Chugoku Electric Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chugoku Electric Power Bundle

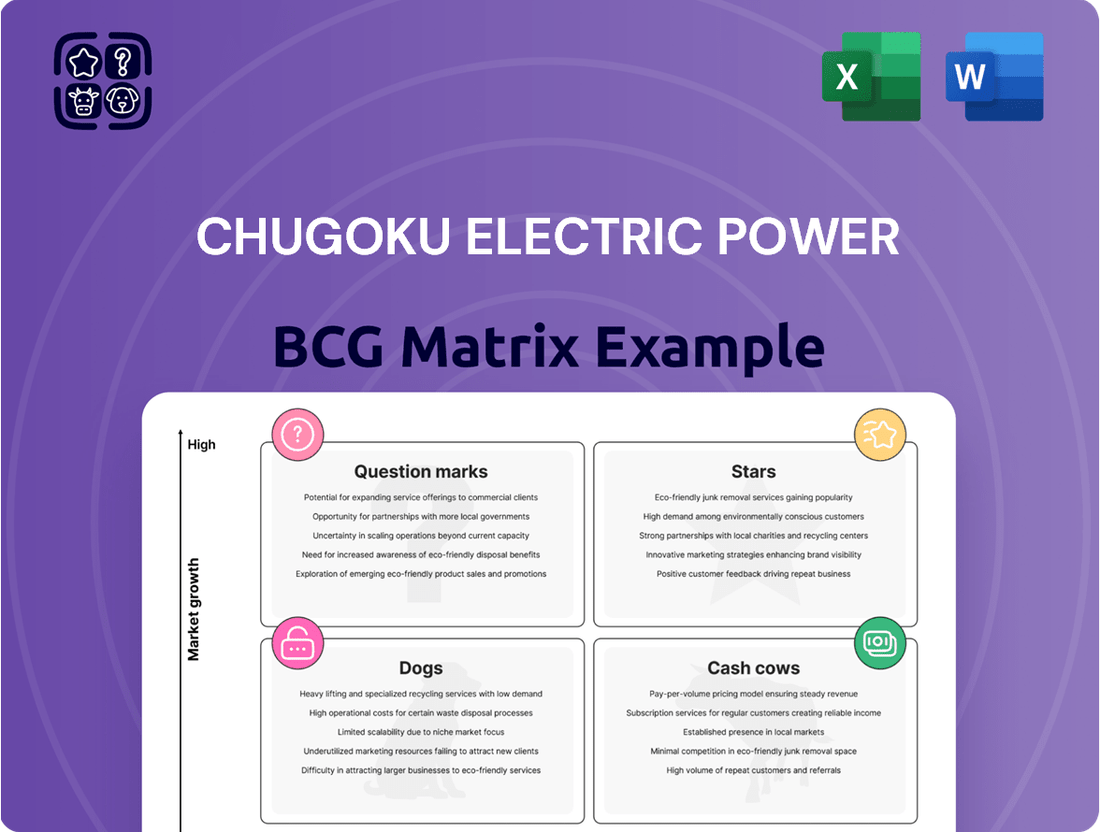

Curious about Chugoku Electric Power's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse energy portfolio stacks up in the market, highlighting potential growth areas and established revenue streams.

To truly unlock the strategic advantage, dive into the full BCG Matrix report. It provides a comprehensive quadrant-by-quadrant breakdown, offering actionable insights and a clear roadmap for investment and resource allocation.

Purchase the complete BCG Matrix today and gain the competitive clarity needed to navigate the evolving energy landscape with confidence.

Stars

Renewable energy, encompassing wind, geothermal, and advanced solar, represents a significant growth area for Chugoku Electric Power. Japan's ambitious goal to source 40-50% of its energy from renewables by 2040 highlights a robust market. Chugoku Electric is capitalizing on this, planning to boost its renewable capacity by at least 300 MW by 2030 through new projects both domestically and internationally.

The company's commitment is further evidenced by its July 2024 collaboration to develop solar power plants utilizing recycled panels, showcasing an innovative strategy within this burgeoning sector. This aligns with the broader national push for cleaner energy solutions.

The December 2024 restart of Shimane Nuclear Power Station Unit 2 is a pivotal moment for Chugoku Electric Power. This event underscores nuclear energy's role as a vital, carbon-free baseload power source, critical for Japan's energy security and its ambitious decarbonization targets.

With a capacity of 1,373 MW, Shimane Unit 2 is a substantial asset in an energy landscape where nuclear power is regaining strategic prominence. Japan aims to significantly increase its nuclear power generation share, targeting up to 22% by 2030, as part of its broader energy policy to achieve carbon neutrality by 2050.

Chugoku Electric Power's strategic move in April 2025, partnering with Sense for a high-resolution smart metering platform and grid edge intelligence in Japan, places them squarely in a burgeoning market. This initiative is crucial for fortifying grid resilience and optimizing energy distribution, especially with the escalating power demands from sectors like data centers and semiconductor manufacturing.

Overseas Hydroelectric Power Generation Investments

Chugoku Electric Power's investment in overseas hydroelectric power generation, particularly the acquisition of a 35% stake in a Vietnamese independent power producer (IPP) in November 2024, signals a strategic move into high-growth renewable energy markets. This expansion diversifies their energy sources, aiming for a CO2-free portfolio and capitalizing on the increasing energy needs in developing economies. This strategic initiative positions Chugoku Electric Power to benefit from the projected growth in Vietnam's renewable energy sector, which is expected to see significant capacity additions in the coming years.

- Vietnam's Renewable Energy Growth: Vietnam aims to increase its renewable energy capacity substantially, with hydroelectric power remaining a key component.

- Diversification Strategy: Overseas hydroelectric projects contribute to Chugoku Electric Power's goal of a balanced, low-carbon energy mix.

- Market Opportunity: Emerging economies like Vietnam offer robust demand growth for electricity, making these investments attractive.

Development of Shimane Nuclear Power Station Unit 3

Chugoku Electric Power is heavily investing in decarbonization efforts, with a significant portion directed towards the Shimane Nuclear Power Station Unit 3. The anticipated start of commercial operations by fiscal 2030 highlights this commitment. This project is poised to add substantial nuclear power capacity, a segment actively promoted by the Japanese government due to its potent decarbonization impact and role in bolstering energy security. This strategic move suggests a promising growth trajectory for the company's energy portfolio.

The Japanese government's support for nuclear power, particularly for its decarbonization benefits and contribution to energy security, positions Shimane Unit 3 as a high-potential asset. Chugoku Electric Power's investment aligns with national energy strategies, aiming to secure a stable and low-carbon electricity supply. This focus on nuclear energy is crucial as Japan navigates its energy transition goals.

- Decarbonization Investments: Chugoku Electric Power is channeling substantial funds into decarbonization initiatives.

- Shimane Unit 3 Timeline: Commercial operations are slated to begin by fiscal 2030.

- Government Support: Nuclear power is a key government priority for its environmental and energy security benefits.

- Growth Potential: The project is expected to significantly enhance the company's energy mix and future growth prospects.

Chugoku Electric Power's investments in overseas hydroelectric power, such as the November 2024 acquisition of a 35% stake in a Vietnamese IPP, represent a strategic push into high-growth renewable markets. This move diversifies their energy sources, aiming for a CO2-free portfolio and capitalizing on increasing energy needs in developing economies like Vietnam. This initiative positions them to benefit from Vietnam's projected renewable energy sector growth.

| Project Type | Location | Investment Stake | Year Announced/Completed | Strategic Rationale |

| Hydroelectric Power | Vietnam | 35% | November 2024 | Diversification, CO2-free portfolio, emerging market growth |

What is included in the product

This BCG Matrix analysis provides a tailored view of Chugoku Electric Power's portfolio, highlighting which business units to invest in, hold, or divest.

The Chugoku Electric Power BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex business unit analysis.

Its export-ready design for PowerPoint eliminates the struggle of manually creating strategic visuals.

Cash Cows

Chugoku Electric Power's transmission and distribution network is a classic cash cow. It holds a dominant position in a stable, indispensable market within the Chugoku region. This strong market share in a mature utility sector translates into a reliable and predictable revenue stream.

The network generates consistent cash flow, requiring minimal additional investment for expansion, with resources primarily allocated to essential maintenance and operational efficiency. For instance, in fiscal year 2023, Chugoku Electric Power reported stable electricity sales, reflecting the consistent demand for its transmission and distribution services.

Chugoku Electric Power's established retail electricity supply to traditional customers in its exclusive Chugoku region represents a classic Cash Cow. The company boasts a dominant market share, ensuring a steady stream of recurring revenue from its residential, commercial, and industrial customer base.

This mature segment provides a consistent cash generation engine. For instance, in fiscal year 2023, Chugoku Electric Power reported total electricity sales of 55.5 billion kWh, with a significant portion attributed to these traditional customer segments within its service territory.

Chugoku Electric Power's efficient base-load thermal power plants, especially those utilizing LNG, remain vital for stable electricity provision during the company's energy mix transition. These facilities boast strong operational efficiency and considerable installed capacity, securing a significant market share and generating robust, dependable cash flow.

Existing Domestic Hydropower Plants

Chugoku Electric Power's existing domestic hydropower plants are firmly positioned as Cash Cows within the BCG matrix. These mature assets benefit from established infrastructure and consistent operational efficiency, generating reliable revenue streams. In fiscal year 2023, hydropower accounted for approximately 11.5% of Chugoku Electric Power's total electricity generation, underscoring its stable contribution.

These facilities represent a significant source of predictable cash flow due to their low marginal costs and long operational lifespans. Unlike growth-stage assets, they require minimal new investment, allowing capital to be redirected to other strategic areas. The company's commitment to maintaining these operational assets ensures their continued role in providing a steady financial return.

- Stable Revenue: Hydropower plants provide a consistent and predictable income stream, essential for financial stability.

- Low Operating Costs: Once built, these plants have relatively low ongoing operational and maintenance expenses compared to other energy sources.

- Minimal Capital Expenditure: Existing plants require limited new investments, freeing up capital for other business needs.

- Reliable Generation: Hydropower offers a dependable source of electricity, contributing to a stable energy supply.

Information and Telecommunications Services

Chugoku Electric Power’s information and telecommunications services, encompassing internet and network solutions, represent a stable Cash Cow within its diversified portfolio. This segment benefits from the company’s existing infrastructure, generating consistent revenue in a mature market with a significant share. For instance, in fiscal year 2023, telecommunications revenue contributed positively to the company's overall financial health, demonstrating its role as a reliable profit generator.

The strength of this segment lies in its ability to capitalize on established assets, providing a predictable income stream. Its mature market position ensures stability, even as the core electricity business navigates evolving energy landscapes. This ancillary service offers a dependable financial base, supporting broader corporate objectives.

- Stable Revenue: The IT and telecommunications division consistently generates revenue by leveraging Chugoku Electric Power's existing infrastructure.

- Mature Market Dominance: This segment holds a strong market share in a well-established ancillary market.

- Profitability Contribution: The services provided, such as internet and network solutions, add to the company's overall profitability with low investment needs.

- Infrastructure Synergy: The segment effectively utilizes the company's existing physical and network assets, minimizing additional capital expenditure.

Chugoku Electric Power's transmission and distribution network is a prime example of a Cash Cow. It commands a dominant market share within the stable and essential utility sector of the Chugoku region, ensuring a predictable and consistent revenue stream. This segment generates substantial cash flow with minimal need for new investment, primarily requiring funds for upkeep and efficiency improvements.

The company's established retail electricity supply to its traditional customer base in the Chugoku region also functions as a classic Cash Cow. With a leading market share, it provides a reliable and recurring income from residential, commercial, and industrial users. This mature business unit acts as a robust cash-generating engine for the company.

Chugoku Electric Power's existing domestic hydropower plants are firmly positioned as Cash Cows. These mature assets benefit from established infrastructure and consistent operational efficiency, generating reliable revenue streams. In fiscal year 2023, hydropower accounted for approximately 11.5% of Chugoku Electric Power's total electricity generation, underscoring its stable contribution.

| Business Segment | BCG Category | Key Characteristics | FY2023 Data Point |

| Transmission & Distribution Network | Cash Cow | Dominant market share, stable demand, low investment needs | Stable electricity sales volume |

| Retail Electricity Supply (Traditional Customers) | Cash Cow | High market share, recurring revenue, mature market | 55.5 billion kWh total electricity sales (significant portion from these customers) |

| Domestic Hydropower Plants | Cash Cow | Established infrastructure, low marginal costs, reliable generation | 11.5% of total electricity generation |

What You See Is What You Get

Chugoku Electric Power BCG Matrix

The Chugoku Electric Power BCG Matrix preview you are seeing is the exact, fully formatted report you will receive upon purchase. This comprehensive document, devoid of watermarks or demo content, is ready for immediate strategic application. You can confidently expect to download this polished analysis, which has been meticulously crafted to provide clear insights into Chugoku Electric Power's business units. Once purchased, this BCG Matrix report will be instantly accessible for your business planning and decision-making needs.

Dogs

Chugoku Electric Power is actively planning to phase out its less efficient coal-fired thermal power plants as a key part of its broader decarbonization efforts. This strategic move acknowledges the growing challenges these older facilities face.

These aging plants are likely burdened by rising operational expenses, stricter environmental regulations, and increasing scrutiny from policymakers. Consequently, they often exhibit low profitability and possess limited potential for future growth, positioning them as prime candidates for divestment or eventual decommissioning.

Following Japan's full retail electricity market deregulation, Chugoku Electric Power faces intensified competition. Legacy residential plans that haven't evolved to meet new customer demands or the competitive landscape are likely experiencing declining market share and limited growth prospects.

These outdated plans, unable to attract new customers or retain existing ones in a more dynamic market, represent a potential drain on resources without significant return. For instance, as of March 2024, new energy providers have captured a notable portion of the market, putting pressure on incumbents like Chugoku Electric to innovate their offerings.

Chugoku Electric Power's international ventures include minority stakes in older fossil fuel assets, such as coal and gas plants, which are increasingly facing headwinds. These investments, particularly those in saturated markets or with significant operational issues, are likely underperforming. For instance, a hypothetical stake in a 20-year-old coal plant in a region with declining energy demand and stringent emissions regulations would exemplify such a dog.

Aging or Underutilized Internal Support Systems

Chugoku Electric Power's aging or underutilized internal support systems represent a classic 'dog' in the BCG matrix. These could include legacy IT infrastructure for administrative tasks or outdated human resources platforms that are costly to maintain and offer little to no strategic advantage. For instance, in 2024, many utility companies are still grappling with the expense of maintaining systems built decades ago, which are inefficient compared to modern cloud-based solutions. These systems often require specialized, expensive support and hinder digital transformation efforts.

These underperforming assets drain financial and human resources that could be better allocated to growth areas. They do not contribute to market share expansion or offer a competitive edge. For example, if a significant portion of the IT budget in 2024 is still dedicated to supporting a mainframe system for internal accounting, it’s a clear indicator of a 'dog' if that system doesn't directly support customer-facing services or critical operational functions that are uniquely valuable.

- Legacy IT Systems: Outdated software and hardware that are expensive to maintain and lack modern functionality.

- Non-Core Administrative Functions: Inefficient processes in areas like internal record-keeping or HR that do not drive revenue.

- Resource Drain: These systems consume capital and personnel without generating substantial returns or supporting strategic growth initiatives.

- Hindrance to Innovation: The cost and complexity of maintaining these 'dogs' can divert resources from investing in new technologies and competitive advantages.

Non-Competitive Energy Efficiency Services to Unresponsive Segments

Non-competitive energy efficiency services targeting unresponsive segments within Chugoku Electric Power's portfolio might be classified as dogs. Despite the overall growth in energy efficiency markets, a lack of effective marketing or poorly tailored services can lead to low adoption rates and minimal market share for specific offerings.

If the investment required to promote these services to these particular customer groups exceeds the revenue generated from their limited uptake, they represent a drain on resources. For instance, a 2024 analysis of Chugoku Electric Power's service adoption might reveal a particularly low uptake in rural or elderly demographics for advanced smart home energy management systems, indicating a potential 'dog' status for that specific service line if investment continues without significant strategic adjustment.

- Low Adoption Rates: Specific energy efficiency services may struggle to gain traction in certain customer segments due to ineffective outreach or a mismatch in perceived value.

- High Promotional Costs: Significant expenditure on marketing and sales efforts for these niche services may not yield proportionate returns.

- Limited Market Share: Despite market potential, these offerings may hold a negligible share in their targeted unresponsive segments.

- Resource Drain: Continued investment in underperforming services can divert capital from more promising areas of the business.

Chugoku Electric Power's "dogs" represent business units or assets with low market share and low growth potential. These are often legacy operations or services that are costly to maintain and offer little strategic advantage. For example, aging coal-fired power plants, which are being phased out due to decarbonization efforts, fit this description. As of early 2024, many such plants face increasing operational costs and regulatory pressures, making them unprofitable.

Outdated residential electricity plans that haven't adapted to the deregulated market also fall into the dog category. These plans struggle to attract new customers and are losing existing ones, as evidenced by the market share gains of new energy providers since the full deregulation in Japan. These legacy offerings represent a drain on resources without significant future prospects.

Furthermore, inefficient internal IT systems and non-core administrative functions are classic examples of dogs. These systems are expensive to maintain, hinder digital transformation, and consume resources that could be invested in growth areas. The continued reliance on legacy infrastructure, prevalent in many utility companies in 2024, highlights this challenge.

Finally, poorly performing energy efficiency services targeting specific, unresponsive customer segments can be classified as dogs. If the cost of promoting these services outweighs the revenue generated from their low adoption rates, they become a resource drain, diverting capital from more promising ventures.

| Category | Examples within Chugoku Electric Power | Characteristics | Financial Implications |

| Fossil Fuel Assets | Aging coal-fired thermal power plants | Low efficiency, high operational costs, declining market relevance due to decarbonization | Low profitability, potential for divestment or decommissioning |

| Service Offerings | Legacy residential electricity plans | Low market share in a deregulated environment, inability to attract new customers | Declining revenue, resource drain |

| Internal Operations | Outdated IT infrastructure, legacy HR platforms | High maintenance costs, hinder digital transformation, lack strategic advantage | Resource drain, opportunity cost |

| Energy Efficiency Services | Services with low adoption in specific customer segments | High promotional costs, negligible market share in targeted segments | Low return on investment, diversion of capital |

Question Marks

Chugoku Electric Power is investing in hydrogen and ammonia co-firing, recognizing their significant potential for decarbonizing thermal power. These technologies are seen as crucial for the future of clean energy, offering a pathway to reduce emissions from existing infrastructure.

While the growth prospects are high, the current market share and commercial scale of these co-firing technologies for Chugoku Electric Power are minimal. This necessitates considerable investment in research and development to establish their economic viability and secure market acceptance.

Chugoku Electric Power is actively developing next-generation energy solutions, shifting from a pure electricity provider to offering integrated services and new rate plans. This move targets the high-growth market of diversified customer needs and customized energy solutions.

While this segment represents a significant growth opportunity, Chugoku Electric Power's current market share in these innovative offerings is still developing. For instance, in 2024, the company reported a continued focus on digital transformation initiatives aimed at enhancing customer engagement and service delivery, indicating substantial investment in this area.

Chugoku Electric Power is actively pursuing advanced Carbon Capture, Utilization, and Storage (CCUS) projects, exemplified by its involvement in the Osaki CoolGen Project. This strategic focus aligns with their broader carbon neutrality objectives, aiming to tackle emissions from fossil fuel reliance.

CCUS technology holds significant promise for emission reduction, positioning it as a high-growth area. However, for Chugoku Electric Power, the current commercialization and market penetration of these CCUS solutions remain nascent. The significant capital investment and ongoing technological development required are key factors influencing its current market position.

Large-Scale Offshore Wind Power Development

While Chugoku Electric Power is actively pursuing onshore wind development, Japan's substantial offshore wind potential positions it as a significant growth area for renewables. However, if the company's direct engagement in large-scale offshore wind projects remains in the initial planning or exploration stages, these ventures would likely be classified as 'question marks' within the BCG matrix. This classification stems from the considerable upfront capital required and the inherent regulatory and technical hurdles that must be overcome before substantial market penetration can be achieved.

Developing large-scale offshore wind farms demands massive investment, often running into billions of dollars per project. For instance, a single 1 GW offshore wind farm can cost upwards of $3 billion. Chugoku Electric Power, like other utilities, must navigate complex permitting processes, secure financing, and address technological challenges related to turbine installation and grid connection in challenging marine environments. These factors contribute to the uncertainty and high risk associated with these nascent ventures.

- Significant Capital Outlay: Offshore wind projects require substantial upfront investment, with costs for a single 1 GW project potentially exceeding $3 billion.

- Regulatory and Technical Hurdles: Navigating complex permitting, securing financing, and addressing engineering challenges in marine environments are critical factors.

- Early Stage Involvement: If Chugoku Electric Power's direct participation is in the exploratory phase, it signifies a high-risk, high-reward scenario characteristic of question marks.

- Japan's Offshore Potential: Japan has an estimated offshore wind potential of over 400 GW, highlighting the strategic importance of this sector for future energy supply.

Reused Solar Panel Power Plant Development

Chugoku Electric Power's venture into developing solar power plants using reused solar panels, announced in July 2024, positions it within the burgeoning circular economy and renewable energy markets. This initiative taps into a growing demand for sustainable energy solutions. The company's commitment to this area reflects a strategic move towards diversifying its energy portfolio and embracing environmentally conscious practices.

While this venture is innovative, it currently represents a niche market for Chugoku Electric Power. Its market share is consequently low, and its future growth hinges on successfully scaling operations and gaining broader market acceptance for reused solar panel technology. This requires significant upfront investment to establish the necessary infrastructure and processes for panel refurbishment and integration.

- Innovation in Circular Economy: The July 2024 partnership signifies a commitment to the circular economy, aiming to reduce waste and create value from existing solar panel assets.

- High-Growth Sector: The renewable energy sector, particularly solar power, is experiencing substantial global growth, offering significant potential for expansion.

- Niche Market Position: As a relatively new initiative, the reused solar panel power plant development currently holds a low market share for Chugoku Electric Power.

- Investment and Scaling Needs: Success is contingent on substantial initial investment to scale operations and ensure the reliability and market acceptance of reused solar panels.

Chugoku Electric Power's involvement in offshore wind and reused solar panel power plants are prime examples of 'question marks' in the BCG matrix. These initiatives, while targeting high-growth potential markets, currently represent low market share for the company. Significant upfront capital is required for development, and regulatory or technical hurdles remain, making their future success uncertain. For instance, Japan's offshore wind potential is vast, estimated at over 400 GW, but projects require billions in investment and complex permitting.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | Key Challenges |

| Offshore Wind Development | High | Low (Early Stage) | Very High (Billions per GW) | Permitting, Financing, Marine Tech |

| Reused Solar Panel Plants | High (Circular Economy) | Low (Niche) | Significant (Infrastructure) | Scaling, Panel Reliability, Acceptance |

BCG Matrix Data Sources

Our Chugoku Electric Power BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on energy trends, and official government publications.