Discount Tire Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Discount Tire Bundle

Discount Tire navigates a competitive landscape shaped by moderate buyer power and significant supplier relationships. The threat of new entrants is present, though barriers to entry exist, particularly concerning brand loyalty and established distribution networks. Understanding these forces is crucial for any business operating in or analyzing the automotive service sector.

The complete report reveals the real forces shaping Discount Tire’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration in the tire industry presents a mixed bag for Discount Tire. Major global manufacturers like Michelin and Bridgestone, holding significant market share, could exert considerable influence. For instance, in 2023, Michelin reported global sales of €28.2 billion, underscoring its scale.

However, Discount Tire's position as the largest independent tire and wheel retailer in the United States grants it substantial bargaining power. Its massive purchasing volumes, estimated in the tens of millions of tires annually, allow it to negotiate favorable terms, effectively mitigating the leverage of concentrated suppliers.

Switching costs for Discount Tire from its current suppliers are likely moderate. While the company has built strong relationships and integrated systems with its existing tire manufacturers and distributors, the largely commoditized nature of many tire products means that sourcing alternatives isn't inherently difficult.

However, transitioning to new suppliers would involve some investment. This includes the potential costs of establishing new logistical arrangements, updating inventory management systems, and potentially re-negotiating terms, which can add up. For instance, in 2024, the global tire market saw significant shifts in raw material costs, impacting supplier pricing and potentially encouraging renegotiations or explorations of new partnerships for companies like Discount Tire.

Supplier product differentiation significantly impacts Discount Tire's bargaining power. Tire manufacturers actively differentiate their offerings through strong brand recognition, innovative technologies like advanced tread compounds or smart tire capabilities, and distinct performance metrics. For example, in 2024, premium tire brands continued to command higher prices due to perceived quality and technological advancements, giving them leverage.

This differentiation means Discount Tire must maintain relationships with a diverse set of suppliers to cater to varied customer preferences, from budget-conscious buyers to performance enthusiasts. When a particular tire brand is highly sought after or offers unique features, its manufacturer gains considerable bargaining power, influencing pricing and supply terms for Discount Tire.

Threat of Forward Integration by Suppliers

The threat of tire manufacturers integrating forward by opening their own retail stores or expanding direct-to-consumer online sales is a consideration. While some tire brands do have a retail presence, the vast network of physical locations and established service capabilities that Discount Tire possesses makes a complete takeover through forward integration by manufacturers a substantial challenge and not an immediate, significant threat.

For instance, in 2024, Discount Tire operated over 1,100 stores across the United States, a scale that would be incredibly costly and time-consuming for individual tire manufacturers to replicate. This extensive footprint provides significant customer access and brand loyalty that is difficult for suppliers to bypass directly.

- Extensive Retail Network: Discount Tire's over 1,100 locations offer a significant barrier to entry for manufacturers considering direct retail expansion.

- Service Infrastructure: The company's well-established service capabilities and customer relationships are difficult for suppliers to replicate quickly.

- Brand Diversification: Discount Tire carries a wide range of tire brands, reducing reliance on any single manufacturer and diluting the impact of a supplier's potential forward integration.

Importance of Discount Tire to Suppliers

Discount Tire's position as the largest independent tire and wheel retailer in the United States grants it substantial bargaining power with its suppliers. This scale translates into significant purchasing volume, making Discount Tire a highly valuable distribution channel for tire manufacturers.

The sheer volume of tires Discount Tire procures annually provides considerable leverage in price negotiations. For example, in 2024, the company continued to expand its market presence, solidifying its role as a key partner for major tire brands seeking broad consumer reach across the nation.

- Significant Market Share: Discount Tire's extensive retail footprint and high sales volume make it a critical partner for tire manufacturers aiming for widespread market penetration.

- Volume Purchasing Power: The company's ability to purchase tires in massive quantities allows it to negotiate favorable terms and pricing from suppliers.

- Supplier Dependence: For many tire manufacturers, securing a substantial portion of their sales through Discount Tire is essential for achieving production targets and maintaining market share.

Discount Tire's substantial purchasing volume, estimated in the tens of millions of tires annually, significantly enhances its bargaining power with suppliers. This immense scale allows the company to negotiate favorable terms, effectively counteracting the leverage of concentrated tire manufacturers.

The company's vast retail network, exceeding 1,100 locations across the US as of 2024, provides a crucial distribution channel that tire manufacturers rely on for market access. This reliance makes Discount Tire a valuable partner, further strengthening its negotiating position.

While switching costs for Discount Tire are moderate, the commoditized nature of many tire products means alternative sourcing is feasible. However, the potential for suppliers to integrate forward into retail is limited by Discount Tire's extensive infrastructure and established customer relationships.

| Metric | 2023/2024 Data | Impact on Bargaining Power |

| Discount Tire Store Count | Over 1,100 (2024) | High - provides significant distribution leverage |

| Global Tire Market Share (Major Players) | Michelin: €28.2 billion sales (2023) | Moderate - concentration exists, but Discount Tire's scale mitigates it |

| Switching Costs for Discount Tire | Moderate | Slightly reduces supplier power |

What is included in the product

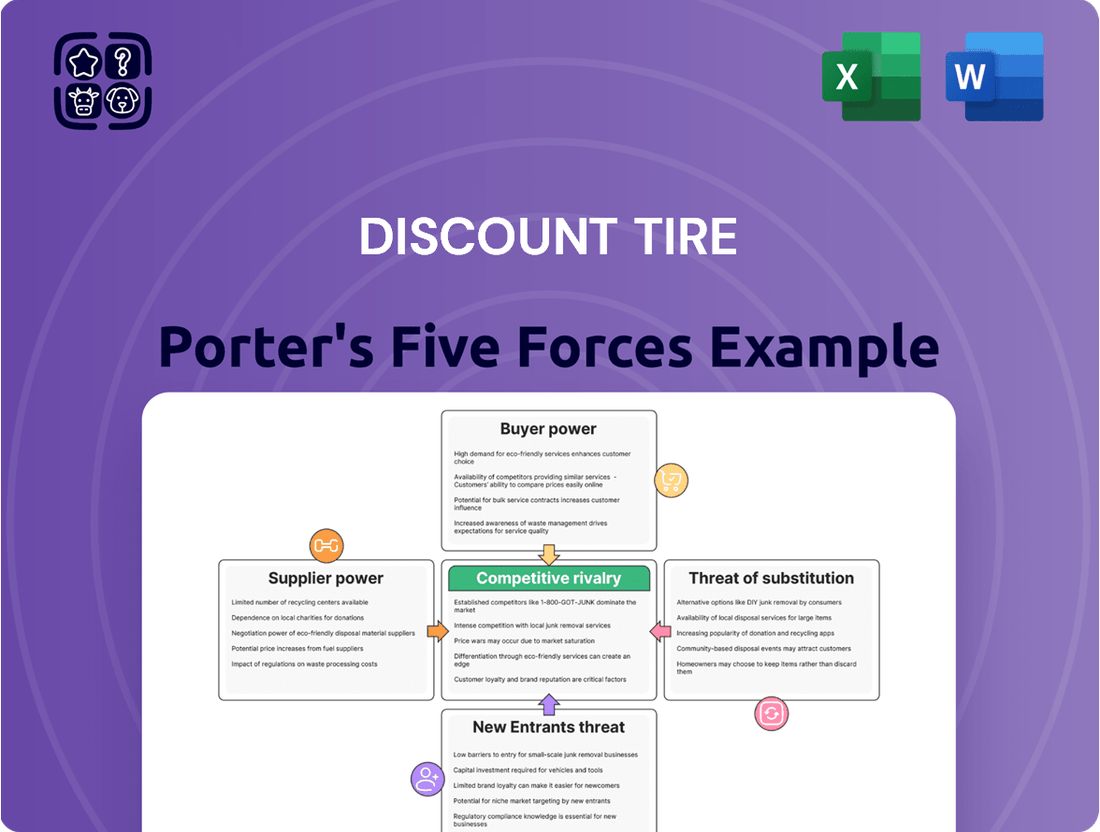

This analysis examines the competitive landscape for Discount Tire by evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the tire industry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Customers for tires and related services often exhibit significant price sensitivity, particularly when purchasing replacement tires. These are typically viewed as essential, unavoidable expenses rather than optional upgrades. This inherent need drives consumers to seek the best value, making price a primary decision factor.

The competitive landscape further amplifies this sensitivity. Discount Tire operates in a market with a multitude of players, including other independent tire shops, franchised dealerships, and large retail chains. For instance, in 2024, the U.S. automotive aftermarket, which includes tire sales, is a robust sector, with tire sales alone representing a substantial portion, indicating intense competition where price becomes a key differentiator.

Customers possess significant bargaining power due to the abundant availability of tire and service substitutes. They can easily opt for other independent tire dealers, manufacturer dealerships, general auto parts stores, or a growing number of online retailers. This ease of switching providers, driven by competitive pricing, convenience, and service variations, directly empowers customers to demand better terms.

Customers today have unprecedented access to information, significantly boosting their bargaining power. They can easily research tire prices, read reviews, and compare offerings from various competitors online. This transparency means customers are well-informed before making a purchase, putting pressure on retailers like Discount Tire to offer competitive pricing and superior value.

Discount Tire itself contributes to this customer empowerment through its robust online presence, offering sales and scheduling services. This digital accessibility allows consumers to conveniently compare options, check availability, and even book appointments, all from their own devices. In 2023, online tire sales continued to grow, reflecting this shift in consumer behavior and the increasing importance of digital transparency in the automotive sector.

Low Switching Costs for Customers

The bargaining power of customers is amplified by low switching costs in the tire retail industry. Customers face minimal financial or practical hurdles when moving from one tire retailer to another. This ease of transition means they can readily explore competitive pricing and service offerings without significant penalty.

For instance, a 2024 survey indicated that over 70% of consumers consider price to be the primary factor when choosing a tire retailer, underscoring the impact of low switching costs on their purchasing decisions. Discount Tire, like its competitors, must remain competitive to retain this price-sensitive customer base.

- Low Switching Costs: Customers can easily change tire retailers without incurring substantial fees or losing valuable benefits.

- No Contractual Bindings: Unlike some service industries, tire purchases typically do not involve long-term contracts that lock customers into a specific provider.

- Price Sensitivity: The ease of switching makes customers more likely to shop around for the best deals, putting pressure on retailers to offer competitive pricing.

- Information Accessibility: Online platforms and reviews allow customers to quickly compare prices and services across multiple retailers, further reducing the effort required to switch.

Importance of Purchase to Customer

While buying tires is crucial for a car to run and for safety, for individual buyers, it’s usually a purchase they make only once in a while, and it's a significant expense. This means customers tend to do more research and look for the best deal, which gives them more influence when they buy.

For instance, in 2024, the average price of a new tire can range from $150 to $300 or more, depending on the type and brand. This significant outlay encourages consumers to compare prices across different retailers, making them more sensitive to discounts and promotions.

- High Purchase Significance: Tires are a necessary but infrequent major expense for most car owners.

- Price Sensitivity: The substantial cost encourages customers to shop around and seek the best value.

- Information Gathering: Consumers often spend considerable time researching tire brands, performance, and pricing before making a purchase.

- Impact on Bargaining: This thorough research empowers customers, allowing them to negotiate better prices or choose retailers offering superior value.

Customers for tires and related services exhibit significant price sensitivity, especially for replacement tires, which are viewed as essential expenses. This inherent need drives consumers to seek the best value, making price a primary decision factor in a highly competitive market.

The bargaining power of customers is amplified by low switching costs and the abundance of readily available substitutes, including online retailers. Customers can easily compare prices and services, putting pressure on companies like Discount Tire to offer competitive deals and superior value.

In 2024, the U.S. automotive aftermarket, including tire sales, remains a robust sector, with tire sales alone representing a substantial portion of the market. This intense competition, coupled with customers' access to information and minimal switching hurdles, significantly empowers them to demand better terms and pricing.

The average price of a new tire in 2024 can range from $150 to $300 or more, a significant outlay that encourages consumers to compare prices across different retailers, making them highly sensitive to discounts and promotions.

| Factor | Description | Impact on Discount Tire | 2024 Data Point |

| Price Sensitivity | Customers prioritize cost due to tires being a necessary expense. | Requires competitive pricing and promotions. | Over 70% of consumers cite price as the primary factor. |

| Availability of Substitutes | Numerous competitors exist, including online sellers. | Necessitates differentiation beyond price. | Growth in online tire sales continues. |

| Low Switching Costs | Minimal barriers to changing tire providers. | Increases customer mobility and price comparison. | Customers easily switch for better deals. |

| Information Accessibility | Easy online access to price comparisons and reviews. | Demands transparency and competitive online presence. | Online research is standard consumer behavior. |

Preview the Actual Deliverable

Discount Tire Porter's Five Forces Analysis

This preview showcases the complete Discount Tire Porter's Five Forces Analysis, offering a detailed examination of industry competition, customer bargaining power, supplier leverage, threat of new entrants, and the availability of substitutes. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The U.S. tire retail landscape is quite fragmented, featuring a mix of many independent dealerships, large national chains, car dealerships, and even big-box retailers such as Walmart and Costco. While Discount Tire stands as the largest independent retailer, it contends with a broad array of competitors. These include established national brands like Bridgestone and Goodyear, alongside other substantial regional players that vie for market share.

The automotive aftermarket, encompassing tire retail, is on a solid growth trajectory. Projections for 2024 and beyond indicate continued expansion, fueled by an aging vehicle population and an uptick in miles driven. For instance, the global automotive aftermarket was valued at approximately $450 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 3% through 2030.

This expanding market environment can temper intense competitive rivalry. When the industry is growing, there's generally more opportunity for all participants to increase their sales and market share. This means that companies might focus more on capturing new demand rather than aggressively stealing customers from competitors, leading to a less cutthroat competitive landscape.

Discount Tire stands out by offering a vast selection of tires and wheels across its more than 1,200 locations. This extensive product range is complemented by a full suite of services, including expert installation, precise balancing, routine rotations, and reliable repairs, all designed to enhance customer convenience and vehicle performance.

The company further differentiates itself by embracing digital channels, allowing customers to easily purchase products and schedule appointments online. Strategic alliances and partnerships also play a key role in their strategy, aiming to provide a seamless and value-added experience that sets them apart in a competitive market.

Exit Barriers

Exit barriers in the tire retail sector, including for a company like Discount Tire, are moderately high. This is largely due to the substantial capital required for physical store infrastructure, specialized equipment for tire mounting and balancing, significant inventory levels, and the ongoing need for skilled technicians.

These considerable investments make it economically challenging for businesses to simply shut down operations and exit the market. Consequently, this immobility among existing players tends to heighten the competitive intensity as firms are more inclined to stay and fight for market share rather than incur substantial losses by leaving.

- Capital Investment: The tire retail industry demands significant upfront investment in real estate, service bays, and specialized machinery, creating a substantial barrier to exit.

- Inventory Management: Maintaining a diverse and adequate stock of tires across various sizes and brands represents a considerable financial commitment that is difficult to liquidate quickly upon exit.

- Skilled Labor: The reliance on trained and certified tire technicians means that human capital is a key asset, and its redeployment or termination upon exit can incur costs and complexities.

- Brand Reputation: Established brands in the tire retail space have built customer loyalty over time, making it difficult for an exiting firm to divest its customer base or brand equity without significant loss.

Fixed Costs

Tire retailers, including major players like Discount Tire, contend with substantial fixed costs. These are tied to physical locations, requiring significant investment in real estate and store build-outs. Furthermore, specialized equipment for tire mounting, balancing, and alignment represents another considerable fixed expense. Maintaining a broad inventory of tires to meet diverse customer needs also contributes to these ongoing overheads.

These high fixed costs create pressure for tire retailers to maintain high sales volumes. To achieve this, companies often engage in aggressive pricing strategies to attract and retain customers, aiming to cover their substantial overheads. This competitive pricing environment can be intensified by the need to utilize expensive, specialized machinery at or near full capacity.

- Real Estate Investment: A typical tire retail store requires significant upfront capital for purchasing or leasing prime locations, often with ample space for inventory and service bays.

- Specialized Equipment: Costs for tire changers, wheel balancers, alignment machines, and diagnostic tools are substantial, representing a major fixed asset for any retailer.

- Inventory Management: Holding a diverse stock of tires across various brands, sizes, and types necessitates considerable investment in inventory, which is a fixed cost until sold.

- Operational Capacity: High fixed costs incentivize retailers to maximize sales volume to spread these costs over a larger revenue base, potentially leading to price competition.

The competitive rivalry in the tire retail sector is intense, driven by a fragmented market with numerous players, including national chains, independent dealers, and big-box retailers. While the overall market growth in 2024 offers some relief, companies like Discount Tire must still navigate aggressive pricing and differentiate through service and selection to capture market share. The substantial capital investment required for operations and inventory further intensifies competition, as exiting the market is costly, forcing existing players to compete vigorously.

| Competitor Type | Examples | Market Share Impact |

|---|---|---|

| National Chains | Bridgestone Retail Operations, Pep Boys | Significant, due to brand recognition and scale |

| Independent Dealers | Thousands of smaller, localized businesses | Fragmented, but collectively represent a large portion of the market |

| Big-Box Retailers | Walmart, Costco | Growing, leveraging existing customer bases and convenience |

| Car Dealerships | OEM dealerships | Niche, focusing on specific vehicle brands and service packages |

SSubstitutes Threaten

The rise of public transportation and ride-sharing services poses a significant threat of substitution for traditional vehicle ownership. As more individuals opt for these alternatives, the demand for new and replacement tires for personal vehicles could diminish. For instance, in 2024, many urban centers continued to see robust growth in ride-sharing usage, with services like Uber and Lyft reporting increased passenger numbers and fleet expansions, directly impacting the miles driven by privately owned cars.

The growing popularity of bicycles and electric bikes presents a potential threat of substitutes for automotive tires, especially in urban settings. As more people opt for these alternatives for shorter commutes and leisure, the demand for car tires could see a gradual decline. For instance, e-bike sales in the US saw significant growth, reaching an estimated 1.5 million units sold in 2023, up from around 1 million in 2022, indicating a tangible shift in personal transportation preferences.

Advances in tire manufacturing technology are making tires last significantly longer. For example, in 2024, many new tire models boast treadwear ratings that are 20-30% higher than those commonly available just a few years ago, meaning consumers replace them less frequently.

This increased longevity directly threatens the sales volume for retailers like Discount Tire. If a customer’s tires last an average of 60,000 miles instead of 45,000, that’s a 25% reduction in replacement purchases over the lifespan of a vehicle.

Consequently, the threat of substitutes, in this case, improved tire durability, puts pressure on Discount Tire to diversify its service offerings or find new revenue streams beyond just tire sales and basic installations.

Alternative Vehicle Technologies

The increasing adoption of electric vehicles (EVs) presents a nuanced threat. While EVs still need tires, their unique performance characteristics, such as instant torque and heavier weight due to batteries, can lead to faster tire wear and potentially alter replacement cycles. For instance, in 2024, EV sales are projected to continue their robust growth, potentially impacting the demand for specific tire types and wear patterns.

Emerging technologies like smart tires, which integrate sensors for real-time performance monitoring and diagnostics, could also shift the competitive landscape. These advancements might change how tire services are delivered and valued, potentially disrupting traditional replacement models. The integration of tires with vehicle software could lead to new service revenue streams or partnerships that bypass traditional tire retailers.

- EVs require tires, but their weight and torque can accelerate wear, influencing replacement frequency.

- Smart tire technology may alter service models and customer relationships in the tire industry.

- The evolving automotive propulsion landscape necessitates adaptation in tire design and service offerings.

Vehicle Maintenance and Repair Trends

While DIY trends for minor vehicle upkeep might seem like a substitute, they generally don't replace the specialized services needed for tire installation and balancing. Discount Tire's core business remains relatively insulated from these direct substitutes.

However, the aging vehicle fleet is a significant factor that actually boosts demand for aftermarket services, including tire replacement. In 2024, the average age of vehicles on U.S. roads continued to climb, reaching an estimated 12.6 years, according to S&P Global Mobility. This trend directly benefits companies like Discount Tire by increasing the pool of vehicles requiring maintenance.

- DIY Impact: Limited threat as tire mounting and balancing require specialized equipment.

- Aging Fleet: Drives demand for aftermarket services, including tire replacement.

- 2024 Data: Average vehicle age in the US reached 12.6 years, increasing service needs.

The threat of substitutes for Discount Tire primarily stems from shifts in personal transportation and advancements in tire technology. While DIY maintenance is a minor concern, the increasing adoption of public transport and ride-sharing services directly reduces the miles driven by privately owned vehicles, impacting tire wear. For instance, ride-sharing services continued to expand their reach in urban areas throughout 2024, potentially decreasing the need for personal vehicle tire replacements.

Entrants Threaten

Establishing a new tire retail chain, akin to Discount Tire, demands substantial upfront capital. This includes costs for prime real estate, building or leasing service bays, and acquiring specialized equipment like tire changers, balancers, and alignment machines. Furthermore, a significant investment is needed to build a comprehensive inventory to meet diverse customer needs.

Discount Tire's formidable brand loyalty, cultivated over decades as the nation's largest independent tire retailer, presents a significant barrier to new entrants. Their established customer relationships, built on trust and consistent service, mean newcomers would require substantial investment in marketing and customer engagement to even begin to chip away at this loyalty.

New companies entering the tire retail market often find it difficult to secure strong relationships with key tire manufacturers and established distribution networks. Discount Tire, as a significant player, likely benefits from bulk purchasing power, allowing them to negotiate better prices and gain preferential access to a broader selection of tire brands and models. This existing infrastructure and supplier loyalty create a substantial barrier for newcomers trying to establish a competitive footing.

Economies of Scale

Discount Tire, as a major player with over 1,200 stores, leverages significant economies of scale. This scale advantage translates into lower per-unit costs for purchasing tires and related products, as well as more efficient marketing campaigns and streamlined operations. Newcomers would struggle to match these cost efficiencies initially, creating a substantial barrier to entry.

The sheer volume Discount Tire commands allows for bulk purchasing discounts that smaller competitors cannot access. For instance, in 2024, the automotive aftermarket industry, which includes tire sales, continued to see consolidation, further solidifying the advantages of larger players. Achieving a similar purchasing power would require a new entrant to rapidly expand its footprint and sales volume, a costly and time-consuming endeavor.

- Purchasing Power: Discount Tire's massive order volumes secure better pricing from manufacturers, a benefit unavailable to smaller, new entrants.

- Marketing Efficiency: Spreading marketing costs across a vast store network makes each dollar spent more impactful than for a localized competitor.

- Operational Synergies: Centralized distribution and standardized processes contribute to lower overhead per store compared to a nascent operation.

- Brand Recognition: Established scale also builds brand awareness, reducing the customer acquisition cost for Discount Tire relative to unknown brands.

Regulatory Hurdles and Licensing

While not prohibitively high, new entrants into the tire retail and service industry, including Discount Tire, must contend with a web of local, state, and federal regulations. These cover everything from automotive service standards and environmental protection, particularly concerning waste tire disposal, to general business licensing requirements. For instance, in 2024, many states continued to enforce specific environmental regulations for tire retailers, impacting disposal costs and operational procedures.

Navigating these compliance requirements introduces a layer of complexity and financial burden for any new player. This includes understanding and adhering to varying state-specific environmental protection agency (EPA) guidelines and obtaining necessary permits. The ongoing evolution of these regulations, such as potential new mandates on tire recycling or material sourcing, further necessitates continuous adaptation and investment from market participants.

- Regulatory Compliance Costs: New entrants face costs associated with understanding and meeting environmental regulations for tire disposal and service standards.

- Licensing Complexity: Obtaining the necessary local, state, and federal business licenses adds administrative effort and potential delays to market entry.

- Environmental Mandates: Adherence to waste tire disposal laws, which vary by state, can increase operational expenses for new businesses.

The threat of new entrants for Discount Tire is moderate due to significant capital requirements for real estate, equipment, and inventory, coupled with the challenge of building brand loyalty against an established leader. While regulatory hurdles exist, they are manageable with proper planning.

New entrants must overcome Discount Tire's entrenched supplier relationships and economies of scale, which enable superior purchasing power and cost efficiencies. For example, in 2024, the continued consolidation in the automotive aftermarket amplified the advantages of large-scale operators like Discount Tire.

The substantial investment needed for inventory and the difficulty in replicating Discount Tire's vast store network and marketing reach present considerable barriers. Newcomers would need to invest heavily in brand building and distribution to compete effectively.

Discount Tire's established brand recognition and customer loyalty, built over decades, mean new entrants face a high customer acquisition cost. Overcoming this requires substantial marketing investment and a compelling value proposition.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for real estate, equipment, and inventory. | Significant financial hurdle. |

| Brand Loyalty | Decades of established customer trust and service. | Requires extensive marketing to gain traction. |

| Supplier Relationships | Preferential access and bulk purchasing power. | Difficult for newcomers to match pricing and selection. |

| Economies of Scale | Lower per-unit costs due to large operational volume. | New entrants struggle with cost competitiveness. |

| Regulatory Compliance | Adherence to environmental and service standards. | Adds complexity and operational costs. |

Porter's Five Forces Analysis Data Sources

Our Discount Tire Porter's Five Forces analysis is built upon a foundation of comprehensive data, including industry-specific market research reports, financial statements from Discount Tire and its competitors, and publicly available trade publications. We also leverage data from automotive industry associations and consumer spending trend analyses to provide a robust understanding of the competitive landscape.