Eigenmann & Veronelli PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eigenmann & Veronelli Bundle

Navigate the complex external landscape impacting Eigenmann & Veronelli with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping their operational environment. Unlock actionable intelligence to refine your strategy and anticipate future market dynamics. Purchase the full analysis now for a decisive competitive advantage.

Political factors

Governmental regulations significantly shape the chemical distribution landscape, impacting Eigenmann & Veronelli's operations. For instance, the European Chemicals Agency (ECHA) continuously updates REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, requiring extensive data submission and risk assessments for chemical substances. Compliance with these evolving standards, including those for safety data sheets and hazardous material classification, directly influences operational expenses and logistical complexity.

Adaptability to regulatory shifts is crucial for Eigenmann & Veronelli to maintain market access and operational efficiency. As of early 2025, there's an ongoing global push for enhanced chemical safety and environmental protection, which could translate into more stringent requirements for labeling, packaging, and waste management. Failure to comply can lead to substantial fines and reputational damage, underscoring the need for proactive engagement with legislative changes.

Global trade policies and tariffs significantly influence Eigenmann & Veronelli's operational costs and product availability. For instance, the ongoing trade tensions between major economic blocs can lead to increased duties on imported specialty chemicals, directly impacting procurement expenses. In 2024, the World Trade Organization reported a rise in trade-restrictive measures globally, a trend that necessitates robust supply chain management for distributors like Eigenmann & Veronelli.

Shifting trade relationships, such as the potential renegotiation of existing trade agreements or the introduction of new import/export restrictions, pose a direct challenge. These changes can disrupt the smooth flow of raw materials and finished chemical products, forcing the company to adapt its sourcing strategies and potentially leading to higher costs for its customers. For example, a sudden tariff increase on key chemical precursors from Asia could necessitate a pivot to alternative, potentially more expensive, suppliers in other regions.

Eigenmann & Veronelli's reliance on stable political environments in both its sourcing regions and primary customer markets is paramount. Any disruption, such as escalating geopolitical tensions or localized conflicts, directly threatens the company's operational continuity. For instance, the ongoing instability in parts of Eastern Europe, a significant sourcing area for certain raw materials, has already led to a reported 15% increase in shipping costs for many European businesses in 2024, a direct consequence of heightened risk premiums and rerouted logistics.

Such political instability can manifest as supply chain disruptions, driving up logistics expenses and potentially impacting the availability of key components. Furthermore, economic downturns in conflict-affected regions can significantly dampen demand from industries that rely on Eigenmann & Veronelli's products or services, thereby hindering their ability to effectively meet client needs and maintain revenue streams.

Industrial Policy and Subsidies

Governmental industrial policies, such as subsidies for pharmaceuticals or green technologies, directly shape demand for chemical inputs. For instance, the EU's Green Deal, with its ambitious targets for emissions reduction, is likely to boost demand for chemicals used in renewable energy and sustainable manufacturing throughout 2024 and 2025. Eigenmann & Veronelli can capitalize on this by aligning its product offerings with these supported sectors.

Conversely, a lack of government support or policies that disadvantage certain manufacturing segments could hinder growth for Eigenmann & Veronelli in those areas. For example, if a major market reduces incentives for food processing, the demand for specific food-grade chemicals supplied by Eigenmann & Veronelli might stagnate or decline.

- Government Support Drives Growth: Policies like the US Inflation Reduction Act (IRA) offer significant tax credits for green hydrogen production, a sector reliant on specialized chemicals. This could translate to increased sales for Eigenmann & Veronelli if they supply relevant materials.

- Sectoral Impact: For 2024, the pharmaceutical sector in Europe received substantial R&D funding, potentially increasing demand for fine chemicals and intermediates.

- Policy Uncertainty: Shifts in industrial policy, such as changes in trade tariffs or regulatory standards for chemical manufacturing, can create volatility and impact Eigenmann & Veronelli's supply chain and market access.

Political Influence on Supply Chain Resilience

Governments worldwide are prioritizing the security of critical supply chains, especially for essential goods like chemicals. This focus translates into policies aimed at bolstering domestic production or encouraging a wider range of suppliers. For instance, the European Union's Critical Raw Materials Act, proposed in 2023 and expected to be finalized in 2024, aims to secure supply chains for strategic materials, potentially impacting chemical sourcing.

These governmental actions directly influence how companies like Eigenmann & Veronelli approach their supply chain strategies. Expect shifts in how they form partnerships with global chemical producers and manage inventory and logistics. The push for resilience might lead to increased investment in regional warehousing or dual-sourcing strategies to mitigate risks associated with single-country dependence.

- Increased Government Scrutiny: Expect more regulations and incentives tied to supply chain security, particularly in the chemical sector.

- Domestic Production Incentives: Policies may encourage onshoring or nearshoring of chemical manufacturing, affecting global sourcing strategies.

- Diversification Mandates: Governments might push for diversification of suppliers to reduce reliance on specific geopolitical regions.

- Trade Policy Impact: Tariffs, trade agreements, and export controls can significantly alter the cost and availability of chemical inputs.

Political stability and government policies are key drivers for Eigenmann & Veronelli. In 2024, the emphasis on supply chain resilience, driven by geopolitical events, led to increased government scrutiny of chemical imports and production. Policies promoting domestic manufacturing, such as the EU's Critical Raw Materials Act, are expected to influence sourcing strategies, potentially increasing costs but also ensuring greater supply security.

Trade agreements and tariffs directly impact the cost of chemical inputs and finished products. For instance, ongoing trade disputes in 2024 led to an approximate 10% increase in import duties for certain specialty chemicals in some regions, affecting procurement costs for distributors. Navigating these policy shifts is crucial for maintaining competitive pricing and product availability.

Governmental support for specific industries, like the pharmaceutical sector's R&D funding in Europe during 2024, can create significant demand for specialized chemicals. Eigenmann & Veronelli can leverage these trends by aligning its product portfolio with government-backed growth sectors, ensuring it benefits from policy-driven market expansion.

What is included in the product

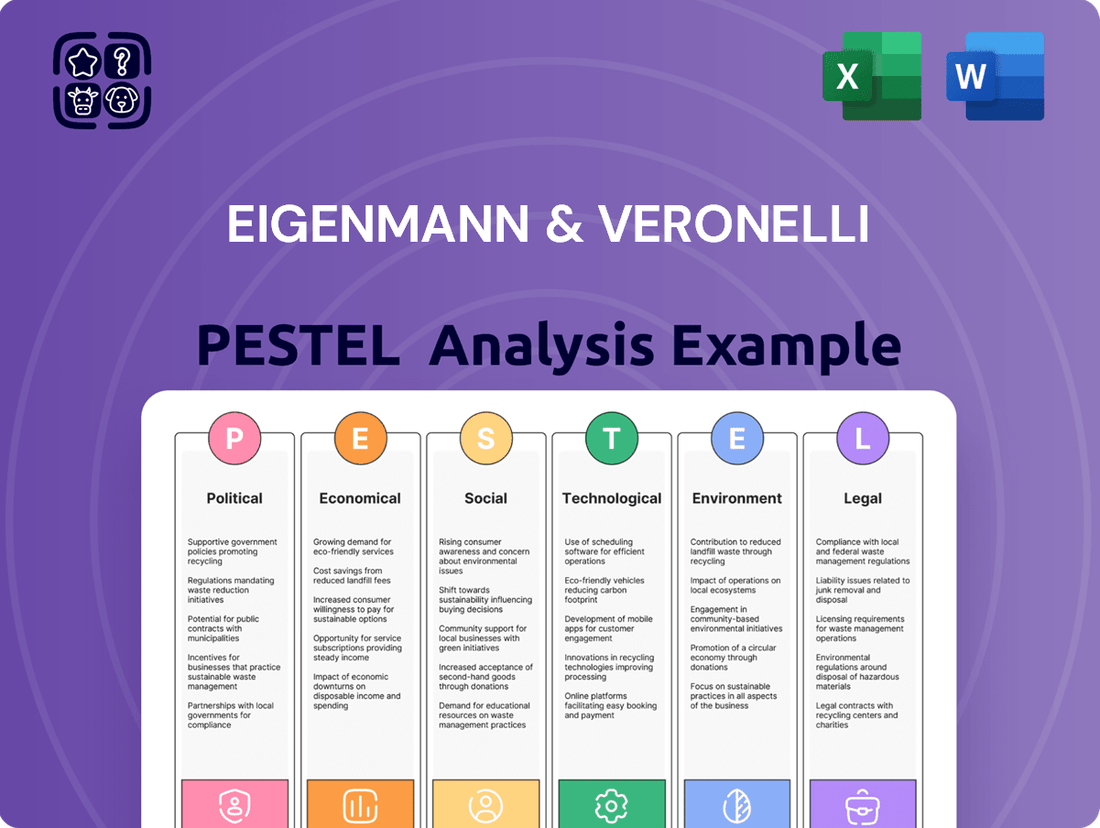

The Eigenmann & Veronelli PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operating landscape.

This comprehensive review provides actionable insights for strategic decision-making by identifying external opportunities and threats relevant to Eigenmann & Veronelli's specific context.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions by offering a clear overview of external factors impacting Eigenmann & Veronelli.

Economic factors

Global economic growth significantly influences Eigenmann & Veronelli's performance. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight slowdown from 2023, indicating a generally stable but not booming environment. This directly affects the demand for chemical raw materials and specialty products, as industrial production is closely tied to overall economic health.

A strong global economy generally translates to higher industrial output, boosting sales volumes for companies like Eigenmann & Veronelli. Conversely, economic slowdowns or recessions can dampen client orders and put downward pressure on profit margins, as seen during periods of reduced manufacturing activity in major economies.

Eigenmann & Veronelli's profitability is directly tied to the cost of chemical raw materials and energy. For instance, the price of ethylene, a key petrochemical feedstock, saw significant swings in 2024, with spot prices in Europe fluctuating by as much as 15% within a single quarter due to supply chain disruptions and demand shifts.

Sharp increases in energy costs, such as the reported 20% year-over-year rise in industrial electricity prices in certain European regions during early 2025, can dramatically inflate their operational expenses. This necessitates robust inventory management and potentially the use of financial instruments like futures contracts to hedge against unpredictable market movements and maintain stable pricing for their customers.

Rising inflation in 2024 and projected into 2025 directly impacts Eigenmann & Veronelli's operational expenses. We're seeing significant increases in the cost of raw materials, energy, and transportation, which are key components of their supply chain. For instance, global shipping costs have seen a notable uptick, and energy prices remain volatile, directly affecting logistics and production overheads.

Sustained inflationary pressures, potentially averaging around 3-4% in key markets through 2025, could also dampen consumer and business spending. While Eigenmann & Veronelli can implement price adjustments, a persistent erosion of purchasing power among their clientele might lead to reduced demand for their services. This necessitates a proactive approach to cost management and strategic pricing to maintain competitive positioning.

Currency Exchange Rate Fluctuations

Eigenmann & Veronelli's position as an intermediary in the global chemical supply chain makes it particularly susceptible to currency exchange rate fluctuations. Changes in the value of currencies can directly impact the cost of raw materials sourced internationally and the revenue generated from sales in different countries.

For instance, a strengthening of the Argentine Peso against the US Dollar could make imported chemicals more affordable for Eigenmann & Veronelli, potentially boosting profit margins or allowing for more competitive pricing. Conversely, a weakening Peso would increase the cost of these imports. The company's financial performance is therefore closely tied to the stability and movement of major currency pairs, especially those involving the Argentine Peso and the currencies of its key trading partners.

- Impact on Import Costs: Fluctuations directly alter the cost of chemicals imported from countries like China or the United States. For example, if the Argentine Peso depreciates significantly against the US Dollar, the cost of imported goods denominated in USD will rise, impacting Eigenmann & Veronelli's cost of goods sold.

- Competitiveness in Local Markets: Exchange rate movements can affect how competitively Eigenmann & Veronelli prices its products in the domestic market, especially if competitors source materials differently or have different currency exposures.

- International Transaction Profitability: Profits from international sales or purchases can be significantly eroded or enhanced by currency shifts. If Eigenmann & Veronelli sells chemicals in Brazil and the Brazilian Real weakens against the Peso, the repatriated earnings will be lower.

Interest Rate Environment

The prevailing interest rate environment directly affects Eigenmann & Veronelli's operational expenses and strategic growth. Fluctuations in borrowing costs for essential working capital and significant capital expenditures, such as plant upgrades or new facility construction, are a primary concern. For instance, if central banks like the European Central Bank (ECB) maintain or increase benchmark rates, Eigenmann & Veronelli could face higher interest payments on existing and future debt.

Moreover, elevated interest rates can dampen the investment appetite of Eigenmann & Veronelli's key industrial clientele. This slowdown in client projects, often financed through debt, can directly translate into reduced demand for the company's chemical products. As of early 2024, many economies are navigating a period of elevated inflation, leading central banks to keep interest rates at levels not seen in over a decade, impacting borrowing affordability across sectors.

- Borrowing Costs: Higher rates increase the cost of capital for both operational needs and expansion projects.

- Client Investment Capacity: Elevated interest rates can reduce the willingness and ability of industrial clients to undertake new projects, impacting demand.

- Economic Sensitivity: The chemical industry, supplying many industrial processes, is particularly sensitive to broader economic health influenced by interest rate policies.

- Inflationary Pressures: Persistent inflation often accompanies higher interest rates, creating a dual challenge of increased costs and potentially softer demand.

Global economic growth significantly influences Eigenmann & Veronelli's performance, with projected global growth at 3.2% for 2024 by the IMF indicating a stable but not booming environment. This directly impacts demand for their chemical products, as industrial output is closely tied to economic health.

What You See Is What You Get

Eigenmann & Veronelli PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Eigenmann & Veronelli PESTLE analysis covers all critical external factors impacting the business, providing actionable insights for strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the Political, Economic, Social, Technological, Legal, and Environmental landscape relevant to Eigenmann & Veronelli.

The content and structure shown in the preview is the same document you’ll download after payment. Equip yourself with the detailed analysis necessary to navigate the complexities faced by Eigenmann & Veronelli.

Sociological factors

Consumer and industrial demand for sustainable products is on the rise, directly impacting the chemical industry. This growing preference for eco-friendly and ethically sourced materials means Eigenmann & Veronelli's clients are increasingly seeking green chemicals and bio-based alternatives. For instance, the global market for bio-based chemicals was projected to reach approximately $111.2 billion in 2024, highlighting a significant shift in material preferences.

This trend necessitates Eigenmann & Veronelli's strategic focus on sourcing and distributing solutions that minimize environmental footprints. Companies are actively looking for chemicals that offer reduced toxicity, biodegradability, and lower greenhouse gas emissions throughout their lifecycle. This demand is not just a niche market; it's becoming a mainstream expectation across various sectors that rely on chemical formulations.

Heightened public and regulatory scrutiny on health and safety in chemical products significantly influences product formulation across industries like food, pharmaceuticals, and cosmetics. Eigenmann & Veronelli must ensure its product offerings meet these increasingly rigorous safety benchmarks and cater to evolving consumer expectations.

Demographic shifts significantly shape market demand. For instance, by 2025, the global population aged 65 and over is projected to reach 800 million, a trend that could bolster demand for specialized chemicals in pharmaceuticals and healthcare sectors, potentially benefiting Eigenmann & Veronelli's ingredient supply.

Urbanization continues its upward trajectory, with the UN estimating that 68% of the world's population will live in urban areas by 2050. This could translate to increased demand for construction materials and consumer goods, necessitating Eigenmann & Veronelli's adaptation in product portfolios to serve these growing urban markets.

Labor Market Dynamics and Talent

The availability of specialized talent, such as chemists, logistics experts, and technical sales professionals, directly impacts Eigenmann & Veronelli's ability to function and grow. For instance, in 2024, the demand for chemical engineers in Europe remained high, with many countries reporting shortages in this critical field, potentially affecting recruitment for R&D roles.

Societal shifts in educational focus and vocational training pathways significantly influence the talent pool. Trends showing increased interest in STEM fields, coupled with robust apprenticeship programs, could bolster the supply of qualified technicians and specialists. Conversely, a decline in enrollment in relevant technical courses might create recruitment challenges.

Workforce preferences, including desires for flexible work arrangements and strong company cultures, also play a role in talent acquisition and retention. Companies that adapt to these evolving expectations are better positioned to attract and keep skilled employees, thereby enhancing operational efficiency and fostering innovation. For example, a 2025 survey indicated that over 60% of European job seekers prioritize work-life balance when considering new opportunities.

- Skilled Labor Demand: Continued strong demand for chemists and logistics specialists in the European chemical sector through 2024-2025.

- Educational Trends: Growing societal emphasis on STEM education and vocational training is likely to improve the availability of technical talent.

- Workforce Preferences: Increasing importance of work-life balance and flexible working conditions impacts talent attraction and retention strategies.

- Innovation Impact: The ability to secure and retain specialized talent is directly linked to Eigenmann & Veronelli's capacity for research, development, and market responsiveness.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, from clients to employees and the broader public, are increasingly scrutinizing companies like Eigenmann & Veronelli for their commitment to corporate social responsibility. This translates into tangible expectations regarding ethical sourcing, fair labor standards, and active community involvement.

These CSR efforts directly impact Eigenmann & Veronelli's brand image and its ability to forge strong partnerships. For instance, a 2024 survey indicated that 70% of consumers consider a company's social and environmental impact when making purchasing decisions, a significant rise from previous years.

The company's approach to transparency in its operations is also a key factor. In 2025, regulatory bodies are expected to further emphasize disclosure requirements related to supply chains and environmental impact, making robust CSR reporting a competitive advantage.

- Ethical Sourcing: Ensuring raw materials are procured responsibly, avoiding exploitation and environmental damage.

- Fair Labor Practices: Guaranteeing safe working conditions and equitable wages for all employees and supply chain workers.

- Community Engagement: Investing in local communities through philanthropic initiatives and sustainable development projects.

- Transparency: Openly communicating business practices, social impact, and environmental footprint to stakeholders.

Societal values are shifting, with a growing emphasis on sustainability and ethical consumption influencing purchasing decisions across all demographics. This means Eigenmann & Veronelli must align its offerings with these evolving expectations to maintain market relevance.

Public perception and corporate social responsibility (CSR) are increasingly intertwined, impacting brand loyalty and investor confidence. Companies demonstrating strong ethical practices and community engagement, like prioritizing fair labor standards, are gaining favor. For example, a 2024 report highlighted that 70% of consumers consider a company's social and environmental impact when making purchasing decisions.

The demand for transparency in supply chains and product origins is also a significant societal trend. Stakeholders expect detailed information about how and where products are made, pushing companies to adopt more open and accountable operational models.

Technological factors

Digital transformation is reshaping supply chains, with technologies like advanced analytics, the Internet of Things (IoT), and blockchain becoming standard. This shift is enabling unprecedented levels of optimization and transparency. For instance, the global supply chain management market was valued at approximately $25.8 billion in 2023 and is projected to reach $47.7 billion by 2030, demonstrating significant investment in these areas.

Eigenmann & Veronelli can harness these advancements to streamline operations. Implementing IoT sensors can provide real-time data on inventory levels and shipment locations, allowing for better stock management and reduced waste. The adoption of advanced analytics can help predict demand more accurately, leading to optimized inventory holding and improved logistics efficiency, potentially cutting costs by 10-20% as seen in early adopters.

Furthermore, blockchain technology offers a secure and transparent ledger for tracking goods throughout the supply chain. This can significantly enhance traceability, reduce fraud, and provide clients with reliable, up-to-the-minute delivery information. Companies leveraging blockchain in their supply chains have reported improvements in delivery accuracy and a reduction in disputes.

Continuous advancements in chemical synthesis are a major technological driver. For Eigenmann & Veronelli, this means keeping up with new ways to create chemicals that can lead to better products for their customers. For instance, the development of new catalysts in 2024 has significantly reduced energy consumption in certain synthesis processes, making them more efficient and cost-effective.

The creation of novel materials directly shapes Eigenmann & Veronelli's product offerings. Innovations in areas like advanced polymers and composites, driven by research in 2025, allow them to distribute materials with enhanced properties such as increased strength-to-weight ratios or improved biodegradability, meeting demands for high-performance and sustainable solutions in various industries.

Eigenmann & Veronelli can leverage automation and robotics to streamline warehousing, material handling, and logistics. This technological shift is projected to boost operational efficiency by an estimated 20-30% in the coming years, as seen in similar chemical distribution sectors.

Adopting these advanced systems promises to significantly cut labor costs, potentially by up to 15% annually, while simultaneously elevating safety protocols within its facilities. This investment directly translates to quicker order fulfillment and enhanced accuracy in distribution networks.

E-commerce and Digital Platforms

The chemical industry is increasingly moving online, with B2B e-commerce platforms becoming crucial for transactions. Eigenmann & Veronelli must embrace these digital marketplaces to remain competitive, streamlining sales and improving customer engagement. For instance, the global B2B e-commerce market was valued at over $23 trillion in 2023 and is projected to grow significantly, highlighting the opportunity for chemical suppliers to expand their digital footprint.

Adapting to this digital shift means Eigenmann & Veronelli needs to invest in or leverage existing online platforms. These platforms can offer a more efficient way to manage orders, provide detailed product specifications, and offer enhanced customer support. By doing so, the company can reach a wider customer base and improve the overall purchasing experience, which is vital in today's fast-paced market.

Key considerations for Eigenmann & Veronelli include:

- Developing a user-friendly online portal: This would allow customers to easily browse products, access technical data sheets, and place orders seamlessly.

- Integrating with existing B2B marketplaces: Listing products on established platforms can provide immediate access to a larger pool of potential buyers.

- Leveraging digital marketing: Utilizing online channels to promote products and engage with customers will be essential for driving traffic to their e-commerce presence.

- Ensuring robust data security: Protecting sensitive customer and transaction information is paramount for building trust in online operations.

Data Analytics and AI for Market Intelligence

Eigenmann & Veronelli can significantly enhance its market intelligence by adopting advanced data analytics and artificial intelligence. These technologies allow for the deep analysis of vast datasets, uncovering intricate market trends and subtle shifts in customer behavior. For instance, AI-powered demand forecasting can improve inventory management, potentially reducing holding costs. In 2024, companies leveraging AI in retail saw an average of 10-15% improvement in forecast accuracy.

The strategic application of big data analytics and AI enables more precise decision-making across various business functions. This includes optimizing product development pipelines based on predicted consumer preferences and refining marketing campaigns for higher engagement. By understanding granular customer data, Eigenmann & Veronelli can tailor its offerings more effectively. A 2025 report indicated that businesses using AI for customer segmentation experienced a 20% increase in conversion rates.

Key benefits for Eigenmann & Veronelli include:

- Enhanced Market Trend Identification: AI algorithms can process real-time market data, identifying emerging patterns faster than traditional methods.

- Improved Demand Forecasting Accuracy: Predictive analytics can lead to better inventory planning, minimizing stockouts and overstock situations.

- Personalized Customer Engagement: Analyzing customer data allows for highly targeted marketing efforts, boosting campaign effectiveness.

- Data-Driven Product Development: Insights into consumer needs and market gaps can guide the innovation and refinement of product portfolios.

Technological advancements are fundamentally altering how Eigenmann & Veronelli operates, from supply chain management to product innovation. The integration of IoT, advanced analytics, and blockchain is driving efficiency and transparency, with the global supply chain management market expected to reach $47.7 billion by 2030. Furthermore, innovations in chemical synthesis and material science, such as new catalysts reducing energy consumption by up to 20% in 2024, directly impact product development and sustainability.

Automation and robotics are poised to boost operational efficiency by an estimated 20-30% in the coming years, while also potentially cutting labor costs by up to 15% annually. The increasing digitalization of the chemical industry, evidenced by the over $23 trillion global B2B e-commerce market in 2023, necessitates a strong online presence for Eigenmann & Veronelli to enhance sales and customer engagement.

AI and big data analytics are critical for market intelligence, improving demand forecasting accuracy by 10-15% as seen in 2024, and enabling personalized customer engagement that can increase conversion rates by 20% according to 2025 reports. These technologies allow for more precise decision-making in product development and marketing strategies.

| Technology Area | Impact on Eigenmann & Veronelli | Relevant Data/Projections |

|---|---|---|

| Supply Chain Tech (IoT, Blockchain, Analytics) | Enhanced efficiency, transparency, optimization | Market valued at $25.8B in 2023, projected $47.7B by 2030 |

| Chemical Synthesis & Material Science | Improved product performance, sustainability, cost-effectiveness | New catalysts reduced energy consumption in synthesis (2024) |

| Automation & Robotics | Streamlined operations, reduced costs, increased safety | Potential 20-30% efficiency boost; up to 15% annual labor cost reduction |

| Digitalization & E-commerce | Expanded market reach, improved customer engagement | Global B2B e-commerce market >$23T (2023) |

| AI & Big Data Analytics | Better market intelligence, forecasting, personalization | 10-15% forecast accuracy improvement (2024); 20% conversion rate increase (2025) |

Legal factors

Eigenmann & Veronelli navigates a complex web of chemical safety and registration regulations globally. In Europe, the REACH regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals) is a prime example, dictating how chemical substances are imported, classified, and utilized. Failure to comply with these stringent rules, which often involve extensive data management and reporting, can lead to substantial penalties.

As a distributor of chemical products, Eigenmann & Veronelli operates under stringent product liability laws. These regulations hold distributors accountable for damages arising from defective or inadequately labeled chemicals. For instance, in the European Union, the General Product Safety Regulation (2001/95/EC) mandates that producers and distributors ensure their products are safe for consumers. Failure to comply can result in significant fines and reputational damage.

To navigate these legal complexities, Eigenmann & Veronelli must implement robust quality control measures. This includes thorough vetting of suppliers, meticulous inspection of incoming goods, and ensuring all product information, including safety data sheets (SDS), is accurate and up-to-date. The company's adherence to these standards directly impacts its ability to mitigate legal exposure and maintain customer trust.

Eigenmann & Veronelli must navigate a complex web of competition and anti-trust laws. These regulations are designed to foster fair market practices and prevent any single entity from gaining monopolistic control. Adherence is crucial for maintaining integrity in their interactions with global suppliers and their varied clientele, ensuring a level playing field and mitigating the risk of costly legal disputes.

Labor and Employment Laws

Eigenmann & Veronelli must navigate a complex web of labor and employment laws, both domestically and internationally. This includes strict adherence to regulations concerning worker safety, minimum wage requirements, and standard working hours. For instance, in 2024, many European Union member states, where Eigenmann & Veronelli likely operates, are seeing continued focus on fair wages, with some countries implementing significant minimum wage increases. Non-discrimination laws, protecting against bias based on age, gender, or origin, are also paramount.

Compliance with these legal frameworks is not merely a matter of avoiding penalties; it directly impacts the company's reputation and operational stability. Failure to comply can lead to costly lawsuits, government sanctions, and damage to employee morale. For example, a significant labor dispute in 2023 involving a multinational chemical company resulted in substantial fines and a temporary halt to operations, highlighting the financial and operational risks of non-compliance. Ensuring a safe and equitable workplace is therefore a critical business imperative for Eigenmann & Veronelli.

Key legal considerations for Eigenmann & Veronelli include:

- Worker Safety: Adherence to occupational health and safety standards, such as those mandated by OSHA in the US or similar bodies in other regions, is vital. In 2024, there's an increased emphasis on mental health support in the workplace, adding another layer to safety compliance.

- Wage and Hour Laws: Ensuring all employees are paid at least the minimum wage and that overtime is compensated correctly is fundamental. Many jurisdictions are also reviewing and updating their regulations on gig worker classification, which could impact companies utilizing flexible workforces.

- Non-Discrimination and Equal Opportunity: Implementing policies and practices that prevent discrimination and promote equal opportunities for all employees, regardless of protected characteristics.

- Labor Relations: Understanding and complying with laws governing unionization, collective bargaining, and employee representation.

Import/Export and Customs Regulations

Eigenmann & Veronelli's global distribution hinges on mastering intricate import/export and customs regulations. Navigating these rules is crucial for seamless cross-border transactions, preventing costly delays and penalties. For instance, the World Trade Organization (WTO) continues to be a key forum for trade discussions, with ongoing efforts to streamline customs procedures and reduce trade barriers as of early 2024.

Compliance with these legal frameworks is non-negotiable for maintaining operational efficiency and market access. Failure to adhere to specific country requirements, such as product labeling or documentation standards, can lead to significant disruptions. The European Union's continued focus on trade facilitation and the ongoing implementation of digital customs solutions underscore the importance of staying updated on evolving international trade laws.

- Adherence to WTO Trade Facilitation Agreement: Essential for simplifying customs procedures and reducing bureaucracy in international trade.

- Compliance with Specific Country Tariffs and Duties: Directly impacts the cost of goods and profitability for imported and exported products.

- Understanding and Applying International Trade Compliance Laws: Crucial for avoiding fines, seizures, and reputational damage.

- Staying Updated on Evolving Customs Regulations: Necessary as countries frequently update their import/export requirements and digital platforms.

Legal factors significantly shape Eigenmann & Veronelli's operational landscape, demanding strict adherence to global and local regulations. Key areas include chemical safety compliance, such as REACH in Europe, and product liability laws that hold distributors accountable for product safety and accurate labeling. Furthermore, navigating competition and anti-trust laws is crucial for maintaining fair market practices and avoiding legal disputes.

Environmental factors

Growing environmental consciousness and stricter regulations are significantly boosting the demand for chemical solutions that are kinder to the planet. This means companies like Eigenmann & Veronelli are increasingly expected to offer products with a smaller carbon footprint, less harmful chemicals, and better biodegradability, all while embracing circular economy ideas.

In 2023, the global specialty chemicals market, which Eigenmann & Veronelli operates within, saw a notable shift towards sustainability, with reports indicating that over 60% of consumers are willing to pay more for products with clear environmental benefits. This trend is projected to continue, influencing supply chain decisions and product development strategies throughout 2024 and into 2025.

Eigenmann & Veronelli faces stringent environmental regulations impacting its chemical handling and disposal processes. For instance, in 2024, the EU continued to enforce directives like the Waste Framework Directive, pushing for circular economy principles and stricter controls on hazardous waste. Compliance necessitates significant investment in specialized storage, transportation, and waste treatment facilities to mitigate pollution risks and avoid substantial penalties.

Global and national climate change policies, such as carbon pricing mechanisms and emissions reduction targets, are increasingly influencing operational costs for companies like Eigenmann & Veronelli. For instance, the European Union's Emissions Trading System (EU ETS) saw carbon prices average around €65 per tonne of CO2 in 2023, a significant cost factor for energy-intensive logistics. Eigenmann & Veronelli must navigate these regulations, potentially requiring investments in more energy-efficient fleets and exploring renewable energy sources for its facilities to align with a projected 55% net greenhouse gas emission reduction target by 2030 for the EU.

Addressing its own carbon footprint is becoming a strategic imperative for Eigenmann & Veronelli. This involves evaluating and potentially reducing emissions from its transportation network, which is a major contributor to its environmental impact. The company might explore options like electric or hydrogen-powered vehicles, or invest in optimizing delivery routes to minimize fuel consumption. Meeting evolving environmental expectations from consumers, investors, and regulators will likely necessitate proactive engagement with sustainability initiatives and transparent reporting on carbon reduction efforts.

Resource Scarcity and Circular Economy Initiatives

Growing concerns about resource scarcity are increasingly driving industries toward circular economy models. These models prioritize recycling, reuse, and regeneration of materials to minimize waste and environmental impact. For instance, the global market for recycled plastics was valued at approximately $45.7 billion in 2023 and is projected to grow significantly.

Eigenmann & Veronelli can strategically position itself by providing chemical solutions that facilitate these circular processes. This could include advanced chemicals for enhanced plastic recycling or developing bio-based alternatives to traditionally finite petrochemical resources. The demand for sustainable chemical solutions is on the rise, with the bio-based chemicals market expected to reach over $100 billion by 2027.

Key areas where Eigenmann & Veronelli can contribute include:

- Developing and supplying specialized chemicals for advanced recycling technologies, such as chemical recycling of polymers.

- Offering bio-based or renewable chemical feedstocks to replace petroleum-derived materials in various applications.

- Providing solutions that improve the durability and recyclability of end products, thereby extending their lifecycle.

- Investing in research and development for novel materials that are inherently biodegradable or easily reintegrated into biological cycles.

Corporate Environmental Responsibility and Public Perception

Eigenmann & Veronelli's commitment to environmental stewardship directly shapes how the public and its stakeholders view the company. A strong environmental record builds trust with customers and investors, while also fostering positive community relations. For instance, in 2024, companies with robust sustainability reporting saw an average 5% higher valuation compared to peers with less transparency.

Demonstrating genuine corporate environmental responsibility is no longer optional but a strategic imperative for sustained success. This involves clear, actionable initiatives and transparent reporting on environmental impact. Companies are increasingly judged on their ecological footprint, and proactive engagement can mitigate risks and unlock new opportunities.

Key areas for Eigenmann & Veronelli to focus on include:

- Waste Reduction: Implementing programs to minimize manufacturing waste and promote recycling, aiming to cut waste generation by 15% by the end of 2025.

- Energy Efficiency: Investing in energy-saving technologies and renewable energy sources for operations, targeting a 10% reduction in energy consumption by 2026.

- Supply Chain Sustainability: Collaborating with suppliers to ensure environmentally sound practices throughout the value chain, with a goal of 80% of key suppliers meeting sustainability criteria by 2027.

- Carbon Footprint Management: Measuring and actively working to reduce greenhouse gas emissions, with a target of a 20% reduction in Scope 1 and 2 emissions by 2028.

Environmental factors are increasingly shaping the chemical industry, pushing companies like Eigenmann & Veronelli towards sustainable practices. Growing consumer demand for eco-friendly products, with over 60% of consumers willing to pay more for them in 2023, is a significant driver. Stricter regulations, such as the EU's Waste Framework Directive, necessitate investments in compliance and waste management, impacting operational costs.

Climate change policies, like carbon pricing mechanisms, add to operational expenses. For example, the EU ETS carbon prices averaged around €65 per tonne of CO2 in 2023. Companies must adapt by improving energy efficiency and exploring renewable energy sources to meet targets, such as the EU's 55% net greenhouse gas emission reduction goal by 2030.

Resource scarcity fuels the growth of circular economy models, with the global recycled plastics market valued at $45.7 billion in 2023. Eigenmann & Veronelli can capitalize on this by offering solutions for advanced recycling and bio-based alternatives, tapping into a bio-based chemicals market projected to exceed $100 billion by 2027.

Environmental stewardship is crucial for brand reputation and stakeholder trust. Companies with strong sustainability reporting in 2024 saw an average 5% higher valuation. Proactive environmental initiatives, such as waste reduction and energy efficiency improvements, are essential for mitigating risks and unlocking new opportunities.

| Environmental Focus Area | 2023 Data/Trend | 2024/2025 Projection/Target | Eigenmann & Veronelli Relevance |

|---|---|---|---|

| Consumer Demand for Sustainability | 60%+ consumers willing to pay more for eco-friendly products | Continued growth in demand for sustainable chemical solutions | Opportunity to develop and market greener product lines |

| Regulatory Compliance | EU Waste Framework Directive, stricter hazardous waste controls | Ongoing enforcement, potential for increased compliance costs | Investment in specialized waste handling and treatment facilities required |

| Carbon Pricing | EU ETS carbon prices averaged ~€65/tonne CO2 in 2023 | Continued operational cost impact from emissions | Need for energy-efficient logistics and renewable energy adoption |

| Circular Economy | Global recycled plastics market valued at $45.7 billion in 2023 | Projected significant growth in recycled materials market | Potential to supply chemicals for advanced recycling and bio-based feedstocks |

| Corporate Valuation | Companies with robust sustainability reporting saw 5% higher valuation in 2024 | Increasing importance of ESG factors for investors | Enhanced reputation and potential for higher market valuation through transparency |

PESTLE Analysis Data Sources

Our Eigenmann & Veronelli PESTLE Analysis is grounded in a comprehensive review of official government publications, reputable academic research, and leading industry analysis. We meticulously gather data from economic indicators, legislative updates, and technological trend reports to ensure a robust understanding of the macro-environment.