Endonovo Therapeutics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endonovo Therapeutics Bundle

Uncover the critical political, economic, and technological forces shaping Endonovo Therapeutics's trajectory. Our expert-crafted PESTLE analysis provides the deep-dive insights you need to anticipate challenges and capitalize on opportunities. Download the full version now and gain a decisive strategic advantage.

Political factors

Government regulatory scrutiny is a significant factor for Endonovo Therapeutics. The U.S. medical sector is bracing for ongoing shifts in regulatory landscapes, with a particular emphasis in 2025 on the approval processes for medical products.

The Food and Drug Administration (FDA) is actively developing detailed guidelines for 2025 that will specifically address the use of artificial intelligence within medical devices. These evolving regulations are poised to exert a substantial influence on the timeline and feasibility of bringing new medical technologies to market.

Healthcare policy shifts significantly impact the medical device market, influencing everything from the ease of getting products approved to how much insurers will pay for them. For instance, the U.S. Food and Drug Administration's (FDA) accelerated approval pathways, while not strictly a policy shift, reflect an ongoing trend towards faster market access for innovative therapies, which could benefit companies like Endonovo. In 2024, continued emphasis on value-based care models in both the US and Europe means that devices demonstrating clear cost-effectiveness and improved patient outcomes will likely see greater adoption and favorable reimbursement.

Global efforts to align medical device regulations are advancing, with the International Medical Device Regulators Forum (IMDRF) actively working towards greater consistency. This harmonization aims to streamline market access for innovative therapies like those developed by Endonovo Therapeutics.

The European Union is currently overhauling its pharmaceutical and medical device regulations, with significant updates anticipated by 2026. These revisions are designed to create a more unified regulatory landscape across member states.

This trend toward convergence presents both opportunities and challenges; while consistent standards can simplify global product launches, a single regulatory misstep could have broader repercussions across multiple markets, impacting Endonovo Therapeutics' international operations.

Biotechnology Regulatory Streamlining

In October 2024, U.S. agencies like the FDA, USDA, and EPA introduced a new web-based tool designed to simplify the regulatory landscape for biotechnology developers. This move, stemming from Executive Order 14081, is specifically intended to boost transparency, predictability, and overall efficiency within the sector.

The initiative aims to foster better coordination among regulatory bodies, which could significantly smooth the path for companies like Endonovo Therapeutics. By making the regulatory process more straightforward, it potentially accelerates product development cycles and eases market entry for new biotechnological innovations.

- Regulatory Coordination: Aims to improve collaboration between FDA, USDA, and EPA.

- Transparency & Predictability: Enhances clarity in regulatory pathways for biotech firms.

- Efficiency Gains: Streamlines processes, potentially reducing time-to-market for new products.

- Executive Order 14081: The driving force behind the initiative to modernize biotech regulation.

FDA Approval Process Delays

The U.S. Food and Drug Administration's (FDA) Center for Devices and Radiological Health (CDRH) has experienced staff reductions, potentially impacting the predictability of medical device regulatory approvals. This situation could lead to extended or delayed timelines for companies like Endonovo Therapeutics seeking clearance for their innovative medical devices.

These delays can significantly affect product launch schedules and revenue projections. Companies must proactively build contingency plans to navigate potential setbacks in De Novo, 510(k), and Premarket Approval (PMA) review processes. For instance, reports from 2023 indicated a growing backlog in certain device categories, underscoring the need for robust regulatory strategy.

- Staffing Challenges: Reductions in CDRH personnel can directly translate to slower review cycles.

- Impact on Innovation: Delays in FDA approval can stifle the market entry of novel medical technologies.

- Strategic Planning: Companies need to factor in potential extended timelines for regulatory submissions.

Government policies and regulatory frameworks significantly shape the landscape for Endonovo Therapeutics. The U.S. is focusing on AI in medical devices for 2025, impacting approval timelines. Value-based care models, emphasized in 2024 across the US and Europe, favor cost-effective devices.

Global regulatory harmonization efforts, like those by the IMDRF, aim to streamline market access. However, the EU's ongoing regulatory overhaul, with updates expected by 2026, presents both opportunities for consistency and risks for non-compliance across member states.

A new inter-agency tool launched in October 2024 aims to simplify biotech regulations, potentially accelerating product development. Conversely, FDA staff reductions in 2024 could lead to longer review cycles for medical devices, necessitating robust contingency planning for companies like Endonovo Therapeutics.

| Regulatory Focus Area | Key Development/Trend | Potential Impact on Endonovo | Timeline/Year |

|---|---|---|---|

| AI in Medical Devices | Detailed FDA guidelines for 2025 | Affects approval timelines for AI-driven products | 2025 |

| Value-Based Care | Continued emphasis in US & Europe | Favors devices demonstrating cost-effectiveness and improved outcomes | 2024 onwards |

| Regulatory Harmonization | IMDRF efforts | Streamlines global market access | Ongoing |

| EU Regulatory Overhaul | Significant updates anticipated | Creates unified landscape but requires careful navigation | By 2026 |

| Biotech Regulatory Simplification | New inter-agency tool | Potentially accelerates product development and market entry | October 2024 |

| FDA Staffing | Reported reductions in CDRH | May lead to extended review cycles and product launch delays | 2024 |

What is included in the product

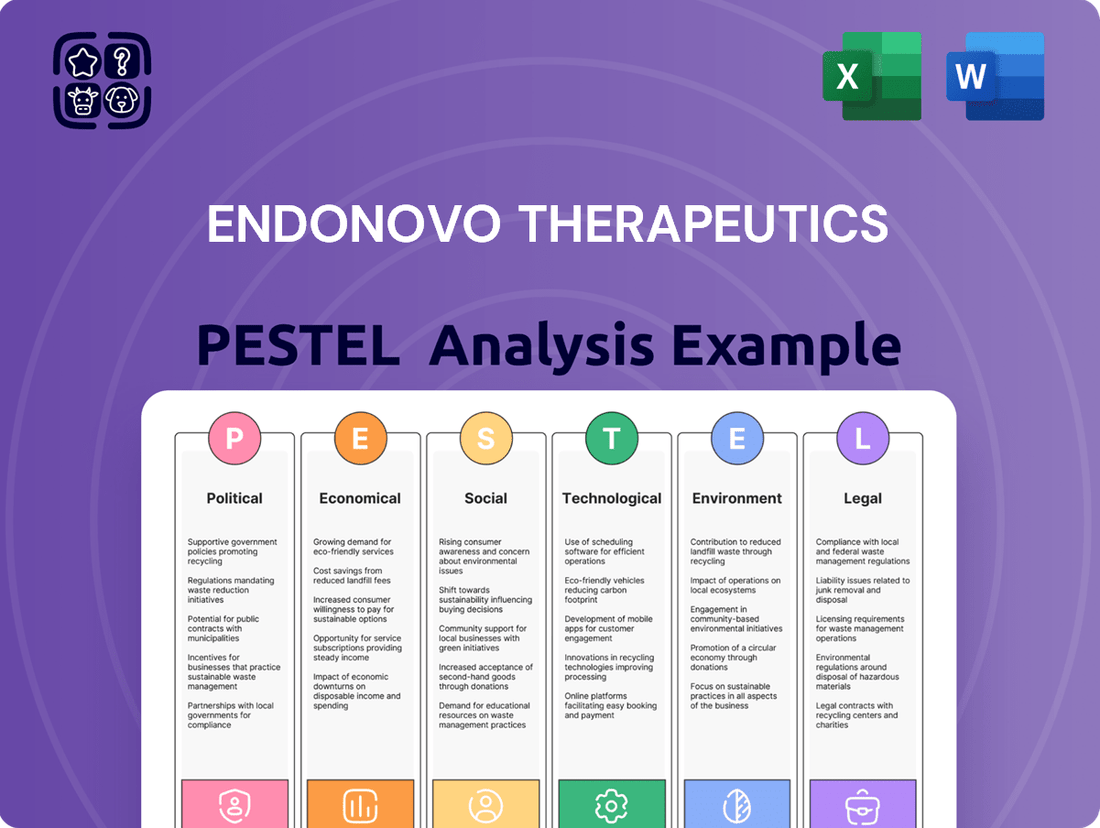

This PESTLE analysis examines the external macro-environmental forces impacting Endonovo Therapeutics, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both strategic threats and opportunities.

It provides a data-driven overview of market and regulatory dynamics, equipping stakeholders with foresight for proactive strategy development and investor confidence.

This PESTLE analysis for Endonovo Therapeutics offers a clear, summarized view of external factors impacting pain relief innovation, serving as a vital tool for strategic decision-making and risk mitigation.

Economic factors

The global market for Pulsed Electromagnetic Field (PEMF) therapy devices is expanding rapidly, fueled by growing recognition of its health advantages. This trend is particularly beneficial for companies like Endonovo Therapeutics, whose SofPulse® device leverages this technology.

In 2024, the PEMF therapy device market was valued at roughly USD 557.7 million. Projections indicate a significant increase, with the market expected to reach USD 953.2 million by 2033, demonstrating a compound annual growth rate (CAGR) of 6.2%.

Reimbursement policies are a critical lever in the medical device sector, directly impacting the financial viability and market penetration of new technologies like those developed by Endonovo Therapeutics. Changes in these policies can dramatically alter healthcare provider purchasing decisions.

For instance, if Medicare or private insurers reduce reimbursement rates for procedures utilizing Endonovo's electroceutical devices, hospitals and clinics might become hesitant to adopt them, leading to a potential downturn in sales. In 2024, CMS proposed a 2.5% increase for the Medicare Physician Fee Schedule, but specific device reimbursement rates are subject to ongoing review and can vary significantly.

Conversely, an expansion of reimbursement coverage for innovative, non-pharmacological treatment modalities could serve as a significant catalyst for Endonovo's revenue growth. The increasing focus on value-based care and alternative therapies suggests a potential tailwind for devices that demonstrate cost-effectiveness and improved patient outcomes, a trend likely to continue through 2025.

The biotech investment landscape in 2024 showed a modest uptick in initial public offerings (IPOs), with 18 biotech companies going public in the first half of 2024, raising approximately $1.5 billion. However, persistent market volatility and ongoing uncertainties surrounding global trade policies, particularly concerning tariffs, pose potential headwinds for sustained growth into 2025. These factors can impact investor confidence and the overall attractiveness of the sector.

Companies like Endonovo Therapeutics, particularly those with less robust cash reserves, may face challenges in securing timely funding. This could manifest as delays in planned fundraising efforts or extended timelines for achieving IPO status. Navigating this economic climate requires a keen focus on financial management and strategic capital allocation.

Endonovo's capacity to effectively manage its financial resources and secure necessary capital will be paramount in the coming year. Demonstrating financial prudence and a clear path to profitability will be key differentiators in attracting investment amid the prevailing economic uncertainties.

Cost of Devices and Accessibility

The cost of Pulsed Electromagnetic Field (PEMF) therapy devices remains a significant hurdle, impacting their widespread accessibility, particularly in developing economies. This price point can restrict market penetration, as potential users in low- and middle-income countries may find these innovations financially out of reach.

Endonovo Therapeutics, like other companies in this sector, faces the challenge of balancing technological advancement with affordability. For instance, while advanced PEMF systems can range from several thousand to tens of thousands of dollars, simpler, less sophisticated devices might still be too costly for many healthcare systems or individual consumers in emerging markets.

To overcome this, Endonovo might explore strategies such as:

- Tiered pricing models to cater to different market segments and income levels.

- Partnerships with local distributors or healthcare providers to facilitate more accessible payment plans or leasing options.

- Developing more cost-effective versions of their technology without compromising core efficacy, potentially through simplified designs or manufacturing efficiencies.

- Exploring government subsidies or grants in specific regions to lower the initial purchase price for essential healthcare applications.

Company Asset Divestment

Company asset divestment significantly reshapes Endonovo Therapeutics' operational and financial landscape. In March 2024, the company finalized an Asset Purchase Agreement with SofPulse, Inc., divesting its medical division and associated intellectual property for a minimum of $50 million. This transaction is a pivotal moment, allowing Endonovo to streamline its focus.

The divestment allows Endonovo to concentrate on distinct growth areas. While SofPulse, Inc. will champion the expansion of the SofPulse® device within medical environments, Endonovo retains crucial rights. These include the development of non-medical human Pulsed Electromagnetic Field (PEMF) intellectual property and the burgeoning wellness markets, alongside its telehealth division.

This strategic divestment reorients Endonovo's financial trajectory and revenue potential. The $50 million minimum proceeds provide capital for reinvestment in its retained business segments. This move signals a deliberate strategy to unlock value and pursue growth in specialized, high-potential markets outside of its former core medical device operations.

- Divestment Agreement: Endonovo Therapeutics sold its medical division and related IP to SofPulse, Inc. in March 2024.

- Minimum Proceeds: The deal secured a minimum of $50 million for Endonovo.

- Retained Assets: Endonovo keeps rights for non-medical human PEMF IP, wellness markets, and its telehealth division.

- Strategic Shift: The divestment allows Endonovo to redefine its financial focus and explore new revenue streams.

Economic factors significantly shape Endonovo Therapeutics' operational landscape, particularly concerning market accessibility and investment. The cost of PEMF devices, with advanced systems ranging from thousands to tens of thousands of dollars, presents a barrier, especially in developing economies. This necessitates strategies like tiered pricing or cost-effective versions to broaden market reach.

The biotech investment climate in early 2024, while showing some IPO activity, remains subject to market volatility and global trade uncertainties, impacting funding availability. Endonovo's strategic divestment of its medical division in March 2024 for a minimum of $50 million provides capital but also shifts its financial focus to retained segments like non-medical PEMF and telehealth.

Reimbursement policies are critical; a reduction in coverage for procedures using Endonovo's technology could hinder sales, whereas expanded coverage for alternative therapies could boost revenue. For example, CMS proposed a 2.5% increase for the Medicare Physician Fee Schedule in 2024, but specific device reimbursement rates are under continuous review.

Same Document Delivered

Endonovo Therapeutics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Endonovo Therapeutics delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering critical insights into the external forces shaping Endonovo Therapeutics' operations and future growth. This detailed breakdown will equip you with a thorough understanding of the market dynamics.

Sociological factors

There's a clear societal shift towards non-invasive and alternative medicine. This growing awareness means more people are actively seeking treatments that avoid surgery or heavy medication. A 2024 survey indicated that over 60% of consumers are interested in exploring drug-free pain management options.

Endonovo Therapeutics is perfectly positioned to capitalize on this. Their focus on non-pharmacological approaches directly addresses this demand. The SofPulse device, for example, offers a drug-free solution, resonating with a significant segment of the population looking for alternatives to traditional pharmaceuticals.

The world's population is getting older, and with that comes more chronic health issues. Conditions like arthritis, osteoporosis, and persistent pain are becoming more common, driving a strong need for treatments that don't involve surgery or invasive procedures. This trend is particularly relevant for companies like Endonovo Therapeutics, which offers solutions like its SofPulse® pulsed electromagnetic field (PEMF) therapy.

PEMF therapy is gaining traction as a way to manage the symptoms of these age-related and chronic conditions. As more people live longer and experience these health challenges, the demand for effective, non-invasive options like PEMF is expected to grow significantly. This demographic shift presents a substantial market opportunity for Endonovo's innovative therapies.

For instance, the World Health Organization projects that between 2015 and 2050, the proportion of the world's population over 60 years will nearly double, from 12% to 22%. This increasing elderly population directly correlates with a higher incidence of chronic diseases, creating a fertile ground for therapies that can improve quality of life without invasive interventions.

The persistent opioid crisis in the United States, which saw an estimated 107,543 drug overdose deaths in 2023, directly fuels the demand for effective non-addictive pain management alternatives. This societal imperative creates a fertile ground for innovations like Endonovo Therapeutics' SofPulse®, a technology designed to alleviate pain without the risks associated with opioids.

SofPulse®'s demonstrated efficacy in reducing pain and subsequently lowering the reliance on opioid medications positions it as a highly attractive solution within the current healthcare landscape. The technology's potential to address a critical public health issue enhances its market appeal and encourages wider adoption among patients and providers alike.

This significant societal concern regarding opioid addiction elevates the importance and desirability of non-pharmacological pain management options. As healthcare providers and patients actively seek safer and more sustainable pain relief strategies, technologies like SofPulse® are poised for increased integration into treatment protocols.

Patient Preference for Home-Based Care

Patients increasingly prefer receiving care in their own homes, a trend amplified by the rise of telemedicine and remote monitoring. Endonovo's non-invasive PEMF therapy devices align perfectly with this demand for convenient, at-home treatment solutions.

This shift towards home-based healthcare is a significant market expansion opportunity for Endonovo. For instance, the global remote patient monitoring market was valued at approximately $30.1 billion in 2023 and is projected to reach $175.1 billion by 2030, growing at a CAGR of 28.5% during the forecast period, according to Grand View Research. This demonstrates a clear and growing patient appetite for accessible, technology-enabled healthcare delivery outside traditional clinical settings.

- Growing Demand for Home Healthcare: Patients are actively seeking convenient and effective treatment options that can be administered within their residences.

- Telemedicine and Remote Monitoring Growth: The increasing adoption of these technologies further supports the feasibility and desirability of home-based care solutions.

- PEMF Therapy's Suitability: Endonovo's non-invasive and user-friendly PEMF devices are well-positioned to capitalize on this patient preference.

- Market Expansion Potential: The trend towards home healthcare directly translates to a broader potential market reach for Endonovo's innovative therapeutic products.

Public Perception of Alternative Therapies

Public acceptance of alternative and complementary therapies, including pulsed electromagnetic field (PEMF) therapy, is on an upward trend. This growing acceptance is fueled by an increasing number of clinical studies and positive patient testimonials that showcase the benefits of these treatments.

As awareness and evidence mount, both healthcare providers and patients are showing greater interest in and adoption of these therapies. For instance, a 2024 report indicated that the global market for complementary and alternative medicine was projected to reach over $295 billion by 2027, with PEMF being a significant contributor.

Endonovo Therapeutics can capitalize on this favorable public sentiment to enhance its market penetration. The company's strategy can involve highlighting its research and development efforts and showcasing successful patient outcomes to further build trust and encourage wider adoption.

- Growing Acceptance: Public perception of alternative therapies like PEMF is increasingly positive.

- Evidence-Based Growth: Clinical studies and patient testimonials are driving this increased adoption.

- Market Opportunity: The global complementary and alternative medicine market is expanding, with PEMF playing a key role.

- Strategic Advantage: Endonovo can leverage positive public sentiment for market penetration.

Societal attitudes are increasingly favoring non-pharmacological and non-invasive medical treatments, a trend Endonovo Therapeutics is well-positioned to exploit with its PEMF technology. Growing public concern over the opioid crisis, which resulted in an estimated 107,543 overdose deaths in the US in 2023, further amplifies the demand for safer, non-addictive pain management solutions like SofPulse®.

The global population is aging, with the proportion of individuals over 60 projected to nearly double from 12% in 2015 to 22% by 2050, according to the WHO. This demographic shift means a greater prevalence of chronic conditions, driving demand for therapies that improve quality of life without invasive interventions.

Furthermore, a significant shift towards home-based healthcare, supported by the burgeoning telemedicine market valued at approximately $30.1 billion in 2023, aligns perfectly with Endonovo's user-friendly, non-invasive devices, offering convenient at-home treatment options.

Public acceptance of alternative therapies, including PEMF, is on the rise, evidenced by a projected growth in the global complementary and alternative medicine market to over $295 billion by 2027, creating a substantial opportunity for Endonovo to expand its market reach.

Technological factors

The market for Pulsed Electromagnetic Field (PEMF) therapy equipment is seeing robust expansion, largely due to ongoing technological progress. This innovation is making PEMF devices more sophisticated and effective for a wider range of applications.

Contemporary PEMF systems, such as Endonovo's SofPulse®, are now equipped with enhanced capabilities. These include a variety of frequency options, increased intensity outputs, and customizable waveform designs, all contributing to better treatment outcomes.

These advancements are crucial for broadening the use cases of PEMF technology, making it suitable for diverse medical treatments and general wellness applications. The global PEMF therapy market was valued at approximately $1.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 7% through 2030, reflecting this technological drive.

Endonovo Therapeutics is focused on creating safe, wearable, and non-invasive medical devices, aligning with a significant trend in healthcare technology. This sector is increasingly prioritizing portable and user-friendly solutions, which inherently makes advanced therapies more accessible. For instance, the global wearable medical device market was valued at approximately $57.6 billion in 2023 and is projected to reach $207.6 billion by 2030, indicating strong investor and consumer interest in this area.

The move towards wearable technology is driven by its ability to offer continuous monitoring of vital signs and physiological parameters. This real-time data stream is invaluable for healthcare professionals, allowing for more informed and timely treatment decisions. The increasing adoption of telehealth and remote patient monitoring, amplified by advancements in IoT and AI, further supports the integration of these devices into everyday patient care, including home-based treatment plans.

Artificial intelligence and machine learning are set to transform pain assessment and management. By sifting through extensive patient data, AI can optimize treatment strategies and forecast results. For instance, in 2024, AI-driven diagnostic tools are increasingly being used in healthcare, with the global AI in healthcare market projected to reach over $187 billion by 2030, indicating significant investment and adoption.

The incorporation of AI into neuromodulation technologies promises breakthroughs in real-time treatment monitoring and adjustment. Endonovo Therapeutics can capitalize on this by exploring AI to refine the precision and effectiveness of its electroceutical therapies. Early adopters of AI in medical devices have reported improved patient outcomes and operational efficiencies.

Innovations in Pain Management

The pain management sector is experiencing a significant shift, moving beyond traditional pills to embrace advanced technologies. Neuromodulation, which uses electrical signals to influence nerve activity, is a key area of growth, offering new avenues for chronic pain relief. This technological evolution creates a dynamic market for innovative solutions.

Endonovo Therapeutics' SofPulse®, an electroceutical device, aligns perfectly with these emerging trends. By leveraging electrical stimulation for therapeutic purposes, SofPulse® taps into a growing demand for non-pharmacological pain management options. This positions Endonovo to capitalize on the increasing adoption of such advanced medical technologies.

The market for neuromodulation devices is projected for substantial growth. For instance, the global neuromodulation market was valued at approximately $5.5 billion in 2023 and is anticipated to reach around $11.2 billion by 2030, growing at a compound annual growth rate (CAGR) of roughly 10.7% during this period. This upward trajectory underscores the significant opportunities for companies like Endonovo.

Key technological advancements impacting pain management include:

- Advanced Neuromodulation Techniques: Innovations in spinal cord stimulation (SCS) and peripheral nerve stimulation (PNS) are offering more targeted and effective pain relief.

- Wearable and Implantable Devices: The development of smaller, more sophisticated wearable and implantable devices is enhancing patient convenience and treatment efficacy.

- AI and Machine Learning Integration: Artificial intelligence is being used to personalize treatment plans and predict patient responses to different therapies, optimizing outcomes.

Telehealth and Remote Monitoring

Endonovo Therapeutics is strategically building out its telehealth capabilities, recognizing the significant technological shift towards remote healthcare solutions. This focus aligns perfectly with the growing trend of telemedicine and remote patient monitoring, which empowers individuals to manage their health from the comfort of their homes.

The adoption of these technologies is accelerating, with the global telehealth market projected to reach approximately $373.5 billion by 2027, according to some industry estimates. This expansion offers Endonovo a prime opportunity to leverage its non-invasive devices, potentially broadening its service delivery model and enhancing patient engagement.

- Market Growth: The telehealth sector is experiencing robust expansion, driven by technological advancements and increasing patient acceptance.

- Remote Monitoring: Patient monitoring from home is becoming a standard of care, reducing hospital visits and improving chronic disease management.

- Endonovo's Alignment: Endonovo's non-invasive device technology is well-suited to integrate with these remote monitoring platforms, offering a seamless patient experience.

- Service Expansion: This technological trend allows Endonovo to explore new service delivery models, potentially reaching a wider patient base and generating new revenue streams.

Technological advancements are a primary driver for Endonovo Therapeutics, particularly in the burgeoning fields of neuromodulation and wearable health tech. The company's focus on non-invasive, electroceutical devices like SofPulse® directly taps into these growth areas.

The global neuromodulation market, valued at approximately $5.5 billion in 2023, is projected to reach $11.2 billion by 2030, showcasing significant technological adoption. Similarly, the wearable medical device market, already at $57.6 billion in 2023, is expected to surge to $207.6 billion by 2030, highlighting the demand for Endonovo's device philosophy.

AI integration is also a key technological factor, with the AI in healthcare market anticipated to exceed $187 billion by 2030. Endonovo can leverage AI to enhance treatment personalization and predictive analytics for its therapies.

| Technology Area | 2023 Market Value (USD Billion) | Projected 2030 Market Value (USD Billion) | Endonovo Relevance |

|---|---|---|---|

| Neuromodulation | 5.5 | 11.2 | Core technology for pain management solutions |

| Wearable Medical Devices | 57.6 | 207.6 | Supports Endonovo's focus on portable, user-friendly devices |

| AI in Healthcare | (Estimate varied, significant growth) | 187+ | Potential for optimizing treatment and patient outcomes |

Legal factors

Endonovo Therapeutics' SofPulse® device has achieved FDA clearance, a critical legal hurdle for its marketing and sale within the United States. This clearance signifies that the device meets regulatory standards for safety and effectiveness.

The U.S. Food and Drug Administration (FDA) employs distinct pathways for device approval. For devices deemed substantially equivalent to legally marketed predicate devices, the 510(k) clearance process is utilized. Conversely, novel or high-risk devices typically require the more stringent Premarket Approval (PMA) pathway.

Successfully navigating these complex and rigorous FDA approval processes is fundamental to Endonovo's ability to gain and expand market access for its innovative therapies. As of late 2024, the FDA continues to refine its review timelines, with an average 510(k) review taking approximately 6 months, while PMA reviews can extend significantly longer.

Protecting Endonovo Therapeutics' proprietary Electroceutical® Therapy and the unique multi-coil IP of its SofPulse® device is paramount for maintaining its competitive edge. These intellectual property rights grant the company exclusive control over the development and commercialization of its groundbreaking treatments. The recent Asset Purchase Agreement with SofPulse, Inc., finalized in early 2024, specifically included the transfer of substantial intellectual property assets, reinforcing the importance of this legal pillar.

As connected medical devices and telehealth become more prevalent, data privacy and cybersecurity regulations are tightening. Endonovo Therapeutics must safeguard sensitive patient data and ensure its devices are resilient against cyber threats. For instance, the US Food and Drug Administration (FDA) released updated premarket cybersecurity guidance for medical devices in late 2023, emphasizing continuous monitoring and vulnerability management.

The European Union is also actively strengthening its data protection framework. The General Data Protection Regulation (GDPR) continues to set a high standard for data handling, impacting how companies like Endonovo manage patient information collected through their therapeutic devices and platforms. Non-compliance can result in substantial fines, with GDPR penalties reaching up to 4% of global annual turnover.

International Regulatory Compliance

Endonovo Therapeutics' global reach hinges on adhering to international regulatory standards beyond U.S. FDA approval. The company's Electroceutical® Therapy holds CE Marking for European markets, signifying adherence to stringent health, safety, and environmental regulations within the European Union. This compliance is a crucial stepping stone for broader market penetration.

Successfully navigating the complex web of international regulatory frameworks, including those in the UK and various Asia-Pacific nations, is paramount for Endonovo's strategic global expansion. Each region presents unique compliance requirements that must be met for market access and sustained growth.

Recent regulatory shifts, such as amendments to the EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), directly influence Endonovo's ability to introduce and market its products across Europe. Staying abreast of and adapting to these evolving regulations is a continuous and critical operational challenge.

- CE Marking: Endonovo's Electroceutical® Therapy is CE Marked, allowing market access in the European Economic Area.

- EU MDR/IVDR Impact: Amendments to these regulations in 2024/2025 necessitate ongoing compliance efforts for continued European market presence.

- Asia-Pacific Expansion: Regulatory pathways in key Asian markets, such as Japan and South Korea, are being actively assessed for 2025 market entry strategies.

Product Liability and Safety Standards

Endonovo Therapeutics, as a medical device developer, must navigate a complex web of product liability and safety standards. These regulations are crucial for ensuring the safety and efficacy of its innovative therapeutic solutions. For instance, adherence to ISO 13485, a globally recognized standard for quality management systems in the medical device industry, is paramount. Failure to meet these stringent requirements can result in significant financial penalties and irreparable damage to the company's reputation.

The company's commitment to robust quality management systems and diligent post-market surveillance is therefore not just a regulatory necessity but a core operational principle. This proactive approach helps mitigate risks associated with product performance and patient safety. For example, the U.S. Food and Drug Administration (FDA) mandates rigorous reporting of adverse events, with medical device manufacturers expected to submit reports within specific timeframes to ensure timely intervention and public safety updates.

- Compliance with FDA regulations, including pre-market approval and post-market surveillance, is essential for Endonovo's U.S. market access.

- Adherence to international standards like ISO 13485 demonstrates a commitment to quality and facilitates global market entry.

- Product liability lawsuits can lead to substantial financial settlements and damage brand trust, making risk management a continuous priority.

- The increasing scrutiny on medical device safety by regulatory bodies worldwide necessitates ongoing investment in quality assurance and control processes.

Endonovo Therapeutics' legal landscape is shaped by stringent regulatory approvals, intellectual property protection, and evolving data privacy laws. The company's SofPulse® device has secured FDA clearance, a crucial step for U.S. market entry, demonstrating compliance with safety and efficacy standards. Intellectual property, particularly for its Electroceutical® Therapy and SofPulse® multi-coil technology, is actively protected through agreements like the early 2024 Asset Purchase Agreement with SofPulse, Inc.

Global expansion necessitates adherence to diverse international regulations, with CE Marking for the Electroceutical® Therapy enabling access to the European Economic Area. However, amendments to the EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) in 2024/2025 require continuous adaptation and compliance efforts for sustained European market presence. Furthermore, the company is assessing regulatory pathways in key Asia-Pacific markets like Japan and South Korea for potential 2025 market entry.

Data privacy and cybersecurity are increasingly critical, especially with the rise of connected medical devices and telehealth. Endonovo must comply with regulations like GDPR, which imposes penalties up to 4% of global annual turnover for non-compliance, and follow updated FDA premarket cybersecurity guidance released in late 2023. Product liability and safety standards, including adherence to ISO 13485, are also paramount, with the FDA mandating rigorous adverse event reporting to ensure patient safety.

| Regulatory Aspect | Status/Action | Impact | Key Date/Period |

|---|---|---|---|

| FDA Clearance (SofPulse®) | Achieved | U.S. market access | Ongoing |

| Intellectual Property Protection | Secured (e.g., via APA) | Competitive edge, exclusive commercialization | Early 2024 |

| CE Marking (Electroceutical® Therapy) | Granted | European Economic Area market access | Ongoing |

| EU MDR/IVDR Compliance | Ongoing adaptation | Continued European market presence | 2024/2025 |

| Asia-Pacific Market Assessment | Underway | Potential 2025 market entry | 2025 |

| Data Privacy Compliance (e.g., GDPR) | Mandatory adherence | Avoidance of significant fines (up to 4% global turnover) | Ongoing |

| Cybersecurity Guidance (FDA) | Adherence required | Device resilience against threats | Late 2023 update |

| ISO 13485 Compliance | Essential | Facilitates global market entry, quality assurance | Ongoing |

Environmental factors

The medical device sector is under growing scrutiny to adopt greener manufacturing methods. This pressure extends from sourcing materials to how products are ultimately discarded. For instance, the European Union's Green Deal initiatives are pushing for circular economy principles, impacting supply chains and product lifecycles.

Endonovo Therapeutics, like its peers, needs to embed sustainability into its design philosophy for both devices and their packaging. This means looking at material choices and end-of-life considerations from the outset. A 2024 report by Deloitte highlighted that over 70% of consumers consider sustainability when making purchasing decisions, a trend likely to influence B2B relationships in healthcare.

Optimizing production to cut down waste and energy use is crucial. In 2023, the medical device manufacturing industry reported an average energy consumption increase of 5% year-on-year, signaling a need for efficiency improvements. Companies are exploring renewable energy sources and lean manufacturing techniques to mitigate this impact.

The medical device industry, including companies like Endonovo Therapeutics, faces significant environmental scrutiny regarding waste management and disposal. Packaging waste and the proliferation of single-use devices contribute substantially to landfill burdens and environmental pollution.

Addressing the end-of-life cycle for medical devices is critical. Endonovo must actively develop strategies for remanufacturing, refurbishment, and implementing comprehensive recycling programs, particularly considering the potential biohazard risks associated with medical waste. For instance, in 2023, the healthcare sector globally generated an estimated 5.9 million tons of medical waste, a significant portion of which is disposable plastics.

The medical device sector is increasingly embracing circular economy principles, focusing on reusing and refurbishing products to prolong their use and lessen the strain on raw materials. This shift is expected to gain momentum through 2025.

By integrating circularity, companies like Endonovo can not only cut down on resource usage but also improve the longevity and value of their medical devices. For instance, the global circular economy market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, indicating a strong market pull for sustainable practices.

Endonovo Therapeutics can proactively adopt eco-design strategies, such as designing for disassembly and using recycled materials, to align with this growing trend and potentially tap into new market segments focused on sustainability.

Energy Consumption and Carbon Footprint

Traditional manufacturing processes, including those for medical devices, often demand substantial energy and contribute to greenhouse gas emissions. For instance, the U.S. manufacturing sector alone accounted for approximately 23% of total U.S. energy consumption in 2023, with a significant portion tied to emissions. This highlights the inherent environmental challenge within the industry.

Medical device companies are increasingly prioritizing the reduction of their direct (Scope 1) and indirect (Scope 2) emissions. In 2024, many companies are setting ambitious targets, with some aiming for 50% reductions in Scope 1 and 2 emissions by 2030. This trend reflects growing regulatory pressure and investor demand for sustainable practices.

Endonovo Therapeutics can proactively explore avenues to minimize the carbon footprint associated with its devices. This involves a comprehensive lifecycle assessment, from sourcing raw materials and optimizing production energy efficiency to streamlining distribution logistics and considering end-of-life management.

Specific opportunities for Endonovo include:

- Investing in renewable energy sources for manufacturing facilities: Many companies are transitioning to solar or wind power, which can significantly cut Scope 2 emissions.

- Optimizing supply chain and distribution networks: Reducing transportation distances and utilizing more fuel-efficient logistics can lower emissions.

- Designing for recyclability and reduced material usage: Incorporating sustainable design principles can lessen the environmental impact throughout the product's life.

- Exploring energy-efficient manufacturing technologies: Adopting advanced machinery and processes can lead to lower energy consumption per unit produced.

Evolving Environmental Regulations

Environmental regulations are becoming increasingly stringent, particularly within the European Union, compelling medical device companies like Endonovo Therapeutics to integrate sustainability into their core strategies. This focus extends to product design, with an emphasis on recyclability and the potential for repurposing materials at the end of a device's lifecycle to minimize environmental impact and ensure compliance. Proactive monitoring of these evolving regulatory landscapes is essential for Endonovo to maintain adherence and identify opportunities within the green economy.

Endonovo Therapeutics must navigate a landscape of increasing environmental accountability, from sourcing to disposal. The push for circular economy principles, exemplified by the EU's Green Deal, directly impacts how medical devices are designed and managed throughout their lifecycle. By 2025, sustainability is expected to be a non-negotiable aspect of operations, influencing market access and consumer preference.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Endonovo Therapeutics is built on a robust foundation of data from leading financial institutions, regulatory bodies, and specialized industry research firms. We leverage insights from economic forecasts, healthcare policy updates, and technological advancements to provide a comprehensive view.