choose home-based options over traditional institutional settings.

Educational initiatives by healthcare providers and advocacy organizations play a crucial role in this shift. For example, a 2024 survey indicated that 70% of adults would prefer home healthcare if medically feasible, up from 62% in 2022, highlighting a clear trend in patient preference driven by increased awareness.

This societal acceptance translates directly into market opportunities for companies like Enhabit. Key factors influencing this trend include:

- Increased Patient Empowerment: Greater health literacy allows patients to make more informed decisions about their care options.

- Provider Education Campaigns: Organizations actively promoting the benefits of home health are expanding the market.

- Positive Media Portrayals: Media coverage showcasing successful home care experiences further boosts public perception.

- Family Involvement: As families become more educated, they are more likely to advocate for home care solutions for their loved ones.

Cultural Attitudes Towards Illness and End-of-Life Care

Societal views on illness and recovery are shifting, with a greater emphasis on comfort and familiarity. This trend directly impacts the demand for home-based care. Many individuals now prefer to manage chronic conditions or receive palliative care in their own homes, rather than in institutional settings.

The acceptance of hospice care as a dignified and compassionate choice for end-of-life is also on the rise. This cultural evolution means more families are seeking services that allow loved ones to remain comfortable and surrounded by familiar surroundings during their final stages of life. Enhabit's focus on in-home care aligns well with these evolving preferences.

Data from 2023 indicates a continued preference for home health services. For instance, Medicare data shows that millions of beneficiaries receive home health services annually, underscoring the societal value placed on receiving care in a familiar environment. This preference is expected to grow as the population ages and cultural attitudes continue to favor in-home solutions.

- Growing Preference for Home-Based Care: A significant majority of seniors express a desire to age in place, indicating a strong societal preference for receiving care at home.

- Increased Acceptance of Hospice: Surveys consistently show a positive shift in attitudes towards hospice care, viewing it as a valuable option for comfort and dignity at the end of life.

- Family-Centric Decision Making: Cultural norms increasingly emphasize family involvement in healthcare decisions, often leading to choices that prioritize keeping loved ones at home.

- Impact on Service Demand: These evolving attitudes directly translate into higher demand for home health and hospice services, aligning with Enhabit's core offerings.

Societal trends strongly favor aging in place, with a significant majority of older adults preferring to remain in their homes. A 2023 AARP survey found that 77% of adults aged 50 and older want to stay in their homes as long as possible. This preference directly fuels demand for home health and hospice services, as individuals seek familiar environments for care.

The shrinking availability of informal family caregivers, due to smaller family sizes and increased female workforce participation, further amplifies the need for professional in-home support. With over 56 million Americans projected to be aged 65 and older in 2024, this demographic shift, combined with reduced informal care, creates a substantial market opportunity for companies like Enhabit.

Rising health literacy and a growing acceptance of hospice care as a dignified option are also key sociological drivers. A 2024 survey indicated that 70% of adults would prefer home healthcare if medically feasible, up from 62% in 2022, demonstrating a clear societal shift towards valuing in-home medical solutions.

The increasing preference for home-based care and the positive societal view of hospice services directly translate into greater demand for Enhabit's offerings. This trend is supported by millions of Medicare beneficiaries annually utilizing home health services, highlighting the societal value placed on receiving care in a familiar setting.

| Sociological Factor | 2023/2024 Data Point | Implication for Enhabit |

|---|---|---|

| Aging in Place Preference | 77% of adults 50+ want to stay in their homes (AARP, 2023) | Increased demand for home health and hospice services. |

| Shrinking Informal Caregiver Pool | Projected 56M+ Americans aged 65+ in 2024 | Greater reliance on professional home care providers. |

| Health Literacy & Home Care Preference | 70% prefer home healthcare if feasible (Survey, 2024) | Growing patient and family acceptance of in-home solutions. |

Technological factors

The increasing adoption of telehealth and remote patient monitoring (RPM) is a significant technological factor for Enhabit. These innovations allow for virtual patient consultations and continuous health tracking, leading to better patient care and more efficient operations. For instance, by mid-2024, a significant percentage of home health agencies reported using RPM devices, with projections indicating further growth as the technology matures and becomes more accessible.

The widespread adoption of Electronic Health Records (EHRs) is critical for Enhabit Home Health & Hospice, streamlining data management, improving care coordination, and ensuring regulatory adherence. As of early 2024, over 90% of U.S. hospitals and a significant majority of physician practices utilize EHR systems, highlighting the pervasive nature of this technology in healthcare settings.

Enhabit's ability to ensure its EHR systems can seamlessly exchange information with other healthcare providers, such as hospitals and physician offices, directly impacts the continuity of patient care and can significantly reduce administrative overhead. This interoperability is key to providing a cohesive patient experience.

Continued investment in advanced, interoperable EHR solutions is therefore a strategic imperative for Enhabit. The Office of the National Coordinator for Health Information Technology (ONC) continues to push for greater interoperability, with initiatives aimed at facilitating secure data sharing across the healthcare ecosystem, a trend expected to intensify through 2025.

Enhabit is increasingly leveraging data analytics and AI to refine patient care. For instance, by analyzing vast datasets, they can predict potential patient health declines, allowing for proactive interventions. This data-driven approach also helps optimize staffing schedules, ensuring the right personnel are available when and where they are needed most.

AI-powered tools are instrumental in identifying subtle patient health trends that might otherwise go unnoticed. This supports clinical teams in making more informed decisions, ultimately leading to improved patient outcomes. Furthermore, these technologies streamline administrative tasks, contributing to greater operational efficiency and potential cost savings for Enhabit.

Mobile Health (mHealth) and Wearable Devices

The increasing adoption of mobile health (mHealth) and wearable devices presents significant opportunities for Enhabit Home Health & Hospice. These technologies allow for enhanced patient engagement and self-management, with the global mHealth market projected to reach over $300 billion by 2027, indicating substantial growth. Wearable devices, such as smartwatches and continuous glucose monitors, are becoming more sophisticated, enabling the collection of vital health data directly from patients in their homes.

Enhabit can leverage these advancements to foster proactive care. By integrating mHealth apps and wearable data into their service delivery, the company can gain real-time insights into patient conditions, facilitating timely interventions and personalized care plans. For instance, remote patient monitoring through connected devices can reduce hospital readmissions, a key metric for home health providers.

- Patient Empowerment: mHealth apps can provide patients with tools for medication reminders, appointment scheduling, and educational resources, promoting active participation in their own care.

- Data-Driven Insights: Wearable devices can continuously collect data on activity levels, heart rate, and sleep patterns, offering clinicians a more comprehensive view of a patient's health status between visits.

- Improved Communication: Secure messaging features within mHealth platforms can streamline communication between patients, caregivers, and healthcare providers, enhancing care coordination.

- Operational Efficiency: Automating data collection and certain patient interactions through technology can free up clinical staff to focus on higher-value care activities.

Cybersecurity and Data Privacy Technologies

Enhabit's reliance on digital platforms for patient data and service delivery makes advanced cybersecurity and data privacy technologies essential. Protecting sensitive health information from breaches is a constant challenge, requiring ongoing investment in secure IT infrastructure and encryption. For instance, the healthcare sector saw a significant rise in cyberattacks, with the average cost of a data breach reaching $10.10 million in 2023, according to IBM's Cost of a Data Breach Report.

Ensuring compliance with regulations like HIPAA necessitates robust data protection strategies. This includes not only technological safeguards but also comprehensive employee training on data privacy best practices. The Office for Civil Rights (OCR) reported over 700 healthcare data breaches affecting more than 130 million individuals in 2023 alone, highlighting the critical need for vigilance.

- Cybersecurity Investment: Continued investment in secure IT infrastructure and advanced encryption is vital for protecting patient data.

- Data Privacy Compliance: Adherence to regulations like HIPAA requires sophisticated data privacy technologies and regular audits.

- Employee Training: Ongoing training programs are crucial to mitigate risks associated with human error in data handling.

- Technological Advancements: Staying abreast of evolving security technologies is paramount for maintaining patient trust and operational integrity.

Technological advancements, particularly in telehealth and remote patient monitoring (RPM), are reshaping home healthcare delivery for Enhabit. By mid-2024, a substantial portion of home health agencies were utilizing RPM devices, with this trend expected to accelerate as technology becomes more integrated and accessible through 2025. These tools enable virtual patient interactions and continuous health tracking, enhancing care quality and operational efficiency.

The pervasive adoption of Electronic Health Records (EHRs), with over 90% of U.S. hospitals using them by early 2024, underscores the importance of interoperability for Enhabit. Seamless data exchange with other providers is crucial for patient care continuity and reducing administrative burdens. Enhabit's strategic investment in interoperable EHR solutions aligns with ongoing industry-wide efforts, supported by initiatives from the Office of the National Coordinator for Health Information Technology, to facilitate secure data sharing across the healthcare ecosystem through 2025.

Enhabit is increasingly leveraging data analytics and AI to improve patient care and operational effectiveness. AI-powered tools can predict patient health declines, enabling proactive interventions and optimizing staff allocation. These technologies also help identify subtle health trends, supporting clinical decision-making and streamlining administrative tasks, which contributes to greater efficiency and potential cost savings.

The growing use of mHealth and wearable devices offers Enhabit significant opportunities for patient engagement and data collection. The global mHealth market is projected to exceed $300 billion by 2027, with devices like smartwatches and continuous glucose monitors providing real-time health insights. This allows Enhabit to foster proactive care, with remote patient monitoring through connected devices showing promise in reducing hospital readmissions.

| Technology Area | Adoption/Trend (as of mid-2024/early 2025) | Impact on Enhabit | Future Outlook (through 2025) |

|---|---|---|---|

| Telehealth & RPM | Significant adoption by home health agencies; projections indicate continued growth. | Enhances patient care quality, operational efficiency, and patient engagement. | Increased integration and sophistication of virtual care and monitoring. |

| EHR Interoperability | Over 90% of U.S. hospitals use EHRs; focus on data exchange is critical. | Streamlines data management, improves care coordination, reduces administrative overhead. | Continued push for secure data sharing across the healthcare ecosystem. |

| Data Analytics & AI | Increasingly used for predictive care and operational optimization. | Enables proactive interventions, optimizes staffing, improves clinical decision-making. | Further development of AI tools for patient health trend identification and administrative efficiency. |

| mHealth & Wearables | Global mHealth market projected to exceed $300 billion by 2027. | Facilitates patient engagement, real-time data collection, and proactive care. | Sophistication of devices leading to richer patient health insights and reduced readmissions. |

Legal factors

Enhabit Home Health & Hospice operates under stringent healthcare regulations like HIPAA, the Anti-Kickback Statute (AKS), and the Stark Law. These laws govern patient privacy, prohibit illegal inducements for referrals, and restrict physician self-referrals, respectively. For instance, HIPAA violations can lead to penalties up to $1.5 million per year for repeat offenses as of 2024.

Non-compliance with these mandates carries significant risks, including substantial fines, exclusion from federal healthcare programs, and severe reputational harm. Enhabit's commitment to rigorous compliance programs and continuous monitoring of evolving legal landscapes is therefore critical for its operational integrity and financial stability.

Enhabit Home Health & Hospice, as a significant provider reimbursed by Medicare and Medicaid, must adhere to strict Conditions of Participation (CoPs) set by the Centers for Medicare & Medicaid Services (CMS). These regulations, updated regularly, cover critical areas like patient care quality, staffing qualifications, and operational integrity. For instance, CMS continues to emphasize robust infection control protocols and telehealth capabilities, reflecting evolving healthcare needs and patient safety standards as of 2024.

Non-compliance with these CoPs can have severe financial and operational consequences for Enhabit. Penalties can range from monetary fines to the ultimate loss of the ability to bill Medicare and Medicaid, which represents a substantial portion of revenue for home health providers. In 2023, CMS continued its focus on data integrity and patient outcomes, with potential sanctions for providers failing to meet performance benchmarks.

Enhabit Home Health & Hospice must navigate a complex web of state-specific licensing and certification mandates for each location it operates. These legal requirements are not uniform; they differ significantly from one state to another, dictating everything from the physical standards of facilities and the educational and experiential qualifications of staff to the precise range of services offered and the frequency of regulatory inspections. For instance, as of early 2024, states like Texas might have different staffing ratios for hospice care compared to California, impacting operational costs and personnel management.

Staying compliant means diligently maintaining up-to-date and valid licenses and certifications across Enhabit's entire operational footprint. This is an ongoing legal responsibility, not a one-time achievement. Failure to meet these stringent requirements can lead to significant penalties, including fines and even the suspension or revocation of operating licenses, directly impacting revenue and market access.

Labor and Employment Laws

Enhabit Home Health & Hospice, as a significant employer, navigates a complex landscape of labor and employment laws. These regulations cover critical areas such as minimum wage and overtime pay, as mandated by the Fair Labor Standards Act (FLSA). For instance, in 2024, the FLSA continues to set the federal minimum wage at $7.25 per hour, though many states and localities have higher rates, impacting Enhabit's payroll costs and compliance strategies. Workplace safety is also paramount, with the Occupational Safety and Health Administration (OSHA) setting standards to protect healthcare workers from hazards, a key focus for a company with a mobile workforce.

Furthermore, Enhabit must adhere to stringent anti-discrimination laws like the Americans with Disabilities Act (ADA) and Title VII of the Civil Rights Act. These laws prohibit unfair treatment based on race, religion, sex, national origin, disability, and age. The company also needs to be prepared for potential collective bargaining situations, which can influence employment terms and operational flexibility. Ensuring robust HR compliance is essential for maintaining smooth operations and avoiding costly legal disputes.

Key legal considerations for Enhabit include:

- Wage and Hour Compliance: Adherence to federal and state minimum wage and overtime regulations.

- Workplace Safety: Implementing and maintaining OSHA-compliant safety protocols for all employees.

- Anti-Discrimination: Ensuring all hiring, promotion, and employment practices are free from unlawful bias.

- Labor Relations: Managing relationships with organized labor if collective bargaining agreements are in place.

Patient Rights and Advocacy Laws

Laws safeguarding patient rights, like the right to informed consent and privacy, form the bedrock of Enhabit's operations. For instance, the Health Insurance Portability and Accountability Act (HIPAA) mandates strict patient data privacy. Failure to adhere can result in significant penalties, impacting financial performance and reputation.

Compliance with regulations concerning advance directives and end-of-life choices is critical. These laws ensure patients' wishes are respected, directly influencing care plans and service delivery. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize patient autonomy in healthcare decisions.

Patient advocacy frameworks also shape Enhabit's service delivery and communication strategies. These legal structures empower patients and their families, requiring transparent information sharing and support. This focus on advocacy is increasingly important as healthcare systems evolve to be more patient-centric.

- Informed Consent: Patients have the legal right to understand and agree to their treatment plans.

- Privacy: Laws like HIPAA protect sensitive patient health information.

- Advance Directives: Legal documents outlining patient wishes for end-of-life care are crucial.

- Patient Advocacy: Legal frameworks support patient representation and their right to voice concerns.

Enhabit must navigate complex federal and state regulations governing healthcare providers, including HIPAA, the Anti-Kickback Statute, and Stark Law, with HIPAA violations potentially costing up to $1.5 million annually per repeat offense as of 2024. Adherence to CMS Conditions of Participation is vital for Medicare/Medicaid reimbursement, with CMS focusing on data integrity and patient outcomes in 2023. State-specific licensing and certification requirements also demand continuous compliance, as failure can lead to fines or license revocation.

Environmental factors

The escalating frequency and intensity of extreme weather events, driven by climate change, pose a direct threat to Enhabit Home Health & Hospice's service delivery. For instance, in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $92.9 billion in damages, according to NOAA. Such events can impede staff access to patients, force temporary service interruptions, and lead to patient displacement, directly impacting care continuity.

Consequently, robust disaster preparedness and response strategies are no longer optional but environmentally critical for Enhabit. This includes contingency planning for staff travel, ensuring resilient communication channels, and establishing protocols for patient safety and relocation during emergencies. Proactive measures are essential to maintain operational integrity and patient well-being amidst a changing climate.

Growing environmental consciousness is pushing healthcare providers like Enhabit to embrace more sustainable operations. This includes efforts to cut down on waste from medical supplies, make their vehicle fleets more fuel-efficient, and implement energy-saving strategies in their offices. For instance, many home health agencies are exploring electric vehicle options for their mobile staff as part of a broader push for greener fleets.

While the direct environmental impact of home health and hospice care is inherently less than that of large hospital systems, adopting sustainable practices significantly bolsters a company's corporate social responsibility profile. This focus on sustainability can resonate with patients, employees, and investors who increasingly prioritize environmentally conscious organizations. Enhabit's commitment to reducing its carbon footprint, even in smaller ways, contributes to its overall reputation.

Infectious disease outbreaks, like the lingering effects of COVID-19 and recurring seasonal flu, directly impact Enhabit's home health and hospice services. These events demand rigorous infection control measures and a steady supply of personal protective equipment (PPE). For instance, during the height of the pandemic, home health agencies saw significant shifts in patient care delivery, with telehealth becoming a crucial component for many.

Geographic Access and Infrastructure

Enhabit Home Health & Hospice's operational efficiency is significantly shaped by the geographic makeup of its service areas. Urban centers, while dense with potential patients, can present traffic congestion and parking challenges, impacting travel times between home visits. Conversely, rural and remote locations often demand longer travel distances, potentially increasing fuel costs and requiring more staff hours for patient care delivery. For instance, in 2024, the average travel time for home health aides can vary dramatically, with rural routes often exceeding urban commutes by 30-50%.

The quality of local infrastructure plays a crucial role in Enhabit's ability to deliver timely and effective care. Reliable road networks are essential for consistent patient access, while robust internet connectivity is increasingly vital for telehealth services, electronic health record updates, and communication with physicians. Areas with poor road conditions or limited broadband access may necessitate alternative service models, such as more frequent in-person visits or the use of satellite communication technology, impacting overall resource allocation and the speed at which care can be provided.

- Rural vs. Urban Disparities: In 2024, approximately 19% of the U.S. population lives in rural areas, where access to specialized healthcare services, including home health, can be more limited compared to urban settings.

- Infrastructure Impact on Efficiency: Poor road quality in certain regions can increase vehicle maintenance costs by an estimated 10-15% for healthcare providers, directly affecting operational budgets.

- Digital Divide: As of late 2024, an estimated 15-20% of U.S. households in rural areas still lack reliable high-speed internet access, posing a challenge for telehealth adoption and remote patient monitoring.

Waste Management and Biohazardous Materials

Even though Enhabit Home Health & Hospice delivers care in patients' residences, the organization still produces medical waste, such as sharps and contaminated dressings. Proper and environmentally sound disposal of these biohazardous materials is not only a legal requirement but also an ethical duty. For instance, in 2023, the healthcare industry generated an estimated 6.2 million tons of medical waste globally, highlighting the scale of this challenge.

Adhering to stringent environmental regulations for medical waste management is paramount for Enhabit to prevent contamination and safeguard public health. Failure to comply can lead to significant fines; in 2024, several healthcare facilities faced penalties exceeding $50,000 for improper biohazardous waste disposal. This underscores the critical need for robust waste management protocols.

Enhabit's commitment to responsible waste handling directly impacts its operational integrity and public perception. Effective waste management strategies are essential to maintain compliance and demonstrate corporate responsibility. For example, a 2025 survey indicated that 78% of consumers consider a company's environmental practices when making purchasing decisions, including healthcare services.

- Regulatory Compliance: Strict adherence to EPA and OSHA guidelines for medical waste disposal is essential.

- Public Health Protection: Proper handling prevents the spread of infections and protects communities.

- Environmental Stewardship: Implementing sustainable disposal methods minimizes ecological impact.

- Operational Risk Mitigation: Avoiding fines and reputational damage through diligent waste management practices.

Climate change presents significant operational challenges for Enhabit, with extreme weather events in 2023 causing over $92.9 billion in damages across the U.S. These events can disrupt service delivery and patient access, necessitating robust disaster preparedness. Furthermore, a growing emphasis on sustainability is prompting healthcare providers to adopt greener practices, such as optimizing vehicle fleets for fuel efficiency, as many explore electric vehicle options for mobile staff.

Enhabit's service delivery is also influenced by environmental factors like geographic disparities and infrastructure quality. In 2024, rural areas, where roughly 19% of the U.S. population resides, often present longer travel times for home health aides compared to urban settings, potentially increasing fuel costs by 10-15% due to poorer road conditions. Reliable internet access remains crucial, yet an estimated 15-20% of rural U.S. households lacked high-speed internet as of late 2024, impacting telehealth adoption.

Proper management of medical waste is a critical environmental consideration for Enhabit. The healthcare industry generated approximately 6.2 million tons of medical waste globally in 2023, underscoring the scale of this issue. Non-compliance with regulations, such as those from the EPA and OSHA, can result in substantial fines, with some healthcare facilities facing penalties over $50,000 in 2024 for improper biohazardous waste disposal. This highlights the importance of effective waste management for both operational integrity and public perception, as a 2025 survey found 78% of consumers consider environmental practices in their purchasing decisions.

| Environmental Factor | Impact on Enhabit | Data/Example (2023-2025) |

| Extreme Weather Events | Disruption of service, impeded staff access, patient safety concerns | 2023 U.S. weather/climate disasters totaled over $92.9 billion in damages. |

| Sustainability Push | Need for greener operations, fuel-efficient fleets, waste reduction | Exploration of electric vehicles for mobile staff; 78% of consumers consider environmental practices (2025 survey). |

| Geographic Disparities & Infrastructure | Increased travel times and costs in rural areas, challenges with telehealth due to poor internet | Rural travel times 30-50% longer; 15-20% of rural households lacked reliable high-speed internet (late 2024). |

| Medical Waste Management | Regulatory compliance, public health protection, operational risk | Healthcare industry generated 6.2 million tons of medical waste globally (2023); fines over $50,000 for non-compliance (2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Enhabit Home Health & Hospice is built on a comprehensive review of government healthcare policies, economic indicators from reputable financial institutions, and technological advancements impacting patient care. We also incorporate demographic trends and societal shifts from leading research firms and regulatory updates from relevant health organizations.