Eigenmann & Veronelli Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eigenmann & Veronelli Bundle

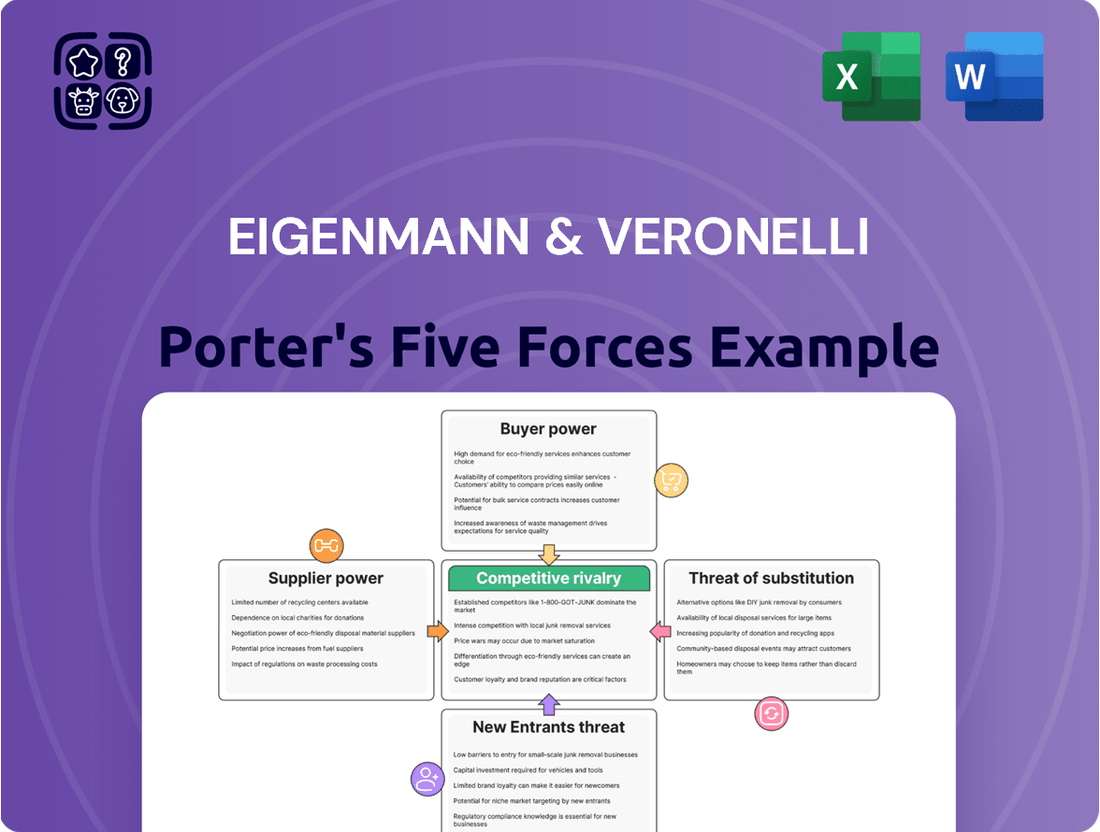

Eigenmann & Veronelli navigates a competitive landscape shaped by powerful buyer bargaining and the looming threat of substitutes. Understanding these forces is crucial for any strategic decision.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Eigenmann & Veronelli’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of specialized chemical raw materials wield considerable bargaining power over Eigenmann & Veronelli. This stems from the unique nature of their products, often essential inputs for diverse industrial applications, leaving limited readily available alternatives for the distributor.

The scarcity of substitute chemical compositions directly translates into suppliers dictating terms, potentially leading to increased procurement costs for Eigenmann & Veronelli. For instance, in 2024, the global chemical industry experienced supply chain disruptions impacting key raw materials, with some specialty chemicals seeing price hikes of up to 15% due to geopolitical factors and increased demand.

The bargaining power of suppliers in the chemical industry, including for companies like Eigenmann & Veronelli, is significantly influenced by the volatility of raw material prices. This volatility, often driven by global economic shifts and supply chain disruptions, can grant suppliers considerable leverage.

Geopolitical tensions and increasingly stringent environmental regulations, especially in key manufacturing hubs like China, further amplify supplier power. These factors can lead to reduced export capacities and instability in supply chains, allowing suppliers to dictate terms and prices to distributors.

While manufacturers increasingly lean on distributors for outsourced services, this reliance is tempered by a strategic push for diversified supplier bases. This diversification aims to mitigate supply chain risks, potentially lessening the leverage of any single supplier if alternative sources for comparable products are readily available. In 2024, for instance, the global chemical distribution market, a key sector for many manufacturers, saw continued consolidation, yet many large chemical producers maintained multiple distribution partners to ensure market reach and price negotiation flexibility.

Supplier Power 4

Suppliers are increasingly demanding more from chemical distributors, seeking partners who offer specialized services beyond basic logistics. This includes a need for technical support and value-added solutions tailored to specific industry needs. For instance, in 2024, the global chemical distribution market saw a growing emphasis on digital integration and customized product blending, with distributors investing heavily in these areas to meet supplier expectations.

Distributors like Eigenmann & Veronelli that proactively offer these comprehensive services can cultivate more robust and strategic relationships with their suppliers. By providing technical expertise, market insights, and customized solutions, such as formulation assistance or regulatory guidance, these distributors can effectively mitigate the suppliers’ inherent bargaining power. This shift allows for a more balanced partnership, where value creation extends beyond simple product delivery.

- Increased Demand for Value-Added Services: Suppliers are prioritizing distributors offering technical support, market intelligence, and custom solutions.

- Eigenmann & Veronelli's Strategic Approach: By providing these comprehensive services, the company can build stronger supplier partnerships.

- Mitigating Supplier Power: Offering specialized expertise and integrated solutions helps to balance the bargaining power dynamic.

- Market Trends in 2024: The chemical distribution sector saw significant investment in digital platforms and bespoke blending services to meet evolving supplier demands.

Supplier Power 5

Consolidation within the chemical industry, a trend observed throughout 2024, has significantly bolstered the bargaining power of suppliers like those serving Eigenmann & Veronelli. Major chemical producers have been actively engaging in mergers and acquisitions, creating larger, more dominant entities. This concentration means fewer, but more powerful, suppliers are interacting with distributors.

These larger chemical conglomerates can wield considerable influence over pricing, production output, and the very channels through which their products reach the market. For distributors, especially smaller or less specialized ones, this translates into a tougher negotiating stance from suppliers. For instance, in 2024, reports indicated that the top 10 global chemical companies controlled a larger market share than in previous years, directly impacting their ability to dictate terms.

- Increased Supplier Leverage: Mergers and acquisitions in the chemical sector have led to fewer, larger suppliers, enhancing their negotiating strength.

- Pricing and Volume Control: Dominant suppliers can more effectively dictate pricing and manage production volumes, impacting distributor margins.

- Distribution Channel Influence: Larger suppliers may exert greater control over how their products are distributed, potentially limiting options for smaller players.

- 2024 Market Dynamics: The trend of consolidation continued in 2024, with major chemical firms solidifying their market positions and supplier power.

The bargaining power of suppliers for Eigenmann & Veronelli is substantial, driven by the specialized nature of chemical inputs and limited alternatives. This leverage allows suppliers to influence pricing and terms, as seen in 2024 when supply chain disruptions led to price increases of up to 15% for certain specialty chemicals.

Geopolitical factors and stricter environmental regulations, particularly from regions like China, further empower suppliers by potentially reducing export capacity and creating supply instability. This situation grants them greater control over pricing and distribution agreements.

Consolidation within the chemical industry in 2024 has concentrated power among fewer, larger suppliers. These dominant entities can dictate terms more effectively, impacting distributor margins and market access, with the top 10 global chemical companies increasing their market share.

| Factor | Impact on Eigenmann & Veronelli | 2024 Trend/Data |

|---|---|---|

| Specialized Inputs | Limited substitutes increase supplier leverage | N/A (inherent characteristic) |

| Supply Chain Disruptions | Price volatility and limited availability | Up to 15% price hikes for specialty chemicals |

| Geopolitical/Regulatory Factors | Reduced export capacity, supply instability | Increased supplier control due to global factors |

| Industry Consolidation | Fewer, larger suppliers with greater market power | Top 10 chemical companies increased market share |

What is included in the product

This analysis meticulously examines the competitive forces impacting Eigenmann & Veronelli, providing strategic insights into industry structure and profitability.

Instantly assess competitive intensity with a visual breakdown of each force—eliminating the guesswork in strategic planning.

Customers Bargaining Power

Eigenmann & Veronelli's diverse customer base across food, pharmaceuticals, cosmetics, and industrial sectors significantly tempers buyer power. This fragmentation means the company isn't overly dependent on any single customer or industry, reducing the leverage any one buyer holds. In 2024, with continued demand across these varied manufacturing segments, this diversification remains a key strength.

Customers in the chemical distribution sector are increasingly seeking customized solutions, expert technical assistance, and additional services beyond basic product delivery. This shift means that buyers are not just looking for chemicals, but for a complete package of support.

Eigenmann & Veronelli’s strategic emphasis on offering this specialized support and a broad range of products helps to mitigate customer power. By investing in tailored services and building strong client relationships, the company can increase the costs and complexities for customers looking to switch to a competitor, thereby solidifying its market position.

The increasing consumer emphasis on sustainability is significantly boosting the bargaining power of customers in the chemical distribution sector. As demand for eco-friendly chemicals grows, buyers can leverage this preference to negotiate better terms, pushing distributors like Eigenmann & Veronelli to prioritize greener product offerings and more sustainable operational practices.

Buyer Power 4

Economic pressures and sluggish demand in sectors like automotive, construction, and consumer goods significantly amplify customer bargaining power. For instance, a slowdown in new vehicle production in 2024 could lead automotive manufacturers to demand steeper discounts from distributors. This weak demand environment forces customers to push for lower prices or more favorable payment terms, directly squeezing distributor margins.

This increased leverage can manifest in several ways for customers:

- Price Sensitivity: When demand is low, customers are more likely to shop around and switch suppliers for even minor price differences.

- Bulk Purchasing Power: Larger customers, especially those facing their own demand challenges, can leverage their volume to negotiate better deals.

- Threat of Backward Integration: In some industries, large customers might consider producing components themselves if supplier terms become unfavorable.

- Information Availability: Increased transparency in pricing and product specifications online empowers customers to make more informed purchasing decisions and negotiate from a stronger position.

Buyer Power 5

The bargaining power of customers within the chemical distribution sector, particularly for commodity chemicals, is significantly influenced by the sheer number of available distributors. This abundance of choice empowers buyers, as they can readily compare pricing, product availability, and service levels from various suppliers to negotiate the most advantageous terms. For instance, in 2024, the global chemical distribution market was valued at approximately $390 billion, with a substantial portion comprised of commodity chemicals where price sensitivity is high.

Customers leverage this competitive landscape to their advantage. They can easily obtain quotes from multiple distributors, putting pressure on individual firms to offer competitive pricing and enhanced service packages to retain business. This dynamic is especially pronounced for large-volume purchasers who have the scale to negotiate substantial discounts and favorable payment terms.

Key factors contributing to customer bargaining power include:

- Availability of Substitutes: For many commodity chemicals, alternative suppliers are readily accessible, reducing switching costs for customers.

- Price Sensitivity: When the cost of chemicals represents a significant portion of a customer's overall expenses, they are more motivated to seek the lowest prices.

- Information Availability: Market transparency, facilitated by online platforms and industry reports, allows customers to easily benchmark prices and services.

Eigenmann & Veronelli's diverse customer base across multiple sectors, including food, pharmaceuticals, and industrial applications, helps to dilute individual customer bargaining power. However, economic downturns and a high number of distributors for commodity chemicals in 2024, a market valued at approximately $390 billion, empower buyers to negotiate for lower prices and better terms.

Customers are increasingly demanding customized solutions and sustainability, which can shift leverage towards them if not adequately addressed. For instance, a slowdown in automotive manufacturing in 2024 would intensify price sensitivity for chemical suppliers. This heightened price sensitivity, coupled with greater information availability, allows buyers to effectively compare offerings and secure more favorable deals.

| Factor | Impact on Customer Bargaining Power | Example (2024 Context) |

|---|---|---|

| Customer Diversification | Lowers individual customer power | Eigenmann & Veronelli serving food, pharma, and industrial sectors |

| Market Saturation (Distributors) | Increases customer power for commodity chemicals | High number of distributors in the ~$390 billion global chemical distribution market |

| Economic Slowdown | Increases customer power (price sensitivity) | Automotive sector demanding steeper discounts due to reduced production |

| Demand for Customization/Sustainability | Can increase customer power if not met | Customers leveraging preference for eco-friendly chemicals to negotiate terms |

Preview Before You Purchase

Eigenmann & Veronelli Porter's Five Forces Analysis

This preview showcases the complete Eigenmann & Veronelli Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The global chemical distribution market is indeed a dynamic arena. With a projected growth trajectory, it's no surprise that competition is heating up. For instance, the market was valued at approximately $1.5 trillion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of around 5% through 2030, according to industry reports from early 2024. This expansion naturally draws more attention and investment, leading existing companies to adopt more aggressive strategies to capture a larger slice of this growing pie.

The chemical distribution market, while historically fragmented, is witnessing significant consolidation. Major global players such as Brenntag, Univar Solutions, and IMCD are actively engaged in mergers and acquisitions, creating larger entities with increased market power. For instance, Brenntag completed several acquisitions in 2023 and early 2024, expanding its reach in specialty chemicals. This trend intensifies rivalry as these dominant players can leverage economies of scale, broader product portfolios, and enhanced logistical capabilities, putting pressure on smaller, independent distributors.

Eigenmann & Veronelli's dominant standing in Italy and significant presence in Iberia, Turkey, and the MEA region, reaching over 45 countries, provides a strong competitive advantage. However, this strategic positioning doesn't insulate them entirely, as they contend with other substantial regional and global chemical distributors who also possess extensive networks and a broad product portfolio.

Competitive Rivalry 4

Competitive rivalry within the chemical distribution sector, particularly for companies like Eigenmann & Veronelli, is intense. Success hinges on differentiating through more than just product availability. This means offering significant value-added services, leveraging deep technical expertise, and possessing specialized knowledge that clients can't easily replicate.

Companies that can provide tailored solutions, robust technical support, and navigate complex regulatory landscapes effectively are best positioned to thrive. For instance, in 2024, the demand for specialized chemical formulations in industries like pharmaceuticals and advanced materials continued to grow, rewarding distributors with strong R&D support and application knowledge.

- Value-Added Services: Offering custom blending, just-in-time delivery, and inventory management solutions.

- Technical Expertise: Providing in-depth product knowledge, formulation assistance, and troubleshooting.

- Specialized Knowledge: Understanding niche market needs and regulatory compliance for specific industries.

- Customer Relationships: Building strong partnerships through reliability and responsive support.

Competitive Rivalry 5

Technological advancements and digitalization are significantly reshaping the chemical distribution landscape, influencing how efficiently companies operate and how transparent their processes are. This shift demands continuous innovation from all participants to stay relevant.

Competitors are actively investing in digital platforms for critical functions like inventory management, order processing, and customer interaction. For instance, in 2024, many chemical distributors are rolling out enhanced e-commerce capabilities and AI-driven forecasting tools to streamline operations and improve customer experience.

- Digital Transformation Investments: Companies are allocating substantial capital to digital infrastructure, aiming to improve operational efficiency and customer engagement.

- Platform Competition: The development and adoption of digital platforms for sales, logistics, and data analytics are becoming key battlegrounds for market share.

- Need for Innovation: Failure to adapt to these digital trends can lead to a loss of competitive edge, impacting market position and profitability.

Competitive rivalry in chemical distribution is fierce, driven by a growing market and consolidation among major players. Companies like Brenntag and Univar Solutions are expanding through acquisitions, increasing pressure on smaller distributors.

To stand out, distributors must offer more than just products; value-added services, deep technical expertise, and specialized market knowledge are crucial differentiators. For example, in 2024, demand for specialized chemical formulations in high-growth sectors like pharmaceuticals fueled the need for distributors with strong application support.

Digitalization is also a key battleground, with companies investing in e-commerce and AI-driven tools to enhance efficiency and customer experience. Staying ahead requires continuous innovation in both service offerings and technological adoption.

| Key Competitors | Market Presence | Key Strategies |

| Brenntag | Global leader | Acquisitions, specialty chemicals focus |

| Univar Solutions | Global leader | Digitalization, sustainability initiatives |

| IMCD | Global leader | Specialty chemicals, technical expertise |

| Eigenmann & Veronelli | Italy, Iberia, Turkey, MEA | Value-added services, regional strength |

SSubstitutes Threaten

For Eigenmann & Veronelli's specialized chemical raw materials, the threat of substitutes is generally low. This is primarily because many manufacturing processes are built around very specific chemical compositions, making it difficult for customers to switch to entirely different product categories without significant retooling or a complete overhaul of their production methods.

For instance, in the realm of performance coatings, a specific epoxy resin might be crucial for achieving particular durability and adhesion properties. Finding a direct substitute that offers the same performance profile without altering the entire formulation and application process is often impractical, thus reinforcing Eigenmann & Veronelli's market position.

The growing emphasis on sustainability and green chemistry is spurring innovation in bio-based chemicals and alternative product designs. These eco-friendly options represent a potential long-term challenge, as they could displace conventional petroleum-based chemicals. For instance, the global bio-based chemicals market was valued at approximately $250 billion in 2023 and is projected to reach over $400 billion by 2030, indicating a significant shift towards these alternatives.

Large industrial customers with significant volume requirements for commodity chemicals may explore direct sourcing from manufacturers, effectively bypassing distributors. This direct procurement represents a substitute for the distribution services Eigenmann & Veronelli provides, particularly when the value-added services offered by distributors are less critical to the transaction. For instance, in 2024, the global chemical distribution market was valued at approximately $210 billion, with a notable portion attributed to commodity chemicals where price sensitivity is high.

4

The threat of substitutes for Eigenmann & Veronelli is influenced by how advancements in manufacturing or new product development in customer industries can lessen the reliance on their chemical inputs. For instance, a breakthrough in biodegradable packaging could reduce the demand for certain polymers that Eigenmann & Veronelli supplies. This dynamic means distributors must remain agile, constantly monitoring industry shifts and broadening their product portfolios to mitigate the impact of these innovations.

Consider the automotive sector, a key market for many chemical distributors. As electric vehicles (EVs) gain traction, the demand for specific chemicals used in internal combustion engine components may decline. In 2024, EV sales were projected to reach over 16 million units globally, a significant increase from previous years. This trend highlights the need for distributors like Eigenmann & Veronelli to explore supplying chemicals for battery production or lightweight materials, which are crucial for EV efficiency.

The threat is not just about entirely new products but also about improved versions of existing ones. For example, if a new, more efficient catalyst is developed for a chemical process currently relying on a product distributed by Eigenmann & Veronelli, that could represent a significant substitution.

- Manufacturing Innovations: New processes might bypass the need for specific chemical intermediates.

- Product Redesign: End-user products could be re-engineered to use fewer or different chemical inputs.

- Material Science Breakthroughs: Development of novel materials can replace traditional chemical components.

- Sustainability Drivers: Growing demand for eco-friendly alternatives can lead to substitutions away from conventional chemicals.

5

The threat of substitutes for Eigenmann & Veronelli is moderate. Large chemical companies, a key supplier base, possess substantial in-house production capabilities. For instance, major players in the chemical industry often invest heavily in backward integration to control their supply chains. This means they could potentially produce chemicals they previously sourced externally or distribute directly to end-customers, bypassing third-party distributors like Eigenmann & Veronelli.

This trend of backward integration is a significant factor. In 2024, several large chemical conglomerates announced or completed significant vertical integration projects, aiming to capture more value and reduce reliance on intermediaries. For example, BASF’s ongoing investments in its Verbund sites aim to optimize its entire value chain, potentially reducing the need for external distribution partners for certain product lines.

The ability of these large chemical producers to directly reach customers or manufacture their own distribution networks presents a direct substitute for Eigenmann & Veronelli's core business. This could lead to:

- Reduced demand for distribution services from Eigenmann & Veronelli as suppliers bring distribution in-house.

- Increased price pressure on distribution fees as suppliers have alternative, self-managed channels.

- Potential disintermediation where Eigenmann & Veronelli is cut out of the supply chain for specific chemicals or customer segments.

- The need for Eigenmann & Veronelli to differentiate by offering value-added services beyond basic logistics to remain competitive.

The threat of substitutes for Eigenmann & Veronelli is moderate, driven by customer innovation and evolving industry needs. For instance, the push towards electric vehicles in 2024, with global sales projected to exceed 16 million units, reduces demand for chemicals tied to internal combustion engines, necessitating a pivot to EV-related materials.

Furthermore, the burgeoning bio-based chemicals market, valued at approximately $250 billion in 2023 and set to surpass $400 billion by 2030, presents a significant substitution threat to conventional petroleum-based products. This shift underscores the need for distributors to adapt their portfolios to greener alternatives.

The direct sourcing of commodity chemicals by large industrial customers also acts as a substitute for distribution services, particularly where value-added offerings are minimal. The global chemical distribution market, valued at around $210 billion in 2024, sees price-sensitive commodity segments vulnerable to this disintermediation.

| Substitution Threat Factor | Description | Impact on Eigenmann & Veronelli |

|---|---|---|

| Manufacturing Innovations | New processes may eliminate the need for specific chemical intermediates. | Reduced demand for certain product lines. |

| Product Redesign | End-user products re-engineered to use fewer or different chemical inputs. | Potential loss of market share if key products are impacted. |

| Material Science Breakthroughs | Novel materials replace traditional chemical components. | Necessitates portfolio diversification and adoption of new materials. |

| Sustainability Drivers | Demand for eco-friendly alternatives displaces conventional chemicals. | Opportunity to expand into bio-based and sustainable chemical offerings. |

| Direct Sourcing (Commodities) | Large customers bypass distributors for high-volume commodity chemicals. | Pressure on margins and need to emphasize value-added services. |

Entrants Threaten

The threat of new entrants in the chemical distribution sector, particularly for a company like Eigenmann & Veronelli, is generally moderate to low. This is largely due to the substantial capital required to establish the necessary infrastructure. Think about the specialized warehouses, extensive logistics networks, and dedicated transportation fleets needed to handle chemicals safely and efficiently. For instance, building a new, compliant chemical distribution center can easily run into tens of millions of dollars, a significant hurdle for newcomers.

The chemical industry, particularly for specialized players like Eigenmann & Veronelli, faces substantial barriers to entry due to rigorous regulatory landscapes. New companies must navigate complex environmental, health, and safety (EHS) regulations, which require significant upfront investment in compliance systems and specialized personnel. For instance, adhering to REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe alone can cost millions of euros for new chemical substances.

New companies entering the chemical distribution market face significant hurdles in establishing the deep-rooted networks and trust that Eigenmann & Veronelli has cultivated over a century. Building relationships with global chemical producers, who often prefer established, reliable partners, takes considerable time and effort. Furthermore, securing a diverse industrial client base, each with unique needs and rigorous vetting processes, presents another substantial barrier.

4

The threat of new entrants for Eigenmann & Veronelli is relatively low. This is primarily due to the significant investment required in specialized knowledge, application expertise, and technical laboratories. Establishing these capabilities is both time-consuming and expensive, creating a substantial barrier for potential newcomers.

Furthermore, the necessity of providing tailored solutions, robust technical support, and a broad spectrum of value-added services makes it challenging for new players to compete effectively. Companies like Eigenmann & Veronelli have built long-standing relationships and a reputation for service that new entrants would struggle to replicate quickly.

- High Capital Investment: The need for specialized technical labs and R&D facilities requires substantial upfront capital.

- Technical Expertise: Developing deep application knowledge and specialized skills takes years of experience and training.

- Customer Relationships: Established trust and long-term partnerships are difficult for new entrants to penetrate.

- Value-Added Services: Offering comprehensive support and customized solutions demands significant operational infrastructure.

5

The threat of new entrants in the chemical distribution sector, particularly for a company like Eigenmann & Veronelli, is currently moderate. Ongoing consolidation among established chemical distributors and the formation of strategic partnerships by major players are significantly increasing the barriers to entry. For instance, in 2024, several mid-sized distributors merged, creating larger entities with enhanced bargaining power and broader geographic reach.

Larger, integrated players in the chemical distribution market can achieve greater economies of scale, which allows them to offer more competitive pricing. They also tend to provide a more comprehensive suite of services, from logistics and technical support to regulatory compliance, making it difficult for smaller, newly formed companies to match their offerings. This market power makes it considerably harder for new entrants to carve out a significant market share.

The capital required to establish a robust chemical distribution network, including warehousing, transportation fleets, and inventory management systems, is substantial. Furthermore, securing reliable supply agreements with major chemical manufacturers often favors established players with proven track records and significant order volumes. These factors collectively create a considerable hurdle for potential new competitors.

Key factors influencing the threat of new entrants include:

- Capital Requirements: High initial investment needed for infrastructure and operations.

- Economies of Scale: Established players benefit from cost advantages due to larger operational volumes.

- Brand Loyalty and Reputation: Existing customer relationships and trust are difficult for new entrants to replicate.

- Regulatory Hurdles: Compliance with safety, environmental, and transportation regulations can be complex and costly.

The threat of new entrants for Eigenmann & Veronelli remains largely moderate due to significant capital requirements and established customer relationships. The chemical distribution industry demands substantial investment in specialized infrastructure, including compliant warehousing and logistics, which can easily cost tens of millions of dollars. Furthermore, building the deep-rooted trust and supply chain networks that Eigenmann & Veronelli possesses takes years, posing a considerable challenge for newcomers attempting to gain traction.

Regulatory complexity and the need for specialized technical expertise further deter new entrants. Navigating stringent environmental, health, and safety regulations, such as REACH, requires significant upfront investment and specialized personnel, with compliance costs for new chemical substances potentially reaching millions of euros. Additionally, developing the application knowledge and value-added services that clients expect, like tailored solutions and robust technical support, is a time-consuming and expensive endeavor.

Market consolidation in 2024, with several mid-sized distributors merging, has amplified economies of scale for larger players, increasing price competitiveness and service comprehensiveness. This makes it harder for new, smaller entities to match the integrated offerings and established supplier agreements that favor incumbent firms, thereby raising the barriers to entry for potential competitors.

| Barrier Type | Description | Estimated Cost/Timeframe |

|---|---|---|

| Capital Investment | Specialized warehousing, logistics, transportation fleets | Tens of millions of dollars for a new facility |

| Regulatory Compliance | EHS, REACH, transportation safety regulations | Millions of euros for new chemical substances |

| Technical Expertise | Application knowledge, R&D, specialized labs | Years of experience and significant training investment |

| Customer Relationships | Building trust with suppliers and industrial clients | Years of consistent service and relationship management |

| Economies of Scale | Cost advantages from larger operational volumes | Achieved through market share and consolidation |

Porter's Five Forces Analysis Data Sources

Our Eigenmann & Veronelli Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and financial databases to provide a comprehensive view of the competitive landscape.