Elia Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elia Group Bundle

Elia Group's market position reveals significant strengths in its regulated infrastructure, but also highlights potential vulnerabilities to evolving energy policies. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind Elia Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Elia Group commands a dominant market position as a transmission system operator (TSO) in Belgium and Germany, operating the high-voltage grids through its subsidiaries Elia and 50Hertz. This strategic presence is vital for ensuring the reliable flow of electricity across these economically significant European territories.

As one of Europe's top five TSOs, Elia Group manages extensive networks, underpinning its substantial influence and operational capacity within the continent's energy landscape. For instance, 50Hertz alone is responsible for over 10,000 km of high-voltage power lines, demonstrating the sheer scale of its operations in Northern and Eastern Germany and its offshore connections.

Elia Group is making a significant commitment to grid infrastructure, planning to invest €31.6 billion between 2024 and 2028. A substantial portion, €26.8 billion, is earmarked for the period of 2025 through 2028, highlighting a focused effort on grid modernization and expansion.

These substantial investments are crucial for upgrading and extending the grid, directly aligning with and enabling Europe's ambitious decarbonization targets. This strategic capital allocation positions Elia Group for robust long-term growth and enhances its capacity to manage evolving energy needs.

Elia Group consistently achieves exceptionally high operational reliability, with grid uptime reaching 99.9% in Belgium and 99.8% in Germany throughout 2024. This superior performance underscores the company's advanced operational management and technological infrastructure. Such dependability is vital for maintaining national energy security and ensuring uninterrupted power flow for millions of customers and businesses.

Pivotal Role in Energy Transition

Elia Group plays a crucial role in the energy transition, actively integrating substantial amounts of renewable energy into the grid. This is a key strength as Europe moves towards decarbonization. The company is also developing vital cross-border interconnections, enhancing grid stability and facilitating the flow of clean energy across the continent.

The group's strategic emphasis on building a sustainable energy system, including significant investments in offshore wind, places it at the vanguard of Europe's low-carbon transition. For instance, Elia Group's investment plans for 2023-2032 include approximately €1.8 billion for offshore grid connections in Germany. This strong alignment with climate objectives provides a clear strategic roadmap and undeniable societal value.

- Facilitating Renewable Integration: Elia Group is a leader in connecting large-scale renewable energy projects to the grid.

- Cross-Border Interconnections: Development of critical interconnections strengthens European energy security and efficiency.

- Offshore Wind Investments: Significant capital allocation to offshore wind projects underscores commitment to the energy transition.

- Societal Relevance: Alignment with climate goals enhances the company's strategic direction and public image.

Strong Financial Performance and Funding Capacity

Elia Group exhibits exceptional financial strength, evidenced by its robust performance in early 2025. The company reported increased net profit for both Q1 and the first half of 2025, signaling strong operational efficiency and market demand. This financial health is further bolstered by significant capital infusion, including a substantial €2.2 billion equity package that enhances its financial flexibility and capacity for growth.

The group's proactive approach to liquidity management is also a key strength. In 2024, Elia Group successfully secured €9.7 billion in liquidity, providing a substantial financial cushion. This ample financial resource is critical for funding its ambitious investment plans and strategic expansion initiatives, ensuring that infrastructure development can proceed without significant capital constraints.

- Robust Profitability: Increased net profit reported in Q1 and H1 2025.

- Significant Equity Funding: Secured a €2.2 billion equity package.

- Ample Liquidity: €9.7 billion in liquidity secured in 2024.

- Investment Capacity: Financial resilience supports ambitious investment plans.

Elia Group's core strength lies in its dominant position as a Transmission System Operator (TSO) in Belgium and Germany, managing extensive high-voltage grids essential for European energy flow. Its scale is demonstrated by 50Hertz operating over 10,000 km of power lines. The company's commitment to grid development is substantial, with plans to invest €31.6 billion between 2024 and 2028, with €26.8 billion specifically allocated from 2025 to 2028, directly supporting Europe's decarbonization goals.

Exceptional operational reliability, achieving 99.9% grid uptime in Belgium and 99.8% in Germany during 2024, highlights its advanced infrastructure and management. Elia Group is pivotal in the energy transition, actively integrating renewables and developing crucial cross-border interconnections. Its significant investments, such as €1.8 billion for offshore grid connections in Germany (2023-2032), underscore its strategic alignment with climate objectives and societal value.

Financially, Elia Group exhibits robust health, reporting increased net profit in early 2025 and securing a €2.2 billion equity package. Its liquidity management is also a key asset, having obtained €9.7 billion in liquidity in 2024, ensuring ample financial capacity for its ambitious investment and expansion plans.

| Strength | Description | Supporting Data/Fact |

| Market Dominance | Leading TSO in Belgium and Germany | Operates high-voltage grids through Elia and 50Hertz |

| Operational Scale | Manages extensive transmission networks | 50Hertz operates over 10,000 km of high-voltage lines |

| Investment Commitment | Significant capital allocation for grid development | €31.6 billion planned investment (2024-2028), €26.8 billion (2025-2028) |

| Reliability | High operational uptime | 99.9% in Belgium, 99.8% in Germany (2024) |

| Energy Transition Role | Facilitates renewable integration and cross-border connections | €1.8 billion for offshore grid connections (2023-2032) |

| Financial Strength | Strong profitability and liquidity | Increased net profit (early 2025), €2.2 billion equity, €9.7 billion liquidity (2024) |

What is included in the product

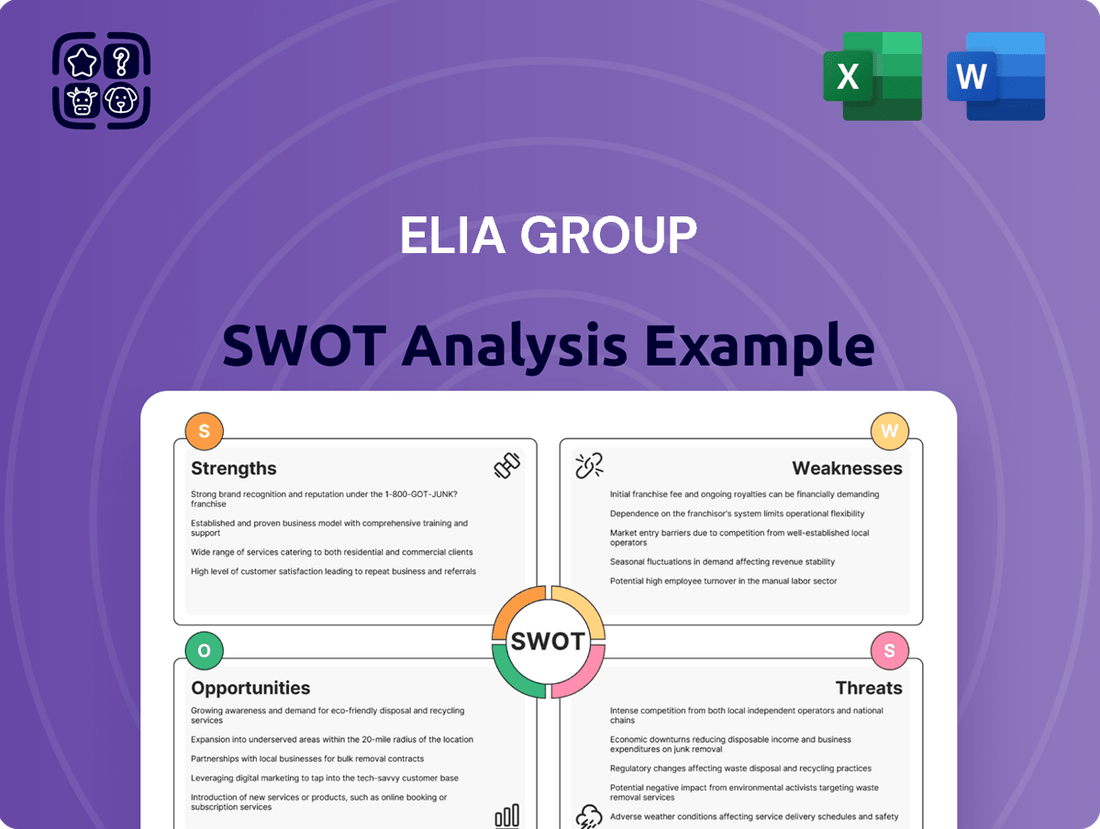

Delivers a strategic overview of Elia Group’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Elia Group's SWOT analysis provides a clear, actionable framework to identify and address potential weaknesses and threats, thereby alleviating strategic planning pain points.

Weaknesses

Elia Group's extensive investment plans, crucial for expanding its energy infrastructure, require substantial capital outlay. This naturally leads to a more leveraged financial structure.

As of the first half of 2025, Elia Group's net financial debt, excluding specific regulatory mechanisms, stood at a significant €11.6 billion. This level of borrowing demands meticulous financial oversight.

The company's debt-to-equity ratio was reported at 0.42 in the first quarter of 2025. Managing this leverage is key to preserving its creditworthiness and ensuring continued access to funding sources.

Elia Group faces significant uncertainty due to ongoing regulatory updates, especially in Germany from Q1 2025 to Q1 2026. These changes could affect future profitability as new regulatory models are implemented.

The potential shift to cost-plus models, coupled with new incentives and standardized Weighted Average Cost of Capital (WACC), may alter Elia Group's regulated returns. The full impact of these regulatory adjustments is still under evaluation, introducing potential financial volatility.

Elia Transmission Belgium faced significant hurdles with the Princess Elisabeth Island project, leading to contract pauses. These issues stemmed from escalating inflation, increased material expenses, and scarcity of suppliers, as reported in early 2024. Such disruptions directly translate into potential project delays and budget overruns, which can negatively affect investment schedules and Elia Group's financial outcomes.

Increased Carbon Emissions Reported

Elia Group's sustainability efforts faced a hurdle in 2024 with an reported increase in total carbon emissions compared to the previous year. This uptick, specifically within Scope 2 and Scope 3 emissions, presents a notable challenge to their stated climate objectives. For instance, the company aims for a 28% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, a target that requires careful management of emission sources.

The rise in emissions could impact Elia Group's standing as an environmental leader and potentially affect investor confidence in their long-term sustainability strategy. Addressing the root causes of this increase is crucial for maintaining credibility and achieving their ambitious decarbonization goals.

- Increased Emissions: Total carbon emissions rose in 2024 versus 2023.

- Scope 2 & 3 Impact: The increase was particularly evident in Scope 2 and Scope 3 emissions.

- Climate Commitment Challenge: This trend complicates achieving the 2030 goal of a 28% reduction in Scope 1 and 2 emissions.

- Environmental Leadership: Maintaining environmental leadership requires addressing this upward emission trend.

Reliance on Favorable Policy and Regulation

Elia Group's performance is intrinsically linked to the stability of energy policies and regulatory frameworks, both at national and European levels. As a regulated entity, its revenue streams and permitted investment returns are directly shaped by these external decisions. For instance, changes in tariff methodologies or environmental standards, such as those emerging from the European Green Deal, can significantly alter the company's financial projections.

This reliance means Elia Group has limited control over key aspects of its business. A shift towards more stringent environmental regulations or a revision of how grid investments are remunerated could directly impact profitability and the feasibility of strategic projects. For example, if new regulations mandate accelerated grid upgrades without corresponding tariff adjustments, it could strain financial resources.

- Policy Dependence: Elia Group's financial health is tied to national and EU energy policies.

- Regulatory Impact: Changes in tariff setting or environmental rules directly affect revenue and investment returns.

- Limited Autonomy: The company's operational and financial strategies are constrained by regulatory decisions.

- Potential Financial Strain: Unfavorable policy shifts could negatively impact financial outlook and strategic execution.

Elia Group's significant debt load, reaching €11.6 billion in net financial debt by mid-2025, necessitates careful financial management to maintain its creditworthiness. The company's debt-to-equity ratio stood at 0.42 in Q1 2025, indicating a leveraged position that requires ongoing attention to ensure continued access to funding. This financial structure, while supporting extensive investment plans, inherently carries risks associated with interest rate fluctuations and the ability to service its obligations.

Same Document Delivered

Elia Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, showcasing the comprehensive breakdown of Elia Group's Strengths, Weaknesses, Opportunities, and Threats. The complete version becomes available after checkout, offering actionable insights.

Opportunities

Europe is on the cusp of a massive grid infrastructure overhaul, with estimates suggesting a need for €1.4 trillion to €2.294 trillion in investments by 2040-2050. This substantial capital injection is crucial for modernizing and expanding transmission and distribution networks across the continent.

This extensive demand for grid upgrades and expansion represents a significant and enduring market opportunity for Elia Group, directly aligning with its core business operations. The sheer scale of these planned investments perfectly matches Elia's strategic direction and established capabilities in grid development and management.

Elia Group is well-positioned to capitalize on Europe's ambitious offshore wind expansion goals, with targets of 120 GW by 2030 and 300 GW by 2050. This surge in renewable energy requires substantial investment in grid infrastructure and interconnections, precisely Elia Group's core competencies.

Key projects like the Princess Elisabeth Island energy hub exemplify the scale of development needed. Elia Group's involvement in such strategic initiatives, including new cross-border interconnectors, directly translates into significant revenue and growth opportunities in grid development and integration services.

Elia Group can capitalize on the energy sector's digital transformation to boost grid efficiency and create new customer offerings. For instance, their investment in smart grid technologies, like advanced metering infrastructure, allows for better real-time data collection, which is crucial for optimizing energy distribution. By embracing digital innovation, Elia Group is positioned to improve system stability and unlock new revenue streams through data-driven services.

Expanding Market Services for Flexibility

The energy landscape is rapidly evolving towards greater flexibility and consumer involvement, presenting a significant opportunity for Elia Group. By developing services that facilitate flexible consumption, where consumers can adjust their electricity use in line with renewable energy availability, Elia can play a crucial role in grid balancing and generate new revenue streams. This shift is supported by increasing consumer demand for personalized energy solutions and greater control over their consumption patterns.

Elia Group can capitalize on this trend by creating innovative platforms and real-time pricing mechanisms. These tools would empower consumers to actively participate in the energy market, optimizing their usage and potentially reducing their energy bills. For instance, the company could implement demand-response programs that reward consumers for reducing their load during peak hours, a strategy that has shown success in other European markets, with some programs achieving participation rates of over 15% in pilot phases.

- Development of new market services: Offering services that enable consumers to adjust their electricity usage based on renewable energy availability.

- Grid balancing and value creation: Helping to stabilize the grid by managing demand and creating economic value for consumers through flexible usage.

- Real-time pricing mechanisms: Implementing dynamic pricing structures that reflect current grid conditions and energy costs.

- Platforms for market participation: Creating user-friendly digital platforms that allow consumers to easily engage in flexible energy trading.

Emerging Hydrogen-Electricity Synergies

The increasing focus on hydrogen as a clean energy solution creates significant opportunities for Elia Group to leverage its expertise in electricity infrastructure. By exploring synergies between electricity and hydrogen systems, Elia can position itself as a key player in the evolving energy landscape. For instance, Elia’s innovation strategy actively investigates these connections, aiming to unlock new revenue streams and enhance its strategic importance in the emerging hydrogen economy.

Developing integrated infrastructure that can manage both electricity and hydrogen flows offers a compelling path for growth. This dual-purpose infrastructure could lead to new business models and solidify Elia Group's role in facilitating the transition to a decarbonized energy system. As of early 2024, investments in green hydrogen production are accelerating globally, with projects often requiring robust electrical grid connections, highlighting the direct relevance of Elia’s core business.

- Infrastructure Integration: Elia Group can develop and manage infrastructure that supports both electricity transmission and hydrogen transport, creating a more efficient and interconnected energy network.

- New Revenue Streams: By offering services related to hydrogen storage, transportation, and integration with the electricity grid, Elia can diversify its income sources beyond traditional electricity transmission.

- Strategic Relevance: Elia's early engagement in hydrogen-electricity synergies positions it to be a critical enabler of the future hydrogen economy, enhancing its long-term value proposition.

Elia Group is strategically positioned to benefit from the massive European grid infrastructure overhaul, with projected investments reaching up to €2.294 trillion by 2050, directly aligning with its core business. The company is also set to capitalize on ambitious offshore wind targets, aiming for 300 GW by 2050, requiring significant grid expansion and interconnection investments where Elia excels. Furthermore, embracing digital transformation and developing new market services for consumer flexibility, such as demand-response programs, offers substantial avenues for efficiency gains and new revenue streams, with pilot programs showing over 15% participation. The growing importance of hydrogen as a clean energy source presents an opportunity for Elia to integrate electricity and hydrogen infrastructure, opening new business models and enhancing its strategic role in the decarbonized future.

Threats

Global geopolitical events are a significant threat, capable of causing major disruptions in energy markets. This leads to wild swings in gas and electricity prices, and can also mess with supply chains. For Elia Group, this means a less predictable operating environment.

Inflation, particularly the rising cost of materials, directly impacts project expenses. For instance, the Princess Elisabeth Island project, like many large infrastructure developments, faces increased costs due to these inflationary pressures. This directly squeezes profitability margins.

These external forces, geopolitical instability and inflation, inject a substantial amount of financial and operational uncertainty into Elia Group's business. Managing these unpredictable elements is crucial for maintaining stability and achieving financial goals.

As a key operator of Europe's energy grids, Elia Group is a prime target for cyberattacks. The interconnected nature of critical infrastructure means a breach could cause widespread power outages, impacting millions. For instance, the US experienced over 1,000 reported cyber incidents affecting critical infrastructure in 2023, highlighting the scale of this threat.

A successful cyberattack on Elia Group’s systems could result in severe operational disruptions, leading to significant financial losses and a severe blow to its reputation. Data breaches of sensitive operational or customer information are also a major concern. The estimated cost of a single major cyberattack on critical infrastructure can run into billions of dollars.

To counter these persistent threats, Elia Group must continually invest in advanced cybersecurity defenses and maintain a high level of operational vigilance. Protecting grid stability and safeguarding sensitive data are paramount. In 2024, global spending on cybersecurity is projected to reach over $200 billion, underscoring the industry's commitment to addressing these risks.

Elia Group faces significant threats from complex and lengthy permitting and regulatory processes. These administrative hurdles can substantially delay critical grid development projects, impacting the pace of essential infrastructure upgrades. For instance, in 2024, several major European grid expansion projects experienced delays averaging 18 months due to these bureaucratic complexities, directly affecting the integration timelines for new renewable energy capacity.

Such delays not only result in missed opportunities to bring clean energy online but also drive up project costs. The extended timelines can lead to increased financing expenses and potential penalties, eroding project profitability. In 2025, the estimated cost increase for delayed projects across the EU's energy sector is projected to be around 7-10%, a direct consequence of these protracted approval procedures.

Ultimately, streamlining these permitting and regulatory pathways is paramount for Elia Group to efficiently deploy the necessary infrastructure. Without this, the timely integration of renewable energy sources, a key strategic objective, will remain significantly challenged, potentially hindering progress towards decarbonization goals and energy security targets.

Potential for Shifting Political and Policy Priorities

Changes in government and evolving political landscapes across Belgium, Germany, and the EU pose a significant threat to Elia Group. These shifts can directly influence energy policy and regulatory priorities, potentially altering the landscape for infrastructure investments and operational frameworks.

While Elia Group actively participates in shaping market evolution, unexpected or substantial policy changes could disrupt its strategic investment plans and revenue models. For instance, a sudden pivot away from renewable energy targets or a re-regulation of grid access fees could necessitate rapid strategic adjustments.

- Policy Uncertainty: Evolving political priorities in key markets like Germany and Belgium could lead to unexpected regulatory changes impacting grid development and energy transition strategies.

- Investment Risk: Shifts in government support for renewable energy or grid modernization projects could affect Elia Group's planned capital expenditures and long-term revenue streams.

- Regulatory Adaptation: Elia Group must maintain strategic agility to adapt to potentially altered revenue models and operational frameworks resulting from new political mandates.

Integration Challenges with Distributed Energy Resources

The increasing decentralization of energy, with more renewables connecting at the distribution level, poses significant integration challenges for Elia Group as a transmission system operator. This shift requires substantial adaptation in grid management and technology to effectively handle intermittent power flows and maintain overall system stability. For instance, in 2024, the European Union saw a substantial increase in installed renewable capacity, placing greater demands on grid balancing mechanisms.

Failure to adequately adapt to these distributed energy resources (DERs) could result in grid inefficiencies and elevated congestion management costs. Elia Group must invest in advanced forecasting and control systems to manage the bidirectional power flows characteristic of DER integration. By 2025, the need for sophisticated digital grid solutions will be paramount to ensure reliability amidst this evolving energy landscape.

- Grid Management Complexity: Managing a grid with numerous, smaller, and often variable energy sources requires more sophisticated real-time monitoring and control compared to traditional centralized generation.

- Technological Investment: Significant capital expenditure is needed for smart grid technologies, advanced metering, and communication infrastructure to facilitate seamless DER integration.

- Intermittency and Stability: Ensuring grid stability when power generation fluctuates due to weather-dependent renewables necessitates advanced forecasting and backup capacity solutions.

- Congestion Costs: Inadequate grid capacity or control to manage DER output can lead to localized congestion, requiring costly curtailment of renewable generation or infrastructure upgrades.

The increasing complexity of energy markets, driven by volatile commodity prices and shifting regulatory landscapes, presents a significant challenge for Elia Group. These factors create uncertainty in revenue streams and operational planning, impacting long-term investment strategies and profitability. For example, the wholesale electricity price in Europe experienced significant fluctuations throughout 2024, directly affecting the financial performance of grid operators.

Elia Group must navigate a challenging economic environment characterized by persistent inflation and the potential for interest rate hikes. These macroeconomic trends can increase the cost of capital for essential infrastructure projects, such as the ongoing development of offshore wind connections, potentially impacting their financial viability and timelines. In 2024, inflation rates across the Eurozone remained elevated, impacting construction and material costs for large-scale projects.

The company also faces the threat of increased competition, particularly from new market entrants and evolving business models in the energy sector. This necessitates continuous innovation and strategic adaptation to maintain its market position and ensure the long-term sustainability of its operations. The European energy market is seeing increased activity from distributed energy resource aggregators, adding a new layer of competitive pressure.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Elia Group's official financial statements, comprehensive market research reports, and expert industry analyses to provide a detailed and accurate strategic overview.