Dentsu Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dentsu Group Bundle

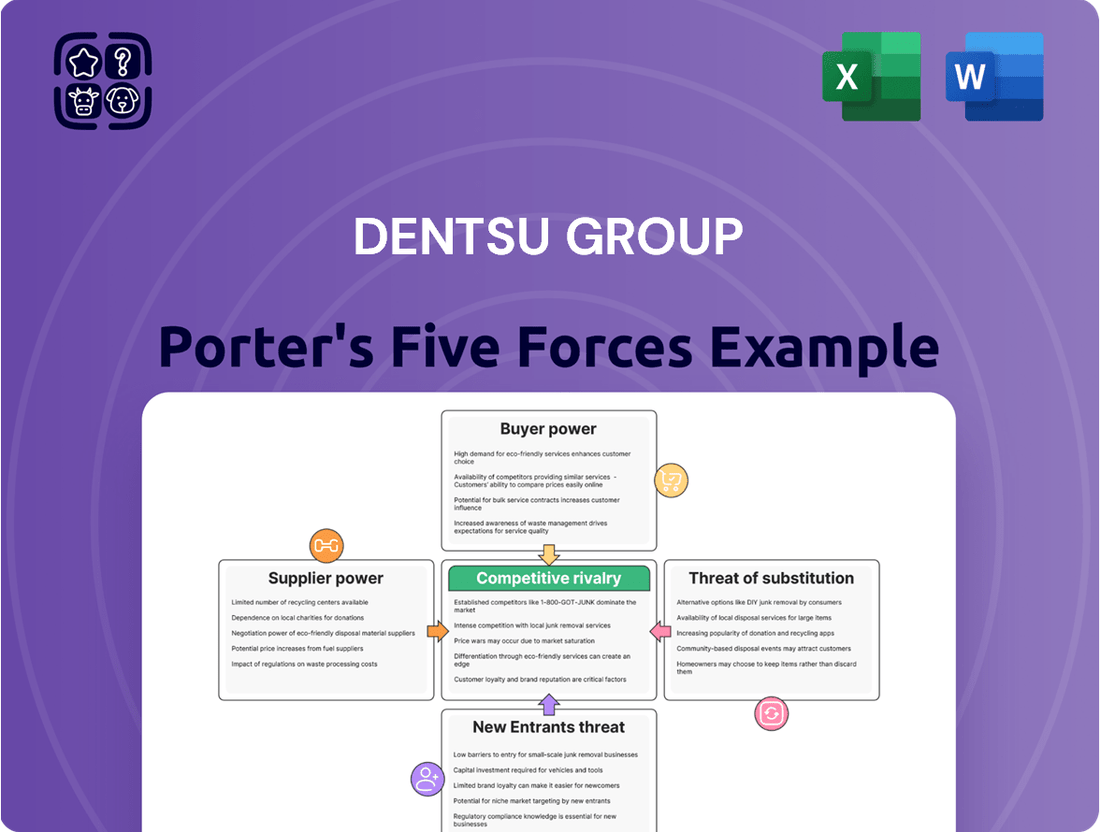

The Dentsu Group operates in a dynamic advertising and marketing landscape, facing moderate threats from new entrants and a significant threat from substitutes like in-house marketing teams. Buyer power is also a key consideration, as clients can leverage their scale to negotiate terms.

The complete report reveals the real forces shaping Dentsu Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dentsu Group's reliance on specialized talent, especially in data science and AI, gives these professionals significant leverage. The demand for these skills outstrips supply, meaning Dentsu must offer attractive compensation packages to secure and keep them. This aligns with their stated strategy of investing heavily in both human capital and technological advancement.

Dentsu's increasing reliance on advanced technology, particularly in its 'Algorithmic Era' strategy focusing on data and AI, amplifies the bargaining power of its technology providers. Companies offering unique software, analytics platforms, and AI solutions can command higher licensing fees and impose stringent integration requirements.

In 2024, the global market for marketing technology (MarTech) reached an estimated $350 billion, highlighting the significant spend and dependence of agencies like Dentsu on these specialized providers. This dependence allows dominant tech firms to negotiate favorable terms in service level agreements and potentially charge premium prices for essential functionalities.

Major media owners, from traditional broadcasters to digital giants like Google and Meta, wield significant power over Dentsu. Their vast audiences and exclusive data allow them to command premium pricing and set terms for advertising inventory, impacting Dentsu's media buying capabilities.

The rise of retail media networks further concentrates this power, offering new avenues for brands and advertisers but also increasing the leverage of these platform owners. Dentsu's global scale provides some negotiation strength, but the fundamental control over essential advertising channels remains with these powerful entities.

Content Production Houses

The bargaining power of content production houses for Dentsu Group is influenced by their unique creative capabilities and specialized equipment. When production houses offer distinctiveness and high quality, particularly for major campaigns, their leverage grows significantly. This is because replicating such specialized output can be challenging and costly for Dentsu.

For instance, in 2024, the demand for high-quality, AI-enhanced video content surged, giving specialized studios with advanced AI integration capabilities a stronger negotiating position. Dentsu's reliance on these niche providers for cutting-edge creative solutions means these suppliers can command better terms.

- Specialized Skills: Production houses with unique animation techniques or advanced CGI rendering skills can command higher prices.

- Proprietary Technology: Access to exclusive or difficult-to-replicate production technology enhances supplier power.

- High-Profile Campaign Dependence: When a campaign's success hinges on a specific production house's distinctive style, their bargaining power increases.

- Limited Alternatives: If few other production houses can meet the specific creative or technical requirements, suppliers gain leverage.

Data and Research Firms

Data and research firms hold significant bargaining power over Dentsu Group. Access to robust market intelligence, consumer insights, and performance analytics is crucial for Dentsu's strategic offerings and client solutions. For instance, in 2024, the global market for marketing analytics software was valued at approximately $5.5 billion, highlighting the demand for such data.

Suppliers of specialized information can command premium prices, especially if their data sets are exclusive or offer superior predictive capabilities. This is particularly true for firms providing granular consumer behavior data or advanced AI-driven analytics, which are essential for Dentsu's data-driven decision-making and client reporting. Companies like Nielsen or Kantar, which provide critical audience measurement and market research, often have strong negotiating positions due to the proprietary nature and depth of their data.

- Exclusive Data Sets: Suppliers with unique or proprietary data sources can charge higher prices.

- Predictive Capabilities: Firms offering advanced analytics and forecasting tools leverage their technological edge.

- Essential for Client Solutions: Dentsu's reliance on data for client reporting and strategy development increases supplier leverage.

- Market Concentration: A limited number of high-quality data providers can lead to concentrated supplier power.

The bargaining power of suppliers for Dentsu Group is a significant factor, particularly concerning specialized talent and technology providers. The demand for expertise in areas like data science and AI means that skilled professionals and the companies offering advanced MarTech solutions can negotiate favorable terms. This is evident in the substantial global MarTech market, which reached an estimated $350 billion in 2024, underscoring agencies' dependence on these specialized providers.

Major media owners, including digital giants like Google and Meta, also exert considerable influence due to their vast audiences and exclusive data. This allows them to dictate advertising prices and terms, impacting Dentsu's media buying strategies. Similarly, content production houses with unique creative capabilities or proprietary technology can command higher prices, especially when their output is critical for major campaigns.

Data and research firms are another key area where supplier power is high. Dentsu's need for robust market intelligence and consumer insights means firms providing exclusive or superior predictive data, such as those in the $5.5 billion marketing analytics software market in 2024, can charge premium prices. This concentration of power among a few high-quality data providers enhances their negotiating leverage.

What is included in the product

This analysis of the Dentsu Group's competitive environment highlights the intense rivalry among advertising and marketing agencies, the significant bargaining power of clients, and the moderate threat of new entrants and substitutes.

Effortlessly gauge competitive intensity across all five forces with a dynamic, interactive dashboard, simplifying complex strategic analysis for immediate insights.

Customers Bargaining Power

Dentsu Group's reliance on a few major clients can significantly amplify customer bargaining power. These large multinational corporations, with their substantial marketing expenditures, are in a strong position to negotiate better rates and demand tailored services, directly impacting Dentsu's profit margins.

For instance, in 2023, Dentsu reported that its largest client accounted for approximately 10% of its total net revenue, highlighting the concentration risk. This dependence means that losing even one of these key accounts could have a material impact on the company's financial performance, further empowering these clients in negotiations.

Decreasing switching costs for clients are a significant factor influencing the bargaining power of customers for Dentsu Group. The increasing standardization of digital advertising platforms, such as Google Ads and Meta Ads, means that clients can more readily move their digital spend between agencies with less disruption. This ease of transition empowers clients to negotiate more aggressively on pricing and service terms, knowing they have viable alternatives readily available.

The growing number of alternative service providers, from specialized boutique agencies to in-house teams, further amplifies customer power. In 2024, the digital advertising market continues to see an influx of new players and a consolidation of specialized skills, offering clients a wider array of choices. If Dentsu's performance, pricing, or service quality falters, clients can more easily explore and engage with these competitors, putting pressure on Dentsu to maintain high standards and competitive offerings.

Clients are increasingly demanding that marketing agencies demonstrate clear, measurable results. This focus on performance-based metrics significantly amplifies customer power. For instance, a growing trend in 2024 sees clients negotiating contracts where a substantial portion of agency fees are directly linked to achieving specific KPIs, such as lead generation or sales conversion rates.

This shift means Dentsu's revenue is more directly tied to client success, giving clients greater leverage in negotiations. If Dentsu fails to meet agreed-upon performance targets, their compensation is directly impacted, leading to more intense scrutiny of their strategies and spending.

Growth of In-house Capabilities

Many large corporations are increasingly building out their internal marketing, media buying, and digital transformation functions. This 'in-housing' trend allows clients to bring services in-house, lessening their reliance on external agencies such as Dentsu. This shift directly enhances their bargaining power during negotiations with agencies.

This move towards in-housing is a significant driver of customer bargaining power. For instance, a 2023 survey indicated that 70% of marketers were considering or actively increasing their in-house capabilities, a notable rise from previous years. This allows clients to have greater control over their marketing spend and strategy.

- Increased Control: Clients gain more direct oversight of their marketing campaigns and data.

- Cost Efficiency: In-housing can potentially lead to cost savings compared to agency fees, especially for ongoing or high-volume work.

- Agility and Speed: Internal teams can often react more quickly to market changes and internal needs.

- Talent Acquisition: Companies are investing in attracting and retaining in-house talent, building specialized expertise.

Increased Information Access and Transparency

Clients in the advertising and marketing sector now possess unprecedented access to information. They can readily compare agency pricing, service benchmarks, and performance data through numerous online resources and industry reports. For instance, in 2024, platforms like Clutch and Forrester continued to provide detailed agency reviews and market insights, empowering clients with comparative data that was less readily available a decade ago.

This heightened transparency directly impacts Dentsu Group's bargaining power. Clients are better equipped to scrutinize proposals, identify potential cost savings, and negotiate more favorable terms. They can leverage data on industry averages to challenge pricing and demand clearer justifications for service expenditures, thereby increasing their leverage in discussions with agencies like Dentsu.

- Enhanced Client Knowledge: Clients can easily access and analyze competitor pricing and service offerings, leading to more informed decision-making.

- Demand for ROI: Increased transparency fuels client expectations for demonstrable return on investment, pressuring agencies to prove their value.

- Data-Driven Negotiations: Clients utilize industry benchmarks and performance metrics to negotiate contract terms and service fees more effectively.

- Shift in Power Dynamic: The ease of information access shifts some negotiation power from service providers to clients, requiring agencies to be more competitive and transparent.

The bargaining power of customers for Dentsu Group is significant due to several factors, including client concentration, decreasing switching costs, and the rise of in-housing. Large clients, often accounting for a substantial portion of revenue, can negotiate favorable terms, impacting Dentsu's profitability. For example, in 2023, Dentsu's largest client represented around 10% of its net revenue, illustrating this dependency.

The ease with which clients can switch between digital advertising platforms and agencies, coupled with the growing availability of alternative providers, further empowers them. In 2024, the market is characterized by more choices, forcing Dentsu to remain competitive in pricing and service quality. Clients are also increasingly demanding performance-based contracts, directly linking agency fees to measurable results like lead generation, giving them more leverage.

The trend of clients bringing marketing functions in-house is also a major contributor to customer bargaining power. A 2023 survey showed a notable increase, with 70% of marketers considering or expanding in-house capabilities, allowing for greater control over marketing spend and strategy.

Enhanced client knowledge through readily available data and industry benchmarks further strengthens their negotiating position. In 2024, platforms continue to provide detailed agency reviews and market insights, enabling clients to scrutinize proposals and negotiate more effectively.

| Factor | Impact on Dentsu | Example/Data Point |

|---|---|---|

| Client Concentration | High leverage for major clients | Largest client accounted for ~10% of 2023 net revenue |

| Switching Costs | Increased client flexibility | Standardization of digital ad platforms lowers switching barriers |

| In-housing Trend | Reduced reliance on agencies | 70% of marketers considered increasing in-house capabilities (2023) |

| Information Access | Empowered negotiation | Online platforms provide comparative pricing and performance data (2024) |

Preview Before You Purchase

Dentsu Group Porter's Five Forces Analysis

This preview showcases the complete Dentsu Group Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the advertising and marketing industry. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact, professionally formatted file, ready for immediate use and strategic application.

Rivalry Among Competitors

Dentsu Group faces formidable competition from global advertising holding companies like WPP, Publicis Groupe, Omnicom, and Interpublic Group. This rivalry is driven by the constant pursuit of major international client contracts, skilled industry professionals, and increased market presence across creative, media, and digital services.

The lines between advertising, tech, and consulting are blurring, creating intense competition. Firms like Accenture Interactive and Deloitte Digital are now offering comprehensive marketing and digital transformation services, directly challenging Dentsu's traditional strengths, especially in customer experience management.

In 2023, Accenture's consulting segment, which includes its digital and marketing services, saw revenue grow by 10% to $26.1 billion, highlighting the significant investment and success of consultancies in this space. This expansion means Dentsu faces rivals with deep pockets and broad capabilities, capable of offering end-to-end solutions that go beyond traditional advertising.

Dentsu Group is facing intense competition, evidenced by its flat organic revenue growth of approximately 0% in FY2024. This sluggish performance highlights the difficulty in gaining market share in the current advertising and marketing landscape.

Looking ahead to FY2025, Dentsu projects only about 1% organic revenue growth. This minimal expected increase further emphasizes the highly competitive environment where even modest expansion requires significant effort and strategic maneuvering.

To counter these pressures, Dentsu is actively engaged in restructuring and re-evaluating its underperforming business units. This strategic pivot demonstrates the company's commitment to shedding inefficiencies and refocusing resources to better compete against rivals in a challenging market.

Rapid Technological Advancements and AI Investment

The advertising industry is in the midst of a major shift, with artificial intelligence becoming a central force. This rapid technological evolution is significantly increasing competitive rivalry.

Highly scaled players, both established within and new to the advertising sector, are emerging. These companies, alongside major tech and consulting firms, are pouring substantial capital into AI development and implementation. For instance, in 2024, global spending on AI is projected to reach hundreds of billions of dollars, with a significant portion directed towards marketing and advertising applications.

Dentsu's own commitment to AI investment is therefore not just beneficial but essential. These investments are key to maintaining its competitive edge and successfully navigating the increasingly complex and AI-driven advertising landscape.

- AI Integration: The advertising industry is rapidly integrating AI technologies, transforming campaign management, data analysis, and creative processes.

- Investment Surge: Tech and consulting giants are making massive investments in AI, creating a highly competitive environment for advertising firms.

- Dentsu's Strategy: Dentsu's significant AI investments are crucial for differentiation and staying competitive in this evolving market.

Price and Value-Based Competition

In the advertising and marketing services industry, particularly within mature markets, competitive rivalry is intense, often centering on price and perceived value. Clients, especially those with significant marketing budgets, are increasingly scrutinizing every dollar spent, demanding clear evidence of return on investment. This pressure forces agencies like Dentsu Group to adopt aggressive pricing strategies, which can include service bundling to offer more comprehensive solutions at a competitive price point.

The need to demonstrate quantifiable value is paramount. Agencies must continuously innovate and refine their service offerings to justify their fees and secure client retention. For instance, in 2024, many clients are looking beyond traditional media buys to integrated digital strategies and performance-based marketing, where success can be more directly measured. This shift compels agencies to invest heavily in data analytics and technology to prove their worth, leading to a constant cycle of service enhancement and pricing adjustments to stay ahead of competitors.

- Price Sensitivity: Clients in the advertising sector frequently prioritize cost-effectiveness, especially in 2024.

- ROI Demonstration: Agencies face constant pressure to prove the tangible benefits and financial returns of their campaigns.

- Aggressive Pricing: This often manifests as competitive bidding, service bundling, and flexible contract terms.

- Innovation as a Differentiator: Agencies that can offer novel, data-driven solutions are better positioned to command higher fees and retain clients.

Dentsu Group faces intense competition from global advertising holding companies and increasingly from tech and consulting firms like Accenture Interactive. This rivalry is intensified by the blurring lines between advertising, technology, and consulting services, forcing Dentsu to compete on broader capabilities and end-to-end solutions. The industry's rapid integration of AI further escalates competition, with major players investing heavily in these technologies.

Dentsu's organic revenue growth of approximately 0% in FY2024 and a projected 1% for FY2025 underscore the challenging competitive landscape. Clients are highly price-sensitive and demand demonstrable ROI, compelling agencies to offer competitive pricing, service bundling, and innovative, data-driven solutions to retain business.

The substantial global investment in AI, projected in the hundreds of billions of dollars for 2024, highlights the critical need for Dentsu's own AI investments to maintain its competitive edge. The company’s ongoing restructuring efforts aim to enhance efficiency and refocus resources to better compete against these formidable rivals.

SSubstitutes Threaten

The rise of powerful marketing technology and data analytics tools allows many companies to handle more marketing tasks internally. This trend makes in-house marketing departments a significant substitute for external agencies like Dentsu Group, as brands can now manage strategy, execution, and data analysis themselves.

For instance, the global marketing technology market was projected to reach over $100 billion in 2024, indicating a strong investment in tools that facilitate in-house capabilities. Brands leveraging these platforms can develop sophisticated campaigns and gain deeper customer insights without relying on external partners for core functions.

Brands increasingly bypass traditional agencies by advertising directly on major digital platforms like Google, Meta, and Amazon, as well as emerging retail media networks. These platforms provide self-service tools, rich audience data, and direct campaign measurement, directly substituting agency media buying services.

This trend is fueled by the platforms' capabilities, allowing brands to manage their own advertising strategies. For instance, in 2024, digital advertising spend is projected to reach over $600 billion globally, with a significant portion likely flowing through these direct channels rather than agency intermediaries.

The rise of specialized freelance and gig economy talent presents a significant threat of substitutes for traditional agency models like Dentsu Group. Online platforms now offer direct access to niche marketing, creative, and digital professionals, allowing businesses to bypass agencies for specific project needs.

For instance, in 2024, the global freelance platform market was valued at over $4.5 trillion, indicating a substantial shift towards flexible talent acquisition. This accessibility means companies can source highly skilled individuals for short-term campaigns or specialized tasks, potentially at a lower cost than engaging a full-service agency.

This trend directly substitutes for agency services, particularly for businesses with fluctuating demands or those requiring very specific expertise not readily available in-house. The ability to hire top-tier talent on a project-by-project basis diminishes the necessity of long-term agency retainers for certain functions.

Management Consulting Firms

Management consulting firms pose a significant threat of substitution for Dentsu Group's broader marketing and advisory services. These firms increasingly offer specialized strategic advice in areas like digital transformation and customer experience, directly competing with Dentsu's integrated solutions. For instance, major consulting players like Accenture and Deloitte have expanded their creative and marketing capabilities, blurring the lines between traditional advertising agencies and consulting powerhouses.

These consulting giants often leverage their deep industry expertise and existing relationships with C-suite executives to offer end-to-end business solutions. This can make them a compelling alternative for clients seeking holistic strategic guidance, potentially bypassing Dentsu's more marketing-centric offerings. In 2023, the global management consulting market was valued at over $300 billion, with digital transformation consulting being a major growth driver, indicating the scale of this competitive threat.

- Digital Transformation Services: Consulting firms provide specialized expertise that can substitute for Dentsu's digital marketing and transformation advisory.

- Customer Experience Strategy: Many consulting firms offer comprehensive CX strategies, directly competing with Dentsu's customer-focused marketing solutions.

- Industry Expertise and C-Suite Relationships: Established consulting firms leverage deep sector knowledge and existing client relationships to offer alternative strategic partnerships.

- Market Size: The substantial global management consulting market, exceeding $300 billion in 2023, highlights the significant scale of potential substitutes.

AI-Powered Marketing Automation Software

The rise of AI-powered marketing automation software presents a significant threat of substitutes for traditional agency services. These platforms can now handle tasks like personalized email campaigns, social media scheduling, and even basic content creation, functionalities previously exclusive to agencies.

For instance, in 2024, the global marketing automation market was valued at approximately $5.5 billion and is projected to grow substantially. This growth indicates that more businesses are adopting these tools, potentially reducing their reliance on external agencies for certain marketing functions.

- AI can automate routine tasks: Many repetitive marketing activities, such as data segmentation and ad performance tracking, are increasingly managed by AI, lessening the need for human intervention.

- Cost-effectiveness of AI solutions: For businesses, implementing AI marketing tools can be more cost-effective than engaging an agency for similar, data-intensive services.

- Scalability and efficiency: AI platforms offer scalability and efficiency in executing marketing campaigns, directly competing with the service delivery models of marketing agencies.

The threat of substitutes for Dentsu Group is substantial, driven by advancements in technology and evolving business strategies. Companies can now perform many marketing functions internally, leverage direct advertising channels, utilize freelance talent, engage management consultants, and deploy AI-powered automation tools, all of which reduce the need for traditional agency services.

The increasing capability of marketing technology allows brands to manage strategy and execution in-house. For example, the global marketing technology market was projected to exceed $100 billion in 2024. Similarly, direct advertising on platforms like Google and Meta, which offer self-service tools and audience data, bypasses agencies. Global digital ad spend was expected to surpass $600 billion in 2024, with a growing portion going through these direct channels.

The gig economy offers specialized talent, with the global freelance platform market valued at over $4.5 trillion in 2024, providing alternatives for specific project needs. Furthermore, management consulting firms, with a market size over $300 billion in 2023, increasingly offer digital transformation and customer experience strategies, directly competing with Dentsu's integrated solutions.

AI-driven marketing automation is also a significant substitute. The marketing automation market was valued at approximately $5.5 billion in 2024, with AI tools handling tasks like personalized campaigns and content creation, offering cost-effectiveness and scalability that compete with agency service models.

| Substitute Category | Key Characteristics | Market Indicator (2023-2024 Data) | Impact on Dentsu |

| In-house Marketing Tech | Internal control, data analytics capabilities | Marketing Technology Market: >$100 billion (2024) | Reduces need for agency strategy and execution |

| Direct Digital Advertising | Self-service platforms, direct audience access | Global Digital Ad Spend: >$600 billion (2024) | Substitutes agency media buying services |

| Freelance/Gig Economy | Specialized skills, project-based engagement | Global Freelance Platform Market: >$4.5 trillion (2024) | Offers alternatives for specific project needs |

| Management Consulting | Holistic strategy, industry expertise, CX focus | Management Consulting Market: >$300 billion (2023) | Competes with integrated advisory services |

| AI Marketing Automation | Automated tasks, cost-efficiency, scalability | Marketing Automation Market: ~$5.5 billion (2024) | Replaces routine agency functions |

Entrants Threaten

Establishing a global advertising and public relations powerhouse like Dentsu Group, with its comprehensive suite of marketing, media, creative, PR, and digital transformation services, requires immense capital. This includes significant investments in cutting-edge technology, robust infrastructure, and, crucially, a deep pool of highly skilled talent across diverse disciplines. For instance, major global marketing groups consistently report billions in annual revenue, indicating the scale of operations and investment needed to compete at this level.

Dentsu Group's established client relationships and strong reputation, built over a long history and global reach, present a significant barrier to new entrants. It's incredibly difficult for newcomers to replicate the trust and proven track record Dentsu offers, especially when competing for substantial, long-term contracts with major multinational corporations.

The advertising and marketing industry, particularly in its data-driven segments, is heavily influenced by intricate and ever-changing global regulations. Navigating this requires significant investment in legal and compliance teams, making it a considerable hurdle for newcomers.

Data privacy laws like GDPR and CCPA, for instance, impose strict requirements on how customer data can be collected, processed, and stored. Companies entering this space must build robust compliance frameworks from the ground up, a costly and time-consuming endeavor.

In 2024, the global spending on compliance within the tech and advertising sectors continued to rise, with many firms allocating upwards of 10-15% of their operational budget to regulatory adherence. This ongoing expense acts as a substantial deterrent for potential new entrants.

Integrated Service Offering Complexity

The complexity of Dentsu Group's integrated service offering presents a significant barrier to entry. Their 'Integrated Growth Solutions' and 'One Dentsu' model combine marketing, media, creative, and digital transformation capabilities, making it challenging for newcomers to replicate this comprehensive approach and its associated synergistic efficiencies.

The sheer scale and interconnectedness of Dentsu's operations require substantial investment in technology, talent, and global infrastructure, which new entrants would struggle to match. For instance, in 2023, Dentsu reported total net sales of ¥1,138.3 billion, underscoring the financial muscle required to compete at this level.

- High Capital Investment: Establishing a comparable integrated service platform demands massive upfront capital for technology, talent acquisition, and global operational setup.

- Operational Synergies: New entrants face difficulties in achieving the cost and revenue synergies that Dentsu has cultivated through its long-standing integrated model.

- Client Relationship Depth: Dentsu's ability to offer end-to-end solutions fosters deep client relationships, a level of trust and integration that is time-consuming and difficult for new players to build.

Rapid Technological Evolution and AI Investment

The advertising industry is undergoing a significant transformation driven by rapid technological evolution, especially the pervasive integration of artificial intelligence. New entrants face the daunting challenge of making continuous and substantial investments in cutting-edge AI and data analytics to compete effectively.

This capital-intensive requirement inherently favors established incumbents like Dentsu Group, which possess existing resources and robust research and development budgets. For instance, global spending on AI in advertising is projected to reach billions of dollars annually by 2024, a figure that underscores the high barrier to entry for newcomers without substantial financial backing.

- AI Investment: New entrants must commit significant capital to AI and data analytics to remain competitive.

- Incumbent Advantage: Established players with existing resources and R&D budgets have a distinct advantage.

- Capital Intensity: The need for continuous technological investment creates a high barrier to entry.

- Market Dynamics: Rapid advancements mean constant reinvestment is necessary to avoid obsolescence.

The threat of new entrants for Dentsu Group remains moderate, primarily due to the substantial capital requirements and established brand loyalty within the advertising and marketing sector. Newcomers need significant financial backing to compete with Dentsu's global infrastructure, talent pool, and integrated service offerings. For instance, in 2023, Dentsu reported net sales of ¥1,138.3 billion, illustrating the scale of operations new entrants must match.

Furthermore, the increasing complexity of data privacy regulations, such as GDPR and CCPA, adds another layer of difficulty for potential entrants, requiring substantial investment in legal and compliance frameworks. In 2024, compliance spending in the tech and advertising sectors often represented 10-15% of operational budgets, a considerable hurdle for new businesses.

The rapid advancement of technologies like AI necessitates continuous, heavy investment, favoring incumbents like Dentsu with established R&D budgets. Global spending on AI in advertising is projected to reach billions annually by 2024, highlighting the financial barrier for those without deep pockets.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High costs for technology, talent, and global operations. | Significant financial hurdle. |

| Brand Loyalty & Relationships | Dentsu's established trust and long-term client contracts. | Difficult for new players to replicate client depth. |

| Regulatory Compliance | Navigating complex global data privacy laws. | Requires substantial investment in legal and compliance. |

| Technological Advancement (AI) | Constant need for investment in AI and data analytics. | Favors incumbents with existing R&D budgets. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dentsu Group is built upon a robust foundation of data, drawing from Dentsu's annual reports, investor presentations, and public financial filings. We supplement this with industry-specific market research reports and insights from reputable financial news outlets.