Emperor Watch & Jewellery PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emperor Watch & Jewellery Bundle

Understand the intricate web of political, economic, social, technological, legal, and environmental factors shaping Emperor Watch & Jewellery's trajectory. This comprehensive PESTLE analysis provides crucial insights into market dynamics, regulatory shifts, and consumer behavior. Equip yourself with the strategic intelligence needed to navigate challenges and capitalize on opportunities.

Gain a competitive edge with our meticulously researched PESTLE analysis of Emperor Watch & Jewellery. Delve into the external forces impacting the luxury retail sector, from evolving consumer preferences to technological advancements. Download the full version now for actionable intelligence to inform your investment decisions and business strategies.

Political factors

Chinese government policies, particularly those aimed at boosting domestic consumption and tourism, have a substantial impact on the luxury goods sector. Initiatives like the development of Hainan as a duty-free shopping hub are designed to capture spending that might otherwise occur abroad, directly benefiting retailers of high-value items like watches and jewelry.

For Emperor Watch & Jewellery, shifts in these policies can create both opportunities and challenges. For instance, the Hainan Free Trade Port policy, aiming to become a globally influential duty-free shopping destination by 2035, presents a significant market for luxury goods. However, the implementation of measures such as the 'seal-off' policy in Hainan, intended to curb smuggling and ensure compliance, can also affect the accessibility and flow of goods, influencing sales volumes.

Broader geopolitical tensions, especially between major economies like the US and China, can significantly impact the luxury goods sector. These tensions often manifest as trade disputes, leading to potential tariffs on imported goods, which directly affect the pricing and accessibility of luxury items like those sold by Emperor Watch & Jewellery.

For instance, the ongoing trade friction between the US and China, which has seen fluctuating tariff rates in recent years, creates an environment of economic uncertainty. This uncertainty can dampen consumer confidence, particularly among affluent buyers who are key to the luxury market. When consumers feel less secure about the economic future, discretionary spending, including on high-end watches and jewelry, tends to decrease.

Furthermore, these geopolitical dynamics can disrupt supply chains and influence the flow of luxury goods across borders. Companies like Emperor Watch & Jewellery must navigate these complexities, potentially facing higher operational costs or needing to adjust their sourcing and distribution strategies to mitigate the impact of trade restrictions and economic volatility.

The political stability and autonomy of Hong Kong, a vital market for Emperor Watch & Jewellery, remain a significant factor. Any shifts in Hong Kong's governance or its relationship with mainland China could directly impact the operating environment for luxury goods retailers.

Economic pessimism, exacerbated by global monetary policies and ongoing geopolitical tensions, has been observed to affect consumer confidence in Hong Kong. For instance, in early 2024, Hong Kong's Composite Hang Seng Index experienced volatility, reflecting broader market uncertainties that can translate into reduced discretionary spending on high-end items like luxury watches and jewelry.

Government Support for Domestic Brands

The Chinese government's strategic push to boost tourism in Hong Kong, particularly from its lower-tier cities, is a significant political factor. This initiative aims to revitalize the region's economy, which can indirectly benefit luxury retailers like Emperor Watch & Jewellery by increasing foot traffic and potential customer bases.

Concurrently, a rising tide of nationalistic sentiment in China is fostering a stronger preference for domestic luxury brands. This trend, often referred to as 'guochao' or national trend, encourages local consumption and could potentially shift consumer loyalty away from established international players towards homegrown alternatives, altering the competitive dynamics Emperor Watch & Jewellery operates within.

- Government Tourism Initiatives: China's efforts to encourage tourism from lower-tier cities to Hong Kong aim to stimulate economic activity and consumer spending.

- Nationalistic Consumer Trends: A growing preference for domestic luxury brands in China is influencing purchasing decisions, potentially impacting the market share of international brands.

- Shifting Consumer Loyalty: These political and social trends can lead to a reallocation of consumer spending, favoring local brands and potentially impacting Emperor Watch & Jewellery's sales.

Regulatory Environment and Compliance

The regulatory landscape in China presents a dynamic challenge for businesses like Emperor Watch & Jewellery. Recent shifts in market entry regulations and evolving product licensing requirements necessitate constant vigilance. For instance, changes to import duties and VAT on luxury goods, which can fluctuate annually, directly impact pricing strategies and profitability.

Compliance with China's increasingly stringent data protection laws, such as those enacted in recent years, is paramount for safeguarding customer information and maintaining brand trust. Furthermore, updated labeling standards and consumer protection legislation require meticulous adherence to avoid penalties and reputational damage. Navigating these complexities is crucial for smooth operations and brand integrity.

Key regulatory considerations for Emperor Watch & Jewellery in China include:

- Evolving market entry policies impacting foreign investment.

- Strict product licensing and certification requirements for imported luxury goods.

- Changes in taxation, including VAT and consumption tax on high-value items.

- Increasingly robust data privacy and cybersecurity regulations.

Government initiatives to boost domestic tourism, such as the development of Hainan as a duty-free hub, directly benefit luxury retailers like Emperor Watch & Jewellery by capturing spending. However, geopolitical tensions, particularly US-China trade friction, can lead to tariffs and economic uncertainty, impacting consumer confidence and discretionary spending on high-end goods.

Political stability in Hong Kong is crucial, as shifts in its governance can affect the operating environment for luxury brands. Concurrently, rising nationalistic sentiment in China favors domestic brands, potentially altering consumer loyalty and market dynamics for international players.

China's evolving regulatory landscape, including changes in import duties, VAT, and data protection laws, necessitates constant adaptation for businesses like Emperor Watch & Jewellery to ensure compliance and maintain brand integrity.

What is included in the product

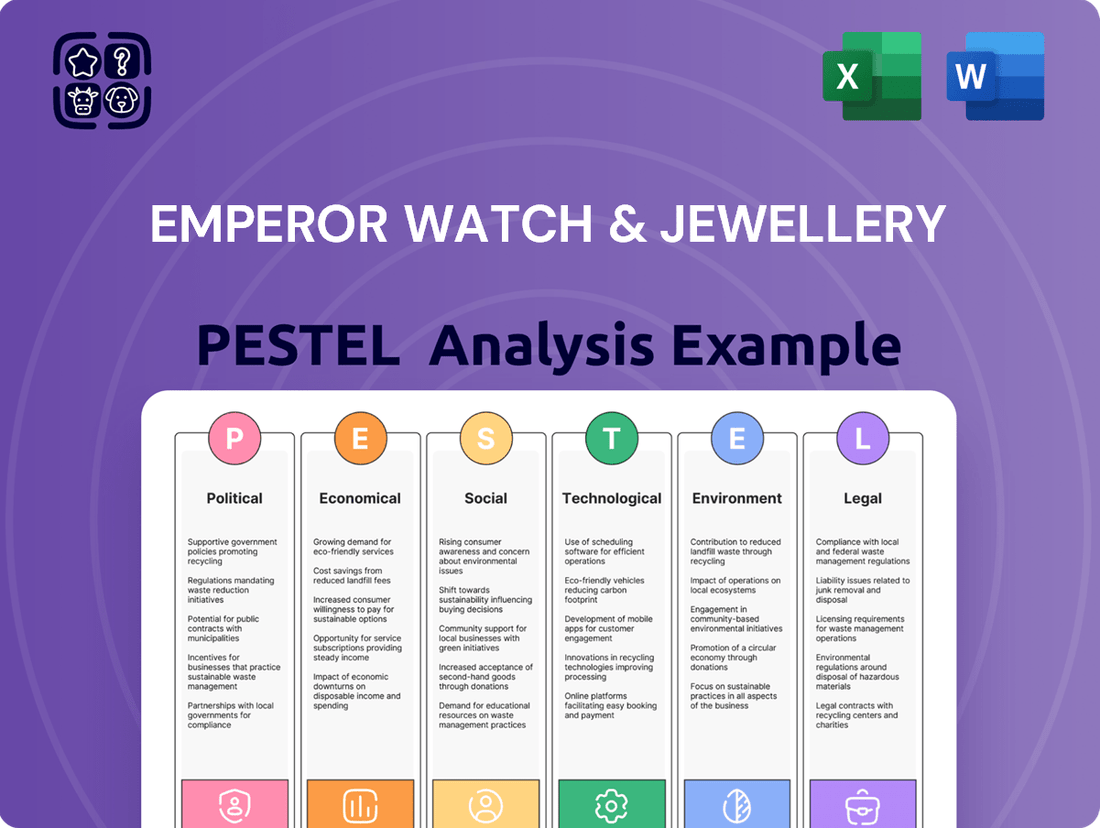

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Emperor Watch & Jewellery, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape the company's strategic landscape, identifying potential opportunities and threats within its operating context.

The Emperor Watch & Jewellery PESTLE Analysis offers a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of information overload.

Economic factors

Consumer confidence and overall economic growth in Greater China are pivotal for luxury goods, directly influencing spending patterns for Emperor Watch & Jewellery. A downturn in confidence, often linked to economic headwinds, can significantly dampen demand for high-end items.

In Mainland China, while economic growth has shown resilience, concerns like the property sector's stability and employment figures can create a more cautious consumer. This caution translates to potentially slower growth in discretionary spending on luxury, impacting sales volumes.

Hong Kong, in particular, has experienced a more pronounced impact on consumer sentiment due to economic uncertainty and employment concerns. This cautious mood directly affects luxury purchases, as consumers may prioritize essential spending over discretionary luxury items, a factor Emperor Watch & Jewellery must monitor closely.

The Hong Kong Dollar's (HKD) strength relative to currencies like the Chinese Renminbi (RMB) and Japanese Yen (JPY) directly impacts Emperor Watch & Jewellery's pricing strategy. For instance, in early 2024, the HKD maintained a firm position against the RMB, potentially offering price advantages for mainland Chinese consumers shopping in Hong Kong compared to purchasing the same luxury watches or jewelry domestically. This currency dynamic can significantly influence purchasing decisions, driving cross-border traffic to Hong Kong.

Significant price gaps for luxury goods between Hong Kong and mainland China, often exacerbated by currency fluctuations and varying import duties, can be a major draw for Chinese tourists. If the HKD remains strong while the RMB weakens, or if Chinese tariffs increase, the cost savings realized by purchasing in Hong Kong become more pronounced. This creates a compelling incentive for consumers to travel to Hong Kong specifically for high-value purchases, benefiting retailers like Emperor Watch & Jewellery.

Rising disposable incomes across Greater China and Southeast Asia are significantly boosting the luxury market, with a notable increase in consumer spending power. This trend is further amplified by substantial intergenerational wealth transfers, injecting considerable capital into the luxury goods sector.

The expanding affluent demographic, particularly high-net-worth individuals in these regions, directly translates to heightened demand for premium and high-end products. For instance, in 2024, the Asia-Pacific luxury market is projected to see continued robust growth, driven by these very factors.

Competition from E-commerce and Duty-Free Zones

Emperor Watch & Jewellery faces significant competition from the burgeoning e-commerce sector and specialized duty-free zones. Online platforms, including major global marketplaces and niche luxury retailers, offer consumers convenience and often aggressive pricing, directly impacting traditional brick-and-mortar sales. For instance, the global e-commerce market was projected to reach over $6.3 trillion in 2024, a substantial portion of which includes luxury goods.

The emergence of duty-free zones, such as Hainan in China, presents another competitive challenge. These zones attract consumers with tax exemptions, leading to lower prices on luxury items, including watches and jewelry. Hainan's duty-free sales alone reached approximately $17.5 billion in 2023, highlighting the scale of this competitive channel.

In response, Emperor Watch & Jewellery must bolster its digital strategy and integrate its online and offline retail experiences. This adaptation is crucial as consumer shopping habits continue to shift towards digital channels, demanding seamless omnichannel engagement. A strong online presence allows for wider reach and caters to the increasing preference for digital purchasing, even for high-value items.

- E-commerce Growth: Global e-commerce sales are expected to surpass $6.3 trillion in 2024, impacting all retail sectors.

- Duty-Free Competition: Hainan's duty-free market generated around $17.5 billion in sales in 2023, offering price advantages.

- Consumer Behavior Shift: A growing number of consumers prefer online shopping and expect integrated retail experiences.

- Strategic Imperative: Emperor Watch & Jewellery needs to enhance its online presence and omnichannel capabilities to remain competitive.

Impact of Inflation and Interest Rates

Global economic uncertainties, particularly persistent inflation and elevated interest rates, are creating a challenging environment for discretionary spending. This directly impacts sectors reliant on consumers purchasing non-essential, high-value items. For Emperor Watch & Jewellery, this translates to potential headwinds as consumers may curb spending on luxury goods.

The impact is amplified for items often considered status symbols, like luxury watches and fine jewelry. As disposable incomes tighten due to rising costs of living and higher borrowing expenses, consumers are likely to postpone or reduce purchases of such aspirational products. This trend was evident in early 2024, with reports indicating a slowdown in luxury goods sales in several key markets as inflation remained a concern.

- Inflationary Pressures: Persistent inflation erodes purchasing power, making luxury items less accessible. For instance, the US Consumer Price Index (CPI) saw significant year-over-year increases throughout 2023 and into early 2024, impacting real incomes.

- Interest Rate Hikes: Higher interest rates increase the cost of borrowing, discouraging financing for large purchases and reducing available funds for luxury spending. Central banks globally, including the Federal Reserve and the European Central Bank, maintained higher policy rates through much of 2023 and early 2024.

- Consumer Confidence: Economic uncertainty and cost-of-living concerns often lead to decreased consumer confidence, prompting a shift towards saving rather than spending on non-essential luxury goods.

Economic growth in Greater China significantly influences Emperor Watch & Jewellery's performance, as consumer spending on luxury items is closely tied to economic health and confidence levels. While mainland China's economy shows resilience, property market concerns and employment figures can lead to cautious consumer behavior, impacting discretionary spending. Hong Kong's economic uncertainties and employment issues have also dampened consumer sentiment, potentially shifting spending away from luxury goods.

Currency exchange rates, particularly the Hong Kong Dollar's strength against the Chinese Renminbi, create significant price advantages for mainland Chinese consumers purchasing luxury goods in Hong Kong. This dynamic, coupled with potential import duty differentials, incentivizes cross-border shopping, directly benefiting retailers like Emperor Watch & Jewellery. For example, in early 2024, the HKD's firm position against the RMB made Hong Kong purchases more cost-effective.

Rising disposable incomes and substantial intergenerational wealth transfers in Greater China and Southeast Asia are fueling the luxury market. This expanding affluent demographic, including high-net-worth individuals, directly drives demand for premium products, with the Asia-Pacific luxury market projected for robust growth in 2024. For instance, the global luxury goods market was estimated to reach approximately $305 billion in 2024.

Persistent inflation and elevated interest rates globally create headwinds for discretionary spending on luxury items like watches and jewelry. Higher living costs and borrowing expenses can lead consumers to postpone or reduce purchases of aspirational products. For example, while inflation began to moderate in some regions by early 2024, it remained a concern impacting real incomes and consumer confidence.

| Economic Factor | Impact on Emperor Watch & Jewellery | Supporting Data/Trend (2023-2024) |

| Economic Growth & Consumer Confidence (Greater China) | Directly influences spending on luxury goods. Economic headwinds can dampen demand. | Mainland China GDP growth projected around 5% for 2024. Hong Kong consumer sentiment affected by economic uncertainty. |

| Currency Exchange Rates (HKD vs. RMB) | Creates price advantages for cross-border shopping in Hong Kong, boosting sales. | HKD remained firm against RMB in early 2024, widening price gaps due to tariffs/taxes. |

| Disposable Income & Wealth Transfer | Fuels luxury market growth through increased purchasing power and demand from affluent demographics. | Asia-Pacific luxury market projected for continued robust growth. Global luxury market estimated at $305 billion for 2024. |

| Inflation & Interest Rates | Reduces consumer purchasing power and increases borrowing costs, potentially curbing luxury spending. | Inflation persisted in key markets through early 2024, impacting real incomes. Central banks maintained higher interest rates. |

Same Document Delivered

Emperor Watch & Jewellery PESTLE Analysis

The preview shown here is the exact Emperor Watch & Jewellery PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the luxury retail sector, offering crucial insights for strategic decision-making.

Understand the external forces shaping Emperor Watch & Jewellery's operations and future growth. This PESTLE analysis provides a detailed breakdown of each element, equipping you with the knowledge to navigate market complexities and identify opportunities.

Sociological factors

Younger generations, like Gen Z and Millennials, are reshaping the luxury market. They prioritize experiences and personal well-being over traditional status symbols. For instance, a 2024 Deloitte survey indicated that 70% of Gen Z consumers value experiences more than material possessions.

This shift means luxury brands, including Emperor Watch & Jewellery, must adapt. Consumers now expect brands to offer personalized services and unique, memorable interactions. This focus on individual connection is becoming a key differentiator in the competitive luxury landscape.

A significant shift towards domestic luxury brands is reshaping the Chinese consumer landscape. This burgeoning national pride fuels a desire for products that resonate with Chinese culture and aesthetics, directly impacting the market share of international retailers.

For instance, by early 2024, reports indicated that domestic Chinese luxury brands saw sales growth exceeding 20%, outpacing many established international players in key categories. This trend is particularly pronounced in the jewelry sector, where brands emphasizing traditional craftsmanship and cultural motifs are gaining substantial traction.

Social media platforms such as Xiaohongshu, Douyin, and WeChat are pivotal in how consumers, particularly in the luxury sector, discover new products and are influenced to make purchases. These platforms are not just for browsing; they actively shape purchasing journeys, with user-generated content and endorsements from Key Opinion Leaders (KOLs) holding significant sway.

In 2024, influencer marketing continues to be a cornerstone for brands aiming to reach younger, digitally native audiences. For instance, a successful campaign on Douyin might see a significant uplift in brand engagement and direct sales, underscoring the power of these platforms in driving consumer behavior for luxury goods.

Demand for Experiential Luxury

The demand for experiential luxury is surging, with consumers prioritizing memorable experiences over material possessions. This trend has been particularly pronounced in the post-pandemic period, as people seek to reconnect and indulge after periods of restriction. For instance, luxury travel saw a significant rebound, with global luxury travel spending projected to reach $1.5 trillion by 2025, up from approximately $1.1 trillion in 2023.

This shift means that brands like Emperor Watch & Jewellery need to offer more than just high-quality products. Consumers are looking for unique, personalized experiences that create lasting memories. This could involve exclusive in-store events, bespoke customization services, or partnerships that offer access to curated lifestyle activities.

- Experiential spending: Global luxury experiential spending is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2029.

- Brand engagement: 72% of consumers report that they are more likely to purchase from a brand that offers a good experience.

- Post-pandemic impact: Surveys indicate that over 60% of affluent consumers are now allocating more of their budget to experiences than pre-pandemic.

Growing Importance of Second-Hand Luxury

The growing emphasis on sustainability and the appeal of long-term value are significantly fueling the pre-owned luxury goods sector. This trend is particularly pronounced among younger consumers who are increasingly embracing the circular economy through buying pre-owned, renting, and reselling luxury items.

In 2024, the global second-hand luxury market was valued at approximately $137 billion, with projections indicating continued robust growth. This expansion is driven by a desire for more affordable access to high-quality goods and a conscious effort to reduce environmental impact.

- Market Growth: The pre-owned luxury market is expected to reach $337 billion by 2030, demonstrating a compound annual growth rate of over 10%.

- Consumer Demographics: Millennials and Gen Z are key drivers, with studies showing over 60% of these age groups are willing to purchase pre-owned luxury items.

- Sustainability Focus: A significant portion of consumers now consider the environmental footprint of their purchases, making second-hand a more attractive option.

Younger consumers, particularly Gen Z and Millennials, are increasingly prioritizing experiences and personal well-being over traditional luxury markers, with a 2024 Deloitte survey showing 70% of Gen Z valuing experiences more than possessions.

This shift necessitates that brands like Emperor Watch & Jewellery offer personalized services and memorable interactions to stand out in the competitive luxury market.

Furthermore, a growing national pride in China is driving demand for domestic luxury brands, with reports in early 2024 indicating over 20% sales growth for these brands, often outperforming international competitors.

Social media platforms like Xiaohongshu and Douyin are crucial for product discovery and purchasing decisions, with influencer marketing on these channels significantly impacting consumer behavior in the luxury sector.

| Sociological Factor | Trend Description | Impact on Emperor Watch & Jewellery | Supporting Data (2024/2025) |

|---|---|---|---|

| Generational Shifts | Preference for experiences over material goods by younger consumers. | Need to integrate experiential offerings and personalized services. | 70% of Gen Z value experiences over possessions (Deloitte, 2024). |

| Rise of Domestic Brands | Increased consumer loyalty towards national luxury brands in China. | Potential challenge to international players; opportunity for culturally resonant designs. | Domestic Chinese luxury brands saw >20% sales growth (early 2024). |

| Digital Influence | Social media and KOLs shaping purchasing decisions. | Importance of robust social media marketing and influencer collaborations. | Strong engagement and sales uplift from Douyin campaigns (2024). |

| Sustainability & Pre-owned Market | Growing interest in circular economy and sustainable luxury. | Opportunity in the pre-owned market and emphasis on longevity/value. | Pre-owned luxury market valued at ~$137 billion (2024), projected to reach $337 billion by 2030. |

Technological factors

The escalating adoption of e-commerce in Greater China and Southeast Asia demands Emperor Watch & Jewellery to prioritize a sophisticated digital strategy. This involves enhancing online sales platforms, guaranteeing smooth customer experiences, and utilizing digital channels for both sales and promotional activities.

In 2024, e-commerce sales in Southeast Asia were projected to reach $211 billion, with a significant portion attributed to luxury goods, highlighting the critical need for Emperor Watch & Jewellery to fortify its online presence and digital marketing efforts to capture this growing market share.

Omnichannel retail solutions are increasingly critical for luxury brands like Emperor Watch & Jewellery. Integrating online and offline sales channels creates a seamless customer journey, a trend that saw global e-commerce sales reach an estimated $6.3 trillion in 2024, according to Statista. This integration allows for real-time inventory visibility across all platforms and enables personalized customer engagement, such as targeted event invitations based on purchase history.

By offering a fluid shopping experience, Emperor Watch & Jewellery can significantly enhance customer satisfaction. For instance, a customer might browse online, try a watch in-store, and complete the purchase via a mobile app, all within a single, cohesive experience. This approach is vital as consumer expectations for convenience and personalization continue to rise, with studies indicating that omnichannel customers spend more than single-channel shoppers.

AI-driven personalization is transforming luxury retail, allowing brands like Emperor Watch & Jewellery to deeply understand customer preferences. By analyzing vast amounts of consumer behavior data, AI enables hyper-personalized product recommendations and highly targeted marketing efforts, significantly boosting customer engagement. For instance, in 2024, luxury brands leveraging AI for personalization saw an average increase of 15% in customer retention rates.

Emerging Technologies (VR, AR, Blockchain)

The luxury sector, including brands like Emperor Watch & Jewellery, is increasingly exploring technologies such as Virtual Reality (VR) and Augmented Reality (AR) to offer more engaging customer experiences. These technologies can allow customers to virtually try on watches or explore intricate jewellery designs from anywhere, potentially boosting sales and brand loyalty. For instance, a significant portion of luxury consumers are open to using AR for product visualization, with reports indicating that AR can increase purchase intent by up to 94%.

Blockchain technology presents opportunities for enhancing transparency and security in the luxury goods market. It can be used to create digital certificates of authenticity for high-value items like luxury watches, combating counterfeiting and building consumer trust. The global blockchain in luxury goods market was valued at approximately $200 million in 2023 and is projected to grow substantially in the coming years, highlighting its increasing relevance.

The integration of these emerging technologies can lead to innovative marketing campaigns and new sales channels for Emperor Watch & Jewellery.

- VR/AR for Immersive Showrooms: Enabling virtual store visits and product try-ons.

- Blockchain for Authenticity: Securing provenance and combating fakes for high-value timepieces.

- Enhanced Customer Engagement: Creating unique digital experiences that resonate with tech-savvy luxury consumers.

Data Privacy and Cybersecurity

With the increasing digitalization of business operations, Emperor Watch & Jewellery faces significant technological challenges related to data privacy and cybersecurity. Compliance with evolving data protection regulations, such as China's Personal Information Protection Law (PIPL), is paramount. For instance, PIPL, which came into effect in November 2021, imposes strict rules on how companies collect, process, and store personal information, with potential fines for non-compliance reaching up to 5% of annual turnover or RMB 50 million.

Protecting sensitive customer data from cyber threats is not just a legal obligation but a critical component of maintaining brand reputation and customer trust. A data breach could severely damage Emperor Watch & Jewellery's standing in the market, impacting sales and customer loyalty. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the substantial financial and reputational risks involved.

- Regulatory Compliance: Adherence to PIPL and similar global data protection laws is essential for operations involving customer data.

- Cybersecurity Investment: Ongoing investment in robust cybersecurity measures is necessary to safeguard against data breaches and cyberattacks.

- Customer Trust: Maintaining strong data privacy practices is directly linked to building and preserving customer confidence in the brand.

- Reputational Risk: Data breaches can lead to significant reputational damage, impacting sales and market position.

Emperor Watch & Jewellery must leverage advanced digital platforms, with e-commerce in Southeast Asia projected to hit $211 billion in 2024, to enhance sales and customer experiences. The company should also explore AI for personalized recommendations, as luxury brands using AI saw a 15% increase in customer retention in 2024, and consider VR/AR for virtual try-ons, which can boost purchase intent by up to 94%.

Legal factors

Navigating import regulations and customs duties for luxury goods like those sold by Emperor Watch & Jewellery into Greater China is a significant hurdle. These regulations directly impact the cost and speed of bringing high-value items into the market. For instance, in 2024, China's average import duty on luxury watches remained substantial, with rates often exceeding 20%, alongside VAT and consumption tax, adding considerably to the final retail price.

Expertise in managing the intricate documentation required for customs clearance is paramount. Failure to comply with these procedures can lead to costly delays, potential confiscation of goods, and penalties, impacting inventory turnover and profitability. For example, the average customs clearance time in China can range from a few days to several weeks depending on the accuracy and completeness of submitted paperwork.

Protecting intellectual property is crucial for luxury brands like Emperor Watch & Jewellery. This involves safeguarding against counterfeit goods, which can dilute brand value and mislead consumers. For instance, the OECD estimated in 2019 that trade in fake goods represented 3.3% of global trade, a figure likely to have grown.

Combating unauthorized parallel imports, often facilitated by daigou networks, is another key legal challenge. These channels can disrupt controlled distribution, impact pricing strategies, and erode the exclusive customer experience that luxury retailers strive to provide. The grey market can significantly affect a brand's carefully managed sales channels.

Emperor Watch & Jewellery must meticulously adhere to consumer protection laws across all operating regions to ensure fair business practices. This commitment is crucial for building and maintaining consumer trust, a vital asset in the luxury goods market. For instance, in 2024, the European Union's consumer protection framework, including directives on unfair commercial practices and digital services, continues to shape how businesses interact with customers online and offline, impacting sales and marketing strategies.

Non-compliance can lead to significant legal disputes, fines, and reputational damage, which are particularly detrimental for a brand associated with luxury and quality. Reports from 2024 indicate an increasing focus by regulatory bodies on transparency in pricing and product authenticity, especially for high-value items like luxury watches and jewelry. Failure to meet these standards could result in penalties, impacting profitability and market standing.

Evolving E-commerce Regulations

Navigating the complex and ever-changing landscape of e-commerce regulations is crucial for Emperor Watch & Jewellery's digital presence. This includes strict adherence to data privacy laws like GDPR and CCPA, which govern how customer information is collected, stored, and used online. Failure to comply can result in significant fines, impacting profitability and brand reputation.

Advertising standards also play a key role, ensuring that online promotions are truthful and not misleading to consumers. For luxury goods, maintaining brand integrity through compliant advertising is paramount. Online sales protocols, such as secure payment gateways and clear return policies, are also mandated by various jurisdictions, affecting cross-border transactions.

The global e-commerce market is projected to reach $10.8 trillion by 2024, highlighting the immense opportunity but also the increased regulatory scrutiny. For instance, in 2023, the EU continued to refine its Digital Services Act, impacting how platforms manage content and user data, a factor directly relevant to online sales and marketing efforts for luxury brands.

Key regulatory considerations for Emperor Watch & Jewellery include:

- Data Privacy Compliance: Adhering to regulations like GDPR, which imposes fines up to 4% of global annual revenue for breaches.

- Advertising Standards: Ensuring all online marketing is transparent and avoids deceptive practices, as enforced by bodies like the Advertising Standards Authority.

- Online Sales Protocols: Implementing secure transaction systems and clear consumer rights for returns and warranties, as stipulated by consumer protection laws.

- Cross-Border E-commerce Laws: Understanding and complying with varying international regulations for online sales and digital marketing.

Ethical Sourcing and Supply Chain Legislation

The luxury watch and jewelry sector, including Emperor Watch & Jewellery, faces growing legal obligations concerning ethical sourcing. Regulations are tightening around conflict-free diamonds and responsible mining practices, demanding greater transparency and traceability throughout the supply chain. Failure to comply can lead to significant penalties and damage brand reputation, making adherence a critical business imperative.

Key legislative trends impacting Emperor Watch & Jewellery include:

- Increased focus on conflict minerals legislation: Laws like the Dodd-Frank Act in the US continue to influence global supply chain due diligence for minerals such as gold, which is prevalent in watchmaking.

- European Union regulations on responsible sourcing: The EU is actively developing and enforcing directives that require companies to identify and address risks in their supply chains, particularly for raw materials.

- Growing consumer protection laws: Legislation aimed at preventing deceptive practices regarding product origin and ethical claims puts pressure on brands to substantiate their sourcing narratives.

- Anticipated future legislation on environmental, social, and governance (ESG) factors: Many jurisdictions are moving towards mandatory ESG reporting, which will likely encompass supply chain ethics more broadly.

Emperor Watch & Jewellery must navigate stringent import regulations and customs duties, particularly in Greater China, where luxury goods face substantial tariffs. Compliance with complex documentation is vital to avoid costly delays and penalties, as exemplified by China's average import duty on luxury watches often exceeding 20% in 2024, plus VAT and consumption tax.

Protecting intellectual property against counterfeits and unauthorized parallel imports is paramount, as the trade in fake goods represented 3.3% of global trade in 2019. Adherence to consumer protection laws, including those in the EU regarding unfair commercial practices, is crucial for maintaining trust and avoiding legal disputes, with regulatory bodies in 2024 increasing focus on pricing transparency and product authenticity.

E-commerce regulations, including data privacy laws like GDPR, require meticulous adherence, with potential fines up to 4% of global annual revenue for breaches. Truthful advertising and secure online sales protocols are mandated, impacting cross-border transactions, as the global e-commerce market is projected to reach $10.8 trillion by 2024.

The company must also address growing legal obligations for ethical sourcing, particularly concerning conflict-free diamonds and responsible mining, with laws like the Dodd-Frank Act influencing supply chain due diligence for minerals such as gold. Anticipated future legislation on ESG factors will likely broaden these ethical requirements.

Environmental factors

The luxury sector, including high-end watch and jewelry retailers like Emperor Watch & Jewellery, faces increasing scrutiny regarding the sustainable sourcing of materials. Consumers and regulators alike are demanding greater transparency and ethical practices, particularly concerning precious metals and gemstones.

This translates to a push for the use of recycled materials and a commitment to conflict-free, environmentally responsible mining. For instance, the Responsible Jewellery Council reports that in 2024, over 80% of its certified members have implemented policies for responsible sourcing of gold and diamonds, reflecting a significant industry shift.

Brands that fail to adapt risk reputational damage and potential loss of market share. In 2025, industry surveys indicate that over 70% of luxury consumers consider sustainability a key factor in their purchasing decisions, highlighting the financial imperative for ethical material procurement.

A growing segment of luxury consumers, particularly younger demographics like Gen Z, are prioritizing sustainability. Surveys from 2024 indicate that over 60% of Gen Z consumers consider a brand's environmental impact when making purchasing decisions, and a substantial portion are willing to pay more for eco-friendly luxury goods.

This heightened environmental awareness directly translates into increased demand for luxury brands, including those in the watch and jewelry sector, that can clearly demonstrate their commitment to responsible sourcing, ethical production, and reduced environmental footprints.

Consumers and regulators increasingly expect luxury brands like Emperor Watch & Jewellery to provide detailed insights into their supply chains. This means tracking every stage, from the sourcing of raw materials to the final sale, to verify ethical labor standards and reduce environmental harm.

For instance, the Responsible Jewellery Council (RJC) reported in 2024 that over 1,500 member companies, including many in the luxury sector, are committed to enhanced due diligence and traceability. This push for transparency is driven by a growing awareness of issues like conflict minerals and unsustainable mining practices.

This demand for traceability directly impacts Emperor Watch & Jewellery's operational strategies, requiring robust systems to document provenance and compliance, thereby building consumer trust and meeting evolving regulatory requirements in key markets like the EU and the US.

Waste Reduction and Circular Economy Initiatives

The luxury sector, including high-end watch and jewelry retailers like Emperor Watch & Jewellery, is increasingly embracing recommerce and buyback programs. This trend is a direct response to the growing consumer demand for sustainability and aligns with the principles of a circular economy. By facilitating the resale and reuse of pre-owned luxury items, these initiatives significantly reduce waste and extend the lifespan of valuable products.

These circular economy efforts are not just about environmental responsibility; they also present a compelling business opportunity. For instance, the global second-hand luxury market was valued at approximately $30 billion in 2023 and is projected to reach $70 billion by 2030, according to Bain & Company. This growth underscores the increasing consumer willingness to engage with pre-owned luxury goods, making recommerce a strategic imperative for brands seeking to capture this expanding market segment and appeal to an environmentally conscious customer base.

Emperor Watch & Jewellery can leverage these environmental shifts by:

- Expanding or launching certified pre-owned programs: Offering authenticated and refurbished pre-owned watches and jewelry can attract new customers and provide a sustainable option for existing ones.

- Implementing in-store trade-in or buyback services: This encourages customer loyalty and provides a consistent supply of desirable pre-owned inventory.

- Highlighting the environmental benefits: Communicating the reduced carbon footprint and waste diversion associated with purchasing pre-owned luxury items can resonate with ethically-minded consumers.

Energy Consumption and Carbon Footprint

Luxury brands, including Emperor Watch & Jewellery, are under increasing pressure to curb their energy consumption and reduce their carbon footprint. This focus is driven by growing consumer demand for sustainability and stricter environmental regulations. Many are investing in energy-efficient technologies for their retail spaces and implementing sustainable operational practices to minimize greenhouse gas emissions.

For instance, a significant portion of the luxury retail sector is exploring or adopting LEED (Leadership in Energy and Environmental Design) certifications for new and existing stores. By 2024, several major luxury groups reported a reduction in their Scope 1 and Scope 2 emissions by an average of 15-20% compared to 2019 baselines, often through renewable energy sourcing and improved building management systems. Emperor Watch & Jewellery's commitment to these practices directly impacts its environmental performance and brand reputation.

Key initiatives impacting Emperor Watch & Jewellery's energy consumption and carbon footprint include:

- Adoption of Energy-Efficient Retail Design: Implementing LED lighting, smart HVAC systems, and sustainable building materials in stores.

- Sustainable Supply Chain Practices: Working with suppliers who prioritize reduced energy use and emissions in their manufacturing processes.

- Renewable Energy Sourcing: Exploring options to power retail outlets and operations with electricity generated from renewable sources.

- Waste Reduction and Recycling Programs: Minimizing operational waste, which indirectly reduces the energy needed for production and disposal.

Environmental factors are increasingly shaping the luxury watch and jewelry market, pushing brands like Emperor Watch & Jewellery towards greater sustainability. Consumer demand for ethically sourced materials, such as conflict-free diamonds and recycled precious metals, is a significant driver. By 2025, over 70% of luxury consumers consider sustainability in their purchasing decisions, making it a crucial business imperative.

The industry is also seeing a rise in circular economy models, with recommerce and buyback programs gaining traction. The global second-hand luxury market was valued at approximately $30 billion in 2023 and is projected to grow substantially, presenting a clear opportunity for brands to reduce waste and engage environmentally conscious consumers.

Furthermore, reducing carbon footprints and energy consumption is a key focus. Many luxury retailers are investing in energy-efficient technologies and exploring renewable energy sources. In 2024, major luxury groups reported average emission reductions of 15-20% compared to 2019, highlighting a strong industry commitment to environmental performance.

Emperor Watch & Jewellery's environmental strategy should focus on transparency in sourcing, embracing circular business models, and minimizing operational energy use. These efforts are vital for maintaining brand reputation and meeting the evolving expectations of a discerning, eco-aware customer base.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Emperor Watch & Jewellery is informed by a robust blend of data sources, including official government reports on trade and economic policies, reputable market research firms specializing in luxury goods, and up-to-date industry publications. This ensures a comprehensive understanding of the external factors impacting the business.