Diös Fastigheter Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diös Fastigheter Bundle

Diös Fastigheter's marketing mix is a carefully orchestrated symphony of strategies designed to capture and retain market share.

Delve into their product offerings, exploring how they tailor properties to meet diverse tenant needs and market demands.

Uncover the nuances of their pricing strategies, understanding how they balance value and profitability in a competitive landscape.

Discover the strategic placement of their properties, examining how location and accessibility contribute to their overall appeal.

Analyze their promotional tactics, revealing how they communicate their brand message and attract their target audience.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Diös Fastigheter. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Diös Fastigheter maintains a diversified property portfolio, strategically balancing commercial and residential assets across northern Sweden. Commercial properties, encompassing offices, retail, and industrial/warehouse spaces, generate the majority of their rental income. As of Q1 2025, a substantial portion of this income, approximately 40%, is derived from stable public-sector tenants, including municipalities and regions. This strong tenant base provides a secure and predictable cash flow, underpinning the company's financial stability and mitigating market volatility. The strategic focus on these resilient segments ensures consistent operational performance.

Diös Fastigheter’s core product offering deeply integrates urban and property development across its key markets, focusing on creating modern and attractive areas. This includes active engagement in new construction, with ongoing projects valued at approximately SEK 2.5 billion for 2024-2025, and significant redevelopment initiatives. By transforming existing sites, Diös not only adds high-quality, energy-efficient buildings to its portfolio, but also enhances the value of surrounding properties. This strategy contributes to the overall attractiveness and economic vitality of the cities, aligning with an expected 3-5% annual rental income growth from new developments by mid-2025.

Diös Fastigheter prioritizes sustainability, evidenced by a growing portfolio of environmentally certified properties, with a significant portion meeting stringent BREEAM standards. Their commitment includes substantial investments in energy efficiency upgrades and sustainable materials for new constructions, aligning with increasing market demand for green buildings. This product focus is bolstered by a robust green financing framework, making Diös's offerings highly attractive to both environmentally conscious tenants and investors in 2024-2025.

Tenant-Centric Solutions

Diös Fastigheter’s tenant-centric solutions embody its value proposition of 'Everything is possible!', ensuring tenant prosperity through tailored premises. The company focuses on delivering modern, efficient spaces and custom adaptations to meet specific business needs. Recognizing the evolving role of offices as crucial brand builders and meeting places, Diös actively invests in fulfilling these demands. For instance, Diös reported an occupancy rate of around 92.5% across its portfolio as of late 2024, reflecting strong tenant satisfaction and retention in its adapted spaces.

- Diös prioritizes tenant needs, offering adaptable premises.

- The office environment is seen as a key brand builder and meeting hub.

- Occupancy rates near 92.5% in late 2024 highlight successful tenant retention.

- Investments focus on modern, efficient, and customized spaces for businesses.

Value-Adding Property Management

Diös Fastigheter’s product extends beyond physical space, encompassing comprehensive property management services. Local teams across their ten cities in northern Sweden ensure a close-to-market presence, a significant competitive advantage. This active management strategy aims to boost rental levels and minimize vacancies, ensuring properties are well-maintained and maximizing value. As of Q1 2024, Diös maintained an economic occupancy rate of approximately 92.4%, reflecting effective management.

- Local presence in ten cities enhances tenant relations and operational efficiency.

- Targeted management efforts contribute to an economic occupancy rate of around 92.4% as of Q1 2024.

- Focus on increasing rental levels supports sustainable revenue growth.

- Proactive maintenance reduces operational costs and preserves asset value.

Diös Fastigheter’s product encompasses a diversified portfolio of commercial and residential properties, with a strong focus on urban development and sustainable building practices. They actively engage in new construction and redevelopment, investing approximately SEK 2.5 billion for 2024-2025 in energy-efficient, environmentally certified spaces. Their tenant-centric approach delivers tailored premises, supported by comprehensive local property management, achieving an economic occupancy rate of around 92.4% as of Q1 2024.

| Product Aspect | Key Feature | 2024/2025 Data |

|---|---|---|

| Property Portfolio | Diversified commercial and residential assets | 40% rental income from public-sector tenants (Q1 2025) |

| Development & Sustainability | New construction, redevelopment, green certifications | SEK 2.5 billion in projects (2024-2025); 3-5% annual rental growth from new developments (mid-2025) |

| Tenant Solutions & Management | Tailored spaces, local property management | 92.5% occupancy rate (late 2024); 92.4% economic occupancy (Q1 2024) |

What is included in the product

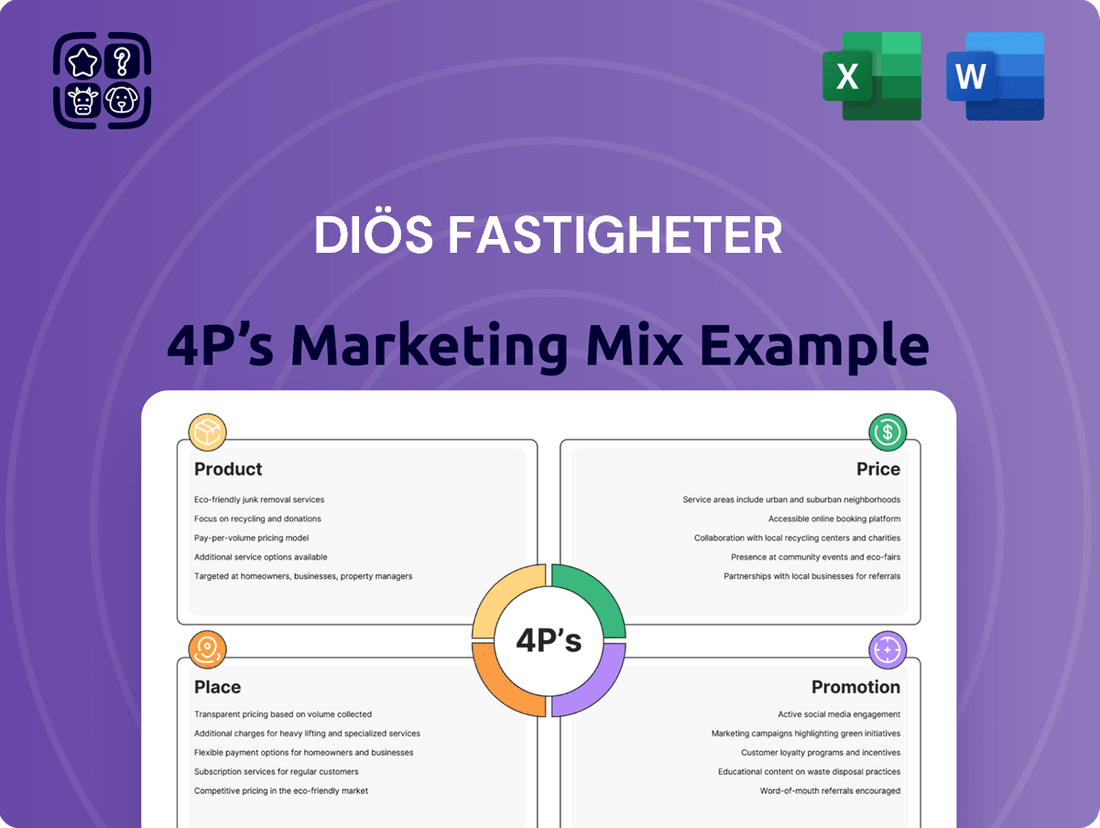

Diös Fastigheter's 4P's Marketing Mix Analysis provides a comprehensive examination of their Product, Price, Place, and Promotion strategies, offering actionable insights into their market positioning.

This document is designed for professionals seeking a data-driven understanding of Diös Fastigheter's marketing approach, enabling strategic comparisons and informed decision-making.

Simplifies Diös Fastigheter's marketing strategy by clearly outlining their 4Ps, addressing the pain point of complex marketing plans for quick stakeholder understanding.

Provides a concise, actionable overview of Diös Fastigheter's marketing mix, relieving the burden of sifting through extensive data for busy executives.

Place

Diös Fastigheter strategically concentrates its operations within ten designated growth cities in northern Sweden, stretching from Borlänge to Luleå. This localized approach fosters a dominant market position and deep expertise in regions experiencing significant economic expansion. The strategy leverages the strong underlying growth potential, particularly driven by the ongoing green industrial transition. For instance, northern Sweden is projected to receive substantial investments, with an estimated SEK 1,000 billion by 2030, significantly boosting demand for commercial properties.

Diös Fastigheter strategically centers its property portfolio within the vibrant central business districts of its chosen northern Swedish cities. This prime placement ensures exceptional visibility and accessibility, significantly boosting attractiveness for both commercial and residential tenants. As of early 2025, over 80% of Diös's property value is located in these core urban areas. Owning properties in these high-demand locations provides long-term revenue stability and significantly limits vacancy risk, contributing to their strong financial performance.

Diös Fastigheter maintains dedicated local teams across its ten strategic cities in northern Sweden, ensuring close tenant relationships and proactive market engagement.

This decentralized approach, a core competitive advantage, allows for efficient property management and strong local market intelligence.

Their emphasis on local presence supports an impressive occupancy rate, reaching 91.5% as of Q1 2024, reflecting effective on-the-ground competence.

This strategy combines economies of scale with crucial local expertise, strengthening their market position in northern Sweden.

Digital and Online Channels

Diös Fastigheter primarily leverages dios.se as its central digital channel, ensuring stakeholders access crucial information. This platform is vital for distributing financial reports, such as their Q1 2024 report, and forthcoming 2024 full-year report, alongside press releases and detailed property portfolio insights. By June 2025, the website remains instrumental for transparent market engagement and investor relations, facilitating direct access to corporate updates.

- Diös.se serves as the official hub for all investor and financial communications.

- The site provides direct access to interim reports and annual reports, enhancing transparency.

- Digital channels facilitate immediate dissemination of press releases and corporate news.

- Online presence ensures 24/7 accessibility for global stakeholders seeking property portfolio details.

Active Transaction Market Participation

Diös Fastigheter actively engages in property transactions, strategically acquiring and divesting assets to refine its portfolio. This approach ensures the company focuses on high-potential properties in northern Sweden, optimizing its geographic footprint. For instance, in 2024, Diös continued to divest non-strategic assets while securing new developments to enhance its market position. This active management maintains a portfolio concentrated in growth areas, supporting future value creation.

- Portfolio Optimization: Diös aims for a net investment level around zero in 2024/2025, balancing acquisitions with divestments to maintain a strong financial position.

- Strategic Divestments: In Q1 2024, Diös divested properties for a total of SEK 31 million, aligning with their strategy to divest non-core assets.

- Acquisition Focus: Acquisitions target prioritized locations within northern Sweden with identified development potential.

- Value Creation: Active transaction management contributes to an improved property value per share, recorded at SEK 109.90 at the close of Q1 2024.

Diös Fastigheter strategically focuses its property portfolio within ten rapidly growing cities across northern Sweden, primarily in central business districts, where over 80% of its property value resides as of early 2025. This localized approach, supported by dedicated on-the-ground teams, ensures deep market penetration and contributes to a robust 91.5% occupancy rate as of Q1 2024. The company further optimizes its geographic footprint through active portfolio management, aiming for a net investment level around zero in 2024/2025. Digital channels like dios.se complement this by providing transparent access to crucial corporate and property information for all stakeholders.

| Metric | Value (Q1 2024) | Strategic Focus |

|---|---|---|

| Property Value in CBDs | >80% (early 2025) | Prime urban locations |

| Occupancy Rate | 91.5% | Local market expertise |

| Net Investment Level | Around zero (2024/2025) | Portfolio optimization |

What You Preview Is What You Download

Diös Fastigheter 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence.

This comprehensive Diös Fastigheter 4P's Marketing Mix Analysis provides an in-depth examination of their product, price, place, and promotion strategies.

You'll gain valuable insights into how Diös Fastigheter positions its properties and services in the market.

The analysis details their approach to product development, rental pricing, property location, and promotional activities.

This is the same ready-made Marketing Mix document you'll download immediately after checkout.

Promotion

Diös Fastigheter prioritizes transparent investor relations, regularly publishing interim and annual reports on its website. For instance, the Q1 2025 report, released in April, was followed by a webcast where CEO and CFO engaged directly with stakeholders. This consistent communication strategy, including teleconferences, aims to foster trust and build long-term shareholder value, reflecting a commitment to financial market engagement in 2024 and 2025.

Diös Fastigheter effectively leverages press releases to announce significant developments, ensuring market transparency and visibility. These releases, often distributed through channels like Cision and Nasdaq, cover new lease agreements, property transactions, and strategic initiatives. For instance, in Q1 2024, Diös announced new leases totaling approximately 9,000 square meters, showcasing active portfolio management. Such frequent updates maintain the company's profile and demonstrate ongoing market activity.

The corporate website, dios.se, functions as Diös Fastigheter's primary digital hub, centralizing information on their property portfolios and sustainability initiatives. This platform is meticulously tailored for diverse stakeholders, including over 3,000 tenants and a growing investor base. It serves as a crucial tool for promoting their vision of creating Sweden's most inspiring cities. The digital presence supports investor relations, with Diös reporting a property value of SEK 28.5 billion as of Q1 2024, accessible through the site.

Sustainability as a al Tool

Diös Fastigheter leverages sustainability as a key promotional tool, highlighting its commitment to green financing and attracting a diverse pool of investors and tenants. The company was an early adopter, aligning its green finance framework with the EU Taxonomy, which underscores its leadership in sustainable urban development in the Nordics. This strategic positioning enhances its appeal, especially as green investments surge, with global sustainable funds reaching over $3.3 trillion by early 2024. Certifications such as BREEAM and the Sweden Green Building Council validate the environmental performance of their properties, reinforcing their market credibility.

- Diös's green finance framework aligns with the EU Taxonomy, attracting ESG-focused capital.

- Utilizes BREEAM and Sweden Green Building Council certifications to validate property environmental standards.

- Sustainability initiatives attract tenants seeking energy-efficient and environmentally responsible premises.

- Promotional efforts highlight Diös's role in sustainable urban development, enhancing brand value.

Direct Communication and Local Engagement

Diös Fastigheter leverages its local teams across every city to foster direct communication and robust engagement with tenants. This approach aligns with their core values of being Simple, Close, and Active, emphasizing proximity and responsiveness. By actively listening and remaining accessible, Diös transforms its local presence into a significant promotional asset, aiming to cultivate tenant loyalty and create enduring value. For instance, in Q1 2025, Diös reported a tenant retention rate of approximately 85% across its portfolio, reflecting the success of these direct engagement strategies.

- Diös maintains local teams in every city for direct tenant interaction.

- Core values Simple, Close, Active guide their promotional outreach.

- Tenant retention rates, such as 85% in Q1 2025, underscore engagement success.

- Proximity and responsiveness build loyalty and add tenant value.

Diös Fastigheter’s promotion strategy integrates transparent investor relations and strategic press releases, like those detailing Q1 2025 reports and Q1 2024 leases. Their corporate website, dios.se, serves as a central digital hub, showcasing a Q1 2024 property value of SEK 28.5 billion. Sustainability, aligned with EU Taxonomy, is a key differentiator, attracting ESG-focused capital. Direct engagement through local teams ensures high tenant retention, reaching 85% in Q1 2025.

| Promotional Channel | Key Activity/Focus | 2024/2025 Data Point |

|---|---|---|

| Investor Relations | Transparent reporting & stakeholder engagement | Q1 2025 report released in April |

| Press Releases | Market transparency & significant developments | Q1 2024 new leases: 9,000 sqm |

| Corporate Website | Digital information hub & stakeholder resource | Q1 2024 property value: SEK 28.5 billion |

| Sustainability Initiatives | Green financing & ESG appeal | EU Taxonomy alignment, global sustainable funds over $3.3T (early 2024) |

| Local Teams/Tenant Engagement | Direct communication & tenant loyalty | Q1 2025 tenant retention: 85% |

Price

Diös Fastigheter's rental income is its primary revenue source, with prices dynamically set according to prevailing market rates in each specific location. The company observes an increasing willingness to pay for modern, efficient premises, pushing peak rent levels to new highs in its strongest cities. For Q2 2025, rental income reached SEK 666 million, a clear increase from the prior year.

Diös Fastigheter strategically locks in stable revenue through long-term lease agreements, a key component of its pricing strategy. Many new developments, like the property leased to Dalarna University, feature contracts extending to 2039, ensuring predictable income streams for over 15 years. This approach, often involving public sector tenants, significantly mitigates market volatility. Such agreements provide a robust financial foundation, supporting consistent profitability and valuation stability through 2025 and beyond.

Diös Fastigheter effectively implements value-based pricing for its premium properties, commanding higher rents for newly developed, sustainability-certified buildings, which often feature high energy efficiency ratings. Their strategic urban development, exemplified by projects like the revitalization of central Sundsvall or Östersund, elevates quality standards, allowing for average rent increases of 3-5% on new leases in desirable locations during 2024. By divesting fully developed, lower-yielding assets, Diös reinvests capital into projects with higher return potential, such as new builds projected to achieve initial yields of 6-7% upon completion in 2025.

Dynamic Transaction Pricing

Diös Fastigheter employs a dynamic transaction pricing strategy for property acquisitions and divestments, driven by book value, yield, and strategic alignment. The company aims to divest properties above their book value, reflecting strong asset management and market positioning. For acquisitions, Diös prioritizes assets offering robust cash flows and significant development potential within their core northern Swedish markets. This active transaction approach is fundamental to their value creation model, optimizing portfolio performance.

- Diös targets acquiring properties with yields aligning with or exceeding current market rates, often above 5.0% for prime assets in 2024.

- Divestments frequently aim for prices exceeding book value, as seen in their 2023 transactions where sales prices generally matched or slightly surpassed book values.

- The portfolio’s strategic fit, focusing on growth regions, guides investment decisions, ensuring long-term value appreciation.

- This flexibility enables Diös to adapt swiftly to market shifts, enhancing overall shareholder returns.

Financing Costs Management

Financing costs, representing the price of capital, are central to Diös's financial strategy. The company prioritizes actively lowering its average interest rate through strategic debt refinancing. By Q2 2025, Diös successfully reduced its average interest rate to 4.0%. This reduction directly boosts property management income and enhances overall profitability, reflecting effective capital cost management.

- Q2 2025 average interest rate: 4.0%

- Directly improves property management income.

- Enhances overall profitability.

Diös Fastigheter employs dynamic pricing based on market rates, achieving 3-5% average rent increases on new leases for premium properties in 2024. Long-term agreements secure stable revenue, with some extending to 2039. Acquisitions target yields above 5.0% in 2024, while new builds project 6-7% yields by 2025. Financing costs are actively managed, with the average interest rate at 4.0% by Q2 2025.

| Metric | 2024 | 2025 |

|---|---|---|

| New Lease Rent Increase | 3-5% | N/A |

| Target Acquisition Yield | >5.0% | N/A |

| New Builds Initial Yield | N/A | 6-7% |

| Avg Interest Rate (Q2) | N/A | 4.0% |

4P's Marketing Mix Analysis Data Sources

Our Diös Fastigheter 4P's analysis is constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside market data from property listings and industry real estate reports. We also incorporate information on their property portfolio and development strategies.