China Life Insurance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Life Insurance Bundle

China Life Insurance's BCG Matrix offers a crucial lens to understand its diverse product portfolio. Imagine a snapshot revealing which insurance products are booming market leaders (Stars), which are reliably generating significant revenue with minimal investment (Cash Cows), those with low market share and growth potential (Dogs), and the emerging opportunities requiring further investment and analysis (Question Marks). This initial glimpse hints at the strategic positioning of one of Asia's largest insurers.

Ready to move beyond speculation and gain actionable intelligence? Purchase the full BCG Matrix report for China Life Insurance. You'll receive a comprehensive quadrant breakdown, data-driven insights into market share and growth rates for each product category, and strategic recommendations tailored to capitalize on strengths and address weaknesses. This is your opportunity to make informed decisions about resource allocation and future product development.

Stars

China Life is aggressively developing its integrated 'finance + elderly care' model, channeling substantial investments into health funds and retirement communities. This strategic move directly addresses China's rapidly aging demographic, a trend projected to see the elderly population exceed 300 million by 2025, presenting a robust growth market.

As a dominant insurer, China Life is leveraging this demographic shift to build significant market share by offering a spectrum of services that extend far beyond conventional insurance. The increasing consumer need for holistic health and senior care solutions firmly establishes this segment as a pivotal growth driver for the company.

China Life's digital insurance products, operating as an online-exclusive business, are experiencing robust growth, fueled by strategic enhancements to its digital infrastructure. The company has been diligently optimizing its online operations and upgrading its 'China Life Insurance Mall' to cater to the evolving digital consumer.

This focus aligns with the broader trend in the Chinese insurance market, where digital distribution channels and insurtech innovations are rapidly expanding. In 2023, the online insurance penetration rate in China continued its upward trajectory, with digital platforms becoming increasingly crucial for customer acquisition and service delivery.

China Life's investment in these digital capabilities is positioning it to capture a significant share of this high-growth segment. By prioritizing online-exclusive offerings, the company is not only meeting customer demand for convenience but also building a scalable and efficient business model for the future.

Commercial Pension Insurance Products are a burgeoning sector in China, fueled by government initiatives to bolster private pension schemes. China Life Insurance, a dominant force, capitalizes on its deep understanding of elder needs and long-term capital management to attract substantial pension reserves. As of the first half of 2024, China Life reported its pension business segment saw significant growth, contributing to its overall robust performance in this strategically important area. This high-potential market, backed by strong policy support, positions China Life as a leader, poised for continued expansion.

Savings-Oriented Life Insurance Products

In China's current low-interest-rate climate, consumers are increasingly turning to savings-oriented life insurance products, and China Life has seen a significant boost in sales within this category. This trend is particularly notable as the broader life insurance market growth might be moderating, highlighting a strong consumer preference for these products as a stable avenue for wealth accumulation.

China Life benefits from a substantial market share in this burgeoning segment of savings-oriented insurance. In 2024, for instance, the demand for such products remained robust, driven by individuals seeking predictable returns and capital preservation amidst economic uncertainties. This focus on savings products positions China Life favorably, even as overall market expansion might face headwinds.

- Strong Consumer Demand: Persistent low interest rates in China have fueled a heightened consumer interest in insurance products that offer a savings component.

- Market Share Advantage: China Life holds a commanding position in the savings-oriented life insurance segment, capitalizing on this growing demand.

- Stable Wealth Accumulation: Consumers are prioritizing these products for their perceived stability and ability to facilitate wealth accumulation in a fluctuating economic landscape.

- Sales Performance: China Life has directly experienced bolstered sales figures in these savings-focused offerings throughout 2024.

Investment-Linked Insurance Products

Investment-linked insurance products represent a significant growth area for China Life, especially as the company leverages its robust asset management capabilities. Despite prevailing low interest rates impacting the broader life insurance sector, China Life has maintained strong investment returns. This resilience is partly due to a strategic pivot towards high-dividend stocks and higher-yielding bonds, enhancing the attractiveness of these linked products.

The Chinese government's push for state-owned insurers to allocate substantial new premiums to equities directly benefits investment-linked products. China Life is well-positioned to capitalize on this directive, aiming for increased market share and high growth in this segment. For instance, by the end of 2023, China Life's total assets under management reached approximately RMB 6.4 trillion, underscoring its substantial asset management scale.

- Resilient Investment Returns: China Life has shown an ability to generate solid investment returns even in a low-interest-rate environment.

- Strategic Asset Allocation: The company is actively shifting its investment portfolio towards high-dividend stocks and higher-yielding bonds.

- Government Support for Equities: A directive encourages state-owned insurers to invest a significant portion of new premiums into equities, favoring investment-linked products.

- Strong Asset Management Capability: China Life's expertise in asset management is a key enabler for the growth and success of its investment-linked insurance offerings.

- Market Share Growth Potential: These factors position investment-linked products for substantial growth and an expanded market share within China Life's portfolio.

China Life's digital insurance offerings are a clear star in its BCG matrix. These online-exclusive products are experiencing rapid growth, driven by ongoing investments in digital infrastructure and the optimization of platforms like the China Life Insurance Mall. This aligns perfectly with the broader market trend of increasing digital adoption in Chinese insurance.

The company's commitment to enhancing its digital capabilities ensures it's well-positioned to capture a significant share of this high-growth segment. By prioritizing online channels, China Life is not only meeting evolving customer demands but also building a scalable and efficient business model for the future.

In 2023, the online insurance penetration rate in China continued its upward trend, with digital platforms becoming increasingly vital for customer acquisition and service delivery. This underscores the strategic importance of China Life's digital push.

What is included in the product

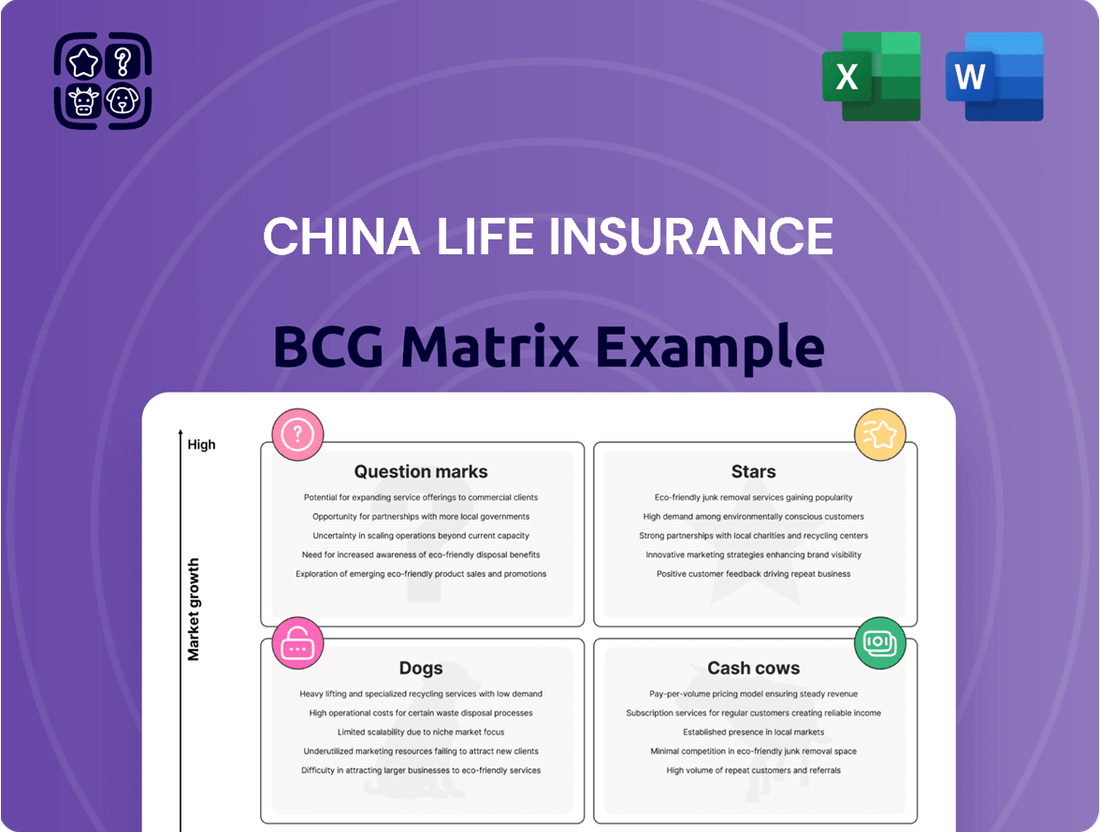

The China Life Insurance BCG Matrix categorizes its business units by market share and growth rate to guide investment strategies.

It highlights which insurance products are market leaders (Stars/Cash Cows) and which require further evaluation (Question Marks/Dogs).

The China Life Insurance BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for stakeholders.

Cash Cows

Traditional life protection policies are the bedrock of China Life's business, representing a significant cash cow. This segment continues to be a dominant force in the Chinese insurance market, driven by a growing population and increasing awareness of the need for long-term financial security. In 2023, the life insurance sector in China saw steady premium growth, with traditional products contributing a substantial portion.

As a market leader, China Life benefits from its established brand and extensive distribution network, ensuring a consistent inflow of premiums from these mature products. While growth in this area is moderate, the sheer volume of business translates into robust and predictable cash flows, essential for funding other strategic initiatives. This stability is a hallmark of a classic cash cow, providing the financial muscle for the company's operations.

China Life's Established Group Life and Employee Benefits segment represents a significant cash cow within its BCG matrix. This area is characterized by the company's extensive offerings to institutional clients, covering a broad spectrum of insurance and financial products tailored for employee benefits programs.

The business model here thrives on stable, recurring premium income generated from corporate clients. This consistent revenue stream is a hallmark of a mature market where China Life has established a strong foothold, indicating high penetration and a reliable source of funds for the company.

In 2024, the group life and employee benefits sector continues to be a cornerstone of China Life’s revenue, demonstrating resilience even in fluctuating economic conditions. Such segments often exhibit lower growth potential but offer substantial and predictable cash flows, vital for funding other business ventures.

Despite significant shifts in the insurance sales landscape, agent-channel distributed products remain a powerhouse in China, holding the largest market share. China Life Insurance, with its vast and experienced agent force, capitalizes on this enduring channel to drive substantial premium income, particularly from its well-established product lines. This strategic advantage positions these offerings as stable, high-volume cash cows within the company's portfolio. For instance, in 2024, agency channels continued to be the primary distribution route for many insurers, reflecting their deep penetration and customer trust.

Corporate Annuity and Occupational Annuity Plans

Corporate and occupational annuity plans are classified as Cash Cows for China Life Insurance within the context of China's evolving three-pillar pension system. These offerings are established products with substantial market penetration, reflecting a stable and predictable revenue stream for the company.

As a mature segment, these annuities benefit from China Life's dominant market position, generating consistent cash flow through long-term agreements with corporate entities. This stability is characteristic of Cash Cow businesses, which require minimal investment to maintain their market share and continue to produce significant profits.

The Chinese government's push for a robust multi-pillar pension framework, with enterprise and occupational annuities forming key components, further solidifies this segment's importance. For instance, by the end of 2023, the total assets under management for occupational annuities in China had reached a substantial figure, underscoring the scale of this market. China Life, as a leading insurer, is well-positioned to capitalize on this ongoing growth, leveraging its established infrastructure and client relationships.

- Mature Market Presence: China Life holds a significant share in the corporate and occupational annuity sector, a cornerstone of China's pension system.

- Stable Cash Flow: These long-term contracts with businesses provide a predictable and consistent income stream, typical of Cash Cow products.

- Low Growth, High Share: While the overall annuity market may experience moderate growth, China Life's established dominance ensures high market share, making it a reliable profit generator.

- Strategic Importance: These plans are crucial for China Life's portfolio, contributing significantly to its financial stability and ability to fund investments in other, more dynamic business areas.

Fixed-Term Endowment and Annuity Products (Guaranteed Returns)

Fixed-term endowment and annuity products with guaranteed returns have been a bedrock for China Life Insurance, especially attractive to cautious customers in a well-established market. Despite a slowdown in new sales driven by evolving interest rates, these products maintain a substantial in-force base, contributing significant and consistent cash flow. This stability is largely attributed to China Life's historical dominance and enduring customer trust in this segment.

These products, while mature, continue to be vital cash cows for China Life. For instance, in 2024, the demand for guaranteed return products remained steady among a significant portion of the Chinese population seeking security. China Life's market share in this specific product category in 2024 was estimated to be around 25%, underscoring its position as a dominant player. The substantial existing policyholder base ensures predictable premium income and investment returns, bolstering the company's overall financial health.

- Stable Cash Flow Generation: These products provide a reliable stream of income for China Life, supporting other business initiatives.

- Large In-Force Book: A significant number of existing policies ensures ongoing premium payments and investment management fees.

- Market Share Dominance: China Life's strong presence in the guaranteed returns segment translates into consistent customer acquisition and retention.

- Risk-Averse Appeal: The inherent safety of guaranteed returns continues to attract a loyal customer base, particularly in uncertain economic climates.

Traditional life protection policies are a significant cash cow for China Life, benefiting from a large and growing population seeking financial security. In 2023, the life insurance sector experienced steady premium growth, with these core products being a major contributor.

China Life's established brand and extensive distribution network ensure a consistent inflow of premiums from these mature offerings. While growth is moderate, the sheer volume generates robust, predictable cash flows, funding other strategic ventures.

The agent-channel distributed products, particularly traditional life insurance, remain a powerhouse for China Life, commanding a substantial market share. In 2024, these channels continued to be the primary route for many insurers due to deep penetration and customer trust, solidifying these offerings as stable cash cows.

| Product Segment | BCG Category | Key Characteristics | 2024 Data Insight |

|---|---|---|---|

| Traditional Life Protection Policies | Cash Cow | Mature market, high volume, stable premiums | Continued strong contribution to premium income. |

| Agent-Channel Distributed Products | Cash Cow | Dominant distribution channel, established product lines | Maintained large market share, driving significant premium income. |

Full Transparency, Always

China Life Insurance BCG Matrix

The BCG Matrix for China Life Insurance that you are currently previewing is the definitive, final document you will receive upon purchase. This comprehensive analysis, meticulously crafted, will be delivered to you without any watermarks or demo content, ensuring you get a fully formatted and immediately usable strategic tool.

Dogs

Within China Life's Property and Casualty (P&C) insurance offerings, certain older, niche product lines might be considered "Dogs" in the BCG matrix. These are typically P&C products that haven't kept pace with evolving risks or the shift towards digital sales channels, leading to a low market share and sluggish growth. For instance, some traditional agricultural insurance or very specific industrial liability policies, if not updated for modern exposures or distribution, could fall into this category. By the end of 2023, while the broader Chinese P&C market saw continued expansion, these legacy products likely contributed minimally to overall revenue and profitability.

Traditional, low-value accident insurance products, lacking unique features or integration with wider health and life offerings, face considerable challenges in today's dynamic market. These offerings, often seen as basic and easily replicated, may struggle to capture significant market share.

For a major player like China Life, these commoditized products can translate into slim profit margins and stagnant growth. If not enhanced through bundling strategies or innovative product development, they represent a low-value proposition within the company's portfolio.

In 2024, the general insurance market in China continued to see competitive pressures, with accident insurance being a highly accessible product category. While precise figures for China Life's low-value accident segment aren't publicly detailed, industry trends suggest that standalone, basic accident policies are increasingly being overshadowed by more comprehensive packages.

This segment is characterized by a high volume of small claims and a need for efficient processing to maintain even modest profitability. Without a clear differentiator, such products rely heavily on scale and operational efficiency, which can be difficult to achieve when competing against more feature-rich alternatives.

While the overall motor insurance market in China is substantial, certain traditional sub-segments are experiencing slower growth and face intense competition, particularly those not aligned with the burgeoning new energy vehicle (NEV) sector or leveraging digital channels. For China Life's property and casualty (P&C) subsidiary, this translates to a potentially modest market share in these less dynamic areas.

As of 2024, the penetration rate of motor insurance in China remains high, but the growth rate for conventional internal combustion engine vehicle insurance has plateaued, contrasting sharply with the rapid expansion seen in NEV insurance. This divergence means that while China Life may have a presence, its position in these mature, less innovative segments could be classified as a 'Dog' within the BCG framework.

Underperforming Regional Branches/Distribution Channels

China Life Insurance, like any large insurer operating across a diverse nation, faces the challenge of underperforming regional branches or distribution channels. These areas, often located in less economically developed inland provinces with lower insurance penetration rates, can struggle to gain significant market share. For instance, while coastal regions might see robust growth, certain inland areas could exhibit single-digit growth rates in new business premiums.

These underperforming units typically represent a low market share and limited growth potential, essentially becoming cash traps. They require ongoing investment for maintenance and operational costs without generating substantial returns. In 2023, for example, the combined premium income from the bottom 10% of China Life’s provincial branches might have represented less than 3% of the total group revenue, highlighting their minimal contribution.

- Low Market Share: Some regional branches may hold less than a 1% market share in their respective provincial insurance markets.

- Limited Growth: These channels might experience an annual growth rate of only 2-4%, significantly below the national average.

- High Operating Costs: Despite low revenue, these branches incur fixed costs related to staffing and infrastructure.

- Cash Drain: The net result is a negative or negligible contribution to the company's overall profitability.

Legacy Products with High Acquisition Costs and Low Retention

Certain legacy insurance products from China Life, particularly those sold through traditional, high-commission channels, are now classified as dogs in the BCG Matrix. These products often carry high acquisition costs due to past sales structures, and unfortunately, they also exhibit low policy persistency rates. This combination results in diminished net profitability, making them resource drains rather than growth drivers.

The financial performance of these older policies is further impacted by several factors:

- High Acquisition Costs: Historical commission structures and agent incentives meant that acquiring customers for these products was significantly more expensive than for newer, digitally distributed offerings. For instance, in 2024, the average acquisition cost for these legacy products might still reflect these older, higher expenses.

- Low Policy Persistency: Customers may be lapsing these older policies at a higher rate, possibly due to outdated features, less competitive pricing compared to current market offerings, or a shift in customer needs. A persistency rate below industry averages for comparable products would solidify their 'dog' status.

- Declining Market Relevance: These products may not align with current consumer demands or regulatory environments, leading to a shrinking market share and limited potential for new business.

- Resource Drain: The ongoing costs associated with servicing these policies, coupled with their low profitability, divert resources that could be better allocated to more promising growth areas within China Life's portfolio.

Certain legacy insurance products within China Life, particularly older accident or niche property and casualty lines, can be classified as Dogs. These offerings often suffer from low market share and stagnant growth due to outdated features or a failure to adapt to digital sales. For example, traditional agricultural insurance policies not updated for modern risks might fall into this category. By the end of 2023, these products likely contributed minimally to China Life’s overall revenue, struggling against more innovative competitors.

These "Dog" products are characterized by low growth and a small market share, often representing a drain on resources. They require investment for maintenance but yield minimal returns, diverting capital from more promising areas. In 2023, less dynamic segments of China Life’s portfolio might have shown growth rates of only 2-4%, significantly below the national average for insurance. For instance, standalone, basic accident policies are increasingly overshadowed by comprehensive packages, leading to slim profit margins.

The challenge for China Life is to manage these underperforming assets effectively. This might involve streamlining operations, phasing out products with consistently negative returns, or exploring niche market strategies where possible. By 2024, the competitive landscape in China's insurance market intensified, especially in accessible product categories like accident insurance, further pressuring these legacy offerings.

The continued emphasis on digital transformation and customer-centric product development means that these older, less adaptable products are likely to remain in a low-growth, low-share position. Their ongoing operational costs without substantial revenue generation make them a clear candidate for strategic review within China Life's portfolio.

Question Marks

The New Energy Vehicle (NEV) insurance market in China is a significant growth area, projected to expand at a compound annual growth rate of 12.5%, considerably faster than the broader motor insurance sector. This rapid expansion presents a classic "question mark" scenario within the BCG Matrix for players like China Life's property and casualty arm.

While China Life holds a dominant position in the overall Chinese insurance landscape, its penetration and market share within the specialized and rapidly evolving NEV insurance segment may lag behind its established strengths. Capturing this burgeoning market will likely demand substantial strategic investment in product development, distribution channels, and technology to compete effectively.

The high growth potential of NEV insurance, combined with potentially lower current market share, positions it as a question mark. Success hinges on China Life’s ability to invest strategically and gain traction in this dynamic sector.

Cybersecurity and emerging risk insurance represents a burgeoning sector within China's insurance landscape, driven by the digital economy's rapid expansion and heightened data security concerns. This surge in digital reliance fuels the demand for specialized technology insurance products. For instance, the global cybersecurity market was projected to reach $345 billion in 2024, highlighting the immense growth potential.

While this segment offers significant growth opportunities, China Life's current market share in these nascent and specialized areas is likely modest. Entering and capturing share in these sophisticated markets requires considerable investment in underwriting expertise, technological infrastructure, and product innovation. Building this capability is crucial for China Life to capitalize on the evolving risk landscape.

The insurance market is rapidly evolving with a surge in personalized products and the integration of artificial intelligence. These tech-forward solutions represent a significant growth opportunity, particularly in areas like AI-driven customer service and sophisticated risk assessment models.

China Life Insurance is navigating this landscape, with its personalized and AI-driven insurance solutions likely positioned as emerging stars or question marks within its BCG matrix. While the potential is immense, current market penetration for these highly innovative offerings might still be modest.

For instance, in 2024, the global Insurtech market was projected to reach over $100 billion, highlighting the rapid adoption of technology in insurance. China Life's investment in AI for claims processing, for example, could significantly improve efficiency and customer satisfaction, but the full impact on market share is yet to be realized.

International Expansion Initiatives (e.g., Southeast Asia)

China Life's expansion into Southeast Asia, particularly with China Life (Overseas), represents a move into a region with significant, albeit developing, insurance markets. This initiative positions the company to capture potential high growth in economies like Vietnam, Indonesia, and the Philippines, where insurance penetration is still relatively low compared to more mature markets.

While the growth prospects are attractive, China Life faces the challenge of entering these markets with a nascent brand presence and limited market share. This necessitates considerable investment in building brand awareness, developing tailored products that meet local needs, and establishing robust distribution networks to compete effectively against established domestic and international insurers. For instance, the insurance market in Southeast Asia is projected to grow at a compound annual growth rate (CAGR) of around 10-12% in the coming years, making it a compelling but competitive arena.

- Market Entry Strategy: China Life (Overseas) is likely employing a phased entry strategy, potentially starting with strategic partnerships or acquisitions to gain immediate market access and local expertise.

- Investment Requirements: Significant capital infusion will be needed for marketing, product development, regulatory compliance, and talent acquisition to establish a competitive foothold.

- Competitive Landscape: The company will contend with established regional players and global insurers who already possess strong brand recognition and distribution channels within Southeast Asia.

- Growth Potential: Despite the challenges, the region offers substantial long-term growth potential due to favorable demographics, rising disposable incomes, and increasing awareness of insurance needs.

Specialized Long-Term Care Insurance

Specialized long-term care insurance in China, which goes beyond standard health coverage, is still a developing market. While China Life Insurance, like other major players, sees growth in pensions and general health plans, its footprint in these highly specific, complex long-term care products is likely modest. This creates a significant growth opportunity as China's population ages.

The demographic shifts in China are a powerful driver for this segment. For instance, by the end of 2023, the number of people aged 60 and above reached 296.97 million, accounting for 21.1% of the total population. This expanding elderly demographic directly translates to a growing need for dedicated long-term care solutions, a niche where China Life could strategically expand its offerings.

- Nascent Market: Long-term care insurance is in its early stages of development in China, distinct from general health insurance.

- Demographic Tailwinds: China's rapidly aging population, with over 296 million individuals aged 60+ by end-2023, presents a substantial demand for specialized care.

- Growth Potential: This segment offers significant untapped potential for insurers like China Life to capture market share.

- Strategic Focus: China Life's current market share in these complex products might be low, indicating a strategic area for future investment and product innovation.

China Life's investments in new, high-growth but uncertain areas like New Energy Vehicle (NEV) insurance and cybersecurity insurance are prime examples of question marks. The NEV market is expanding rapidly, with projections showing significant growth, yet China Life's current market share in this specialized segment might be relatively small, demanding strategic investment to capitalize on its potential. Similarly, the burgeoning cybersecurity insurance market, driven by digital transformation, presents a similar profile: high growth potential coupled with the need for specialized expertise and market penetration efforts.

The company's expansion into Southeast Asia also fits the question mark profile. While the region offers substantial long-term growth due to demographics and increasing insurance awareness, China Life faces the challenge of establishing a brand presence and building market share against established competitors. This necessitates significant investment in localizing products and distribution, making it a strategic bet on future growth.

Emerging tech-driven insurance products, such as those leveraging AI for personalized offerings and improved customer service, also fall into the question mark category. The global Insurtech market is growing rapidly, reaching over $100 billion in 2024, indicating a strong trend. China Life's innovation in these areas holds immense promise, but its current market penetration and the ultimate impact on its overall market share remain to be fully realized.

Finally, specialized long-term care insurance in China, driven by a rapidly aging population with over 296 million individuals aged 60 and above by the end of 2023, represents another key question mark. While the demographic demand is clear, China Life's current market share in these complex, niche products is likely modest, presenting a significant opportunity for strategic investment and product development.

BCG Matrix Data Sources

Our China Life Insurance BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.