Electronic Arts Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Electronic Arts Bundle

Electronic Arts, a titan in the gaming industry, navigates a dynamic market with its diverse portfolio. Understanding where its flagship titles and emerging ventures fall within the BCG Matrix—Stars, Cash Cows, Dogs, or Question Marks—is crucial for strategic growth and resource allocation.

This preview offers a glimpse into EA's product positioning, but the full BCG Matrix report unlocks a comprehensive breakdown of each quadrant, complete with data-backed recommendations and actionable insights to optimize your investment and product development strategies.

Don't miss out on the complete strategic blueprint. Purchase the full BCG Matrix for Electronic Arts and gain the clarity needed to make informed decisions, capitalize on market opportunities, and drive future success.

Stars

EA Sports College Football 25 is a prime example of a Star in the BCG Matrix for Electronic Arts. The game achieved an impressive five million unique players in its inaugural week, showcasing immediate high growth.

This rapid adoption signifies EA's strong market share in a revitalized and eagerly awaited sports video game category. The title's robust launch performance suggests substantial potential for sustained growth and market leadership.

EA Sports FC's Ultimate Team, a cornerstone of its live services, demonstrates exceptional strength. Despite a slight dip in full game sales for EA Sports FC 25, player monetization within Ultimate Team saw a significant double-digit increase starting mid-January 2024.

The Global Football franchise, encompassing EA Sports FC, has experienced impressive growth, with net bookings rising over 70% in the last five fiscal years. This sustained financial performance, driven by the highly engaging and monetizable Ultimate Team mode, firmly establishes it as a star performer.

The Madden NFL franchise is a shining star in Electronic Arts' portfolio, consistently dominating the American football simulation market. For fiscal year 2025, this powerhouse is projected to exceed $1 billion in net bookings, a testament to its enduring appeal and market leadership.

Both weekly average users in the popular Ultimate Team mode and total net bookings are experiencing robust double-digit year-over-year growth. This upward trend highlights Madden's significant market share and its ability to attract and retain a large, engaged player base, solidifying its status as a key growth driver for EA.

Apex Legends

Apex Legends continues to shine as a star within Electronic Arts' portfolio. Despite some fluctuations, it boasts 18 million active monthly players in 2024, with expectations to climb to 20-22 million by 2025. This strong player base solidifies its position as a leading battle royale title, demonstrating significant market share in a dynamic genre.

EA's commitment to Apex Legends is evident through their focus on implementing "significant, innovative changes." These strategic updates are designed to boost player re-engagement and foster continued growth, underscoring the game's ongoing star status and its potential for sustained success.

- 18 million active monthly players in 2024.

- Projected to reach **20-22 million** active monthly players by 2025.

- Maintains a high market share in the competitive battle royale genre.

- EA is investing in innovative changes to drive re-engagement and growth.

Upcoming Battlefield Game

Electronic Arts is heavily investing in the Battlefield franchise, assembling the largest development team in its history for a major new title slated for fiscal year 2026. This strategic move signals a strong expectation for high growth and a significant push to reclaim market share in the competitive first-person shooter (FPS) genre.

The substantial resources dedicated to this new Battlefield game underscore its potential as a future star within EA's portfolio. This focus indicates EA's belief in the IP's ability to drive substantial revenue and player engagement, positioning it as a key growth driver for the company.

- Largest Development Team: EA has mobilized its biggest Battlefield development team ever.

- Fiscal Year 2026 Launch: A significant new title is planned for release within FY26.

- Market Share Ambitions: The investment aims to re-establish dominance in the FPS market.

- High Growth Potential: The franchise's established IP is expected to yield strong returns.

The Madden NFL franchise is a standout Star, projected to surpass $1 billion in net bookings for fiscal year 2025. Its Ultimate Team mode shows robust double-digit year-over-year growth in both active users and net bookings, confirming its market dominance and strong player engagement.

Apex Legends also shines as a Star, with 18 million active monthly players in 2024, expected to grow to 20-22 million by 2025. EA's strategic investment in innovative updates aims to boost re-engagement and sustain its leading position in the battle royale genre.

EA Sports College Football 25 has made a powerful debut as a Star, attracting five million unique players in its first week, indicating strong market capture in a highly anticipated sports title. The EA Sports FC franchise, driven by its lucrative Ultimate Team mode, saw net bookings increase over 70% in the last five fiscal years, solidifying its Star status.

| Franchise | BCG Category | Key Performance Indicators (2024-2025) | Growth Drivers |

| Madden NFL | Star | Projected >$1 Billion Net Bookings (FY25); Double-digit YoY growth in Ultimate Team users and bookings | Ultimate Team monetization, sustained market leadership |

| Apex Legends | Star | 18 Million Monthly Active Players (2024); Projected 20-22 Million by 2025 | Innovative updates, strong player base, competitive genre position |

| EA Sports College Football 25 | Star | 5 Million Unique Players (First Week) | Revitalized market, strong initial adoption |

| EA Sports FC | Star | >70% Net Bookings Growth (Last 5 FYs); Strong Ultimate Team monetization | Ultimate Team engagement, franchise appeal |

What is included in the product

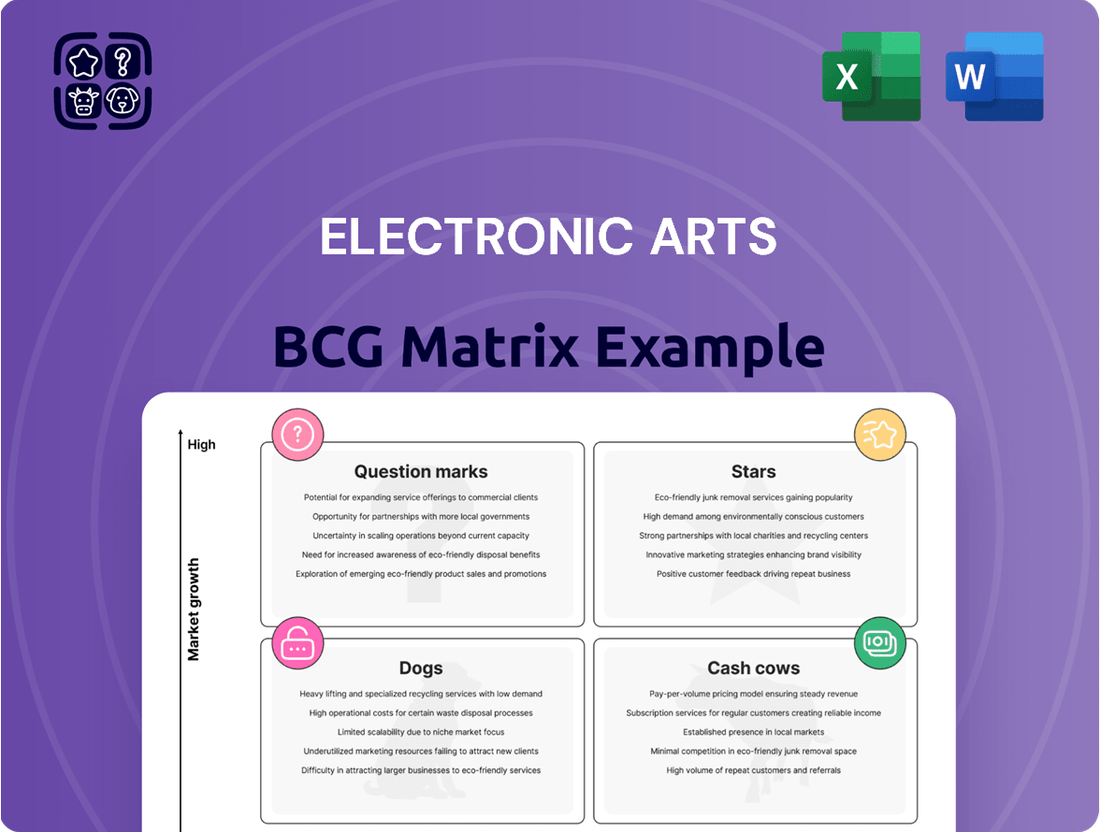

This BCG Matrix analysis identifies Electronic Arts' gaming titles as Stars, Cash Cows, Question Marks, and Dogs.

A clear Electronic Arts BCG Matrix visualizes business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

The Sims 4, a decade into its lifecycle, remains a significant cash cow for Electronic Arts. As of May 2024, it has attracted over 15 million new players in the past year, bringing its total player base to an impressive 85 million. This sustained growth is largely attributed to its free-to-play model, which has broadened its accessibility considerably.

The game’s consistent revenue stream is fueled by a steady release of downloadable content (DLC), which players eagerly purchase. This mature product generates substantial and reliable cash flow for EA, requiring minimal new investment in its core development, a hallmark of a successful cash cow in the BCG matrix.

EA's overall live services, including in-game purchases, subscriptions, and downloadable content, form the company's dominant revenue stream. This segment, which includes popular franchises, accounted for roughly 75% of net bookings in the 12 months leading up to Q1 FY25.

These live services consistently deliver strong cash flow with comparatively lower development expenses than new game launches. By capitalizing on established player communities and well-known franchises, this segment acts as a reliable and highly profitable cash cow for Electronic Arts.

EA SPORTS FC's base game sales, including the 2024 release of EA Sports FC 25, are classified as a Cash Cow. Despite EA Sports FC 25 underperforming initial sales expectations in 2024, the franchise maintains a dominant market share in the global football simulation genre.

This segment continues to be a significant revenue generator for Electronic Arts due to its established annual release schedule. The consistent demand for the core game, even with fluctuating performance of individual titles, solidifies its position as a reliable source of substantial cash flow for the company.

EA SPORTS F1 Series

The EA SPORTS F1 Series, exemplified by titles like F1 24, operates as a reliable cash cow for Electronic Arts. This franchise targets a specific, yet robust, segment of the racing simulation market, ensuring consistent demand year after year.

While its revenue might not rival EA's blockbuster sports franchises, the F1 series consistently achieves solid sales figures and maintains high player engagement. For instance, F1 23, released in June 2023, saw strong initial sales and positive player reception, contributing to EA's overall financial performance.

The mature nature of the F1 racing genre and its dedicated fanbase translate into predictable development costs and marketing expenditures. This allows EA to forecast revenue streams with a high degree of certainty, making the series a stable contributor to its portfolio.

- Annual Release Cycle: The F1 series benefits from a predictable annual release schedule, ensuring a consistent revenue stream.

- Niche Market Strength: It commands a strong position within the dedicated racing simulation niche, fostering loyalty and repeat purchases.

- Predictable Cash Flow: The mature market and established fanbase allow for reliable cash flow generation with manageable development costs.

- Brand Loyalty: Years of consistent quality and authentic representation have built significant brand loyalty, ensuring sustained player interest.

Madden NFL Ultimate Team Monetization

Madden NFL Ultimate Team is a prime example of a cash cow within Electronic Arts' portfolio. This mode consistently generates substantial revenue, contributing significantly to the Madden NFL franchise's over $1 billion in net bookings. Its success stems from a well-established player base and a microtransaction-driven model that thrives on continuous engagement within the popular sports simulation market.

- Dominant Revenue Driver: Ultimate Team is a cornerstone of Madden's monetization, consistently driving in-game purchases.

- High-Margin Business: The model leverages an existing, engaged player base, leading to high profit margins.

- Mature Market Success: It capitalizes on the enduring popularity of American football, a dominant sports genre.

- Consistent Performance: Ultimate Team's ability to generate reliable revenue makes it a predictable and valuable asset.

Electronic Arts' live services segment, encompassing in-game purchases and downloadable content across its major franchises, represents a significant cash cow. This segment consistently delivers strong, predictable cash flow with relatively lower investment compared to new game development.

The Sims 4, a decade old, continues to be a powerhouse, attracting millions of new players annually and generating revenue through extensive DLC. EA SPORTS FC and the F1 series also function as reliable cash cows, benefiting from established annual releases and dedicated fanbases.

Madden NFL Ultimate Team is another key cash cow, driving substantial revenue through its microtransaction model within the popular American football simulation. These mature, high-demand titles and modes are crucial for EA's sustained financial health.

| Product/Service | BCG Category | Key Characteristics | FY24 Relevance |

| The Sims 4 | Cash Cow | Mature title, extensive DLC, large player base | Over 15M new players in FY24, 85M total |

| EA SPORTS FC (incl. 2024 release) | Cash Cow | Dominant market share, annual release cycle | Despite underperforming initial expectations, remains a significant revenue generator |

| EA SPORTS F1 Series (incl. F1 24) | Cash Cow | Niche market strength, loyal fanbase, predictable costs | Consistent solid sales and high player engagement |

| Madden NFL Ultimate Team | Cash Cow | Microtransaction-driven, dominant revenue driver for Madden | Contributes significantly to Madden's >$1B net bookings |

| Live Services (Overall) | Cash Cow | In-game purchases, subscriptions, DLC | Accounted for ~75% of net bookings in 12 months to Q1 FY25 |

Full Transparency, Always

Electronic Arts BCG Matrix

The Electronic Arts BCG Matrix preview you are viewing is the definitive, final document you will receive upon purchase. This means the analysis, formatting, and strategic insights are precisely as they will be delivered, ensuring you know exactly what you're acquiring for your business planning.

Dogs

Battlefield 2042, despite its initial hype, has been categorized as a 'dog' within Electronic Arts' portfolio due to a rocky launch and persistent performance issues. The game struggled to gain significant market share and sustained player engagement following its release.

While the Battlefield franchise remains a valuable asset for EA, Battlefield 2042 itself has not translated into the expected commercial success. Even with a player base reaching 25 million, the game has consumed substantial development and marketing resources without delivering commensurate returns, solidifying its position as a underperforming product.

Tales of Kenzera: Zau, a recent release from Electronic Arts, is a prime example of a 'dog' in the BCG Matrix. The game reportedly did not perform as expected, leading to studio cuts, a clear indicator of its poor market reception.

With its low market share and a competitive gaming landscape, Zau struggled to gain significant traction. This lack of performance means it likely ties up valuable resources without generating substantial returns, a hallmark of a cash trap.

Dragon Age: The Veilguard, a highly anticipated title from Electronic Arts, has unfortunately landed in the 'dog' category of the BCG Matrix. The game significantly underperformed expectations, attracting only 1.5 million players compared to a projected 3 million, a shortfall of almost 50%.

This substantial miss on player engagement for a major AAA release directly impacted EA's financial performance, contributing to lower net bookings. The game's low market penetration, especially considering the significant investment, solidifies its position as a dog in EA's portfolio.

Older, Declining Catalog Titles

Older, declining catalog titles represent Electronic Arts' Dogs in the BCG Matrix. These are games that have seen their peak sales and are no longer a significant focus for promotion or substantial content updates. Their market share is likely small within segments that are not experiencing much growth.

Electronic Arts' financial reports have highlighted a slowdown in full game sales, and specifically mentioned "headwinds related to release and content timing" impacting these older catalog titles. This suggests that their contribution to overall revenue is diminishing, and they may not be strategically important for future growth.

These titles often require minimal ongoing investment for maintenance but generate very little revenue. Consequently, they are prime candidates for potential divestiture or for being managed with the absolute lowest level of resource allocation. For instance, if a catalog title from 2018 is no longer generating significant player engagement or recurring revenue, its strategic value is minimal.

- Low Market Share: Older games typically have a reduced player base compared to new releases.

- Slow Growth Segments: The genres or platforms these games belong to may be mature or declining.

- Minimal Revenue Generation: They contribute little to overall sales and are unlikely to drive future growth.

- Potential for Divestiture: EA might consider selling off rights to these titles if they require any maintenance costs.

Underperforming Specific Iterations of Annual Franchises (e.g., EA Sports FC 25 initial sales)

While the EA Sports FC franchise generally performs well, the initial sales of EA Sports FC 25 in late 2024 were disappointing. This underperformance contributed to a revised financial forecast for Electronic Arts.

This specific iteration of the annual franchise, despite the overall brand strength, did not meet its sales targets. This situation places it in the 'dog' category of the BCG Matrix, indicating low growth for that particular release and a potentially weaker market position for that year's edition.

- EA Sports FC 25 initial sales fell short of expectations in late 2024.

- This underperformance impacted Electronic Arts' financial outlook.

- The specific iteration is classified as a 'dog' due to low growth and market capture for that year's release.

Electronic Arts' 'Dogs' represent products with low market share in slow-growing industries. These are typically older catalog titles that have passed their prime, or recent releases that failed to gain traction. They consume resources without generating significant returns, often requiring minimal investment but offering little in the way of future growth potential.

The classification of games like Battlefield 2042 and Dragon Age: The Veilguard as 'dogs' highlights their underperformance relative to expectations and market penetration. For instance, Dragon Age: The Veilguard attracted only 1.5 million players, significantly missing its 3 million player target, a clear indicator of its dog status.

Similarly, EA Sports FC 25's initial sales in late 2024 were disappointing, impacting EA's financial forecasts and placing that specific iteration in the dog category due to its low growth and market capture for the year.

These underperforming assets often necessitate a strategic review, potentially leading to divestiture or a drastic reduction in resource allocation to mitigate ongoing losses and free up capital for more promising ventures.

| Product | BCG Category | Market Share | Market Growth | Notes |

| Battlefield 2042 | Dog | Low | Slow/Declining | Rocky launch, performance issues, failed to gain significant traction. |

| Tales of Kenzera: Zau | Dog | Low | Slow/Declining | Poor market reception, studio cuts, low player engagement. |

| Dragon Age: The Veilguard | Dog | Low | Slow/Declining | Significant player engagement miss (1.5M vs 3M target), impacted net bookings. |

| Older Catalog Titles | Dog | Low | Slow/Declining | Past peak sales, minimal focus for promotion or updates, diminishing revenue contribution. |

| EA Sports FC 25 (Initial) | Dog | Low | Slow/Declining | Disappointing initial sales in late 2024, revised financial forecasts. |

Question Marks

Project Rene, the next iteration of The Sims, is currently in early development, meaning it has no market share yet. This positions it as a question mark in EA's BCG matrix, representing a high-growth potential market for a well-established intellectual property. EA's substantial investment in its development and marketing will be crucial to its future success.

Electronic Arts plans to launch two unannounced games before the end of its fiscal year on March 31, 2025. One of these will be a collaborative project released under the EA Originals banner. These ventures are positioned as potential high-growth opportunities, entering the market with novel concepts or new partnerships.

While these new intellectual properties (IPs) and partner games hold promise for significant market penetration, their current market share is indeterminate. Success will necessitate substantial investment in marketing and development to establish a foothold and capture player interest.

Skate. (New Iteration) is positioned as a question mark within Electronic Arts' BCG Matrix. The game is anticipated to launch in fiscal year 2026, aiming to capitalize on the revival of a beloved skateboarding franchise and a potentially resurgent genre. While it targets a market with strong growth prospects, its future market share and overall success remain uncertain, necessitating careful strategic investment from EA.

Plants vs. Zombies 3

Plants vs. Zombies 3 is positioned as a question mark within Electronic Arts' BCG Matrix. This new mobile installment aims to revitalize a beloved casual gaming series in a rapidly expanding mobile market, which saw global revenue reach an estimated $184 billion in 2023. The game must carve out a significant market share amidst intense competition from countless other titles.

It represents a calculated investment by EA to attract new players and broaden the appeal of the Plants vs. Zombies brand. The success of this venture hinges on its ability to differentiate itself and capture a substantial user base, making its future market standing uncertain.

- Market Position: Question Mark

- Growth Rate: High (Mobile Gaming Market)

- Market Share: Low/Uncertain

- Strategic Objective: Gain Market Share, Capture New Audiences

New Mobile Game Initiatives

Electronic Arts' new mobile game initiatives are positioned as Question Marks in the BCG Matrix. These ventures, including potential expansions or entirely new titles beyond established successes like FC Mobile, are characterized by their nascent stage in the market. They require substantial investment for development and marketing, aiming to capture a share in the dynamic mobile gaming sector, which saw global revenue reach approximately $90 billion in 2023.

These new titles typically begin with a low market share. For instance, a newly launched mobile game might only capture a fraction of a percent of the market initially. The success of these Question Marks is not guaranteed, with significant uncertainty surrounding player adoption and monetization. EA's strategy involves heavy investment in these areas, hoping that successful titles can evolve into Stars or Cash Cows.

- Low Market Share: New mobile games often start with minimal player bases and revenue.

- High Investment Needs: Significant capital is allocated to development, marketing, and user acquisition for these unproven titles.

- Uncertain Returns: The potential profitability of these initiatives is highly speculative, dependent on market reception and competitive landscape.

- Strategic Importance: EA's continuous exploration of new mobile titles is crucial for future growth and staying competitive in a market that generated over $100 billion in 2024.

Question Marks in Electronic Arts' portfolio represent new or unproven ventures operating in high-growth markets. These products, like Project Rene or new mobile initiatives, begin with low market share but possess the potential to become market leaders if successful. EA's strategy involves significant investment in these areas, aiming to convert them into Stars or Cash Cows.

The success of these Question Marks is inherently uncertain, as they face intense competition and require substantial marketing and development resources to gain traction. For example, the mobile gaming market, a key area for EA's Question Marks, generated over $100 billion in revenue in 2024, highlighting both the opportunity and the competitive challenge.

EA's approach to Question Marks involves careful evaluation and strategic resource allocation. The company is actively investing in upcoming titles like Skate. (New Iteration) and Plants vs. Zombies 3, both positioned as Question Marks, to capture market share in their respective genres and platforms.

| Product/Initiative | BCG Category | Market Growth | Market Share | Strategic Focus |

| Project Rene (The Sims) | Question Mark | High | Low/Nascent | Development & Marketing Investment |

| Skate. (New Iteration) | Question Mark | High | Low/Nascent | Capitalize on Franchise & Genre Revival |

| Plants vs. Zombies 3 | Question Mark | High (Mobile) | Low/Nascent | Revitalize Brand in Growing Mobile Market |

| Unannounced EA Originals Title | Question Mark | High | Low/Nascent | Explore New Partnerships & Concepts |

BCG Matrix Data Sources

Our Electronic Arts BCG Matrix is built on a foundation of comprehensive market data, integrating financial reports, sales figures, and player engagement metrics to accurately assess product portfolio performance.