Eicher Motors Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eicher Motors Bundle

Eicher Motors faces moderate bargaining power from buyers due to product differentiation in the commercial vehicle segment, but intense competition from established players like Tata Motors and Ashok Leyland. The threat of new entrants is somewhat mitigated by high capital requirements and established brand loyalty.

The complete report reveals the real forces shaping Eicher Motors’s industry—from supplier influence to substitute threats. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Eicher Motors faces potential supplier leverage when its critical components, like specialized engine parts for Royal Enfield or advanced chassis systems for Volvo trucks, are sourced from a limited number of providers. This concentration means these suppliers hold considerable sway over pricing and terms, directly affecting Eicher's cost structure and production continuity.

For instance, the automotive industry often relies on a few key manufacturers for advanced electronics or high-performance engine components. If Eicher Motors finds itself dependent on such specialized suppliers, their ability to dictate terms increases, especially if switching to alternatives involves substantial re-tooling or qualification costs, impacting Eicher's operational agility and profitability.

Suppliers offering unique or proprietary inputs, like advanced engine technologies or specialized component designs, hold significant sway. Eicher Motors' ability to negotiate is diminished if these critical components are essential for its product's performance and quality, and few substitutes exist. For instance, if a key supplier provides a patented emission control system vital for meeting stringent regulatory standards, Eicher would have limited options.

For Eicher Motors, high switching costs from existing suppliers significantly bolster supplier bargaining power. If Eicher faces substantial expenses for re-tooling manufacturing lines, re-designing components to fit new supplier specifications, or the lengthy process of re-qualifying new suppliers, its ability to negotiate favorable terms is diminished. These embedded costs effectively lock Eicher into current supplier relationships, reducing their leverage.

Supplier's Ability to Forward Integrate

Should a supplier possess the capability or pose a threat to forward integrate, meaning they could potentially begin manufacturing and selling similar motorcycles or commercial vehicles themselves, their bargaining power would increase substantially. This looming threat would compel Eicher Motors to cultivate strong relationships and favorable terms with such suppliers to preempt direct competition.

For instance, a key component supplier for Eicher's Royal Enfield motorcycles, if capable of producing entire bikes, could leverage this potential to negotiate better pricing or terms. The risk of Eicher facing a new, established competitor with deep supply chain knowledge would be significant.

- Supplier Forward Integration Threat: If a supplier can start producing Eicher's products, their power increases.

- Eicher's Response: Eicher must maintain good supplier relations to avoid this competition.

- Impact on Eicher: Increased costs or unfavorable terms could result if suppliers gain this leverage.

Importance of Eicher Motors to the Supplier

Eicher Motors' significance as a customer directly influences its bargaining power with suppliers. If Eicher represents a substantial portion of a supplier's sales, that supplier is more likely to offer favorable pricing and terms to retain Eicher's business. Conversely, if Eicher is a minor client for a supplier, the supplier holds greater leverage.

For instance, in 2023, Eicher Motors' total procurement spend across its automotive segments, including Royal Enfield and VECV, would have been a key metric for suppliers. A supplier whose revenue is heavily reliant on Eicher would be more amenable to negotiation than one for whom Eicher constitutes a small fraction of their overall customer base.

- Eicher's Revenue Contribution: Suppliers whose revenue is significantly driven by Eicher Motors are likely to have less bargaining power.

- Supplier Dependence: If Eicher Motors accounts for a large percentage of a supplier's total sales, the supplier will be more accommodating.

- Market Concentration: The number of alternative suppliers available for critical components impacts Eicher's leverage.

- Supplier Profitability: A supplier with thin profit margins might be less willing to negotiate than a more profitable one.

Eicher Motors' bargaining power with suppliers is influenced by the concentration of suppliers for critical components. When few suppliers can provide specialized parts, such as advanced engine technologies for Royal Enfield or specific chassis components for VECV trucks, these suppliers gain significant leverage over pricing and terms. This dependency can lead to increased costs for Eicher, impacting its profitability and operational flexibility. For instance, the availability of high-performance, proprietary engine parts often rests with a limited number of manufacturers, giving them a strong negotiating position.

High switching costs for Eicher Motors further amplify supplier bargaining power. If transitioning to a new supplier involves substantial investments in re-tooling, component redesign, or lengthy qualification processes, Eicher's ability to negotiate favorable terms is reduced. This situation effectively locks Eicher into existing supplier relationships. For example, in 2023, the automotive industry saw continued reliance on specialized electronic component suppliers, where re-qualifying for new systems could take over a year and incur significant R&D expenses.

The threat of supplier forward integration also plays a role in supplier leverage. If a supplier has the potential to enter Eicher's market by producing motorcycles or commercial vehicles, they can use this as a bargaining chip. This means Eicher must maintain strong relationships and favorable terms to deter direct competition. For example, a supplier of critical engine parts for Royal Enfield might leverage its knowledge and capabilities to consider producing its own motorcycles, thereby increasing its power over Eicher.

Eicher Motors' position as a customer also shapes its negotiation strength. If Eicher constitutes a significant portion of a supplier's revenue, the supplier is more inclined to offer better pricing and terms to retain its business. Conversely, if Eicher is a minor client, the supplier holds more sway. For instance, Eicher Motors' substantial procurement spend in 2023 across its brands would have been a key factor for its suppliers, with those heavily reliant on Eicher likely to be more accommodating in negotiations.

What is included in the product

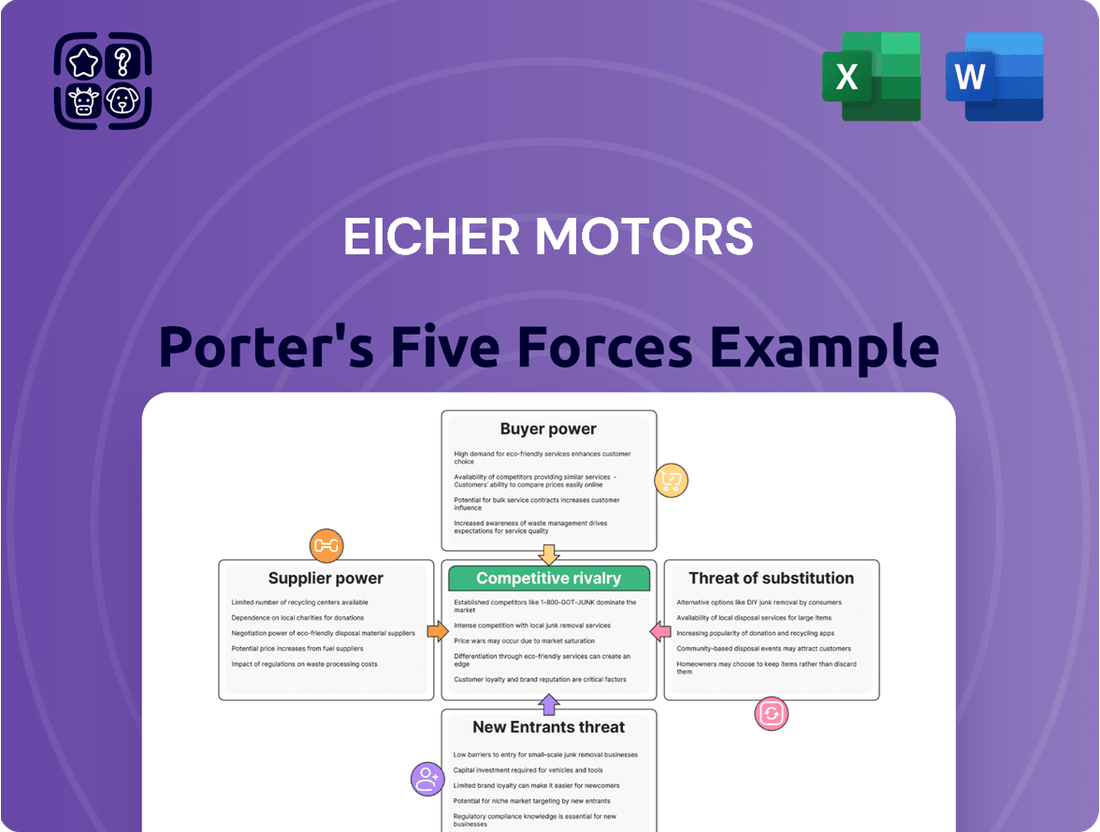

This analysis delves into the competitive forces impacting Eicher Motors, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the commercial vehicle and motorcycle segments.

Instantly assess competitive intensity across Eicher Motors' Porter's Five Forces, revealing key pressure points to strategically mitigate risks.

Customers Bargaining Power

The bargaining power of customers for Eicher Motors, particularly within its Royal Enfield motorcycle segment, is generally low due to the fragmented nature of its customer base. Eicher Motors caters to a vast number of individual buyers, and no single customer accounts for a substantial portion of sales. This means that the purchasing decisions of any one individual have a negligible impact on Eicher's overall revenue or profitability, thereby diminishing their individual leverage.

Customers for Eicher Motors' motorcycles and commercial vehicles in India often exhibit significant price sensitivity, particularly within more competitive market segments. For instance, while Royal Enfield commands a premium, the wider Indian two-wheeler market, and especially the commercial vehicle sector operated by VECV, frequently sees price and value becoming key decision factors for buyers.

This inherent price sensitivity necessitates that Eicher Motors meticulously manages its pricing strategies. Failing to do so could jeopardize market share and overall sales volume as customers readily compare options based on cost and perceived value.

The availability of numerous motorcycle brands and commercial vehicle manufacturers, both domestic and international, significantly enhances customer choice. This broad selection empowers customers, as they can readily switch to competitors if Eicher Motors' pricing or product offerings are not perceived as competitive. For instance, in the Indian motorcycle market, brands like Bajaj Auto, TVS Motor Company, and Hero MotoCorp offer a wide range of alternatives to Eicher's Royal Enfield and other offerings, putting pressure on Eicher to maintain attractive value propositions.

Customer's Ability to Backward Integrate

For Eicher Motors, the ability of customers to backward integrate is a negligible factor in their bargaining power. It is highly improbable for individual motorcycle buyers or even large commercial fleet operators to establish their own manufacturing facilities for vehicles. This lack of a credible threat means customers cannot realistically produce their own motorcycles or trucks, thereby limiting their leverage.

This absence of backward integration capability significantly diminishes customer bargaining power. For instance, in 2023, Royal Enfield, a key Eicher Motors brand, sold over 800,000 motorcycles. None of these customers possessed the capability or inclination to manufacture their own bikes, reinforcing Eicher's strong position.

- Customer's inability to backward integrate: Individual customers and fleet operators lack the capital, expertise, and scale to manufacture their own motorcycles or commercial vehicles.

- Reduced customer leverage: This inability prevents customers from threatening to produce their own products, thus limiting their bargaining power.

- Eicher's strong market position: Eicher Motors benefits from this dynamic, as customers must rely on its offerings.

Information Availability and Product Standardization

Customers today possess an unprecedented wealth of information concerning vehicle specifications, pricing, and user reviews. This extensive access empowers them to meticulously compare offerings from various manufacturers, significantly enhancing their bargaining power. For instance, online platforms and automotive review sites provide detailed insights that were previously unavailable to the average consumer.

While Royal Enfield, a key brand under Eicher Motors, boasts a distinctive brand identity and a loyal following, the increasing standardization of certain vehicle components and features across the motorcycle industry can further amplify customer leverage. This means that even with a strong brand, customers can more easily identify comparable alternatives, thereby increasing the pressure on Eicher to maintain competitive pricing and feature sets.

- Information Accessibility: Online platforms and review sites offer extensive data on vehicle performance, pricing, and customer satisfaction, enabling informed comparisons.

- Product Standardization: The increasing use of common components and features across motorcycle models allows customers to more readily identify alternatives.

- Brand vs. Features: While Royal Enfield's brand is strong, standardized features can reduce its unique selling proposition, giving customers more negotiation power.

- Competitive Landscape: In 2023, the Indian motorcycle market saw increased competition, with new entrants offering feature-rich models, further pressuring established players like Eicher.

The bargaining power of customers for Eicher Motors is generally moderate, influenced by brand loyalty, price sensitivity, and the availability of alternatives. While Royal Enfield enjoys strong brand equity, the broader Indian automotive market, especially for commercial vehicles, presents more price-conscious buyers. The sheer volume of individual buyers for motorcycles limits the power of any single customer, but collective consumer sentiment and online information sharing can still exert pressure. In 2023, Eicher Motors sold over 800,000 Royal Enfield motorcycles, highlighting a large, yet individually powerless, customer base.

| Factor | Eicher Motors' Position | Impact on Bargaining Power |

|---|---|---|

| Brand Loyalty (Royal Enfield) | High | Lowers customer power |

| Price Sensitivity (Overall Market) | Moderate to High | Increases customer power |

| Availability of Alternatives | High | Increases customer power |

| Information Accessibility | High | Increases customer power |

| Backward Integration Capability | Negligible | Significantly lowers customer power |

Preview the Actual Deliverable

Eicher Motors Porter's Five Forces Analysis

This preview showcases the complete Eicher Motors Porter's Five Forces Analysis, detailing the competitive landscape including threat of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring you receive the full, ready-to-use analysis without any alterations or missing sections.

Rivalry Among Competitors

The Indian automotive landscape is fiercely competitive, featuring a robust presence of both domestic and global manufacturers across two-wheeler and commercial vehicle sectors. For Eicher Motors' Royal Enfield brand, competition spans from other mid-size motorcycle makers to premium segment brands, creating a dynamic market. In 2023, the Indian motorcycle market saw sales exceeding 15 million units, highlighting the sheer volume of players vying for market share.

Eicher Motors' commercial vehicle arm, VECV, contends with formidable rivals such as Tata Motors and Ashok Leyland, both long-standing leaders in the Indian truck and bus industry. These established players offer a wide array of products, intensifying the rivalry. In the fiscal year 2023-24, Tata Motors reported domestic CV sales of over 370,000 units, while Ashok Leyland sold more than 190,000 units, underscoring the scale of competition VECV faces.

The Indian automotive industry's growth trajectory significantly impacts competitive rivalry. While segments like passenger vehicles and two-wheelers have demonstrated strong expansion, the commercial vehicle sector faced a minor contraction in FY 2024-25. This slowdown in a key segment for Eicher Motors can heighten the fight for existing market share.

Royal Enfield has carved a niche by emphasizing its classic design, rich heritage, and an authentic motorcycling experience, cultivating a fiercely loyal customer base. This distinct positioning effectively reduces pressure from direct price competition, allowing them to maintain premium pricing for their iconic motorcycles.

In the competitive commercial vehicle sector, Eicher Motors' joint venture, VECV, differentiates itself by focusing on critical operational aspects such as superior fuel efficiency and robust reliability. Furthermore, a strong emphasis on comprehensive after-sales service and support plays a crucial role in securing customer trust and repeat business, particularly in a market where uptime and maintenance costs are paramount.

Exit Barriers

Eicher Motors, like many in the automotive sector, faces high exit barriers. These include substantial investments in specialized manufacturing plants and a large, skilled workforce, making it difficult and costly to simply shut down operations. For instance, the automotive industry is capital-intensive, with new vehicle manufacturing plants often costing billions of dollars to build and equip. This forces companies to continue competing even when market conditions are unfavorable, potentially leading to price wars and increased competitive intensity.

These high exit barriers mean that companies like Eicher Motors are effectively locked into the industry. Even if profitability declines, the sheer cost of exiting the market prevents a swift departure. This can result in prolonged periods of intense rivalry as firms fight for market share to cover their fixed costs and maintain operations. In 2024, the global automotive industry continued to navigate supply chain challenges and fluctuating demand, underscoring the importance of managing these entrenched competitive dynamics.

The consequence of these barriers is often aggressive competition. Companies are motivated to fight for every sale to justify their continued investment and operational expenses. This can manifest in various ways:

- Aggressive Pricing: Manufacturers may lower prices to move inventory and maintain production levels, impacting profit margins across the board.

- Increased Marketing Spend: Companies often ramp up advertising and promotional activities to capture consumer attention and drive sales.

- Product Innovation Pressure: The need to stay relevant and attract buyers can accelerate the pace of new model development and feature introductions.

Strategic Stakes

The strategic stakes for Eicher Motors and its rivals are exceptionally high, fueled by the substantial growth trajectory and evolving landscape of the Indian automotive market. This includes a significant pivot towards electric mobility, making the competition for future market share intense.

Companies are demonstrating this commitment through substantial investments in:

- New Product Development: Launching innovative models to capture emerging consumer preferences.

- Technology Advancement: Focusing on electric vehicle (EV) technology and sustainable solutions.

- Market Presence Expansion: Broadening dealership networks and manufacturing capabilities.

This aggressive investment strategy underscores a fierce battle for long-term dominance, with companies vying to establish themselves as leaders in both traditional and upcoming electric vehicle segments. For instance, the two-wheeler market in India, a core segment for Eicher Motors, saw sales of over 15 million units in the fiscal year 2023-24, highlighting the sheer volume and potential at play.

Competitive rivalry is a significant force for Eicher Motors, particularly given the dynamic Indian automotive market. Both its Royal Enfield motorcycle division and its commercial vehicle (CV) segment through VECV face intense competition from established domestic and international players. The sheer volume of sales, such as over 15 million units in the Indian motorcycle market in FY 2023-24, indicates a crowded field where capturing market share is a constant challenge.

The intensity is further amplified by high exit barriers within the capital-intensive automotive industry, forcing companies to compete vigorously even in challenging market conditions. This often leads to aggressive pricing strategies, increased marketing efforts, and a continuous push for product innovation to maintain relevance and sales volumes.

For Eicher Motors' CV business, VECV competes with giants like Tata Motors, which sold over 370,000 domestic CV units in FY 2023-24, and Ashok Leyland, with over 190,000 units. This direct comparison highlights the scale of competition VECV navigates, where differentiation through fuel efficiency and reliability is crucial.

The market's growth, coupled with a strategic pivot towards electric mobility, intensifies this rivalry as companies invest heavily in new product development and technology to secure future market leadership.

| Competitor | Eicher Motors Segment | Key Competitive Factor | FY 2023-24 Domestic Sales (Units) |

| Tata Motors | Commercial Vehicles (VECV) | Product Range, Market Share | 370,000+ (CV) |

| Ashok Leyland | Commercial Vehicles (VECV) | Product Range, Market Share | 190,000+ (CV) |

| Other Mid-size Motorcycle Brands | Motorcycles (Royal Enfield) | Brand Heritage, Design, Performance | >15 Million (Total Motorcycle Market) |

SSubstitutes Threaten

For Eicher Motors' Royal Enfield brand, direct substitutes like cars, public transport, and electric scooters present a significant threat. The growing appeal of electric two-wheelers, offering lower running costs and environmental benefits, could draw customers away from traditional internal combustion engine motorcycles, particularly in urban commuting segments. In 2023, the Indian electric two-wheeler market saw substantial growth, with sales reaching over 1.2 million units, a significant increase from previous years, indicating a rising preference for these alternatives.

In the commercial vehicle segment, Eicher's VECV faces competition from substitutes like railways, shipping, and air cargo. These modes can fulfill transportation needs for specific goods, potentially impacting demand for trucks and buses. For instance, in 2024, Indian Railways continued its focus on freight capacity expansion, aiming to move a larger share of bulk commodities, a segment where trucks are traditionally strong.

The threat of substitutes for Eicher Motors, particularly Royal Enfield motorcycles, is significantly shaped by the price-performance trade-off. As electric two-wheelers continue to evolve, their lower running costs and increasing performance capabilities present a compelling alternative for consumers. For instance, in 2024, the total cost of ownership for electric scooters and motorcycles is projected to be substantially lower than their ICE counterparts due to reduced fuel expenses and maintenance, making them a strong contender, especially in urban commuting segments.

Customer Propensity to Substitute

Customer propensity to substitute for Eicher Motors products, particularly its Royal Enfield motorcycles, is influenced by shifting consumer preferences and technological advancements. Factors such as the increasing demand for electric vehicles (EVs) and the growing appeal of shared mobility services directly impact this propensity.

The evolving urban landscape and heightened environmental consciousness are key drivers. As cities become more congested and regulations around emissions tighten, consumers may find alternatives like electric scooters or ride-sharing platforms more convenient and aligned with their values. For instance, the global electric two-wheeler market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years, indicating a strong potential shift away from traditional internal combustion engine (ICE) vehicles.

- Convenience and Cost: The availability of more convenient and potentially lower-cost transportation options, such as electric scooters for urban commuting or subscription-based mobility services, can sway customer choices.

- Environmental Concerns: Growing awareness of climate change and a desire for sustainable transport solutions encourage a move towards electric and cleaner alternatives, impacting the demand for ICE motorcycles.

- Lifestyle and Technology: Evolving lifestyle preferences, including a greater embrace of technology and a desire for connected experiences, might favor newer mobility solutions over traditional ones.

- Market Trends: The burgeoning electric two-wheeler market, with new players and increasing product variety, presents a direct substitute threat to established ICE motorcycle manufacturers like Eicher Motors.

Technological Advancements in Substitutes

Technological advancements are rapidly evolving, particularly in the automotive sector. The rise of electric vehicles (EVs) and the development of autonomous driving systems pose a significant threat of substitution for traditional internal combustion engine (ICE) motorcycles, Eicher Motors' core business. For instance, by the end of 2023, global EV sales had surpassed 13 million units, a substantial increase from previous years, indicating growing consumer acceptance and technological maturity. This shift could erode demand for Eicher's current product portfolio if they do not adapt.

Eicher Motors is proactively addressing this threat. The company is investing in electric mobility for its Royal Enfield brand, a strategic move to stay competitive. While specific investment figures for 2024 are still emerging, the industry trend shows significant capital allocation towards EV development. For example, major automotive players are committing billions to EV research and manufacturing, signaling the importance of this transition. The success of Eicher's electric offerings will hinge on the pace of technological innovation and consumer adoption rates in the coming years.

The threat is amplified by the potential for new entrants or existing players to disrupt the market with superior EV technology or business models. Consider that in 2024, several new EV startups have gained significant market traction, challenging established manufacturers. This dynamic landscape means Eicher must not only develop competitive EVs but also ensure their charging infrastructure and overall ownership experience are appealing to consumers. The speed at which these substitute technologies improve in performance, cost, and convenience will directly impact Eicher's market position.

- Technological Disruption: The rapid advancement of EV technology and autonomous driving presents a direct substitute threat to Eicher Motors' traditional motorcycle business.

- Industry Investment Trends: Global investments in EV technology are substantial, with major players committing billions, indicating the accelerating pace of this technological shift.

- Eicher's Response: Eicher Motors' investment in electric mobility for Royal Enfield is a crucial step to mitigate this substitution threat.

- Adoption Factors: The ultimate impact of substitutes will depend on the speed of technological improvement and consumer acceptance of electric and autonomous two-wheelers.

The threat of substitutes for Eicher Motors, particularly its Royal Enfield motorcycles, is significant due to the increasing viability of electric two-wheelers and alternative transportation. These substitutes offer potential advantages in terms of lower running costs and environmental impact, appealing to a growing segment of consumers.

In 2023, the Indian electric two-wheeler market surpassed 1.2 million units sold, a clear indicator of rising consumer interest in these alternatives. This trend suggests a potential shift away from traditional internal combustion engine (ICE) motorcycles, especially for urban commuting.

For Eicher's commercial vehicle segment (VECV), substitutes like railways and shipping can capture freight volume, particularly for bulk commodities. Indian Railways' continued focus on freight capacity expansion in 2024 aims to increase its share of bulk cargo movement, directly impacting the demand for Eicher's trucks.

| Substitute Type | Key Advantages | Impact on Eicher Motors (Royal Enfield) | Impact on Eicher Motors (VECV) |

| Electric Two-Wheelers | Lower running costs, environmental benefits, technological appeal | Direct competition for urban commuters, potential brand perception shift | Minimal direct impact |

| Public Transport/Shared Mobility | Cost-effectiveness for occasional use, convenience in congested cities | Reduced demand for personal motorcycle ownership in urban areas | Minimal direct impact |

| Railways/Shipping/Air Cargo | Economical for bulk transport, specific cargo types | Minimal direct impact | Competition for freight volumes, especially in bulk commodity transport |

Entrants Threaten

The automotive sector, encompassing both motorcycles and commercial vehicles, necessitates immense capital outlay. This includes significant investments in research and development, state-of-the-art manufacturing plants, extensive distribution channels, and robust marketing campaigns. For instance, establishing a new automotive manufacturing facility can easily run into billions of dollars.

These high initial capital requirements serve as a formidable barrier for any new company aspiring to enter the market. Potential entrants must secure substantial funding to even begin operations, let alone compete effectively with established players like Eicher Motors.

This financial hurdle significantly mitigates the threat of new entrants, as only well-capitalized and strategically positioned companies can realistically consider challenging the existing market structure. Eicher Motors, with its established infrastructure and financial strength, benefits from this inherent barrier.

Eicher Motors, a prominent player in the automotive industry, leverages significant economies of scale. This means they can produce motorcycles and commercial vehicles more cheaply per unit than a newcomer could. For instance, in fiscal year 2024, Eicher Motors reported a robust revenue of INR 42,400 crore, indicative of their substantial production volumes.

This cost advantage makes it challenging for new entrants to match Eicher's pricing strategies. A new company would need massive upfront investment to achieve comparable production levels and thus similar per-unit cost efficiencies, a considerable barrier to entry.

Royal Enfield's enduring brand loyalty, a cornerstone of its success, presents a formidable barrier for any new entrant aiming to capture market share in the motorcycle segment. This loyalty, built over decades, translates into a strong customer preference that new players struggle to replicate.

In the commercial vehicle arena, Eicher's reputation for robust engineering and dependable after-sales service has cemented its position. New entrants face the uphill battle of establishing similar trust and demonstrating comparable reliability to even begin competing effectively.

Access to Distribution Channels

New entrants face a significant hurdle in establishing a robust distribution and service network across India, a critical factor for success in the automotive sector. Eicher Motors, through its well-established brands like Royal Enfield and its commercial vehicle division VECV, possesses an extensive and proven network. This existing infrastructure provides a substantial competitive moat, making it challenging for newcomers to achieve comparable reach and offer reliable after-sales support to customers.

Eicher Motors' advantage is underscored by its vast presence. For instance, Royal Enfield boasted over 1,000 dealerships and service centers across India as of early 2024, ensuring widespread customer accessibility. Similarly, VECV (Volvo Eicher Commercial Vehicles) maintains a strong network of dealerships and service points catering to the heavy-duty truck and bus segments. This deep penetration makes it economically and logistically difficult for a new player to replicate Eicher's market coverage and customer service capabilities quickly.

- Extensive Dealer Network: Eicher Motors operates a comprehensive network of over 1,000 Royal Enfield dealerships and service centers nationwide.

- Commercial Vehicle Reach: VECV also maintains a significant footprint with numerous touchpoints for its truck and bus offerings.

- After-Sales Support Advantage: This established network facilitates superior after-sales service and parts availability, a key differentiator.

- Barriers to Entry: The cost and time required to build a comparable distribution and service infrastructure create a substantial barrier for new entrants.

Government Policy and Regulations

Government policies and regulations significantly shape the threat of new entrants for Eicher Motors. Stringent emission standards and vehicle safety regulations, for instance, can elevate the capital expenditure required for new manufacturers to establish compliant production facilities. This can act as a substantial barrier, favoring established players like Eicher Motors who have already invested in meeting these requirements.

Conversely, government initiatives aimed at promoting specific technologies, such as subsidies for electric vehicles (EVs) or preferential tax treatment for green manufacturing, could lower the entry barriers for new players in those segments. For example, India's Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, with its phased rollouts and evolving incentives, directly impacts the attractiveness of the EV market for potential new entrants.

- Regulatory Hurdles: Compliance with evolving emission norms (e.g., Bharat Stage VI) and safety standards necessitates significant R&D and manufacturing upgrades, increasing the cost of entry.

- Incentives for New Technologies: Government support for EVs, such as subsidies and charging infrastructure development, can attract new players into the electric two-wheeler and three-wheeler segments.

- Trade Policies: Import duties on components or finished vehicles can either protect domestic manufacturers from foreign competition or increase the cost for new entrants relying on imported parts.

The threat of new entrants for Eicher Motors is generally low due to substantial capital requirements, economies of scale, strong brand loyalty, and extensive distribution networks. These factors create significant barriers that deter potential competitors from easily entering the motorcycle and commercial vehicle markets.

New players must overcome immense financial hurdles, including R&D, manufacturing, and marketing investments, to even begin operations. Eicher's established scale, exemplified by its INR 42,400 crore revenue in FY2024, allows for cost efficiencies that are difficult for newcomers to match.

Furthermore, the established trust in Eicher's brands like Royal Enfield and VECV, coupled with a nationwide network of over 1,000 Royal Enfield touchpoints by early 2024, presents a formidable challenge for any aspiring entrant seeking to build comparable market presence and customer loyalty.

| Factor | Impact on New Entrants | Eicher Motors' Position |

|---|---|---|

| Capital Requirements | Very High | Established infrastructure and financial strength |

| Economies of Scale | Challenging to match | Cost advantage due to high production volumes (e.g., INR 42,400 Cr revenue FY24) |

| Brand Loyalty & Reputation | Difficult to replicate | Decades of trust in Royal Enfield and VECV |

| Distribution & Service Network | Costly and time-consuming to build | Extensive network (1,000+ Royal Enfield outlets by early 2024) |

| Government Regulations | Can increase entry cost (e.g., emission standards) or create opportunities (e.g., EV incentives) | Invested in compliance; adaptable to new tech incentives |

Porter's Five Forces Analysis Data Sources

Our Eicher Motors Porter's Five Forces analysis is built upon a robust foundation of data, including Eicher Motors' annual reports, investor presentations, and filings with regulatory bodies like the Ministry of Corporate Affairs. We also incorporate insights from reputable industry research firms and automotive sector publications.