Chugoku Electric Power Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chugoku Electric Power Bundle

Chugoku Electric Power faces significant competitive forces, including the substantial bargaining power of its buyers and the constant threat of substitutes in the energy market. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Chugoku Electric Power’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Chugoku Electric Power's reliance on imported fossil fuels, including coal, oil, and LNG, positions fuel suppliers as a significant force. Global commodity price volatility and supply chain vulnerabilities, exacerbated by geopolitical events and high demand from other nations, grant considerable leverage to these international suppliers. For instance, Japan's energy sector, including Chugoku Electric, experiences substantial price impacts directly tied to fluctuations in the global LNG market, underscoring the suppliers' bargaining power.

The bargaining power of nuclear fuel and technology suppliers for Chugoku Electric Power is significant due to the highly specialized and regulated nature of the industry. A limited number of global entities possess the expertise and certifications required, concentrating market power.

This reliance is underscored by Japan's ongoing nuclear plant restarts, such as Shimane Unit 2, which necessitate continued procurement of fuel and technological services from these few providers. For instance, global uranium prices, a key component of nuclear fuel, saw fluctuations in 2024, impacting procurement costs for utilities.

As Chugoku Electric Power invests heavily in renewables, it faces increasing reliance on specialized equipment suppliers for solar panels, wind turbines, and battery storage. The competitive landscape for some components, such as solar panels, is intensifying, potentially reducing supplier leverage. However, advanced or niche technologies within the renewable sector might still offer suppliers significant bargaining power.

In 2024, the global solar PV market, a key area for Chugoku Electric, saw continued price competition among manufacturers, with polysilicon prices fluctuating but generally stabilizing after earlier volatility. This increased competition among panel makers can shift some power back to utilities like Chugoku Electric. Nevertheless, for cutting-edge battery storage solutions or highly efficient wind turbine components, suppliers with proprietary technology could still command higher prices and favorable terms.

Chugoku Electric's proactive approach, including partnerships for solar panel reuse and recycling, suggests a strategic effort to secure its renewable supply chain and mitigate potential supplier power. This focus on circular economy principles for renewable components aims to create more predictable supply and potentially reduce dependence on single sources, especially for critical materials.

Grid Technology and Infrastructure Suppliers

The bargaining power of suppliers in grid technology and infrastructure for Chugoku Electric Power is influenced by the specialized nature of their products and Japan's focus on grid modernization. Suppliers of smart grid components, cybersecurity solutions, and advanced energy management systems hold considerable sway due to the technical expertise and proprietary technology involved. Japan's commitment to upgrading its electricity infrastructure, with significant investments planned through 2025 and beyond, further bolsters the position of these key providers.

Key factors influencing supplier power include:

- Specialized Technology: Suppliers offering unique or patented smart grid technologies and cybersecurity solutions face less competition, increasing their leverage.

- High Switching Costs: Integrating new grid infrastructure often involves substantial upfront investment and compatibility challenges, making it costly for Chugoku Electric Power to switch suppliers.

- Limited Supplier Pool: The market for highly advanced and reliable grid components is often dominated by a few key players, concentrating bargaining power among them.

- Government Initiatives: Japan's national strategy for grid modernization, including substantial funding allocations, can empower leading technology suppliers by creating consistent demand for their advanced offerings.

Labor Suppliers (Skilled Workforce)

The bargaining power of labor suppliers, especially skilled workers, is a significant factor for Chugoku Electric Power. The highly specialized nature of the electric utility sector, encompassing nuclear plant operations, sophisticated grid management, and the development of emerging energy technologies, demands a workforce with unique and in-demand expertise.

A scarcity of qualified professionals in these critical areas can substantially elevate the leverage these labor suppliers hold. This, in turn, directly influences Chugoku Electric's operational expenditures and overall efficiency, as companies may face increased wage demands or recruitment challenges to secure and retain essential talent.

- Specialized Skill Requirements: The electric utility industry, particularly in areas like nuclear engineering and advanced grid modernization, requires highly specific and often certified skills.

- Potential for Labor Shortages: As the energy sector evolves and older skilled workers retire, there's a growing risk of shortages in key technical roles, increasing labor's bargaining power.

- Impact on Costs: Higher wages and benefits negotiated by a skilled workforce can lead to increased operating costs for Chugoku Electric, potentially affecting profitability.

- Operational Continuity: Ensuring a consistent supply of skilled labor is crucial for maintaining the reliable operation of power generation and distribution infrastructure.

Chugoku Electric Power faces considerable supplier bargaining power across its diverse energy portfolio. Fuel suppliers, particularly for imported fossil fuels like LNG, wield significant influence due to global market volatility and limited sourcing options. Similarly, specialized nuclear fuel and technology providers, operating in a highly regulated niche with few global players, command strong leverage. This power dynamic is further amplified by the specialized nature of grid technology and labor suppliers, where unique expertise and high switching costs benefit providers.

| Supplier Category | Key Influencing Factors | Impact on Chugoku Electric | 2024 Data/Trend Example |

|---|---|---|---|

| Fossil Fuel Suppliers (Coal, Oil, LNG) | Global commodity prices, geopolitical stability, supply chain disruptions | Increased procurement costs, operational risk | Japan's LNG import costs saw continued sensitivity to global supply/demand in 2024. |

| Nuclear Fuel & Technology Suppliers | Limited number of certified providers, regulatory requirements, specialized expertise | High dependence, potential for price increases | Global uranium prices experienced fluctuations impacting utility procurement strategies in 2024. |

| Renewable Equipment Suppliers (Solar, Wind, Batteries) | Technological advancements, manufacturing capacity, material availability | Varying power; strong for niche tech, weaker for commoditized items | Increased competition in solar PV manufacturing in 2024 led to price stabilization. |

| Grid Technology & Infrastructure Suppliers | Proprietary technology, integration complexity, limited supplier pool | High switching costs, reliance on specialized solutions | Japan's grid modernization initiatives created consistent demand for advanced suppliers through 2025. |

| Skilled Labor Suppliers | Specialized skill requirements, potential labor shortages, unionization | Increased wage pressures, recruitment challenges | Demand for nuclear engineers and grid specialists remained high in 2024 due to industry needs. |

What is included in the product

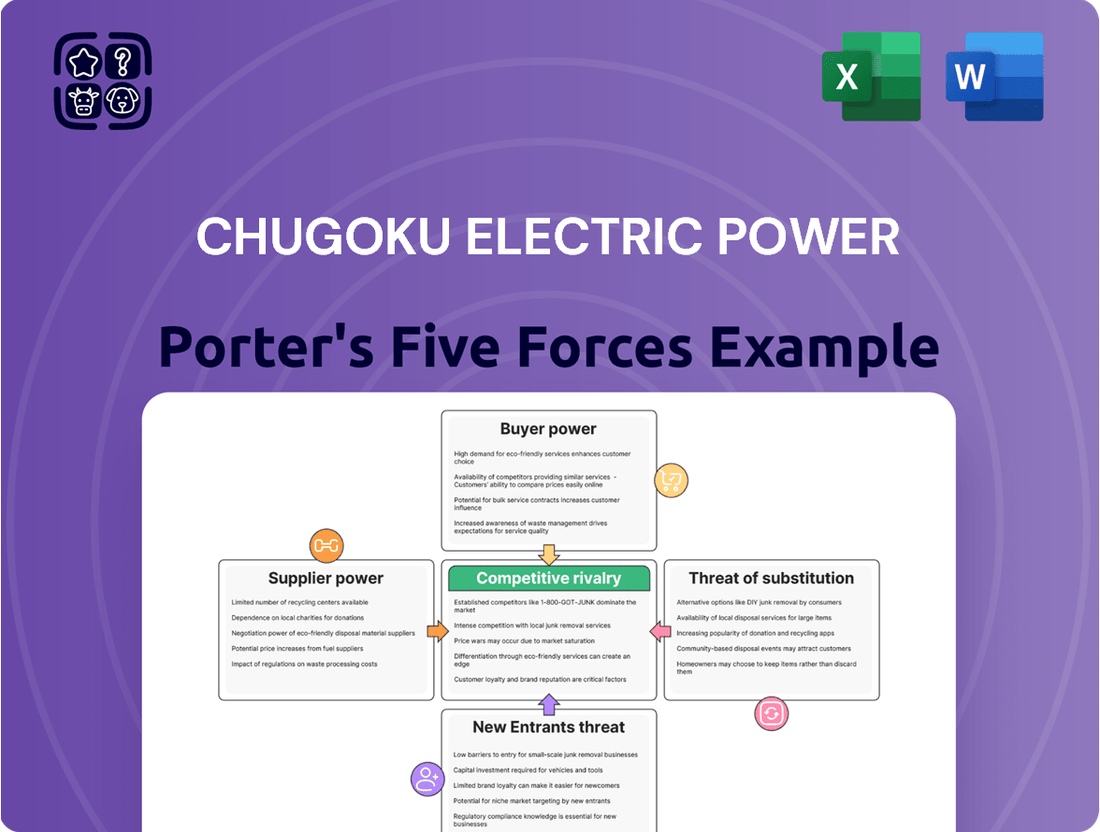

This analysis delves into the competitive forces impacting Chugoku Electric Power, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the Japanese electricity market.

Instantly understand competitive pressures with a visual breakdown of Chugoku Electric Power's industry landscape, simplifying complex strategic analysis.

Customers Bargaining Power

Large industrial and commercial customers wield considerable bargaining power with Chugoku Electric Power. Their substantial electricity consumption means they represent a significant portion of revenue, giving them leverage to negotiate better rates. For instance, in 2023, industrial electricity consumption in Japan accounted for approximately 30% of total electricity sales, highlighting the importance of these customer segments.

Japan's progressive electricity market liberalization, fully realized with retail deregulation in 2016, has further amplified this power. This regulatory shift has introduced greater competition, allowing major consumers to explore and switch to alternative electricity providers or even consider investing in their own on-site generation, such as solar or co-generation facilities, if economically viable.

While individual residential customers might seem to have limited direct influence, their collective power is growing, especially in a market with more options. As of April 2024, new electricity providers captured approximately 23% of sales in the low-voltage sector, which includes most homes. This increasing competition means consumers have more choices, pushing companies like Chugoku Electric Power to be more competitive on price and service.

The Japanese government, through bodies like the Ministry of Economy, Trade and Industry (METI), significantly influences Chugoku Electric Power's operations. METI's Strategic Energy Plan dictates the national energy mix and sets ambitious decarbonization targets, directly shaping Chugoku Electric's investment in renewable energy sources and the phasing out of fossil fuels. For instance, the 2021 revision of the Strategic Energy Plan aimed for a 46% reduction in greenhouse gas emissions by 2030 and a 50% share of renewable energy in the power generation mix by 2030, impacting capital allocation and operational strategies for companies like Chugoku Electric.

Demand-Side Management and Energy Efficiency Initiatives

Customers engaging in demand-side management and adopting energy-efficient solutions can significantly lessen their dependence on Chugoku Electric Power. This shift empowers them by providing alternatives and increasing their leverage in price negotiations or service demands. For instance, in 2024, Japan's Ministry of Economy, Trade and Industry continued to promote energy conservation measures, with residential energy consumption seeing a slight decrease compared to previous years due to increased awareness and adoption of smart home technologies.

Government policies actively support and incentivize these customer behaviors. Initiatives aimed at decarbonization and promoting renewable energy sources further enable consumers to generate their own power or switch to alternative suppliers, thereby amplifying their bargaining power against traditional utilities like Chugoku Electric Power. By 2025, it's projected that distributed solar generation capacity in Japan will continue its upward trend, offering more options for energy consumers.

- Reduced Reliance: Customers participating in demand response programs can curtail usage during peak times, directly impacting the utility's load management and increasing their negotiating leverage.

- Energy Efficiency Investments: Investments in insulation, efficient appliances, and smart thermostats lower overall energy consumption, giving customers more control and reducing their price sensitivity.

- Government Incentives: Subsidies for solar panel installation and energy-saving retrofits encourage customer independence, directly challenging the utility's market dominance.

- Market Diversification: The growing availability of alternative energy solutions and competitive retail electricity markets in Japan provides customers with more choices, enhancing their bargaining power.

Distributed Energy Prosumers

The emergence of distributed energy prosumers significantly impacts the bargaining power of customers for Chugoku Electric Power. These prosumers, who both consume and produce electricity, often via rooftop solar installations, can decrease their reliance on traditional utility power. This shift directly reduces the demand for electricity supplied by Chugoku Electric, giving these customers more leverage.

Japan's commitment to carbon neutrality and the falling costs of renewable energy sources, particularly solar, are fueling the growth of distributed energy. By 2024, the installed capacity of rooftop solar in Japan reached approximately 70 GW, a substantial increase that empowers more households and businesses to become prosumers. This growing segment of the market can potentially feed excess generated electricity back into the grid, further influencing utility pricing and service agreements.

- Reduced Demand: Prosumers decrease their purchases from traditional utilities.

- Grid Feed-in: Excess solar power can be sold back to the grid, creating alternative revenue streams for customers.

- Market Growth: Japan's distributed solar capacity is expanding, increasing the number of prosumers.

- Negotiating Power: A larger base of prosumers strengthens their collective bargaining position with utilities.

Large industrial and commercial customers in Japan, including those served by Chugoku Electric Power, possess significant bargaining power due to their substantial electricity consumption. This leverage allows them to negotiate favorable rates, especially as Japan's electricity market has become more liberalized since 2016, introducing more competition and options for these major users.

The increasing adoption of energy efficiency measures and distributed generation, such as rooftop solar, further empowers customers. By 2024, Japan's installed capacity of rooftop solar reached approximately 70 GW, enabling more consumers to reduce their reliance on utilities and negotiate from a stronger position.

The collective power of individual consumers is also growing, with new electricity providers capturing around 23% of the low-voltage market by April 2024. This heightened competition compels utilities like Chugoku Electric to offer competitive pricing and services to retain their customer base.

| Customer Segment | Impact on Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Large Industrial/Commercial | High | Significant portion of revenue, leverage to negotiate rates. Industrial electricity consumption was ~30% of total sales in 2023. |

| Residential (Collective) | Growing | Increased competition from new providers (23% market share in low-voltage by April 2024). |

| Prosumers (e.g., Rooftop Solar) | High | Reduced reliance on utility, potential to sell excess power. Japan's rooftop solar capacity reached ~70 GW by 2024. |

Preview the Actual Deliverable

Chugoku Electric Power Porter's Five Forces Analysis

This preview shows the exact, professionally written Chugoku Electric Power Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape of the Japanese electricity market. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive document is ready for your immediate use, offering a thorough understanding of the strategic forces shaping Chugoku Electric Power's operations.

Rivalry Among Competitors

While Chugoku Electric Power Company (CEPCO) traditionally dominated its namesake region, Japan's complete retail electricity market liberalization in April 2016 has significantly intensified competitive rivalry. This deregulation allows consumers to choose their electricity provider from anywhere in Japan, meaning CEPCO now contends with major nationwide utilities and a growing number of new market entrants, not just local competitors.

For instance, as of late 2023, companies like Tokyo Electric Power Company (TEPCO) and Kansai Electric Power Company (KEPCO) are actively marketing their services to customers within CEPCO's traditional service territory. Furthermore, the rise of specialized retail electricity providers, often leveraging renewable energy sources, adds another layer of competition, forcing CEPCO to innovate its offerings and pricing strategies to retain its customer base.

The full retail deregulation of Japan's electricity market in 2016 opened the floodgates for new entrants, intensifying competition for established players like Chugoku Electric Power. This liberalization saw a significant number of new retailers enter the market, eager to capture market share.

While some of these new companies have encountered difficulties, particularly with rising electricity prices impacting their business models, the landscape remains dynamic. The market is still undergoing consolidation, and the potential for further entries and exits is high, indicating an ongoing shift in the competitive environment.

Independent power producers and specialized renewable energy developers are increasingly entering the market, often with a focus on specific renewable sources like solar and wind. These players contribute to a more diverse and competitive generation landscape, especially with government support for renewable energy expansion.

In 2024, Japan's renewable energy capacity continued its upward trajectory, with solar power leading the charge. The Ministry of Economy, Trade and Industry (METI) reported that renewable energy sources accounted for approximately 22% of the nation's total electricity generation in the fiscal year 2023, a figure expected to grow as new projects come online.

Inter-Fuel Competition

Chugoku Electric Power navigates competition not just from external utilities but also among its own diverse fuel sources. Thermal power, including coal and natural gas, competes with nuclear and renewables based on fluctuating fuel prices and operational efficiency. In Japan's 2024 energy market, coal continues to be a cost-competitive option within the merit order, often undercutting natural gas prices for electricity generation.

- Fuel Cost Volatility: The price of coal, a significant fuel for Chugoku Electric, remained relatively stable in early 2024, offering a cost advantage over natural gas, which experienced more price fluctuations.

- Operational Efficiency: While nuclear power offers low operational costs once established, its high capital expenditure and regulatory hurdles create a competitive dynamic against the more flexible, albeit fuel-dependent, thermal plants.

- Environmental Regulations: Stricter emissions standards impact the cost-competitiveness of thermal fuels, pushing for greater investment in cleaner energy sources and influencing the internal fuel mix decisions.

Regulatory and Policy Shifts

Chugoku Electric Power operates within a sector profoundly shaped by evolving government energy policies. Initiatives like Japan's Strategic Energy Plan and the broader Green Transformation (GX) push are actively reshaping the energy mix, prioritizing renewables and nuclear power. For instance, the GX promotion tax system, enacted in 2023, offers significant incentives for investments in decarbonization technologies, directly impacting the competitive dynamics.

These policy shifts create a complex environment for Chugoku Electric Power. While the drive towards renewable energy presents opportunities for diversification and new project development, it also intensifies competition from independent power producers and renewable energy specialists. Conversely, the government's stance on nuclear power, which remains a key component of the GX strategy, could offer a more stable, albeit regulated, operational landscape for existing nuclear assets.

- Government Policy Influence: Japan's Strategic Energy Plan and GX initiatives dictate the future energy landscape, favoring renewables and nuclear power.

- Incentives for Decarbonization: The GX promotion tax system, effective from 2023, provides financial backing for green investments, altering competitive advantages.

- Renewable Energy Competition: Increased focus on renewables intensifies rivalry with specialized renewable energy developers and independent power producers.

- Nuclear Power's Role: Government support for nuclear energy as part of the GX strategy offers a potential avenue for stable operations for existing nuclear facilities.

The competitive rivalry for Chugoku Electric Power (CEPCO) has significantly escalated following Japan's 2016 electricity market liberalization. This deregulation allows nationwide customer choice, pitting CEPCO against major national utilities and numerous new entrants, including specialized renewable energy providers.

By late 2023, national players like TEPCO and KEPCO were actively marketing within CEPCO's traditional territory, intensifying the fight for customers. The market continues to evolve, with ongoing consolidation and potential for new players, making the competitive landscape dynamic.

In 2024, the competitive pressure is further amplified by the increasing share of renewable energy in Japan's grid. Renewables, particularly solar, accounted for approximately 22% of total electricity generation in fiscal year 2023, a trend expected to continue as new projects come online.

| Competitor Type | Example | Impact on CEPCO |

|---|---|---|

| Nationwide Utilities | TEPCO, KEPCO | Direct competition for retail customers in CEPCO's region. |

| New Market Entrants | Specialized renewable energy providers | Diversify energy sources, offer niche products, and challenge traditional pricing. |

| Independent Power Producers (IPPs) | Various solar and wind developers | Increase overall supply, particularly from renewables, influencing market prices and demand for CEPCO's generation. |

SSubstitutes Threaten

The rising affordability and accessibility of distributed energy resources like rooftop solar panels and battery storage present a growing threat. Customers can increasingly generate their own electricity, lessening their dependence on traditional power grids.

This shift is substantial, with the Japanese distributed energy market projected to hit USD 38.7 billion by 2033, indicating a significant potential for customer self-generation and reduced demand for Chugoku Electric Power's services.

Improvements in energy efficiency, driven by innovations in appliances, building insulation, and industrial processes, can directly reduce the need for electricity supplied by Chugoku Electric Power. This trend acts as a substitute, as consumers and businesses become less reliant on traditional grid power.

Japan's commitment to decarbonization includes implementing stricter energy efficiency standards for new buildings. For instance, by April 2025, all new homes will be required to meet basic energy-saving standards, a move that will further curb demand for conventional electricity sources.

The emergence of alternative energy carriers like hydrogen and ammonia presents a significant long-term threat of substitution for traditional grid electricity, particularly within industrial and transportation sectors. Japan's strategic push through its 'Green Transformation' (GX) initiative actively explores these advanced energy technologies, signaling a potential shift away from reliance on conventional power sources.

These alternative carriers offer the promise of decarbonization and could be utilized for direct consumption or integrated into power generation, thereby directly competing with electricity supplied by Chugoku Electric Power. For instance, the Japanese government aims to produce 12 million tons of hydrogen annually by 2030, underscoring the growing investment and development in this area.

Direct Use of Heat (e.g., Solar Thermal, Geothermal Heating)

The direct use of heat, such as solar thermal and geothermal heating systems, presents a significant threat to Chugoku Electric Power. These alternatives offer customers a way to meet their heating and cooling needs without relying on electricity, directly impacting the company's demand for power in these sectors. For instance, in 2024, Japan continued to see growth in renewable heating installations, with solar thermal capacity increasing by an estimated 5% year-over-year, according to preliminary industry reports.

This shift is particularly noticeable in residential and commercial buildings where direct thermal energy can be a more cost-effective and environmentally friendly solution. Geothermal heating, while requiring a higher upfront investment, offers long-term operational savings and stable temperature control, making it an attractive substitute for electric heating systems. The increasing awareness of carbon emissions also drives adoption of these cleaner heating methods.

- Solar Thermal Adoption: Growing installations in new constructions and retrofits.

- Geothermal Potential: Increasing interest in geothermal heat pumps for stable, efficient heating.

- Cost Competitiveness: Direct heat sources can offer lower long-term energy costs compared to electricity.

- Environmental Drivers: Customer preference for lower carbon footprints supports these alternatives.

Power Purchase Agreements (PPAs) from Non-Utility Sources

Large corporate customers are increasingly bypassing traditional utility providers like Chugoku Electric by signing Power Purchase Agreements (PPAs) directly with independent renewable energy developers. This trend represents a significant threat of substitution, as these customers can secure their electricity needs from alternative sources.

For example, major corporations are actively pursuing solar and wind power through direct PPAs. Google, a notable player in this space, has already executed PPAs for solar power in Japan, demonstrating the growing adoption of these alternative supply arrangements. This shift allows businesses to gain greater control over their energy costs and environmental impact.

The increasing availability and decreasing cost of renewable energy technologies further bolster the attractiveness of direct PPAs. As more independent developers enter the market and offer competitive pricing, Chugoku Electric faces a growing challenge in retaining its large industrial and commercial customer base.

Key aspects of this threat include:

- Direct PPA Adoption: Large corporations are increasingly contracting directly with renewable energy producers, bypassing traditional utility supply chains.

- Corporate Sustainability Goals: Many companies are driven by sustainability targets, making renewable energy PPAs an attractive option to reduce their carbon footprint.

- Cost Competitiveness: The falling costs of renewable energy generation, particularly solar and wind, make direct PPAs financially viable and often more cost-effective than utility rates for large consumers.

- Market Examples: Google's direct solar PPAs in Japan highlight the global trend and the potential for similar agreements to impact Chugoku Electric's market share.

Distributed energy resources, like rooftop solar and battery storage, are becoming more affordable, allowing customers to generate their own power. This trend directly substitutes demand for electricity from traditional providers. Japan's distributed energy market is expected to reach USD 38.7 billion by 2033, indicating a significant shift towards self-generation.

Energy efficiency improvements in buildings and appliances also reduce the need for grid electricity. Japan's commitment to decarbonization means new buildings must meet energy-saving standards by April 2025, further curbing demand for conventional power. Alternative energy carriers like hydrogen and ammonia, supported by Japan's Green Transformation initiative, also pose a long-term substitution threat, with a goal of producing 12 million tons of hydrogen annually by 2030.

Directly using heat sources, such as solar thermal and geothermal systems, offers an alternative to electric heating and cooling. In 2024, solar thermal capacity in Japan saw an estimated 5% year-over-year increase. These direct heat alternatives can offer lower long-term energy costs and align with customer preferences for reduced carbon footprints.

Large corporations are increasingly opting for direct Power Purchase Agreements (PPAs) with renewable energy developers, bypassing utility companies. This trend is driven by corporate sustainability goals and the falling costs of renewables, making PPAs financially attractive. Google's direct solar PPAs in Japan exemplify this shift, impacting traditional electricity suppliers.

Entrants Threaten

The full liberalization of Japan's retail electricity market in 2016 dramatically reduced entry barriers, allowing numerous new companies to begin supplying electricity. This regulatory shift has welcomed hundreds of new retail providers into the market, significantly increasing the threat of new entrants, even though some have encountered operational difficulties.

The threat of new entrants in Chugoku Electric Power's market is amplified by the rise of decentralized energy developers. The growth of distributed energy systems, like small-scale solar and wind projects, enables new companies to enter the power generation sector without the enormous capital typically needed for traditional, large-scale power plants. This shift significantly lowers the barrier to entry.

Japan's commitment to fostering regional self-supporting distributed energy systems further encourages these new entrants. For instance, the Ministry of Economy, Trade and Industry (METI) continues to support initiatives for energy system reform and the integration of renewable energy sources. By 2023, Japan's installed solar power capacity had surpassed 67 GW, demonstrating the significant market presence and growth potential for smaller, decentralized players.

Technology companies and IT giants pose a significant threat to Chugoku Electric Power. Driven by their own sustainability mandates and the critical need for reliable power for their data centers, these firms are actively investing in renewable energy generation and advanced smart grid technologies.

For instance, Google has been actively pursuing direct renewable energy procurement agreements in Japan, a market where Chugoku Electric Power operates. This trend suggests a potential shift where large tech consumers might bypass traditional utilities by developing their own power sources or partnering directly with renewable energy developers.

Overseas Energy Companies and Investors

The liberalization of Japan's power market, particularly its push into renewables, is attracting overseas energy companies and investors. These new entrants are keen to capitalize on the expanding opportunities, bringing with them fresh capital and specialized knowledge. For instance, sophisticated players from more developed power markets are increasingly targeting Japan's burgeoning energy storage sector, indicating a growing competitive landscape.

This influx of foreign expertise is particularly evident in the energy storage market. By 2024, Japan's energy storage market is projected to reach a significant valuation, driven by government support for decarbonization and grid stability. For example, several major European and North American energy firms have announced investments in Japanese battery storage projects, aiming to secure market share in this rapidly evolving segment.

- International players are entering Japan's power market due to its liberalization and focus on renewables.

- New entrants bring capital and expertise, particularly in the energy storage sector.

- Sophisticated companies from mature power markets are actively investing in Japanese energy storage.

- Japan's energy storage market is expected to see substantial growth by 2024, attracting foreign investment.

Companies from Related Industries (e.g., Gas, Trading Firms)

Companies from adjacent sectors, like gas suppliers or major trading houses, possess significant potential to enter Chugoku Electric Power's domain. Their existing infrastructure and deep understanding of energy markets can be readily adapted to electricity generation or retail. For instance, several Japanese gas companies are actively exploring and expanding into the electricity sector, signaling a growing trend of cross-industry entry.

The threat is amplified by the fact that these related companies often have established customer bases and robust supply chains. In 2024, the Japanese energy market has seen increased diversification, with companies like Tokyo Gas and Osaka Gas actively investing in renewable energy projects and retail electricity sales, directly competing with traditional power utilities.

- Leveraging Existing Infrastructure: Gas companies can utilize their extensive pipeline networks and storage facilities, potentially adapting them for hydrogen or other energy carriers, which can then be used for power generation.

- Trading Firm Expertise: Large trading firms have sophisticated trading platforms and risk management capabilities, crucial for navigating the volatile electricity market.

- Diversification Strategies: Companies are increasingly looking to diversify their revenue streams beyond their core businesses, making the electricity sector an attractive option.

- Regulatory Environment: Evolving regulations in Japan's energy market may also create openings for new entrants with innovative business models.

The threat of new entrants for Chugoku Electric Power remains significant due to Japan's liberalized electricity market and the push for renewables. New players, including tech companies and international firms, are actively entering, particularly in the energy storage sector, which is projected for substantial growth by 2024. Companies from adjacent sectors like gas are also leveraging existing infrastructure and expertise to compete in electricity generation and retail, further intensifying the competitive landscape.

| New Entrant Type | Key Advantage | Example/Trend (as of 2024) |

|---|---|---|

| Decentralized Energy Developers | Lower capital requirements for generation | Growth in small-scale solar and wind projects |

| Technology Companies | Sustainability mandates, need for reliable power | Direct renewable energy procurement agreements (e.g., Google) |

| International Energy Firms | Capital, specialized knowledge | Investment in Japanese battery storage projects |

| Gas Suppliers/Trading Houses | Existing infrastructure, market understanding | Expansion into renewable energy and retail electricity sales (e.g., Tokyo Gas) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Chugoku Electric Power leverages data from their annual reports, investor relations disclosures, and relevant industry publications. We also incorporate information from government energy agencies and economic databases to provide a comprehensive view of the competitive landscape.