Donear Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donear Industries Bundle

Donear Industries operates within a dynamic textile market, facing moderate bargaining power from buyers and suppliers. The threat of new entrants is present, while the intensity of rivalry among existing players, including Donear, shapes competitive strategies.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Donear Industries’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Donear Industries is significantly influenced by the concentration of raw material providers, especially for cotton, synthetic fibers, and dyes. A limited number of suppliers for essential inputs, or those offering highly differentiated products like specialized finishes or eco-friendly dyes, can command higher prices and dictate terms more effectively.

While India's textile sector benefits from a broad raw material supply, niche or sustainable materials may face fewer sourcing options, thereby increasing supplier leverage. For instance, the global market for organic cotton, a key differentiator, saw its share in total cotton production hover around 1.5% in recent years, indicating a more concentrated supply chain for this specific input.

Donear's ability to switch suppliers without incurring significant costs directly impacts the bargaining power of those suppliers. If Donear can easily find and transition to alternative suppliers, the existing suppliers have less leverage.

Conversely, high switching costs, which could include the expense of retooling manufacturing equipment for new material specifications or the complexities of renegotiating lengthy supply agreements, significantly bolster supplier bargaining power. For instance, if Donear's production lines are highly specialized for a particular supplier's unique components, changing suppliers becomes a costly and time-consuming endeavor, giving that supplier more sway over pricing and terms.

The availability of substitute inputs significantly impacts Donear Industries' bargaining power with its suppliers. If Donear can readily source alternative raw materials, such as switching between different types of cotton, polyester, or other synthetic fibers, suppliers of a specific input have less leverage. For instance, in 2024, the global textile market saw fluctuating prices for cotton due to weather patterns, prompting many manufacturers to explore or increase their use of recycled polyester or other man-made fibers, demonstrating this substitution effect.

Threat of Forward Integration by Suppliers

Suppliers in the textile industry, including those providing yarn or dyes, possess a degree of bargaining power through the potential threat of forward integration. This means a supplier could choose to enter Donear Industries' core business of textile manufacturing or finishing themselves. If a significant yarn producer, for instance, began producing finished fabrics, they would transform from a supplier into a direct competitor, potentially impacting Donear's input availability and pricing strategies.

While this threat exists, its impact on a diversified industry like textiles is generally considered moderate. The capital investment required to establish manufacturing and finishing capabilities can be substantial, deterring many suppliers from such a move. However, for specialized inputs or in specific market segments, this threat can be more pronounced, giving those suppliers greater leverage.

For example, in 2024, the global textile market valued at approximately $1 trillion, with various segments ranging from raw material production to finished apparel. A supplier with unique chemical formulations for dyes, or a specialized yarn producer with proprietary technology, could potentially leverage their expertise to move into fabric production, thereby increasing their bargaining power over companies like Donear.

- Potential for Supplier Competition: Suppliers might enter textile manufacturing or finishing, becoming direct rivals to Donear.

- Impact on Input Costs: Forward integration by suppliers could lead to increased input costs or reduced access to essential materials for Donear.

- Industry Diversification Mitigation: The broad nature of the textile industry generally dilutes the threat of forward integration for many suppliers.

- Specialized Input Leverage: Suppliers of niche or proprietary materials may hold greater power due to the specialized nature of their products.

Importance of Donear to the Supplier's Business

If Donear Industries constitutes a substantial portion of a supplier's overall revenue, that supplier's leverage is naturally reduced. Suppliers may be more accommodating with pricing and terms to secure such a significant client. For instance, if Donear accounts for over 15% of a key component supplier's sales, the supplier's ability to dictate terms weakens considerably.

Conversely, for specialized inputs where Donear represents a smaller percentage of the supplier's business, the supplier might hold more sway. This is particularly true if the input is critical and difficult to source elsewhere. For example, if Donear relies on a unique, patented chemical that only one supplier can produce, and Donear's orders are only 5% of that supplier's output, the supplier's bargaining power is amplified.

- Supplier Dependence: If Donear Industries is a major customer, a supplier's dependence increases, lowering their bargaining power.

- Order Size Impact: Large orders from Donear can incentivize suppliers to offer better deals to maintain that volume.

- Input Specialization: For highly specialized or unique inputs, Donear's importance to the supplier is less of a factor in the supplier's bargaining power.

- Market Share of Supplier: The supplier's own market share for the specific input also influences their leverage relative to Donear.

The bargaining power of suppliers for Donear Industries is influenced by supplier concentration and product differentiation. A limited number of suppliers for essential raw materials like cotton or specialized dyes can exert significant leverage, potentially driving up costs. For instance, the global market for organic cotton, a key differentiator, represented a small fraction of total cotton production in recent years, indicating a more concentrated supply chain for this specific input.

Donear's ability to switch suppliers is a crucial factor. High switching costs, such as retooling machinery or renegotiating agreements, empower suppliers. Conversely, the availability of substitute inputs, like recycled polyester when cotton prices fluctuate, as seen in 2024, reduces supplier leverage. The textile industry's overall value, estimated at around $1 trillion globally in 2024, encompasses diverse segments, meaning suppliers of niche or proprietary materials may wield more power.

Suppliers might also pose a threat of forward integration, entering Donear's business. While the textile industry's diversification generally mitigates this, suppliers of unique components or technologies could more readily become competitors. Furthermore, if Donear represents a substantial portion of a supplier's revenue, the supplier's bargaining power diminishes, making them more accommodating on pricing and terms.

What is included in the product

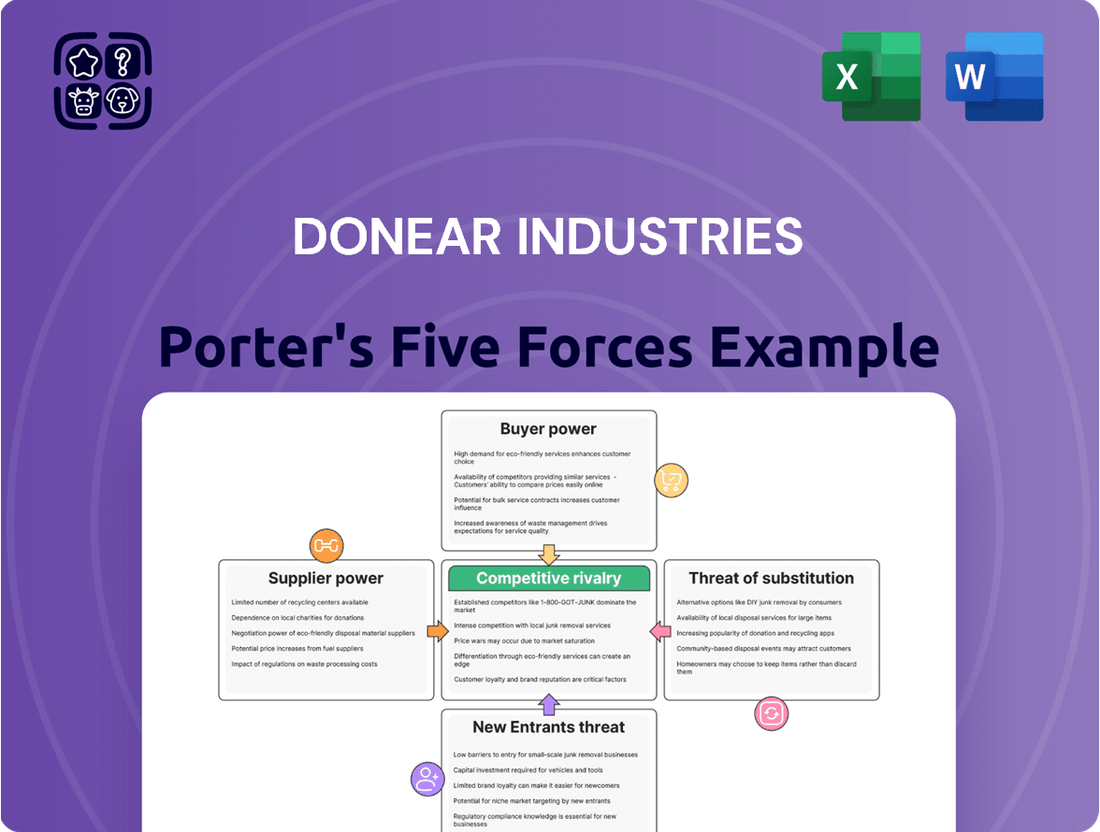

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Donear Industries' textile and apparel sector.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Donear Industries' Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Donear Industries' extensive distribution network, serving both domestic and international markets, means customer concentration can significantly impact its bargaining power. If a few major distributors or retailers account for a substantial portion of Donear's sales volume, these large buyers gain leverage.

These concentrated customers can then push for lower prices, higher quality standards, or more advantageous payment terms, directly affecting Donear's profitability. For example, if a single distributor represents 15% of Donear's revenue, their ability to negotiate favorable terms increases considerably.

The bargaining power of customers for Donear Industries is significantly shaped by buyer switching costs. If it’s simple and cheap for apparel makers to switch from Donear’s fabrics to another supplier, their power to negotiate better prices or terms increases. For instance, if Donear's competitors offer similar quality and design with readily available supply chains, customers face minimal hurdles in changing providers.

Customers in the textile industry, particularly those buying standardized fabrics, often exhibit significant price sensitivity. This means they actively seek the best deals, which naturally strengthens their ability to negotiate. For instance, in 2024, the global textile market experienced fluctuations, with some segments seeing price increases due to raw material costs, making buyers even more vigilant about pricing.

When buyers possess detailed information about Donear's production costs and compare them against competitor pricing, their bargaining power escalates. This transparency in the market, coupled with easy access to multiple suppliers, allows customers to effectively pit companies against each other, demanding more favorable terms and potentially driving down profit margins for Donear.

Threat of Backward Integration by Customers

Customers' potential to engage in backward integration, meaning they could start producing their own fabrics, significantly boosts their bargaining power against Donear Industries. This capability gives them leverage to demand better pricing and terms.

For instance, a major apparel retailer with substantial purchasing volume might consider establishing its own textile manufacturing facilities. While this represents a considerable capital outlay, the mere possibility of such a move acts as a credible threat, influencing Donear's negotiation strategies.

The threat of backward integration is particularly relevant in industries where the cost of setting up textile production is manageable relative to the buyer's scale. For Donear, understanding which of its key clients possess this capability is crucial for managing relationships and pricing effectively.

- Customer Leverage: The ability of customers to produce their own fabrics enhances their bargaining power.

- Investment Barrier: While backward integration is a significant investment, its credibility as a threat is key.

- Negotiation Impact: This threat directly influences the terms and pricing Donear can negotiate with its customers.

- Industry Dynamics: The feasibility of backward integration varies by industry, impacting its potency as a threat.

Availability of Substitute Products for Customers

The sheer volume of alternative fabrics available from competing manufacturers, alongside entirely different material options for specific uses, significantly bolsters customer bargaining power. Donear operates within a broad suiting, shirting, and denim market, presenting consumers with a wide array of choices, which inherently amplifies their leverage.

For instance, the global textile market is vast, with numerous players offering similar fabric types. In 2024, the market for technical textiles alone was projected to reach over $250 billion, indicating the breadth of material innovation and availability that customers can consider beyond traditional apparel fabrics.

- Diverse Material Choices: Customers can opt for fabrics from various domestic and international suppliers, or even explore non-textile alternatives for certain product categories.

- Price Sensitivity: The presence of readily available substitutes often leads to increased price sensitivity among customers, forcing manufacturers like Donear to remain competitive.

- Brand Switching: With numerous options, customers can easily switch brands if they perceive better value or quality elsewhere, diminishing the loyalty to any single manufacturer.

Donear Industries faces considerable customer bargaining power due to the availability of numerous fabric alternatives and substitutes. This wide selection, spanning different material types and suppliers, allows buyers to easily switch if they find better pricing or quality, directly impacting Donear's market position and pricing strategies.

The global textile market's vastness, with many players offering comparable fabrics, means customers can readily compare offerings. For example, in 2024, the market for sustainable textiles saw significant growth, providing buyers with even more options beyond traditional materials, further amplifying their leverage.

This abundance of choice translates into heightened price sensitivity for customers, compelling Donear to maintain competitive pricing. The ease with which customers can shift their business to alternative suppliers or materials underscores the significant power they wield in negotiations.

| Factor | Description | Impact on Donear |

|---|---|---|

| Availability of Substitutes | Customers can choose from a wide range of fabrics from various suppliers, including alternative materials. | Increases price sensitivity and reduces Donear's pricing power. |

| Market Breadth | The global textile market offers numerous competitors and material innovations. | Facilitates easy switching for customers, diminishing brand loyalty. |

| Customer Choice Amplification | Options like sustainable textiles provide buyers with more diverse selections. | Strengthens customer negotiation leverage and demands for competitive terms. |

Preview Before You Purchase

Donear Industries Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Donear Industries, providing a thorough examination of competitive forces within its market. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You're looking at the actual document, ready for download and use the moment you buy, offering immediate strategic insights into Donear Industries' competitive landscape.

Rivalry Among Competitors

The Indian textile industry is currently on a strong growth trajectory. The domestic market is anticipated to hit $147 billion by 2024-25, with exports projected to reach $65 billion by FY26. This expansion generally tempers rivalry, as firms can grow by tapping into new demand rather than directly competing for existing market share.

However, the landscape isn't without its complexities. A recent demand contraction observed in 2024 has unfortunately intensified competitive pressures. This means that while the industry is growing, companies are facing a tougher environment as they vie for limited consumer spending.

The Indian textile market is incredibly fragmented, featuring a vast array of domestic and international companies. This sheer volume and variety of competitors, ranging from large corporations to numerous small and medium enterprises (SMEs), means Donear Industries faces intense rivalry. For instance, in 2023, the Indian textile industry comprised over 12,000 exporting units, highlighting the extensive competitive landscape.

Donear Industries offers a broad fabric portfolio, encompassing suiting, shirting, and denim. However, the actual differentiation within these segments can be minimal, pushing competition towards price points. In 2023, the Indian textile industry saw significant price sensitivity, with cotton prices fluctuating, impacting manufacturers' margins and intensifying price-based competition.

When products are perceived as similar, customers face very low switching costs. This ease of movement between suppliers means that Donear must constantly compete on factors beyond just product features, such as service and delivery speed, to retain its customer base in a highly competitive market.

Exit Barriers

Donear Industries likely faces significant exit barriers, a common characteristic in the textile sector. These barriers can include specialized machinery, like advanced looms and dyeing equipment, which have limited resale value or alternative uses outside of textile production. This means that even if a particular segment of Donear becomes unprofitable, divesting or shutting down operations can be a costly and complex process, forcing the company to continue operating at reduced efficiency.

The presence of high exit barriers means that firms, including Donear, might remain in the market even when generating low or negative returns. This situation can lead to persistent overcapacity within the industry, as companies are reluctant to exit due to the associated costs. Consequently, this overcapacity fuels intense competitive rivalry, as firms fight for market share by potentially engaging in price wars or aggressive promotional activities to move inventory, even if it erodes profitability.

- Specialized Assets: Textile machinery, a core asset for Donear, often has a very narrow application, making its resale difficult and significantly reducing its salvage value.

- High Fixed Costs: Maintaining production facilities, even at low capacity, incurs substantial fixed costs like depreciation, insurance, and security, which are difficult to escape.

- Emotional and Managerial Attachments: Long-standing family businesses or deeply ingrained company cultures can create emotional ties to specific operations, making closure a challenging decision.

- Governmental or Social Considerations: In some regions, textile operations might be significant employers, leading to pressure against closure from local communities or governments, further increasing exit barriers.

Strategic Stakes and Aggressiveness of Competitors

The textile sector holds significant strategic importance for numerous global players, fueling aggressive growth ambitions that naturally intensify competition. This heightened rivalry can manifest through price wars or aggressive marketing campaigns, particularly from competitors benefiting from government backing or possessing substantial operational scale. For instance, in 2024, the Indian textile market, a key area for Donear, saw continued intense competition, with major players investing heavily in modernization and capacity expansion to capture market share.

Competitors with strong financial backing or government incentives are more likely to engage in aggressive tactics. These actions can directly impact Donear's profitability by eroding margins and increasing customer acquisition costs. The strategic imperative to gain or maintain market share in a growing but competitive landscape means that price adjustments and promotional activities are common. For example, reports from early 2024 indicated that some large textile manufacturers were offering significant discounts to secure bulk orders, a strategy that puts pressure on smaller or less capitalized firms.

- Intensified Rivalry: The textile industry's strategic importance drives aggressive growth strategies among competitors, leading to heightened rivalry.

- Price Wars and Marketing: Competitors with government support or large-scale operations may initiate price wars or aggressive marketing to capture market share.

- Profitability Impact: Such aggressive tactics can negatively affect Donear's profitability by squeezing margins and increasing operational costs.

- Market Dynamics in 2024: The Indian textile market in 2024, for example, witnessed substantial investments in capacity and modernization, intensifying competition.

The competitive rivalry for Donear Industries is notably high due to the fragmented nature of the Indian textile market, which hosts over 12,000 exporting units as of 2023. This fragmentation, coupled with a demand contraction in 2024, has intensified competition, pushing many players towards price-based strategies as product differentiation in segments like suiting and shirting can be minimal. Low customer switching costs further exacerbate this, forcing Donear to compete on service and delivery alongside price.

High exit barriers, such as specialized machinery and significant fixed costs, keep firms like Donear in the market even during low profitability periods. This can lead to persistent overcapacity, fueling aggressive competition and potential price wars as companies strive to move inventory. For instance, in early 2024, reports indicated aggressive discounting by larger manufacturers in the Indian market, directly impacting competitors' margins.

| Factor | Impact on Donear | 2023/2024 Data Point |

| Market Fragmentation | Intensified rivalry from numerous domestic and international players. | Over 12,000 Indian textile exporting units in 2023. |

| Product Differentiation | Increased price sensitivity and competition on price. | Minimal differentiation in suiting and shirting segments. |

| Customer Switching Costs | Low costs encourage customer mobility, demanding strong non-price competition. | Customers easily switch between suppliers based on price and service. |

| Exit Barriers | Leads to overcapacity and sustained competitive pressure. | Specialized machinery and high fixed costs make exiting difficult. |

| Competitor Aggression | Erodes margins and increases customer acquisition costs. | Aggressive discounting observed in early 2024 by large players. |

SSubstitutes Threaten

The threat of substitutes for Donear Industries' fabrics is influenced by how effectively alternative materials can satisfy customer needs at a similar or lower cost. While conventional textiles offer distinct qualities, affordability, and comfort, emerging bio-based and recycled fibers present a moderate challenge by providing eco-friendly options. For instance, the global market for sustainable textiles is projected to reach $10.3 billion by 2025, indicating growing consumer preference for alternatives.

The willingness of Donear's customers, primarily apparel manufacturers and retailers, to switch to alternative materials directly impacts the threat of substitutes. For instance, if cotton prices surge significantly, manufacturers might explore polyester blends more readily, increasing substitution. In 2023, global cotton prices saw considerable volatility, with futures contracts trading in a range that could encourage exploration of alternatives.

The textile industry, including companies like Donear, faces competition from a range of alternative materials. These can be natural, like bamboo or hemp, or synthetic. For instance, the rise of advanced non-woven fabrics in applications like hygiene products or technical textiles offers a substitute for traditional woven or knitted materials. In 2023, the global non-woven fabric market was valued at approximately $35 billion, indicating a significant and growing alternative.

Impact of Technological Advancements

Technological advancements are a significant force that can introduce or enhance substitutes for Donear Industries' products. For instance, the ongoing innovation in smart textiles, offering features like temperature regulation or embedded sensors, could directly compete with traditional fabrics by providing added functionality. Similarly, the development of advanced, high-performance materials in sectors like automotive or construction might offer superior durability or lighter weight, thereby decreasing reliance on conventional textiles.

The market is already seeing shifts driven by these innovations. For example, the global technical textiles market, which includes many of these advanced materials, was valued at approximately USD 220 billion in 2023 and is projected to grow substantially, indicating a strong demand for alternatives to conventional fabrics. This growth highlights the increasing viability and adoption of substitute products that leverage new technologies.

- Emerging Smart Textiles: Innovations like self-healing fabrics or textiles with integrated electronics offer enhanced functionalities that can replace standard materials in apparel and industrial applications.

- Advanced Material Development: Research into new polymers, composites, and nanomaterials provides alternatives with superior strength-to-weight ratios or specialized properties, impacting sectors like automotive interiors and construction.

- Digitalization of Design and Production: Technologies like 3D printing for textiles and on-demand manufacturing can reduce waste and lead times, potentially offering a more agile and cost-effective substitute to traditional mass production methods.

Sustainability Trends and Consumer Awareness

Growing consumer awareness and regulatory pressure toward sustainability are significantly impacting the textile industry, pushing for eco-friendly and recycled materials. For Donear Industries, this means that if their product offerings don't keep pace with these evolving preferences, consumers might easily switch to substitutes with a lower environmental impact. For instance, the global market for sustainable textiles was valued at approximately $10.8 billion in 2023 and is projected to grow substantially.

This shift presents a tangible threat from substitutes like organic cotton, recycled polyester, and innovative bio-based fabrics. These alternatives are increasingly accessible and marketed on their environmental credentials, directly challenging conventional materials. In 2024, the demand for recycled polyester alone saw a notable increase, with many brands actively incorporating it into their collections to meet consumer expectations for reduced waste and carbon footprint.

- Consumer Preference Shift: A significant portion of consumers, particularly younger demographics, now prioritize sustainability in their purchasing decisions, making eco-friendly substitutes more attractive.

- Material Innovation: Advances in textile technology are making substitutes like Tencel Lyocell and recycled nylon more competitive in terms of performance and cost.

- Regulatory Tailwinds: Governments worldwide are implementing policies that favor sustainable materials and penalize less eco-conscious production methods, further driving the adoption of substitutes.

- Brand Commitments: Major apparel brands are setting ambitious sustainability targets, often leading them to source materials that are perceived as more environmentally friendly, thereby increasing the threat of substitution for companies like Donear.

The threat of substitutes for Donear Industries' fabrics is moderate, driven by the increasing availability and appeal of eco-friendly and technologically advanced materials. While conventional textiles remain strong, evolving consumer preferences and regulatory pressures are creating a more dynamic landscape. For example, the global market for sustainable textiles was valued at approximately $10.8 billion in 2023, indicating a growing demand for alternatives.

Innovations in materials like Tencel Lyocell and recycled polyester are making them more competitive, directly challenging traditional fabrics. This is further amplified by major brands setting sustainability targets, which often leads them to prioritize these eco-conscious options. In 2024, recycled polyester saw a notable increase in demand as brands incorporated it to meet consumer expectations for reduced waste.

The textile industry is also seeing a rise in advanced materials, such as technical textiles, which offer specialized properties. The global technical textiles market was valued at approximately USD 220 billion in 2023, highlighting the significant growth and adoption of these alternatives across various sectors. This trend suggests a growing potential for these advanced materials to substitute conventional fabrics in specific applications.

| Material Type | 2023 Market Value (Approx.) | Key Drivers | Impact on Donear |

|---|---|---|---|

| Sustainable Textiles | $10.8 billion | Consumer preference, regulatory pressure | Moderate threat to conventional fabrics |

| Technical Textiles | USD 220 billion | Performance, specialized applications | Potential substitute in niche markets |

| Recycled Polyester | Growing demand (2024) | Brand commitments, eco-consciousness | Increasingly competitive alternative |

Entrants Threaten

The textile manufacturing sector, particularly for diversified players like Donear Industries, demands substantial upfront capital. Establishing modern manufacturing facilities, acquiring advanced machinery for suiting, shirting, and denim production, and investing in cutting-edge technology to maintain quality and efficiency can easily run into tens of millions of dollars. For instance, a new, state-of-the-art denim production line alone can cost upwards of $10 million, not including the factory setup. This considerable financial hurdle significantly deters potential new entrants who may lack the necessary funding or access to capital markets.

Established players like Donear Industries leverage significant economies of scale in their operations. This means they can produce goods at a lower cost per unit due to their large production volumes, bulk purchasing power for raw materials, and efficient distribution networks. For instance, in 2023, Donear's manufacturing capacity allowed for optimized resource utilization, a feat difficult for newcomers to replicate quickly.

New entrants face a substantial hurdle in matching these cost efficiencies. Without the established infrastructure and sheer volume of production, they would likely incur higher per-unit costs. This makes it challenging for them to compete effectively on price against a player like Donear, who can absorb costs more readily due to their scale.

Donear Industries relies heavily on its vast network of distributors and retailers, both within India and across global markets. This established infrastructure is a significant barrier for newcomers looking to replicate Donear's market reach.

New entrants would struggle to secure comparable shelf space and reliable distribution partnerships, which are vital for product visibility and sales. For instance, in 2024, Donear's extensive domestic distribution network covered over 10,000 retail touchpoints, a scale difficult for any new player to quickly match.

Brand Loyalty and Differentiation

Donear Industries benefits from established brand loyalty, a crucial factor in the textile sector where cultivating recognition and trust demands substantial investment in marketing and time. Newcomers face the significant hurdle of displacing existing customer allegiances, a challenge amplified by Donear's strategy of operating under its own brand alongside trading in garments from other labels.

The textile market, particularly for branded apparel, sees new entrants struggling to gain traction against established players. For instance, in 2024, major apparel brands continued to heavily invest in marketing campaigns, with global advertising spend in the fashion industry projected to reach over $70 billion. This intense promotional activity makes it difficult for new brands to capture consumer attention and build a loyal customer base.

- Brand Recognition: Donear's established brand name provides a competitive advantage, requiring new entrants to invest heavily in marketing to build similar recognition.

- Customer Loyalty: Existing customer relationships and loyalty are difficult for new companies to break into, especially in a market with many choices.

- Marketing Investment: Significant financial resources are needed for advertising and promotion to overcome the established presence of brands like Donear.

- Differentiation Challenge: New entrants must offer a compelling reason for consumers to switch, whether through unique product offerings, price, or a stronger brand narrative.

Government Policy and Regulations

Government policies significantly shape the threat of new entrants in industries like Donear Industries. For instance, the Indian government's Production Linked Incentive (PLI) schemes, such as those for textiles and apparel, offer financial incentives to existing manufacturers, effectively raising the cost and complexity for newcomers looking to establish a foothold. In 2023-24, the PLI scheme for textiles aimed to boost domestic manufacturing and exports, potentially creating an advantage for established players who can leverage these benefits.

Furthermore, quality control orders (QCOs) for imported materials can act as a barrier. By mandating specific quality standards, these regulations can increase the compliance burden and initial investment required for new entrants relying on imported inputs. While some regulatory changes aim to streamline business operations, others can inadvertently favor those with existing infrastructure and established supply chains, thereby increasing the barriers to entry.

- Government Incentives: Policies like PLI schemes can favor existing manufacturers, increasing entry barriers.

- Quality Control Orders (QCOs): Mandated quality standards for imported materials add to compliance costs for new entrants.

- Regulatory Landscape: While some regulations simplify processes, others can unintentionally benefit established businesses.

- Impact on New Entrants: These policies collectively raise the capital and operational requirements for new companies entering the market.

The threat of new entrants for Donear Industries is moderate. High capital requirements for modern textile manufacturing, estimated at tens of millions of dollars for advanced production lines, act as a significant deterrent. For instance, a single denim production line can cost over $10 million. Established economies of scale, a strong distribution network with over 10,000 retail touchpoints in India as of 2024, and brand loyalty cultivated through substantial marketing investments further elevate these barriers.

| Barrier Type | Description | Estimated Impact on New Entrants |

| Capital Requirements | High investment needed for machinery and facilities. | Significant deterrent; a new denim line can cost $10M+. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants face higher costs, impacting price competitiveness. |

| Distribution Network | Extensive reach of established players. | Difficult for newcomers to match Donear's 10,000+ retail touchpoints (2024). |

| Brand Loyalty & Marketing | Customer allegiance built over time with heavy ad spend. | Requires substantial marketing investment (global fashion ad spend >$70B in 2024) to overcome. |

| Government Regulations | PLI schemes and QCOs can favor existing players. | Increases compliance burden and initial investment for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Donear Industries is built upon a robust foundation of data, integrating information from industry-specific market research reports, company annual filings, and expert analyst assessments. This comprehensive approach ensures a nuanced understanding of competitive pressures.