Orient Securities PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orient Securities Bundle

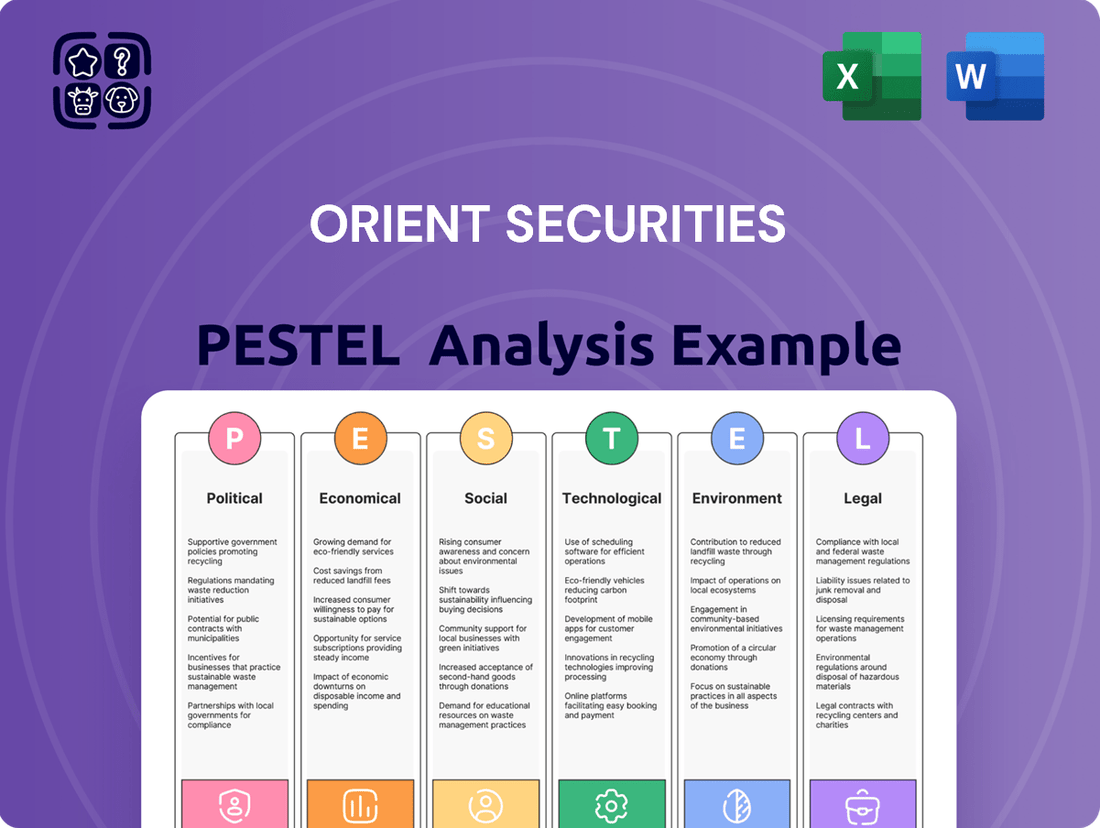

Navigate the complex external forces shaping Orient Securities's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and future growth. Gain a critical advantage by leveraging these expert insights to refine your strategy. Download the full PESTLE analysis now for actionable intelligence.

Political factors

China's State Council unveiled new directives in April 2024, termed the 'new National Nine Articles,' designed to bolster capital market oversight and foster high-quality growth. These reforms aim to construct a robust regulatory framework within five years and cultivate a competitive, inclusive capital market by 2035.

This significant regulatory reshaping directly influences the operational landscape for companies, including financial services firms like Orient Securities, within the Chinese market. The emphasis on enhanced supervision and development suggests a more stringent, yet potentially more stable, environment for financial institutions moving forward.

The China Securities Regulatory Commission (CSRC) is significantly influencing the financial landscape by implementing stricter IPO standards and increasing oversight of listed firms. For instance, in 2023, the CSRC approved 313 IPOs, raising approximately RMB 337.6 billion, demonstrating an active market but also highlighting the increased scrutiny. This regulatory push aims to bolster investor confidence and elevate the quality of publicly traded companies.

China's proactive fiscal policy in 2025, coupled with a moderately loose monetary approach, targets domestic demand and real estate stability. This includes potential interest rate cuts and reserve requirement ratio reductions, injecting liquidity to bolster corporate financing.

These macroeconomic directives directly shape the financial services landscape, impacting Orient Securities by influencing lending costs, investment opportunities, and overall market sentiment.

Support for the Real Economy

The Chinese government is actively pushing for deeper financial system reforms, with a particular focus on the capital markets. The goal is to draw in more medium to long-term investment, which is crucial for bolstering the real economy. This political push signals a clear intent to channel financial resources towards productive sectors of the economy, aligning financial services with national development priorities.

This directive creates a fertile ground for companies like Orient Securities. By focusing on services that directly contribute to the growth of the real economy, such as investment banking for infrastructure projects or asset management for industrial enterprises, Orient Securities can tap into significant new opportunities. For instance, China's commitment to developing its high-tech manufacturing sector, aiming for a 60% self-sufficiency rate in key technologies by 2027, presents a prime area for financial support and thus for Orient Securities' services.

- Capital Market Reform: Aiming to attract long-term capital for real economy growth.

- Real Economy Focus: Encouraging financial institutions to support national development goals.

- Opportunity for Orient Securities: Investment banking and asset management services for growth sectors.

- Sectoral Support: Aligning with national strategies like high-tech manufacturing self-sufficiency.

Geopolitical Stability and Trade Relations

Geopolitical stability and evolving trade relations significantly shape China's financial landscape, impacting firms like Orient Securities. The Chinese government's focus on maintaining domestic stability and navigating complex international economic partnerships is vital for bolstering investor confidence. For instance, in 2024, China continued its efforts to manage trade friction, aiming for a more predictable environment for financial services.

Changes in global trade policies or shifts in international cooperation can directly influence cross-border investment flows and financing opportunities for Chinese financial institutions. As of early 2025, ongoing discussions surrounding global supply chains and digital trade agreements highlight the dynamic nature of these external factors.

- Trade Tensions: Ongoing trade dialogues between major economies in 2024 and early 2025 present both risks and opportunities for cross-border financial activities.

- Government Policy: Beijing's commitment to economic diplomacy and managing international relations directly impacts the operating environment for financial service providers.

- Investor Sentiment: Perceived geopolitical risks can lead to volatility in capital markets, affecting investor appetite for Chinese assets.

- Regulatory Alignment: Evolving international financial regulations may necessitate adjustments in how firms like Orient Securities conduct international business.

China's political landscape is characterized by a strong emphasis on capital market reform, with the government actively directing financial resources towards the "real economy." This strategic focus aims to foster high-quality growth and enhance domestic technological self-sufficiency, as evidenced by initiatives like the 'new National Nine Articles' unveiled in April 2024. These policies directly influence financial institutions like Orient Securities by creating opportunities in sectors aligned with national development goals.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Orient Securities, offering a comprehensive view of the external landscape.

It provides actionable insights for strategic decision-making by highlighting key trends and potential impacts on Orient Securities' operations and market position.

A concise PESTLE analysis of Orient Securities offers a clear, summarized version of external factors, simplifying complex market dynamics for efficient strategic planning and decision-making.

Economic factors

China's economic engine showed impressive strength in late 2024, with a 5.4% year-on-year GDP increase in the fourth quarter, capping off a 5.0% growth for the entire year. This upward trend is expected to continue into 2025, with policymakers prioritizing economic stability and efforts to bolster market confidence.

A healthy domestic economy directly fuels financial markets, creating a more favorable environment for securities firms. Orient Securities, for instance, stands to benefit from increased investor participation and trading volumes that typically accompany robust economic expansion.

China's monetary policy for 2025 is shaping up to be moderately loose, with the People's Bank of China (PBOC) expected to implement measures like reserve requirement ratio (RRR) and interest rate cuts. These actions are aimed at injecting more liquidity into the market and reducing the cost of borrowing for businesses.

By increasing liquidity and lowering financing costs, the PBOC's strategy is intended to boost investment and trading activity across the economy. This environment could prove beneficial for Orient Securities, particularly its brokerage and investment banking divisions, as it typically correlates with increased client engagement and deal flow.

The Chinese capital market is poised for further expansion, with foreign financial institutions anticipating positive developments through 2025. This optimism is mirrored by Orient Securities' own projections, which forecast a substantial increase in its H1 2025 profit, indicating a potential upturn for the brokerage industry.

A key driver for Orient Securities' performance will be heightened investor participation and a generally positive market sentiment. These factors directly influence the company's proprietary trading gains and brokerage commission revenues, underscoring the direct link between market confidence and financial results.

Real Estate Market Stability

Stabilizing China's property sector is a significant economic objective, with policies like reduced mortgage rates and eased purchasing restrictions aimed at boosting consumer spending. For instance, by early 2024, several major cities had already seen adjustments to their housing purchase restrictions, signaling a proactive approach.

Despite ongoing market headwinds, these governmental stabilization efforts are vital for bolstering overall economic confidence and safeguarding household wealth, which is heavily tied to real estate. The property market's health directly impacts consumer spending and can affect broader economic growth trajectories.

The stability of the real estate market has a ripple effect, influencing investor sentiment and the allocation of capital across various financial assets. A more stable property market can encourage investment in other sectors by reducing perceived systemic risk.

- Property Sector Focus: China's government is actively working to stabilize the real estate market through policy interventions.

- Stimulus Measures: Lower mortgage rates and relaxed buying rules are key tools being employed to encourage property transactions.

- Economic Impact: Real estate stability is crucial for national economic confidence and the financial well-being of households.

- Investor Sentiment: A predictable property market can positively influence investor appetite for other financial instruments.

Inflationary/Deflationary Pressures

In 2024, China experienced low inflation, with the Consumer Price Index (CPI) hovering around 0.2%. This, coupled with tepid import growth, suggests ongoing weak domestic demand. Such conditions could inadvertently create price pressures if Chinese exporters shift their focus inward, especially in response to rising global tariffs.

For 2025, China's economic strategy is centered on boosting domestic demand to mitigate these deflationary tendencies. Persistent deflationary trends pose a significant risk, potentially eroding corporate earnings and asset valuations. This environment directly impacts financial services firms like Orient Securities, affecting performance in areas such as investment banking and asset management.

- Low Inflation: China's CPI was around 0.2% in 2024, indicating subdued consumer spending.

- Import Weakness: Tepid import growth further signals a lack of robust domestic demand.

- Deflationary Risk: Persistent low inflation could lead to deflation, negatively impacting corporate profits and asset values.

- Policy Focus: China's 2025 economic agenda prioritizes expanding domestic demand to counter these pressures.

China's economic trajectory for 2024 and into 2025 is marked by a dual focus on growth and stability, with GDP expected to grow around 5.0% for 2024. Policymakers are employing a moderately loose monetary stance, including potential RRR and interest rate adjustments, to inject liquidity and stimulate investment. Efforts to stabilize the property sector through measures like reduced mortgage rates are also underway, aiming to bolster consumer spending and overall economic confidence.

| Economic Indicator | 2024 (Est.) | 2025 (Proj.) | Impact on Orient Securities |

|---|---|---|---|

| GDP Growth | ~5.0% | ~5.0% | Increased trading volumes, higher brokerage commissions |

| Inflation (CPI) | ~0.2% | Targeted increase | Risk of deflationary impact on asset values, focus on boosting domestic demand |

| Monetary Policy | Moderately Loose | Continued easing potential | Increased market liquidity, lower borrowing costs for clients |

| Property Market | Stabilization efforts | Continued policy support | Improved consumer confidence, potential for increased investment in other sectors |

Same Document Delivered

Orient Securities PESTLE Analysis

The preview shown here is the exact Orient Securities PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting Orient Securities.

The content and structure shown in the preview is the same Orient Securities PESTLE Analysis document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

China's demographic landscape is undergoing significant shifts, with the population continuing its decline into 2024. This trend, coupled with a rapidly aging populace, presents a critical challenge for policymakers and the economy. The shrinking labor force and potentially reduced market demand require strategic adjustments across various industries.

However, this demographic evolution also unlocks new avenues for growth. Sectors focused on eldercare, healthcare services, and related technologies are poised for expansion as the demand for specialized support services rises. For instance, the market for elderly care products and services in China was valued at approximately $1.1 trillion in 2023 and is projected to grow substantially.

Securities firms, in particular, must proactively adapt their strategies to this changing demographic. Wealth management offerings need to be tailored to an aging client base, considering their evolving investment horizons, risk appetites, and specific financial needs, such as retirement planning and healthcare cost management. This may involve developing more conservative investment products or expanding services related to estate planning and long-term care financing.

Chinese consumers are increasingly seeking personalized financial solutions, driving growth in areas like wealth and asset management. This trend is particularly evident as disposable incomes rise, encouraging greater engagement with financial markets.

Potential government initiatives to lower household savings rates could further fuel this shift, freeing up capital for investment and consumption. For instance, a projected increase in retail sales growth for 2024, estimated around 5-6%, suggests a growing appetite for spending and potentially investing.

Orient Securities must adapt its offerings to cater to these evolving behaviors, developing targeted products and marketing campaigns to attract both individual and institutional clients in this dynamic market.

Societal expectations are shifting, with a pronounced rise in ESG awareness and a demand for corporate social responsibility. This is particularly evident in China, where ESG disclosure is undergoing significant standardization and expansion. Policy signals from 2024 into 2025 strongly suggest an anticipated increase in both the volume and quality of ESG reporting.

This growing social consciousness directly fuels the demand for responsible investment practices. Orient Securities is well-positioned to capitalize on this trend by proactively developing and marketing financial products and services that adhere to ESG principles, meeting the evolving needs of investors.

Digital Financial Inclusion

Fintech adoption in China is booming, especially with mobile payments. A notable trend from 2024 shows a significant increase in adoption among individuals aged 60 and older, indicating a widening reach of digital finance across age groups. This broadens financial inclusion, bringing more people into the formal financial system.

This surge in digital financial inclusion presents opportunities for Orient Securities. By leveraging digital platforms, the company can tap into previously underserved markets, including those in more remote areas and older demographics who are increasingly comfortable with digital tools. This strategic move can expand their client base considerably.

- Widespread Fintech Adoption: China leads in mobile payment usage, a key driver of digital financial inclusion.

- Demographic Expansion: A notable jump in fintech adoption was observed among users aged 60+ in 2024, demonstrating inclusivity across age segments.

- Opportunity for Orient Securities: Digital platforms can be utilized to reach a broader client base, including older demographics and those in less developed regions.

Wealth Accumulation and Management Needs

China's burgeoning economy has fueled a significant rise in household wealth, creating a robust demand for advanced wealth management solutions. This upward trend in disposable income and savings is directly translating into a greater need for services that can effectively grow and preserve capital.

Orient Securities is strategically positioned to benefit from this societal shift. As a broad-spectrum financial services entity, it can cater to the evolving needs of China's increasingly affluent population by offering a wide array of investment vehicles and personalized financial guidance.

The move away from conventional savings accounts towards more dynamic investment products represents a crucial market opportunity. By 2024, it's estimated that Chinese household financial assets reached approximately $29 trillion, with a growing portion allocated to investments beyond simple savings, highlighting the market's receptiveness to sophisticated financial products.

- Growing Household Wealth: China's middle class and high-net-worth individuals are expanding, leading to increased financial assets available for management.

- Demand for Sophistication: As wealth grows, so does the need for complex investment strategies, risk management, and estate planning.

- Shift to Investments: A notable trend shows a preference for investment products over traditional savings, driven by the pursuit of higher returns.

- Orient Securities' Role: The company can leverage its comprehensive offerings to capture market share in this expanding wealth management sector.

China's societal fabric is evolving, marked by a growing emphasis on environmental, social, and governance (ESG) principles. This shift is driving demand for responsible investing, with a notable increase in ESG-focused financial products. By 2025, it's anticipated that ESG investments in China will see significant growth, reflecting this heightened societal awareness.

Orient Securities can capitalize on this trend by developing and promoting sustainable investment options. Meeting this demand not only aligns with ethical considerations but also taps into a burgeoning market segment seeking to align their financial goals with their values.

The company's strategy should incorporate ESG integration into its investment analysis and product development. This proactive approach will position Orient Securities as a leader in responsible finance, attracting a growing base of socially conscious investors.

China's demographic shifts, including an aging population and a declining birth rate, are reshaping consumer behavior and financial needs. By 2024, the elderly population represented a significant portion of the consumer market, creating opportunities in sectors like healthcare and retirement planning.

| Sociological Factor | Trend | Implication for Orient Securities | Data Point (2024/2025) |

| Aging Population | Increasing proportion of elderly citizens | Demand for retirement planning, wealth preservation, and healthcare-related financial products. | China's elderly population is projected to exceed 300 million by 2025. |

| ESG Awareness | Growing consumer and investor focus on sustainability | Increased demand for ESG-compliant investment products and services. | ESG investment in China is expected to grow by over 20% annually through 2025. |

| Digital Financial Inclusion | Broader adoption of fintech across all age groups | Opportunity to expand reach through digital platforms, especially to older demographics. | Fintech adoption among individuals aged 60+ saw a significant increase in 2024. |

| Rising Household Wealth | Expansion of middle and high-net-worth individuals | Increased demand for sophisticated wealth management and investment solutions. | Chinese household financial assets reached approximately $29 trillion in 2024. |

Technological factors

China's strategic push towards a 'digitalized, intelligent, green and fair' fintech sector by 2025 underscores a significant technological shift. This initiative prioritizes robust digital infrastructure and improved fintech governance, creating a fertile ground for innovation.

Fintech adoption in China is already remarkably high, with a substantial portion of the digitally active population regularly engaging with services like mobile payments. For instance, by the end of 2023, China's mobile payment penetration rate was estimated to be over 85% among internet users, showcasing deep integration.

Orient Securities can capitalize on these advancements by integrating cutting-edge fintech solutions to streamline operations and enrich its customer service. This includes exploring AI-driven wealth management tools and blockchain-based transaction platforms to enhance efficiency and client experience.

The financial services industry is experiencing a significant digital overhaul, with technologies like big data, cloud computing, and artificial intelligence becoming deeply embedded. This digital shift is evident in areas such as intelligent investment advisory and supply chain finance, both designed to reduce costs and boost efficiency. For instance, by the end of 2024, it's projected that over 80% of financial institutions will be leveraging AI for customer service and risk management, a trend Orient Securities can capitalize on.

Orient Securities can strategically invest in and enhance its digital platforms and tools. This investment will be crucial for optimizing its brokerage, asset management, and investment banking services. By embracing these advancements, the company can expect to see a tangible improvement in operational workflows and client engagement, mirroring the industry trend where digital-native financial firms are showing a 15-20% higher revenue growth compared to traditional players.

New draft amendments to China's Cybersecurity Law (CSL) were introduced in March 2025, introducing stricter penalties and clearer enforcement. These changes align with existing data protection laws, meaning financial institutions like Orient Securities, classified as critical information infrastructure operators (CIIOs), will face increased oversight and must meet demanding security standards. This necessitates ongoing investment in advanced cybersecurity measures to safeguard client information and preserve confidence.

Application of Artificial Intelligence and Big Data

Orient Securities is increasingly leveraging artificial intelligence (AI) and big data, particularly with the surge in generative AI's application within China's financial services sector. This technological wave is poised to significantly transform key areas such as risk management and wealth management, offering more sophisticated tools for analysis and client engagement.

Big data analytics provides Orient Securities with unparalleled insights into intricate market trends and nuanced client behaviors. By processing vast datasets, the firm can identify patterns and predict future movements with greater accuracy, informing strategic decisions and product development.

To maintain a competitive edge, Orient Securities is integrating AI and big data across its core operations. This includes enhancing research capabilities, optimizing trading strategies, and delivering highly personalized advisory services. For instance, AI-powered platforms can analyze market sentiment from millions of data points in real-time, a capability that was not feasible just a few years ago.

- AI-driven risk assessment: In 2024, Chinese financial institutions reported a significant increase in the adoption of AI for credit risk scoring, with some models showing a 15% improvement in prediction accuracy compared to traditional methods.

- Personalized wealth management: Big data analytics allows for hyper-segmentation of clients, enabling tailored investment recommendations. By Q1 2025, firms using advanced analytics saw a 10% rise in client retention rates in wealth management.

- Enhanced trading algorithms: AI is being used to develop predictive trading models that can identify arbitrage opportunities and execute trades at speeds measured in microseconds, potentially boosting trading revenues.

- Market trend analysis: The application of natural language processing (NLP) on news and social media data in 2024 allowed financial analysts to identify emerging market trends up to two weeks earlier than traditional methods.

Blockchain and Distributed Ledger Technologies

Blockchain and distributed ledger technologies (DLTs) are poised to significantly impact financial services. China's national fintech development plans highlight the integration of these emerging technologies, aiming to enhance efficiency and security across various financial operations. For Orient Securities, this translates into potential advancements in areas like clearing and settlement processes, the management of digital assets, and the financing of supply chains.

The adoption of blockchain could streamline complex financial transactions, reducing intermediaries and associated costs. This technology's inherent transparency and immutability offer robust solutions for record-keeping and auditing. Orient Securities can explore leveraging DLTs to create more efficient and secure platforms for its clients.

- Clearing and Settlement: Blockchain can enable near real-time settlement, reducing counterparty risk and improving capital efficiency.

- Digital Assets: The technology is fundamental to the creation and management of tokenized securities and other digital financial instruments.

- Supply Chain Finance: DLT can provide greater transparency and traceability in supply chains, facilitating more accessible and efficient financing for businesses.

- Regulatory Compliance: Blockchain's auditability can simplify compliance reporting and enhance regulatory oversight.

China's strategic focus on a digital and intelligent fintech sector by 2025, coupled with high mobile payment penetration exceeding 85% among internet users by end-2023, presents significant opportunities. Orient Securities can leverage AI and big data for enhanced risk assessment, with institutions seeing a 15% improvement in credit risk prediction accuracy in 2024, and personalized wealth management, leading to a 10% rise in client retention by Q1 2025.

The integration of AI and big data is transforming financial services, with AI adoption for customer service and risk management projected to reach over 80% of institutions by end-2024. Orient Securities can benefit from AI-driven trading algorithms and NLP for market trend analysis, identifying emerging trends up to two weeks earlier in 2024.

Blockchain and DLTs are key to China's fintech development, offering potential for near real-time clearing and settlement, and improved efficiency in areas like supply chain finance. Orient Securities can explore these technologies to enhance security and streamline operations, aligning with national plans for technological integration.

| Technology | Application | Impact/Benefit | Data/Projection |

|---|---|---|---|

| AI & Big Data | Risk Assessment | Improved prediction accuracy | 15% improvement in credit risk scoring (2024) |

| AI & Big Data | Wealth Management | Enhanced client retention | 10% rise in retention rates (Q1 2025) |

| AI & Big Data | Trading | Faster execution, revenue boost | Microsecond execution speeds |

| AI & Big Data | Market Analysis | Early trend identification | Up to 2 weeks earlier identification (2024) |

| Blockchain/DLT | Clearing & Settlement | Reduced risk, improved efficiency | Near real-time settlement |

Legal factors

China's State Council unveiled the 'new National Nine Articles' in April 2024, a landmark policy introducing more stringent controls on capital market issuances and listings. This directive also bolsters continuous supervision of listed entities and intensifies delisting oversight, directly impacting the operational landscape for firms like Orient Securities.

These securities laws and capital market regulations are critical for Orient Securities, influencing its investment banking activities, brokerage services, and overall compliance framework. The emphasis on stricter issuance and listing criteria, coupled with enhanced supervision, necessitates robust internal controls and strategic adjustments to navigate the evolving regulatory environment.

China's data privacy and cybersecurity landscape is governed by a robust framework, including the Cybersecurity Law (CSL), Data Security Law (DSL), and Personal Information Protection Law (PIPL). These laws are designed to protect sensitive data and ensure secure network operations, impacting how companies like Orient Securities handle customer information.

Recent developments, such as the March 2025 draft amendments to the CSL, signal an intensification of regulatory scrutiny. These amendments propose significantly harsher penalties and more stringent enforcement, especially for Critical Information Infrastructure Operators (CIIOs), a category that includes financial institutions. Orient Securities must proactively adapt its data handling practices to align with these escalating compliance requirements.

China's regulatory landscape for ESG is rapidly evolving. In February 2024, the nation's three major stock exchanges introduced ESG reporting guidelines, with mandatory disclosure for certain listed firms commencing in 2026, though earlier voluntary reporting is encouraged. This legal push is further reinforced by the Ministry of Finance's December 2024 publication of Corporate Sustainability Disclosure Guidelines.

These new legal mandates directly impact Orient Securities. The company must now develop robust internal ESG reporting frameworks to ensure its own compliance. Furthermore, it is imperative for Orient Securities to equip itself to effectively guide its diverse client base through these evolving disclosure requirements, ensuring their adherence to the new standards.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Regulations

The National Financial Regulatory Administration (NFRA) is set to introduce Management Measures for Cybersecurity in Banking and Insurance Sectors in 2025. While this focuses on cybersecurity, it signals a broader regulatory emphasis on financial integrity and robust risk management, which indirectly impacts AML/CTF compliance by reinforcing the need for secure data handling and transaction monitoring.

Orient Securities must remain vigilant in adapting its internal controls and compliance frameworks to align with these evolving financial crime prevention statutes. This includes staying abreast of any specific directives related to customer due diligence, suspicious activity reporting, and transaction monitoring technologies that may emerge alongside these broader cybersecurity regulations.

The evolving regulatory landscape, including the NFRA's 2025 cybersecurity measures, underscores the critical need for Orient Securities to maintain comprehensive and up-to-date AML/CTF programs. Proactive adaptation ensures the firm not only meets legal obligations but also safeguards its reputation and operational stability in an increasingly scrutinized financial environment.

Cross-Border Investment and Financial Opening-Up Rules

China's commitment to capital market reform and opening up is accelerating, with a clear emphasis on broadening market access for global investors and streamlining cross-border investment. This strategic push aims to foster greater inclusiveness within its financial markets, making it easier for both domestic and international entities to engage in capital flows. For a firm like Orient Securities, with established international operations, understanding and adapting to these evolving regulatory landscapes is paramount to leveraging new opportunities.

The ongoing deepening of market opening-up presents significant avenues for Orient Securities to expand its global reach and services. This includes navigating regulations that facilitate cross-border investment and financing, which are crucial for attracting foreign capital and enabling Chinese companies to access international markets. As of late 2024, China has continued to ease restrictions on foreign ownership in financial institutions, with foreign ownership caps in securities firms, fund management companies, and futures companies being fully lifted, signaling a more open environment.

Orient Securities must actively monitor and strategize around these dynamic cross-border regulatory frameworks. Key developments include the expansion of programs like the Stock Connect and Bond Connect, which facilitate easier access to China's equity and bond markets respectively. For instance, the northbound trading volume through the Shanghai-Hong Kong Stock Connect reached significant levels in 2024, demonstrating increased foreign participation.

- Regulatory Evolution: China's ongoing capital market reforms are designed to enhance market inclusiveness and facilitate cross-border investment and financing.

- Market Access: The continuous deepening of market opening-up provides greater access for global investors to Chinese financial markets.

- International Operations: Orient Securities, with its international presence, must navigate and capitalize on these evolving cross-border regulatory frameworks.

- Key Initiatives: Programs like the Stock Connect and Bond Connect are central to facilitating easier cross-border capital flows, with significant trading volumes observed in 2024.

China's 'new National Nine Articles' from April 2024 impose stricter controls on capital market issuances and listings, increasing oversight of listed companies and delisting processes. These legal shifts necessitate that Orient Securities bolster its internal controls and adapt its investment banking and brokerage services to comply with the heightened regulatory environment.

The nation's data privacy framework, including the CSL, DSL, and PIPL, is tightening, with draft CSL amendments in March 2025 proposing harsher penalties, particularly for Critical Information Infrastructure Operators like financial institutions. Orient Securities must proactively update its data handling practices to meet these escalating compliance demands.

ESG reporting is becoming legally mandated, with stock exchanges introducing guidelines in February 2024 and mandatory disclosures for some firms starting in 2026, supported by the Ministry of Finance's December 2024 sustainability disclosure guidelines. Orient Securities needs to establish robust internal ESG reporting and assist clients in navigating these new requirements.

The National Financial Regulatory Administration's upcoming 2025 Management Measures for Cybersecurity in Banking and Insurance Sectors, while focused on cybersecurity, reinforce the need for secure data handling and transaction monitoring, indirectly impacting Anti-Money Laundering and Counter-Terrorist Financing (AML/CTF) compliance. Orient Securities must ensure its AML/CTF programs are comprehensive and up-to-date.

Environmental factors

China's commitment to a green transition, aiming for carbon peak by 2030 and carbon neutrality by 2060, is driving significant growth in its green financial systems. This national agenda is reinforced by policies like the 2024 'Opinions on Comprehensively Promoting the Construction of a Beautiful China,' which explicitly supports green finance development.

These initiatives encourage robust growth in areas such as green bond issuance, which saw a substantial increase in 2023, with the total volume of green bonds issued reaching over ¥1.2 trillion according to the People's Bank of China. Orient Securities is well-positioned to capitalize on this trend by leveraging its investment banking and asset management expertise to facilitate green financing solutions.

The focus on climate finance innovation presents opportunities for Orient Securities to develop new financial products and services that support sustainable development. By aligning its strategies with these evolving environmental policies, Orient Securities can enhance its market position and contribute to China's ambitious climate goals.

The integration of Environmental, Social, and Governance (ESG) factors into investment decisions is a significant trend, with China actively expanding its ESG disclosure requirements. This includes sustainability reporting guidelines issued by stock exchanges and the Ministry of Finance, signaling a more standardized approach.

Orient Securities can leverage this trend by developing specialized ESG investment products and embedding ESG considerations into its client advisory services, thereby strengthening its competitive edge in the evolving market.

China's commitment to carbon neutrality by 2060 is driving a significant shift, with a growing focus on evaluating environmental risks and channeling investments into sustainable sectors. This transition presents financial institutions like Orient Securities with avenues to develop innovative green finance solutions and back projects in renewable energy and other low-carbon technologies.

The Chinese government has been actively promoting green finance, with the outstanding balance of green loans reaching approximately 22.05 trillion yuan by the end of 2023, according to the People's Bank of China. Orient Securities can leverage this trend by identifying and financing climate-resilient infrastructure and advising clients on navigating the financial implications of climate change.

Carbon Market Development and Expansion

China's national carbon market is poised for significant growth, with plans to extend its reach beyond the power sector to heavy industries like steel, cement, and aluminum by 2025. This expansion is projected to inject considerable vitality into the market, fostering new avenues for trading and financing carbon emissions. For instance, the initial phase of the power sector carbon market saw over 2.2 billion tons of carbon allowances traded by the end of 2023, a figure expected to surge with broader industry participation.

This broadened scope presents substantial opportunities for financial institutions like Orient Securities. The development of a more comprehensive carbon market will create demand for specialized services, including carbon trading, carbon asset management, and bespoke financial advisory for clients navigating these evolving regulatory landscapes. By 2025, it's anticipated that the total value of China's carbon market could reach tens of billions of dollars annually, driven by these industry inclusions.

- Expansion by 2025: China's carbon market to include steel, cement, and aluminum sectors.

- Market Vitality Boost: Expected increase in trading volume and liquidity.

- New Opportunities: Creation of trading, financing, and advisory services for carbon assets.

- Growth Potential: Market value projected to reach tens of billions of dollars annually by 2025.

Environmental Regulations Affecting Corporate Operations

China's commitment to environmental stewardship, particularly evident in 2024, has significantly shaped its financial landscape. The government's proactive policy interventions have fostered a more robust green finance ecosystem, introducing stricter and more unified disclosure requirements for corporations. This regulatory evolution directly impacts how companies, including financial institutions like Orient Securities, manage and report their environmental performance.

These evolving regulations are not merely about compliance; they represent a strategic shift towards sustainability. For Orient Securities, this means integrating national carbon footprint management standards into its operational framework and ensuring transparency in its environmental disclosures. The push for standardized reporting aims to provide investors with clearer insights into corporate environmental impact, a trend expected to intensify in the coming years.

- Unified Disclosure Requirements: Corporations are facing more standardized and comprehensive environmental reporting mandates.

- National Carbon Footprint Standards: The introduction of national standards for carbon footprint management necessitates adherence by all businesses.

- Green Finance Ecosystem Growth: Policy support in 2024 has accelerated the development of China's green finance sector.

- Operational Impact on Orient Securities: Orient Securities must adapt its operations and reporting to align with these environmental regulations.

China's environmental policies are actively driving the growth of green finance, with targets for carbon peak by 2030 and carbon neutrality by 2060. The nation's commitment is further solidified by initiatives like the 2024 'Opinions on Comprehensively Promoting the Construction of a Beautiful China,' which directly supports green finance development.

This policy environment has led to a surge in green bond issuance, exceeding ¥1.2 trillion in 2023, as reported by the People's Bank of China. Orient Securities can leverage its expertise to facilitate these green financing solutions, capitalizing on the expansion of climate finance innovation and the development of new sustainable financial products.

The increasing integration of ESG factors into investment decisions is a key trend, with China enhancing its ESG disclosure requirements through guidelines from stock exchanges and the Ministry of Finance. Orient Securities is positioned to benefit by developing specialized ESG investment products and embedding ESG considerations into its client advisory services, thereby strengthening its market position.

| Environmental Factor | Key Initiatives/Trends | Impact on Orient Securities | Relevant Data (2023/2024) |

|---|---|---|---|

| Green Finance Growth | Carbon neutrality goals, green bond issuance, climate finance innovation | Opportunity for green financing solutions, new product development | Green bond issuance > ¥1.2 trillion (2023) |

| ESG Integration | Expanded ESG disclosure requirements, sustainability reporting | Development of ESG products, enhanced client advisory | Increased ESG adoption across listed companies |

| Carbon Market Expansion | Inclusion of heavy industries (steel, cement, aluminum) by 2025 | Demand for carbon trading, asset management, and advisory services | Carbon market to reach tens of billions of dollars annually by 2025 |

PESTLE Analysis Data Sources

Our Orient Securities PESTLE Analysis is meticulously constructed using data from reputable financial news outlets, official government publications, and leading economic research firms. We ensure comprehensive coverage of political stability, economic forecasts, technological advancements, and regulatory changes impacting the securities industry.