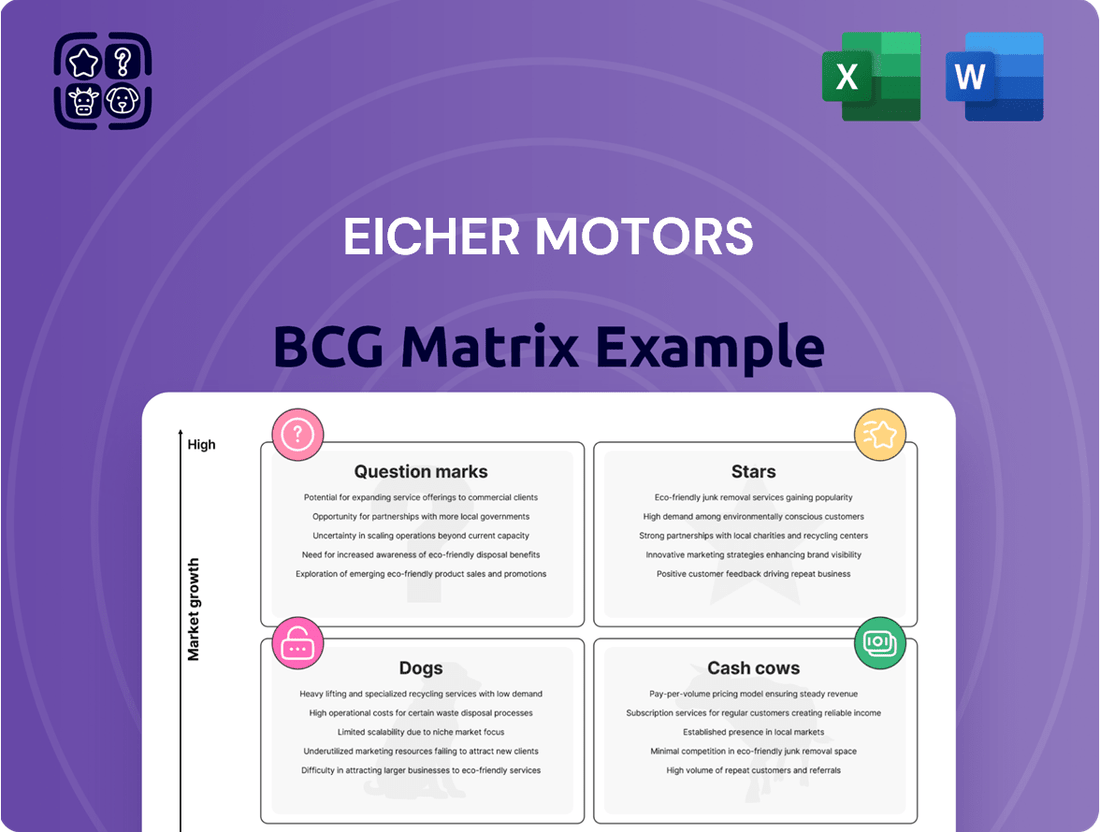

Eicher Motors Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eicher Motors Bundle

Eicher Motors' BCG Matrix reveals a dynamic portfolio, with Royal Enfield likely a strong Cash Cow, generating consistent revenue. However, understanding the nuances of their other ventures, like VECV, is crucial for future growth.

This preview offers a glimpse into Eicher Motors' strategic positioning. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Royal Enfield's 650cc lineup, featuring models like the Interceptor, Continental GT, Super Meteor, Bear, and Shotgun, dominates the 500-800cc motorcycle segment with an impressive 96% market share.

This segment saw a substantial 47% year-on-year sales increase from April to November 2024, highlighting its rapid expansion and Royal Enfield's strong position within it.

These 650cc offerings are vital for Royal Enfield's future growth, attracting a broad spectrum of riders worldwide with their blend of classic styling and modern performance.

The Royal Enfield Hunter 350 has rapidly ascended to become a cornerstone of Eicher Motors' product portfolio, showcasing impressive sales figures. Since its introduction, this model has achieved over 500,000 unit sales, demonstrating its immediate market impact and strong consumer appeal.

Its success is not confined to India; the Hunter 350 has garnered significant traction in international markets, bolstering Royal Enfield's global sales momentum. This widespread acceptance underscores its potential as a key growth engine for the brand.

Within the highly competitive 350cc motorcycle segment, the Hunter 350's robust performance signals a product with substantial growth prospects and a rapidly expanding market share, positioning it favorably within Eicher Motors' strategic business units.

The Royal Enfield Guerrilla 450, a key player in Eicher Motors' portfolio, is demonstrating robust growth within the burgeoning 450cc motorcycle segment. Its impressive sales trajectory, even outselling the Himalayan 450 in August 2024, underscores its market appeal, driven by competitive pricing and attractive design.

Royal Enfield's International Expansion

Royal Enfield's global sales are a clear Star in Eicher Motors' BCG Matrix, driven by impressive export growth. In July 2025 alone, exports surged by a remarkable 95%, contributing to a substantial 72% year-to-date growth for fiscal year 2026.

This expansion is underpinned by strategic investments in international production capabilities. The company has successfully established new CKD (completely knocked down) assembly plants in key markets like Thailand and Brazil. Furthermore, a dedicated manufacturing facility has been set up in Bangladesh, bolstering its global production network.

- Export Surge: 95% increase in July 2025 exports, 72% year-to-date growth for FY26.

- Global Footprint Expansion: New CKD plants in Thailand and Brazil, manufacturing facility in Bangladesh.

- Market Leadership: Dominant presence in key regions, particularly within the APAC market.

- Star Status Justification: Aggressive international growth and strong market position solidify global sales as a Star.

Royal Enfield Overall Brand Performance

Royal Enfield's brand performance is exceptional, positioning it as a Star within Eicher Motors' BCG Matrix. The company achieved a significant milestone in FY2025, surpassing one million annual motorcycle sales for the first time, an 11% jump from the prior year.

In 2024, Royal Enfield recorded its strongest domestic wholesale performance, selling 857,378 units. This sales figure underscores its commanding presence and leadership in the mid-size motorcycle market.

- Record Sales: Achieved over 1 million annual motorcycle sales in FY2025, an 11% increase.

- Domestic Dominance: Recorded 857,378 domestic wholesale units in 2024.

- Market Leadership: Solidified its position in the mid-size motorcycle segment.

- Growth Trajectory: Demonstrates consistent and robust overall brand growth.

Royal Enfield's global sales are a clear Star in Eicher Motors' BCG Matrix, driven by impressive export growth and market leadership. The company achieved over one million annual motorcycle sales in FY2025, an 11% increase, with 857,378 domestic wholesale units recorded in 2024. This robust performance, coupled with strategic international expansion, including new CKD plants in Thailand and Brazil, solidifies its position as a high-growth, high-market-share business unit.

| Metric | Value | Period | Significance |

| Global Motorcycle Sales | Over 1 Million Units | FY2025 | First time milestone, indicating strong overall demand. |

| Domestic Wholesale | 857,378 Units | 2024 | Demonstrates market dominance in India. |

| Export Growth (July) | 95% | July 2025 | Highlights significant international market penetration. |

| Year-to-Date Export Growth | 72% | FY2026 | Confirms sustained international sales momentum. |

What is included in the product

Eicher Motors' BCG Matrix analysis highlights its Royal Enfield motorcycles as Stars and Cash Cows, while its VECV truck and bus division may represent Question Marks needing strategic evaluation.

The Eicher Motors BCG Matrix offers a clear, one-page overview, relieving the pain point of complex business unit analysis.

Cash Cows

The Royal Enfield Classic 350 is a quintessential cash cow for Eicher Motors, consistently driving significant revenue. Its dominance in the 350cc-450cc segment is undeniable, evidenced by its commanding 94% market share within the 350cc category from April to November 2024.

This enduring popularity translates into a robust and reliable cash flow for Eicher Motors. The Classic 350's strong brand equity and established heritage mean it requires minimal marketing spend to maintain its sales momentum, further enhancing its profitability.

The Royal Enfield Bullet 350, a cornerstone of Eicher Motors' portfolio, exemplifies a classic cash cow. Its recent performance highlights this, with sales in March 2025 nearly doubling year-over-year, significantly boosting Royal Enfield's domestic figures.

This iconic motorcycle leverages a deeply loyal customer base and a rich heritage, ensuring consistent cash flow generation. The minimal need for substantial market development investment further solidifies its position as a steady, reliable revenue generator for the company.

VE Commercial Vehicles (VECV) commands a dominant position in the Light and Medium Duty (LMD) truck segment, holding an impressive 34.5% market share in Q1 FY26. This leadership, achieved even in a relatively stagnant commercial vehicle market, highlights VECV's robust performance and its capacity to generate significant and reliable cash flow for Eicher Motors.

The sustained market dominance and operational efficiencies within this mature LMD truck segment solidify its status as a prime cash cow. VECV's consistent ability to capture and maintain market share in this segment underscores its strong earning potential and its role as a foundational contributor to Eicher Motors' overall financial strength.

VE Commercial Vehicles (VECV) Buses

VE Commercial Vehicles (VECV) Buses represent a significant Cash Cow for Eicher Motors. This segment has demonstrated robust growth and a commanding market position.

In the first quarter of fiscal year 2026, VECV's bus volumes surged by an impressive 14.8%, pushing its market share to 21.5%. This upward trajectory is further underscored by the company achieving its highest-ever coach sales in fiscal year 2025, with 618 units delivered.

- Strong Volume Growth: VECV bus volumes increased by 14.8% in Q1 FY26.

- Expanding Market Share: Market share in the bus segment reached 21.5% in Q1 FY26.

- Record Coach Sales: FY2025 saw VECV's highest-ever coach sales at 618 units.

- Consistent Revenue Stream: The segment's high market share and steady growth ensure reliable revenue.

Overall Royal Enfield 350cc Segment

The Royal Enfield 350cc segment, including models like the Classic 350, Bullet 350, and Meteor 350, is a powerhouse for Eicher Motors. This lineup commands an impressive 94% market share in the mid-size motorcycle category, underscoring its dominance.

This segment is the bedrock of Royal Enfield's sales volume and profitability, consistently producing substantial cash flow. Its established market position and deep-rooted brand loyalty contribute to healthy profit margins, often with reduced marketing expenditures.

- Market Dominance: Holds a commanding 94% market share in the mid-size motorcycle segment.

- Profitability Engine: Serves as the primary driver of sales volume and profit for Royal Enfield.

- Cash Generation: Consistently generates significant cash due to its strong market presence.

- Brand Loyalty: Benefits from high customer loyalty, leading to stable demand and profitability.

The Royal Enfield 350cc segment, encompassing models like the Classic 350 and Bullet 350, is Eicher Motors' undisputed cash cow. This segment dominates the mid-size motorcycle market, holding a remarkable 94% share from April to November 2024, ensuring a consistent and substantial inflow of cash.

VE Commercial Vehicles (VECV) in the Light and Medium Duty truck segment is another significant cash cow. VECV secured a 34.5% market share in Q1 FY26, demonstrating its ability to generate reliable profits even in a maturing market, contributing robustly to Eicher Motors' financial strength.

The VECV bus segment also acts as a cash cow, with volumes growing 14.8% in Q1 FY26 and market share reaching 21.5%. This consistent growth, coupled with record coach sales in FY2025, solidifies its position as a steady revenue generator.

| Product Segment | Market Share (Latest Data) | Growth/Performance Indicator | Cash Cow Status |

|---|---|---|---|

| Royal Enfield 350cc | 94% (Mid-size motorcycle, Apr-Nov 2024) | Dominant sales volume and profitability | Strong, consistent cash generation |

| VECV LMD Trucks | 34.5% (Q1 FY26) | Leadership in a mature segment | Reliable and significant cash flow |

| VECV Buses | 21.5% (Q1 FY26) | 14.8% volume growth (Q1 FY26), record coach sales FY25 | Steady revenue stream and growth |

What You See Is What You Get

Eicher Motors BCG Matrix

The preview you see is the exact Eicher Motors BCG Matrix report you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered to you in its complete, unwatermarked form, ready for immediate application in your business planning.

Dogs

The Royal Enfield Himalayan 450, despite initial global acclaim, has encountered a challenging reception in the Indian market. While it has seen success in countries like New Zealand, its performance domestically has been less stellar.

In August 2024, the Himalayan 450's sales in India were nearly halved when compared year-on-year to its stablemate, the Guerrilla 450. This significant drop suggests difficulties in gaining substantial traction within the burgeoning Indian adventure motorcycle segment.

The fact that a newer, more budget-friendly model from within the same Eicher Motors portfolio is outperforming the Himalayan 450 domestically positions the latter as a potential Dog. This underperformance necessitates a strategic review to prevent it from becoming a sustained financial burden.

Within Royal Enfield's popular 350cc lineup, older variants that haven't seen significant refreshes or are overshadowed by newer, more feature-rich models can be categorized as Dogs. These bikes, while maintaining a loyal customer base, might experience sluggish sales growth compared to their more contemporary counterparts. For instance, models that haven't adopted features like updated braking systems or improved engine performance might see their market appeal plateau.

These older 350cc Royal Enfield models, by not receiving recent updates, may struggle to capture new market segments or compete effectively with rivals offering more advanced technology. Their contribution to overall sales volume might be modest, with limited potential for significant market share expansion. Eicher Motors likely allocates minimal resources to these specific variants, focusing investment on models with higher growth prospects, thus fitting the Dog quadrant of the BCG matrix.

VECV's heavy-duty truck segment, while gaining market share, operates within a contracting market, as evidenced by a marginal decline in overall heavy-duty vehicle sales in Q1 FY26. This situation presents a challenge, as VECV's success is occurring against a backdrop of slower industry-wide growth for this category.

The performance suggests that while VECV is outperforming competitors, the overall market dynamics for heavy-duty trucks are not robust. If specific models within this segment are not demonstrating clear market leadership, they may require strategic evaluation, potentially leading to careful management or even divestment to optimize VECV's broader product portfolio.

Niche or Less Popular Older VECV Commercial Vehicle Models

Within Eicher Motors' VECV commercial vehicle segment, some older or niche truck and bus models might fall into the Dogs category. These are vehicles that likely possess low market share and operate in segments with limited growth potential. For instance, if VECV has legacy truck platforms that haven't seen significant updates and face intense competition from newer, more fuel-efficient models, they would fit this description.

These less popular models, characterized by their minimal market penetration and slow or declining demand, represent a strategic challenge. Their contribution to VECV's overall revenue and profitability would be marginal, requiring careful consideration for their future. For example, if a specific older bus chassis model is no longer favored by fleet operators due to evolving emission standards or passenger comfort requirements, it would likely be a Dog.

- Low Market Share: These models typically hold a small percentage of their respective market segments.

- Limited Growth Prospects: The demand for these vehicles is either stagnant or declining.

- Intense Competition: They often compete against newer, more advanced offerings from rivals.

- Potential for Divestment: Companies may consider phasing out or selling off such assets to reallocate resources.

Phased-out or Discontinued Product Lines

Phased-out or discontinued product lines for Eicher Motors would be placed in the Dogs category of the BCG Matrix. These are products that no longer have significant market share or growth potential. Their continued production or support might represent a drain on resources without a corresponding return.

While specific recent discontinuations for Eicher Motors were not readily available in the provided information, this classification typically applies to older models or product segments that have been superseded by newer technologies or market demands. For instance, if Eicher had previously offered a line of agricultural tractors that are no longer competitive due to advancements in engine efficiency or features, those would be considered Dogs.

- Dogs: Products with low market share and low growth potential.

- Eicher Motors' older or less popular vehicle models could fall into this category if they are no longer actively marketed or supported.

- These products often incur maintenance costs without generating substantial revenue.

- Strategic decisions for Dogs usually involve divestment or discontinuation to reallocate resources to more promising ventures.

The Royal Enfield Himalayan 450, despite initial global acclaim, has seen a challenging reception in India, with August 2024 sales nearly halved year-on-year compared to the Guerrilla 450. This underperformance, especially when a more budget-friendly stablemate excels domestically, positions the Himalayan 450 as a potential Dog within Eicher Motors' portfolio. Similarly, older 350cc Royal Enfield variants that haven't been updated may struggle to compete, exhibiting sluggish sales growth and limited market expansion potential. These models, often receiving minimal investment, fit the Dog quadrant due to their low market share and growth prospects.

Within VECV's commercial vehicle segment, certain legacy truck and bus models with low market share and operating in slow-growth segments can be classified as Dogs. For instance, older truck platforms facing intense competition from newer, more fuel-efficient rivals would fit this description. These less popular models, characterized by minimal market penetration and declining demand, represent a strategic challenge, often incurring maintenance costs without substantial revenue generation.

Discontinued product lines for Eicher Motors are definitively placed in the Dogs category, as they no longer possess significant market share or growth potential. While specific recent discontinuations weren't detailed, this classification applies to older models or segments superseded by new technologies or market demands. These products often represent a drain on resources without a corresponding return, leading to strategic decisions favoring divestment or discontinuation.

Eicher Motors' older or less popular vehicle models, especially those with low market share and limited growth prospects, can be categorized as Dogs. These products often incur maintenance costs without generating substantial revenue, and strategic decisions typically involve divestment or discontinuation to reallocate resources to more promising ventures. For example, if a particular truck model has seen its market share decline significantly due to newer, more advanced competitors, it would be considered a Dog.

Question Marks

Royal Enfield's 'Flying Flea' EV brand marks a significant strategic pivot into the burgeoning electric vehicle sector, with the first model slated for release by March 2026. This move positions Eicher Motors, Royal Enfield's parent company, to compete in a high-growth market where it currently holds no existing market share.

The substantial investments in R&D for these initial EV offerings are considerable, reflecting the company's commitment to establishing a foothold. These ventures are classified as Question Marks within the BCG matrix, as they require significant capital but their future market performance and potential to become Stars remain uncertain.

VECV's Eicher Pro X series represents a strategic move into the burgeoning electric small commercial vehicle (SCV) market, adopting an 'EV-First' philosophy. Deliveries are slated to begin in Q1 2025, positioning VECV to capitalize on the segment's rapid expansion fueled by urbanization and e-commerce growth.

While the SCV segment is a high-growth area, VECV's position as a new entrant in the electric SCV space means it faces established players. The development and market penetration of these electric vehicles require significant investment to capture substantial market share in this competitive landscape.

The upcoming Royal Enfield 650cc models, including the Hunter 650, Bullet 650, and Scrambler 650, are positioned as potential Stars within Eicher Motors' portfolio. These models are entering a rapidly expanding premium motorcycle segment, a market that saw a significant 15% year-on-year growth in India during 2024 for bikes above 500cc.

While the existing 650cc platform has proven successful, these new entrants are yet to carve out their definitive market share. Their success hinges on substantial investments in marketing and distribution to capitalize on their high growth potential and establish a strong presence in this competitive space.

Royal Enfield Himalayan Electric and Himalayan 750

Royal Enfield is actively developing new variants of its popular Himalayan model, including an electric version and a more powerful 750cc engine option. These are slated for release between 2025 and 2026, aiming to capture emerging markets in electric adventure touring and the premium adventure segment.

These new Himalayan models are positioned as potential stars within Eicher Motors' portfolio, given the strong growth trajectory of the adventure motorcycle segment. However, Royal Enfield currently holds a negligible market share in these specific niches, necessitating substantial investment to establish a foothold and validate their market potential.

- Himalayan Electric: Targets the growing electric two-wheeler market, a segment projected to see significant expansion in India and globally.

- Himalayan 750: Aims to compete in the higher-displacement adventure touring category, a segment known for its premium pricing and customer loyalty.

- Market Opportunity: Both variants tap into high-growth segments, but require significant R&D and marketing expenditure to gain traction.

- Investment & Risk: As new entrants in these specific niches, these models represent high-risk, high-reward opportunities for Royal Enfield.

Expansion into Untapped International Markets for Royal Enfield

Expansion into untapped international markets for Royal Enfield, while part of its overall Star status within Eicher Motors' BCG matrix, can be specifically viewed as a Question Mark. These nascent markets present significant growth opportunities but demand considerable upfront investment in establishing brand presence and distribution.

These markets, characterized by low brand recognition and underdeveloped distribution networks, require strategic market entry initiatives. Royal Enfield's approach here involves building awareness and infrastructure, a process typical for Question Mark products aiming to become Stars.

- High Growth Potential: Untapped markets offer the chance for rapid sales increases as Royal Enfield establishes its footprint.

- Substantial Investment Required: Significant capital is needed for marketing, dealership setup, and localizing operations.

- Risk of Low Market Share: Without effective strategies, these ventures may struggle to gain traction against established competitors.

- Potential to become a Star: Successful penetration can transform these Question Marks into major revenue drivers for Eicher Motors.

Eicher Motors' ventures into electric vehicles, such as Royal Enfield's 'Flying Flea' and VECV's Eicher Pro X series, are currently classified as Question Marks. These initiatives require substantial investment for research, development, and market entry, with their future success and ability to achieve market leadership yet to be determined.

The new 650cc Royal Enfield models and the upcoming Himalayan variants, including the electric and 750cc versions, also fall into the Question Mark category. While they target high-growth segments like premium motorcycles and adventure touring, they necessitate significant capital for marketing and distribution to establish market share against existing players.

Expanding into new international markets for Royal Enfield represents another set of Question Marks. These regions offer considerable growth potential but demand substantial upfront investment in brand building and distribution networks, carrying the risk of low initial market penetration.

BCG Matrix Data Sources

Our BCG Matrix for Eicher Motors is built on robust data, integrating financial reports, market research, and sales performance metrics.