Dropbox Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dropbox Bundle

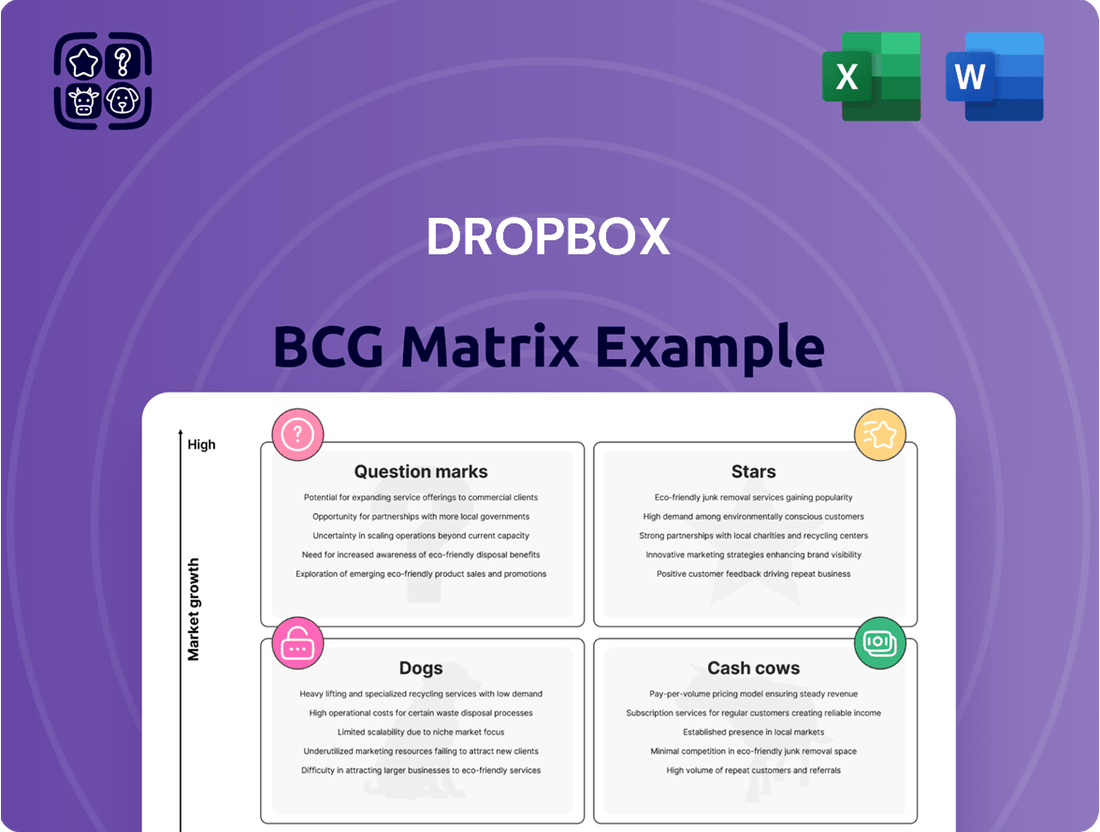

Curious about Dropbox's strategic positioning? Our BCG Matrix analysis reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks in the competitive cloud storage market. Imagine understanding which products are driving growth and which might be draining resources.

This glimpse into Dropbox's portfolio is just the beginning. For a comprehensive understanding of their market share and growth rate across all product lines, and to unlock actionable insights for your own business strategy, dive into the full BCG Matrix report.

With the complete version, you'll gain quadrant-by-quadrant clarity, data-backed recommendations, and a clear roadmap for smart investment and product decisions. Don't miss out on the strategic advantage – purchase the full BCG Matrix today for a decisive edge.

Stars

Dropbox Sign, formerly HelloSign, and DocSend are positioned in the high-growth sectors of e-signatures and secure document sharing, respectively, placing them as potential Stars in the BCG Matrix. The global e-signature market was valued at approximately $6.5 billion in 2023 and is projected to reach over $35 billion by 2030, demonstrating significant expansion. DocSend’s analytics offer a distinct advantage by providing insights into document engagement, a feature increasingly crucial for sales and investor relations. Dropbox's continued investment in these platforms signals a strategic focus on capturing substantial market share within these burgeoning digital workflow segments.

Dropbox is making significant strides in AI-powered productivity, evident in its investments in features like AI-driven search, content summarization, and creation tools. This strategic push aims to capture a piece of the rapidly expanding market for AI-enhanced productivity solutions.

The company's focus on these advanced capabilities, particularly within its Dash product, signals a clear intent to redefine user interaction with content and streamline workflows. For instance, in early 2024, Dropbox announced enhanced AI features designed to surface relevant information faster, a key differentiator in a competitive landscape.

The enterprise collaboration market is booming, with remote and hybrid work becoming the norm. This trend has fueled significant growth in demand for tools that facilitate seamless teamwork.

Dropbox is strategically positioned to capitalize on this, offering advanced collaboration features. Their deep integrations with popular business applications like Slack and Microsoft Teams are key to their appeal in this expanding segment.

By providing robust tools for content sharing and teamwork within an enterprise setting, Dropbox aims to capture a larger slice of this high-growth market. For instance, by Q1 2024, Dropbox reported a 10% year-over-year increase in paid users, many of whom are leveraging these collaboration capabilities.

Security and Compliance Offerings

Dropbox's security and compliance offerings are a significant strength, particularly as data privacy and regulatory adherence become paramount for businesses. For instance, Dropbox's commitment to GDPR compliance, evident in features like Dropbox Dash, directly addresses the growing demand for secure cloud solutions. The market for enterprise-grade security and governance tools is expanding rapidly, with projections indicating continued growth through 2024 and beyond, driven by increasing cybersecurity threats and stringent data protection laws.

These robust security measures and certifications position Dropbox's offerings as a strong contender, especially for organizations handling sensitive information. Their focus on enterprise-grade security and control features directly appeals to businesses needing to meet compliance standards and protect valuable data assets.

- Enhanced Security Features: Dropbox continues to invest in advanced security protocols to protect user data.

- Regulatory Compliance: Adherence to regulations like GDPR and CCPA is a key selling point, particularly for enterprise clients.

- Growing Market Demand: The global market for cloud security solutions is experiencing substantial growth, with increased emphasis on compliance.

- Enterprise Appeal: Robust controls and security certifications make Dropbox attractive to businesses with stringent data handling requirements.

Strategic Integrations and Ecosystem Expansion

Dropbox's strategy focuses on deepening integrations with key platforms like Microsoft 365 and Google Workspace. This move is designed to embed Dropbox more firmly within users' daily workflows, making it an indispensable part of the digital workspace. By connecting with popular project management and productivity tools, Dropbox aims to become the central hub for scattered digital content.

This ecosystem expansion targets the high-growth digital workspace sector. Dropbox's ability to act as a central repository for files from various applications enhances its value proposition. For instance, in 2024, cloud storage market revenue was projected to reach $277.50 billion, signaling strong demand for integrated solutions.

- Strategic Integrations: Deepening ties with Microsoft 365, Google Workspace, and project management tools.

- Ecosystem Expansion: Positioning Dropbox as a central hub within the broader digital workspace.

- Workflow Capture: Aiming to become indispensable by managing content across multiple applications.

- Market Growth: Capitalizing on the expanding digital workspace and cloud storage market.

Dropbox's investments in AI-driven features and its strategic positioning in high-growth areas like e-signatures and secure document sharing through Dropbox Sign and DocSend indicate strong potential for Star status. The company's focus on enhancing collaboration and deepening integrations within the digital workspace further solidifies its growth trajectory.

The AI productivity market is experiencing rapid expansion, with Dropbox actively developing features to capture this growth. Similarly, the e-signature market's significant projected growth and Dropbox's strategic integrations within the digital workspace ecosystem highlight its potential to become a market leader in these segments.

| Product/Service | Market Growth Trajectory | Dropbox's Position |

|---|---|---|

| AI-Powered Productivity Tools | High Growth (AI market projected to grow significantly) | Developing advanced features, aiming for market capture |

| E-signatures (Dropbox Sign) | Very High Growth (Global market projected to exceed $35 billion by 2030) | Strong contender in a burgeoning sector |

| Secure Document Sharing (DocSend) | High Growth (Increasing demand for analytics in document sharing) | Offers distinct advantage with engagement insights |

| Enterprise Collaboration | High Growth (Driven by remote/hybrid work) | Deep integrations with key platforms, centralizing workflows |

| Security & Compliance | High Growth (Increasing cybersecurity threats and data protection laws) | Robust offerings appealing to enterprises needing compliance |

What is included in the product

Dropbox's BCG Matrix analyzes its product portfolio, categorizing offerings to guide strategic investment and resource allocation.

A visual Dropbox BCG Matrix clarifies your product portfolio, easing the pain of strategic decision-making for resource allocation.

Cash Cows

Dropbox's core File Sync and Share (FSS) subscriptions are its undeniable cash cows. These foundational paid plans, serving both individual users and small to medium-sized businesses, have been the bedrock of its revenue for years. Despite the market's maturity, Dropbox continues to command a substantial user base, translating into predictable and profitable income streams.

In 2024, Dropbox's FSS segment remains its primary revenue driver. The company reported that its paying customer base contributed significantly to its financial performance, with average revenue per paying user (ARPU) showing stability. This consistent revenue generation from a loyal customer base allows Dropbox to fund its investments in other, more growth-oriented areas of its business.

Dropbox's established brand recognition and a user base exceeding 700 million registered accounts, including over 18 million paying customers, firmly place it in the Cash Cows quadrant of the BCG Matrix. This significant market presence translates into a predictable and robust revenue stream, primarily driven by its subscription model.

The loyalty of this extensive customer base means Dropbox can rely on recurring income with comparatively lower marketing expenditures than might be needed for products in other stages of their lifecycle. This stability allows the company to allocate resources efficiently, capitalizing on its existing market share.

Dropbox consistently demonstrates impressive gross profit margins, often surpassing 80%. This strong performance in its core cloud storage services highlights operational efficiency and pricing power. For instance, in the first quarter of 2024, Dropbox reported a gross margin of 81.3%, underscoring the profitability of its mature products.

These high gross margins translate directly into substantial free cash flow generation for Dropbox. This financial strength from its established services provides the company with the flexibility to invest in new growth initiatives, such as expanding its collaboration tools and AI capabilities. It also allows for potential capital returns to shareholders, bolstering investor confidence.

Enterprise-Level Legacy Contracts

Enterprise-Level Legacy Contracts represent a significant Cash Cow for Dropbox. These long-term agreements with major corporations ensure a consistent and substantial revenue flow. Many of these clients have been with Dropbox for years, relying on its services for their daily operations. For instance, by the end of 2023, Dropbox reported serving over 150,000 business customers, a significant portion of which are likely tied to these legacy contracts.

The stability of these contracts is a key characteristic. Because enterprises have deeply integrated Dropbox into their workflows, switching to a competitor is often complex and costly. This inherent stickiness translates into low churn rates and predictable income, making these contracts a reliable source of cash. This allows Dropbox to allocate resources effectively across its product portfolio.

- Predictable Revenue: Legacy contracts provide a solid baseline income for Dropbox.

- Low Churn: Deep integrations make it difficult for enterprises to leave.

- Substantial Income: These agreements often represent significant recurring revenue streams.

- Customer Loyalty: Long-standing relationships foster continued reliance on Dropbox services.

Optimized Infrastructure and Operational Efficiency

Dropbox has significantly enhanced its data center infrastructure and operational efficiency, resulting in noticeable cost reductions and better profit margins. This streamlined approach to delivering its core services is a key reason why its established products continue to generate substantial cash flow, despite experiencing slower revenue growth.

This operational excellence is a hallmark of a cash cow. By managing its infrastructure smartly, Dropbox can dedicate more resources to innovation and growth in other areas. For instance, in 2023, Dropbox reported a non-GAAP operating margin of 36.4%, up from 33.6% in 2022, demonstrating the positive impact of these efficiency gains.

- Optimized Infrastructure: Investment in efficient data centers reduces long-term operating expenses.

- Operational Efficiency: Streamlined processes lead to better resource allocation and cost control.

- Cost Reductions: Direct impact on profitability and cash generation from mature services.

- Improved Margins: Higher operating margins, like the 36.4% non-GAAP operating margin in 2023, reflect this efficiency.

Dropbox's core File Sync and Share (FSS) subscriptions are its undeniable cash cows, providing a stable and predictable revenue stream. These foundational paid plans, catering to individuals and businesses, have consistently driven the company's financial performance.

In 2024, Dropbox's paying customer base, exceeding 18 million, fuels this cash cow status, with average revenue per user remaining robust. This consistent income allows for strategic reinvestment in growth areas.

The company's strong brand and a massive registered user base of over 700 million solidify its market dominance in FSS. This translates to predictable income streams with relatively lower marketing costs.

Dropbox's operational efficiency, evidenced by gross profit margins often above 80%, further enhances the cash cow status of its core services. For example, Q1 2024 saw a gross margin of 81.3%.

| Metric | 2023 | Q1 2024 |

| Registered Users | >700 million | N/A |

| Paying Customers | >18 million | N/A |

| Gross Margin | ~81% | 81.3% |

| Non-GAAP Operating Margin | 36.4% | N/A |

Full Transparency, Always

Dropbox BCG Matrix

The Dropbox BCG Matrix preview you're examining is the identical, fully finalized document you'll receive immediately after your purchase. This means no watermarks, no placeholder text, and no demo content – just the complete, professionally formatted strategic analysis ready for immediate application within your business.

Dogs

Dropbox faces a challenge with its underutilized free tier users. A substantial number of its 700 million registered users remain on the free plan. Many of these users likely store very little content or use the service infrequently.

These free users consume valuable resources like storage space and bandwidth, yet they don't contribute directly to revenue. This situation can negatively impact profitability if these users don't transition to paid subscriptions.

For instance, in 2023, while Dropbox reported over 18 million paid users, the vast majority of its user base was on the free tier, highlighting the scale of this demographic.

Dropbox's legacy features, like its original file synchronization technology, might fall into this category. While foundational, newer cloud storage solutions often offer more advanced collaboration and integration capabilities. If these older functionalities require significant upkeep but see minimal new user adoption, they represent a cost without commensurate return.

Consider features that were innovative at launch but haven't kept pace with evolving user needs or competitive offerings. For example, limited integration with other productivity suites or a lack of advanced document editing tools could make certain niche features less appealing. By 2024, the market demands seamless workflows, and features that don't integrate well can become a drag.

These underutilized functionalities can tie up valuable engineering resources that could otherwise be directed towards developing and improving core, high-adoption services. The cost of maintaining these niche features, even if small individually, can accumulate, impacting overall profitability and strategic focus.

FormSwift, acquired by Dropbox, has seen a significant strategic pullback in investment and marketing. This move suggests Dropbox views FormSwift as a low-growth, low-market-share entity, potentially classifying it as a Dog within the BCG Matrix.

Dropbox's decision to reduce resources dedicated to FormSwift, even considering its sale, signals a departure from it being a primary growth engine. This aligns with the characteristics of a Dog, an asset that requires management attention but offers limited future potential.

The financial implications of this shift are key. While specific financial data for FormSwift post-acquisition isn't always publicly detailed, the strategic reduction in spending indicates a prioritization of other Dropbox initiatives with higher expected returns.

By 2024, Dropbox's focus has clearly shifted, with FormSwift no longer being a central pillar of its growth strategy. This re-evaluation places FormSwift in a position where it likely generates minimal revenue relative to the resources it might otherwise consume.

Specific Unsuccessful Integrations or Partnerships

Dropbox's journey has seen its share of collaborations that didn't quite hit the mark. For instance, integrating with certain productivity tools may have offered features, but the actual user adoption and the resulting strategic advantage proved to be less than anticipated. These underperforming integrations can become a drain, consuming resources without delivering the expected competitive edge or contributing significantly to revenue growth.

The tech landscape is dynamic, and not every partnership can be a slam dunk. Consider the potential costs associated with maintaining integrations that failed to gain traction. In 2024, companies across the tech sector are scrutinizing such ventures, often divesting from partnerships that don't demonstrate clear ROI or strategic alignment. This careful evaluation is crucial for optimizing resource allocation and focusing on high-potential growth areas.

- Underperforming Productivity Tool Integrations: Partnerships that saw low user engagement despite initial feature rollout.

- Resource Drain: Maintaining these integrations incurs costs without providing a substantial competitive advantage or revenue stream.

- Strategic Re-evaluation: Companies in 2024 are actively assessing and potentially sunsetting collaborations that do not meet performance benchmarks.

- Focus on High-ROI Ventures: The trend is towards concentrating resources on partnerships with demonstrable strategic value and clear revenue-generating potential.

Segments with Declining Paying Users

Dropbox's 'Dogs' segment, characterized by declining paying users, is a notable concern. Recent reports indicate sequential drops in paying users, particularly within certain team-focused plans.

While the average revenue per user (ARPU) might show stability overall, specific segments experiencing persistent user churn or downgrades, without offsetting new user acquisition, exhibit 'Dog' traits. These areas are in a low-growth phase and may be facing a shrinking market share within their particular niche.

- Declining Paying Users: Dropbox has observed a trend of decreasing paying users in recent quarters, especially within its team-oriented subscription tiers.

- Segment-Specific Churn: Segments with consistent user churn or downselling, where new customer acquisition doesn't compensate for losses, are indicative of 'Dog' status.

- Low-Growth State: These segments are operating in a low-growth environment, suggesting a lack of market expansion or competitive pressure.

- Potential Shrinking Market Share: The consistent decline in users points towards a possible erosion of market share within the specific product categories or user segments affected.

Dropbox's 'Dogs' represent business units or features with low growth and low market share. These segments consume resources without generating significant returns, impacting overall profitability. Identifying and managing these 'Dogs' is crucial for strategic resource allocation.

Examples include underperforming integrations and specific user segments experiencing declining paying users. By 2024, Dropbox is actively re-evaluating these areas to focus on higher-potential ventures.

FormSwift, acquired by Dropbox, is a prime example of a potential 'Dog' due to reduced investment and marketing, indicating a strategic pullback. Similarly, certain legacy features that haven't kept pace with market demands can also be classified as 'Dogs'.

These underutilized offerings tie up valuable engineering and marketing resources that could be better deployed elsewhere, highlighting the need for continuous portfolio assessment.

Question Marks

Dropbox Dash, an AI-powered universal search and knowledge management tool, operates within the rapidly expanding market for AI-driven productivity solutions. This sector is projected for significant growth, with estimates suggesting the AI market could reach $1.5 trillion by 2030, indicating a strong demand for innovative tools like Dash. While Dropbox is heavily investing in this area, recognizing its strategic importance, the tool itself is still navigating the early phases of user adoption and market presence. Its potential is high, but it faces the challenge of gaining traction against more established players in the competitive landscape.

Dropbox Capture, a tool for asynchronous video messaging and screen recording, operates within the burgeoning market of visual communication and remote collaboration. This segment saw significant growth in 2024, with companies increasingly adopting digital tools to bridge geographical divides.

As a relatively new entrant, Dropbox Capture is positioned as a Question Mark in the BCG Matrix. It requires substantial investment to gain traction and expand its user base in a competitive landscape.

To transition from a Question Mark to a Star, Capture needs to dramatically increase its market share and user adoption. Its success hinges on effectively demonstrating value and differentiating itself from established players in the visual communication space.

By 2024, the global market for unified communications and collaboration (UC&C) solutions, which includes tools like Capture, was projected to exceed $100 billion, highlighting the opportunity but also the intense competition.

Dropbox is enhancing its platform with advanced AI capabilities for writing, analyzing, and summarizing documents, tapping into the burgeoning generative AI market. While these are high-growth segments, Dropbox's position as a relatively new entrant in dedicated AI content creation means its current market share within this specific niche is low. For instance, by mid-2024, the global generative AI market was projected to reach over $20 billion, with content creation tools being a significant driver.

New Vertical-Specific AI Solutions

New vertical-specific AI solutions, like advanced AI editing tools for creative workflows or specialized legal tech beyond simple e-signatures, are emerging as promising areas for Dropbox. These innovative offerings represent significant growth potential due to their tailored nature for specific industries. However, they currently hold a low market share as they are in the development and introduction phases, requiring substantial investment to gain widespread adoption and market traction.

The market for AI in specialized verticals is poised for rapid expansion. For instance, the global legal tech market was valued at approximately $25.9 billion in 2023 and is projected to reach $67.1 billion by 2030, showcasing a strong compound annual growth rate (CAGR) of 14.5%. Similarly, AI in the creative industries is seeing accelerated adoption, with the AI in creative tools market expected to grow substantially in the coming years, driven by demand for enhanced efficiency and innovative capabilities.

- High Growth Potential: Industries are increasingly seeking AI solutions that address their unique challenges, creating a fertile ground for specialized tools.

- Low Market Share: As new technologies, these solutions are still in the early stages of market penetration.

- Significant Investment Required: Developing and marketing these niche AI tools demands substantial R&D and go-to-market funding.

- Strategic Importance: Vertical-specific AI can differentiate Dropbox and capture high-value customer segments.

Expansion into New Geographic Markets (for specific products)

Dropbox's strategic expansion of newer offerings, such as Dash for Business, into specific geographic markets like Australia, positions these products within the question marks quadrant of the BCG matrix.

This move signifies entering potentially high-growth territories where the product is new and market share is currently low. For instance, in 2024, Dropbox has been actively exploring and rolling out localized versions of its services, aiming to capture nascent demand in regions where cloud adoption is rapidly increasing.

These markets require substantial investment in marketing, sales, and potentially product adaptation to build brand awareness and secure a competitive position against established local players or other global competitors.

- Targeted Market Entry: Expanding products like Dash into new regions such as Australia.

- High Growth Potential: These markets are identified for significant future revenue generation for the specific product.

- Low Initial Market Share: The product is new to these territories, meaning it has minimal existing customer base.

- Significant Investment Required: Capital is needed for market penetration, brand building, and sales infrastructure.

Question Marks represent products or services with low market share but operating in high-growth markets. They require careful consideration and significant investment to determine if they can become Stars. Dropbox's AI-powered tools like Dash and its expansion into new geographic markets exemplify this category.

These ventures need substantial capital for development, marketing, and user acquisition to build momentum and capture a larger portion of their respective expanding markets. Success hinges on effectively differentiating and demonstrating value to gain traction.

The strategic decision for Dropbox is whether to invest further to increase market share or divest if the potential doesn't materialize.

| Product/Service | Market Growth Rate | Market Share | Investment Recommendation |

|---|---|---|---|

| Dropbox Dash (AI Search) | High (AI productivity market projected to reach $1.5T by 2030) | Low (New entrant) | Invest to gain share |

| Dropbox Capture (Video Messaging) | High (UC&C market exceeded $100B in 2024) | Low (New entrant) | Invest to gain share |

| Vertical-Specific AI Solutions | High (e.g., Legal Tech CAGR 14.5% to $67.1B by 2030) | Low (Early stages) | Invest to gain share |

| Dash in Australia (Geographic Expansion) | High (Increasing cloud adoption) | Low (New market entry) | Invest to gain share |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, industry growth rates, and competitor performance analyses to provide a clear strategic overview.