Electronic Arts Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Electronic Arts Bundle

Electronic Arts navigates a dynamic gaming landscape shaped by intense rivalry and powerful buyers. Understanding the threat of substitutes and the influence of suppliers is crucial for their sustained success.

The complete report reveals the real forces shaping Electronic Arts’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Game engine providers like Unity and Unreal Engine possess considerable bargaining power. Their specialized technology is fundamental to modern game development, and their widespread adoption means many developers, including EA, rely on their platforms. EA's significant investment in proprietary engines doesn't eliminate its need for third-party tools, which grants these suppliers leverage through licensing agreements and the essential technical support they offer.

The bargaining power of suppliers in the game development talent sector is significant for Electronic Arts. Highly skilled game developers, artists, and engineers are the backbone of EA's creative output, and their expertise is in high demand across the industry.

In 2024, the competition for this specialized talent remains intense. This scarcity of top-tier professionals allows them, and the specialized studios that employ them, to negotiate for higher salaries, better benefits, and more favorable contract terms. This directly impacts EA's costs and operational flexibility.

Intellectual property licensors, like the NFL or FIFA, wield considerable sway over Electronic Arts. These entities control the rights to highly sought-after sports leagues and teams, which are critical for EA's most successful game franchises. In 2023, EA reported significant revenue from its sports titles, underscoring the value of these licensed properties and the leverage they provide to the licensors.

Hardware Manufacturers and Platform Holders

The bargaining power of suppliers for Electronic Arts (EA) is significantly influenced by hardware manufacturers and platform holders. Companies like Sony for PlayStation, Microsoft for Xbox, and Nintendo for Switch are critical gatekeepers. These console creators can wield considerable influence over EA through distribution agreements, platform fees, and the technical specifications they mandate for games.

While many individual hardware components for PCs might be commoditized, the concentrated nature of major console platforms limits EA's leverage. This concentration allows console manufacturers to dictate terms, impacting EA's revenue streams via revenue sharing and setting the technical standards that EA must adhere to for game development and release.

- Console manufacturers' control over distribution channels and platform fees directly impacts EA's profit margins.

- The limited number of dominant console platforms concentrates supplier power, reducing EA's negotiation flexibility.

- Technical specifications set by platform holders can increase development costs and time for EA.

Cloud Service and Network Infrastructure Providers

Electronic Arts' reliance on cloud services and network infrastructure is substantial, given its focus on live services and digital distribution. Providers of essential components like cloud hosting, server infrastructure, and content delivery networks (CDNs) therefore wield a notable degree of bargaining power. EA's commitment to seamless online gameplay and timely content delivery necessitates robust and scalable infrastructure, making these suppliers critical partners.

The bargaining power of these providers is amplified by the specialized nature of their services and the significant investment required to build and maintain such networks. For instance, major cloud providers often operate with economies of scale that smaller competitors cannot match, giving them leverage in negotiations. In 2024, the global cloud computing market was valued at over $600 billion, highlighting the scale and influence of these infrastructure giants.

- High switching costs: Migrating complex online gaming infrastructure to a new provider can be time-consuming and expensive, locking EA into existing relationships.

- Concentration of providers: A limited number of dominant players in the cloud and CDN space means fewer alternatives for EA to switch to, increasing supplier leverage.

- Criticality of service: Downtime or performance issues from these providers directly impact EA's revenue and player experience, giving suppliers leverage to demand favorable terms.

The bargaining power of suppliers for Electronic Arts (EA) is multifaceted, encompassing game engines, specialized talent, intellectual property licensors, hardware manufacturers, and cloud service providers. These suppliers often hold significant leverage due to the critical nature of their offerings, the specialized skills involved, or their control over essential distribution channels and intellectual property. For EA, managing these supplier relationships effectively is key to maintaining competitive advantage and profitability in the dynamic gaming industry.

What is included in the product

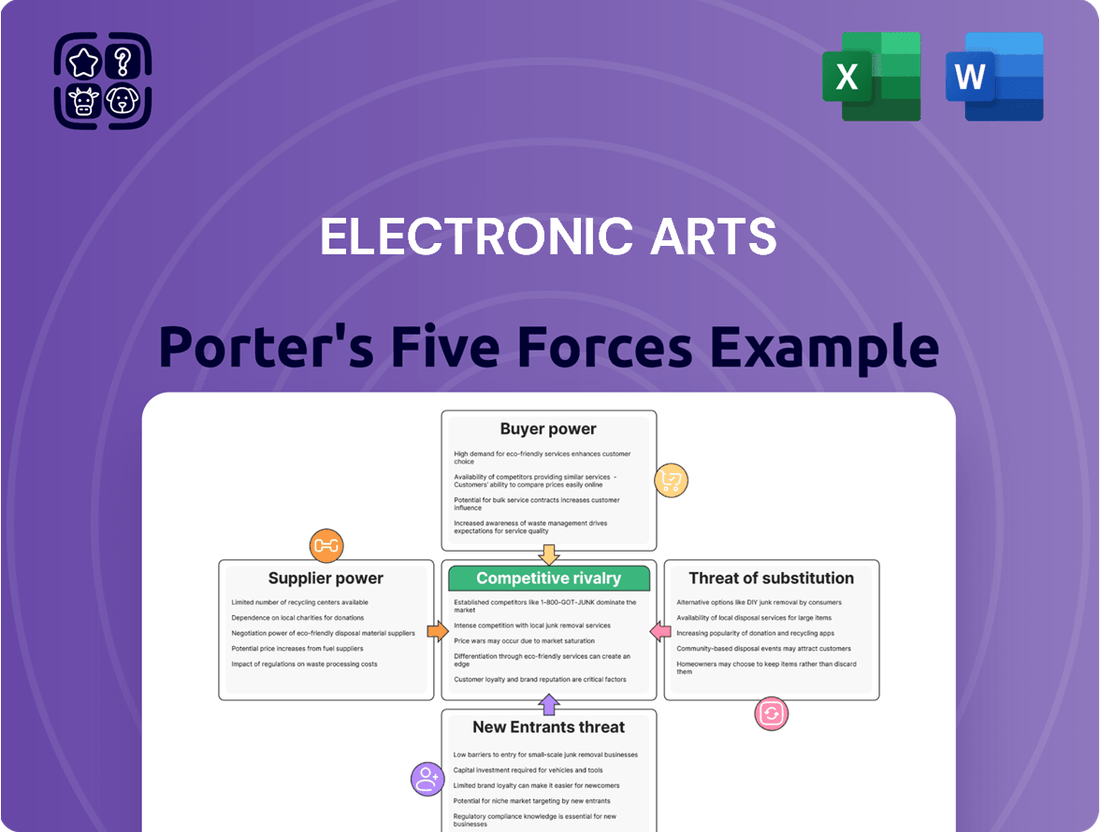

This analysis dissects the competitive forces impacting Electronic Arts, including the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the availability of substitutes.

Instantly identify and mitigate competitive threats within the gaming industry by visualizing EA's Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Electronic Arts' customers exhibit significant price sensitivity, particularly as video games represent discretionary spending. This means gamers carefully consider their purchases, often comparing prices across various platforms and retailers before committing. For instance, a significant portion of gamers actively seeks out deals and discounts, impacting the perceived value of EA's titles.

The ease with which consumers can access and switch between digital games significantly lowers their switching costs. This means a player unhappy with an Electronic Arts title can readily move to a competitor's offering with minimal effort or expense. For instance, the widespread availability of free-to-play titles across various platforms in 2024 means a player can simply download a new game without any financial commitment, further amplifying this effect.

Gamers today have incredibly high expectations for both the visual fidelity and the innovative nature of gameplay. They anticipate immersive worlds, cutting-edge graphics, and novel mechanics that push the boundaries of interactive entertainment. If a title like Electronic Arts' latest release falls short, the backlash can be swift and severe.

This directly impacts Electronic Arts because negative reviews and poor word-of-mouth can drastically reduce sales figures. For instance, a game receiving widespread criticism for its technical issues or uninspired gameplay can see its revenue projections plummet. In 2023, EA's revenue from its live services, which includes many of its major franchises, demonstrated the ongoing reliance on player engagement and satisfaction.

Influence of Gaming Communities and Online Reviews

Gaming communities and online reviews wield considerable influence over Electronic Arts' (EA) sales. A unified negative sentiment, often amplified by a 'pack mentality' within these communities, can drastically alter a game's commercial trajectory. This collective voice effectively grants significant bargaining power to the customer base, as widespread dissatisfaction can deter potential buyers and impact long-term franchise value.

The impact of these communities is substantial. For instance, during the launch of *Anthem* in 2019, initial player feedback, heavily disseminated through online forums and social media, painted a picture of a game that failed to meet expectations. This collective criticism contributed to the game's eventual discontinuation and likely influenced purchasing decisions for subsequent EA titles, demonstrating the tangible power of organized player feedback.

- Community Sentiment Impact: Negative word-of-mouth and online reviews can suppress sales by hundreds of thousands, if not millions, of units.

- Review Aggregation Influence: Platforms like Metacritic, where aggregated scores are readily visible, serve as a focal point for community opinion, directly affecting consumer perception.

- Franchise Reputation: Persistent negative community sentiment can damage the reputation of entire game franchises, making future releases more susceptible to critical scrutiny and buyer hesitation.

Growing Demand for Free-to-Play and Subscription Models

The rising adoption of free-to-play (F2P) and subscription models significantly enhances customer bargaining power. These alternatives allow consumers to access games with minimal or no upfront cost, and through services like EA Play or Xbox Game Pass, they have a wider array of content choices. This shift means customers are less tied to single purchases.

For instance, the global games market was projected to reach $200 billion in 2024, with F2P games and subscriptions forming a substantial portion of this revenue. This widespread availability of choice directly empowers consumers, as they can easily switch to platforms or games offering better value or more appealing content, thereby pressuring publishers like Electronic Arts to remain competitive on price and content accessibility.

- Increased Choice: Consumers can opt for F2P titles or subscription services instead of buying games individually.

- Reduced Switching Costs: Moving between different gaming services or F2P titles is often seamless for players.

- Price Sensitivity: The availability of free or low-cost options makes customers more sensitive to the pricing of traditional game purchases.

- Subscription Fatigue: While subscriptions offer value, customers can also become overwhelmed by the number of services, leading them to prioritize those offering the best content library and value proposition.

Customers possess considerable power due to the sheer volume of gaming options available, especially with the rise of free-to-play titles and subscription services like EA Play. This abundance means consumers can easily bypass traditional game purchases if they deem them too expensive or unappealing. For example, the global games market is projected to exceed $200 billion in 2024, with a significant portion coming from these alternative models, directly influencing EA's pricing strategies.

The ease of switching between games and platforms, coupled with strong community influence, further amplifies customer bargaining power. Negative reviews or community backlash can significantly impact sales, as seen with titles that failed to meet player expectations. This collective voice, amplified by platforms like Metacritic, forces companies like EA to prioritize player satisfaction and game quality to maintain franchise value and drive consistent revenue, especially from live services which are crucial for ongoing engagement.

| Factor | Impact on EA | Example/Data Point |

|---|---|---|

| Price Sensitivity | High | Gamers actively seek discounts and compare prices across platforms. |

| Switching Costs | Low | Easy access to free-to-play games in 2024 reduces commitment to paid titles. |

| Community Influence | Significant | Negative sentiment can suppress sales by millions of units; *Anthem* example. |

| Alternative Models (F2P/Subscription) | High | Consumers can opt for free or subscription content instead of individual purchases, impacting overall market share. |

Same Document Delivered

Electronic Arts Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Electronic Arts, detailing the competitive landscape within the video game industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ready for your immediate use and strategic planning.

Rivalry Among Competitors

Electronic Arts (EA) operates in a highly competitive video game market, facing significant rivalry from established giants like Activision Blizzard, Take-Two Interactive, Ubisoft, and Epic Games. These companies consistently launch new titles and expand their existing popular franchises, directly challenging EA's market position across consoles, PC, and mobile platforms.

Developing top-tier, AAA video games demands massive upfront investment, frequently surpassing $80 million to $100 million per title. This significant R&D expenditure, coupled with extensive marketing campaigns, creates a formidable barrier to entry for new players.

The sheer cost involved means that established companies like Electronic Arts must achieve substantial sales to break even and generate profit. This pressure to recoup investment intensifies rivalry, as each major release becomes a high-stakes battle for market share and player attention.

Gamers often exhibit low brand loyalty, frequently switching between titles and publishers based on game quality and innovation rather than allegiance to a specific brand. This dynamic means Electronic Arts (EA) cannot depend solely on its established name to retain its player base. For instance, while EA's revenue from its top franchises like FIFA (now EA Sports FC) and Madden NFL remains strong, the competitive landscape sees players readily adopting new entries or even switching to competing sports titles if they perceive a superior experience. In 2023, EA reported net revenue of $7.63 billion, a testament to its popular franchises, but the underlying challenge of maintaining player interest in a fickle market persists.

Rapid Technological Advancements and Innovation

The gaming industry is a hotbed of rapid technological change, with innovations like artificial intelligence, cloud gaming, and virtual and augmented reality constantly reshaping the landscape. Companies like Electronic Arts must invest heavily in research and development to keep pace. For instance, in fiscal year 2024, EA reported significant investments in its live services and new game development, a direct response to the need to integrate emerging technologies and offer cutting-edge experiences.

This relentless innovation cycle creates intense rivalry. Staying ahead means not just developing new games, but also integrating these new technologies seamlessly into gameplay and player experiences. Failure to adapt can lead to a swift decline in market share as competitors capture player attention with more advanced offerings. The pressure to innovate is a constant driver of competition.

- AI Integration: AI is enhancing game development, creating more realistic NPCs and dynamic game worlds.

- Cloud Gaming Growth: Services like Xbox Cloud Gaming and PlayStation Plus Premium are making games accessible across devices, reducing reliance on traditional hardware.

- VR/AR Potential: While still niche, VR and AR technologies offer new avenues for immersive gaming experiences that companies are exploring.

- R&D Spending: Major publishers are allocating substantial portions of their revenue to R&D to harness these technological shifts.

Importance of Live Services and Recurring Revenue

Electronic Arts heavily relies on live services, which encompass in-game purchases and downloadable content, forming a substantial revenue stream. This model incentivizes fierce competition among developers to continuously offer engaging post-launch content, thereby extending game lifecycles and player retention.

The drive to maintain player engagement through ongoing updates and new content intensifies rivalry. Companies are constantly innovating to keep players invested, leading to a competitive landscape focused on sustained player interaction and monetization.

- EA's fiscal year 2024 saw significant revenue from its Live Services segment, highlighting the importance of recurring revenue streams.

- The success of titles like Apex Legends and FIFA (now EA SPORTS FC) is largely attributed to their robust live service components, including battle passes and cosmetic items.

- This focus on extending game lifecycles through continuous content updates intensifies competition, as players expect ongoing value and engagement from their purchases.

- The ability to generate consistent revenue beyond the initial game purchase is a key differentiator, forcing competitors to invest heavily in post-launch support and community management.

The competitive rivalry within the video game industry, where Electronic Arts (EA) operates, is exceptionally intense. Major players like Activision Blizzard, Take-Two Interactive, and Ubisoft consistently vie for market share by releasing high-quality titles and expanding popular franchises. This constant stream of new content and updates means EA must continually innovate and invest heavily in development and marketing to maintain its position.

The high cost of AAA game development, often exceeding $100 million, creates a significant barrier to entry, consolidating power among established firms. This financial pressure forces companies to achieve massive sales, fueling fierce competition for player engagement and spending. For example, in fiscal year 2024, EA reported net revenue of approximately $7.6 billion, demonstrating the scale of sales required to be successful in this market.

Player loyalty can be fickle, with gamers readily switching between titles based on quality and innovation. This dynamic compels EA to focus on delivering exceptional gameplay and engaging live services to retain its audience. The success of EA's live service model, evident in titles like Apex Legends, relies on continuous content updates to keep players invested and spending, directly intensifying competition as rivals strive to offer similar or superior ongoing value.

| Competitor | Key Franchises | Estimated Revenue (FY23/24, USD billions) |

|---|---|---|

| Activision Blizzard | Call of Duty, Warcraft, Diablo | ~7.5 |

| Take-Two Interactive | Grand Theft Auto, Red Dead Redemption, NBA 2K | ~5.3 |

| Ubisoft | Assassin's Creed, Far Cry, Rainbow Six | ~2.0 |

| Epic Games | Fortnite, Unreal Engine | (Private Company, significant revenue from FBR & Engine licensing) |

SSubstitutes Threaten

The threat of substitutes for Electronic Arts (EA) is significant, encompassing a wide array of digital entertainment options that vie for consumer attention and spending. Beyond rival game publishers, services like Netflix, Disney+, and YouTube offer compelling alternatives for leisure time, directly competing for discretionary income. In 2024, the global video streaming market alone was projected to reach over $250 billion, highlighting the sheer scale of these competing entertainment sectors.

The rise of casual and mobile gaming presents a significant threat of substitutes for Electronic Arts. The widespread adoption of smartphones and tablets means that accessible, often free-to-play games are readily available, drawing in a massive audience. For instance, in 2023, the global mobile gaming market was valued at over $100 billion, demonstrating its sheer scale and reach.

These casual titles offer quick bursts of entertainment that can easily divert player attention and spending away from EA's more premium console and PC titles. This accessibility means consumers have a low-cost alternative for their entertainment needs, potentially reducing the demand for EA's higher-priced products.

The threat of substitutes for Electronic Arts' video games is significant, as consumers have a vast array of alternative leisure and recreational activities. These include everything from outdoor pursuits like hiking and sports to more sedentary hobbies such as reading, board games, or even streaming services. In 2024, the global entertainment and media industry is projected to reach over $3 trillion, with a substantial portion of consumer discretionary spending allocated to various forms of leisure.

These substitutes directly compete for consumers' limited time and disposable income. If gaming experiences, whether through EA's titles or competitors, fail to deliver compelling value, innovation, or sufficient engagement, consumers may easily shift their spending and attention elsewhere. For instance, the rise of accessible and affordable outdoor recreation or the continued growth of subscription-based streaming services present compelling alternatives that don't require the same technological investment or dedicated playtime as many video games.

Cloud Gaming and Subscription Services

Cloud gaming platforms and subscription services present a significant threat to Electronic Arts by offering an alternative to traditional game purchases. These services allow players to access a wide array of games, including many from EA's catalog, for a recurring fee, bypassing the need to buy individual titles outright. This shift in consumer behavior can diminish the revenue generated from full-game sales, a core component of EA's business model.

The convenience and cost-effectiveness of subscription models, such as Xbox Game Pass or PlayStation Plus, can reduce the perceived value of owning individual EA games. For instance, by mid-2024, services like Xbox Game Pass boasted over 30 million subscribers, many of whom gain access to EA titles through EA Play, which is often bundled or offered as part of the subscription. This directly impacts EA's ability to capture premium pricing for its new releases.

- Cloud Gaming Accessibility: Services like NVIDIA GeForce Now and Xbox Cloud Gaming allow users to play high-fidelity games on less powerful devices, lowering the barrier to entry and potentially diverting players from purchasing dedicated gaming hardware or individual EA titles.

- Subscription Bundling: The integration of EA Play into services like Xbox Game Pass means that millions of gamers can access a substantial portion of EA's library without directly subscribing to EA's own services or purchasing games individually.

- Shifting Consumer Preferences: As of 2024, the trend towards subscription-based entertainment across various media, including gaming, continues to grow, indicating a sustained threat from these substitute models.

User-Generated Content (UGC) Platforms

Platforms that heavily feature user-generated content (UGC), like Roblox and Minecraft, present a significant threat of substitution for Electronic Arts (EA). These platforms offer highly engaging, creative, and social experiences, particularly appealing to younger audiences who might otherwise engage with EA's traditional game titles.

The appeal of UGC platforms lies in their virtually limitless content, constantly refreshed by the community itself. This can directly divert player time and attention away from EA's curated game offerings. For instance, in 2024, Roblox reported over 260 million monthly active users, with a significant portion of that demographic being children and teenagers, a key target market for many EA games.

- Roblox's extensive library of user-created games provides an alternative entertainment source.

- Minecraft's sandbox nature fosters creativity and social interaction, drawing players away from structured game experiences.

- The low barrier to entry for content creation on these platforms ensures a continuous stream of new experiences, increasing their substitutability.

The threat of substitutes for Electronic Arts (EA) is substantial, as consumers have a wide array of entertainment options beyond traditional video games. These include streaming services, social media, and even other forms of digital content, all competing for discretionary spending and leisure time. In 2024, the global digital advertising market alone was projected to exceed $700 billion, indicating the significant portion of consumer attention captured by non-gaming digital platforms.

The increasing accessibility and affordability of these substitutes mean that consumers can easily shift their entertainment budget and time away from EA's offerings. For example, the continued growth of platforms like TikTok and YouTube, which offer endless free content, presents a powerful alternative to paid gaming experiences. By early 2024, YouTube had over 2.5 billion monthly active users, demonstrating its massive reach and engagement.

Furthermore, the rise of esports and competitive gaming, while often involving EA titles, also fosters a broader ecosystem of sports and entertainment consumption. Consumers might opt to watch professional esports tournaments, akin to traditional sports, rather than actively playing games themselves, thereby substituting direct engagement with passive spectating.

The variety of entertainment available means that if EA's games do not offer compelling value or innovation, consumers have readily available alternatives. For instance, the continued expansion of the global sports market, valued at over $500 billion in 2023, represents a significant competitor for leisure time and entertainment dollars.

| Substitute Category | 2024 Market Projection (USD Billions) | Key Characteristics |

| Video Streaming Services | > 250 | On-demand content, diverse genres, subscription-based |

| Mobile Gaming | > 100 | Accessible, often free-to-play, casual engagement |

| Social Media & Digital Content | > 700 (Digital Advertising Market) | User-generated content, social interaction, broad appeal |

| Traditional Sports & Entertainment | > 500 (Global Sports Market) | Live events, competitive spectating, broad cultural relevance |

Entrants Threaten

Developing and publishing AAA video games, a core business for Electronic Arts (EA), requires immense capital. These projects demand significant investment in cutting-edge technology, highly skilled development teams, and extensive marketing campaigns to reach a global audience.

The sheer financial outlay needed to create a high-quality AAA title acts as a formidable barrier to entry for potential new competitors. For instance, the average development cost for a AAA game can easily run into the tens of millions of dollars, with some titles exceeding hundreds of millions, making it incredibly challenging for smaller or emerging companies to compete effectively.

Electronic Arts (EA) enjoys a significant advantage due to its robust brand recognition and a stable of highly successful, popular franchises like EA SPORTS FC and Madden NFL. This established presence makes it incredibly difficult and expensive for newcomers to replicate the same level of customer loyalty and intellectual property ownership.

New entrants into the gaming market face significant hurdles in accessing established distribution channels, especially the dominant console platforms like Sony's PlayStation, Microsoft's Xbox, and Nintendo. These platform holders often have stringent requirements and established relationships that new companies struggle to replicate. For instance, in 2024, securing shelf space or prominent digital storefront placement on these consoles can involve substantial marketing commitments and revenue-sharing agreements, making it difficult for newcomers to gain visibility and reach a broad player base.

Talent Acquisition and Retention

The gaming industry's demand for specialized talent in game design, programming, and art presents a significant barrier for new entrants. Established players like Electronic Arts (EA) possess strong employer branding and can offer attractive compensation packages, making it difficult for newcomers to attract and retain top-tier professionals.

New companies entering the market must contend with EA's established reputation and ability to offer competitive salaries and robust benefits, which are crucial for securing the limited pool of highly skilled individuals. This intense competition for talent can inflate labor costs and slow down development cycles for emerging studios.

- Talent Scarcity: The gaming sector thrives on specialized skills, and attracting experienced developers is a constant challenge.

- EA's Competitive Edge: EA's financial strength allows for premium compensation and benefits, creating a hurdle for new entrants.

- Retention Challenges: Keeping skilled employees engaged and preventing them from moving to competitors is vital for sustained success.

- Impact on Innovation: The ability to acquire and retain talent directly influences a company's capacity for innovation and new game development.

Regulatory and Legal Barriers

The gaming industry faces a growing web of regulations, impacting how companies operate and potentially deterring new entrants. For instance, concerns over loot boxes and microtransactions have led to increased scrutiny and potential legislative action in various regions. In 2024, several countries continued to debate or implement stricter rules around these monetization methods, requiring significant legal expertise and compliance infrastructure for any new player to navigate.

Data privacy laws, such as GDPR and similar regulations globally, also present a substantial hurdle. New companies must invest heavily in secure data handling practices and privacy policies to avoid severe penalties. The cost and complexity of ensuring compliance with these evolving legal frameworks can be a significant barrier to entry, especially for smaller, less-resourced startups looking to compete with established giants like Electronic Arts.

- Regulatory Scrutiny: Ongoing debates and potential legislation regarding loot boxes and microtransactions in 2024 require new entrants to understand and adapt to varying international legal standards.

- Data Privacy Compliance: Adhering to data protection laws like GDPR necessitates substantial investment in legal counsel and robust data security infrastructure.

- Legal Expertise Costs: The need for specialized legal teams to navigate complex compliance requirements adds a significant upfront cost, acting as a barrier for nascent companies.

The threat of new entrants for Electronic Arts (EA) is relatively low, primarily due to the massive capital requirements for developing AAA games, estimated to be in the tens to hundreds of millions of dollars. EA's established brand loyalty and strong franchises like EA SPORTS FC further solidify its position, making it difficult for newcomers to gain traction. Furthermore, securing distribution on major console platforms and attracting top-tier talent are significant hurdles, compounded by increasing regulatory complexities surrounding monetization and data privacy that demand substantial legal and compliance investments.

| Barrier to Entry | Estimated Cost/Impact | EA's Advantage |

|---|---|---|

| Capital Investment (AAA Development) | $50M - $300M+ | Established financial resources |

| Brand Recognition & Franchises | Difficult to quantify, high customer loyalty | Market-leading IPs |

| Distribution Access (Consoles) | Significant marketing commitments, revenue share | Long-standing platform relationships |

| Talent Acquisition & Retention | Premium compensation, competitive benefits | Strong employer brand, financial capacity |

| Regulatory Compliance | Legal fees, privacy infrastructure investment | Existing legal and compliance teams |

Porter's Five Forces Analysis Data Sources

Our Electronic Arts Porter's Five Forces analysis is built upon a robust foundation of data, including EA's annual reports, SEC filings, and investor relations disclosures. We also incorporate industry-specific market research reports and analyses from reputable financial news outlets.