ECMOHO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ECMOHO Bundle

Unlock the hidden forces shaping ECMOHO's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, social trends, environmental regulations, and legal frameworks are impacting the company's operations and future growth. Equip yourself with the strategic foresight needed to navigate this dynamic landscape and identify opportunities others miss.

Our expertly crafted PESTLE analysis for ECMOHO provides actionable intelligence, meticulously researched to go beyond surface-level observations. Discover the critical external factors that present both challenges and significant growth potential for the company. This is your essential guide to making informed decisions and staying ahead of the curve.

Don't get caught off guard by external disruptions. Our PESTLE analysis offers a clear, concise, and in-depth understanding of the macro-environmental factors influencing ECMOHO. It's the perfect tool for investors, strategists, and anyone looking to gain a competitive advantage. Download the full version now for immediate access to these vital insights.

Political factors

The Chinese government's strong backing of 'Internet + Healthcare' initiatives is a significant political factor. These policies aim to merge internet technologies with traditional healthcare services, boosting accessibility and efficiency. Policies have been introduced to enable online consultations, remote diagnostics, and the management of digital health records, contributing to a surge in online medical service usage.

Evidence of this support includes the rapid approval of numerous internet hospitals across China. By the end of 2023, it was reported that over 1,500 internet hospitals had been established, serving millions of patients annually. This governmental push is creating a favorable environment for digital health platforms like ECMOHO to thrive.

China's ongoing anti-corruption drive, particularly within the healthcare industry, significantly shapes the operating environment for companies like ECMOHO. New directives from the State Administration for Market Regulation (SAMR) aim to curb commercial bribery, directly impacting how healthcare businesses engage in procurement and manage compliance. This heightened scrutiny means stricter adherence to regulations is paramount for all players in the supply chain, potentially affecting tender processes and operational timelines.

The National Healthcare Security Administration (NHSA) plays a crucial role in shaping the pharmaceutical landscape through its regular updates to the National Reimbursement Drug List (NRDL). These adjustments directly influence drug pricing and the accessibility of medications within the market.

Recent NRDL updates, particularly those finalized in late 2024 and extending into early 2025, have introduced a dynamic shift. New drugs have been incorporated, while others have been delisted, reflecting evolving healthcare needs and efficacy assessments.

A key feature of these recent updates is the implementation of significant price reductions for newly listed drugs. This strategy aims to enhance affordability and patient access to innovative treatments, but it also directly impacts the profitability margins for drug manufacturers and distributors, including companies like ECMOHO.

For ECMOHO, these NRDL changes necessitate a strategic recalibration of its product portfolio and pricing models. The ability to adapt to these pricing pressures and secure inclusion for high-demand, potentially lower-margin drugs will be critical for maintaining market share and ensuring continued revenue growth.

Cross-Border Data Transfer Regulations

China's evolving data privacy landscape, particularly the Personal Information Protection Law (PIPL) and related security statutes, significantly shapes cross-border data management. These regulations, with updates anticipated through 2025, mandate rigorous security assessments and, in certain scenarios, explicit governmental approval for transferring Chinese user data internationally. This directly impacts how digital health platforms, including those operating similarly to ECMOHO, must structure their data handling processes.

The implications for companies like ECMOHO are substantial. For instance, 2024 saw increased scrutiny on how health data is anonymized and transferred, with fines for non-compliance potentially reaching millions of dollars. Navigating these requirements means adapting operational models to ensure data localization where mandated or obtaining necessary certifications for international transfers, potentially increasing compliance costs.

- PIPL mandates security assessments for data transfers abroad, impacting over 1 billion internet users in China.

- Updated guidelines in 2024 and 2025 may require specific government approval for sensitive data, like health records.

- Non-compliance penalties can exceed 5% of annual revenue, affecting companies like ECMOHO operating in the digital health sector.

- Operational models must adapt to data localization requirements or secure explicit consent and certifications for cross-border flows.

Geopolitical Tensions and Trade Policies

Geopolitical tensions significantly impact companies like ECMOHO. For instance, ongoing trade disputes, such as the US Biosecure Act, can create considerable uncertainty for Chinese pharmaceutical and medical device firms with international operations. This legislation, potentially affecting companies with ties to certain countries, could lead to increased scrutiny and market access challenges.

These tensions often translate into tangible economic consequences. Increased tariffs, a common tool in trade conflicts, can directly impact the cost of goods for export-oriented businesses. For ECMOHO, this could mean higher prices for their products entering certain markets, potentially dampening export growth and affecting their competitive edge.

Supply chain stability is another critical area affected by geopolitical friction. Companies relying on global sourcing or export markets may face disruptions, leading to increased operational costs and potential delays. For example, the imposition of trade barriers can force companies to re-evaluate their entire supply chain strategy, seeking alternative suppliers or production locations, which is a complex and costly undertaking.

Furthermore, geopolitical instability can chill foreign investment in a nation's healthcare sector. Investors may become hesitant to commit capital when faced with unpredictable policy changes or trade wars. This could limit ECMOHO's access to crucial funding for research, development, and expansion, hindering its long-term growth prospects in the dynamic global healthcare market.

- US Biosecure Act: Aims to address national security concerns related to biotechnology, potentially impacting Chinese firms.

- Tariff Impacts: Trade conflicts can lead to elevated tariffs, increasing costs for imported components and exported finished goods.

- Supply Chain Vulnerability: Geopolitical events can disrupt the flow of goods and materials, necessitating diversified sourcing strategies.

- Foreign Investment Hesitation: Political instability can deter international investors, limiting capital availability for expansion and innovation in the Chinese healthcare sector.

Government support for digital health initiatives is a key driver. China's 'Internet + Healthcare' policies, fostering online consultations and digital health records, have led to over 1,500 internet hospitals by late 2023. This governmental push creates a fertile ground for platforms like ECMOHO.

What is included in the product

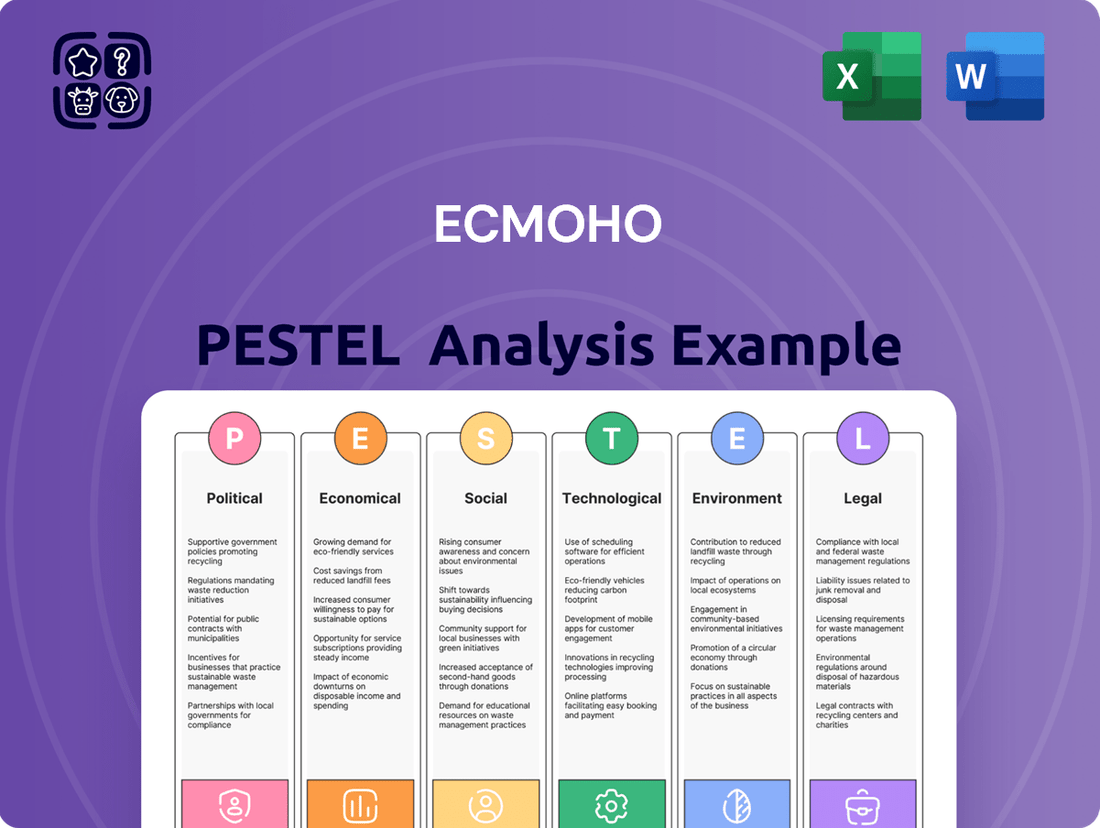

The ECMOHO PESTLE Analysis systematically dissects the external macro-environmental landscape across Political, Economic, Social, Technological, Environmental, and Legal factors, offering a comprehensive view of market influences.

The ECMOHO PESTLE Analysis provides a structured framework to identify and address external factors impacting a business, thereby alleviating the pain point of uncertainty and enabling more informed strategic decision-making.

Economic factors

China's healthcare expenditure is on a significant upward trajectory. Projections indicate it could reach approximately $3 trillion by 2030. This growth is primarily fueled by a rapidly aging demographic and the government's commitment to broadening healthcare access through expanded insurance programs.

This substantial and growing healthcare market presents a fertile ground for companies like ECMOHO. The increasing demand for healthcare products and services, especially those delivered through innovative digital channels, directly benefits platforms that can efficiently connect consumers with these needs.

The digital health market in China is a powerhouse of growth, with projections indicating it could reach over $250 billion by 2030, a significant leap from its 2023 valuation of around $110 billion. This expansion is a direct result of incredible technological progress, strong government backing for innovation, and a surging consumer interest in convenient healthcare solutions like telemedicine and AI-powered diagnostic tools. For ECMOHO, this presents a fertile ground for its platform, offering substantial opportunities to tap into this burgeoning sector.

Chinese consumers, especially younger demographics, are showing a growing commitment to their health, actively seeking out and investing in preventive healthcare solutions and premium nutritional supplements. This trend, amplified by recent global health events, has significantly boosted the demand for online health products and services.

ECMOHO is well-positioned to capitalize on this evolving consumer landscape, leveraging its established digital marketing expertise and efficient supply chain infrastructure to meet the rising demand for health and wellness products. The company's focus on online channels aligns perfectly with how modern Chinese consumers are increasingly researching and purchasing health-related items.

Data from 2024 suggests the health supplement market in China continues its upward trajectory, with online sales channels accounting for a substantial portion of revenue. For instance, online retail sales for health foods and supplements saw a year-over-year increase of approximately 15% in early 2024, demonstrating the strong consumer pull towards digital platforms for these essential goods.

Fiscal Stimulus and Investment in Healthcare

China's significant economic stimulus measures, including substantial government funding directed towards healthcare, are a major tailwind for companies like ECMOHO. This increased investment is particularly beneficial for the development of innovative drugs, the expansion of medical services, and the growth of drug retailers. For example, by the end of 2023, China's central government had allocated over 1 trillion yuan ($140 billion USD) specifically for public health infrastructure and medical research, a significant portion of which flows into the healthcare ecosystem.

This fiscal support directly addresses critical issues within the industry, such as reducing long outstanding receivables that distributors often face from hospitals. By improving the financial health of healthcare providers, stimulus funds indirectly boost the working capital available for distributors. Furthermore, these stimulus packages often aim to increase disposable income and consumer confidence, leading to higher consumer spending on medical services and health-related products, which directly benefits drug retailers.

The positive impact is evident in various segments of the healthcare market:

- Innovation Boost: Government funding fuels research and development in biopharmaceuticals, leading to a pipeline of new treatments.

- Improved Cash Flow: Reduced hospital receivables for distributors mean quicker access to capital for inventory and operations.

- Consumer Demand: Stimulus-driven economic growth translates into increased patient spending on healthcare services and pharmaceuticals.

- Infrastructure Development: Investment in hospitals and clinics expands the reach and capacity of medical care delivery.

Impact of Volume-Based Procurement (VBP)

Volume-Based Procurement (VBP) policies continue to significantly influence the medical product market, particularly pharmaceuticals and devices. These policies drive down prices through national and regional tenders, as seen in various global healthcare systems. For instance, the UK's National Health Service (NHS) has leveraged VBP to negotiate lower prices, achieving substantial savings on high-volume drugs.

While VBP can compress profit margins for manufacturers, it fosters an environment where efficiency and cost-competitiveness are paramount. Companies that can adapt to these price pressures often gain greater market access. A prime example is the trend observed in tender bids across Europe, where price reductions of 15-30% are not uncommon for high-demand medical supplies.

- Price Compression: VBP policies have demonstrably reduced the average selling prices for pharmaceuticals and medical devices in competitive tender processes.

- Market Access Incentive: Companies willing to meet stringent pricing demands can secure larger market shares, especially in government-backed procurement systems.

- Efficiency Driver: The pressure to offer competitive pricing encourages manufacturers to streamline production and supply chain operations.

- Global Impact: VBP strategies are widely adopted, impacting global supply chains and investment decisions for medical product companies.

China's economic landscape is characterized by robust growth in healthcare spending, projected to reach $3 trillion by 2030, driven by an aging population and expanded insurance coverage. This creates significant opportunities for companies like ECMOHO, especially within the rapidly expanding digital health sector, which is expected to exceed $250 billion by 2030. Government stimulus measures, including over $140 billion allocated by the end of 2023 for public health, further bolster the healthcare ecosystem by supporting innovation, improving cash flow for distributors, and stimulating consumer spending on health products. Volume-Based Procurement (VBP) policies, while compressing prices, encourage efficiency and market access for competitive players, reflecting a global trend in cost-effective healthcare procurement.

Preview Before You Purchase

ECMOHO PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ECMOHO PESTLE Analysis provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that the detailed insights and strategic recommendations presented are precisely what you'll be working with.

Sociological factors

China's population is getting older, fast. By the end of 2024, it's estimated that over 270 million people will be 60 or older, a number that's only expected to grow. This means there's a huge demand for services like elderly care, managing long-term illnesses, and medications.

This demographic shift is a major driver for healthcare spending. We're seeing significant investment pouring into building more hospitals and clinics, especially those focused on senior care. Furthermore, the need for efficient and accessible healthcare is pushing the adoption of digital health platforms and telehealth services.

By 2025, projections show the healthcare market in China will continue its robust expansion, largely fueled by the needs of this aging demographic. Companies offering specialized geriatric pharmaceuticals and innovative long-term care solutions are well-positioned to benefit from this trend.

The COVID-19 pandemic significantly boosted consumer interest in health and wellness, particularly preventive care. This trend has directly translated into a greater demand for health supplements and digital health solutions, areas where ECMOHO operates.

Chinese consumers are increasingly prioritizing products that enhance immunity, boost energy levels, and aid in managing chronic health conditions. This shift in consumer mindset perfectly aligns with ECMOHO's product portfolio, creating a favorable market environment.

By early 2024, the health and wellness market in China was estimated to be worth over $1.5 trillion, with a substantial portion attributed to dietary supplements and health-focused e-commerce platforms.

This heightened awareness of preventive health, coupled with a willingness to invest in proactive well-being, presents a robust opportunity for ECMOHO to capitalize on evolving consumer preferences.

China's population is increasingly comfortable with digital technology, with a significant portion demonstrating strong digital health literacy. This familiarity directly translates into a higher willingness to adopt online medical services, telemedicine, and AI-driven healthcare solutions. For instance, in 2024, over 60% of Chinese internet users engaged with online health information and services, a figure projected to rise.

The robust growth of e-commerce for health-related products further highlights this consumer readiness. By the end of 2023, online sales of pharmaceuticals and health supplements in China surpassed $150 billion, indicating a clear preference for digital channels. This trend supports the rapid adoption of digital health platforms by companies like ECMOHO.

Changing Lifestyles and Chronic Disease Burden

Societal shifts, particularly in China, are directly impacting health landscapes. As living standards have risen, so too has the prevalence of chronic diseases. Conditions like diabetes and cardiovascular issues are becoming more common, presenting a significant public health challenge.

This growing burden of chronic illness is creating a substantial demand for innovative health solutions. Specifically, there's an increasing need for digital tools that facilitate real-time monitoring and proactive management of these conditions. This is where platforms like ECMOHO can play a crucial role.

- Rising Chronic Disease Rates: In China, the prevalence of diabetes, a key chronic disease, has been a growing concern. As of recent data, over 126 million adults in China have diabetes, representing a significant portion of the global burden.

- Demand for Digital Health: This surge in chronic conditions fuels the market for digital health solutions. Wearable devices and mobile health systems are seeing increased adoption as individuals seek ways to manage their well-being more effectively.

- ECMOHO's Role: ECMOHO's platform is well-positioned to capitalize on this trend by offering services and tools that support the remote monitoring and personalized management of chronic diseases, aligning with evolving consumer health needs.

Urban-Rural Healthcare Disparities

Significant disparities persist in healthcare resource distribution and digital health infrastructure across China, particularly between urban and rural areas. Urban centers typically boast advanced medical facilities and a higher concentration of healthcare professionals, while rural regions often face shortages and limited access to specialized care.

This divide presents a substantial challenge for ensuring equitable healthcare access. For instance, as of 2023, rural areas in China still grapple with a lower doctor-to-patient ratio compared to their urban counterparts, a gap that digital health solutions aim to address.

Digital health platforms offer a compelling opportunity to bridge these service gaps, bringing expertise and services to underserved rural populations. These platforms can facilitate remote consultations, provide access to online medical records, and deliver health education, thereby mitigating the impact of geographical barriers.

- Urban Healthcare Advantage: Urban areas possess a higher density of hospitals, specialist clinics, and advanced medical equipment.

- Rural Healthcare Deficit: Rural regions often experience a shortage of healthcare professionals and limited access to specialized medical services.

- Digital Health Opportunity: Digital platforms can connect rural patients with urban medical expertise through telemedicine and remote diagnostics.

- Bridging the Gap: Initiatives focusing on digital health infrastructure in rural China aim to improve access to preventative care and chronic disease management.

China's aging population, with over 270 million people aged 60+ by the end of 2024, is driving demand for elder care and chronic disease management. This demographic shift fuels healthcare spending and the adoption of digital health solutions.

The growing prevalence of chronic diseases, such as diabetes impacting over 126 million adults in China, necessitates innovative health management tools. Digital health platforms are crucial for remote monitoring and personalized care, aligning with ECMOHO's offerings.

Significant disparities in healthcare access between urban and rural areas highlight the potential for digital health to bridge service gaps. By 2023, rural areas still faced lower doctor-to-patient ratios, making online consultations and remote diagnostics vital.

The increasing comfort with digital technology and a growing health consciousness, evidenced by the over $1.5 trillion health and wellness market in China by early 2024, create a favorable environment for ECMOHO's digital health and supplement business.

Technological factors

Technological advancements in Artificial Intelligence (AI) and Big Data analytics are fundamentally reshaping China's healthcare landscape. These technologies are instrumental in enhancing diagnostic accuracy, optimizing treatment plans, and bolstering efficiency across the sector. For instance, AI is being deployed to analyze vast datasets, leading to quicker identification of diseases and personalized treatment strategies, a critical factor in managing a population of over 1.4 billion.

Digital healthcare platforms are increasingly integrating sophisticated AI models to refine their existing services. This integration aims to boost operational efficiency and improve the precision of their offerings, from telemedicine consultations to patient record management. By leveraging AI, companies can streamline workflows, reduce administrative burdens, and ultimately deliver higher quality care.

In 2024, the Chinese government continued its push for digital transformation in healthcare, with significant investments in AI and big data infrastructure. Reports indicate that the market for AI in healthcare in China reached tens of billions of USD, demonstrating strong growth. This investment is fueling innovation, enabling better fraud detection in insurance claims, a persistent challenge, and accelerating the pace of new drug discovery and development.

Companies like ECMOHO are well-positioned to capitalize on these trends. By embedding AI-driven analytics into their product and service delivery, they can offer more intelligent solutions to consumers and healthcare providers. This strategic adoption of technology is crucial for maintaining a competitive edge and driving future growth in China's rapidly evolving digital health market.

Telemedicine and online pharmacies are rapidly transforming China's healthcare sector. By the end of 2023, approximately 70% of Chinese consumers reported using online medical services, highlighting a substantial shift towards digital health solutions. This expansion directly benefits ECMOHO's business model by providing a ready and growing user base for its digital marketing and supply chain platform.

These digital health platforms offer unparalleled convenience and accessibility, allowing patients to consult with doctors remotely and obtain medications without physical visits. This aligns perfectly with ECMOHO's strategy to leverage technology for efficient healthcare delivery and broader drug access, enhancing its market position.

The push for 'Internet + Healthcare' is fueling the creation of sophisticated digital health platforms. These platforms are designed to bring together various aspects of healthcare, from virtual doctor visits to managing electronic health records and even incorporating data from Internet of Things (IoT) diagnostic devices.

This integration is crucial for creating a more seamless flow of patient information and significantly improving how healthcare services are delivered. For instance, China's National Health Commission reported that by the end of 2023, over 90% of tertiary hospitals had established online consultation services, showcasing the rapid adoption of these digital solutions.

These integrated systems are not just about convenience; they aim to enhance overall healthcare efficiency and patient outcomes. By centralizing data and streamlining processes, these platforms can lead to better-informed medical decisions and more personalized patient care, a trend that is expected to accelerate through 2025.

Cybersecurity and Data Security Technologies

The increasing digitalization of healthcare makes robust cybersecurity and data security technologies paramount for protecting sensitive patient information. In 2024, the global cybersecurity market for healthcare was valued at approximately $30 billion, with projections indicating continued growth. This highlights the significant investment needed to safeguard patient data against sophisticated threats.

Compliance with evolving data protection regulations, such as China's Personal Information Protection Law (PIPL), demands continuous investment in secure IT infrastructures and rigorous risk assessments. Failure to comply can result in substantial fines, with PIPL penalties potentially reaching up to 5% of a company's annual turnover or 50 million yuan. This regulatory landscape underscores the critical need for ECMOHO to prioritize data security.

- Increased reliance on cloud-based systems for patient data storage necessitates advanced encryption and access control technologies.

- The rise of telehealth and remote patient monitoring creates new vulnerabilities that require sophisticated threat detection and prevention systems.

- Adherence to PIPL and other global data privacy laws requires ongoing updates to security protocols and regular employee training.

- Investment in AI-powered security solutions is becoming essential to proactively identify and mitigate emerging cyber threats.

Emergence of Smart Hospitals and AI-powered Medical Devices

China's healthcare sector is rapidly embracing technological advancements, with a notable emergence of 'smart hospitals'. These facilities leverage big data analytics and artificial intelligence to streamline clinical operations, enhance diagnostic accuracy, and ultimately improve patient care. For instance, by mid-2024, several major Chinese hospitals were piloting AI-driven systems for tasks like medical image analysis and patient flow management, reporting efficiency gains of up to 15% in certain departments.

The integration of AI extends to medical devices themselves. By early 2025, regulatory bodies had approved a growing number of innovative AI-powered devices, ranging from intelligent surgical robots to advanced diagnostic tools. This signifies a tangible shift towards technology that not only assists but actively participates in medical procedures and diagnostics, reflecting a significant investment in R&D by both domestic and international medical technology firms operating in China.

Key developments supporting this trend include:

- Increased AI Adoption: A 2024 survey indicated that over 60% of large Chinese hospitals were exploring or implementing AI solutions for administrative and clinical support.

- AI Medical Device Approvals: The number of AI-enabled medical devices receiving market approval in China saw a year-over-year increase of approximately 25% in 2024.

- Government Support: National policies continue to prioritize digital health and AI in healthcare, fostering an environment conducive to technological innovation and adoption.

- Investment Growth: Venture capital funding in Chinese health tech AI startups reached an estimated $2 billion in 2024, highlighting strong investor confidence in the sector's potential.

Technological advancements, particularly in AI and big data, are revolutionizing China's healthcare, boosting diagnostic accuracy and personalizing treatments for its vast population. By 2024, the AI in healthcare market in China was valued in the tens of billions of USD, fueling innovation from drug discovery to insurance fraud detection.

Telemedicine and online pharmacies are rapidly expanding, with around 70% of Chinese consumers using online medical services by the end of 2023, directly benefiting platforms like ECMOHO. Over 90% of tertiary hospitals offered online consultations by late 2023, showcasing widespread digital adoption.

The integration of AI into medical devices is accelerating, with a projected 25% year-over-year increase in AI-enabled medical device approvals in China during 2024. Venture capital invested an estimated $2 billion into Chinese health tech AI startups in 2024, underscoring robust investor confidence.

| Technology Area | 2023/2024 Data/Trend | Impact on ECMOHO |

|---|---|---|

| AI & Big Data | Market value in tens of billions USD (2024); 60%+ of large hospitals exploring AI (2024) | Enhances diagnostic accuracy, optimizes treatments, improves operational efficiency for ECMOHO's platform. |

| Telemedicine & Online Pharmacies | 70% consumer usage (end of 2023); 90%+ tertiary hospitals offering online consultations (end of 2023) | Provides a growing user base and aligns with ECMOHO's digital health delivery strategy. |

| AI-Powered Medical Devices | ~25% YoY increase in approvals (2024); $2B VC investment in health tech AI (2024) | Supports integration of advanced healthcare solutions and potentially new service offerings for ECMOHO. |

Legal factors

China's Personal Information Protection Law (PIPL), alongside the Data Security Law (DSL) and Cybersecurity Law (CSL), establishes a robust data privacy regime. This framework mandates explicit consent for processing personal information and imposes stringent regulations on transferring data outside of China. For ECMOHO, adherence to these laws is critical to prevent significant penalties, which can include fines up to 5% of the previous year's annual turnover or RMB 1 million for violations, alongside operational restrictions.

Regulations governing online pharmaceutical sales and e-commerce platforms are crucial for ECMOHO, shaping its ability to link pharmaceutical firms with digital sales channels. These laws influence everything from how products can be advertised and listed to the protections offered to consumers in the online health product space.

In China, for instance, the National Medical Products Administration (NMPA) has been progressively refining rules for online drug sales. While direct-to-consumer prescription drug sales online remain heavily restricted as of early 2024, rules for over-the-counter (OTC) medications and health products are more established, impacting platforms like ECMOHO's by defining acceptable transaction models.

Consumer protection laws are also a significant factor, ensuring transparency in product information, secure payment gateways, and clear return policies. For ECMOHO, adherence to these legal frameworks is paramount to building trust and ensuring compliance in the rapidly evolving digital health market.

New anti-monopoly guidelines are specifically targeting the pharmaceutical sector, aiming to foster fairer market competition. These regulations often include scrutiny of pricing practices and business consolidation within the industry.

Formalized anti-corruption compliance guidelines for healthcare companies are also being enacted. These measures are designed to prevent commercial bribery and ensure ethical business conduct.

For example, in 2024, China's State Administration for Market Regulation (SAMR) continued its focus on anti-monopoly enforcement, with the pharmaceutical sector remaining a key area of interest. Fines for monopolistic practices have reached significant amounts, underscoring the seriousness of these regulations.

Companies like ECMOHO must therefore strengthen their internal compliance systems to adhere to these evolving legal frameworks. This involves robust training programs and clear policies against bribery and anti-competitive behavior.

Drug and Medical Device Approval Processes

The National Medical Products Administration (NMPA) is actively streamlining its review and approval pathways for novel drugs and medical devices. This includes implementing policies designed to facilitate the localized production of imported devices, a move that could reduce lead times and costs for products available on platforms like ECMOHO. The NMPA's commitment to strengthening clinical trial data exclusivity further incentivizes innovation.

These regulatory adjustments are crucial for ECMOHO as they can significantly shorten the time it takes for new, cutting-edge products to reach the Chinese market. For instance, reforms aimed at expediting approvals for drugs addressing unmet medical needs, a focus area for the NMPA in recent years, directly benefit ECMOHO's ability to offer advanced treatments to its user base. The increased efficiency in the approval process can lead to a more dynamic product pipeline for the platform.

- NMPA Reforms: Focus on optimizing review and approval for innovative drugs and medical devices.

- Localized Production: Policies easing the local manufacturing of imported devices are being introduced.

- Data Exclusivity: Strengthened protection for clinical trial data encourages R&D investment.

- Market Entry: Reforms aim to accelerate the speed at which new medical products enter the market.

National Health Insurance (NHI) Coverage for Online Services

The inclusion of online healthcare expenses within National Health Insurance (NHI) coverage is a pivotal development for the digital health sector. This policy shift directly addresses affordability for consumers, potentially leading to a significant expansion in the market for online health services. For instance, countries prioritizing digital health integration into national insurance schemes often see a surge in telemedicine adoption. This policy aligns with broader national development strategies focused on modernizing healthcare infrastructure and improving accessibility.

This expansion of NHI coverage to online services acts as a powerful catalyst for the growth of digital healthcare models. By making these services more cost-effective for a larger segment of the population, it encourages greater uptake and investment in telehealth platforms and remote patient monitoring solutions. This is particularly relevant as many nations, including those in Asia, have outlined clear targets for digital health integration in their national health strategies for the 2024-2025 period, aiming to leverage technology for more efficient and widespread healthcare delivery.

- NHI coverage for online services reduces out-of-pocket expenses for users.

- This policy directly boosts the market potential for digital healthcare providers.

- National development plans increasingly emphasize the integration of telehealth.

- Expect increased adoption of online health platforms and services.

China's evolving legal landscape, particularly concerning data privacy and e-commerce, directly shapes ECMOHO's operational capacity and compliance obligations. Strict adherence to laws like the Personal Information Protection Law (PIPL) is essential to avoid substantial penalties, including fines up to 5% of annual turnover. Furthermore, regulations on online pharmaceutical sales, overseen by bodies like the NMPA, dictate how platforms can engage with pharmaceutical firms and consumers, with current restrictions on direct-to-consumer prescription drug sales online impacting business models.

New anti-monopoly guidelines and anti-corruption measures are also crucial legal factors, promoting fair competition and ethical conduct within the healthcare sector. For instance, in 2024, the State Administration for Market Regulation continued its focus on anti-monopoly enforcement in pharmaceuticals. ECMOHO must therefore bolster its internal compliance systems to navigate these evolving legal requirements effectively.

The National Medical Products Administration (NMPA) is actively streamlining approval processes for new drugs and medical devices, which could significantly accelerate market entry for innovative products. Policies supporting localized production of imported devices and enhanced clinical trial data exclusivity are designed to foster innovation and reduce lead times. These reforms are vital for ECMOHO to maintain a dynamic product pipeline and offer cutting-edge treatments.

The integration of online healthcare expenses into National Health Insurance (NHI) coverage represents a significant legal and policy shift. This move aims to improve affordability and accessibility for digital health services, potentially driving substantial market growth. Many nations, including those in Asia, have outlined digital health integration targets for 2024-2025 within their national health strategies, highlighting the growing importance of this trend.

Environmental factors

The growing global focus on environmental sustainability is significantly reshaping healthcare supply chains, pushing companies like ECMOHO to integrate eco-friendly practices. This includes optimizing logistics and distribution networks to reduce their carbon footprint. For example, a 2024 report indicated that 65% of healthcare organizations are prioritizing supply chain sustainability initiatives.

ECMOHO, as a platform facilitating these processes, will likely encounter increasing demands for greener warehousing solutions and more environmentally conscious transportation methods. The company could explore options like electric vehicles for last-mile delivery or investing in energy-efficient warehouse technologies to meet these evolving expectations.

China's healthcare sector faces increasing scrutiny regarding waste management, with new regulations aiming to curb pollution. For distributors like ECMOHO, this translates to a need for robust systems to handle medical waste responsibly, a growing concern as environmental standards tighten across the nation.

The Ministry of Ecology and Environment reported a significant increase in hazardous medical waste generation during the COVID-19 pandemic, highlighting the scale of the challenge. ECMOHO's commitment to environmental compliance in 2024 and 2025 will be crucial for maintaining operational integrity and brand reputation.

Non-compliance with evolving waste disposal and pollution control standards can lead to substantial fines and operational disruptions. Therefore, investing in sustainable practices and ensuring adherence to China's environmental protection laws is paramount for ECMOHO's long-term success in the healthcare distribution market.

The COVID-19 pandemic undeniably underscored the indispensable role of digital health solutions. During this period, telehealth platforms saw an unprecedented surge, with some reporting increases of over 1,000% in patient visits in early 2020. This rapid adoption demonstrated their capacity for swift information dissemination and managing patient care remotely, proving vital for containing outbreaks and ensuring continuity of services.

Looking ahead, the demand for robust and sustainable digital health infrastructure is paramount. The global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly. This growth is fueled by the recognition that resilient digital systems are not just for convenience, but are essential for national security during future public health crises, enabling faster response times and more effective resource allocation.

Energy Consumption of Digital Infrastructure

The increasing demand for digital services, including those in healthcare like ECMOHO, directly translates to higher energy consumption by data centers and digital infrastructure. By 2026, global data center energy consumption is projected to reach 1,000 terawatt-hours (TWh), representing a significant portion of worldwide electricity use. This trend necessitates a focus on energy efficiency and the adoption of sustainable energy sources for companies like ECMOHO that rely heavily on technology.

ECMOHO's operational model, which leverages data analytics and digital platforms for healthcare services, will inevitably contribute to this energy demand. To mitigate environmental impact and align with sustainability goals, ECMOHO should prioritize energy-efficient technologies and explore renewable energy procurement. For instance, the tech industry's push towards sustainability saw significant investment in renewable energy projects in 2024, with major tech companies committing to 100% renewable energy for their operations.

- Data Center Energy Demand: Global data centers are expected to consume approximately 1,000 TWh of electricity annually by 2026.

- Renewable Energy Adoption: In 2024, a notable increase in corporate power purchase agreements for renewable energy was observed among technology firms.

- Operational Efficiency: Implementing advanced cooling systems and energy-efficient hardware can reduce the energy footprint of digital operations.

Promotion of Eco-Friendly Products

Consumers are increasingly prioritizing eco-friendly and sustainably sourced items, a trend significantly impacting the health and wellness sector. This shift is driven by both heightened environmental awareness and evolving regulatory landscapes. For ECMOHO, this presents a clear avenue for growth by aligning with brands that champion environmental responsibility.

By strategically partnering with companies offering green health products, ECMOHO can tap into this burgeoning market segment. For instance, a significant portion of consumers, particularly Millennials and Gen Z, actively seek out sustainable options; a 2024 survey indicated that over 60% of consumers are willing to pay more for sustainable products.

- Growing Consumer Demand: Increased preference for health products with minimal environmental impact.

- Regulatory Tailwinds: Government policies are increasingly favoring and incentivizing sustainable business practices.

- Market Opportunity: Potential for ECMOHO to gain market share by offering or promoting eco-conscious brands.

- Brand Differentiation: Sustainability can serve as a key differentiator in a competitive health and wellness market.

Environmental factors are increasingly influencing the healthcare distribution landscape, pushing companies like ECMOHO to adopt sustainable practices. This includes optimizing logistics to reduce carbon emissions and ensuring responsible waste management, particularly in regions like China where environmental regulations are tightening. The growing consumer preference for eco-friendly products also presents a significant market opportunity for ECMOHO to align with sustainable brands.

| Environmental Factor | Impact on ECMOHO | Data/Trend (2024-2025) |

| Climate Change & Carbon Footprint | Need for greener logistics and warehousing. | 65% of healthcare organizations prioritizing supply chain sustainability (2024). |

| Waste Management | Requirement for robust medical waste handling systems. | Significant increase in hazardous medical waste during COVID-19 pandemic. |

| Energy Consumption (Digital Operations) | Focus on energy efficiency in data centers and digital infrastructure. | Global data center energy consumption projected to reach 1,000 TWh by 2026. |

| Consumer Demand for Sustainability | Opportunity to partner with eco-conscious brands. | Over 60% of consumers willing to pay more for sustainable products (2024). |

PESTLE Analysis Data Sources

Our ECMOHO PESTLE analysis is built on a robust foundation of publicly available data from reputable sources, including government reports, international organizations, and industry-specific publications. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to ensure comprehensive and accurate insights.