Elia Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elia Group Bundle

Elia Group operates in a dynamic energy transmission sector, facing moderate threats from new entrants and the bargaining power of buyers. Understanding the intensity of these forces is crucial for strategic planning.

The full Porter's Five Forces Analysis reveals the real forces shaping Elia Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Elia Group, as a crucial transmission system operator (TSO), depends on highly specialized equipment like high-voltage cables, transformers, and sophisticated grid management technology. These essential components are often sourced from a limited number of manufacturers, granting them considerable bargaining power. For instance, the European market for certain high-voltage grid components faced significant supply chain constraints in 2023 and early 2024, with lead times extending up to 24 months for some critical items.

The concentration of suppliers for such advanced technology means Elia Group has fewer alternatives, amplifying supplier leverage. Furthermore, the long lead times associated with this specialized equipment, coupled with existing insufficient manufacturing capacities across Europe, pose a direct challenge to Elia's ambitious investment plans. This situation can translate into project delays and escalated costs, directly impacting Elia's operational efficiency and capital expenditure timelines.

The bargaining power of construction and engineering service providers in the infrastructure sector is significant, particularly for Elia Group. These specialized firms possess unique expertise essential for large-scale projects like offshore wind farm connections and interconnections. The complexity and technical demands of these undertakings mean only a limited number of companies can effectively execute them, granting them considerable leverage.

Elia Group's substantial investment plans underscore the critical reliance on these suppliers. With a projected investment pipeline of €31.6 billion between 2024 and 2028, Elia Group needs these specialized construction and engineering service providers to deliver on its ambitious growth and infrastructure development goals, further amplifying supplier bargaining power.

Elia Group, like other Transmission System Operators (TSOs), faces significant reliance on financiers and capital providers due to the immense capital required for grid modernization and expansion. European TSOs are expected to invest a substantial €345 billion over the next five years, a figure that underscores the need for robust financing strategies.

While Elia has demonstrated success in securing funding, such as a €2.2 billion equity package in 2025, the cost and accessibility of this capital are directly tied to the dynamics of financial markets and prevailing investor sentiment. This dependency means that fluctuations in these external factors can directly impact Elia's ability to fund its critical infrastructure projects.

Furthermore, the bargaining power of capital providers is indirectly influenced by regulatory frameworks. Regulators determine the allowed rate of return on Elia's investments, which directly affects the profitability and attractiveness of Elia's projects to investors, thereby shaping the terms of financing.

Energy Producers and Balancing Service Providers

Energy producers and balancing service providers hold significant bargaining power within Elia Group's operational framework. While not traditional component suppliers, their role in providing electricity and essential grid stability services is paramount. The increasing reliance on renewable energy sources, which are inherently intermittent, amplifies the demand for flexible balancing services, thereby strengthening the negotiating position of these providers.

Elia's active involvement in platforms like MARI underscores the critical nature of these ancillary services. For instance, in 2023, the European Union's average share of electricity generation from renewable sources reached approximately 42%, a figure that continues to grow, necessitating more sophisticated grid management and balancing capabilities. This trend directly impacts Elia's need for reliable partners in this domain.

- Demand for Flexibility: The growing integration of renewables necessitates greater grid flexibility, increasing the value of balancing services.

- Intermittency of Renewables: As wind and solar power contribute more to the energy mix, the need for services that compensate for their variability rises.

- Strategic Platforms: Elia's participation in platforms like MARI signifies the importance and strategic value of balancing service providers in ensuring grid stability.

Software and Digital Solution Providers

Elia Group's increasing reliance on specialized software and digital twin solutions for grid modernization amplifies the bargaining power of software and digital solution providers. These providers often possess proprietary technologies crucial for operational efficiency and planning, making their offerings indispensable.

The ongoing digitalization trend, a significant driver for Elia Group, means these providers hold substantial sway. For instance, the global smart grid market was valued at approximately $25 billion in 2023 and is projected to grow substantially, indicating a strong demand for the very solutions these suppliers offer.

- Criticality of Solutions: Digital twins and advanced grid management software are vital for Elia's operational planning, real-time monitoring, and integration of new energy sources.

- Proprietary Technology: Many providers offer unique, patented software that is difficult for Elia to replicate internally or source from alternative vendors.

- Market Concentration: The market for highly specialized grid software can be concentrated, with a few key players dominating the landscape, further enhancing their leverage.

The bargaining power of suppliers for Elia Group is considerable, particularly for specialized high-voltage equipment and advanced grid management technology. Limited manufacturers and long lead times, such as up to 24 months for critical items in early 2024, grant these suppliers significant leverage. This concentration of suppliers and existing capacity constraints directly impacts Elia's investment plans, potentially causing delays and cost increases.

Construction and engineering firms with unique expertise for large-scale projects also wield significant power, especially given Elia's substantial investment pipeline. The need for specialized skills in areas like offshore wind connections means fewer qualified providers, amplifying their negotiating position. Elia's projected €31.6 billion investment between 2024 and 2028 highlights this dependency.

Financiers and capital providers also exert influence, as Elia relies heavily on external funding for its massive infrastructure projects. The European TSO investment forecast of €345 billion over five years underscores this reliance. While Elia secured a €2.2 billion equity package in 2025, financing terms are subject to market conditions and regulatory frameworks, which dictate allowable rates of return.

Energy producers and balancing service providers gain power due to the increasing demand for grid flexibility driven by renewables. With renewables comprising around 42% of EU electricity generation in 2023, the need for services managing intermittency grows, strengthening these providers' positions. Elia's engagement in platforms like MARI further emphasizes the critical nature of these services.

What is included in the product

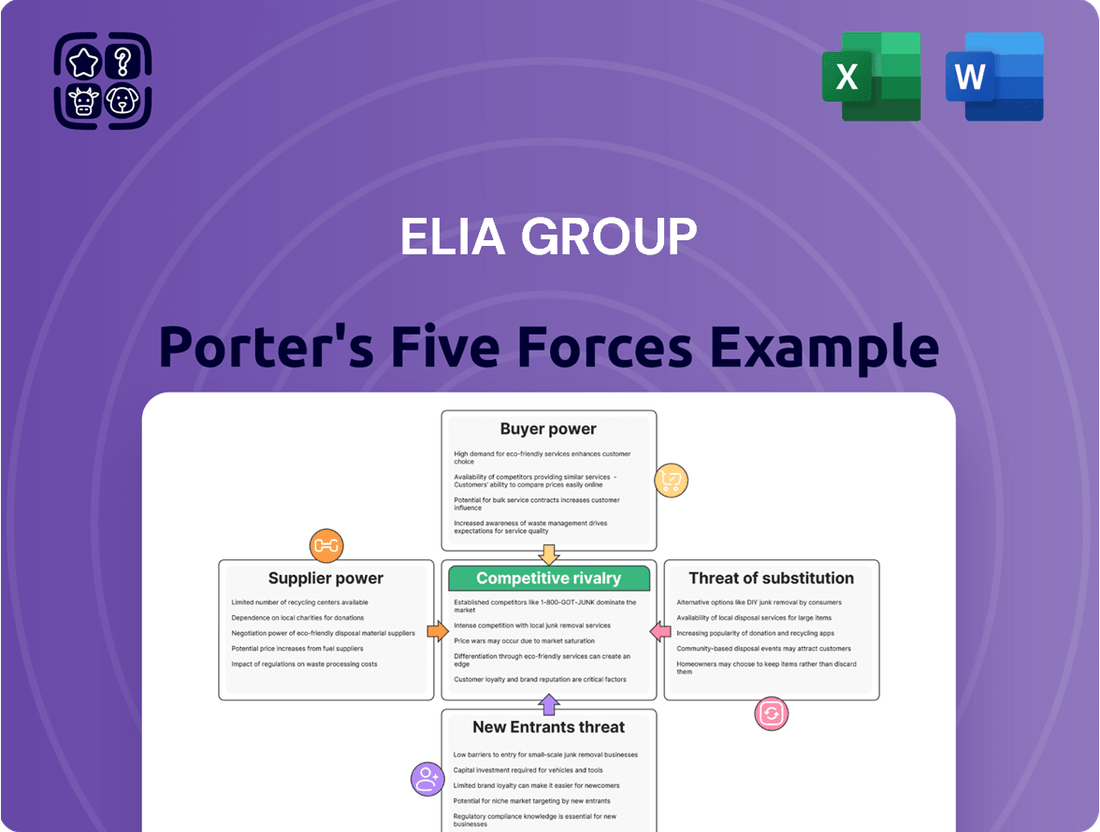

This analysis meticulously assesses the competitive forces impacting Elia Group, providing insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces dashboard, allowing for rapid identification of strategic pressures.

Customers Bargaining Power

Distribution System Operators (DSOs) in Belgium and Germany are Elia Group's main customers, acting as intermediaries to deliver electricity to homes and businesses. These DSOs, though also regulated, hold sway over Elia's operations by influencing investment decisions and service standards through regulatory frameworks and national energy strategies. Their role is crucial for incorporating new renewable energy sources and managing local electricity consumption patterns.

Large industrial consumers, directly linked to Elia Group's high-voltage grid, are significant electricity purchasers. Their substantial demand and economic importance grant them leverage, especially concerning grid service quality and pricing. For instance, in 2023, industrial customers accounted for a considerable share of Elia's total electricity sales, influencing discussions around transmission tariffs and service reliability.

Energy traders and market participants are crucial to Elia Group's operations, as they utilize Elia's infrastructure and services to manage energy flows and facilitate cross-border trading. Their reliance on Elia for stable and efficient market access gives them significant bargaining power.

In 2024, the European energy market saw continued volatility, with wholesale electricity prices fluctuating significantly. This dynamic environment increases the importance of reliable market platforms, strengthening the position of traders who can easily switch providers or influence market rules if Elia's services become less competitive or reliable.

The collective demand from these participants for transparent, efficient, and cost-effective market access means Elia must continuously invest in and improve its platforms. Failure to do so could lead traders to seek alternative solutions or exert pressure through industry associations for regulatory changes that favor more open or competitive market structures.

Government and Regulatory Bodies

Government and regulatory bodies, such as the Commission de Régulation de l'Électricité et du Gaz (CREG) in Belgium, act as powerful stakeholders for Elia Group. While not direct purchasers of services, they dictate the operational and financial landscape. CREG, for instance, sets the transmission tariffs that form the backbone of Elia's revenue, directly influencing profitability. In 2024, regulatory decisions on allowed returns on capital and investment frameworks continue to shape Elia's financial performance and strategic planning.

These bodies hold significant sway over Elia's business by defining performance standards and investment incentives. Their pronouncements on grid expansion, renewable energy integration, and efficiency targets directly impact Elia's capital expenditure plans and operational efficiency. For example, regulatory mandates for grid upgrades to accommodate increased renewable energy sources in 2024 necessitate substantial investment, which is then subject to regulatory approval and tariff adjustments.

- Regulatory Framework: Government and regulatory bodies establish the rules for electricity transmission, including tariffs and performance standards.

- Tariff Setting: These entities determine the rates Elia can charge for using its transmission infrastructure, directly impacting revenue.

- Investment Incentives: Regulations can encourage or discourage specific types of investments, influencing Elia's capital allocation.

- Performance Standards: Compliance with mandated operational and efficiency targets is crucial for regulatory approval and financial health.

Public and Society

The bargaining power of the public and society on Elia Group is significant, particularly as a provider of critical infrastructure. Societal demands for a sustainable energy future, affordable electricity, and reduced environmental impact directly shape Elia's investment strategies and operational priorities, especially during the ongoing energy transition. For instance, public acceptance is crucial for new transmission infrastructure, and Elia actively engages with local communities on these projects, as seen in their efforts for new high-voltage lines.

Elia Group's commitment to public engagement is evident in its proactive communication regarding infrastructure development. In 2023, Elia continued its dialogue with stakeholders on projects aimed at reinforcing the grid and integrating renewable energy sources. Public opinion, influenced by factors like energy prices and environmental concerns, can exert indirect pressure on regulatory bodies, which in turn affects Elia's operating environment and strategic direction.

- Public Opinion: Growing public awareness and concern over climate change amplify the demand for cleaner energy solutions, influencing Elia's investment in grid modernization and renewable energy integration.

- Affordability Concerns: While Elia operates under regulated tariffs, persistent public concerns about rising energy costs can indirectly pressure regulators to consider the impact of grid investments on end-user prices.

- Community Engagement: Elia's proactive engagement with local communities for infrastructure projects, such as new substations or transmission lines, aims to mitigate potential opposition and ensure project viability by addressing local concerns.

Elia Group's customers, primarily Distribution System Operators (DSOs) and large industrial users, possess considerable bargaining power. Their ability to influence Elia stems from their significant electricity consumption and their role as essential intermediaries in the energy supply chain. In 2023, industrial customers represented a substantial portion of Elia's sales, giving them leverage in tariff negotiations and demands for service reliability.

Energy traders also wield influence by utilizing Elia's grid infrastructure for market operations. The volatile European energy market in 2024, marked by fluctuating wholesale prices, enhances the bargaining power of traders who can seek alternative, more cost-effective solutions if Elia's services are perceived as less competitive. This necessitates Elia's continuous investment in platform efficiency and transparency to retain these crucial market participants.

| Customer Segment | Bargaining Power Drivers | Impact on Elia Group |

|---|---|---|

| DSOs | Intermediary role, regulatory influence | Shapes investment decisions, service standards |

| Large Industrial Consumers | High consumption volume, economic importance | Influences pricing, service reliability |

| Energy Traders | Reliance on infrastructure, market access | Pressures for competitive pricing, platform efficiency |

Full Version Awaits

Elia Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the Elia Group, detailing the competitive landscape and strategic implications. You are viewing the exact, fully formatted document that will be delivered instantly upon purchase, ensuring no discrepancies or missing information. This professional analysis is ready for immediate application to inform your strategic decision-making.

Rivalry Among Competitors

Elia Group enjoys a position of limited direct competition in its core electricity transmission markets of Belgium and Germany. These are regulated monopoly environments, meaning Elia is the sole provider of transmission services in these regions. This structure is a direct result of the significant barriers to entry.

The immense capital investment required to build and maintain electricity transmission infrastructure, coupled with stringent regulatory approvals, effectively prevents new companies from entering and competing directly. For instance, Elia Group's 2023 capital expenditure was €1.4 billion, highlighting the scale of investment needed to operate and expand these critical networks.

While European Transmission System Operators (TSOs) like Elia Group primarily manage their domestic grids, they do engage in a form of indirect competition. This rivalry centers on securing funding and regulatory approval for crucial cross-border interconnector and offshore grid projects, vital for Europe's energy transition.

These projects, often co-financed and developed through consortia, see TSOs vying for priority within the ENTSO-E framework. For instance, the European Commission's Projects of Common Interest (PCI) list influences which projects receive enhanced permitting and potential financial support, creating a competitive landscape for TSOs to demonstrate the value and necessity of their proposed cross-border infrastructure.

In 2023, the European Network of Transmission System Operators for Electricity (ENTSO-E) identified numerous cross-border projects crucial for grid integration, with significant investment planned in the coming years. The competition lies in effectively proposing and executing these complex, high-value projects, which are essential for meeting renewable energy targets and ensuring security of supply across the continent.

Regulators frequently use efficiency benchmarking, even for monopolies like Elia, to foster a competitive dynamic among Transmission System Operators (TSOs). This encourages Elia to pursue operational efficiencies and cost-effectiveness to meet regulatory goals and sustain profitability. For instance, Germany's regulatory framework utilizes benchmarking to set TSO revenue caps.

Competition for Investment Funds and Talent

Elia Group faces significant competitive rivalry for both investment capital and skilled personnel within the European energy sector. Infrastructure projects, especially those focused on grid modernization and expansion, require substantial funding, putting Elia in direct competition with other utilities and large-scale energy ventures vying for the same financial resources. This competition for capital is particularly acute given the massive investments needed to support the energy transition across the continent.

The demand for specialized talent, particularly engineers and technical experts crucial for developing and digitalizing energy grids, further intensifies this rivalry. Elia Group must compete with a broad range of energy companies and technology firms for these highly sought-after professionals. The increasing complexity and technological advancements in grid infrastructure necessitate a highly skilled workforce, making talent acquisition a critical battleground.

- Intensifying Competition for Capital: Elia Group contends with numerous European energy companies and infrastructure developers for access to investment funds, as large-scale grid projects demand significant financial commitments.

- Talent Acquisition Challenges: The Group competes for specialized engineering and technical talent, essential for grid development and digitalization, with other energy sector players and technology firms.

- Growing Investment Needs: The scale of investment required for European grid development and the energy transition amplifies competition for both financial and human capital.

Indirect Competition from Energy Efficiency and Decentralization

While Elia Group operates in the transmission sector, advancements in energy efficiency and the increasing adoption of decentralized energy sources like rooftop solar and battery storage present indirect competition. These trends can lead to a reduction in the overall demand for electricity transmitted through traditional, centralized grids. For instance, in 2023, the International Energy Agency reported that global renewable energy capacity additions continued to break records, with solar PV leading the charge, indicating a growing trend towards localized generation.

This shift can indirectly limit Elia Group's transmission volume growth, as more energy is consumed closer to its point of generation. Such a scenario puts pressure on the company's revenue streams, which are often tied to the volume of electricity transmitted across its networks. The ongoing development and integration of distributed energy resources (DERs) are key factors to monitor in this competitive landscape.

- Energy Efficiency Impact: Improved energy efficiency measures across residential, commercial, and industrial sectors directly reduce the total electricity demand, lessening the need for extensive transmission infrastructure.

- Decentralization Growth: The proliferation of rooftop solar panels and residential battery storage systems, particularly in markets like Australia and parts of Europe, allows consumers to generate and store their own power, bypassing the traditional grid for a portion of their needs.

- Transmission Volume Pressure: As decentralized generation increases, the volume of electricity flowing through Elia Group's high-voltage transmission lines may stagnate or even decline, affecting revenue models dependent on transmission throughput.

- Investment Implications: This indirect competition necessitates strategic planning for Elia Group, potentially shifting focus towards grid modernization, flexibility services, and managing bi-directional power flows rather than solely expanding traditional transmission capacity.

Elia Group's competitive rivalry is primarily indirect, stemming from competition for capital and talent within the broader European energy sector. While direct competition in its core transmission markets is minimal due to regulatory monopolies, the company vies with other utilities and infrastructure developers for substantial investment funds needed for grid modernization and expansion. Furthermore, Elia faces intense competition for specialized engineering and technical expertise, crucial for digitalization and the energy transition, against a backdrop of increasing investment needs across the continent.

SSubstitutes Threaten

The rise of decentralized energy generation, like rooftop solar and local battery storage, presents a significant threat to traditional high-voltage transmission. These distributed resources, often forming microgrids, can meet local demand directly, reducing reliance on long-distance electricity transport. For instance, by the end of 2023, the European Union saw a substantial increase in installed renewable capacity, with solar PV alone adding over 40 GW, directly impacting the need for grid transmission.

Improvements in energy efficiency are a significant threat to Elia Group's transmission services. As buildings and industries become more efficient, they require less electricity overall. For instance, in 2024, advancements in smart grid technology and building insulation continued to drive down energy consumption per unit of output in many European countries.

This reduced demand directly impacts the volume of electricity that needs to be transmitted. If widespread adoption of highly efficient technologies continues, it could dampen the growth in electricity demand, thereby limiting the need for Elia Group to invest in expanding its transmission network capacity. This is a key consideration for future infrastructure planning.

Advanced demand-side management programs, a key element of Elia Group's strategy, offer a powerful substitute for traditional grid infrastructure. These programs, leveraging smart grid technologies, allow for optimized energy consumption and a reduction in peak demand. For instance, in 2023, Elia Group's flexibility markets facilitated the activation of over 500 MW of demand response capacity, demonstrating the tangible impact of these substitutes.

By enabling flexible energy consumption, Elia Group can effectively manage grid congestion and integrate a higher share of renewable energy sources without the immediate need for extensive physical grid upgrades. This 'virtual' substitution of new transmission lines represents a cost-effective and agile approach to grid modernization. The increasing adoption of such services is a direct response to the growing need for grid flexibility in the face of fluctuating renewable energy generation.

Direct Local Consumption of Renewables

The increasing adoption of renewable energy sources presents a potential threat of substitution for traditional grid operators like Elia Group. As more industries and communities invest in their own on-site renewable generation, such as solar farms or wind turbines, they may choose to consume this power directly, bypassing the need for high-voltage transmission services. This trend is particularly notable for large industrial consumers who have the scale to make significant investments in self-generation. For instance, by 2024, many large industrial players are projected to integrate distributed renewable energy systems to meet a portion of their energy needs, thereby reducing their reliance on the main grid.

This shift towards direct local consumption of renewables can be seen as a substitute for the services provided by transmission system operators. It represents a move towards greater energy independence and potentially lower costs for end-users who can generate and consume their own power.

- Reduced Grid Dependency: Industries investing in on-site renewables may decrease their demand for transmission services.

- Cost Savings for Consumers: Direct consumption can offer a more predictable and potentially lower energy cost.

- Decentralization of Energy: The rise of distributed generation challenges the centralized model of transmission.

- Market Disruption: This trend could impact the revenue streams of traditional grid operators.

Hydrogen or Other Energy Carriers

The threat of substitutes, particularly from hydrogen and other energy carriers, poses a long-term consideration for Elia Group. If hydrogen becomes a widely adopted energy source for industries, heating, and transport, it could decrease demand for electricity transmission services in those sectors.

The potential for localized hydrogen production and consumption could further diminish the necessity for extensive electricity grid infrastructure. For instance, a significant shift towards hydrogen in heavy industry, which currently relies heavily on electricity, could represent a substantial substitution threat.

Elia Group is actively exploring synergies between hydrogen and electricity, recognizing this evolving energy landscape. In 2024, investments in green hydrogen infrastructure are accelerating globally, with many countries setting ambitious targets. For example, the European Union's Hydrogen Strategy aims for 40 GW of electrolyzers by 2030, indicating a substantial potential shift in energy carrier preferences.

- Hydrogen as a direct substitute: In industrial processes and transportation, hydrogen can directly replace electricity in certain applications, bypassing the need for transmission networks.

- Decentralization risk: Highly localized hydrogen production and use could reduce reliance on centralized electricity generation and transmission infrastructure.

- Elia's strategic response: Elia is investigating how to integrate hydrogen systems with the electricity grid, potentially creating new roles and revenue streams rather than being entirely displaced.

- Market trends: Global investment in hydrogen technologies reached tens of billions of dollars in 2023 and is projected to grow significantly through 2025, highlighting the increasing viability of this substitute.

The threat of substitutes for Elia Group's transmission services is multifaceted, encompassing distributed energy, energy efficiency, demand-side management, and alternative energy carriers. These substitutes can reduce the overall demand for electricity transmission, impacting revenue and infrastructure investment needs.

Decentralized energy generation, like rooftop solar, and improved energy efficiency directly reduce the volume of electricity requiring transmission. Furthermore, advanced demand-side management programs offer a flexible alternative to physical grid upgrades by optimizing consumption and peak demand. The growing interest in hydrogen as an energy carrier also presents a long-term substitution risk, potentially diminishing electricity demand in key sectors.

| Substitute Category | Impact on Elia Group | Key Data/Trends (2023-2025) |

|---|---|---|

| Distributed Generation (e.g., Solar PV) | Reduces reliance on long-distance transmission | EU solar PV added >40 GW in 2023; continued growth expected through 2025. |

| Energy Efficiency | Lowers overall electricity demand | Advancements in smart grids and insulation drove down consumption per unit in 2024. |

| Demand-Side Management | Offers flexibility, reducing need for new infrastructure | Elia Group activated >500 MW demand response in 2023. |

| Alternative Energy Carriers (e.g., Hydrogen) | Potential long-term reduction in electricity demand | Global hydrogen investments reached tens of billions in 2023; EU targets 40 GW electrolyzers by 2030. |

Entrants Threaten

The electricity transmission sector is characterized by exceptionally high capital investment requirements. Building and maintaining grid infrastructure, encompassing substations, overhead lines, and submarine cables, necessitates substantial upfront funding.

For instance, Elia Group has outlined ambitious investment plans, projecting expenditures of €31.6 billion for the period 2024-2028. These figures highlight the prohibitive financial barrier that deters potential new entrants from entering the market.

The electricity transmission sector, including Elia Group's operations, is characterized by a stringent regulatory framework and complex licensing requirements across Europe. These regulations, overseen by national and EU bodies, create significant barriers to entry.

Securing the necessary permits and approvals to operate a high-voltage transmission grid is an arduous and lengthy undertaking. This complexity, coupled with substantial capital investment, effectively establishes a natural monopoly, deterring potential new competitors.

Elia Group, as an established Transmission System Operator (TSO), benefits significantly from its extensive and already built grid infrastructure. This existing network is a major barrier for any potential new entrant. Think about it, building a new, high-voltage electricity grid across multiple countries is an incredibly complex and costly undertaking.

Furthermore, the concept of network effects plays a crucial role here. The more interconnected and utilized Elia's grid is, the more valuable it becomes for all participants. A new entrant would struggle to replicate this existing interconnectedness and the associated efficiencies. For instance, in 2024, the European Union continues to invest heavily in grid modernization and expansion, but these are typically upgrades and extensions of existing frameworks, not the creation of entirely new, parallel systems.

The sheer capital expenditure required to build a competing grid, coupled with the logistical challenges of securing rights-of-way and integrating with existing energy flows, makes the threat of new entrants extremely low. Acquiring existing assets would also be prohibitively expensive, as TSO infrastructure is already highly valued and integrated into the European energy landscape.

Technical Expertise and Operational Complexity

Operating a high-voltage transmission grid, like Elia Group’s, demands a very specific and deep level of technical know-how. This includes managing advanced control systems and intricate operational procedures to keep the grid stable and reliable. For instance, ensuring the seamless integration of renewable energy sources, which is a growing trend, requires sophisticated grid management techniques that take years to master. This specialized knowledge acts as a formidable barrier for any new companies looking to enter the market.

The sheer complexity of managing such critical infrastructure means that newcomers face substantial hurdles in acquiring the necessary expertise and developing robust operational capabilities. Elia Group, for example, invests heavily in training and development for its engineers and technicians to maintain its leading position. In 2023, Elia Group reported significant investments in grid modernization and digitalization, underscoring the advanced technological requirements of the sector.

- High-tech infrastructure: Transmission grids rely on cutting-edge technology and sophisticated control systems.

- Specialized workforce: Operating these grids requires highly trained engineers and technicians with unique skills.

- Regulatory compliance: New entrants must navigate complex regulations and safety standards, adding to the operational burden.

- Capital intensity: Building and maintaining a transmission grid demands massive upfront investment in specialized equipment and infrastructure.

National Security and Strategic Importance

The threat of new entrants for Elia Group, particularly concerning its electricity transmission infrastructure, is significantly mitigated by the sector's critical national security and strategic importance. Governments worldwide recognize electricity transmission as a vital asset, essential for economic stability and public safety. This inherent criticality means that regulatory bodies and national governments maintain stringent control over who can operate in this space.

New, unproven entities face immense hurdles in gaining approval to operate such essential infrastructure. Governments prioritize established, regulated Transmission System Operators (TSOs) like Elia Group, ensuring a high degree of reliability and accountability. For instance, in 2024, many European nations continued to reinforce their energy security strategies, often involving increased state oversight of critical infrastructure, making it exceptionally difficult for new, independent players to emerge without substantial government backing or partnership.

Furthermore, the escalating concerns surrounding cybersecurity in critical infrastructure amplify the barriers to entry. Protecting the national grid from sophisticated cyber threats requires advanced expertise, robust security protocols, and significant investment, which new entrants may struggle to demonstrate or afford. This focus on security, a paramount concern in 2024, ensures that only entities with proven track records and stringent security clearances are likely to be considered for any role in electricity transmission.

- National Security Imperative: Electricity transmission is deemed a critical national infrastructure, essential for economic stability and public safety.

- Governmental Oversight: Governments are highly reluctant to permit new, unproven entities to operate in this vital sector, favoring established and regulated TSOs.

- Cybersecurity Risks: Advanced cybersecurity requirements and the potential for national disruption create significant barriers for new entrants lacking proven security capabilities.

The threat of new entrants into Elia Group's electricity transmission sector is exceptionally low due to immense capital requirements, with Elia Group planning €31.6 billion in investments from 2024-2028. Stringent regulatory frameworks and complex licensing across Europe also create significant hurdles, making it difficult for newcomers to secure the necessary permits. Furthermore, the established, extensive grid infrastructure and network effects enjoyed by Elia Group present a formidable barrier, as replicating such interconnectedness and efficiencies is incredibly costly and complex.

| Factor | Impact on New Entrants | Elia Group's Position |

|---|---|---|

| Capital Investment | Extremely High (e.g., €31.6bn planned by Elia Group 2024-2028) | Established infrastructure reduces per-unit cost, but new builds are prohibitive. |

| Regulatory & Licensing | Complex, lengthy, and costly approval processes. | Existing licenses and strong relationships with regulators. |

| Existing Infrastructure | Requires building entirely new, expensive networks. | Significant competitive advantage through established grid. |

| Technical Expertise | Requires highly specialized skills in grid management and cybersecurity. | Deep, proven operational and technological capabilities. |

| National Security & Control | High scrutiny and preference for established, reliable operators. | Recognized as a critical national infrastructure provider. |

Porter's Five Forces Analysis Data Sources

Our Elia Group Porter's Five Forces analysis is built upon a foundation of robust data, including the company's annual reports, regulatory filings from relevant energy authorities, and industry-specific market research from reputable sources.