Donear Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donear Industries Bundle

Curious about Donear Industries' strategic product positioning? Our BCG Matrix analysis offers a glimpse into their market share and growth potential, highlighting key areas for investment and attention.

Don't miss out on the full picture! Purchase the complete Donear Industries BCG Matrix to unlock detailed quadrant placements, uncover actionable insights, and gain a strategic roadmap for optimizing your portfolio and driving future success.

Stars

Donear's Neo Stretch fabric, a groundbreaking four-way stretch material designed for both suiting and shirting, is a definite Star in their Business Growth Share Matrix. Its innovative design prioritizes wearer comfort and excellent shape retention, key selling points in today's apparel market.

The fabric's debut at Bharat Tex 2024, amplified by a high-profile campaign featuring Tiger Shroff, highlights its strategic importance and market potential. This launch signifies Donear's commitment to pushing the boundaries of textile technology.

Already holding the title of India's largest manufacturer of four-way stretch fabric, Donear's extensive supply chain to European brands underscores its strong market presence. This established position in a rapidly expanding segment for performance-enhanced textiles solidifies Neo Stretch fabric's Star status.

Donear Industries' focus on premium luxury fabrics, evident in brands like Grado, Donear, Mayur, and Graviera, positions them strongly in a market segment that values quality and evolving style. This strategic emphasis suggests a significant market share within this niche.

The company's initiative to launch specialty menswear stores, specifically curating these premium fabric lines, underscores their commitment to this high-growth, high-margin sector. This move is designed to capture a larger slice of the premium market.

For example, in fiscal year 2024, Donear Industries reported a substantial revenue growth, partly driven by the strong performance of its premium fabric offerings. The menswear segment, in particular, saw increased demand, reflecting the success of their brand positioning.

Donear Industries' ambitious ₹400 crore investment in a new Jammu plant, primarily for carpet and rug manufacturing with nearly 90% earmarked for export, signals a robust push into the thriving global home textiles sector. This strategic move into a high-growth, export-oriented product category firmly places Home Textiles (Carpets and Rugs) as a Star in its BCG Matrix, poised for significant future expansion and profitability.

Four National Brands and Eight Sub-brands

Donear Industries' plan to open 50 to 100 multi-brand outlets showcases a strategic push to broaden its market presence for its four national and eight sub-brands. This expansion aims to capitalize on the growing domestic textile market, positioning these brands for significant growth.

The company's existing strong brand portfolio, coupled with this aggressive retail expansion, suggests a confident outlook for its established offerings. This initiative is designed to capture a more substantial market share within the Indian textile sector.

- Market Expansion: Launching 50-100 multi-brand outlets to increase accessibility and sales volume.

- Brand Portfolio Strength: Leveraging four national and eight sub-brands to cater to diverse consumer needs.

- Growth Potential: Targeting a growing domestic textile market to drive revenue and market share.

- Strategic Focus: Consolidating retail presence to enhance brand visibility and customer reach.

Fabrics for Automotive, Aviation, Industrial, Defense, and Government Sectors

Donear Industries' extensive fabric offerings for automotive, aviation, industrial, defense, and government sectors highlight its significant presence in the high-growth technical textiles market. This diversification points to a substantial market share within specialized fabric segments that experience robust demand.

The company's capability to meet the stringent requirements of these varied industries underscores its position as a key player in niche technical textile categories. For instance, the automotive sector alone saw global revenue for automotive textiles reach approximately $32.5 billion in 2023, with projections indicating continued growth.

- Automotive Sector: Supplying fabrics for seating, interiors, and safety components, meeting rigorous durability and aesthetic standards.

- Aviation Industry: Providing lightweight, fire-resistant, and high-strength fabrics for aircraft interiors and components.

- Industrial Applications: Offering durable fabrics for protective clothing, filtration systems, and conveyor belts, crucial for operational efficiency and safety.

- Defense and Government: Manufacturing specialized fabrics for military uniforms, protective gear, and equipment, demanding advanced material properties.

Donear's Neo Stretch fabric is a prime example of a Star in the BCG Matrix. Its innovative four-way stretch technology, showcased at Bharat Tex 2024 and endorsed by Tiger Shroff, positions it as a leader in the comfort-driven apparel market. As India's largest four-way stretch fabric manufacturer with significant European exports, Neo Stretch benefits from strong market share in a growing segment.

What is included in the product

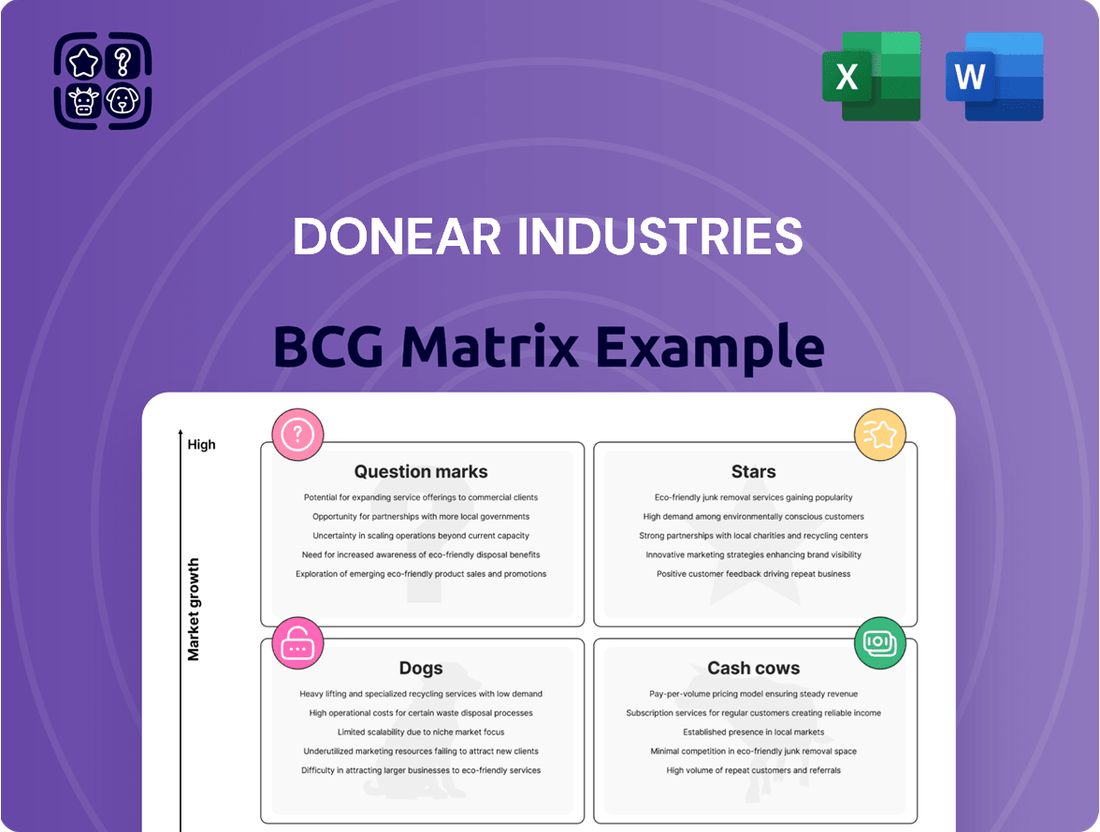

This BCG Matrix analysis categorizes Donear Industries' product portfolio into Stars, Cash Cows, Question Marks, and Dogs.

It highlights which units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visual for Donear Industries eliminates the pain of indecision by strategically allocating resources to Stars and Question Marks, while managing Cash Cows and Dogs.

Cash Cows

Donear's traditional suiting and shirting fabrics, under the well-recognized Donear Suiting brand, represent a significant cash cow for the company. This segment benefits from a long-standing reputation and a robust, extensive distribution network that has been cultivated over years, ensuring widespread availability across numerous retail touchpoints.

The market for traditional suiting and shirting fabrics is mature and stable, yet Donear maintains a high market share within it. This strong market position, coupled with established brand loyalty, translates into consistent and reliable cash flow generation, a hallmark of a true cash cow.

For the fiscal year ending March 31, 2024, Donear Industries reported total revenue of INR 1,050 crore, with the traditional suiting and shirting segment forming the bedrock of this revenue. The company's operational efficiency in this segment, supported by its vast distributor base, ensures healthy profit margins, further solidifying its cash cow status.

Donear Industries' existing wholesale and retail channels are powerful cash generators. This mature infrastructure, boasting a wide network of distributors and retailers, ensures consistent sales and efficient product movement, contributing significantly to the company's steady cash flow.

These established channels require minimal additional investment for promotion, allowing them to operate as strong cash cows. In fiscal year 2024, Donear Industries reported a robust revenue stream from these segments, underscoring their importance in the company's financial stability and ability to fund other ventures.

D'Cot and Donear NXG represent Donear Industries' established players in the readymade apparel market. With over 450 D'Cot stores, the brand signifies a substantial market presence.

These brands, particularly D'Cot, likely function as cash cows for Donear Industries. Their extensive store network and established customer base in the readymade apparel segment suggest consistent revenue generation, even if the overall market growth is moderate.

Acquired Spinning Units

Donear Industries' acquisition of two spinning units, boosting its total spindleage to over one lakh, signifies a strategic move towards vertical integration. This expansion in a mature segment of the textile value chain suggests a commitment to enhancing cost efficiency and securing raw material supply.

These newly acquired spinning units are positioned as Cash Cows within Donear's portfolio. Their consistent output is expected to contribute reliably to the company's revenue, acting as a stable cash generator by potentially lowering production costs and ensuring a steady flow of essential raw materials for downstream operations.

- Spindleage Growth: Donear's total spindleage now exceeds 100,000 units following the acquisition of two spinning units.

- Vertical Integration: The move strengthens Donear's position within the textile value chain by controlling more stages of production.

- Cost Efficiency Focus: Operating in a mature segment, these units are expected to drive down overall production costs.

- Revenue Stability: The consistent output from these spinning units provides a predictable and stable contribution to the company's top line.

Export of Formalwear Woven Products to 20 Countries

Donear Industries' formalwear woven product exports represent a significant Cash Cow. The company consistently exports six million meters of these products annually to around 20 countries spanning five continents. This established international footprint highlights a mature market presence and a dependable revenue stream.

This steady export business is a cornerstone for Donear, generating stable and predictable cash flow. The sheer volume and geographical reach indicate a well-oiled operation that reliably contributes to the company's financial health.

- Established Export Market: Reaching approximately 20 countries across five continents.

- Consistent Volume: Annual export volume of six million meters of formalwear woven products.

- Stable Revenue Generation: Provides a reliable and recurring source of income for Donear.

- Mature Business Line: Signifies a well-developed and profitable segment within the company's portfolio.

Donear's traditional suiting and shirting fabrics, along with its established readymade apparel brands like D'Cot, are key cash cows, generating consistent revenue. The company's recent expansion into vertical integration with its spinning units is also positioned to be a reliable cash generator. Furthermore, the company's substantial formalwear woven product exports contribute significantly to its stable cash flow.

| Business Segment | BCG Matrix Category | Key Characteristics | Fiscal Year 2024 Data/Insights |

|---|---|---|---|

| Traditional Suiting & Shirting | Cash Cow | Mature market, high market share, strong brand loyalty, extensive distribution network. | Formed the bedrock of INR 1,050 crore total revenue; benefits from operational efficiency and a vast distributor base. |

| Readymade Apparel (D'Cot) | Cash Cow | Established brand, extensive store network (over 450 D'Cot stores), consistent revenue generation. | Significant market presence suggests consistent revenue, contributing to financial stability. |

| Spinning Units (Vertical Integration) | Cash Cow | Mature segment, expected cost efficiency, secured raw material supply, consistent output. | Total spindleage now exceeds 100,000 units; expected to lower production costs and ensure raw material flow. |

| Formalwear Woven Product Exports | Cash Cow | Mature international presence, dependable revenue stream, consistent volume. | Exports six million meters annually to approximately 20 countries across five continents, providing stable income. |

Delivered as Shown

Donear Industries BCG Matrix

The Donear Industries BCG Matrix preview you are currently viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive document, devoid of watermarks or demo content, is meticulously prepared for immediate strategic application. You'll gain access to an analysis-ready file, designed to empower your business planning and competitive insights without any further modifications required.

Dogs

Donear Industries' underperforming or obsolete fabric lines are likely found in the Dogs quadrant of the BCG Matrix. These are older collections with low market share and minimal growth potential, often requiring significant resources for production and inventory management without generating substantial returns. For instance, a fabric line introduced in the early 2000s that doesn't align with current fashion trends might fall into this category.

These stagnant product lines consume capital and management attention that could be better allocated to more promising areas of the business. In 2024, many textile companies are reviewing their portfolios to shed such low-margin, slow-moving inventory, potentially through liquidation sales or by ceasing production altogether to improve overall profitability and resource allocation.

Donear Industries' manufacturing units not operating at optimal capacity represent a potential 'Cash Cow' or 'Dog' depending on their future prospects. For instance, if a production line for a mature product is running at 60% capacity, it ties up capital and incurs maintenance costs without generating significant returns. This underutilization can lead to lower profit margins, especially if newer, more efficient technologies are available and the product demand is stagnant or declining.

In the highly competitive textile sector, Donear Industries faces challenges with products experiencing a decline in market share. This is often driven by competitors employing aggressive pricing strategies or introducing products with superior features. For instance, if a particular fabric line sees its market share shrink from 15% in 2023 to 12% in 2024, it signals a potential issue.

These products, even if historically strong performers, could be categorized as Dogs if their sales continue to dwindle within a low-growth market segment. Without a clear strategy to reverse this trend and regain market traction, they represent a drag on overall performance. For example, a product that saw a 5% year-over-year sales decrease in a market segment growing at only 2% annually is a prime candidate for this classification.

Certain Regional Market Offerings with Low Penetration

Donear Industries may have certain regional markets, both within India and globally, where its penetration is notably low. These could be areas with limited distribution channels or where its product offerings haven't yet gained significant traction. In 2024, for instance, emerging markets in Southeast Asia or specific sub-Saharan African countries might represent such opportunities or challenges.

Products specifically tailored for these low-penetration, low-growth regions would fall into the 'Dogs' category of the BCG Matrix. This classification suggests they are not contributing significantly to market share or revenue and have limited future growth potential in their current form. A strategic assessment is crucial for these offerings.

- Low Market Share: Products in these regions likely hold a very small percentage of the local market share, potentially below 5%.

- Stagnant Growth: The projected annual growth rate for these specific regional markets is estimated to be in the low single digits, perhaps 1-3%.

- Resource Drain: Continued investment in these 'Dog' segments might divert resources from more promising business units.

- Strategic Decision: Donear Industries must decide whether to divest these underperforming regional assets or attempt a turnaround through targeted product innovation and market entry strategies.

Products with High Inventory Turnover Issues

Products with high inventory turnover issues, often found in the Dogs quadrant of the BCG Matrix, represent a significant drain on resources. These are items that accumulate in warehouses, failing to sell at a pace that justifies their storage and handling costs. For instance, in 2024, many fashion retailers experienced substantial write-downs on unsold seasonal apparel, a classic symptom of slow inventory turnover.

These underperforming products tie up valuable capital that could be reinvested in more profitable ventures. Their low market appeal means they are not generating sufficient cash flow, impacting the overall financial health of the business. Companies must identify these "Dogs" to streamline operations and improve capital efficiency.

Consider these characteristics of products in the Dogs quadrant:

- High carrying costs: Expenses associated with storing, insuring, and managing unsold inventory.

- Low sales velocity: Products that remain on shelves for extended periods without significant sales.

- Risk of obsolescence: The potential for products to become outdated or unsellable due to market changes or new product introductions.

- Capital immobilization: Funds tied up in inventory that could otherwise be used for growth initiatives.

Products in the Dogs quadrant of the BCG Matrix, like certain older or out-of-favor fabric lines for Donear Industries, exhibit low market share and minimal growth prospects. These segments often require substantial investment in production and inventory management without yielding significant returns, exemplified by discontinued lines that still occupy warehouse space. In 2024, the textile industry saw many companies actively pruning such low-margin, slow-moving stock to enhance profitability.

These underperforming assets tie up capital and management focus that could be better directed towards high-potential business areas. For instance, a fabric collection that experienced a 5% year-over-year sales decline in a market segment growing at only 2% annually would be a strong candidate for the Dogs classification. Strategic decisions to divest or revitalize these products are crucial for optimizing resource allocation.

Donear Industries' portfolio may include fabric lines with diminishing market share due to competitive pressures or evolving consumer tastes. If a particular fabric line's market share dropped from 15% in 2023 to 12% in 2024, it signals a potential shift towards the Dogs category. Without a clear strategy to regain traction, these products can hinder overall business performance.

Products with high inventory carrying costs and low sales velocity, such as unsold seasonal apparel in 2024, are classic examples of Dogs. These items remain in storage, incurring expenses for handling, insurance, and potential obsolescence, thereby immobilizing capital that could be used for growth initiatives. Identifying and addressing these "Dogs" is vital for improving capital efficiency.

| BCG Quadrant | Characteristics | Donear Industries Example | 2024 Market Insight |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth Potential | Outdated fabric lines, low-penetration regional markets | Focus on inventory reduction and divestment of non-core assets |

| High carrying costs, risk of obsolescence | Fabric lines with slow inventory turnover | Industry-wide trend of write-downs on unsold seasonal goods | |

| Consume resources without significant returns | Manufacturing units with low capacity utilization for mature products | Need for strategic review of underutilized production lines |

Question Marks

Donear Industries' strategic push into 50 new specialty stores and multi-brand outlets, particularly for its Neo Stretch textiles and premium fabrics, signals a bold move into what is anticipated to be a high-growth segment. This expansion targets a market where Donear aims to establish a significant presence, though its current market share in these specific formats is still developing.

The significant capital outlay for these new retail ventures means their performance is critical. If these stores successfully capture substantial market share and demonstrate strong revenue growth, they could evolve into Stars within Donear's portfolio. Conversely, if they fail to gain traction, they risk becoming Dogs, requiring careful management or divestment.

Donear Industries' ventures into new product categories, particularly in specialized technical textiles, position them as potential Stars or Question Marks within their BCG Matrix. For instance, their recent development of advanced composite materials for the aerospace sector, a market projected to grow significantly, represents a high-growth area.

While Donear is already established in technical textiles, these specific new applications, like fire-resistant fabrics for the automotive industry, are in nascent stages with high growth potential but currently low market share. The global technical textiles market is expected to reach approximately $310 billion by 2027, indicating substantial room for expansion.

These new product lines would likely be classified as Question Marks, requiring substantial investment to gain traction and market share in these specialized, high-growth segments. For example, their entry into biodegradable technical textiles for agricultural applications faces intense competition but taps into a burgeoning sustainability trend.

Donear Industries' acquisition of a closed Indorama unit in Madhya Pradesh and a spinning unit in Andhra Pradesh represents a strategic move to bolster its manufacturing capacity. These acquisitions are positioned as potential stars within Donear's BCG matrix, aiming to capitalize on growth opportunities in key textile manufacturing regions. The company's stated intention is to bring these units back to operational status, thereby expanding its production footprint.

The success of these acquisitions hinges on effective integration and the ability to capture desired market share and profitability. In the short to medium term, their classification remains uncertain, pending operational ramp-up and market reception. For instance, the textile industry in India, particularly in Madhya Pradesh, saw significant investment in modernization and expansion throughout 2024, with government initiatives supporting textile park development.

Expansion into Home Textiles beyond Carpets and Rugs

Expanding into broader home textile categories like bedding and curtains from their established carpet and rug export business, currently a Star in the BCG matrix, would position Donear Industries in the Question Mark quadrant. This move signifies entering high-growth markets with the potential for significant future returns.

These new segments, while promising, would likely see Donear with a relatively low initial market share. Significant investment would be crucial to build brand recognition, establish distribution channels, and develop competitive product lines in these diverse home furnishing areas.

- Diversification Opportunity: Moving into bedding and curtains represents a strategic expansion into adjacent, high-growth home textile markets.

- Market Entry Challenge: Donear would likely enter these new categories with a low market share, requiring substantial investment to gain traction.

- Investment Requirement: Competing effectively in established bedding and curtain markets necessitates significant capital for product development, marketing, and distribution.

- Potential for Growth: Successfully navigating these Question Marks could lead to future Stars or Cash Cows within the broader home furnishings sector.

Digital Sales and E-commerce Expansion Initiatives

Donear Industries' digital sales and e-commerce expansion initiatives would likely be categorized under the Question Mark in a BCG Matrix. India's textile market is seeing substantial growth through online channels, with e-commerce sales in the apparel sector projected to reach approximately $12 billion by 2025, indicating a fertile ground for digital expansion.

While these initiatives present a high growth potential, Donear's current market share in the digital space and the significant investments needed for scaling are not yet established. For instance, the overall Indian e-commerce market is expected to grow at a CAGR of 21% between 2023 and 2030, according to some reports, highlighting the opportunity but also the competitive landscape Donear would enter.

- High Growth Potential: The Indian e-commerce apparel market is expanding rapidly, offering significant revenue opportunities.

- Uncertain Market Share: Donear's current penetration and competitive standing in the digital sales domain are not clearly defined.

- Significant Investment Required: Scaling e-commerce operations demands substantial capital for technology, marketing, and logistics.

- Strategic Importance: Successful digital expansion could diversify revenue streams and reach a broader customer base.

Donear Industries' ventures into new, specialized textile markets, such as biodegradable agricultural textiles or advanced aerospace composites, represent classic Question Marks. These areas offer substantial growth potential, aligning with a global technical textiles market projected to reach around $310 billion by 2027, but Donear's current market share is minimal.

Significant investment is essential for these nascent product lines to gain traction and build market share against established players. The success of these initiatives hinges on their ability to capture a meaningful portion of these high-growth segments, potentially transforming them into future Stars.

The company's expansion into broader home textile categories like bedding and curtains, moving from its established carpet and rug business, also falls into the Question Mark quadrant. This diversification taps into promising markets, but requires substantial capital for brand building and distribution to compete effectively.

Donear's digital sales and e-commerce expansion initiatives are similarly positioned as Question Marks. While the Indian e-commerce apparel market is expanding rapidly, projected to reach approximately $12 billion by 2025, Donear's current digital market share and the investment needed for scaling remain uncertain.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Classification | Strategic Consideration |

|---|---|---|---|---|

| Biodegradable Agricultural Textiles | High | Low | Question Mark | Requires significant investment for market penetration and product development. |

| Aerospace Composite Materials | High | Low | Question Mark | Nascent market entry, needs substantial R&D and market acceptance efforts. |

| Bedding & Curtains Expansion | High | Low | Question Mark | Diversification into adjacent markets; success dependent on brand building and distribution. |

| Digital Sales & E-commerce | High | Low | Question Mark | Leveraging growing online channels requires investment in technology and marketing. |

BCG Matrix Data Sources

Our Donear Industries BCG Matrix is constructed using a blend of internal financial statements, comprehensive market research reports, and competitor analysis to provide a clear strategic overview.