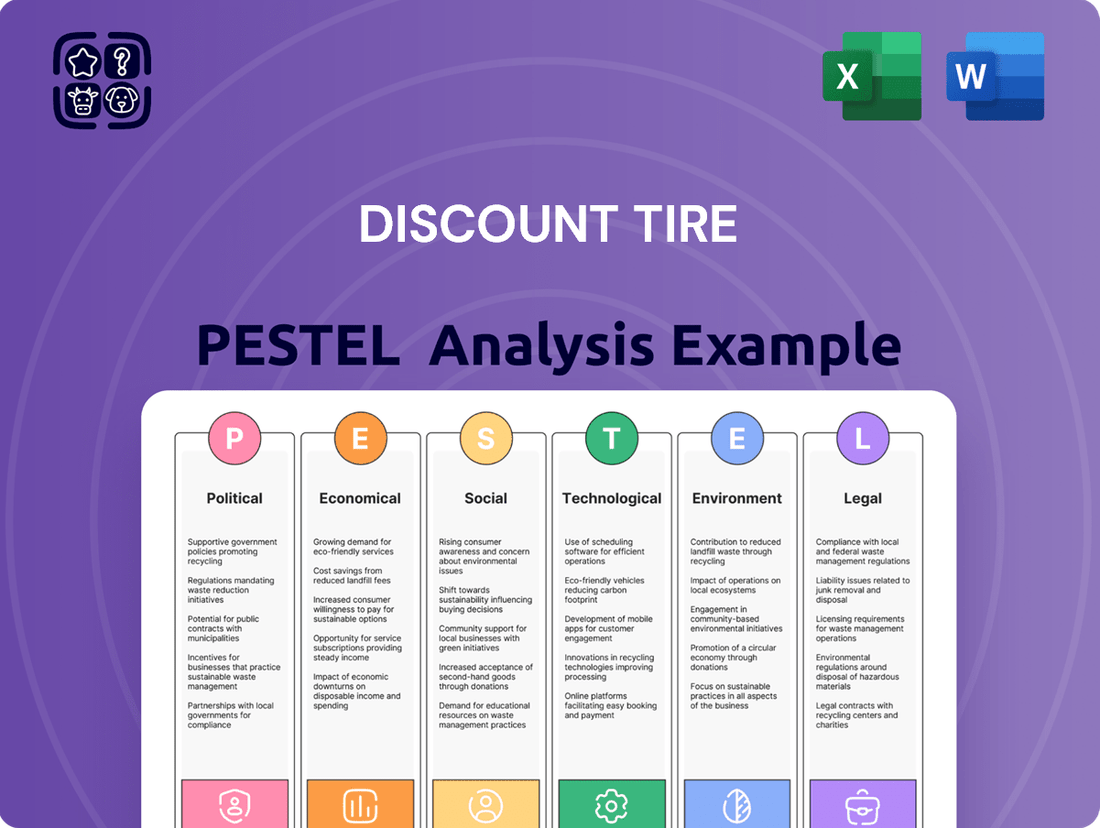

Discount Tire PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Discount Tire Bundle

Discount Tire operates within a dynamic external environment, facing evolving political landscapes, economic fluctuations, and technological advancements that significantly influence its market position. Understanding these forces is crucial for strategic planning and identifying future opportunities or threats. Gain a competitive edge by exploring the full PESTLE analysis, packed with actionable insights tailored for Discount Tire.

Political factors

Changes in international trade policies, especially tariffs on imported tires, directly affect the cost of goods for retailers like Discount Tire. For example, a new 25% tariff on imported automotive components, including tires, scheduled to begin on May 3, 2025, could raise tire prices for U.S. consumers and disrupt global supply chains.

Discount Tire, as a significant tire retailer, must manage these rising costs and potential shifts in its supply chain. This could involve sourcing more tires domestically or absorbing some of the tariff-related price increases, impacting profit margins.

Government-mandated automotive safety standards, such as those from the National Highway Traffic Safety Administration (NHTSA) in the US, directly shape the tire products available to Discount Tire. For instance, upcoming regulations focusing on tire durability and performance in varied weather conditions, expected to be further refined in 2024-2025, will necessitate adjustments in inventory and product offerings.

Compliance with these evolving regulations, including tire pressure monitoring system (TPMS) mandates and updated fuel efficiency standards, is paramount for Discount Tire's operational integrity and brand reputation. Failure to meet these benchmarks can result in significant penalties and loss of consumer confidence.

These safety regulations are a significant driver of innovation within the tire manufacturing industry. As manufacturers develop tires that meet or exceed new standards, Discount Tire benefits from access to advanced products, potentially increasing sales and customer satisfaction by offering safer, more efficient options.

Government incentives for electric vehicles (EVs) are a significant political factor impacting tire demand. Initiatives like federal tax credits and state rebates directly boost EV sales, which in turn creates a larger market for specialized EV tires. These tires are engineered with lower rolling resistance for better range and higher load capacity to handle EV battery weight.

As of early 2024, the US federal EV tax credit offers up to $7,500 for eligible new EVs, and many states provide additional incentives, further accelerating adoption. This trend is projected to continue, with EV sales in the US expected to reach approximately 1.5 million units in 2024, up from around 1.2 million in 2023, according to industry forecasts.

Discount Tire, as a major tire retailer, benefits from this growth by seeing increased demand for EV-specific tire models. The company's ability to stock and market these specialized tires will be crucial for capitalizing on this evolving automotive landscape.

Political Stability and Consumer Confidence

Political stability significantly influences consumer confidence, which in turn impacts spending on non-essential goods like new tires. When the political climate is uncertain, consumers tend to become more cautious with their money, often delaying purchases or seeking out cheaper options. For instance, periods of political upheaval can correlate with a dip in consumer sentiment surveys, directly affecting big-ticket purchases.

In 2024, ongoing geopolitical tensions and upcoming elections in several major economies could create economic uncertainty. This uncertainty might lead consumers to prioritize essential spending and postpone discretionary purchases, such as replacing tires that are not critically worn. Discount Tire, like other automotive service providers, would likely see a shift towards repair services over new tire sales during such times.

- Consumer spending on discretionary automotive items is sensitive to political stability.

- Economic uncertainty, often linked to political events, can lead to delayed tire purchases or a preference for budget-friendly alternatives.

- A stable political environment generally encourages consumers to invest more readily in vehicle maintenance and upgrades.

Lobbying and Industry Advocacy

Industry associations like the U.S. Tire Manufacturers Association (USTMA) actively lobby on behalf of tire manufacturers. Their advocacy efforts aim to shape policies and regulations that affect the entire tire ecosystem, from production to sales. This collective voice influences discussions around trade, environmental standards, and product safety, creating a broader operating environment for all players, including retailers like Discount Tire.

While Discount Tire is primarily a retailer, the political advocacy of the manufacturing sector has direct implications. For instance, USTMA's engagement on issues like tariffs on imported tires can impact the cost of goods for Discount Tire. Similarly, their involvement in environmental policy debates, such as those concerning tire recycling or emissions standards, shapes the regulatory landscape that Discount Tire must navigate.

- Industry Advocacy Impact: USTMA's lobbying efforts influence regulations on tire production and import, potentially affecting Discount Tire's supply chain costs and product availability.

- Environmental Regulations: As environmental regulations evolve, driven in part by industry advocacy, Discount Tire may need to adapt its operations or product offerings to comply with new standards for tire disposal or sustainability.

- Trade Policy Influence: Discussions on trade policies, including tariffs on imported tires, are a key focus for industry associations, with potential ripple effects on the pricing and competitiveness of tires sold by Discount Tire.

Government trade policies, such as tariffs on imported tires, directly impact Discount Tire's operational costs and pricing strategies. For example, a potential 25% tariff on imported automotive components effective May 3, 2025, could increase tire prices for consumers and necessitate adjustments in Discount Tire's sourcing and inventory management.

Evolving automotive safety standards, like those from NHTSA, influence the types of tires available. Upcoming regulations in 2024-2025 focusing on tire durability and performance in diverse weather conditions will require Discount Tire to adapt its product selection to meet these new benchmarks.

Political stability plays a crucial role in consumer confidence and discretionary spending. Economic uncertainty stemming from geopolitical tensions or elections in 2024 might lead consumers to delay non-essential purchases like new tires, potentially shifting demand towards repairs.

Industry associations, such as the U.S. Tire Manufacturers Association (USTMA), actively lobby for policies affecting tire production and sales. Their advocacy on trade, environmental standards, and product safety shapes the regulatory environment for retailers like Discount Tire, influencing everything from import costs to product compliance.

What is included in the product

This Discount Tire PESTLE analysis examines how Political, Economic, Social, Technological, Environmental, and Legal factors impact the company, providing actionable insights for strategic decision-making.

Discount Tire's PESTLE analysis provides a clear, summarized version of external factors for easy referencing during meetings, alleviating the pain point of navigating complex market dynamics.

Economic factors

The overall health of the economy directly impacts tire demand. When the economy is strong, consumers have more disposable income, leading to increased vehicle usage and a greater willingness to invest in tire maintenance and replacement. This positive correlation means that economic downturns can significantly dampen tire sales.

The global tire market is a good indicator of this economic relationship. Valued at an estimated $142.7 billion in 2024, the industry is projected to experience growth. This upward trend suggests a generally favorable economic environment, which bodes well for companies like Discount Tire.

Inflationary pressures and rising interest rates, as seen with the US Federal Reserve's continued monetary tightening through 2024, directly impact consumer spending power. For instance, if inflation remains elevated, consumers might delay non-essential purchases like new tires, opting instead to maintain their existing ones longer.

This economic climate encourages a shift towards more budget-friendly tire options. Discount Tire, facing this, needs to ensure its product mix includes a robust selection of value-oriented tires to capture market share from consumers prioritizing cost savings.

The average price of tires can fluctuate significantly with economic conditions. For example, if the Producer Price Index for tires sees a substantial increase in 2024 due to supply chain costs, Discount Tire's pricing strategy will be crucial in balancing affordability for customers with maintaining profitability.

Fluctuations in fuel prices directly impact how much people drive, which in turn affects how quickly tires wear out. For example, if gasoline prices surge, consumers might cut back on non-essential trips, leading to less tire wear. Conversely, when fuel costs are low, people tend to drive more, increasing the demand for tire replacements.

In 2024, average gasoline prices in the US have seen some volatility, with AAA reporting national averages ranging from approximately $3.40 to $3.70 per gallon at various points. This cost is a significant component of overall vehicle ownership expenses, alongside insurance and maintenance, influencing a consumer's willingness to invest in new tires versus extending the life of older ones.

Automotive Aftermarket Growth

The U.S. automotive aftermarket is a significant growth area, with sales reaching an estimated $413.7 billion in 2024. This sector is expected to expand further, with a projected increase of 5.1% in 2025.

A key driver for this expansion is the trend of American drivers opting to keep their vehicles longer. The average age of vehicles on U.S. roads now exceeds 12.8 years, which naturally boosts the demand for replacement parts and maintenance services.

This extended vehicle lifespan directly translates into increased opportunities for companies like Discount Tire, as more cars require repairs and new components to remain operational.

- Sustained Growth: The U.S. automotive aftermarket reached $413.7 billion in 2024.

- Projected Expansion: Expected to grow by 5.1% in 2025.

- Vehicle Longevity: Average vehicle age on U.S. roads is over 12.8 years.

- Demand Driver: Increased demand for replacement parts and services due to older vehicles.

Competitive Pricing and Market Share

The tire retail sector is fiercely competitive, with established giants and emerging players constantly seeking to expand their market share. Discount Tire, holding the position of the largest independent tire and wheel retailer in the United States, navigates this environment where aggressive pricing and compelling promotions are key differentiators. For instance, during 2024, many retailers offered significant discounts, with some national chains advertising savings of up to $100 on select tire purchases, directly impacting consumer purchasing decisions and reinforcing the importance of competitive pricing for market share.

Strategic maneuvers like partnerships and acquisitions are common tactics to gain an edge. Discount Tire itself has been a player in this arena, aiming to enhance its reach and service offerings. In this intensely competitive landscape, customer loyalty is often built on a foundation of value, making price a critical factor for consumers who are increasingly budget-conscious, especially when considering major purchases like tires.

- Market Competition: The US tire retail market is characterized by intense competition among numerous national and regional players.

- Discount Tire's Position: As the largest independent retailer, Discount Tire faces pressure to maintain competitive pricing to defend its market share.

- Consumer Priorities: Value and price are paramount for consumers, driving the need for strategic promotions and competitive pricing.

- 2024 Pricing Trends: Significant discounts, often exceeding $100 on tire sets, were observed across major retailers in 2024, highlighting the pricing war.

Economic factors significantly influence the tire industry. A robust economy generally boosts vehicle usage and tire replacement demand, as seen in the U.S. automotive aftermarket's projected 5.1% growth in 2025, reaching an estimated $434.5 billion.

However, inflation and rising interest rates in 2024, exemplified by the Federal Reserve's monetary tightening, can reduce consumer spending power, potentially delaying tire purchases. Furthermore, fluctuating fuel prices, with U.S. averages around $3.40-$3.70 per gallon in 2024, impact driving habits and tire wear rates.

| Economic Factor | 2024 Data/Trend | Impact on Discount Tire |

|---|---|---|

| US Automotive Aftermarket Size | $413.7 billion | Indicates a large market for replacement parts. |

| Projected Aftermarket Growth (2025) | 5.1% | Suggests continued demand for tires and services. |

| Average US Gas Prices (2024) | $3.40 - $3.70/gallon | Influences driving frequency and tire wear. |

| Inflation/Interest Rates | Elevated, with Fed tightening | May reduce consumer discretionary spending on tires. |

Preview Before You Purchase

Discount Tire PESTLE Analysis

The preview you see here is the exact Discount Tire PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis upon completing your purchase.

The content and structure shown in the preview is the same Discount Tire PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

Consumer preferences are shifting, with a notable rise in demand for specialized tire types like low rolling resistance options, crucial for electric vehicles. Alongside this, there's a growing consumer interest in tires made with sustainable materials, reflecting broader environmental concerns.

Economic headwinds are also influencing choices, pushing consumers towards more budget-friendly, often referred to as 'tier-three,' tire brands. For instance, in 2024, reports indicated a significant portion of consumers were actively seeking value-oriented purchases across many retail sectors, a trend likely extending to automotive parts.

Discount Tire needs to strategically adjust its product mix and promotional efforts to cater to these evolving demands. This includes ensuring adequate stock of EV-compatible tires and potentially highlighting more accessible brand options in their marketing campaigns.

Consumers are increasingly prioritizing environmental impact, with a significant portion actively seeking out eco-friendly products. This shift directly affects the automotive sector, boosting demand for tires manufactured with recycled or bio-based materials. For instance, a 2024 survey indicated that over 60% of car buyers consider sustainability a key factor in their purchasing decisions.

Discount Tire can capitalize on this by emphasizing its partnerships with tire manufacturers that utilize sustainable materials and by promoting its tire recycling programs. The company's commitment to responsible disposal, which diverts millions of tires from landfills annually, resonates with this growing environmentally aware consumer base.

The average age of vehicles on U.S. roads continues to climb, reaching an estimated 12.5 years in 2023, a record high. This aging fleet directly fuels demand for replacement tires and maintenance services, a positive trend for Discount Tire.

Furthermore, evolving work-from-home policies influence driving habits. While some may drive less, others might experience different wear patterns on their tires due to altered commuting routes or increased local travel, creating a mixed but generally sustained need for tire upkeep.

Demographic Changes and Vehicle Types

Demographic shifts are profoundly impacting the automotive market. For instance, a growing global population, projected to reach 8.1 billion by 2025 according to UN estimates, directly translates to an increased demand for personal transportation. This expansion is particularly pronounced in developing economies where rising disposable incomes are empowering more consumers to purchase vehicles, especially passenger cars, which are the backbone of tire sales.

These evolving demographics necessitate a keen focus from companies like Discount Tire. Understanding these trends allows for better anticipation of future market needs. For example, as the global middle class expands, the demand for more sophisticated and specialized tires, such as all-season or performance tires, is likely to rise, influencing product mix and inventory management.

- Population Growth: The world population is expected to continue its upward trajectory, driving overall vehicle ownership.

- Rising Incomes: Increasing disposable income in emerging markets correlates with higher vehicle purchase rates.

- Passenger Car Dominance: The majority of new vehicle sales in many regions are passenger cars, directly benefiting tire manufacturers and retailers.

- Shifting Tire Preferences: Demographic changes can influence demand for specific tire types, from basic all-season to specialized performance or electric vehicle (EV) tires.

Customer Service Expectations and Digital Convenience

Customers today demand effortless and integrated shopping journeys, from browsing online to booking appointments and even receiving mobile services. Discount Tire's investment in digital platforms and expanding mobile tire installation directly addresses this trend, aiming to meet consumers where they are.

The retail landscape sees customer service as a crucial differentiator. For instance, a 2024 report indicated that 73% of consumers consider customer experience a key factor in their purchasing decisions. Discount Tire's commitment to both convenient digital access and high-quality in-store service positions them well.

- Digital Integration: Consumers expect online purchasing, appointment scheduling, and mobile service options.

- Convenience is Key: Seamless experiences across all touchpoints are paramount for customer satisfaction.

- Service as a Differentiator: Excellent customer service is a significant factor in competitive advantage, with 73% of consumers citing it in 2024 purchasing decisions.

- Mobile Expansion: Discount Tire's focus on mobile tire installation caters to the growing demand for at-home service solutions.

Societal values are increasingly emphasizing sustainability, leading to a greater demand for eco-friendly tire options. This trend is supported by data showing a significant portion of consumers, over 60% in a 2024 survey, consider sustainability when buying vehicles. Discount Tire's emphasis on recycling programs and partnerships with sustainable manufacturers aligns with these evolving consumer priorities.

The aging vehicle fleet, averaging 12.5 years on U.S. roads in 2023, directly boosts the need for replacement tires. Additionally, shifts in work-from-home policies create varied driving patterns, maintaining a consistent demand for tire maintenance and replacement.

Demographic shifts, including global population growth projected to reach 8.1 billion by 2025, fuel increased vehicle ownership, particularly in emerging markets. This expansion drives demand for passenger cars, the primary segment for tire sales.

| Sociological Factor | Impact on Discount Tire | Supporting Data/Trend |

|---|---|---|

| Sustainability Focus | Increased demand for eco-friendly tires; brand reputation enhancement through recycling. | Over 60% of consumers consider sustainability in 2024 purchasing decisions. |

| Aging Vehicle Fleet | Higher demand for replacement tires and maintenance services. | Average vehicle age in the U.S. reached 12.5 years in 2023. |

| Global Population Growth | Increased overall vehicle ownership and tire demand, especially in emerging markets. | World population projected to reach 8.1 billion by 2025. |

Technological factors

The tire industry is seeing rapid technological evolution, with 'digital tires' now featuring embedded sensors. These sensors offer crucial real-time data on tire wear, temperature, and pressure, allowing for proactive maintenance and improved vehicle performance. For instance, Michelin's recent advancements in connected tire technology aim to provide fleet managers with unprecedented insights into tire health, potentially reducing downtime and optimizing fuel efficiency.

Further innovations like airless tires and self-healing rubber compounds are on the horizon, promising significant gains in safety and durability. Goodyear, for example, has been investing heavily in airless tire technology, aiming to eliminate flats and improve overall tire lifespan. These advancements directly impact product offerings and the services Discount Tire can provide.

Staying ahead of these technological shifts is critical for Discount Tire to maintain its competitive edge. By offering the latest in tire innovation, from smart sensors to more robust materials, the company can cater to evolving customer demands for safety, efficiency, and advanced vehicle integration, ensuring they remain a leader in the automotive service sector.

The surge in electric vehicle (EV) adoption is fundamentally reshaping tire design. EVs, with their instant torque and the added weight of battery packs, demand tires engineered for greater durability and grip. Furthermore, maximizing an EV's driving range hinges on minimizing rolling resistance, pushing manufacturers towards specialized rubber compounds and tread patterns. For Discount Tire, this means a growing need to adapt inventory and service capabilities to cater to these evolving EV tire requirements.

By 2025, the global EV market is projected to exceed 30 million vehicles, according to various industry forecasts. This significant growth necessitates a strategic shift for tire retailers like Discount Tire to ensure they can meet the demand for EV-specific tires, which often feature noise-reduction technology and reinforced sidewalls to support heavier loads. Failure to adapt could mean missing out on a substantial and rapidly expanding segment of the automotive aftermarket.

The automotive aftermarket is experiencing a substantial migration to online sales, with e-commerce platforms playing a pivotal role in market expansion. Discount Tire's investment in robust online sales and appointment scheduling is vital for catering to consumer preferences for digital accessibility and maintaining a competitive edge.

In 2024, online tire sales are projected to continue their upward trajectory, with many analysts expecting double-digit growth year-over-year. This trend underscores the necessity for companies like Discount Tire to maintain and enhance their digital storefronts and customer service portals to capture a larger share of this burgeoning market.

Data Analytics and AI for Operations

The tire industry is seeing a significant shift with the adoption of data analytics and AI. These technologies are key to improving how tires are made, managed, and sold, ultimately impacting customer satisfaction. For instance, AI can predict when a tire might need replacement based on driving habits and wear patterns, offering a proactive service.

Discount Tire can harness these advancements to refine its operations. Better inventory management, for example, can be achieved by analyzing sales data and market trends to forecast demand more accurately. This reduces overstocking and stockouts, directly impacting profitability.

Furthermore, understanding consumer behavior through data analytics allows for personalized marketing and service offerings. By analyzing purchase history and preferences, Discount Tire can provide tailored recommendations and promotions, enhancing customer loyalty. In 2024, the global AI in manufacturing market was valued at over $10 billion and is projected to grow substantially, indicating the significant potential for companies like Discount Tire to gain a competitive edge.

Key applications for Discount Tire include:

- Predictive Maintenance: Using AI to forecast tire wear and suggest optimal replacement times for customers.

- Inventory Optimization: Employing data analytics to match stock levels with predicted demand, minimizing carrying costs and lost sales.

- Personalized Customer Engagement: Leveraging AI to offer tailored product recommendations and service reminders.

- Supply Chain Efficiency: Analyzing data to streamline logistics and improve delivery times.

Innovations in Tire Installation and Repair Services

Innovations in how tires are installed and repaired are significantly shaping the automotive service landscape. Beyond just the tires themselves, the way customers receive these services is evolving rapidly. Discount Tire has been a key player in this shift, notably through the expansion of its mobile tire installation services. This move directly addresses the growing consumer demand for convenience and on-demand solutions, bringing essential automotive care right to the customer's doorstep.

This technological advancement in service delivery allows for greater flexibility and efficiency. For example, Discount Tire's mobile units can handle a variety of services, from tire mounting and balancing to rotations and flat repairs, all at a customer's home or workplace. This not only saves the customer time but also positions Discount Tire as a forward-thinking provider in a competitive market. By embracing these mobile solutions, the company is adapting to changing consumer preferences and leveraging technology to enhance customer satisfaction and operational reach.

- Mobile Tire Installation Growth: Discount Tire has been actively increasing its fleet of mobile service vehicles, aiming to cover more geographic areas and serve a larger customer base with convenient, at-home tire services.

- Customer Convenience Focus: The expansion of mobile services directly caters to consumers seeking time-saving and hassle-free solutions for their tire maintenance needs.

- Technological Integration: These mobile units often utilize advanced equipment for efficient tire servicing, mirroring the capabilities of in-store locations.

Technological advancements are rapidly transforming the tire industry, with innovations like embedded sensors in 'digital tires' providing real-time data on wear, temperature, and pressure. This allows for proactive maintenance and improved vehicle performance, as seen with Michelin's connected tire technology. Airless tires and self-healing rubber compounds are also emerging, promising enhanced safety and durability, with companies like Goodyear investing heavily in these areas. These developments directly influence the products and services Discount Tire offers, necessitating adaptation to stay competitive.

Legal factors

Government regulations are a cornerstone of tire safety, dictating everything from manufacturing processes to performance benchmarks. For instance, in the US, the National Highway Traffic Safety Administration (NHTSA) sets Federal Motor Vehicle Safety Standards (FMVSS) that tires must meet, covering aspects like tire strength and durability. Failure to comply can result in significant penalties and damage to a company's reputation.

Discount Tire operates within this stringent regulatory framework, which includes detailed recall procedures. When safety defects are identified, manufacturers and retailers must follow specific protocols for notifying consumers and addressing the issue, often involving product replacement or repair. In 2023, the automotive industry saw numerous recalls, highlighting the ongoing importance of robust safety compliance programs.

Adherence to these tire safety regulations is not just about avoiding legal repercussions; it's fundamental to building and maintaining consumer trust. Customers rely on Discount Tire to provide safe and reliable products, and any lapse in compliance can erode that confidence, impacting sales and brand loyalty. The company's commitment to safety standards directly influences its long-term viability and market standing.

Environmental protection agencies like the EPA and state-level bodies are increasingly stringent on how used tires are stored, processed, and disposed of. For Discount Tire, this means compliance with evolving mandates is crucial for responsible operation. Failing to meet these standards can result in significant penalties, impacting profitability and brand reputation.

These regulations are driving a greater emphasis on tire recycling and sustainable waste management. For instance, in 2023, the U.S. generated an estimated 290 million scrap tires, with a growing percentage being diverted from landfills through recycling initiatives. Discount Tire's commitment to adhering to these environmental laws directly supports these broader sustainability goals.

As a major employer with hundreds of retail locations across the U.S., Discount Tire must navigate a complex web of federal, state, and local labor laws. These regulations cover everything from minimum wage requirements and overtime pay to workplace safety standards and anti-discrimination statutes. For instance, the Fair Labor Standards Act (FLSA) sets the baseline for these protections nationwide, while individual states may impose stricter rules, such as California’s recent increases to its minimum wage, which reached $16.00 per hour for all employers as of January 1, 2024.

Staying compliant with these ever-evolving employment regulations is crucial for Discount Tire’s operational continuity and reputation. Failure to adhere to these laws can result in significant financial penalties, costly litigation, and damage to employee morale. For example, the Occupational Safety and Health Administration (OSHA) enforces workplace safety, and in 2023, the agency continued its focus on industries with higher risks of injury, which could include automotive service environments.

Consumer Protection Laws and Warranties

Consumer protection laws are a significant legal factor for Discount Tire. These regulations govern fair business practices, product warranties, and how disputes are handled. For instance, the Magnuson-Moss Warranty Act in the United States sets standards for consumer product warranties, ensuring clarity and preventing deceptive practices. Discount Tire must adhere to these by providing transparent warranty policies on tires and services, which is crucial for maintaining consumer trust and avoiding potential legal challenges. In 2023, the Federal Trade Commission (FTC) reported a significant number of complaints related to automotive repair services, underscoring the importance of compliance.

Discount Tire's commitment to clear warranty policies and transparent service agreements directly impacts its reputation and customer loyalty. By proactively addressing consumer rights, the company can mitigate legal risks and build a stronger brand image. This is especially important in the automotive sector, where trust in service providers is paramount. For example, providing clear information about tire mileage warranties and installation guarantees can prevent misunderstandings and disputes.

- Clear Warranty Information: Discount Tire must ensure all tire and service warranties are clearly communicated to customers, detailing coverage, limitations, and claim procedures.

- Transparent Service Agreements: All service contracts and pricing should be presented upfront, avoiding hidden fees or misleading terms.

- Dispute Resolution: Having accessible and fair mechanisms for resolving customer complaints is vital for maintaining compliance and customer satisfaction.

- Regulatory Adherence: Staying updated on and complying with federal and state consumer protection laws, such as those related to advertising and product safety, is non-negotiable.

Data Privacy Regulations

Discount Tire navigates a complex landscape of data privacy regulations, particularly with its expanding online presence and digital customer interactions. Laws like the California Consumer Privacy Act (CCPA), which grants consumers rights over their personal information, and the potential for new federal privacy legislation in the US, necessitate robust data protection strategies. Failure to comply can lead to substantial fines; for instance, violations of CCPA can incur penalties of up to $7,500 per intentional violation, as of 2024. Maintaining customer trust through stringent data security is paramount to avoiding reputational damage and financial repercussions.

Government regulations significantly impact Discount Tire, particularly concerning tire safety and environmental standards. The National Highway Traffic Safety Administration (NHTSA) in the U.S. mandates strict Federal Motor Vehicle Safety Standards (FMVSS) for tire strength and durability, with non-compliance leading to penalties. Environmental agencies like the EPA also impose rules on tire disposal and recycling, with the U.S. generating approximately 290 million scrap tires in 2023, highlighting the need for sustainable practices.

Labor laws are also a critical legal factor, with Discount Tire needing to adhere to federal, state, and local regulations covering minimum wage, overtime, and workplace safety. For example, California’s minimum wage reached $16.00 per hour for all employers in 2024. Adherence to Occupational Safety and Health Administration (OSHA) standards is crucial in automotive service environments.

Consumer protection laws, such as the Magnuson-Moss Warranty Act, dictate fair business practices and warranty transparency. The Federal Trade Commission (FTC) noted numerous complaints in the automotive repair sector in 2023, emphasizing the importance of clear warranty policies and dispute resolution mechanisms for Discount Tire to maintain customer trust and avoid legal issues.

Environmental factors

The tire industry, including companies like Discount Tire, is navigating a landscape of increasingly stringent environmental regulations concerning end-of-life tires. Anticipate tougher EPA regulations and state-level mandates to be fully implemented by 2025, directly impacting how scrap tires are managed.

Compliance with these evolving rules means Discount Tire must invest in and maintain robust systems for the proper handling, processing, and disposal of used tires. These regulations are crucial for mitigating environmental risks, such as the potential for tire fires and the breeding grounds they create for pests.

For instance, states like California have already implemented advanced disposal fees, and by 2025, many more are expected to bolster their recycling mandates, potentially increasing operational costs for tire retailers. Failure to adapt could lead to significant fines and reputational damage.

The automotive industry, including tire manufacturing and retail, is seeing a significant shift towards sustainability. Consumers are increasingly seeking out products with a lower environmental impact, which translates to a greater demand for tires made from renewable and recycled materials. This trend is particularly evident in the growing market for tires incorporating natural rubber, recycled rubber, and advanced compounds like silica.

Discount Tire, as a major tire retailer, is directly impacted by this evolving consumer preference. While they don't manufacture tires, their product selection must align with market demand. For instance, by 2024, several major tire manufacturers are expected to increase their use of sustainable materials, with some aiming for up to 75% of their product lines to incorporate renewable or recycled content by 2030. This means Discount Tire will likely see a greater availability of these eco-friendly options on its shelves.

The environmental impact of tire manufacturing and distribution, especially the carbon footprint, is a major focus for the automotive sector. Discount Tire, as a significant retailer, must consider how its store energy usage and logistics network contribute to its overall environmental impact.

Reducing emissions throughout the entire supply chain, from production to the end consumer, is a growing imperative. For instance, the transportation sector alone accounted for approximately 29% of total U.S. greenhouse gas emissions in 2022, highlighting the importance of efficient logistics for companies like Discount Tire.

Energy Consumption and Operational Efficiency

Discount Tire's extensive network of retail stores and its mobile service operations inherently involve significant energy consumption, impacting its environmental footprint. For instance, in 2023, the retail sector's energy use accounted for a substantial portion of overall business energy needs, with lighting and HVAC being major contributors. By implementing energy-efficient technologies, such as LED lighting upgrades across its locations and optimizing HVAC systems, Discount Tire can directly reduce its electricity bills and carbon emissions. Furthermore, exploring the integration of renewable energy sources, like solar panels on store rooftops, presents an opportunity to further decarbonize operations. This commitment to sustainable practices not only mitigates environmental impact but also resonates positively with a growing segment of environmentally conscious consumers, potentially boosting brand loyalty and market share.

Investing in operational efficiency through energy reduction strategies can yield tangible financial benefits. For example, a 10% reduction in energy consumption across a large retail chain can translate into savings of millions of dollars annually. Discount Tire's focus on this area aligns with broader industry trends; by 2025, it's projected that energy efficiency measures will be a key differentiator for businesses seeking to manage operational costs and enhance their environmental, social, and governance (ESG) profiles.

- Energy Consumption: Retail locations and mobile fleets are primary energy users.

- Efficiency Measures: LED lighting and HVAC optimization are key reduction strategies.

- Renewable Energy: Solar panel installations offer a path to decarbonization.

- Brand Image: Sustainable operations appeal to eco-conscious consumers.

Impact of Climate Change on Driving Conditions

Climate change is increasingly impacting driving conditions, leading to more frequent and severe weather events. This shift directly affects consumer needs for tire safety and performance. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, a significant increase that highlights the growing volatility.

This environmental transformation is likely to boost demand for specialized tires. Consumers are seeking all-weather or winter tires more frequently to navigate unpredictable conditions, from heavy rain and flooding to unexpected snowfalls. Data from the U.S. Tire Manufacturers Association indicates a steady rise in the adoption of all-season and winter tire usage over the past decade, a trend expected to accelerate.

Discount Tire must strategically adapt its product inventory and marketing efforts to align with these evolving environmental factors. This includes:

- Expanding inventory of all-weather and winter tire options to meet rising consumer demand for year-round safety.

- Developing targeted seasonal promotions that highlight the benefits of specific tire types for changing weather patterns.

- Educating consumers on the importance of tire maintenance and selection for extreme weather conditions, leveraging data on accident reduction with appropriate tires.

Environmental regulations are tightening, impacting tire disposal and recycling. By 2025, expect more stringent EPA and state-level rules, increasing compliance costs for companies like Discount Tire. This also fuels demand for tires made from sustainable and recycled materials, with manufacturers aiming for higher percentages of such content in their product lines by 2030.

PESTLE Analysis Data Sources

Our Discount Tire PESTLE analysis is grounded in comprehensive data from government automotive regulations, economic forecasts from leading financial institutions, and industry-specific market research reports. This ensures a thorough understanding of the political, economic, and market landscapes impacting the tire industry.