Easy Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Easy Holdings Bundle

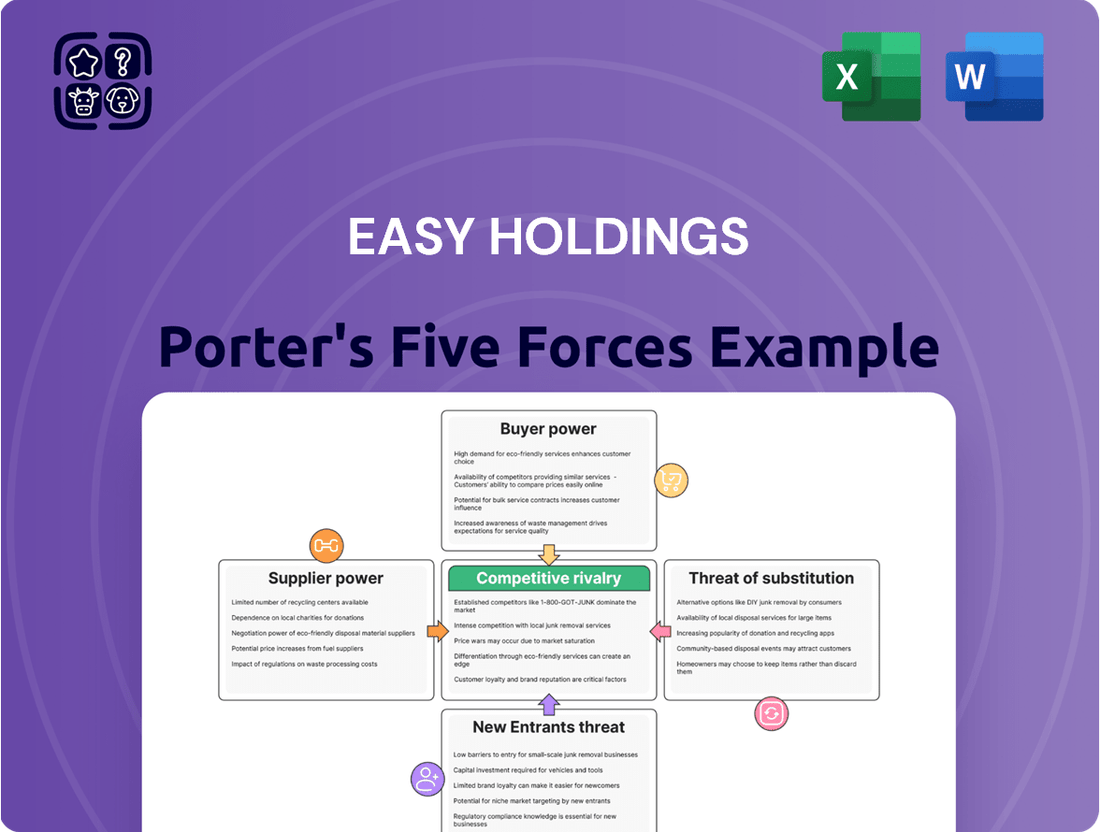

Easy Holdings faces a dynamic competitive landscape, with moderate threats from new entrants and a significant bargaining power of buyers. Understanding these pressures is crucial for strategic planning.

The complete report reveals the real forces shaping Easy Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Easy Holdings' reliance on essential agricultural commodities such as corn, wheat, and soybean meal for its animal feed manufacturing is a significant factor in its supply chain. South Korea, as a nation, is notably dependent on importing these vital ingredients, meaning Easy Holdings faces a concentrated supplier base with considerable influence.

The global market for these commodities is inherently volatile. Fluctuations in international commodity prices, driven by factors like weather patterns, geopolitical events, and global demand, directly impact Easy Holdings' input costs. For instance, in early 2024, corn prices saw notable upward movement due to supply concerns in major producing regions, directly affecting feed ingredient costs for companies like Easy Holdings.

Furthermore, international trade agreements and policies play a crucial role in the availability and cost of these raw materials. Changes in tariffs, import quotas, or trade disputes can disrupt supply chains and shift bargaining power towards suppliers who can navigate or benefit from these international dynamics, potentially increasing costs for Easy Holdings.

Easy Holdings' reliance on specialized biotechnology inputs like enzymes, amino acids, and probiotics grants significant bargaining power to its suppliers. These are not commodities; they are high-value, often proprietary, ingredients crucial for animal health and productivity.

Suppliers with unique, bioengineered solutions can leverage their technology to dictate terms. For instance, a supplier of a novel probiotic strain that demonstrably increases feed conversion ratios by 5% could command premium pricing, as this directly impacts Easy Holdings' profitability.

The specialized nature of these inputs means switching suppliers can be costly and time-consuming, involving reformulation and re-testing, further strengthening the position of established, innovative suppliers in the 2024 market.

The global animal feed additives market is dominated by a few major players, including ADM, BASF, dsm-firmenich, Cargill, Evonik, and Nutreco. This concentration means that Easy Holdings has fewer alternative suppliers for critical additives.

When specific, less commoditized, or highly specialized additives are required, these key suppliers gain significant leverage. For instance, in 2024, the market for specific amino acids, crucial for animal nutrition, saw price increases driven by supply chain constraints and demand from emerging markets, directly impacting purchasing power for companies like Easy Holdings.

Switching Costs for Proprietary Ingredients

Switching from one supplier to another for highly specialized or proprietary feed additives can involve significant costs for Easy Holdings. These costs include R&D for new formulations, extensive testing to ensure efficacy and safety, and potential disruptions to established production processes. This reality significantly bolsters the bargaining power of suppliers who provide these unique ingredients.

For instance, if a proprietary additive enhances feed conversion ratios by a measurable percentage, the cost and time associated with reformulating and re-validating a new additive could outweigh the immediate benefits of switching. This makes it difficult for Easy Holdings to negotiate lower prices or better terms without facing substantial operational hurdles.

- High R&D Investment: Developing and testing new feed additive formulations can cost hundreds of thousands of dollars.

- Production Line Adjustments: Modifying production lines to accommodate new ingredients can incur capital expenditure and downtime.

- Regulatory Compliance: New additives require rigorous testing and approval processes, adding time and expense.

- Supplier Lock-in: Proprietary nature creates a de facto lock-in, strengthening supplier leverage.

Supplier's Ability to Forward Integrate

The bargaining power of suppliers can be amplified if they possess the capability to integrate forward into the buyer's business. For Easy Holdings, while less common, major agricultural commodity suppliers or advanced biotechnology firms could theoretically move into feed production, directly competing with Easy Holdings’ core operations. This threat, however, is somewhat contained by Easy Holdings' established vertical integration and dominant market share within South Korea, which provides significant leverage.

The potential for forward integration by suppliers poses a notable challenge. For instance, a large-scale grain producer in 2024, with access to advanced processing technology, might consider entering the animal feed market. This could directly impact Easy Holdings by increasing competition and potentially driving down margins for its feed products. However, Easy Holdings' robust supply chain management and long-standing relationships with its current suppliers in South Korea act as a buffer against such disruptive moves.

- Supplier Forward Integration Threat: Large commodity suppliers or biotech firms could enter Easy Holdings' feed production market.

- Mitigating Factors: Easy Holdings' existing vertical integration and strong South Korean market position reduce this risk.

- Industry Example: A major agricultural producer in 2024 might consider backward integration into feed manufacturing, impacting Easy Holdings.

Easy Holdings faces substantial supplier bargaining power due to its reliance on imported agricultural commodities like corn and soybeans, with South Korea's import dependency concentrating power among global suppliers. The volatility of these commodity markets, influenced by global events and weather, directly impacts input costs for Easy Holdings, as seen with corn price surges in early 2024.

The company's need for specialized biotechnology inputs, such as unique amino acids and probiotics, further empowers suppliers. These high-value, often proprietary ingredients require significant investment and time to switch, allowing dominant players in the 2024 additives market to dictate terms and pricing.

The bargaining power of suppliers is also enhanced by the potential for forward integration, where large commodity or biotech firms could enter Easy Holdings' feed production market. However, Easy Holdings' established vertical integration and strong position in South Korea mitigate this specific threat.

What is included in the product

This analysis delves into the competitive forces impacting Easy Holdings, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its industry.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, making complex strategic analysis accessible to any team member.

Customers Bargaining Power

Easy Holdings caters to a broad customer spectrum, encompassing numerous individual livestock farms and larger processed meat manufacturers. This diversity generally dilutes the bargaining power of any single customer.

However, significant commercial farming operations, particularly in the poultry and swine sectors, represent a counterbalancing force. These large entities, by virtue of their substantial purchase volumes, can exert considerable negotiation leverage over Easy Holdings.

Customers buying standard animal feed are very sensitive to price. This is because feed costs make up a large chunk of their total expenses in raising livestock. For example, feed can account for 60-70% of a hog producer's costs and 50-60% for a broiler chicken operation.

This high price sensitivity gives buyers significant leverage to negotiate lower prices with Easy Holdings for its bulk feed. They can easily switch to competitors if prices are not competitive, forcing Easy Holdings to manage its costs carefully.

Customers possess significant bargaining power due to the wide availability of alternative feed sources. They can easily switch between numerous domestic and international suppliers for feed ingredients or basic feed mixes, putting pressure on Easy Holdings to offer competitive pricing and terms.

The South Korean compound feed market is quite mature, meaning customers, particularly larger agricultural operations, have well-established relationships and readily available choices from multiple providers. This maturity amplifies their ability to negotiate favorable terms, as they are not reliant on a single supplier.

Impact of Processed Meat Market Trends

In the processed meat sector, Easy Holdings faces customers like supermarkets and restaurant chains. These buyers hold significant bargaining power, especially as consumer tastes shift towards convenience and healthier, organic choices. For instance, the global processed meat market, valued at approximately $275 billion in 2023, is expected to grow, but this expansion also brings more informed and demanding buyers.

The increasing demand for transparency and perceived health benefits in food products directly impacts Easy Holdings' customer leverage. Retailers, in particular, can exert pressure on pricing and product specifications, leveraging the availability of numerous suppliers in a competitive market.

- Customer Concentration: The bargaining power of customers is amplified if a few large retailers or foodservice providers account for a substantial portion of Easy Holdings' processed meat sales.

- Availability of Substitutes: If consumers increasingly opt for fresh or plant-based alternatives, retailers may have less reliance on processed meat, thereby increasing their bargaining power.

- Switching Costs: Low switching costs for retailers and foodservice providers mean they can easily shift to alternative suppliers if Easy Holdings' offerings or prices are not competitive.

- Price Sensitivity: High price sensitivity among end consumers can translate into greater pressure on retailers, who then pass this pressure onto Easy Holdings.

Customer's Threat of Backward Integration

Customers, particularly large-scale livestock farms, may consider backward integration by producing their own basic feed components, especially for widely available ingredients. This could reduce their reliance on suppliers like Easy Holdings.

However, Easy Holdings' significant investments in biotechnology, proprietary feed additives, and a well-established vertical integration model across the entire agro-livestock sector present substantial barriers. These capabilities make it difficult and costly for most customers to replicate Easy Holdings' specialized offerings and supply chain efficiencies.

- Specialized Feed Additives: Easy Holdings' R&D in feed additives, which can improve animal health and growth, represents a significant competitive advantage. For example, in 2024, the global feed additives market was valued at approximately $25 billion, with biotechnology-derived additives showing strong growth.

- Vertical Integration: Easy Holdings' control over various stages of the agro-livestock value chain, from raw material sourcing to finished feed production, creates economies of scale and supply chain resilience that are hard for individual customers to match.

- Cost of Replication: The capital investment and expertise required for a customer to develop similar biotechnology capabilities and establish a comparable integrated supply chain would likely be prohibitive, especially for common feed ingredients.

Customers, especially large agricultural operations, exhibit significant bargaining power due to their high price sensitivity for animal feed, which constitutes a substantial portion of their operational costs. This leverage is further amplified by the readily available substitutes and low switching costs in the mature South Korean market, compelling Easy Holdings to maintain competitive pricing and terms.

While Easy Holdings' specialized offerings and vertical integration create barriers, the sheer volume purchased by major clients and the increasing demands from processed meat buyers like supermarkets exert considerable pressure. These factors collectively underscore the substantial bargaining power customers wield within the industry.

| Customer Segment | Key Drivers of Bargaining Power | Impact on Easy Holdings |

|---|---|---|

| Large Livestock Farms (Poultry, Swine) | High price sensitivity (feed costs 60-70% of hog production), availability of substitutes, low switching costs. | Negotiate lower prices, demand favorable terms. |

| Processed Meat Buyers (Supermarkets, Restaurants) | Consumer demand shifts (healthier, organic), transparency requirements, availability of numerous suppliers. | Pressure on pricing and product specifications. |

| Individual Small Farms | Lower individual volume, but collective purchasing power can be a factor. | Less direct leverage, but market trends influence their demands. |

Preview the Actual Deliverable

Easy Holdings Porter's Five Forces Analysis

You're previewing the final version of our comprehensive Porter's Five Forces analysis for Easy Holdings, precisely the same document that will be available to you instantly after buying. This detailed report breaks down the competitive landscape, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors within Easy Holdings' industry. Understanding these forces is crucial for strategic decision-making and identifying potential opportunities and threats.

Rivalry Among Competitors

The South Korean animal feed market is characterized by its maturity and stable demand, fostering a highly competitive environment. Easy Holdings, as one of the nation's largest feed producers, operates within this landscape, facing significant rivalry from other well-established players.

In 2023, the South Korean feed industry saw robust activity, with Easy Holdings reporting total revenue of approximately 1.1 trillion KRW, underscoring its substantial market presence and the scale of competition it navigates. This intense rivalry means that differentiating through product quality, efficiency, and innovation is crucial for sustained success.

Easy Holdings, primarily through EASY BIO, navigates a highly competitive global feed additive market. Major multinational corporations like ADM, BASF, dsm-firmenich, Cargill, Evonik, and Nutreco are significant players, intensifying the rivalry.

This intense global competition demands constant innovation and strategic market expansion from Easy Holdings to maintain its market position. For instance, the global feed additives market was valued at approximately $22.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating substantial growth but also fierce competition for market share.

Competitive rivalry in the animal feed industry is intensely fueled by innovation, especially in biotechnology. Companies are constantly developing new feed solutions and additives designed to boost animal health, accelerate growth, and improve sustainability. This technological race means significant investment in research and development is crucial for any player aiming to maintain a competitive edge and offer truly differentiated products.

Vertical Integration and Diversification Strategies

Easy Holdings' extensive vertical integration, spanning from feed production to processed meat, and its strategic expansion into poultry operations significantly bolster its competitive stance. This integration allows for greater control over its supply chain and creates diverse revenue streams, putting pressure on rivals who lack similar integration. For instance, in 2024, the global meat processing market saw continued consolidation, with companies like Easy Holdings leveraging their integrated models to gain market share.

Competitors are compelled to either mirror Easy Holdings' integrated approach or carve out specialized niches to remain competitive. This dynamic intensifies rivalry, as players must innovate in their supply chain management and product offerings. The focus on efficiency and cost control through vertical integration is a key differentiator, forcing others to re-evaluate their operational strategies.

- Supply Chain Control: Easy Holdings’ end-to-end operations in livestock and poultry provide a significant advantage in managing costs and ensuring product quality.

- Revenue Diversification: By operating across multiple stages of the value chain, Easy Holdings mitigates risks associated with single-stage operations and captures value at each step.

- Competitive Pressure: Rivals must either invest heavily in vertical integration or find unique value propositions to compete effectively against Easy Holdings' integrated model.

- Market Dynamics: The trend towards integration, exemplified by Easy Holdings' strategy, shapes the competitive landscape, pushing for greater efficiency and broader market reach among industry players.

Consolidation and M&A Activities

Consolidation is a significant factor shaping competitive rivalry in the feed additive industry. Recent strategic acquisitions, such as Easy Holdings' subsidiary EASY BIO acquiring Devenish Nutrition LLC in North America, highlight this trend. These moves are not isolated incidents but reflect a broader industry push towards consolidation.

Such mergers and acquisitions directly intensify competition. By increasing market share and expanding geographical reach, leading players become more formidable. For instance, the Devenish Nutrition acquisition likely bolstered EASY BIO's presence and product offerings in the North American market, putting pressure on existing competitors.

- Industry Consolidation: Acquisitions like EASY BIO's purchase of Devenish Nutrition LLC in North America are indicative of a wider consolidation trend.

- Increased Market Share: These strategic moves allow acquiring companies to capture a larger portion of the market, intensifying rivalry.

- Geographical Expansion: Companies are leveraging M&A to broaden their operational footprint and customer base, creating a more competitive landscape.

- Enhanced Product Portfolios: Acquisitions often bring new technologies and product lines, forcing competitors to innovate or risk falling behind.

The South Korean animal feed market is mature and highly competitive, with Easy Holdings facing significant rivalry from established players. This intensity is further amplified in the global feed additive market, where multinational corporations like ADM and BASF are major competitors, driving a need for continuous innovation and strategic expansion.

Easy Holdings' vertical integration, from feed production to processed meat and poultry operations, provides a distinct advantage in cost control and supply chain management. This integrated model, highlighted by continued consolidation in the global meat processing market in 2024, pressures competitors to either adopt similar strategies or focus on specialized niches.

Consolidation through mergers and acquisitions, such as EASY BIO's acquisition of Devenish Nutrition LLC in North America, is a key driver of intensified rivalry. These moves expand market share and geographical reach, forcing competitors to innovate their product portfolios and operational strategies to remain competitive.

SSubstitutes Threaten

The animal feed industry is increasingly seeing a threat from alternative protein sources like algae, insect meal, and microbial proteins. These options are gaining traction due to the rising costs of conventional ingredients such as soymeal and fishmeal, which experienced significant price volatility in 2023 and early 2024. Sustainability concerns also fuel this shift, as these alternatives often have a lower environmental footprint.

Growing consumer demand for ethically sourced and antibiotic-free animal products is fueling a significant shift towards natural and organic additives in animal feed. This trend directly challenges traditional feed additive manufacturers, as consumers increasingly scrutinize ingredient lists and production methods. For instance, the global organic animal feed market was valued at approximately $12.5 billion in 2023 and is projected to grow substantially in the coming years, indicating a clear substitute threat.

In the processed meat sector, the growing appeal of plant-based options and the development of lab-grown meat represent a substantial substitute threat over the long haul. These alternatives appeal to consumers prioritizing health and sustainability. For instance, the plant-based meat market was valued at approximately $7.5 billion in 2023 and is projected to reach over $15 billion by 2030, indicating a clear shift in consumer preference.

Direct Sourcing of Basic Feed Ingredients by Farmers

Farmers, especially those with significant operations, are increasingly exploring direct sourcing of basic feed ingredients. This allows them to bypass compound feed manufacturers, potentially lowering their overall feed costs. For instance, in 2024, reports indicated a growing trend of large-scale poultry and swine farms in North America investing in on-farm feed milling equipment, aiming to achieve cost savings estimated between 5-15% on their feed expenses.

This direct sourcing acts as a significant substitute for simpler, commodity-based feed products offered by companies like Easy Holdings. By mixing their own rations from raw materials such as corn, soybean meal, and vitamin premixes, farmers can tailor nutrient profiles precisely to their animals' needs while simultaneously cutting out the markup associated with pre-formulated feeds.

- Farmer Cost Savings: Direct sourcing can reduce feed costs by 5-15% for large farms.

- Customization: Farmers can create bespoke feed formulations.

- Substitution Threat: Impacts sales of Easy Holdings' simpler, commodity feed products.

- Investment in Infrastructure: Growing farm investment in on-site feed milling capabilities.

Improved Animal Management Practices

Advances in precision feeding and smart farming technologies are emerging as significant substitutes for traditional animal management. These innovations allow for highly optimized animal nutrition and health, potentially decreasing the need for certain feed additives or growth promoters. For instance, in 2024, the global smart farming market was valued at approximately $26.5 billion, indicating a strong adoption trend.

The increasing sophistication of these technologies offers alternative ways to achieve desired outcomes in animal production, directly impacting the demand for existing inputs. This shift presents a threat as companies relying on traditional feed components may see reduced market share.

- Precision feeding systems can reduce feed waste by up to 15%, a significant cost-saving for producers.

- Smart farming technologies, including AI-driven health monitoring, can lower mortality rates by an estimated 10-20%.

- The market for animal feed additives, a segment directly challenged by these substitutes, was projected to reach over $50 billion globally by 2024.

The threat of substitutes for Easy Holdings is multifaceted, encompassing alternative protein sources, direct farmer sourcing, and advancements in precision feeding. These substitutes challenge traditional feed formulations by offering cost efficiencies, enhanced sustainability, or improved animal performance, potentially eroding market share for conventional feed products.

| Substitute Category | Examples | Impact on Easy Holdings | Key Data Point (2023/2024) |

|---|---|---|---|

| Alternative Proteins | Algae, insect meal, microbial proteins | Reduces demand for conventional protein sources like fishmeal and soymeal. | Global organic animal feed market valued at ~$12.5 billion in 2023. |

| Direct Farmer Sourcing | On-farm feed milling | Bypasses compound feed manufacturers, impacting sales of commodity feeds. | Large farms in North America investing in on-site milling for 5-15% cost savings. |

| Precision Feeding & Smart Farming | AI-driven nutrition, health monitoring | Decreases reliance on certain feed additives and growth promoters. | Global smart farming market valued at ~$26.5 billion in 2024. |

Entrants Threaten

The animal feed and processed meat sectors demand significant upfront capital for advanced manufacturing plants, research and development into new formulations, and robust distribution channels. For instance, establishing a modern feed mill can easily cost tens of millions of dollars, while a state-of-the-art meat processing facility can run into hundreds of millions.

Established companies like Easy Holdings already enjoy considerable economies of scale. In 2024, major players in the animal feed industry reported production volumes in the millions of tons annually, allowing them to negotiate lower raw material prices and spread fixed costs over a larger output. This cost advantage makes it exceedingly challenging for new entrants to match their pricing and achieve profitability from the outset.

The animal feed and processed meat industries are heavily regulated, with strict rules on product safety, quality, and environmental impact. For instance, the U.S. Food and Drug Administration (FDA) oversees feed additives, while the U.S. Department of Agriculture (USDA) regulates processed meat. These regulations create significant barriers for newcomers.

New entrants must navigate complex approval processes and incur substantial compliance costs. These expenses, often running into millions of dollars for facility upgrades and testing, can deter potential competitors. In 2024, for example, companies introducing novel feed ingredients often face multi-year approval timelines and extensive scientific validation requirements, adding to the financial burden.

The biotechnology and feed solutions sectors where Easy Holdings operates demand substantial technological expertise and ongoing research and development. New companies entering this space would need to commit significant capital to develop innovative, proprietary technologies or acquire them, creating a formidable barrier to entry. For instance, in 2024, the global biotechnology market was valued at over $1.7 trillion, with a considerable portion dedicated to R&D, highlighting the investment required to compete.

Established Distribution Channels and Customer Relationships

Easy Holdings leverages deeply entrenched relationships with a vast network of livestock farms, a critical asset that new competitors would find exceedingly difficult to replicate. This established trust and access to supply are foundational to its operations.

Furthermore, the company's vertically integrated subsidiaries have cultivated a comprehensive and efficient distribution network. This robust infrastructure allows for seamless product delivery and market penetration, presenting a significant barrier for any new entrant aiming to establish comparable reach and reliability.

The threat of new entrants is therefore considerably low due to these established distribution channels and customer relationships.

- Established Farm Relationships: Easy Holdings has cultivated long-standing partnerships with numerous livestock farms, securing a consistent and reliable supply chain.

- Vertically Integrated Distribution: The company's subsidiaries manage a comprehensive distribution network, ensuring efficient product movement from farm to market.

- Customer Trust: Years of operation have built significant customer loyalty and trust, making it challenging for new players to gain market acceptance.

- High Market Access Costs: New entrants would face substantial investment and time requirements to build comparable distribution infrastructure and customer rapport.

Brand Loyalty and Reputation

Building strong brand loyalty and a solid reputation in the agricultural and food industries is a long and costly endeavor. Easy Holdings, a significant South Korean entity with international operations, benefits from an established reputation that new entrants find difficult to overcome.

New competitors face the challenge of not only matching product quality but also building consumer trust, which is crucial for repeat business in these sectors. For instance, in 2024, global food and beverage companies invested billions in marketing and brand building to differentiate themselves in increasingly competitive markets.

- High initial investment required for brand building and market penetration.

- Established players like Easy Holdings leverage years of trust and recognition.

- Consumer preference for known brands in food safety and quality creates a barrier.

- New entrants must overcome significant marketing and advertising costs to gain visibility.

The threat of new entrants for Easy Holdings is significantly low. The animal feed and processed meat sectors require substantial capital for advanced manufacturing, R&D, and distribution, with new feed mills costing tens of millions and processing facilities hundreds of millions of dollars. Established players like Easy Holdings benefit from economies of scale, producing millions of tons annually in 2024, which allows for lower raw material costs and competitive pricing that new entrants struggle to match.

Navigating stringent regulations on product safety and environmental impact, such as those overseen by the FDA and USDA, presents another major hurdle. New companies face multi-year approval processes and extensive scientific validation, adding millions in compliance costs, as seen with novel feed ingredients in 2024. Furthermore, the need for technological expertise in biotechnology and feed solutions requires considerable investment in R&D, with the global biotech market valued over $1.7 trillion in 2024.

Easy Holdings' deeply entrenched relationships with livestock farms and its vertically integrated distribution network are formidable barriers. Replicating this established trust and comprehensive infrastructure, which ensures seamless product delivery, demands significant time and capital from newcomers. Building brand loyalty and reputation in these industries is also a long, costly process, with global food companies investing billions in marketing in 2024 to differentiate themselves.

| Barrier to Entry | Description | Estimated Cost/Impact (2024 Data) |

|---|---|---|

| Capital Requirements | Establishing advanced manufacturing plants and R&D facilities. | Feed mills: $10M-$50M+; Processing plants: $100M+ |

| Economies of Scale | Lower production costs due to high-volume output. | Major feed producers: Millions of tons annually |

| Regulatory Compliance | Meeting safety, quality, and environmental standards. | Millions in upgrades and testing; Multi-year approval for new ingredients |

| Technological Expertise | Developing or acquiring proprietary biotech and feed solutions. | Global biotech market R&D: Significant portion of $1.7T+ valuation |

| Distribution & Relationships | Building a comparable network of farm partnerships and supply chains. | Extensive time and capital investment required |

| Brand Reputation & Loyalty | Cultivating consumer trust and recognition in food safety. | Billions invested globally in marketing and brand building |

Porter's Five Forces Analysis Data Sources

Our Easy Holdings Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available financial statements, investor relations materials, and reputable industry research reports.