Emperor Watch & Jewellery Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emperor Watch & Jewellery Bundle

Emperor Watch & Jewellery faces a dynamic market shaped by several key forces, including the bargaining power of its discerning customers and the intense rivalry among established luxury brands. Understanding these pressures is crucial for navigating the competitive landscape effectively.

The complete report reveals the real forces shaping Emperor Watch & Jewellery’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Emperor Watch & Jewellery's reliance on a select group of high-end European watch brands, including Rolex, Audemars Piguet, Cartier, and Omega, significantly strengthens supplier bargaining power. These brands are not only internationally recognized but also highly exclusive, often controlling production volumes and market presence.

The inherent scarcity of certain luxury timepieces, exemplified by Patek Philippe's annual production of fewer than 70,000 watches, directly translates into substantial leverage for these suppliers. This limited supply allows them to dictate terms, pricing, and allocation of inventory to retailers like Emperor Watch & Jewellery.

The immense brand prestige and consistent high demand for luxury watches from top-tier manufacturers grant them substantial leverage over retailers like Emperor Watch & Jewellery. Consumers actively seek specific brands, making it vital for Emperor to cultivate strong supplier relationships to ensure inventory availability. For instance, Rolex, a dominant player with watches maintaining high resale values, wields considerable bargaining power due to its market position and desirability.

Luxury watch and jewelry makers often hold a strong hand due to their unique technology and skilled craftsmanship, making it hard for retailers to find alternatives or create similar products themselves. This exclusivity, seen in brands like Patek Philippe with its complex watch movements and Audemars Piguet with its groundbreaking designs, significantly limits a retailer's ability to switch suppliers.

Supplier Control Over Distribution

Luxury watch and jewelry brands often maintain stringent control over how their products reach consumers. This can involve limiting the number of authorized retailers, a strategy that directly impacts companies like Emperor Watch & Jewellery. By restricting access, these suppliers can dictate terms, including marketing support and minimum inventory levels, thereby enhancing their bargaining power.

This selective distribution model is crucial for preserving brand image and ensuring consistent pricing across the market. For instance, many high-end watchmakers in 2024 continued to enforce strict retail agreements, with some even expanding their own direct-to-consumer channels, further consolidating their control. This approach allows them to safeguard brand exclusivity and maintain premium pricing integrity, which in turn strengthens their position when negotiating with retailers.

- Selective Distribution: Luxury brands limit the number of authorized dealers, reducing competition among retailers.

- Brand Exclusivity: Tight control over distribution preserves the prestige and desirability of luxury goods.

- Pricing Integrity: Suppliers can enforce minimum advertised prices and prevent discounting, protecting profit margins.

- Inventory Commitments: Retailers may be required to hold specific inventory levels, shifting some risk to the retailer.

Reliance on Long-Term Relationships

The specialized nature of luxury watches and fine jewelry means Emperor Watch & Jewellery likely cultivates deep, long-term relationships with its primary suppliers. These established connections are vital for securing consistent access to desirable and often exclusive inventory. Disrupting these crucial supplier ties could significantly hinder the company's ability to source sought-after products, potentially impacting its competitive edge and overall sales performance.

For instance, in the high-end watch market, brands often allocate limited production runs to trusted retailers. Emperor Watch & Jewellery's ability to maintain strong supplier relationships directly translates to its capacity to offer customers the latest and most coveted models. In 2024, many luxury watch brands reported strong demand, making supplier relationships even more critical for securing allocations.

- Supplier Dependence: Emperor Watch & Jewellery's reliance on a limited number of specialized suppliers for luxury goods grants those suppliers significant bargaining power.

- Inventory Access: Maintaining strong, long-term relationships is essential for ensuring consistent and preferential access to high-demand luxury watch and jewelry inventory.

- Brand Relationships: The exclusivity of luxury brands often means that retailers like Emperor Watch & Jewellery must nurture supplier partnerships to secure coveted product allocations.

The bargaining power of suppliers for Emperor Watch & Jewellery is substantial, largely due to the exclusive nature of the luxury brands it carries. These suppliers, such as Rolex and Patek Philippe, benefit from limited production and high global demand, allowing them to dictate terms and allocations. This exclusivity means Emperor must maintain strong relationships to secure sought-after inventory, as demonstrated by the continued strong demand for luxury watches in 2024.

| Supplier Characteristic | Impact on Emperor Watch & Jewellery | Example Brands |

|---|---|---|

| Brand Exclusivity & Prestige | High supplier leverage; critical for retailer's product offering | Rolex, Audemars Piguet, Cartier |

| Limited Production Volumes | Restricts retailer's inventory access; strengthens supplier pricing power | Patek Philippe (under 70,000 watches annually) |

| Controlled Distribution Channels | Suppliers dictate terms, marketing, and inventory levels | Many high-end watchmakers enforcing strict retail agreements in 2024 |

| Unique Technology & Craftsmanship | Reduces retailer's ability to switch suppliers | Patek Philippe's complex movements, Audemars Piguet's designs |

What is included in the product

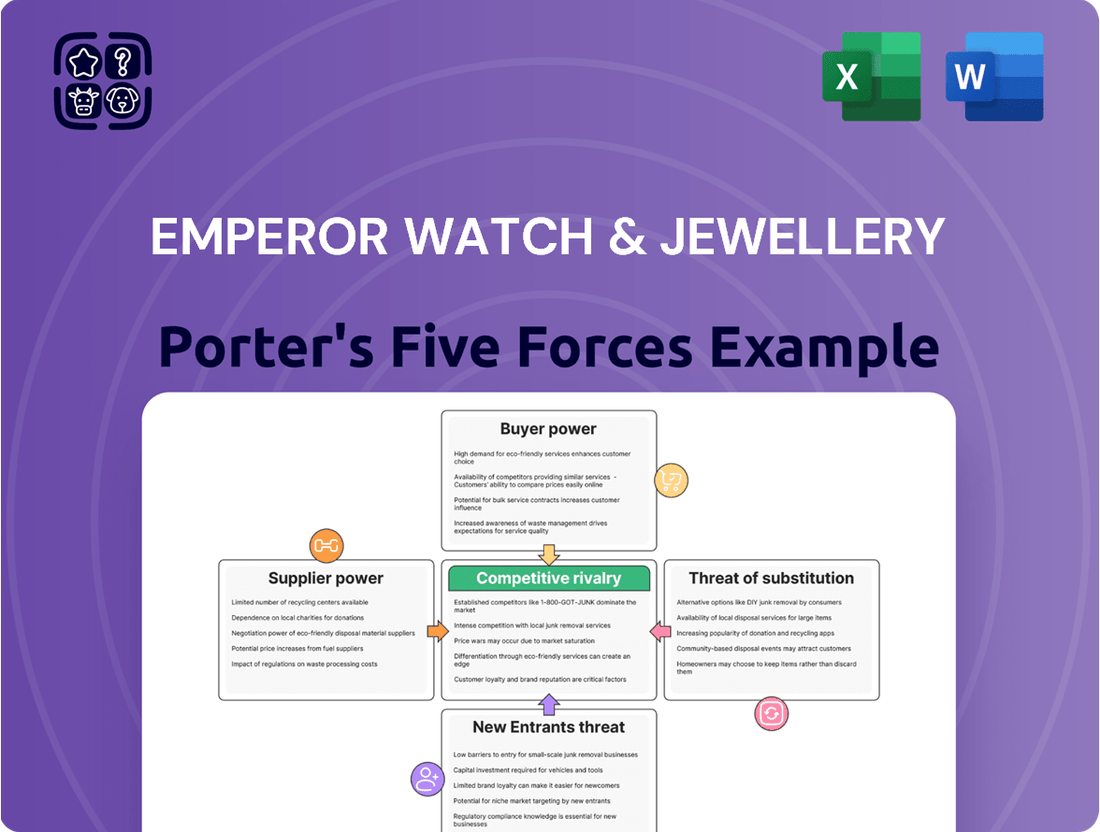

This Porter's Five Forces analysis delves into the competitive forces impacting Emperor Watch & Jewellery, examining industry rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes.

Understand competitive intensity and potential profitability with a clear, visual representation of each force.

Easily identify key threats and opportunities by seeing the interplay of supplier power, buyer power, new entrants, substitutes, and rivalry.

Customers Bargaining Power

Customers of Emperor Watch & Jewellery often engage in high-value, discretionary spending, making them sensitive to economic shifts. A significant portion of their clientele falls into the high-income bracket, where purchases of luxury watches and jewelry are often influenced by disposable income and consumer sentiment. For instance, in 2023, luxury goods sales in Greater China, a key market for Emperor, experienced a slowdown, reflecting cautious consumer behavior amidst economic headwinds.

Consumers in certain luxury markets, notably China, are exhibiting heightened price sensitivity. This trend means they are less inclined to accept regular price hikes without a compelling justification of added value. This dynamic directly impacts retailers such as Emperor Watch & Jewellery, necessitating a strategic approach to pricing and a focus on delivering competitive value propositions to maintain market share.

The increasing prevalence of online channels significantly amplifies the bargaining power of customers for luxury goods like those offered by Emperor Watch & Jewellery. Customers now have unprecedented access to information, allowing them to easily compare prices, features, and reviews across numerous global retailers. This transparency means customers can readily identify the best deals, potentially forcing retailers to offer more competitive pricing or value-added services to retain their business.

Demand for Customization and Unique Experiences

Modern luxury consumers, particularly those in younger demographics, are increasingly seeking out personalized products and distinctive shopping experiences. This trend significantly amplifies their bargaining power.

Retailers like Emperor Watch & Jewellery must adapt by offering bespoke services, limited edition product releases, and captivating digital content. This allows customers to exert greater influence over what is offered and the quality of service they receive.

For instance, a 2024 report indicated that 65% of luxury consumers are willing to pay a premium for personalized products. This demand for customization directly translates to increased customer leverage.

- Demand for Personalization: Consumers expect products tailored to their specific tastes and preferences.

- Unique Experiences: Beyond the product itself, the shopping journey and associated services are crucial.

- Influence on Offerings: Customer preferences now directly shape product development and service delivery.

- Premium for Customization: A significant portion of consumers are willing to spend more for bespoke options.

Emergence of the Pre-Owned Market

The expanding pre-owned luxury watch and jewellery market is a significant factor influencing customer bargaining power. As more consumers turn to pre-owned and certified pre-owned (CPO) options, they gain access to high-quality items at more accessible price points. This growing availability of alternatives directly challenges the pricing power of new product manufacturers.

This trend is particularly impactful for cost-conscious buyers who can now acquire premium goods that might otherwise be out of reach. For instance, the global pre-owned luxury watch market was valued at approximately $20 billion in 2023 and is projected to reach over $35 billion by 2028, indicating a substantial shift in consumer purchasing habits. This increased accessibility to secondary markets empowers customers by providing them with viable alternatives, thereby strengthening their negotiating position when considering new purchases.

- Growing Pre-Owned Market: The pre-owned luxury watch market is experiencing robust growth, offering consumers more choices and competitive pricing.

- Increased Affordability: Customers can access luxury items at lower price points through the pre-owned channel, reducing their reliance on new product purchases.

- Enhanced Bargaining Power: The availability of alternatives in the secondary market gives consumers greater leverage when negotiating prices for new luxury goods.

- Sustainability Appeal: The pre-owned market also appeals to environmentally conscious consumers, further diversifying demand away from solely new products.

The bargaining power of customers for Emperor Watch & Jewellery is substantial, driven by increased price transparency and the availability of alternatives. The growing pre-owned luxury market, valued at approximately $20 billion in 2023, offers consumers more accessible price points, directly impacting the perceived value of new items. Furthermore, a 2024 report highlighted that 65% of luxury consumers are willing to pay more for personalized products, indicating a strong demand for customization that shifts influence towards the buyer.

| Factor | Impact on Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Price Transparency | Increases customer ability to compare and negotiate. | Ubiquitous online access to global pricing information. |

| Pre-owned Market Growth | Provides viable, lower-cost alternatives. | Global pre-owned luxury watch market valued at ~$20 billion in 2023, projected to exceed $35 billion by 2028. |

| Demand for Personalization | Empowers customers to influence product offerings and pricing. | 65% of luxury consumers willing to pay a premium for personalized products (2024 report). |

Full Version Awaits

Emperor Watch & Jewellery Porter's Five Forces Analysis

This preview showcases the exact Emperor Watch & Jewellery Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This detailed document is fully formatted and ready for your immediate use, ensuring no surprises and complete value.

Rivalry Among Competitors

Emperor Watch & Jewellery faces intense competition from a crowded field of international luxury brands and formidable local players throughout Greater China and Southeast Asia. This dynamic market includes other authorized dealers of prestigious European watch brands, as well as sophisticated multi-brand luxury retailers.

Established local jewellery chains, such as Chow Tai Fook Jewellery Group, also present significant competition, often leveraging deep brand loyalty and extensive retail networks. In 2023, the luxury goods market in Asia continued its robust growth, with demand for high-end watches and jewellery remaining strong, underscoring the competitive pressures Emperor Watch & Jewellery navigates.

Markets where Emperor Watch & Jewellery operates, particularly Hong Kong and mainland China, are characterized by fierce rivalry. Economic headwinds and evolving consumer tastes are intensifying this competition. The availability of a wider range of luxury goods further squeezes market share for established players.

In Hong Kong, the formal retail landscape is further complicated by a significant 'shadow economy' that bypasses traditional sales channels. This trend can impact sales volumes and pricing power for companies like Emperor Watch & Jewellery. For instance, retail sales in Hong Kong saw a decline of 2.4% in April 2024 compared to the previous year, reflecting broader economic pressures affecting consumer spending on luxury items.

Many luxury watch and jewelry brands are increasingly prioritizing their own direct-to-consumer (DTC) sales channels, both online and through expanded physical boutiques. This shift means brands might offer a more curated selection or even exclusive products directly, potentially reducing the variety available to multi-brand retailers like Emperor Watch & Jewellery. For instance, in 2024, several major luxury conglomerates reported significant growth in their DTC segments, with some seeing over 50% of their revenue generated through these channels, directly impacting wholesale partners.

Marketing and Experiential Offerings

Competitive rivalry in the luxury watch and jewelry sector, particularly concerning marketing and experiential offerings, is intensifying. Competitors are heavily investing in experiential marketing, aiming to create memorable customer journeys and foster deeper brand connections. This includes in-store events, exclusive previews, and personalized consultations that go beyond simple transactions.

Personalized customer service is another key battleground, with brands striving to offer tailored advice and bespoke experiences to their affluent clientele. Innovative digital engagement, such as augmented reality try-ons and virtual showrooms, is also becoming crucial for capturing and retaining attention in a crowded market. Emperor Watch & Jewellery needs to consistently evolve its retail environment and marketing approaches to maintain a competitive edge and differentiate itself from rivals who are also enhancing their customer engagement strategies.

- Experiential Marketing Focus: Competitors are prioritizing immersive in-store events and exclusive previews to build brand loyalty.

- Personalized Service: Tailored clienteling and bespoke consultations are becoming standard expectations for luxury consumers.

- Digital Innovation: Brands are leveraging AR try-ons and virtual showrooms to enhance online engagement and accessibility.

- Market Differentiation: Continuous innovation in retail experience and marketing is essential for Emperor Watch & Jewellery to stand out amidst fierce competition.

Economic Headwinds and Shifting Consumer Spending

The luxury market, including high-end jewelry, faces significant headwinds. Global economic slowdowns and inflation are dampening consumer confidence, leading to reduced discretionary spending. For instance, the global luxury goods market saw a moderation in growth in 2023 compared to the post-pandemic surge, with projections for 2024 indicating continued, albeit slower, expansion.

This economic pressure intensifies competition among luxury retailers. As demand softens, companies like Emperor Watch & Jewellery must work harder to capture market share. This often translates to increased promotional activity or a focus on value, potentially impacting profit margins.

Key factors contributing to this include:

- Slower demand in key markets: Traditional luxury hubs like the United States and mainland China are experiencing a cooling-off period in consumer spending.

- Inflationary pressures: Rising costs for consumers mean less disposable income available for non-essential purchases like luxury jewelry.

- Heightened rivalry: With a smaller pool of available spending, brands are competing more aggressively for customer attention and loyalty.

The competitive landscape for Emperor Watch & Jewellery is intensely crowded, featuring both global luxury powerhouses and strong local contenders across Greater China and Southeast Asia. This rivalry is amplified by brands increasingly focusing on direct-to-consumer (DTC) sales, which can limit product variety for multi-brand retailers. For example, in 2024, major luxury groups reported over 50% of revenue from DTC channels, directly impacting wholesale partners like Emperor Watch & Jewellery.

SSubstitutes Threaten

Consumers looking for luxury and status symbols can easily turn to alternatives like designer handbags, high-fashion apparel, or even premium electronics, diverting discretionary spending away from watches and jewelry. This means that brands like Emperor Watch & Jewellery are not just competing with other watch and jewelry makers, but with the entire luxury goods market. For instance, the global luxury goods market was valued at approximately $300 billion in 2023, with significant portions allocated to apparel and accessories, highlighting the breadth of substitutes available.

While not direct substitutes for the traditional luxury of a fine mechanical timepiece, advanced smartwatches and wearable technology present a compelling alternative for a growing consumer segment. These devices offer a suite of functionalities beyond mere timekeeping, encompassing health monitoring, communication, and digital payments. For instance, Apple Watch sales in 2023 reached over 40 million units, indicating a significant market penetration. This focus on utility and seamless tech integration can attract consumers who prioritize convenience and data-driven insights over the heritage and craftsmanship associated with luxury watches.

For affluent consumers, luxury watches and fine jewelry can be seen as investment assets, but other options exist. In 2024, real estate markets, particularly in prime locations, continued to attract significant investment, offering potential for capital appreciation and rental income. The global real estate market was projected to grow, providing a tangible alternative for wealth preservation.

Stocks and bonds also present viable substitutes, especially for those seeking liquid assets and potential dividends or interest income. The S&P 500, for instance, saw robust performance in early 2024, highlighting the appeal of equity markets for capital growth. This financial market performance offers a direct comparison to the returns expected from luxury goods as investments.

Furthermore, other collectibles such as fine art, classic cars, and rare wines can serve as substitutes. The art market, for example, demonstrated resilience, with major auctions in 2024 reporting strong sales for high-value pieces. These tangible assets compete for the same discretionary spending and investment capital that luxury watches and jewelry do.

Experiences Over Material Goods

The growing preference for experiences over material possessions presents a significant threat to luxury watch and jewelry retailers like Emperor Watch & Jewellery. Younger consumers, in particular, are increasingly allocating their discretionary income towards unique experiences such as luxury travel, fine dining, and exclusive events. This trend diverts spending that might otherwise go towards high-end timepieces or jewelry.

This shift is not just anecdotal; data supports this evolving consumer behavior. For instance, a 2024 report indicated that global spending on experiential travel saw a substantial increase, with many consumers willing to forgo material purchases to fund these adventures. This indicates a fundamental change in luxury consumption priorities.

The impact on Emperor Watch & Jewellery can be seen in:

- Reduced Demand for Traditional Luxury Goods: As consumers prioritize memories over possessions, the inherent value proposition of luxury watches and jewelry may diminish for some segments.

- Increased Competition for Discretionary Spending: The luxury market now competes not only with other luxury brands but also with the entire experience economy, from exclusive resorts to Michelin-starred restaurants.

- Need for Brand Adaptation: Brands may need to integrate experiential elements into their offerings or marketing to remain relevant to consumers who value unique moments.

Pre-Owned and Rental Markets for Luxury Items

The burgeoning pre-owned and rental markets for luxury watches and jewelry present a significant threat of substitutes for Emperor Watch & Jewellery. These alternative channels offer consumers more affordable entry points into luxury ownership, directly competing with new item sales.

The pre-owned luxury market is experiencing substantial growth. For instance, the global second-hand luxury market was projected to reach $327 billion by 2024, a significant increase from previous years, indicating a strong consumer shift towards pre-owned goods.

- Growing Market Size: The pre-owned luxury sector continues to expand, offering a compelling alternative to new purchases.

- Increased Accessibility: Rental and pre-owned platforms democratize luxury, making high-end items available to a wider audience.

- Sustainability Appeal: Consumers are increasingly drawn to the environmental benefits of the circular economy, favoring pre-owned luxury.

- Price Sensitivity: The significant price difference between new and pre-owned items makes the latter an attractive option for budget-conscious buyers.

The threat of substitutes for Emperor Watch & Jewellery is substantial, as consumers have numerous alternatives for luxury, status, and investment. These substitutes range from other luxury goods like designer apparel to experiential purchases and even financial assets.

The global luxury goods market, valued around $300 billion in 2023, illustrates the broad competition, with a significant portion of spending diverted to fashion and accessories. Additionally, wearable technology, exemplified by over 40 million Apple Watch units sold in 2023, offers functional alternatives that appeal to a tech-savvy demographic.

Furthermore, luxury timepieces and jewelry compete with investment vehicles like real estate, which saw continued growth in 2024, and financial markets such as the S&P 500, which demonstrated strong performance in early 2024. Collectibles like fine art also vie for discretionary capital, with robust auction sales reported in 2024.

| Substitute Category | Examples | 2023/2024 Data Point | Impact on Luxury Watches/Jewelry |

|---|---|---|---|

| Other Luxury Goods | Designer Handbags, High-Fashion Apparel | Global luxury goods market ~$300 billion (2023) | Diverts discretionary spending from watches/jewelry. |

| Technology | Smartwatches, Wearable Devices | Apple Watch sales >40 million units (2023) | Appeals to consumers prioritizing utility and tech integration. |

| Investment Assets | Real Estate, Stocks, Bonds | S&P 500 strong performance (early 2024) | Offers alternative wealth preservation and capital growth opportunities. |

| Collectibles | Fine Art, Classic Cars, Rare Wines | Strong auction sales for high-value art (2024) | Competes for investment capital and discretionary spending. |

| Experiences | Luxury Travel, Fine Dining, Events | Global spending on experiential travel increased (2024 report) | Shifts consumer preference from material possessions to memorable events. |

| Pre-owned/Rental Market | Second-hand Luxury Watches/Jewelry | Global second-hand luxury market projected $327 billion (2024) | Offers more affordable access and competes with new item sales. |

Entrants Threaten

The luxury retail sector, particularly for high-end watches and jewelry, presents a formidable barrier to entry due to its significant capital requirements. Establishing a presence comparable to Emperor Watch & Jewellery necessitates substantial investment in acquiring prime retail real estate in prestigious locations, often costing millions of dollars. For instance, prime retail spaces in Hong Kong's luxury shopping districts like Canton Road can command annual rents exceeding $1,000 per square foot. Beyond real estate, extensive funds are needed for opulent store design and fit-outs, securing a diverse and high-value inventory of luxury goods, and implementing robust security infrastructure to protect valuable assets.

The luxury watch and jewellery sector is built on a foundation of brand heritage, deep customer trust, and enduring relationships. For new companies, replicating the decades of brand building and customer loyalty that established players like Emperor Watch & Jewellery possess presents a formidable barrier.

Building the necessary brand recognition and trust to effectively compete with such established entities requires substantial time and investment, making it a significant hurdle for potential new entrants in the luxury market.

Exclusive supplier relationships represent a significant barrier for new entrants in the luxury watch and jewellery market. Emperor Watch & Jewellery, like many established players, benefits from long-standing, often exclusive, distribution agreements with globally recognized watch brands and fine jewellery manufacturers. These partnerships are not easily replicated, as they are built on trust, performance, and significant investment over time.

Securing access to desirable brands, the very drivers of consumer demand in this sector, would be an immense challenge for any newcomer. For instance, major Swiss watch brands often have very selective distribution networks, limiting the number of retailers to maintain brand prestige and control. New entrants would find it difficult to gain the necessary approvals and meet the stringent requirements to stock such sought-after products, impacting their ability to attract customers.

Complex Supply Chain and Sourcing

The luxury watch and jewelry sector, including brands like Emperor Watch & Jewellery, faces a significant threat from new entrants due to the inherent complexity of its supply chain and sourcing requirements. Establishing reliable access to ethically sourced precious metals, rare gemstones, and specialized components is a major hurdle.

New players must invest heavily in building relationships with suppliers and ensuring compliance with stringent ethical and quality standards. For instance, the diamond industry, a cornerstone for many luxury jewelers, operates with complex traceability requirements. In 2024, the Kimberley Process Certification Scheme continued to be a benchmark, but the demand for fully transparent and ethically mined materials is intensifying, requiring substantial upfront investment and expertise to navigate.

Consider these key points regarding the threat of new entrants due to complex supply chains:

- Global Sourcing Expertise: New entrants need to develop sophisticated global networks to source unique materials like specific types of gold, platinum, and high-quality diamonds and gemstones.

- Ethical and Sustainable Practices: The luxury consumer increasingly demands transparency and ethical sourcing. Building and maintaining these credentials requires significant effort and investment, especially with evolving regulations and consumer expectations.

- Specialized Manufacturing: Luxury watch and jewelry production often involves highly specialized craftsmanship and proprietary manufacturing techniques. New entrants must either acquire this expertise or invest in developing it, which is time-consuming and capital-intensive.

- Logistics and Security: The transportation and security of high-value materials and finished goods across international borders add another layer of complexity and cost for any new competitor.

Intense Competition from Existing Players

The threat of new entrants for Emperor Watch & Jewellery is somewhat mitigated by the intense competition already present. Established brands with significant market share and strong customer loyalty create a high barrier to entry. For instance, the luxury watch market, a significant segment for Emperor, saw global sales reach an estimated USD 50 billion in 2023, indicating a mature and well-defended sector.

New players entering this space would need substantial capital investment to compete on brand recognition, distribution networks, and marketing. The slowdown in market growth observed in certain key regions further discourages newcomers, as the potential for rapid market share acquisition is diminished. This existing competitive intensity means that any new entrant would face an uphill battle to carve out a profitable niche against entrenched players.

- High Capital Requirements: Establishing a luxury brand requires significant upfront investment in manufacturing, design, marketing, and retail presence, making it difficult for smaller entities to enter.

- Brand Loyalty and Reputation: Existing players benefit from decades of brand building and customer trust, which new entrants struggle to replicate quickly.

- Economies of Scale: Larger, established companies often enjoy cost advantages in sourcing materials and production, which new entrants cannot match initially.

- Distribution Channel Access: Securing prime retail locations and partnerships with established distributors is challenging for newcomers in the competitive jewelry and watch market.

The threat of new entrants for Emperor Watch & Jewellery is generally low, primarily due to the substantial capital required to establish a presence in the luxury market. This includes significant investments in prime real estate, opulent store design, and securing a high-value inventory. For instance, achieving the brand recognition and trust that Emperor has cultivated over years requires extensive time and financial commitment, acting as a strong deterrent for newcomers.

Furthermore, exclusive supplier relationships and access to desirable brands, such as prestigious Swiss watchmakers, are difficult for new players to replicate. The complexity of sourcing ethically produced precious metals and gemstones, coupled with the need for specialized manufacturing expertise and robust logistics, presents additional formidable barriers. In 2024, the demand for transparent supply chains, as exemplified by the Kimberley Process for diamonds, further increased the investment needed for compliance and ethical sourcing.

The existing intense competition within the luxury watch and jewelry sector, with established players holding significant market share and customer loyalty, also discourages new entrants. Market growth slowdowns in certain regions in 2023 and 2024 further reduce the appeal for newcomers seeking rapid market share acquisition.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for prime retail locations, store design, and inventory. | Significant financial hurdle, limiting entry to well-funded entities. |

| Brand Loyalty & Heritage | Decades of brand building and customer trust. | New entrants struggle to quickly establish credibility and attract customers. |

| Supplier Relationships | Exclusive distribution agreements with luxury brands. | Difficulty in securing access to sought-after products. |

| Supply Chain Complexity | Sourcing ethical materials, specialized manufacturing, logistics. | Requires extensive expertise, investment, and time to build reliable networks. |

| Existing Competition | Mature market with established players and strong brand presence. | Challenging to gain market share against entrenched competitors. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Emperor Watch & Jewellery is built upon a foundation of publicly available financial reports, industry-specific market research from reputable firms, and insights gleaned from competitor announcements and trade publications.