Digi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digi Bundle

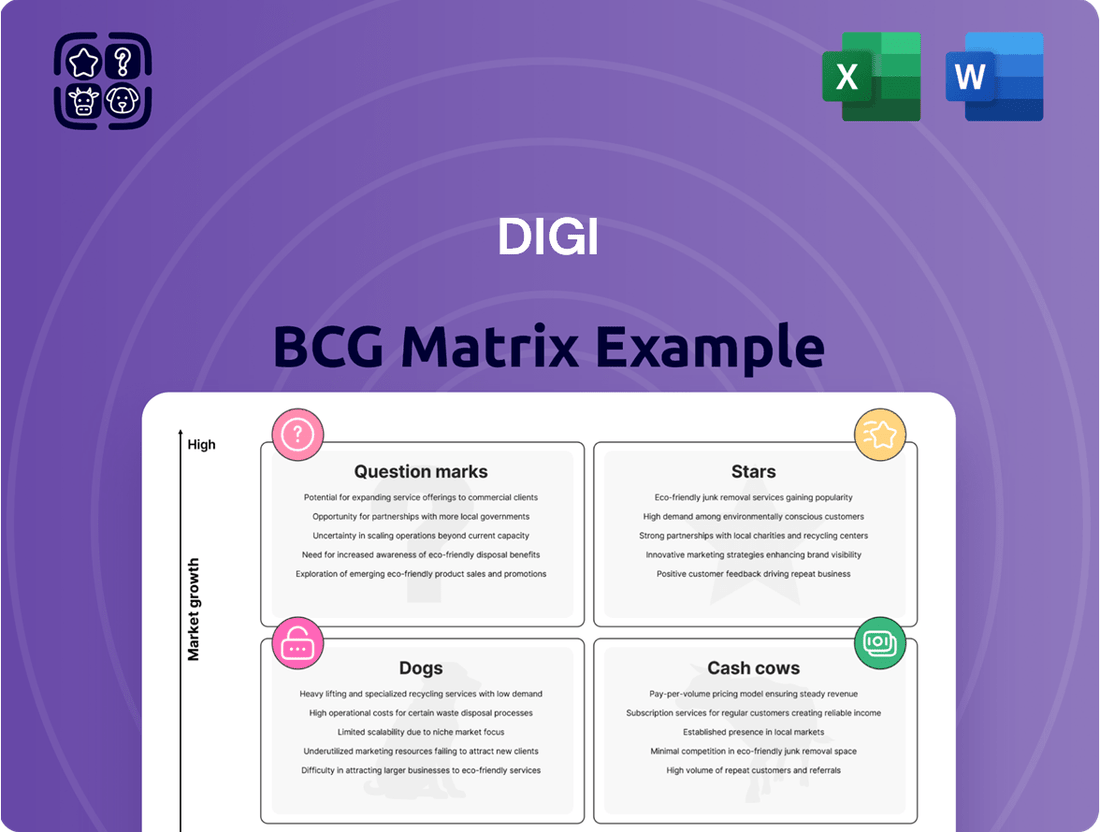

Unlock the power of strategic product portfolio management with the Digi BCG Matrix. This foundational tool helps you visualize your company's offerings, categorizing them into Stars, Cash Cows, Dogs, and Question Marks to illuminate growth opportunities and resource allocation.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Digi's Digi 360 and Digi LifeCycle Assurance Solutions are central to their strategy, designed to simplify complex IoT deployments for businesses. These integrated packages, combining hardware, software, and services, are a key driver of Digi's recurring revenue.

The focus on these solutions is clearly paying off, as evidenced by Digi's impressive ARR growth. By the end of their second fiscal quarter in 2025, Digi reported a 12% year-over-year increase in ARR, reaching $123 million. This growth highlights the market's strong demand for streamlined IoT solutions that deliver tangible business value and maximize return on investment in a rapidly expanding sector.

The Digi IX40 and other 5G industrial cellular routers represent a significant opportunity for Digi, aligning with the burgeoning Industrial IoT (IIoT) sector. This market is expected to reach around $275.70 billion by 2025, highlighting the substantial demand for advanced connectivity solutions.

These routers are crucial for Industry 4.0, offering 5G capabilities, edge computing, and real-time data processing. This positions them as strong contenders in a high-growth market, enabling efficient operations in demanding industrial environments.

SmartSense by Digi represents a significant component of Digi's IoT Solutions segment, a key driver of recurring revenue. This subscription-based offering focuses on sensor technology for monitoring perishables and facilities, contributing substantially to Digi's high-margin business.

In the second fiscal quarter of 2025, the IoT Solutions segment, including SmartSense, saw its Annual Recurring Revenue (ARR) grow by 9%. This growth is underpinned by robust gross profit margins, which stood at an impressive 71.4% for the segment.

SmartSense has carved out a strong niche within its specific market verticals. By consistently delivering tangible value and enhancing operational efficiency for its clientele, it solidifies its position as a reliable and impactful IoT solution provider.

Digi X-ON Edge-to-Cloud IIoT Solution

Digi X-ON Edge-to-Cloud IIoT Solution, a recipient of the 2025 Industrial IoT Product of the Year Award, is positioned as a Star in the BCG Matrix. Its comprehensive approach, integrating hardware, software, and cloud connectivity into a secure platform, directly addresses the rapid expansion and complexity of the industrial IoT market, suggesting strong future growth prospects.

The solution's ability to simplify the integration, deployment, and scaling of IIoT systems is a key driver for its Star status. As the IIoT market continues its upward trajectory, with global spending projected to reach over $1 trillion by 2027, Digi X-ON is well-placed to capture significant market share.

- Market Growth: The global IIoT market is experiencing robust growth, with an estimated compound annual growth rate (CAGR) of 20.7% from 2023 to 2030.

- Innovation: Digi X-ON's award-winning design and end-to-end platform offer a competitive edge in a dynamic technological landscape.

- Simplicity and Scalability: By reducing complexity in IoT adoption, the solution appeals to a broad range of industrial clients looking to leverage IIoT for efficiency and data-driven decision-making.

New Generation Embedded System-on-Modules (e.g., Digi ConnectCore 91/93)

Digi's new generation embedded system-on-modules, like the ConnectCore 91/93, represent a significant investment in a high-growth market. These modules are crucial for OEMs building advanced connected products, ensuring Digi maintains its strong position in the foundational components of IoT. The company's commitment to innovation in this space is evident, as the embedded computing market is projected to reach $25.1 billion by 2027, growing at a CAGR of 6.1%.

- Market Leadership: Digi consistently holds a substantial market share in embedded modules, a testament to the reliability and performance of its offerings.

- Innovation Focus: The introduction of the ConnectCore 91/93 family highlights Digi's dedication to providing scalable, powerful solutions for evolving IoT demands.

- Industry Demand: There's a continuous need for integrated and high-performance embedded computing, driven by advancements in industrial automation, healthcare, and smart city technologies.

- Future Growth: Digi's strategic placement of these advanced modules positions it to capitalize on the expanding IoT ecosystem, where embedded systems are increasingly critical.

Digi X-ON Edge-to-Cloud IIoT Solution is a prime example of a Star in the BCG Matrix. Its award-winning platform simplifies IIoT adoption, aligning with the substantial growth in the industrial IoT market, which is projected to exceed $1 trillion by 2027. This solution's ability to integrate hardware, software, and cloud connectivity securely positions it for continued high market share and expansion.

| Product/Solution | BCG Category | Key Growth Drivers | Market Opportunity (2025) | Digi's Competitive Advantage |

|---|---|---|---|---|

| Digi X-ON Edge-to-Cloud IIoT Solution | Star | IIoT market expansion, demand for simplified deployment and scaling | IIoT market projected to exceed $1 trillion by 2027 | Award-winning, end-to-end secure platform |

| Digi IX40 & 5G Industrial Routers | Star | Industry 4.0 adoption, demand for 5G and edge computing | IIoT market ~ $275.70 billion | 5G capabilities, edge processing for demanding environments |

| ConnectCore 91/93 System-on-Modules | Star | Growth in connected products, embedded computing demand | Embedded computing market ~ $25.1 billion by 2027 | Scalable, high-performance solutions for OEMs |

What is included in the product

The Digi BCG Matrix categorizes digital products/services by market share and growth rate to guide investment decisions.

Quickly identify underperforming digital assets, relieving the pain of wasted resources.

Cash Cows

Digi's established cellular routers, particularly its 4G LTE models, represent a significant cash cow within its product portfolio. These devices offer dependable connectivity for essential operations across various industries, ensuring secure and reliable access.

Despite the ongoing transition to 5G, the substantial installed base of 4G LTE routers continues to deliver consistent and predictable revenue streams. This maturity means these products demand less aggressive reinvestment, benefiting from their established market position and proven track record.

In 2024, the demand for robust cellular connectivity for existing infrastructure, such as IoT deployments and remote site management, continues to support the strong performance of 4G LTE routers. Digi's ability to maintain market share in this segment highlights its cash-generating capabilities.

Digi Remote Manager (Digi RM) is Digi International's cloud-based platform for managing and monitoring IoT devices. It handles configuration, deployment, and security updates for large-scale IoT networks.

Its broad integration across Digi's product lines makes it a consistent source of high-margin, recurring revenue via subscriptions. This steady income stream solidifies Digi RM's position as a foundational cash generator for the company.

Digi's remote console management devices are vital for secure, out-of-band access to critical network gear in data centers and edge sites. These products operate within a well-established market, reliably generating consistent revenue due to their indispensable role in ensuring network uptime and enterprise security.

The demand for these devices remains strong, as evidenced by the continued growth in data center infrastructure. For instance, global data center construction spending was projected to reach over $200 billion in 2024, highlighting the ongoing need for robust management solutions.

Core Professional Services

Digi's core professional services, encompassing site planning, implementation management, application development, and customer training, are the bedrock of their IoT solution deployment and ongoing optimization.

These services generate consistent and reliable revenue, benefiting from Digi's established industry knowledge and requiring minimal investment in new product development. In 2024, Digi reported that its professional services segment contributed significantly to overall revenue stability, with a notable portion stemming from recurring support and maintenance contracts.

- Stable Revenue: Professional services offer predictable income streams, acting as a financial anchor for Digi.

- Expertise Leverage: These services capitalize on Digi's deep industry experience, enhancing customer value.

- Low Investment: Minimal new product development costs are associated with maintaining and expanding these service offerings.

- Customer Retention: Training and support services foster strong customer relationships and encourage long-term engagement.

Older Generation Embedded Modules (e.g., Digi XBee standard RF modules)

Digi's older generation embedded modules, exemplified by the Digi XBee standard RF modules, represent a classic example of a cash cow in the BCG matrix. These modules boast a deeply entrenched market position, having been integrated into a vast array of Original Equipment Manufacturer (OEM) products over many years. Their reliability and proven performance have fostered customer loyalty and a consistent demand, even as newer technologies emerge.

The continued revenue generation from these established modules is substantial, often requiring less investment in research and development compared to cutting-edge products. Digi benefits from economies of scale in manufacturing these mature product lines, which translates into healthy profit margins. This steady income stream provides crucial financial stability, enabling the company to fund investments in its higher-growth potential products.

- Established Market Share: Digi XBee modules have a significant and long-standing presence in the industrial IoT and embedded systems markets.

- Consistent Revenue Stream: The installed base of existing products utilizing these modules ensures a predictable and ongoing revenue flow for Digi.

- High Profitability: Mature products with established manufacturing processes and minimal R&D needs typically exhibit strong profit margins.

- Low Investment Requirement: Unlike stars or question marks, cash cows require minimal new investment to maintain their market position and revenue output.

Digi's legacy cellular routers, particularly its 4G LTE models, are prime examples of cash cows. These devices, while not cutting-edge, are essential for many existing operations, providing reliable connectivity. Their established market presence means they require less investment for maintenance and marketing, generating consistent profits.

Digi Remote Manager (Digi RM) also functions as a cash cow, offering recurring subscription revenue. Its widespread adoption across Digi's product ecosystem ensures a steady, high-margin income stream with minimal additional development costs. This predictable revenue is vital for funding innovation in other areas.

The company's remote console management devices, critical for data center and edge site operations, also fall into the cash cow category. Their indispensable role in network uptime and security guarantees sustained demand, contributing reliably to Digi's revenue. Global data center construction spending exceeding $200 billion in 2024 underscores the ongoing need for these solutions.

Digi's professional services, including implementation and ongoing support, are another significant cash cow. Leveraging deep industry expertise, these services generate consistent, predictable revenue with low reinvestment needs. In 2024, these services were noted for their substantial contribution to revenue stability, particularly through recurring contracts.

Older generation embedded modules, like the Digi XBee RF modules, are classic cash cows. Their deep integration into numerous OEM products ensures a stable demand and revenue flow. These mature products benefit from economies of scale in manufacturing, leading to strong profit margins and providing financial stability for the company.

| Product Category | BCG Matrix Role | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| 4G LTE Cellular Routers | Cash Cow | Dependable connectivity, large installed base, low reinvestment needs | Continued demand for existing infrastructure, stable revenue |

| Digi Remote Manager (Digi RM) | Cash Cow | Recurring subscription revenue, broad integration, high margins | Consistent, high-margin income stream |

| Remote Console Management Devices | Cash Cow | Essential for network uptime, established market, consistent demand | Strong demand driven by data center growth |

| Professional Services | Cash Cow | Predictable income, leverages expertise, low R&D investment | Significant contributor to revenue stability |

| Legacy Embedded Modules (e.g., XBee) | Cash Cow | Deep OEM integration, stable demand, high profit margins | Steady revenue from established product base |

What You See Is What You Get

Digi BCG Matrix

The comprehensive DigiBCG Matrix you are currently previewing is the identical, fully editable document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally formatted, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

Legacy serial connectivity products, like older serial servers and USB solutions, are seeing their market share shrink as businesses adopt newer technologies. These products, once essential, now generate very little cash. For instance, sales of serial device servers, a segment within this category, saw a modest decline of 2% globally in 2023 compared to 2022, indicating a clear trend of diminishing demand.

Specific niche hardware with low differentiation often represents the Dogs in the Digi BCG Matrix. These are products that, despite their specialized nature, have failed to carve out a significant market share or have become so commoditized that meaningful differentiation is nearly impossible. Think of basic, unbranded sensors or simple connectivity modules that are readily available from numerous suppliers.

In 2024, the IoT hardware market continued to see intense competition, particularly in segments like basic environmental sensors or generic microcontrollers. Many smaller manufacturers found themselves competing on price alone, with profit margins often dipping below 5% for these commoditized items. Companies heavily reliant on such products might see them contribute less than 2% to their overall revenue, offering little strategic advantage in a rapidly evolving technological landscape.

One-time hardware sales without service attachments, especially those seeing declining volumes due to inventory adjustments or evolving market preferences, fit the 'Dog' quadrant in the Digi BCG Matrix. These products typically offer minimal recurring revenue, detracting from Digi's strategic emphasis on Annual Recurring Revenue (ARR).

Products in this category may struggle with profitability as they lack the ongoing service revenue streams that bolster margins for other Digi offerings. For instance, if a particular hardware line saw a 15% year-over-year sales decline in Q3 2024, and its associated service attachment rate remained below 10%, it would strongly indicate a 'Dog' status.

Underperforming Acquired Product Lines (if not integrated or revitalized)

Within Digi's portfolio, underperforming acquired product lines represent potential 'Dogs' in the BCG matrix, particularly if integration efforts have stalled or revitalization strategies haven't yielded market traction. These assets, even within generally strong segments like IoT Solutions where acquisitions such as Ventus are performing well, can drain resources without contributing significantly to growth. For instance, a legacy product line acquired in a mature or declining market, which hasn't been updated or repositioned, might fall into this category.

These 'Dog' product lines often require substantial investment in marketing, research, and development to even maintain their current, low market share. Digi's strategic focus should be on identifying these underperformers and making decisive choices: either divest them to free up capital and management attention, or commit significant resources to a turnaround plan. Without such action, they continue to represent a drag on overall profitability and operational efficiency.

- Potential 'Dog' Indicators: Declining revenue streams, low or negative profit margins, minimal R&D investment, and a shrinking customer base.

- Resource Drain: These product lines may consume disproportionate support staff, sales efforts, and management time relative to their financial contribution.

- Strategic Decision: Options include divestment, discontinuation, or a focused revitalization effort with clear performance metrics.

Products in Stagnant or Declining Vertical Markets

Products in stagnant or declining vertical markets, often termed 'Dogs' in the Digi BCG Matrix, represent offerings that struggle to gain traction. These are typically found in sectors experiencing significant contraction or technological obsolescence, limiting their growth potential.

For instance, consider the market for feature phones. While still functional, this segment has seen a dramatic decline with the rise of smartphones. In 2024, the global feature phone market is projected to be worth approximately $10 billion, a stark contrast to the hundreds of billions generated by the smartphone market, indicating a clear contraction.

- Niche Market Contraction: Products targeting highly specialized, shrinking markets are prime candidates for the 'Dog' category.

- Technological Obsolescence: If a product's underlying technology is outdated and unlikely to be revived, it falls into this quadrant.

- Limited Growth Prospects: Even with substantial investment, these product lines face inherent barriers to increasing market share or revenue.

- Example: The declining market for physical media like DVDs, which saw global sales drop by an estimated 15% in 2023, exemplifies a 'Dog' product category.

Dogs in the Digi BCG Matrix represent products with low market share in low-growth markets. These offerings typically generate minimal revenue and often struggle with profitability, draining resources without contributing significantly to overall growth. Companies must carefully evaluate these products, considering divestment or a focused turnaround strategy to optimize resource allocation and enhance financial performance.

Products in stagnant or declining vertical markets, often termed 'Dogs' in the Digi BCG Matrix, represent offerings that struggle to gain traction. These are typically found in sectors experiencing significant contraction or technological obsolescence, limiting their growth potential. For instance, consider the market for feature phones. While still functional, this segment has seen a dramatic decline with the rise of smartphones. In 2024, the global feature phone market is projected to be worth approximately $10 billion, a stark contrast to the hundreds of billions generated by the smartphone market, indicating a clear contraction.

| Product Category | Market Growth Rate | Market Share | Profitability | Strategic Recommendation |

| Legacy Serial Connectivity | Declining | Low | Low/Negative | Divest or Discontinue |

| Niche Hardware (Low Differentiation) | Low | Low | Low | Assess for Divestment or Niche Focus |

| Commoditized IoT Components | Moderate | Low | Very Low | Focus on Value-Added Services or Exit |

| Feature Phones | Shrinking | Very Low | Low | Discontinue |

Question Marks

Digi Axess Mobile App and VPN Service, launched in June 2025, fits into the question mark category of the BCG matrix. It targets the burgeoning Industrial Internet of Things (IIoT) market, which is projected to grow significantly, with global IIoT spending expected to reach over $1 trillion by 2026. Despite this high potential, Digi Axess currently holds a minimal market share, necessitating substantial investment to gain traction and compete effectively.

Digi is strategically integrating Artificial Intelligence to bolster its product and software capabilities, specifically aiming to enable AI processing at the edge. This focus positions them to capitalize on the growing demand for intelligent devices operating independently of centralized cloud infrastructure.

While Digi's commitment to AI-powered edge solutions is clear, these specific offerings are likely in their nascent stages of market adoption. This suggests they represent a significant growth opportunity within the rapidly expanding AI sector, though their current market share remains modest.

Digi is actively developing private 5G network solutions tailored for emerging sectors like industrial security and critical infrastructure. This focus positions Digi to capitalize on a rapidly expanding market, though its current penetration in this nascent niche is understandably modest, necessitating significant strategic capital allocation.

The private 5G market, projected to reach $10.9 billion by 2028 according to MarketsandMarkets, represents a substantial growth opportunity. Digi's investment in this area aligns with the BCG matrix's strategy for 'Question Marks' – high potential but currently low market share, requiring careful consideration of resource deployment to foster future dominance.

Digi LifeCycle Assurance On-Prem Manager

The Digi LifeCycle Assurance On-Prem Manager, introduced in July 2025, is positioned as a "Question Mark" within the Digi BCG Matrix. This solution is designed for highly regulated sectors such as healthcare and utilities, where data sovereignty is paramount, offering a fully local, zero-cloud device management experience.

While it addresses a critical and expanding market need, its recent introduction means it currently holds a low market share. Significant investment in market education and driving adoption will be crucial to unlock its high growth potential.

- Target Market: Highly regulated industries (e.g., healthcare, utilities) requiring local data sovereignty.

- Market Position: Low market share due to recent July 2025 launch.

- Growth Potential: High, driven by increasing demand for on-premise solutions.

- Strategic Need: Requires substantial investment in market education and adoption to move towards a "Star" position.

New International Market Penetration for Specific Solutions

New international market penetration for specific Digi International solutions, particularly in regions with a limited existing presence, would be categorized as Question Marks within the Digi BCG Matrix. These are strategic moves into potentially high-growth areas or specialized sectors.

These ventures demand significant investment to establish a foothold and gain market share, especially when facing strong local competition. For instance, Digi's IoT solutions might be entering a nascent market in Southeast Asia, requiring substantial upfront capital for sales, marketing, and local support infrastructure.

- Target Markets: Focus on emerging economies with increasing demand for connected devices and industrial automation.

- Investment Needs: Significant capital allocation for market development, channel partnerships, and localized product offerings.

- Competitive Landscape: Navigating established local players and potential new entrants in these specific solution segments.

- Growth Potential: Aiming to capture a sizable share of a rapidly expanding market for specialized IoT or embedded computing solutions.

Question Marks represent new products or services with low market share but high growth potential. Digi's entry into the IIoT market with its Mobile App and VPN Service exemplifies this, targeting a sector projected to exceed $1 trillion in spending by 2026, yet currently holding minimal market share.

Similarly, Digi's AI-powered edge solutions and private 5G network offerings are positioned as Question Marks. These ventures tap into rapidly expanding markets, with private 5G alone expected to reach $10.9 billion by 2028, but require substantial investment due to their nascent market penetration.

The Digi LifeCycle Assurance On-Prem Manager, launched in July 2025, also falls into this category, addressing a critical need for data sovereignty in regulated industries with a low initial market share but significant growth prospects.

New international market entries, such as Digi's IoT solutions in Southeast Asia, are also Question Marks. These require considerable capital for market development and local support to compete effectively in potentially high-growth emerging economies.

| Product/Service | Market Category | Target Market | Market Share (Est.) | Growth Potential | Investment Need |

|---|---|---|---|---|---|

| Digi Axess Mobile App & VPN | Question Mark | Industrial Internet of Things (IIoT) | Minimal | High (>$1T by 2026) | Substantial |

| AI-Powered Edge Solutions | Question Mark | AI Sector | Modest | High | Significant |

| Private 5G Network Solutions | Question Mark | Industrial Security, Critical Infrastructure | Modest | High ($10.9B by 2028) | Significant |

| LifeCycle Assurance On-Prem Manager | Question Mark | Regulated Industries (Healthcare, Utilities) | Low (Launched July 2025) | High | Substantial |

| New International Market Penetration | Question Mark | Emerging Economies (e.g., Southeast Asia) | Low | High | Significant |

BCG Matrix Data Sources

Our Digi BCG Matrix leverages a blend of digital performance metrics, customer engagement data, market share analytics, and industry growth forecasts to provide actionable strategic insights.