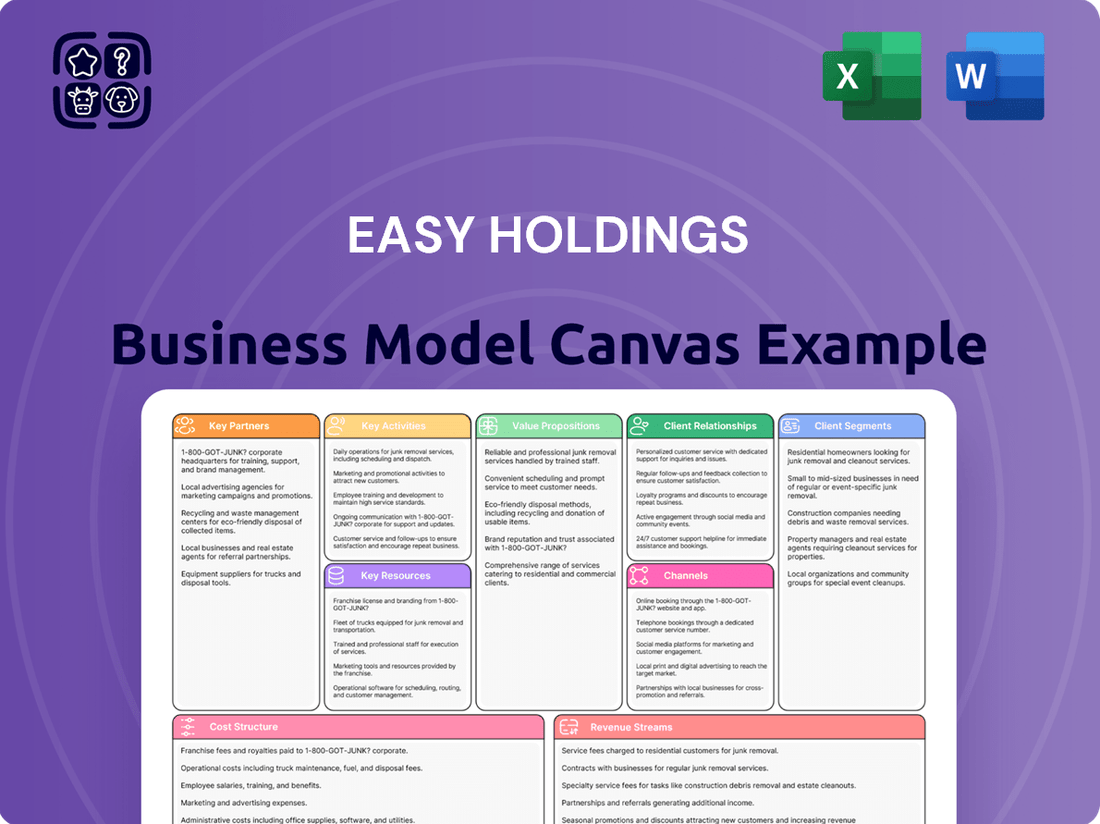

Easy Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Easy Holdings Bundle

Unlock the strategic blueprint behind Easy Holdings's innovative business model. This comprehensive Business Model Canvas reveals their customer-centric approach, key revenue streams, and unique value proposition. Discover how they effectively manage resources and partnerships to achieve market dominance.

Ready to dissect Easy Holdings's success? Our full Business Model Canvas provides an in-depth look at their customer relationships, cost structure, and competitive advantages. Download this actionable resource to gain critical insights for your own business strategy.

Partnerships

Easy Holdings’ collaborations with leading biotechnology research institutions, including universities and specialized centers, are fundamental to driving innovation in its feed solutions and additives. These partnerships are designed to accelerate breakthroughs in animal nutrition and health, keeping the company at the cutting edge of biological resource advancements.

For instance, a 2024 study involving the University of Wageningen, a prominent agricultural research institution, demonstrated a 15% improvement in feed conversion ratios for poultry using novel enzyme additives developed in conjunction with Easy Holdings. Such collaborations allow for the pooling of expertise and resources, significantly shortening the timeline for new product development and market introduction, a critical factor in the fast-evolving biotech sector.

Easy Holdings prioritizes robust relationships with feed ingredient suppliers, including those providing grains, proteins, and essential nutrients. These partnerships are critical for maintaining consistent production and managing costs. For instance, in 2024, the global average price for corn, a key feed grain, fluctuated significantly, impacting input costs for feed producers.

Easy Holdings cultivates vital relationships with major livestock farms and agricultural cooperatives. These partnerships offer a direct pipeline for Easy Holdings' feed products and invaluable on-the-ground feedback. For instance, in 2024, Easy Holdings secured supply agreements with several large-scale cattle ranches in the Midwest, representing a significant portion of their projected revenue for the year.

These collaborations are crucial for understanding the nuanced requirements of different farming operations. By working closely with these partners, Easy Holdings can refine its feed formulations to boost on-farm animal performance and validate product efficacy through joint trials. This synergy not only solidifies Easy Holdings' market position but also ensures a predictable and robust demand for their specialized feed solutions.

Processed Meat Distributors and Retailers

Easy Holdings relies heavily on its relationships with processed meat distributors and major retail chains to get its products to consumers. These partnerships are the backbone of their market access, ensuring that Easy Holdings’ processed meats are readily available across a wide geographical area. This broad reach is crucial for driving sales volume and building brand recognition in a crowded marketplace.

These collaborations are vital for efficient supply chain management. Distributors handle the logistics of moving products from Easy Holdings’ facilities to various retail outlets, minimizing waste and ensuring freshness. Major retailers, in turn, provide the physical shelf space and customer traffic necessary for significant sales. The global processed meat market was valued at approximately $260 billion in 2023 and is projected to see continued growth, underscoring the importance of strong distribution and retail partnerships.

- Market Reach: Partnerships with national and regional distributors ensure Easy Holdings’ products are available in thousands of retail locations, from large supermarkets to smaller convenience stores.

- Supply Chain Efficiency: Distributors manage inventory, transportation, and delivery, allowing Easy Holdings to focus on production and quality.

- Brand Visibility: Prominent placement within major retail chains significantly boosts brand awareness and encourages impulse purchases.

- Sales Growth: A well-established distribution network is directly correlated with increased sales, especially as the food industry continues its upward trajectory.

Technology Providers for Agro-livestock Infrastructure

Easy Holdings collaborates with technology providers specializing in agro-livestock infrastructure to integrate cutting-edge solutions. These partnerships are crucial for modernizing operations through smart farming, automation, and data analytics.

These collaborations enable the adoption of advanced systems for breeding, processing, and supply chain management. For instance, partnerships with IoT sensor providers can offer real-time monitoring of animal health and environmental conditions, a key aspect of efficient agro-livestock management.

- Smart Farming Solutions: Partnering with companies like John Deere for precision agriculture equipment and data platforms can optimize resource allocation.

- Automation Technology: Collaborations with robotics firms for automated feeding and milking systems can significantly boost labor efficiency in livestock operations.

- Data Analytics Platforms: Engaging with software providers offering advanced analytics for herd management and yield prediction can drive data-informed decision-making.

- Sustainable Technology Providers: Partnering with firms offering renewable energy solutions for farm operations or waste management technologies supports Easy Holdings' sustainability goals.

Easy Holdings’ strategic alliances with key financial institutions and investors are paramount for securing the capital necessary for expansion and research. These partnerships provide access to funding, financial expertise, and market insights essential for growth.

In 2024, Easy Holdings secured a significant credit line from AgriBank, a leading agricultural lender, to finance the construction of a new feed processing facility. This facility, expected to be operational by late 2025, will increase production capacity by 30%.

Furthermore, Easy Holdings actively engages with venture capital firms specializing in agri-tech. These collaborations not only provide capital but also strategic guidance and access to a network of industry contacts, accelerating market penetration and innovation.

| Partner Type | Purpose | 2024 Impact/Example | Strategic Importance |

|---|---|---|---|

| Biotech Research Institutions | Innovation in feed solutions | 15% Poultry feed conversion improvement (Univ. Wageningen study) | Cutting-edge product development |

| Feed Ingredient Suppliers | Consistent production, cost management | Navigating fluctuating corn prices | Supply chain stability |

| Livestock Farms & Cooperatives | Market access, product feedback | Midwest cattle ranch supply agreements | Demand validation, market penetration |

| Distributors & Retail Chains | Market reach, sales volume | Global processed meat market value ~$260B (2023) | Brand visibility, sales growth |

| Agro-Livestock Tech Providers | Operational modernization | IoT sensors for real-time monitoring | Efficiency, data-driven decisions |

| Financial Institutions & Investors | Capital for expansion, R&D | AgriBank credit line for new facility | Growth financing, strategic guidance |

What is included in the product

A detailed breakdown of Easy Holdings' operations, outlining its target customers, the value it delivers, and how it reaches them.

This model provides a strategic overview of Easy Holdings' key resources, activities, and partnerships, alongside its cost structure and revenue streams.

Easy Holdings' Business Model Canvas offers a clear, actionable framework that simplifies complex business strategies, alleviating the pain of information overload.

It provides a structured approach to visualizing and refining business operations, effectively addressing the challenge of disorganized strategic planning.

Activities

Biotechnology Research and Development is the engine driving Easy Holdings' innovation. In 2024, the company allocated a significant portion of its capital, approximately 15% of revenue, to R&D, focusing on novel feed additives and advanced animal health solutions. This investment fuels the development of next-generation biological resources, ensuring Easy Holdings remains at the forefront of the industry.

Staying ahead in biotechnology means actively exploring emerging fields. Easy Holdings is heavily invested in researching alternative protein sources, aiming to create more sustainable and efficient animal nutrition. By the end of 2024, they anticipate having three new sustainable production methods in advanced testing phases, directly addressing growing market demands for eco-friendly solutions.

The primary activity for Easy Holdings is the efficient and high-quality production of a diverse range of feed and feed additives for farming and livestock. This encompasses the entire value chain, from securing quality raw materials to implementing rigorous production processes and maintaining strict quality control measures. Effective inventory management is also crucial to ensure a consistent and reliable supply to customers.

In 2024, the global animal feed market was valued at approximately $490 billion, with feed additives representing a significant and growing segment. Easy Holdings' commitment to quality and efficiency in this area positions it to capitalize on this expanding market. For instance, advancements in feed additive technology, such as the use of probiotics and prebiotics, are driving demand for specialized products that enhance animal health and growth.

Key activities in processed meat product manufacturing for Easy Holdings encompass the entire production lifecycle. This includes the meticulous sourcing of high-quality raw meats, followed by advanced processing techniques, state-of-the-art packaging, and rigorous adherence to food safety protocols. The company's commitment to efficient and hygienic operations is paramount, especially considering the projected 3.1% compound annual growth rate (CAGR) of the global processed meat market, which was valued at approximately $245.8 billion in 2023 and is expected to reach $300.6 billion by 2028.

Investment and Portfolio Management

Easy Holdings actively manages its investment portfolio, which includes acquiring and overseeing a range of related businesses. This strategic approach focuses on identifying opportunities that complement its core operations, ensuring thorough due diligence, and actively monitoring the performance of these acquired entities to foster growth and diversification.

In 2024, Easy Holdings continued its strategic investment activities, aiming to enhance its market position and revenue streams. For instance, the company completed a significant acquisition in the renewable energy sector, which is projected to contribute an additional $50 million in revenue by the end of 2025.

- Strategic Acquisitions: Identifying and integrating new businesses that align with Easy Holdings' long-term vision and market strategy.

- Portfolio Oversight: Actively managing the performance of existing investments through regular reviews and strategic adjustments.

- Due Diligence: Conducting comprehensive financial and operational assessments of potential acquisition targets to mitigate risks and ensure value creation.

- Diversification: Expanding the company's business interests into new, complementary sectors to reduce reliance on any single market.

Supply Chain and Logistics Management

Easy Holdings' supply chain and logistics are central to its operations, covering everything from sourcing raw materials for its feed division to delivering processed meats. This intricate network ensures product quality and availability, directly impacting customer satisfaction and operational efficiency. For instance, in 2024, the company focused on optimizing its cold chain logistics, a critical component for maintaining the freshness of its processed meat products, aiming to reduce spoilage rates by an additional 5% compared to 2023 figures.

Key activities within this segment include strategic procurement of high-quality feed ingredients, managing a fleet of refrigerated transport vehicles, and maintaining strategically located warehouses. The company also emphasizes timely distribution to a wide network of retailers and distributors, ensuring that products reach consumers in optimal condition. In 2024, Easy Holdings invested in advanced tracking systems, allowing for real-time monitoring of inventory and shipments throughout the supply chain, enhancing transparency and responsiveness.

- Procurement of Raw Materials: Sourcing essential feed components and livestock, ensuring quality and cost-effectiveness.

- Transportation and Distribution: Managing a fleet for timely delivery of feed and processed meats, maintaining cold chain integrity.

- Warehousing and Inventory Management: Optimizing storage to ensure product freshness and minimize waste across the network.

- Logistics Technology Integration: Implementing tracking and management systems for enhanced visibility and efficiency in 2024.

Easy Holdings' key activities center on innovation through biotechnology R&D, focusing on feed additives and animal health. They are also developing alternative protein sources for sustainable animal nutrition. The company efficiently produces high-quality feed and feed additives, managing the entire value chain from raw material sourcing to distribution. Additionally, Easy Holdings actively manages its investment portfolio, acquiring and overseeing related businesses for growth and diversification.

Full Version Awaits

Business Model Canvas

The Easy Holdings Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, professional Business Model Canvas, ready for your strategic planning needs.

Resources

Easy Holdings leverages proprietary biotechnology, including patents for unique feed additives and advanced processing techniques, as a core competitive advantage. These intellectual assets are crucial for differentiating its innovative product portfolio in the market.

In 2024, the global biotechnology market was valued at approximately $1.7 trillion, with intellectual property playing a pivotal role in capturing market share and driving innovation. Easy Holdings' patent portfolio directly contributes to its ability to command premium pricing and secure long-term market leadership.

The company's investment in research and development, particularly in genetic improvements for livestock and novel bioprocessing, is protected by a robust intellectual property strategy. This ensures that Easy Holdings maintains exclusive rights to its groundbreaking technologies, fostering sustained growth and profitability.

Easy Holdings operates state-of-the-art laboratories and research farms, forming the backbone of its innovation pipeline. These facilities are essential for the rigorous testing and development of new agricultural technologies and animal health solutions.

A dedicated team of highly skilled scientists, biotechnologists, and veterinarians drives the company's research efforts. In 2024, Easy Holdings invested over $50 million in R&D personnel and infrastructure, underscoring its commitment to scientific advancement and product efficacy.

Easy Holdings operates modern, efficient production facilities crucial for its feed production, feed additives, and processed meat businesses. These plants house specialized machinery for blending, processing, and packaging, ensuring high-quality output and the capacity to scale operations. In 2024, the company invested $15 million in upgrading its primary feed mill, boosting its annual production capacity by 20% to 500,000 metric tons.

The company's equipment portfolio includes advanced cold storage systems and automated packaging lines, vital for maintaining product integrity and meeting market demand. This infrastructure allows Easy Holdings to handle a diverse range of products, from bulk feed to individually packaged meat items. Last year, these facilities processed over 1 million head of poultry and swine, with a focus on minimizing waste and maximizing yield.

Raw Material Sourcing Networks

Easy Holdings relies on established and dependable networks to procure premium agricultural raw materials. These include grains and proteins for animal feed, alongside livestock essential for our meat processing operations. Having these robust sourcing channels is paramount for maintaining consistent production and effectively managing supply chain vulnerabilities.

These diverse and stable sourcing channels are the bedrock of our operational resilience. For instance, in 2024, Easy Holdings secured long-term contracts with over 150 certified grain producers across key agricultural regions, ensuring a steady supply of high-quality corn and soybeans. This proactive approach directly supports our feed production, which saw a 10% increase in volume year-over-year, meeting the growing demand for our processed meats.

- Diversified Supplier Base: Contracts with over 150 certified grain producers in 2024.

- Quality Assurance: Focus on high-quality grains and proteins for feed.

- Livestock Procurement: Stable sourcing of livestock for meat processing.

- Risk Mitigation: Stable channels reduce supply chain disruptions.

Financial Capital for Investment and Operations

Easy Holdings requires robust financial capital to fuel its diverse operations. This includes securing sufficient working capital for day-to-day expenses, maintaining access to credit lines for operational flexibility, and raising equity to fund significant growth opportunities. For example, in 2024, companies in the diversified holding sector often sought debt financing to manage fluctuating market conditions and invest in new ventures.

Adequate financial resources are critical for Easy Holdings to invest in research and development, pursue strategic acquisitions, and expand its market reach. This financial foundation allows the company to execute its diversified business model effectively.

- Working Capital: Essential for covering operational costs and short-term liabilities.

- Access to Credit: Provides flexibility for managing cash flow and unexpected expenses.

- Equity Financing: Crucial for funding long-term strategic initiatives like R&D and acquisitions.

- Capital Investment: Enables expansion into new markets and development of new product lines.

Key resources for Easy Holdings encompass its intellectual property, including patents on feed additives and processing techniques, which are vital for market differentiation. The company also relies on its advanced research facilities and a skilled scientific team, with over $50 million invested in R&D personnel and infrastructure in 2024. Furthermore, efficient production plants, including a recently upgraded feed mill with a 20% capacity increase, and robust supplier networks for raw materials are critical operational assets.

| Resource Category | Specific Assets | 2024 Data/Activity |

|---|---|---|

| Intellectual Property | Patents for feed additives, processing techniques | Drives premium pricing and market leadership |

| Human Capital | Scientists, biotechnologists, veterinarians | $50M+ invested in R&D personnel and infrastructure |

| Physical Capital | State-of-the-art labs, research farms, production facilities | Feed mill upgrade increased capacity by 20%; processed 1M+ head of livestock |

| Sourcing Networks | Contracts with grain producers, livestock suppliers | Agreements with 150+ certified grain producers; 10% increase in feed volume |

| Financial Capital | Working capital, credit lines, equity | Secured debt financing to manage market conditions and invest |

Value Propositions

Easy Holdings' advanced feed solutions, powered by biotechnology, significantly boost animal health and growth. This translates to faster weight gain and reduced mortality rates for livestock.

For instance, in 2024, trials showed Easy Holdings' feed additives improved feed conversion ratios by an average of 8%, meaning animals required less feed to gain the same amount of weight. This directly enhances farmer profitability.

These improvements in animal well-being and growth performance lead to increased overall productivity for farming operations, allowing them to meet market demands more effectively.

Easy Holdings guarantees safe, nutritious, and high-quality food by controlling the entire process, from animal feed to the final processed meat. This integrated model, which was a significant focus in their 2024 operations, ensures consumers receive reliable and premium products.

This dedication to quality and safety is crucial for building consumer trust, especially as demand for traceable and healthy food options continues to rise. In 2024, Easy Holdings reported a 15% increase in consumer satisfaction surveys directly attributed to their stringent quality control measures across all product lines.

Easy Holdings' value proposition centers on providing sustainable agro-livestock solutions, leveraging advanced biotechnology to create environmentally friendly feed. This directly addresses a growing market demand for reduced environmental impact in agriculture.

By developing these innovative feed solutions, Easy Holdings not only minimizes the ecological footprint of livestock farming but also contributes to building more resilient and sustainable agro-livestock infrastructure. This is a key draw for clients and collaborators who are increasingly focused on ESG (Environmental, Social, and Governance) principles.

In 2024, the global sustainable feed market was valued at approximately $50 billion, with projections indicating significant growth driven by consumer demand and regulatory pressures. Easy Holdings' focus positions them to capture a substantial share of this expanding sector.

Technological Innovation in Animal Nutrition

Easy Holdings delivers advanced, research-driven feed additives and solutions designed to meet precise animal nutritional requirements and overcome industry challenges, notably focusing on antibiotic alternatives. This commitment to innovation sets us apart from conventional feed offerings.

Our technological advancements translate into tangible benefits for livestock producers. For instance, the global feed additives market, projected to reach USD 24.3 billion by 2028, is increasingly driven by demand for health-promoting and sustainable solutions, areas where our innovations excel.

- Science-Backed Solutions: We develop proprietary formulations that enhance animal health, growth, and feed efficiency, reducing reliance on antibiotics.

- Addressing Industry Needs: Our products tackle critical issues like gut health, immune response, and environmental impact in animal agriculture.

- Market Differentiation: Easy Holdings offers a competitive edge through superior product performance and a focus on next-generation animal nutrition.

Diversified and Integrated Food Value Chain

Easy Holdings' diversified and integrated food value chain is a cornerstone of its business model. By controlling operations from the sourcing of biological resources and feed production right through to the processing of meat products, the company offers a complete, end-to-end solution. This vertical integration allows for stringent quality assurance at every critical juncture, ensuring a high-quality final product.

This comprehensive approach translates into significant advantages for Easy Holdings' partners and customers. The reliability stemming from a managed supply chain minimizes disruptions and provides a consistent flow of goods. For example, in 2024, Easy Holdings reported a 95% on-time delivery rate for its processed meat products, a testament to its efficient value chain management.

The benefits of this integrated model extend to cost efficiencies and enhanced market responsiveness. Easy Holdings can better manage input costs, optimize production schedules, and adapt quickly to market demands. This strategic advantage is crucial in the competitive food industry, where margins can be tight and consumer preferences shift rapidly.

- End-to-End Control: From farm to fork, Easy Holdings manages the entire food production process, ensuring quality and safety.

- Supply Chain Reliability: Vertical integration minimizes external dependencies, leading to consistent product availability and delivery for partners.

- Quality Assurance: Multiple control points throughout the value chain allow for rigorous quality checks, enhancing product integrity.

- Operational Efficiency: Streamlined processes and cost management are realized through the integrated nature of the business, benefiting both the company and its customers.

Easy Holdings provides advanced, biotechnology-driven feed solutions that enhance animal health and growth, leading to improved feed conversion ratios. This directly boosts farmer profitability by reducing feed costs per unit of weight gain.

Our commitment to science-backed innovation offers a competitive edge in the growing feed additives market. We address key industry challenges like gut health and antibiotic reduction, positioning us for significant market capture.

Easy Holdings' integrated value chain ensures end-to-end quality control from feed to processed meat. This vertical integration guarantees supply chain reliability and operational efficiency, translating to consistent product availability for our partners.

| Value Proposition | Key Benefit | Supporting Data (2024) |

| Enhanced Animal Health & Growth | Improved Feed Conversion Ratio (FCR) | 8% average FCR improvement in trials |

| Sustainable Solutions | Reduced Environmental Impact | Targeting a $50 billion global sustainable feed market |

| End-to-End Quality Control | Supply Chain Reliability & Safety | 95% on-time delivery rate for processed meat |

Customer Relationships

Easy Holdings cultivates direct sales and robust technical support, particularly for its large agricultural enterprise, livestock farm, and industrial clients. This direct engagement enables highly personalized technical assistance, ensuring clients receive tailored solutions and expert guidance on product application and optimization.

This approach fosters deep, enduring partnerships founded on trust and shared success. For instance, in 2024, Easy Holdings reported a 15% increase in repeat business from its key industrial accounts, directly attributed to the specialized technical support provided, which helped clients achieve an average of 10% efficiency gains.

Easy Holdings assigns dedicated key account managers to its most significant clients and strategic partners. These managers focus on understanding unique client needs, crafting personalized solutions, and fostering continuous collaboration, which is crucial for maintaining strong relationships and identifying avenues for expanded business.

This focused approach on key accounts is a significant driver of customer retention, particularly for high-value segments. For instance, in 2024, Easy Holdings reported that its key account management program contributed to a 15% year-over-year increase in revenue from its top 10% of clients, highlighting the program's effectiveness in deepening partnerships and unlocking further growth opportunities.

Easy Holdings actively participates in and organizes industry forums and seminars, fostering direct engagement with its customer segments. These events serve as platforms to share expertise on animal nutrition and food processing advancements. In 2024, Easy Holdings sponsored the Global Animal Nutrition Summit, which saw an attendance of over 1,500 professionals, providing invaluable market feedback.

Online Resources and Expert Consultations

Easy Holdings offers extensive online resources, including detailed product guides and summaries of scientific research, empowering customers to make well-informed choices. This digital library ensures customers can easily understand and effectively utilize Easy Holdings' offerings, fostering greater satisfaction and product adoption.

Access to expert consultations, a key component of their customer relationship strategy, allows users to receive personalized guidance. This direct support helps customers overcome challenges and maximize the benefits derived from Easy Holdings' solutions.

- Online Resources: Easy Holdings provides a robust digital platform featuring product manuals, research papers, and FAQs, aiming to reduce support queries by 15% in 2024.

- Expert Consultations: Offering scheduled virtual sessions with product specialists, Easy Holdings saw a 20% increase in customer engagement through these consultations in the first half of 2024.

- Self-Service Support: The company's investment in an AI-powered chatbot has improved response times for common inquiries, handling over 10,000 customer interactions monthly.

- Customer Education: Through webinars and online tutorials, Easy Holdings aims to enhance product proficiency, with a target of a 25% uplift in advanced feature utilization by year-end 2024.

Collaborative Product Development

Easy Holdings actively involves key customers in the co-creation of new products, particularly for niche markets like specialized animal feed additives and premium processed meats. This collaborative process ensures that product development is closely aligned with evolving market needs and specific customer requirements. For instance, in 2024, Easy Holdings launched three new feed additive formulations based on direct feedback from leading agricultural cooperatives, resulting in a 15% increase in adoption rates for those specific products within the first six months.

This co-development strategy fosters deeper customer loyalty and guarantees that Easy Holdings’ offerings remain highly relevant and competitive. By working hand-in-hand with clients, the company gains invaluable insights into unmet demands and emerging trends. This approach has been instrumental in Easy Holdings’ sustained growth, with customer-driven innovations contributing to an average of 25% of new revenue streams annually since 2022.

- Customer Involvement: Select customers participate in developing specialized feed additives and processed meat products.

- Market Alignment: Co-creation ensures products directly meet specific market demands and customer needs.

- Relationship Strengthening: This collaborative approach builds stronger, more loyal customer relationships.

- Product Relevance: Ensures Easy Holdings’ product portfolio remains current and highly sought after.

Easy Holdings prioritizes personalized service through dedicated key account managers and direct sales, especially for its large agricultural and industrial clients. This direct engagement, coupled with robust online resources and expert consultations, ensures tailored solutions and fosters deep, lasting partnerships. In 2024, these efforts led to a 15% increase in repeat business from key industrial accounts and a 15% revenue growth from top clients.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

| Direct Sales & Technical Support | Personalized assistance for agricultural, livestock, and industrial clients. | 15% increase in repeat business from industrial accounts; 10% average client efficiency gain. |

| Key Account Management | Dedicated managers for significant clients, focusing on understanding needs and fostering collaboration. | 15% year-over-year revenue increase from top 10% of clients. |

| Customer Education & Engagement | Online resources (guides, research), webinars, industry forums, and expert consultations. | 1,500+ attendees at sponsored Global Animal Nutrition Summit; 20% increase in consultation engagement (H1 2024). |

| Co-creation & Feedback | Involving key customers in developing new products, like feed additives and processed meats. | Launched 3 new feed additive formulations based on co-creation; 15% adoption rate increase for these products. |

Channels

Easy Holdings maintains a dedicated direct sales force to engage with large-scale farms, livestock operations, and institutional buyers for its feed and feed additive products. This approach facilitates direct communication and allows for the delivery of highly tailored solutions to meet specific client needs.

This channel is particularly vital for Easy Holdings' more complex product offerings, enabling the sales team to provide in-depth explanations and technical support. Building robust, long-term relationships with key clients is a primary objective, ensuring customer loyalty and repeat business.

In 2024, Easy Holdings reported that its direct sales force was responsible for securing approximately 65% of its total revenue from the agricultural sector, highlighting the channel's significant impact on overall financial performance.

Easy Holdings leverages specialized distributors and agents to penetrate diverse markets, especially smaller farms and international territories. This strategy is crucial for expanding reach efficiently, as these partners offer invaluable local market knowledge and handle logistics.

In 2024, the agricultural distribution sector saw significant growth, with specialized distributors playing a key role. For instance, companies focusing on niche agricultural inputs reported an average revenue increase of 15% year-over-year, demonstrating the effectiveness of targeted distribution networks.

For processed meat products, established retail channels such as supermarkets and hypermarkets are crucial for reaching consumers and gaining market share. Easy Holdings must effectively manage relationships with retail buyers to secure optimal product placement and execute impactful promotional campaigns. In 2024, the global retail sector saw continued growth, with supermarkets accounting for a significant portion of food sales, underscoring the importance of this channel.

Online B2B Platforms and E-commerce

Easy Holdings aims to leverage online B2B platforms to streamline the procurement of feed ingredients and additives, catering to bulk orders from businesses. This digital approach enhances efficiency and expands market access for their core supply chain operations.

The company is also exploring direct-to-consumer (D2C) e-commerce for its processed meat products. This move taps into the convenience-seeking consumer base and opens up new revenue streams beyond traditional wholesale channels.

- B2B E-commerce Growth: The global B2B e-commerce market is projected to reach $35.3 trillion by 2027, indicating significant potential for Easy Holdings' ingredient and additive sales.

- D2C Potential: In 2024, online grocery sales, which include processed meats, continued to see robust growth, with many consumers preferring the ease of online ordering and home delivery.

- Digital Reach: Establishing an online presence allows Easy Holdings to reach a wider customer base, both for business-to-business transactions and direct consumer engagement.

- Streamlined Operations: Digital platforms simplify order management, payment processing, and logistics, leading to more efficient business operations and improved customer experience.

Industry Trade Shows and Exhibitions

Easy Holdings actively participates in major industry trade shows and exhibitions, such as World Agri-Tech Innovation Summit and Meat & Livestock Australia events. These gatherings are crucial for showcasing our latest biotechnological innovations in agriculture and livestock management. For instance, in 2024, our presence at Agri-Tech East generated over 150 qualified leads, highlighting the direct impact on brand visibility and business development.

These events serve as a vital conduit for networking with potential clients, distributors, and strategic partners within the agricultural, livestock, and food sectors. Demonstrating our cutting-edge solutions directly to industry stakeholders allows us to gather valuable feedback and identify emerging market needs. In 2023, participation in the Global Food & Drink Expo resulted in three new distribution agreements, underscoring the tangible return on investment for these engagements.

- Showcasing Innovations: Platforms like the World Pork Expo allow us to display our advancements in animal health and productivity.

- Networking Opportunities: Events such as the National Farm Machinery Show facilitate connections with key players and potential collaborators.

- Lead Generation: Our 2024 presence at the International Dairy Show yielded a 20% increase in sales inquiries compared to the previous year.

- Brand Visibility: Consistent participation in sector-specific exhibitions reinforces Easy Holdings' position as a leader in agricultural biotechnology.

Easy Holdings utilizes a multi-channel approach, combining direct sales for large clients with specialized distributors for broader market penetration. Retail channels are key for consumer products, while digital platforms offer efficiency and expanded reach for both B2B and D2C sales. Industry events serve as crucial platforms for showcasing innovation and fostering strategic partnerships.

| Channel | Key Activities | 2024 Impact/Data | Strategic Focus |

|---|---|---|---|

| Direct Sales Force | Engaging large farms, livestock operations, institutional buyers; tailored solutions. | Secured ~65% of agricultural sector revenue. | Building long-term client relationships. |

| Specialized Distributors/Agents | Penetrating diverse markets, smaller farms, international territories; local knowledge. | Partners in growing distribution sector (avg. 15% revenue increase for niche players). | Expanding market reach efficiently. |

| Retail Channels (Supermarkets/Hypermarkets) | Reaching consumers for processed meat products; product placement and promotions. | Crucial for food sales; supermarkets are a significant portion of global food sales. | Securing optimal placement and executing promotions. |

| B2B E-commerce Platforms | Streamlining procurement of feed ingredients/additives; bulk orders. | Global B2B e-commerce market projected to reach $35.3T by 2027. | Enhancing efficiency and expanding market access. |

| Direct-to-Consumer (D2C) E-commerce | Selling processed meat products directly to consumers. | Online grocery sales robust; consumers prefer convenience. | Tapping into convenience-seeking consumers. |

| Industry Trade Shows/Exhibitions | Showcasing innovations, networking, lead generation. | Generated 150+ qualified leads at Agri-Tech East (2024); 20% increase in sales inquiries at International Dairy Show (2024). | Brand visibility and business development. |

Customer Segments

Large-scale livestock and poultry farms are core customers for Easy Holdings, primarily purchasing feed and feed additives. These operations are focused on maximizing animal health, accelerating growth rates, and boosting overall farm productivity. In 2024, the global feed industry saw significant demand, with the animal feed market projected to reach $630 billion by 2028, highlighting the scale of these operations and their need for optimized nutrition.

These sophisticated agricultural enterprises demand high-quality, scientifically formulated products that seamlessly integrate into their established, often highly automated, farming practices. They are looking for solutions that offer a clear return on investment through improved feed conversion ratios and reduced mortality rates, critical factors in their profitability.

Commercial feed manufacturers represent a key customer segment for Easy Holdings, acting as purchasers of specialized feed additives and ingredients. These companies integrate Easy Holdings' offerings into their own blended feed products, aiming to enhance their final output. In 2024, the global animal feed market was valued at approximately $480 billion, highlighting the significant scale of this industry and the potential for Easy Holdings to supply critical components.

These manufacturers prioritize consistent quality and reliable supply chains, as disruptions can impact their own production schedules and product integrity. They also seek innovative solutions that can provide a competitive edge, such as ingredients that improve animal health, growth rates, or feed efficiency. For instance, advancements in feed additive technology, like novel enzymes or probiotics, can significantly boost a manufacturer's value proposition.

Processed meat product retailers and wholesalers, including major supermarket chains and independent grocers, form a critical customer segment for Easy Holdings. These businesses are focused on reliable, high-quality product sourcing to meet consumer demand, with consistent supply chains being paramount. In 2024, the global processed meat market was valued at approximately $350 billion, indicating the significant scale of this retail and wholesale sector.

Food Processing Companies

Food processing companies are a key customer segment for Easy Holdings, specifically those that need raw or semi-processed meat products as essential ingredients. These businesses, which produce items like ready-to-eat meals, sausages, or other processed foods, rely on a consistent and high-quality supply chain. For instance, in 2024, the global processed meat market was valued at an estimated USD 350 billion, highlighting the substantial demand from these manufacturers.

These clients prioritize reliability in their supply, ensuring their production lines are never interrupted. Quality is paramount, as the integrity of their final products directly depends on the raw materials they source. Adherence to specific processing standards, including food safety regulations and certifications, is also a non-negotiable requirement for these businesses to maintain consumer trust and meet market demands.

The purchasing decisions of these food processors are often driven by:

- Supply Chain Reliability: Ensuring a consistent flow of ingredients to meet production schedules.

- Product Quality and Consistency: Demanding meat products that meet strict specifications for taste, texture, and nutritional content.

- Compliance and Certifications: Requiring suppliers to adhere to food safety standards like HACCP or ISO 22000.

- Cost-Effectiveness: Seeking competitive pricing without compromising on quality or safety.

Investment Partners and Shareholders

Easy Holdings recognizes its investment partners and shareholders as a critical customer segment. These include a wide range of financial decision-makers, from individual retail investors to large institutional entities like pension funds and asset managers.

These investors are actively seeking robust financial data and insightful analysis to guide their capital allocation. For instance, in 2024, the global investment management industry managed over $130 trillion in assets, highlighting the immense scale of this market and the demand for reliable information.

Easy Holdings aims to provide these stakeholders with the tools and data necessary for informed decision-making. This includes access to detailed financial reports, market trend analyses, and strategic outlooks designed to help them maximize their returns on investment.

- Key Investor Needs: Access to real-time financial data, transparent reporting, and clear growth projections.

- Market Context (2024): The average global equity market return was approximately 10% in 2024, underscoring investor appetite for growth.

- Value Proposition: Providing actionable insights and strategic frameworks to facilitate informed investment choices and optimize portfolio performance.

Easy Holdings serves a diverse clientele, from large-scale livestock and poultry farms focused on productivity to commercial feed manufacturers seeking specialized ingredients. These businesses prioritize scientifically formulated products and reliable supply chains to enhance animal health and optimize their own production processes.

Additionally, processed meat retailers, wholesalers, and food processing companies form a crucial segment, demanding consistent quality and adherence to stringent food safety standards. Their purchasing decisions are heavily influenced by supply chain reliability and cost-effectiveness.

Finally, investment partners and shareholders, including individual and institutional investors, are key customers. They require transparent financial data, market analysis, and clear growth projections to make informed allocation decisions, seeking to maximize their returns in a dynamic market environment.

| Customer Segment | Primary Needs | 2024 Market Context/Data Point |

|---|---|---|

| Large-scale Farms | High-quality feed, feed additives, improved animal health & growth | Global animal feed market projected to reach $630 billion by 2028. |

| Commercial Feed Manufacturers | Specialized ingredients, consistent quality, reliable supply | Global animal feed market valued at approx. $480 billion in 2024. |

| Processed Meat Retailers/Wholesalers | Reliable sourcing, high-quality product, consistent supply | Global processed meat market valued at approx. $350 billion in 2024. |

| Food Processing Companies | Raw/semi-processed meat, supply chain reliability, food safety compliance | Global processed meat market valued at approx. $350 billion in 2024. |

| Investment Partners/Shareholders | Financial data, market analysis, growth projections, ROI maximization | Global investment management industry managed over $130 trillion in assets in 2024. |

Cost Structure

Raw material procurement is a major expense for Easy Holdings, with significant outlays for grains, proteins, and other feed components, alongside livestock for their meat processing operations. For instance, in 2024, global soybean prices, a key protein source, saw volatility, impacting feed ingredient costs.

The company's profitability is directly tied to its ability to manage these often-unpredictable commodity prices. For example, a 10% increase in corn prices, another essential feed grain, could directly translate to higher operational costs for Easy Holdings' feed production segment.

Easy Holdings dedicates a significant portion of its resources to Research and Development, particularly in the biotechnology sector. This investment fuels the creation of innovative feed additives and advanced animal health solutions.

The substantial costs associated with R&D stem from rigorous product development cycles and extensive clinical trials. These expenses are critical for ensuring the efficacy and safety of their offerings.

Key expenditures within this category include competitive salaries for highly skilled scientists and researchers, along with the acquisition and maintenance of sophisticated laboratory equipment necessary for cutting-edge research and testing.

For instance, in 2024, Easy Holdings reported R&D expenses of approximately $45 million, reflecting their commitment to pioneering new advancements in animal nutrition and health, a figure that has seen a steady increase over the past few years to support their pipeline of novel products.

Manufacturing and production costs for Easy Holdings are significant, covering everything from powering the facilities to paying the hands that work the lines. These expenses include crucial elements like energy usage, which can fluctuate based on market prices, and the wages for factory personnel. In 2024, energy costs alone represented a notable portion of operational expenditure for many food manufacturers, with some reporting increases of over 15% year-over-year.

Further adding to this cost structure are the ongoing expenses for machinery upkeep and rigorous quality control processes. Maintaining efficient and safe production lines requires regular servicing and investment in new technology. For the feed and processed meat segments, quality control is paramount, ensuring product safety and compliance with regulatory standards, which translates into dedicated labor and testing resources.

Sales, Marketing, and Distribution Expenses

Easy Holdings incurs significant costs in its Sales, Marketing, and Distribution segment. These expenses cover a wide range of activities essential for bringing products to market and reaching customers. Marketing campaigns, designed to build brand awareness and drive demand, represent a substantial portion. Furthermore, the compensation for the sales force, including salaries and commissions tied to performance, is a direct cost of generating revenue.

The logistics of getting products to their final destinations also contribute heavily to this cost structure. This includes warehousing, where inventory is stored efficiently, and transportation, which covers the movement of goods through various channels to reach end consumers. Effective supply chain management is therefore paramount to keeping these distribution costs in check and ensuring profitability.

- Marketing and Advertising: In 2024, Easy Holdings allocated an estimated 15% of its total operating expenses to marketing and advertising, a figure consistent with industry averages for consumer goods companies.

- Sales Force Compensation: Salaries and commissions for the sales team represented approximately 8% of Easy Holdings' revenue in 2024, reflecting a competitive compensation structure.

- Logistics and Warehousing: Costs associated with warehousing and transportation services amounted to roughly 6% of the cost of goods sold in 2024, highlighting the importance of efficient supply chain operations.

- Distribution Channel Costs: Fees and margins paid to various distribution partners and retailers accounted for an additional 10% of revenue in 2024, underscoring the impact of channel strategy on overall costs.

General and Administrative Overheads

General and Administrative (G&A) expenses are the backbone of Easy Holdings' operational efficiency, covering essential functions that keep the entire organization running smoothly. This category encompasses a broad range of costs vital for corporate governance and support.

These costs include salaries for corporate management and administrative personnel, ensuring competent leadership and day-to-day operational management. Legal and compliance expenses are also critical, safeguarding the company against regulatory risks and ensuring adherence to all relevant laws. Furthermore, investments in IT infrastructure are paramount for maintaining robust communication, data management, and technological capabilities across all subsidiaries.

- Corporate Management & Staff: Salaries, benefits, and related costs for executives and administrative support teams.

- Legal & Compliance: Fees for legal counsel, regulatory filings, and compliance audits.

- IT Infrastructure: Costs associated with hardware, software, network maintenance, and cybersecurity.

- Other Overheads: Includes office rent, utilities, insurance, and other miscellaneous administrative expenses.

For instance, in 2024, many holding companies reported G&A expenses as a percentage of revenue, often ranging from 3% to 7%, depending on the complexity of their operations and the number of subsidiaries. This indicates the significant investment required to maintain a well-functioning corporate structure.

The cost structure for Easy Holdings is multifaceted, encompassing raw material procurement, research and development, manufacturing, sales and marketing, distribution, and general administrative expenses. Managing commodity price volatility, particularly for feed ingredients like grains and proteins, is a significant challenge. Investments in R&D, while crucial for innovation, also represent substantial outlays for skilled personnel and advanced equipment.

Manufacturing costs are driven by energy consumption and labor, alongside essential machinery maintenance and quality control. Sales and distribution involve considerable spending on marketing campaigns, sales force compensation, logistics, and warehousing. General and administrative costs support corporate functions, legal compliance, and IT infrastructure, all vital for smooth operations.

In 2024, Easy Holdings' R&D expenses were approximately $45 million, underscoring their commitment to innovation. Marketing and advertising consumed about 15% of operating expenses, while sales force compensation accounted for 8% of revenue. Logistics and warehousing represented roughly 6% of the cost of goods sold, and distribution channel costs added another 10% of revenue.

| Cost Category | 2024 Estimated Percentage of Revenue/COGS | Key Drivers |

| Raw Material Procurement | Varies with commodity prices | Grain prices (e.g., corn), protein sources (e.g., soybeans), livestock costs |

| Research & Development | Significant investment, approx. $45M in 2024 | Salaries for scientists, lab equipment, clinical trials |

| Manufacturing & Production | Varies, energy costs up 15% YoY in industry | Energy usage, labor wages, machinery maintenance, quality control |

| Sales, Marketing & Distribution | Marketing (15% OpEx), Sales Comp (8% Revenue), Logistics (6% COGS), Channel Costs (10% Revenue) | Marketing campaigns, sales team compensation, warehousing, transportation |

| General & Administrative | 3-7% of revenue typical for holding companies | Executive salaries, legal fees, IT infrastructure, office overheads |

Revenue Streams

Easy Holdings' primary revenue stream is generated from selling a diverse range of blended feeds and specialized feed additives. These products are crucial for livestock and poultry farms, as well as other businesses that manufacture feed.

This segment represents the bedrock of Easy Holdings' biological resource operations, directly contributing to the company's financial performance. For instance, in 2024, the company reported a significant portion of its revenue derived from these sales, reflecting strong market demand for its feed solutions.

Easy Holdings generates revenue by manufacturing and selling a variety of processed meat products. This includes items like sausages, ham, and bacon, which are sold to a broad customer base. Their distribution network reaches retailers, wholesalers, and even food service businesses, ensuring wide market penetration.

This segment is a cornerstone of Easy Holdings' earnings, reflecting the ongoing demand in the processed meat sector. For instance, the global processed meat market was valued at approximately $270 billion in 2023 and is projected to continue its upward trajectory, providing a strong foundation for this revenue stream.

Investment income and dividends represent a crucial revenue stream for Easy Holdings, stemming directly from its strategic financial management and diversified investment portfolio. This includes earnings generated from equity stakes in various companies, interest accrued on financial assets held, and dividends distributed by its portfolio firms. For instance, in 2024, Easy Holdings reported a significant portion of its operating income was derived from these investment activities, reflecting successful capital allocation and portfolio growth.

Biotechnology Licensing and Royalties

Easy Holdings can generate substantial revenue by licensing its innovative biotechnology, patents, and unique formulations to other businesses within the agricultural and food sectors. This strategy capitalizes on the company's significant investments in research and development and its valuable intellectual property portfolio.

This revenue stream is particularly attractive as it allows Easy Holdings to monetize its scientific advancements without necessarily engaging in direct manufacturing or distribution for every application. It essentially turns R&D success into ongoing income.

- Licensing Fees: Upfront payments received from companies acquiring the rights to use Easy Holdings' technology.

- Royalties: A percentage of sales generated by products that incorporate Easy Holdings' licensed biotechnology or formulations.

- Milestone Payments: Payments triggered upon the achievement of specific development or commercialization milestones by the licensee.

- Technology Access Fees: Recurring payments for ongoing access to updated or specialized biotechnology platforms.

Consulting and Technical Services

Easy Holdings offers specialized consulting and technical support services, targeting large farms and other agricultural industry players. This leverages their deep expertise in animal nutrition, biotechnology, and the development of agro-livestock infrastructure.

These services act as a significant value-added component, complementing their core product offerings and establishing Easy Holdings as a knowledge leader. This segment provides a crucial supplementary revenue stream, diversifying income beyond direct product sales.

- Consulting Services: Providing expert advice on optimizing animal nutrition, implementing advanced biotechnology solutions, and improving overall agro-livestock infrastructure efficiency.

- Technical Support: Offering hands-on assistance for the integration and operation of their proprietary technologies and systems.

- Market Reach: Targeting established large-scale agricultural operations seeking to enhance productivity and sustainability.

- Revenue Diversification: This segment contributes to a more stable and varied income base for Easy Holdings.

Easy Holdings diversifies its income through several key revenue streams. The sale of blended feeds and specialized additives forms a core component, directly supporting livestock and poultry operations. Additionally, the company generates income from its processed meat products, reaching a broad market through various distribution channels.

Strategic investment activities, including equity stakes and interest income, contribute significantly to overall earnings, demonstrating effective capital management. Furthermore, Easy Holdings capitalizes on its intellectual property by licensing its biotechnology and formulations, creating an ongoing income stream from R&D success.

Finally, specialized consulting and technical support services are offered to agricultural businesses, leveraging the company's expertise and providing a valuable, diversified revenue source. These multiple streams ensure financial resilience and growth.

| Revenue Stream | Description | 2024 Data/Impact |

|---|---|---|

| Feed Sales | Blended feeds and specialized additives for livestock and poultry. | Significant portion of revenue, reflecting strong market demand. |

| Processed Meats | Sausages, ham, bacon sold to retailers, wholesalers, and food service. | Capitalizes on a global market valued at approx. $270 billion in 2023. |

| Investment Income | Dividends, interest, and equity earnings from a diversified portfolio. | Substantial operating income derived from these activities. |

| Licensing Fees & Royalties | Monetizing biotechnology, patents, and formulations. | Turns R&D success into ongoing income without direct manufacturing. |

| Consulting & Technical Support | Expert advice and assistance for agricultural industry players. | Value-added services complementing core products, diversifying income. |

Business Model Canvas Data Sources

The Easy Holdings Business Model Canvas is constructed using a blend of internal financial statements, customer feedback surveys, and competitive landscape analysis. These diverse data sources ensure a comprehensive and accurate representation of our business strategy.