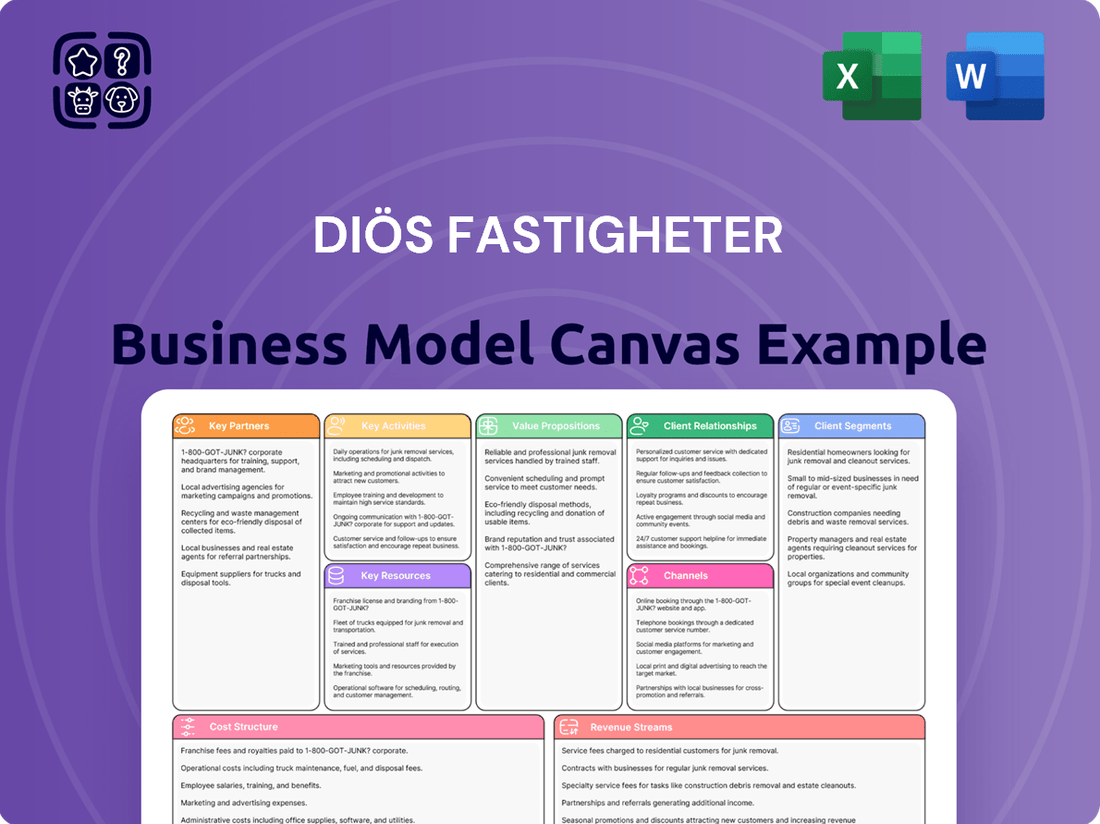

Diös Fastigheter Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diös Fastigheter Bundle

Unlock the full strategic blueprint behind Diös Fastigheter's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Diös Fastigheter’s strategy is deeply intertwined with urban development, making strong partnerships with city and municipal governments across northern Sweden essential. These collaborations are crucial for securing land allocations and navigating complex zoning regulations, ensuring projects align with public infrastructure plans. In 2024, Diös continued active dialogues with municipalities like Umeå and Sundsvall, key growth regions in their portfolio. This symbiotic relationship ensures their projects contribute to and benefit from the region's broader growth agenda and long-term planning.

Diös Fastigheter deeply relies on a robust network of construction, architecture, and engineering firms for its development and renovation projects across northern Sweden. These partnerships are crucial for ensuring the quality, cost-efficiency, and timely delivery of new builds and property upgrades. For instance, Diös plans significant investments in existing properties, with a 2024 investment level projected at approximately SEK 200 million for ongoing projects, underscoring the need for reliable partners. Selecting partners with proven expertise in sustainable building practices is also key to meeting their ambitious ESG goals, such as achieving climate neutrality by 2030.

Robust relationships with financial institutions are fundamental for Diös Fastigheter, vital in the capital-intensive real estate sector. These partners, including major Swedish banks, provide crucial financing for property acquisitions and development projects. As of early 2024, access to diverse funding sources is essential for managing debt and maintaining financial flexibility. Favorable lending terms are key for Diös to execute its growth strategies, enabling continued investment in its property portfolio.

Major Commercial Tenants

Diös Fastigheter considers its major commercial tenants strategic partners, working collaboratively to foster vibrant city centers. By engaging anchor tenants, including large corporations and public sector entities, Diös co-creates spaces tailored for long-term needs. This approach ensures high occupancy, with a reported economic occupancy rate of 94.6% as of Q1 2024, and stable cash flows through extended lease agreements.

- Diös's Q1 2024 economic occupancy rate stood at 94.6%.

- The average lease duration for Diös's commercial portfolio is approximately 4.2 years.

- Public sector tenants represent a significant portion of Diös's rental income, contributing to stability.

- Strategic partnerships with key tenants minimize vacancy risks and enhance property value.

Sustainability and Technology Providers

Diös Fastigheter collaborates with leading sustainability and technology providers to enhance its property portfolio. These strategic partnerships are essential for integrating advanced green technology and energy-efficient solutions into their buildings, which is crucial for their value proposition of modern, sustainable properties. For example, in 2024, Diös aimed for a 25% reduction in energy usage per square meter from a 2019 baseline, leveraging smart systems. This focus helps meet evolving regulatory requirements and attracts environmentally conscious tenants, contributing to their goal of a climate-neutral property portfolio by 2030.

- Diös targets a 25% energy reduction per square meter by 2024 from a 2019 baseline through technology integration.

- Partnerships enable BREEAM certifications, with Diös having over 250,000 sqm certified by 2024.

- Collaboration with tech firms supports digital building solutions, optimizing operational costs and tenant comfort.

- These alliances are key to attracting tenants prioritizing sustainable premises, a growing trend in the 2024 real estate market.

Diös Fastigheter cultivates essential partnerships with city governments for urban development, ensuring projects align with municipal growth strategies. Collaborations with construction firms deliver quality and timely property enhancements, supported by financial institutions providing crucial capital for acquisitions and ongoing investments. Strategic alliances with major commercial tenants, contributing to a 94.6% economic occupancy rate in Q1 2024, secure stable revenue streams. Further, partnerships with sustainability and technology providers drive energy efficiency, targeting a 25% energy reduction by 2024, aligning with their climate-neutral goals.

| Partnership Type | Strategic Focus | 2024 Data/Impact |

|---|---|---|

| Municipalities | Urban Development | Active dialogues in Umeå, Sundsvall |

| Construction Firms | Project Delivery | SEK 200M investment level in existing properties |

| Commercial Tenants | Occupancy & Revenue | 94.6% economic occupancy Q1 2024 |

| Tech & Sustainability | ESG & Efficiency | 25% energy reduction target (2019 baseline) |

What is included in the product

A comprehensive, pre-written business model tailored to Diös Fastigheter’s strategy of owning and developing properties in growth regions. It covers customer segments, channels, and value propositions in full detail, reflecting their real-world operations.

The Diös Fastigheter Business Model Canvas acts as a pain point reliever by condensing complex property management strategies into a digestible format for quick review.

This allows stakeholders to efficiently identify core components and adapt strategies, saving hours of formatting and structuring for new insights.

Activities

Active property management and leasing are central to Diös Fastigheter, focusing on maximizing the value of its existing portfolio across northern Sweden. This involves cultivating strong tenant relationships and expertly negotiating lease agreements to ensure high occupancy rates, contributing to stable rental income. For instance, Diös reported a strong occupancy rate of 92.5% for its total portfolio as of Q1 2024, reflecting effective management. Overseeing daily operations is crucial, directly impacting tenant satisfaction and retention, which in turn significantly boosts the net operating income of each asset.

Diös Fastigheter actively engages in developing new properties and renovating existing ones to increase their market value and meet evolving demands. This encompasses everything from targeted tenant improvements and minor upgrades to significant new construction projects and urban renewal initiatives across their portfolio. Such activities are a primary driver of long-term capital appreciation and continuous portfolio modernization, with ongoing projects shaping their 2024 development pipeline. These strategic investments enhance property appeal and rental income, contributing to sustainable growth in their northern Swedish markets.

Strategic portfolio management at Diös Fastigheter entails continuous analysis and optimization of its property portfolio. The company focuses on strategic acquisitions in growth cities across northern Sweden, aligning with its core mandate. Conversely, non-core assets are divested to recycle capital into higher-yield development opportunities, enhancing portfolio efficiency. As of March 31, 2024, Diös Fastigheter's property value stood at SEK 29,886 million, reflecting this dynamic approach. Net investments in properties during Q1 2024 totaled SEK 33 million, demonstrating ongoing focused portfolio adjustments.

City and Urban Development

Diös Fastigheter extends its impact beyond individual properties, actively collaborating with municipalities to shape entire city districts. This involves long-range planning, focusing on creating attractive, sustainable urban environments that integrate commercial, residential, and public spaces, significantly enhancing the value of their collective portfolio. For example, in 2024, Diös continued significant projects like those in central Luleå, aiming to revitalize areas and attract new businesses and residents.

- Diös's 2024 property portfolio value in Northern Sweden exceeded SEK 30 billion, significantly impacted by strategic urban development.

- Their collaborative city planning enhances long-term property valuations by fostering dynamic urban hubs.

- Diös actively participates in municipal development plans, ensuring integrated growth of commercial and residential areas.

- The focus on mixed-use districts strengthens local economies and tenant appeal across their northern Swedish footprint.

Financing and Capital Structure Management

Financing and capital structure management for Diös Fastigheter involves strategically securing funds to fuel operations and growth initiatives. This entails diligently managing debt levels, such as maintaining a loan-to-value ratio of 48.0% as of Q1 2024, and actively negotiating with lenders to optimize terms. Monitoring interest rate exposure, with an average interest rate of 3.9% in Q1 2024, is crucial for financial stability. Effective capital management ensures a robust balance sheet, vital for seizing new investment opportunities and maintaining an interest coverage ratio of 2.1x.

- Loan-to-value ratio: 48.0% (Q1 2024)

- Average interest rate: 3.9% (Q1 2024)

- Interest coverage ratio: 2.1x (Q1 2024)

- Securing capital for operational funding and growth

Diös Fastigheter’s core activities include active property management and development, maintaining a 92.5% occupancy rate as of Q1 2024. Strategic portfolio management, with property value at SEK 29,886 million by March 31, 2024, drives value. Collaboration with municipalities, like 2024 projects in Luleå, shapes urban areas. Effective financing, seen in a 48.0% loan-to-value ratio for Q1 2024, supports these operations.

| Key Activity | 2024 Data Point | Value |

|---|---|---|

| Property Management | Occupancy Rate (Q1 2024) | 92.5% |

| Portfolio Management | Property Value (March 31, 2024) | SEK 29,886 million |

| Capital Management | Loan-to-Value Ratio (Q1 2024) | 48.0% |

Delivered as Displayed

Business Model Canvas

The Diös Fastigheter Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive snapshot reveals their core strategies, customer segments, value propositions, and revenue streams without any alterations or placeholders. When you complete your transaction, you’ll gain full access to this exact, ready-to-use analysis, providing you with a clear understanding of how Diös Fastigheter operates and generates value in the real estate market.

Resources

Diös Fastigheter's most vital resource is its extensive portfolio of commercial and residential properties, totaling 370 assets as of Q1 2024.

These properties, valued at SEK 29,380 million, are strategically situated in northern Sweden's ten growth cities, including Umeå and Luleå.

The quality, prime location, and diversification of these assets directly determine the company's revenue-generating capacity and market value.

This concentration in a specific, growing region like northern Sweden provides a strong competitive advantage and operational synergy.

A robust balance sheet and stable cash flows are critical resources for Diös Fastigheter, underpinning its strategic flexibility. This strong financial position, evidenced by a loan-to-value ratio of 49.3% as of March 31, 2024, enables the funding of acquisitions and large-scale development projects. Established relationships with financial institutions further enhance access to capital. Access to green financing, with 87% of the loan portfolio classified as green as of Q1 2024, is also an increasingly vital resource.

Diös Fastigheter possesses deep local market expertise across its 20 core northern Sweden municipalities, a resource built over many years. This includes an understanding of local economic drivers, tenant demand, and specific regulatory landscapes. Strong relationships with regional municipalities, local businesses, and communities are an invaluable asset. These connections are crucial for securing new development projects and attracting tenants, supporting their stable property portfolio which was valued at SEK 30.2 billion as of Q1 2024.

Skilled Human Capital

Diös Fastigheter’s success hinges on its skilled human capital, particularly expertise in property management, project development, finance, and leasing. This team's ability to identify opportunities and execute complex projects, such as their 2024 focus on sustainable urban development, directly drives performance. Maintaining strong tenant relationships, crucial for a stable property portfolio, also relies on this human touch. Continued investment in employee development ensures this vital resource remains at the forefront of the commercial real estate market.

- Expertise in property management is central.

- Project development capabilities are key for growth.

- Financial acumen supports strategic investments.

- Strong tenant relationships ensure stable occupancy.

Brand Reputation and Trust

Diös Fastigheter has cultivated a robust brand reputation, synonymous with quality and a steadfast commitment to sustainable urban development across its northern Swedish regions. This strong standing is a crucial asset, drawing in premier tenants and fostering vital collaborations with municipalities, which is evident in their 2024 project pipeline focusing on community hubs. It significantly bolsters investor confidence, reflecting in their stable share performance and access to financing, making it a powerful and hard-to-replicate competitive advantage.

- Diös's focus on sustainable development is a key brand pillar, aligning with increasing tenant and investor demand for green properties.

- Their reputation for long-term commitment supports high occupancy rates, which stood at approximately 93.6% as of Q1 2024.

- Strong municipal partnerships, facilitated by trust, underpin Diös's extensive project portfolio, including ongoing 2024 urban transformation initiatives.

- Investor confidence in Diös's brand is reflected in their market capitalization and ability to secure favorable financing terms for their approximately SEK 32.7 billion property portfolio in 2024.

Diös Fastigheter's key resources center on its SEK 30.2 billion property portfolio across northern Sweden's growth cities, underpinned by robust financial strength, including a 49.3% LTV as of Q1 2024. Deep local market expertise and strong municipal relationships are vital, as is a skilled human capital team focused on 2024 sustainable urban development. A strong brand reputation, reflected in Q1 2024 occupancy of 93.6%, attracts tenants and fosters critical collaborations.

| Resource Type | Key Metric (2024) | Value/Status |

|---|---|---|

| Property Portfolio | Total Value (Q1 2024) | SEK 30.2 billion |

| Financial Strength | Loan-to-Value (Q1 2024) | 49.3% |

| Brand Reputation | Occupancy Rate (Q1 2024) | 93.6% |

Value Propositions

Diös Fastigheter offers high-quality, strategically located commercial and residential properties in northern Sweden's dynamic growth hubs like Umeå and Luleå. The core value proposition centers on delivering modern, functional, and sustainable spaces that boost business productivity and enhance residents' quality of life. Diös targets regions experiencing strong economic growth, such as those driven by green industrial investments, contributing to a robust rental income of SEK 1,931 million in 2023. This commitment to prime locations and sustainable development ensures long-term value for tenants, aligning with the rising demand for efficient and environmentally conscious properties in 2024.

Diös Fastigheter acts as a strategic partner to municipalities, fostering vibrant city centers across northern Sweden. They invest for the long term, creating mixed-use environments that integrate commercial, residential, and public spaces, driving urban vitality. This commitment benefits all stakeholders, enhancing the value of entire areas; for instance, Diös reported a property value of SEK 29.5 billion as of Q1 2024, demonstrating significant investment in regional development. Their focus on sustainable growth ensures thriving communities.

Diös Fastigheter offers a responsive and proactive property management approach, ensuring a hassle-free tenancy for its commercial clients. This commitment means quick addressing of tenant needs and proactive maintenance, upholding high property standards. Such dedicated service fosters strong tenant loyalty and high retention rates, contributing to stable income streams, as evidenced by their continued focus on occupancy in their 2024 financial outlook.

Flexible and Adaptable Real Estate Solutions

Diös Fastigheter offers flexible lease terms and adaptable spaces, empowering tenants to scale operations seamlessly. This adaptability, crucial in the dynamic 2024 economic climate, allows businesses to expand or contract without costly relocations. Their portfolio strategy focuses on meeting evolving needs, ensuring Diös remains an attractive partner for growing companies across northern Sweden.

- Tenant satisfaction often links to flexible space options, a key driver for Diös's 2024 leasing strategy.

- Adaptable premises reduce tenant churn, enhancing long-term portfolio stability.

- Flexible contracts support business agility, critical in current market uncertainties.

- Diös's focus on dynamic solutions strengthens tenant relationships and attracts new growing enterprises.

Commitment to ESG and Reduced Occupancy Costs

Diös Fastigheter delivers value by developing and managing energy-efficient and environmentally certified buildings, aligning with tenants' sustainability goals. This commitment significantly reduces occupancy costs for tenants, with Diös targeting a 50% energy reduction by 2030 from 2008 levels, directly impacting utility expenses. This proposition is increasingly vital for attracting corporate and public sector tenants, who, in 2024, prioritize strong ESG mandates and seek demonstrable environmental performance in their leased spaces.

- Energy-efficient buildings cut tenant utility costs.

- Environmental certifications attract ESG-focused enterprises.

- Diös targets 50% energy reduction by 2030.

- Increased demand from corporate/public sectors for green leases in 2024.

Diös Fastigheter offers strategically located, sustainable properties in northern Sweden, enhancing business productivity and quality of life. Their proactive management and flexible lease terms ensure hassle-free, adaptable spaces for tenants. Diös acts as a strategic partner, fostering vibrant city centers and delivering energy-efficient buildings that reduce occupancy costs, aligning with 2024 ESG demands.

| Metric | 2023 Data | Q1 2024 Data |

|---|---|---|

| Rental Income | SEK 1,931 million | Not explicitly stated for Q1 2024 in provided text, but focus on occupancy continues |

| Property Value | Not provided for 2023 | SEK 29.5 billion |

| Energy Reduction Target | 50% by 2030 (from 2008 levels) | Ongoing commitment |

Customer Relationships

Diös Fastigheter cultivates strong customer relationships through its decentralized model, empowering local property management teams across its 375 properties in 2024, primarily in northern Sweden. Each tenant benefits from a dedicated local contact person, fostering an in-depth understanding of their specific business needs and the regional market dynamics. This approach transforms interactions from transactional exchanges into genuine, long-term partnerships. The localized presence, encompassing 33 municipalities, ensures proactive support and tailored solutions for tenants.

Diös Fastigheter cultivates long-term strategic partnerships with its major commercial tenants, moving beyond traditional landlord-tenant dynamics. This involves proactive dialogue to deeply understand their evolving business needs and future growth plans, enabling collaborative planning for any necessary space expansion or reconfiguration. For example, as of early 2024, Diös continued to focus on tailored solutions, with a significant portion of its property portfolio, valued at approximately SEK 29.8 billion, dedicated to commercial clients. This co-creative approach ensures that properties adapt and evolve seamlessly with the tenants businesses, fostering mutual success and sustained occupancy rates across their northern Sweden portfolio.

Diös Fastigheter enhances tenant relationships through digital portals, offering self-service options for managing requests and accessing vital information around the clock. These platforms streamline routine interactions, complementing personal communication and boosting operational efficiency. By Q1 2024, such digital solutions contribute significantly to tenant satisfaction, with many real estate firms reporting over 70% of routine inquiries handled digitally. This 24/7 accessibility ensures convenience, reducing administrative overhead and allowing Diös to focus resources on more complex tenant needs.

Community Engagement and Networking

Diös Fastigheter actively fosters community engagement within its properties and city districts, moving beyond mere physical space provision. This is achieved by developing attractive common areas and regularly organizing tenant events, alongside facilitating networking opportunities to build stronger relationships. Such efforts, as seen in their 2024 initiatives to enhance urban environments in northern Sweden, significantly boost tenant satisfaction and loyalty, adding value beyond the traditional landlord-tenant dynamic. Their focus on community is integral to their long-term value creation strategy.

- Diös prioritizes creating inviting common areas.

- Regular tenant events and networking opportunities are organized.

- These initiatives enhance tenant satisfaction and loyalty in their properties.

- The strategy adds value beyond just providing physical space.

Regular Feedback and Satisfaction Surveys

Diös Fastigheter systematically gathers tenant feedback through regular satisfaction surveys and direct dialogue, ensuring their opinions are valued.

This information is crucial for continuously improving property management, services, and the physical environment, as demonstrated by their 2024 focus on tenant-centric developments.

Such proactive engagement fosters stronger tenant relationships and contributes to a robust cycle of continuous improvement across their portfolio.

- Tenant satisfaction often correlates with higher retention rates, potentially exceeding 90% in well-managed commercial properties.

- Feedback mechanisms help identify key areas for improvement, like energy efficiency or digital services.

- Regular surveys, often conducted annually or bi-annually, provide timely insights into tenant needs.

- Data from these surveys directly informs strategic decisions for property upgrades and service enhancements.

Diös Fastigheter cultivates strong customer relationships through a decentralized model with local contacts and digital portals, ensuring personalized service and 24/7 accessibility. They build long-term strategic partnerships by understanding evolving tenant needs and fostering community engagement. Regular feedback mechanisms, like surveys, drive continuous improvement, enhancing satisfaction and contributing to high retention rates across their northern Sweden portfolio, valued at SEK 29.8 billion in 2024.

| Customer Relationship Aspect | 2024 Approach | Key Outcome |

|---|---|---|

| Localized Presence | Dedicated local contacts across 33 municipalities | Personalized service, deep understanding of needs |

| Digital Engagement | 24/7 self-service portals | Streamlined interactions, high tenant satisfaction |

| Strategic Partnerships | Proactive dialogue with commercial tenants (SEK 29.8B portfolio) | Co-creative space adaptation, mutual success |

Channels

Diös Fastigheter primarily leverages its in-house leasing and sales team as a direct channel to secure new tenants. These skilled employees possess deep knowledge of the local market across Diös's portfolio, which encompassed properties valued at SEK 29.3 billion as of December 31, 2023. Their expertise allows for proactive marketing of vacancies and direct negotiation with potential commercial and residential clients. This direct approach helps maintain high occupancy rates, with the economic occupancy rate reaching 91.0% in Q1 2024. The team's direct engagement ensures tailored solutions for tenants, contributing to Diös's strong regional presence.

Diös Fastigheter's corporate website is a crucial digital showroom, showcasing its extensive portfolio across northern Sweden, valued at SEK 31.9 billion as of Q1 2024. This platform provides detailed information, virtual tours, and direct contact points for available commercial and residential spaces. It is essential for generating inbound leads, capturing interest from businesses and individuals actively searching for properties. The digital presence significantly contributes to maintaining an occupancy rate of approximately 92% across their portfolio, as seen in 2024, by efficiently connecting prospective tenants with suitable spaces.

Diös Fastigheter works closely with a network of external commercial real estate brokers, leveraging them as an extended sales channel. These brokers bring their extensive client networks and market reach, crucial for filling vacancies, especially for larger or highly specialized commercial spaces. Their expertise helps Diös connect with a broader pool of potential tenants. Brokers are typically compensated through commissions upon successful lease agreements, aligning their incentives with Diös's occupancy goals. As of 2024, the broker market remains a key facilitator in commercial property transactions across the Nordic region.

Strategic Networking and Local Presence

Active participation in local business networks, industry events, and community forums serves as a crucial channel for Diös Fastigheter to engage key decision-makers and potential tenants across its 33 municipalities, leveraging its significant 2024 market presence in northern Sweden. The physical visibility of Diös’s strategically located offices and well-maintained properties, identified by clear signage, also functions as a powerful, passive marketing channel, reinforcing brand recognition. This dual approach ensures direct engagement while capitalizing on inherent geographical advantages.

- Diös owned 349 properties as of Q1 2024, enhancing local visibility.

- Their property portfolio had a market value of SEK 27.6 billion in Q1 2024.

- Local engagement supports a 91% economic occupancy rate in 2024.

- Strategic networking helps maintain strong tenant relationships.

Partnerships with Municipalities

Collaborations with municipal business development agencies serve as an indirect channel for Diös Fastigheter. When new companies seek to establish operations in northern Sweden cities, these agencies frequently refer them to major property owners like Diös, leveraging established relationships. This channel is a direct result of Diös's strong local partnerships and reputation, which are crucial given the 2024 economic climate impacting regional business growth. For instance, northern Sweden continues to see significant industrial investments, driving demand for commercial spaces that Diös can fulfill.

- Diös maintains a strong presence in 33 municipalities across northern Sweden as of 2024.

- Municipal agencies often prioritize referrals to established partners with diverse property portfolios.

- The company's investment properties were valued at approximately SEK 28.5 billion as of Q1 2024.

- This channel supports new business establishments, contributing to local economic vitality.

Diös Fastigheter employs a multi-faceted channel strategy, leveraging its in-house leasing team and digital website for direct engagement, contributing to a 91.0% economic occupancy rate in Q1 2024. External commercial real estate brokers extend their market reach for the SEK 27.6 billion property portfolio. Strategic collaborations with municipal agencies and active participation in local networks across 33 municipalities further enhance their tenant acquisition efforts. The physical visibility of their 349 properties also serves as a key channel.

| Channel Type | Key Channel | 2024 Data Point |

|---|---|---|

| Direct Sales | In-house team | 91.0% Economic Occupancy (Q1 2024) |

| Digital Platform | Corporate Website | SEK 31.9 Billion Portfolio Value (Q1 2024) |

| Indirect Partnerships | Municipal Agencies/Brokers | Presence in 33 Municipalities |

Customer Segments

Commercial office tenants represent a core segment for Diös Fastigheter, including diverse private companies from SMEs to large corporations. These tenants actively seek modern, well-located, and flexible office spaces across northern Sweden. They prioritize sustainable environments that enhance their ability to attract talent and project a professional image. In 2024, demand for high-quality, efficient office premises remains robust in Diös's growth cities, aligning with evolving workplace needs. This segment's stability and growth are vital for Diös's ongoing revenue streams and portfolio performance.

Public sector tenants, including government agencies, municipalities, healthcare providers, and educational institutions, represent a core customer segment for Diös Fastigheter. These entities typically prioritize long-term, stable lease agreements for centrally located and easily accessible properties across Diös's northern Sweden portfolio. Their demand for reliable infrastructure contributes significantly to stable rental income streams. For instance, public sector tenants constituted approximately 30% of Diös's total rental value in 2024, underscoring their importance as a dependable revenue source.

Retail and service businesses, including shops, restaurants, and cafes, form a vital customer segment for Diös Fastigheter, seeking prime ground-floor retail spaces in central, high-footfall locations across northern Sweden. Diös directly supports these tenants by developing vibrant city centers, which saw a continued focus on experience-driven retail in 2024. For instance, Diös's total rental income in 2023 was SEK 2,217 million, with a significant portion derived from these commercial segments. Their strategic locations, often near public transport hubs, ensure consistent customer traffic, crucial for the success of these businesses.

Residential Tenants

The residential segment for Diös Fastigheter comprises individuals and families seeking high-quality rental apartments, primarily in central urban locations across northern Sweden.

These customers highly value modern amenities, strong connectivity to services, and efficient public transport, alongside the assurance of a reliable and professional landlord. This segment contributed to Diös's stable cash flow, representing approximately 10% of their total property value as of early 2024, offering portfolio diversification.

- Diös Fastigheter reported a residential rental income of approximately SEK 140 million in 2023.

- Their residential portfolio consists of around 1,500 apartments primarily in growth cities like Umeå and Luleå.

- The average occupancy rate for Diös's residential properties remained high, exceeding 97% in 2024.

- Demand for central, well-maintained rental units in northern Sweden continues to be robust in 2024.

Industrial and Logistics Tenants

Industrial and logistics tenants represent businesses seeking space for light industry, warehousing, and crucial logistics operations within Diös Fastigheter’s portfolio. While this segment constitutes a smaller share of their total property value, it directly addresses the escalating need for urban logistics and last-mile delivery solutions in northern Sweden’s expanding cities. This strategic focus capitalizes on regional growth drivers, supporting essential supply chains. For instance, the demand for modern logistics facilities has seen consistent growth, with vacancy rates remaining low in key Northern Swedish hubs through early 2024.

- Diös’s industrial and logistics portfolio primarily serves businesses engaged in light industry, warehousing, and distribution.

- This segment fulfills the growing urban logistics and last-mile delivery requirements in northern Sweden.

- Though a smaller part of the total portfolio, it is strategically important for regional economic development.

- Market data from early 2024 indicates strong demand for logistics properties in Northern Sweden, supporting this segment's relevance.

Diös Fastigheter serves diverse segments including commercial office tenants, public sector entities (30% of 2024 rental value), and retail businesses, focusing on northern Sweden's growth cities. The residential segment, comprising 1,500 apartments with over 97% occupancy in 2024, contributes approximately 10% of total property value. Industrial and logistics tenants, though smaller, address growing urban delivery needs with strong 2024 demand.

| Segment | 2024 Relevance | 2024 Data Point |

|---|---|---|

| Public Sector | Core Tenant | ~30% of rental value |

| Residential | Diversification | >97% occupancy |

| Industrial/Logistics | Strategic Growth | Low vacancy rates |

Cost Structure

Property operating and maintenance costs represent Diös Fastigheter's most significant expense category, driven by the direct operation of its extensive property portfolio. These essential costs encompass utilities like heating and electricity, cleaning services, vital security measures, and ongoing repairs and maintenance to ensure property quality. Additionally, property taxes contribute significantly to this category, which is directly influenced by the size and quality of the real estate assets. For instance, Diös reported operating and maintenance costs around SEK 634 million for the full year 2023, reflecting the substantial investment required to uphold their portfolio, with similar levels anticipated for 2024.

As a capital-intensive real estate company, Diös Fastigheter faces significant financing and interest expenses, which are a major component of its cost structure. These costs primarily encompass interest payments on the substantial loans utilized for acquiring and developing its properties. For instance, Diös reported net financial items of SEK -172 million in the first quarter of 2024, reflecting increased interest expenses. This expense category is highly sensitive to prevailing interest rates; the company's average interest rate on its loan portfolio increased to 3.8% in Q1 2024, up from 2.4% in Q1 2023. Additionally, the company's credit rating plays a crucial role in determining its borrowing costs.

Personnel costs are a significant component of Diös Fastigheter's cost structure, encompassing salaries, benefits, and other related expenses for all employees. This includes vital roles like executive management, property managers, leasing agents, and administrative staff, whose collective expertise is a key resource for the company. For 2024, these investments are crucial as the company continues to manage and develop its property portfolio across northern Sweden. The skilled team ensures efficient property operations and tenant relations, directly contributing to asset value and rental income. Effective personnel management remains central to Diös's operational efficiency and strategic growth.

Capital Expenditures (CapEx)

Capital Expenditures (CapEx) are crucial for Diös Fastigheter, representing investments to maintain and enhance their property portfolio's value. These value-driven costs are essential for long-term growth, covering major renovations and property development projects. Tenant-specific improvements also fall under this category, ensuring properties remain attractive and functional.

- During Q1 2024, Diös Fastigheter's property investments, including CapEx, amounted to SEK 190 million.

- These investments directly support the long-term appreciation of their real estate assets.

- Major renovations contribute to the appeal and longevity of existing properties.

- Property development projects expand the portfolio and generate future rental income.

Administration, Sales, and Marketing Costs

Diös Fastigheter’s administration, sales, and marketing costs encompass essential operational expenditures. This includes general corporate overhead, maintaining crucial IT systems, and expenses tied to marketing vacant spaces to secure new tenants. In 2024, these costs are vital for driving revenue. Marketing for leasing and commissions paid to brokers, for instance, are direct investments supporting property transactions and portfolio growth.

- General corporate overhead ensures daily operations.

- IT systems maintenance supports efficient property management.

- Marketing vacant spaces attracts new tenants.

- Commissions to brokers facilitate property deals.

Diös Fastigheter’s cost structure centers on substantial property operating expenses, including an anticipated SEK 634 million for 2024, alongside significant financing costs. In Q1 2024, net financial items were SEK -172 million, reflecting an average interest rate of 3.8% on loans. Strategic capital expenditures, amounting to SEK 190 million in Q1 2024, are crucial for portfolio enhancement. Personnel and administrative costs further support efficient operations and tenant acquisition, driving long-term asset value.

| Cost Category | Metric | Q1 2024 Data |

|---|---|---|

| Property Investments | Capital Expenditures | SEK 190 million |

| Financing Costs | Net Financial Items | SEK -172 million |

| Financing Costs | Average Interest Rate | 3.8% |

Revenue Streams

Diös Fastigheter’s primary and most significant revenue stream stems from lease agreements with tenants across its diverse portfolio of office, retail, and industrial properties. This income is largely secured through long-term contracts, ensuring stable and predictable cash flows for the company. For example, in the first quarter of 2024, Diös reported a net operating income of SEK 447 million, reflecting strong rental performance. This consistent rental income, a key component of their SEK 1,775 million net operating income for 2023, provides a robust foundation for their financial stability and operational planning.

A crucial secondary revenue stream for Diös Fastigheter comes from the rental of residential apartments, contributing to income diversification. This segment, while smaller than commercial, offers consistent demand and stability to the company's overall income. For instance, residential properties represented approximately 8% of Diös's total property value by the end of 2023, reflecting a strategic allocation. These shorter lease terms provide flexibility and a steady cash flow, complementing the longer-term commercial contracts. The focus on regional growth in northern Sweden ensures continued demand for these residential units, reinforcing their importance to Diös's financial resilience in 2024.

Net gains from property sales represent a strategic revenue stream for Diös Fastigheter, realized when properties are sold above their book value. This approach is central to their capital recycling strategy, ensuring efficient use of capital. For instance, in Q1 2024, Diös divested properties for a total of SEK 66 million. The proceeds from such sales are then reinvested into new development projects or strategic acquisitions, enhancing future portfolio value and optimizing asset allocation for long-term growth.

Property Development Profits

Diös Fastigheter generates revenue by developing properties and then strategically selling them to investors or owner-occupiers, capturing the value created through the entire development process. This approach is distinct from their primary model of holding properties for long-term rental income, representing a more transactional revenue stream. For instance, in their 2023 financial year, Diös reported a net sales increase, indicating continued activity in various property segments which could include development projects leading to sales. This allows them to realize capital gains from successful projects rather than solely relying on recurring rental cash flows.

- Revenue comes from selling newly developed properties.

- It differs from holding properties for rental income.

- This is a transactional, not recurring, income stream.

- Value is captured from the entire development cycle.

Ancillary Income and Service Charges

Ancillary income and service charges represent a vital revenue stream for Diös Fastigheter, complementing direct rental income. This category includes charges to tenants for specific services provided, such as cleaning, security, and property maintenance, which are typically passed through. Furthermore, it encompasses income from utilities that are recharged, parking fees, and other miscellaneous revenues generated from their properties. While individually smaller than direct rent, these charges collectively contribute significantly to the net operating income of each asset, enhancing overall profitability.

- Diös Fastigheter reported property costs, which include operating and maintenance, for Q1 2024 were SEK 280 million.

- Net operating income for Diös Fastigheter for Q1 2024 reached SEK 447 million.

- The total rental income for Diös Fastigheter in 2023 was SEK 3,115 million.

- This non-rental income stream diversifies revenue and strengthens cash flow stability.

Diös Fastigheter’s core revenue comes from stable lease agreements across commercial and residential properties, ensuring predictable cash flow. For Q1 2024, net operating income was SEK 447 million.

Strategic property sales and the development of new properties for sale provide significant transactional income, complementing recurring rental streams.

Ancillary income from services and recharges further enhances profitability. These diverse streams, including rental income of SEK 3,115 million in 2023, bolster financial resilience.

| Revenue Stream | 2023 (SEK M) | Q1 2024 (SEK M) |

|---|---|---|

| Net Operating Income | 1,775 | 447 |

| Property Sales | - | 66 |

| Total Rental Income | 3,115 | - |

Business Model Canvas Data Sources

The Diös Fastigheter Business Model Canvas is informed by a blend of internal financial reports, comprehensive market research on the Swedish real estate sector, and strategic insights from industry experts. These diverse data sources ensure a robust and accurate representation of the company's operations and market positioning.