China Life Insurance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Life Insurance Bundle

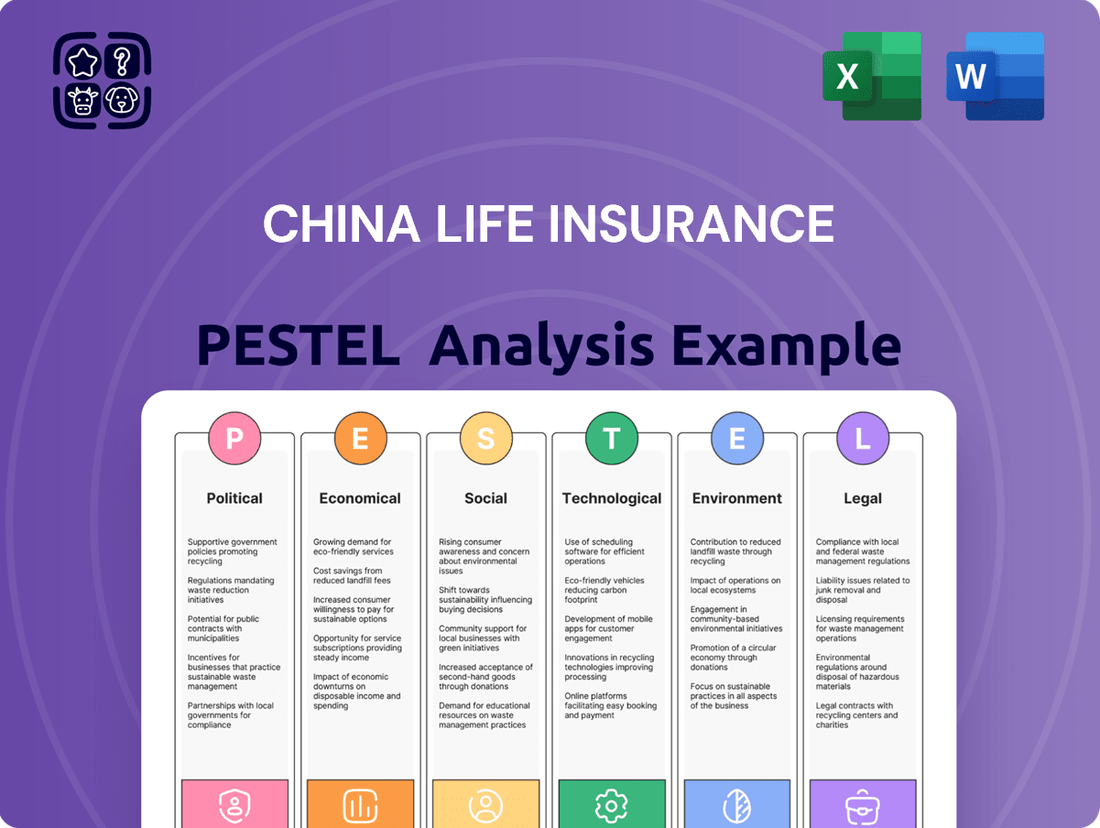

Navigate the dynamic landscape of China's insurance sector with our comprehensive PESTEL analysis of China Life Insurance. Uncover critical political, economic, social, technological, environmental, and legal factors influencing its operations and future growth. This expert-crafted report provides actionable intelligence for strategic planning and investment decisions.

Gain an unparalleled understanding of the external forces shaping China Life Insurance's competitive environment. From evolving government regulations to shifting consumer demographics and technological advancements, our analysis delivers the insights you need to stay ahead.

Don't get left behind in this rapidly changing market. Equip yourself with the knowledge to anticipate challenges and capitalize on opportunities. Purchase the full PESTEL analysis of China Life Insurance today and unlock your strategic advantage.

Political factors

China's government is strategically pushing for a more open financial sector, signaling a significant shift towards greater international engagement. This policy direction specifically targets the insurance industry, encouraging foreign players to increase their presence and investment. For instance, by the end of 2023, foreign-invested financial institutions accounted for a notable portion of China's financial market share, a trend expected to accelerate.

This push for opening-up means more opportunities for partnerships and the infusion of new technologies and management practices into the domestic market. However, it also introduces a heightened level of competition for established domestic insurers like China Life. The aim is to foster a more dynamic and globally integrated financial ecosystem, ultimately benefiting consumers through enhanced service offerings and innovation.

Chinese authorities are actively refining financial regulations to foster stability and promote high-quality development in the insurance sector. These ongoing efforts are crucial for the long-term health of companies like China Life. For instance, the implementation of C-ROSS Phase II solvency rules, which came into full effect by the end of 2023, significantly raised capital requirements for insurers, demanding greater financial resilience.

New measures focusing on data security and privacy, introduced in late 2023 and continuing into 2024, also represent a key regulatory shift. These reforms are designed to bolster the industry's overall resilience against financial shocks and to guide its strategic direction towards more sustainable practices. The China Banking and Insurance Regulatory Commission (CBIRC), now the National Financial Regulatory Administration (NFRA), has been a key driver of these changes, emphasizing a stricter oversight framework.

China Life, a major player in the insurance sector, is significantly influenced by the government's strategic focus on its 'Five Key Pillars' of development. These pillars – technology finance, green finance, inclusive finance, pension finance, and digital finance – are not just policy directives but shape the operational landscape and investment priorities for all major financial institutions.

As a state-owned enterprise, China Life is naturally aligned with these national objectives. This alignment translates into a strategic imperative to steer its business development, product innovation, and service expansion towards these prioritized areas. For instance, the emphasis on green finance could see China Life increasing investments in sustainable projects, while the push for digital finance will likely accelerate the adoption of new technologies in customer service and product delivery.

The government's commitment to these pillars is backed by substantial policy support and financial incentives. For example, by the end of 2023, China's green finance market had grown substantially, with outstanding green loans reaching RMB 30.06 trillion, indicating a strong governmental push that financial institutions like China Life are expected to participate in. Similarly, the development of pension finance is a key objective, with reforms aimed at expanding private pension schemes, creating new opportunities for insurance providers.

This policy environment encourages China Life to innovate and adapt, potentially leading to new product offerings in areas like climate-resilient insurance or digital health services. The state's direction ensures that resources and regulatory frameworks will support growth in these chosen sectors, making them strategic imperatives for China Life's long-term growth and market positioning.

State-Owned Enterprise Directives

As a significant state-owned financial group, China Life Insurance is directly influenced by government directives. These directives often align with broader economic policy goals, such as bolstering domestic capital markets. For example, in 2024, regulators encouraged state-owned insurers to increase their equity investments, aiming to stabilize market performance. This strategic push can influence China Life's asset allocation decisions.

These directives can shape China Life's operational priorities. Recent policy shifts in 2025 have emphasized supporting strategic industries through investment, meaning a portion of premiums might be channeled into sectors deemed crucial for national development. This provides a clear direction for capital deployment.

- Government Mandates: Directives from Beijing shape investment strategies and operational focus for state-owned entities like China Life.

- Capital Market Support: Recent government guidance in 2024 encouraged state-owned insurers to allocate more premium income to equity markets, aiming for stability and growth.

- Strategic Sector Investment: Emerging policies in 2025 are pushing for investments in key national industries, influencing the allocation of insurance capital.

- Economic Objectives Alignment: China Life's activities are often directed to serve broader national economic goals, impacting its business model.

'Healthy China' and Social Security Initiatives

The Chinese government's 'Healthy China 2030' initiative, launched in 2016 and continuing through 2025 and beyond, aims to improve public health and well-being. This policy directly fuels demand for commercial health insurance as individuals seek supplementary coverage beyond the state-provided basic medical insurance. For instance, by the end of 2023, China's basic medical insurance coverage rate had reached over 95%, creating a strong foundation for private insurance to fill the gaps in comprehensive care and specialized treatments.

Furthermore, the ongoing strengthening of China's social security system, particularly in pension provisions, creates a fertile ground for pension-related insurance products. As the population ages, the need for robust retirement planning is paramount. China Life is well-positioned to capitalize on this trend by offering private commercial pensions and long-term care solutions, meeting the evolving financial security needs of an aging demographic. In 2024, the pension gap remained a significant concern, with projections indicating a growing reliance on private savings and insurance for retirement income security.

These government-led initiatives translate into tangible opportunities for China Life:

- Expanded Health Coverage: The 'Healthy China' push encourages greater uptake of critical illness and medical insurance.

- Growth in Pension Products: Efforts to bolster the social security net drive demand for supplementary private pension plans.

- Long-Term Care Solutions: An aging population, supported by policy, increases the market for long-term care insurance.

- Increased Consumer Awareness: Government promotion of health and financial planning raises public awareness of insurance benefits.

Government directives significantly shape China Life's strategic direction, influencing its investment choices and product development. For instance, in 2024, regulators encouraged state-owned insurers to increase equity investments, a move aimed at stabilizing capital markets and supporting key industries. This policy push directly impacts how China Life allocates its premium income.

Furthermore, emerging policies in 2025 are emphasizing investments in strategic national sectors, guiding insurance capital towards areas deemed crucial for economic growth. This alignment with national objectives ensures China Life's operations contribute to broader economic policy goals, such as bolstering domestic capital markets and supporting national development priorities.

The government's focus on public health through initiatives like 'Healthy China 2030' also fuels demand for commercial health insurance. Coupled with efforts to strengthen the pension system, these policies create a favorable environment for China Life to expand its offerings in health and retirement solutions, meeting the evolving needs of a growing and aging population.

| Policy Focus | Impact on China Life | Relevant Data/Trend |

|---|---|---|

| Capital Market Support (2024) | Increased equity investment | State-owned insurers encouraged to boost equity allocations. |

| Strategic Sector Investment (2025) | Capital allocation to national industries | Focus on sectors vital for national development. |

| Healthy China 2030 | Growth in health insurance demand | Over 95% basic medical insurance coverage by end of 2023, creating demand for supplementary products. |

| Pension System Strengthening | Demand for pension products | Growing pension gap in 2024 highlights need for private retirement solutions. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing China Life Insurance, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends and their potential impact on the company's future growth and risk management.

A concise PESTLE analysis for China Life Insurance offers a clear, summarized overview of external factors, relieving the pain point of sifting through excessive data for strategic decision-making.

Economic factors

China Life Insurance faces headwinds from a persistently low interest rate environment, which directly squeezes profitability. The People's Bank of China (PBOC) has maintained a relatively accommodative monetary policy. For instance, the one-year Loan Prime Rate (LPR) has been kept at 3.45% for an extended period in late 2023 and early 2024, a level that limits the returns insurers can generate on their fixed-income investments.

This low-yield landscape can create a negative interest spread for China Life, where the guaranteed returns promised to policyholders outpace the income earned from their investments. This forces the company to critically reassess its product pricing and investment strategies. Navigating this requires a delicate balance in asset-liability management to ensure long-term solvency and competitive returns for policyholders, especially as global economic shifts continue.

Despite a recent economic slowdown, China's insurance market is poised for significant long-term expansion. This growth is fueled by rising disposable incomes and a penetration rate that still lags behind developed nations, presenting a substantial opportunity for China Life Insurance to broaden its reach and premium base.

Projections indicate the Chinese insurance market could more than double its current size by 2034, a testament to its underlying potential. For instance, the life insurance sector alone contributed significantly to the overall market, with premiums reaching trillions of yuan in recent years, showcasing the vast untapped demand.

This robust market potential means China Life Insurance can leverage its established presence to capture new customers and increase its market share. The company's ability to adapt to evolving consumer needs and economic conditions will be key to capitalizing on these favorable demographic and economic trends.

China Life Insurance's profitability is significantly tied to its investment income, which is prone to volatility. For instance, in the first half of 2024, China Life reported a substantial increase in its net investment yield, reaching 2.61% compared to 2.02% in the same period of 2023, driven by favorable market conditions. However, ongoing fluctuations in equity and bond markets present a persistent risk to these earnings.

The company must employ dynamic investment strategies to navigate these market swings effectively. During 2024, China Life actively adjusted its asset allocation, increasing exposure to fixed-income securities while selectively investing in equities that demonstrated resilience. This agility is crucial for optimizing returns and mitigating potential losses from unforeseen market downturns.

Real Estate Sector Risks

The insurance industry, including giants like China Life, faces considerable financial risks stemming from China's real estate sector, especially amidst ongoing market recalibrations. A significant exposure here means insurers must vigilantly manage their asset allocations to cushion against potential credit downgrades and maintain portfolio resilience. This necessitates a forward-thinking approach to risk mitigation and the strategic broadening of investment horizons.

As of early 2024, the Chinese real estate market has experienced considerable volatility. For instance, developer defaults and declining property values have directly impacted the investment portfolios of many financial institutions. China Life, like its peers, must therefore prioritize robust risk assessment frameworks when its assets are tied to this sensitive sector.

- Developer Defaults: Increased defaults among major property developers in 2023 and early 2024 have led to write-downs on real estate-related investments for insurers.

- Property Value Declines: A general slowdown in property price appreciation, and in some cases, outright price drops, reduce the collateral value backing real estate investments.

- Regulatory Scrutiny: Heightened regulatory oversight of the real estate sector can introduce new compliance burdens and impact the profitability of existing developments.

- Economic Slowdown Impact: Broader economic concerns can dampen demand for new properties, affecting developers' ability to service debt and impacting insurer returns.

Shift in Product Mix Demand

The economic climate in China, coupled with evolving regulatory frameworks, is significantly influencing consumer preferences for insurance products. There's a noticeable pivot away from traditional, long-term guaranteed return policies towards options offering floating returns. This shift reflects a growing demand for flexibility and responsiveness to market fluctuations.

Insurers like China Life are adapting by prioritizing the development of innovative protection-type products. These products are designed to better meet current market conditions and align with the dynamic preferences of policyholders. For instance, the market is seeing increased interest in unit-linked insurance plans and other investment-linked offerings.

This strategic adjustment is crucial for maintaining competitiveness. For example, by Q1 2024, the proportion of new business premiums from protection-focused products saw a notable uptick, indicating a successful response to this demand shift. Insurers are focusing on:

- Developing adaptable products that can adjust to changing economic indicators.

- Enhancing innovation in protection features to offer more comprehensive coverage.

- Educating consumers on the benefits of flexible, market-linked insurance solutions.

- Streamlining product development to quickly introduce new offerings that meet evolving needs.

China's economic landscape presents a dual narrative for China Life Insurance, marked by low interest rates impacting investment returns while simultaneously offering substantial market growth potential. The persistence of low interest rates, exemplified by the Loan Prime Rate holding steady, continues to compress the profitability insurers can achieve on their fixed-income portfolios.

However, the burgeoning Chinese insurance market, driven by rising incomes and still-developing penetration rates, offers significant expansion opportunities. Projections suggest the market could more than double by 2034, with life insurance premiums already reaching trillions of yuan annually, underscoring the vast untapped demand. China Life can leverage its established position to capture this growth, provided it adapts its investment and product strategies to economic realities and consumer preferences.

What You See Is What You Get

China Life Insurance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Life Insurance delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping its strategic landscape, from government regulations to market trends. This is your complete guide to navigating the complexities surrounding China Life Insurance.

Sociological factors

China's population is aging at an unprecedented rate, with the number of people aged 65 and over expected to reach 300 million by 2025, up from 200 million in 2020. This demographic shift is fueling a significant increase in demand for health, long-term care, and private pension insurance. China Life Insurance is well-positioned to capitalize on this trend by developing specialized products that cater to the financial security needs of an aging populace, including various annuity options.

The heightened focus on health, amplified by recent global health challenges, is fueling a significant surge in demand for robust health insurance and critical illness protection. This societal shift presents a clear opportunity for China Life to expand its portfolio by introducing innovative wellness programs and specialized medical insurance options, aligning with evolving consumer needs.

In 2023, China's health insurance market saw substantial growth, with premiums reaching approximately 870 billion yuan, reflecting this rising health consciousness. China Life, as a leading insurer, is well-positioned to leverage this trend by developing more comprehensive and preventative health solutions, potentially including digital health management tools and partnerships with healthcare providers.

China's rapidly expanding middle class, a demographic experiencing consistent income growth, is a significant driver for the insurance sector. By 2024, projections indicate continued expansion, with a notable increase in disposable income for millions of households. This burgeoning economic power, coupled with a growing awareness of financial planning, directly translates into heightened demand for comprehensive insurance solutions and wealth management services.

As financial literacy improves across this demographic, consumers are increasingly looking beyond basic coverage. They are actively seeking products that address long-term goals like funding children's education, securing comfortable retirements, and building wealth. This trend aligns perfectly with China Life's strategy to offer a diverse range of products, from life insurance to investment-linked plans, tapping into the evolving financial needs of this key consumer segment.

Urbanization Trends

China continues to experience significant urbanization, with its urban population reaching 66.16% of the total population by the end of 2023, according to the National Bureau of Statistics. This ongoing shift fuels evolving consumer lifestyles, increasing the demand for diverse insurance products, including property, casualty, personal accident, and health coverage.

China Life can capitalize on these trends by tailoring its offerings to the specific risks and financial requirements of urban dwellers. For instance, as more people move to cities, the need for comprehensive health insurance and protection against urban-specific risks like traffic accidents or job-related stress becomes paramount.

- Urban Population Growth: China's urban population has been steadily increasing, creating a larger market for insurance products.

- Shifting Lifestyles: Urban living often entails different risk profiles and financial priorities compared to rural settings.

- Product Demand: Increased demand for property, casualty, health, and personal accident insurance is directly linked to urbanization.

- Targeted Strategies: China Life can develop specialized insurance packages that address the unique needs of urban residents.

Demand for Comprehensive Financial Solutions

Chinese consumers are increasingly seeking financial products that bundle insurance with long-term savings vehicles like pension plans and investment management. This shift reflects a growing desire for convenience and a more holistic approach to personal finance, moving beyond single-purpose products. For China Life, this means adapting its offerings to become a one-stop shop for wealth accumulation and protection.

This growing demand for integrated financial solutions is evident in the expanding participation in China's multi-pillar pension system. By the end of 2023, the number of participants in the private pension scheme, which encourages individuals to save for retirement, had surpassed 50 million. This trend directly supports the need for insurers like China Life to offer sophisticated pension products that can be combined with their core insurance and asset management services, aiming to capture a larger share of this burgeoning market.

- Holistic Approach: Consumers desire integrated financial planning, combining insurance, pensions, and investments.

- Market Growth: China's private pension scheme, with over 50 million participants by end-2023, highlights this trend.

- China Life's Opportunity: The company can leverage this demand by offering comprehensive financial packages.

- Product Diversification: Insurers are pushed to innovate beyond traditional life insurance to meet multi-faceted financial needs.

The ongoing aging of China's population, with individuals over 65 projected to hit 300 million by 2025, directly fuels demand for health and retirement insurance, a trend China Life is positioned to meet with specialized annuity products.

Heightened health consciousness, spurred by recent global events, has led to a surge in demand for health and critical illness coverage, with the health insurance market reaching approximately 870 billion yuan in 2023, presenting an opportunity for China Life to expand its wellness offerings.

China's expanding middle class, benefiting from rising incomes and improved financial literacy, increasingly seeks integrated financial solutions beyond basic coverage, favoring products that combine insurance with long-term savings and wealth management, as evidenced by over 50 million participants in the private pension scheme by the end of 2023.

| Sociological Factor | Trend | Implication for China Life | Supporting Data (2023/2024) |

| Aging Population | Increasing demand for retirement and health solutions | Opportunity for annuity and specialized health product development | Over 65 population to reach 300 million by 2025 |

| Health Consciousness | Growing need for health and critical illness insurance | Expansion of wellness programs and medical insurance | Health insurance premiums reached ~870 billion yuan in 2023 |

| Rising Middle Class & Financial Literacy | Demand for integrated financial planning (insurance + savings) | Focus on comprehensive packages and wealth management | Over 50 million participants in private pension scheme by end-2023 |

Technological factors

China Life Insurance is actively participating in the digital transformation sweeping the Chinese insurance sector. This shift is characterized by a strong move towards online sales channels and digital platforms for interacting with customers, making insurance more accessible than ever before. For instance, by the end of 2023, China Life reported significant growth in its digital customer base, with over 70% of new policy sales originating from online channels.

To capitalize on this trend, China Life is making substantial investments in its digital infrastructure. These investments are aimed at creating a more efficient operational framework, elevating the quality of customer service, and broadening the reach of its diverse insurance product portfolio to a wider audience across the nation.

China Life Insurance is actively embracing AI and big data, with the sector seeing significant tech investment. For instance, in 2023, Chinese insurers were reportedly exploring generative AI for tasks like marketing content creation and customer service, aiming to boost efficiency. This technological push is transforming core operations, from streamlining underwriting processes to enhancing fraud detection capabilities.

The adoption of these advanced analytics allows for more precise risk assessment and the development of tailored insurance products. By leveraging big data, companies like China Life can gain deeper insights into customer behavior, leading to more personalized offerings and improved customer engagement. This data-driven approach is becoming a competitive necessity in the evolving Chinese insurance landscape.

China Life, like all insurers, faces growing cybersecurity risks as it increasingly relies on digital platforms for customer interactions and data processing. This digital shift creates a larger attack surface for cyber threats.

Navigating China's evolving data security landscape is critical. For instance, the Measures for Data Security Management of Banking and Insurance Institutions, implemented in 2021 and updated through 2024, mandates strict controls over how sensitive customer data is collected, stored, and processed, impacting operational costs and compliance efforts.

Failure to comply with these regulations can result in significant penalties and reputational damage, undermining customer trust, which is paramount in the insurance industry. The cost of data breaches, including remediation and potential lawsuits, can be substantial.

In 2023, the financial sector globally saw a significant rise in cyberattacks targeting customer data, with average costs of a breach reaching millions of dollars. China Life must invest heavily in advanced security measures, including encryption, intrusion detection systems, and regular vulnerability assessments, to mitigate these threats effectively.

Insurtech Innovation

The surge in Insurtech innovation is fundamentally altering the insurance sector. Companies leveraging advanced technologies are introducing novel products and streamlining processes, compelling established players like China Life to adapt. This dynamic requires ongoing investment in technological upgrades to stay competitive and relevant.

China Life, like its global peers, faces the imperative to continuously invest in technology to remain competitive. For instance, the global Insurtech market was valued at approximately $10.4 billion in 2023 and is projected to grow significantly. This growth underscores the need for traditional insurers to embrace digital transformation.

Key technological advancements impacting China Life include:

- Artificial Intelligence (AI) and Machine Learning (ML): For enhanced risk assessment, personalized pricing, and automated claims processing.

- Big Data Analytics: To gain deeper customer insights and identify new market opportunities.

- Blockchain: For improved transparency, security, and efficiency in policy management and claims.

- Internet of Things (IoT): Enabling usage-based insurance and proactive risk mitigation.

To maintain its market position, China Life must actively integrate these technologies, developing innovative insurance solutions and improving operational efficiencies. Failure to do so risks ceding market share to more agile Insurtech competitors.

Enhanced Risk Assessment and Pricing

Technological advancements are revolutionizing how China Life Insurance assesses and prices risk. By leveraging big data analytics and artificial intelligence, insurers can now develop highly sophisticated, data-driven models. These models allow for a much more granular understanding of policyholder behavior and emerging risks, leading to more accurate pricing and the development of customized insurance products. For instance, in 2024, the global insurtech market was valued at over $60 billion, reflecting the significant investment in these technological capabilities.

This enhanced risk assessment is critical for navigating the complexities of modern markets, including climate change impacts and cybersecurity threats. China Life's ability to precisely price these risks translates directly into more competitive offerings for customers. Furthermore, these technologies empower insurers to implement proactive loss prevention strategies, which benefits both the company's profitability and the policyholder's security. By 2025, it's projected that AI in the insurance sector will contribute to billions in cost savings through improved underwriting and claims processing.

- Data-Driven Underwriting: AI algorithms analyze vast datasets to predict claim likelihood with greater accuracy.

- Personalized Pricing: Tailored premiums based on individual risk profiles, moving beyond traditional demographic segmentation.

- Emerging Risk Modeling: Sophisticated tools to quantify and price novel risks like cyberattacks or pandemic-related losses.

- Loss Prevention Technology: Utilizing IoT and telematics data to encourage safer customer behaviors and reduce claims.

China Life Insurance is leveraging AI and big data to refine risk assessment and create personalized insurance products. By the end of 2024, generative AI adoption in Chinese finance was projected to increase by over 50% for customer-facing roles, boosting efficiency.

This technological integration allows for more accurate pricing and proactive loss prevention strategies, crucial for managing risks like climate change and cyber threats. By 2025, AI is expected to save the insurance sector billions through improved underwriting and claims processing.

Legal factors

China's insurance sector is navigating a dynamic legal landscape, with ongoing amendments to its Insurance Law shaping market practices. These regulatory shifts, driven by the government's focus on high-quality development, require companies like China Life to be agile in adapting their operations and product portfolios to ensure ongoing compliance.

For instance, the China Banking and Insurance Regulatory Commission (CBIRC) has been actively refining rules, impacting areas like product design and solvency requirements. In 2023, the insurance sector saw premiums reaching approximately 5.1 trillion yuan, underscoring the significant economic impact of these evolving regulations.

The National Financial Regulatory Administration (NFRA) is a key player in China's financial landscape, particularly impacting sectors like banking and insurance. Its role involves setting crucial solvency requirements, such as adhering to C-ROSS Phase II standards, which directly affects how companies like China Life manage their capital and assess risks.

Furthermore, the NFRA's implementation of new data security measures is vital for China Life's operational compliance. For instance, in 2024, the NFRA has continued to emphasize robust data governance, requiring financial institutions to invest in advanced cybersecurity infrastructure to protect sensitive customer information. This regulatory push ensures that China Life not only meets financial stability mandates but also maintains stringent data protection protocols, influencing its operational costs and strategic planning.

China's evolving legal landscape presents significant data security and privacy challenges for companies like China Life. The Personal Information Protection Law (PIPL), effective since November 1, 2021, alongside the Data Security Law (DSL) implemented in September 2021, mandates stringent handling of personal data. These laws require financial institutions to obtain explicit consent for data collection, clearly outline data usage, and implement robust security measures to prevent breaches. Penalties for non-compliance can be substantial, impacting operational continuity and reputation.

Further tightening these regulations, the Network Data Security Management Regulations are set to take effect in January 2025. These will impose even more detailed requirements on financial institutions concerning data processing, storage, and critically, cross-border data transfers. China Life must proactively adapt its internal processes and technological infrastructure to ensure full compliance, particularly as data localization and transfer restrictions become more pronounced. This includes implementing robust data anonymization and pseudonymization techniques where applicable and ensuring secure channels for any permitted international data flows.

ESG Disclosure Mandates

Beginning in 2025, China is set to significantly expand its mandatory ESG (Environmental, Social, and Governance) disclosure requirements for publicly traded companies. This regulatory shift is anticipated to fuel a greater demand for insurance products specifically tied to sustainability performance, benefiting companies like China Life Insurance.

China Life will need to bolster its internal ESG reporting capabilities to comply with these new mandates. Furthermore, the company is expected to embed ESG principles more deeply into its investment decision-making processes and day-to-day operations.

- Increased Demand for Green Insurance: Analysts project a 15-20% growth in the green insurance market in China by 2026, driven by regulatory incentives and corporate sustainability goals.

- Enhanced ESG Reporting: Companies will face stricter scrutiny on their ESG data accuracy, with potential penalties for non-compliance introduced in the upcoming regulatory framework.

- Investment Strategy Integration: A growing number of institutional investors in China are now screening companies based on ESG performance, influencing capital allocation towards more sustainable businesses.

- Operational Impact: China Life will likely need to invest in new data management systems and training to effectively track and report on its ESG performance metrics.

Foreign Investment and Market Access Rules

China's financial sector has seen significant regulatory shifts, with recent relaxations in foreign investment rules opening the door wider for international insurance companies. This strategic move, enacted to boost market competitiveness and attract foreign capital, could lead to increased competition for domestic players like China Life. For instance, by the end of 2024, foreign insurers are expected to hold a larger stake in the Chinese market, potentially reaching 51% in joint ventures, up from previous limits.

These evolving legal factors present a dual impact on China Life. On one hand, increased foreign participation is likely to intensify competition, pushing domestic insurers to innovate and enhance their service offerings. On the other hand, exposure to global best practices and capital infusion from foreign entities can foster a more dynamic and efficient market. In 2023, foreign direct investment in China's financial services sector saw a notable uptick, signaling growing international confidence and interest.

- Regulatory Liberalization: China has progressively lowered foreign ownership caps in its financial services sector, including insurance, aiming to spur competition and modernization.

- Increased Competition: The opening up of the market invites global insurance giants, potentially leading to more aggressive pricing and product development strategies that China Life must counter.

- Innovation Drive: Greater foreign presence can introduce advanced technologies and management techniques, compelling China Life to adopt similar innovations to maintain its market share.

- Market Access Growth: By the close of 2024, foreign-controlled or wholly foreign-owned insurance entities are projected to represent a more substantial portion of the market, influencing overall industry dynamics.

China's evolving legal framework significantly impacts China Life, particularly concerning data privacy and security. Laws like the Personal Information Protection Law (PIPL) and the Data Security Law (DSL), effective since 2021, mandate stringent data handling, consent, and security measures, with substantial penalties for non-compliance. The upcoming Network Data Security Management Regulations, effective January 2025, will further tighten requirements on data processing, storage, and cross-border transfers.

Environmental factors

China is actively championing green finance, with government policies pushing financial institutions, including insurers like China Life, to channel investments into eco-friendly and low-carbon initiatives. This strategic push aims to foster sustainable development by directing capital towards projects that benefit the environment.

In 2023, China's green finance market continued its robust expansion. The outstanding balance of green loans reached approximately 30.5 trillion yuan by the end of the third quarter of 2023, marking a significant increase of 10.4% year-on-year. This indicates a strong trend of financial resources flowing into green sectors.

Insurers are increasingly developing and offering green financial products, such as green insurance policies and investment funds focused on sustainability. These products not only contribute to environmental goals but also provide new avenues for insurance companies to manage risk and generate returns in a changing economic landscape.

Climate change presents a significant challenge, prompting the insurance sector to innovate with specialized products and enhanced risk assessment. China Life, aligning with national priorities, is poised to play a key role in climate risk management. This includes offering green insurance solutions designed to cover natural disasters, a growing concern given the increasing frequency and severity of extreme weather events impacting China. For instance, in 2023, China experienced widespread flooding and typhoons, underscoring the need for robust disaster insurance coverage.

Furthermore, China Life is expected to integrate climate-related factors directly into its underwriting processes and investment strategies. This proactive approach involves assessing the physical risks associated with climate change, such as rising sea levels or extreme temperatures, and their potential impact on insured assets and liabilities. By incorporating these considerations, the company aims to build resilience and ensure the long-term sustainability of its operations in a changing environmental landscape.

China Life Insurance is increasingly navigating a landscape where Environmental, Social, and Governance (ESG) factors are paramount in the financial sector. This shift is driven by evolving investor expectations and a growing awareness of climate-related risks and opportunities.

New regulatory directives from bodies like the China Banking and Insurance Regulatory Commission (CBIRC) are compelling financial institutions to embed ESG principles into their investment strategies and risk management frameworks. For instance, by early 2024, many listed Chinese companies were expected to enhance their ESG disclosures, a trend directly impacting how insurers like China Life assess their investments and their own operational footprint.

This regulatory push encourages China Life to not only improve its own ESG performance but also to prioritize investments in sustainable businesses and green financial products. The adoption of ESG criteria is becoming a key differentiator, influencing capital allocation and long-term competitiveness within the Chinese insurance market.

Development of Green Insurance Products

Insurers like China Life are increasingly encouraged to develop and offer a wider array of green insurance products. This push aims to cover critical areas such as funding for low-carbon technology innovation, protection for green energy projects, and liability insurance for environmental pollution incidents. China Life has a significant opportunity to take a leading role in creating diverse financial solutions that meet the escalating demand for environmentally conscious investments and risk management.

The growth in this sector is substantial. For instance, the global green insurance market was valued at approximately $10.5 billion in 2023 and is projected to reach over $25 billion by 2030, growing at a compound annual growth rate of around 13%. This expansion highlights a clear market trend and a growing appetite for insurance that supports sustainable development.

- Market Growth: The global green insurance market is experiencing robust expansion, indicating strong investor and consumer interest in environmental risk coverage.

- Product Diversification: Insurers are actively encouraged to broaden their offerings to include specialized products for emerging green sectors.

- China Life's Opportunity: The company is well-positioned to innovate and lead in developing tailored green insurance solutions for the Chinese market.

- Demand Driver: Increasing awareness of climate change and regulatory support for sustainability are key drivers fueling demand for green insurance.

Contribution to 'Beautiful China' Vision

China's national strategy to build a 'Beautiful China' places significant emphasis on green finance and the insurance industry's role in fostering a sustainable, low-carbon economy. China Life, as a major player, is strategically positioned to support this vision by integrating its business practices and investment portfolios with the nation's environmental goals.

This alignment is crucial for driving green development and mitigating climate risks. In 2023, China's green bond market continued its robust growth, with issuance reaching approximately $130 billion, demonstrating a strong commitment to sustainable investments. China Life's participation in this market directly contributes to funding environmentally friendly projects.

The company's efforts extend to developing innovative green insurance products that encourage environmentally responsible behavior and provide financial protection against climate-related damages. By doing so, China Life not only supports the 'Beautiful China' initiative but also strengthens its own resilience and market position in an evolving economic landscape.

- Green Finance Growth: China's green bond market saw issuance of around $130 billion in 2023, highlighting increased investment in sustainable projects.

- Insurance Sector Role: The insurance industry is pivotal in supporting China's transition to a low-carbon economy and managing climate-related financial risks.

- China Life's Contribution: The company actively aligns its investment strategies and product development with national environmental objectives, fostering sustainable growth.

- Product Innovation: Development of green insurance products incentivizes environmentally conscious actions and offers protection against ecological disruptions.

Environmental factors are increasingly shaping China Life Insurance's strategy, driven by national green finance initiatives and the growing urgency of climate change. The company is actively channeling investments into eco-friendly projects, aligning with China's commitment to sustainable development and a low-carbon economy. This focus on green finance is not just about compliance but also about capitalizing on emerging market opportunities and mitigating climate-related risks.

China's green finance market demonstrated significant expansion, with green loans reaching approximately 30.5 trillion yuan by Q3 2023, a 10.4% year-on-year increase. This trend underscores the financial sector's pivot towards environmental sustainability. China Life is responding by developing specialized green insurance products and integrating climate risk into its underwriting and investment strategies, reflecting a proactive approach to environmental challenges.

The company's alignment with national environmental goals, such as the 'Beautiful China' initiative, is evident in its participation in the green bond market, which saw issuance of around $130 billion in 2023. This participation directly supports environmentally friendly projects and positions China Life as a key contributor to the nation's sustainable growth trajectory.

| Environmental Factor | Impact on China Life | Supporting Data/Trend (2023/2024) |

|---|---|---|

| Green Finance Push | Increased investment in eco-friendly projects; development of green financial products. | Outstanding green loans ~30.5 trillion yuan (Q3 2023); Green bond issuance ~$130 billion (2023). |

| Climate Change Risks | Need for specialized disaster insurance; integration of climate risk into underwriting and investment. | Increased frequency of extreme weather events (flooding, typhoons) impacting China. |

| ESG Mandates & Disclosures | Requirement to embed ESG principles; enhanced ESG disclosures by companies. | Expectation for listed Chinese companies to enhance ESG disclosures by early 2024. |

| Growing Green Insurance Market | Opportunity for product innovation and market leadership. | Global green insurance market valued at ~$10.5 billion in 2023, projected to exceed $25 billion by 2030. |

PESTLE Analysis Data Sources

Our China Life Insurance PESTLE Analysis is built on a comprehensive foundation of data from official Chinese government agencies, reputable financial institutions, and leading market research firms. This includes economic indicators, regulatory updates, technological advancements, and social demographic shifts to provide a holistic view.