Dentsu Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dentsu Group Bundle

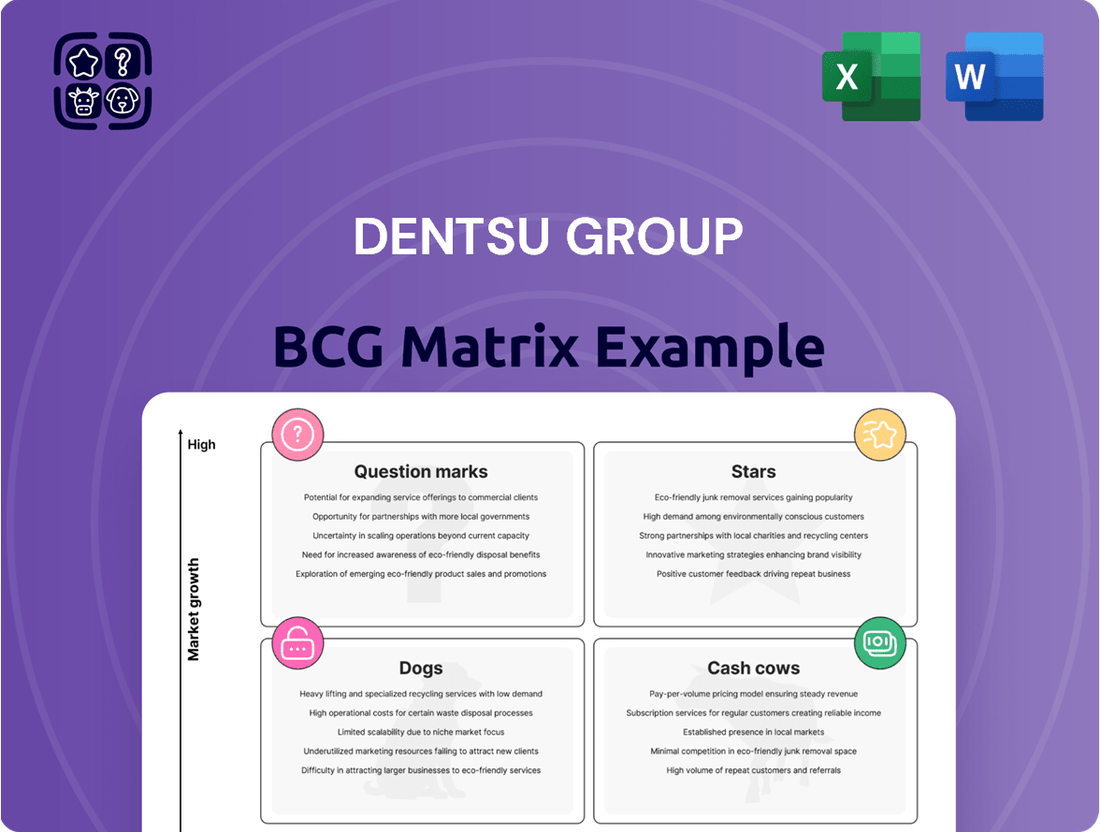

Curious about the Dentsu Group's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture!

Unlock the complete Dentsu Group BCG Matrix for a comprehensive understanding of their market share and growth potential across all business units. Purchase the full report to gain actionable insights and make informed strategic decisions.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Dentsu Group.

Stars

Dentsu's digital advertising business in Japan is a powerhouse, demonstrating robust organic growth and a leading market position. This segment is a key contributor to the company's overall revenue, fueled by strong demand in internet advertising and business transformation services.

Dentsu's AI-Driven Marketing Solutions are positioned as a Star in the BCG Matrix, reflecting significant investment and rapid growth potential. The company is actively integrating AI into media planning, content creation, and customer engagement, anticipating a substantial market share capture in this burgeoning technological sector.

Dentsu's 2025 Media Trends report underscores AI's pivotal role in transforming the marketing landscape. This strategic focus is further evidenced by their development of AI-powered creative tools and the exploration of virtual influencer technologies, aiming to lead innovation in the field.

Dentsu is significantly bolstering its Business Transformation (BX) services, a strategic move to guide clients through profound changes in strategy, culture, and operations. This sector is booming due to global demand for comprehensive digital and operational evolution solutions. In 2024, Dentsu's investment in Integrated Growth Solutions highlights its ambition to lead this high-growth market.

Retail Media Networks Development

The retail media sector is experiencing robust expansion, with projections indicating continued strong growth. Dentsu is actively building its expertise in this area, aiming to utilize shopper data to create highly effective and personalized advertising campaigns for brands. This focus positions Dentsu to capture significant new revenue opportunities within a rapidly evolving market.

Retail media networks represent a significant growth frontier, offering retailers and brands new avenues for monetization and customer engagement. Dentsu's strategic development in this space is designed to capitalize on the increasing demand for data-driven advertising solutions. The global retail media market was valued at approximately $126 billion in 2023 and is forecast to reach $200 billion by 2027, highlighting the immense potential.

- Projected Growth: The retail media sector is expected to see continued double-digit growth, driven by increased retailer investment and brand adoption.

- Dentsu's Strategy: Dentsu is focusing on leveraging shopper data to deliver precise targeting and measurable campaign results for clients.

- Revenue Streams: Retail media networks create valuable new revenue streams for both retailers and the brands advertising on their platforms.

- Market Opportunity: This segment represents a high-growth market where Dentsu aims to enhance its presence and influence.

Connected TV (CTV) Advertising

Connected TV (CTV) advertising is a rapidly expanding sector, driven by the global migration to ad-supported streaming services. Dentsu Group’s strategic focus on digital and streaming platforms positions it well to leverage this growth. For instance, global CTV ad spend was estimated to reach $20.1 billion in 2023 and is projected to climb to $32.9 billion by 2025, according to eMarketer. This indicates a strong market opportunity.

- Rapid Growth: The shift to streaming fuels significant expansion in CTV advertising.

- Dentsu's Alignment: Dentsu's investments in digital and streaming platforms match this market trend.

- Market Potential: Projected increases in CTV ad spend highlight substantial revenue opportunities.

- Audience Engagement: CTV offers new avenues for advertisers to reach audiences effectively.

Dentsu's AI-Driven Marketing Solutions are positioned as Stars due to their high growth and market leadership potential. The company is actively integrating AI across its services, from creative development to media planning, anticipating significant gains in this rapidly evolving field. This strategic focus is supported by Dentsu's 2025 Media Trends report, which emphasizes AI's transformative impact.

Dentsu's Business Transformation (BX) services are also Stars, reflecting strong demand for digital and operational evolution solutions. The company's investment in Integrated Growth Solutions in 2024 underscores its ambition to lead in this high-growth area, guiding clients through complex strategic and cultural changes.

The retail media sector, with its projected double-digit growth, represents another Star for Dentsu. The company is enhancing its capabilities to leverage shopper data for precise targeting, capitalizing on the global retail media market's anticipated growth from $126 billion in 2023 to $200 billion by 2027.

Connected TV (CTV) advertising is a Star for Dentsu, driven by the shift to streaming services. Global CTV ad spend is expected to rise from $20.1 billion in 2023 to $32.9 billion by 2025, a trend Dentsu is well-positioned to capitalize on through its digital and streaming platform investments.

| Business Area | BCG Category | Key Drivers | Market Data (2023/2024 Est.) | Dentsu's Strategic Focus |

|---|---|---|---|---|

| AI-Driven Marketing | Star | Rapid AI adoption, demand for personalized marketing | AI in marketing market growing significantly | Integration across services, AI creative tools |

| Business Transformation (BX) | Star | Digitalization, operational efficiency needs | Global BX market shows robust demand | Integrated Growth Solutions investment |

| Retail Media | Star | Growth of e-commerce, data monetization | Global retail media market ~$126B (2023) | Leveraging shopper data, precise targeting |

| Connected TV (CTV) Advertising | Star | Shift to streaming, audience fragmentation | Global CTV ad spend ~$20.1B (2023) | Digital and streaming platform investments |

What is included in the product

The Dentsu Group BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Dentsu Group BCG Matrix provides a clear visual of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Dentsu's traditional media buying and planning in Japan stands as a robust cash cow within its portfolio. Despite market maturity, the company's significant market share, estimated to be around 20-25% of the Japanese advertising market in recent years, translates into substantial and predictable revenue streams.

This established segment consistently delivers strong operating margins, often in the high single digits, due to economies of scale and long-standing client relationships. In 2023, Dentsu's domestic advertising spending, heavily influenced by traditional media, remained a core contributor, underpinning the group's overall financial stability.

Dentsu's global media networks, such as Carat, dentsuX, and iProspect, are indeed cash cows for the group. These established brands leverage vast client portfolios and operational synergies across numerous global markets, ensuring consistent revenue streams.

While growth in some mature markets might be moderate, the sheer scale and deep-rooted client relationships of these networks translate into stable and predictable earnings. For instance, Dentsu reported a 7.5% organic growth in its Media segment for the first quarter of 2024, underscoring its continued strength and ability to generate substantial cash flow.

Dentsu's integrated marketing communications (IMC) services for major clients are a clear Cash Cow. These long-standing relationships with global brands, like those with Procter & Gamble and Toyota, generate consistent, high-margin revenue. This stability is a significant driver of Dentsu's overall profitability, as evidenced by the recurring nature of their service agreements.

Public Relations and Corporate Communications

Dentsu's Public Relations and Corporate Communications division operates as a classic Cash Cow within its BCG Matrix. This segment benefits from consistent client needs for brand management and strategic messaging, leading to stable revenue streams. The foundational nature of these services for businesses ensures ongoing demand, translating into predictable profitability for Dentsu.

The recurring nature of PR and corporate communications projects, essential for maintaining brand reputation and navigating public perception, solidifies its Cash Cow status. Clients consistently invest in these areas, providing Dentsu with a reliable income source. For instance, Dentsu's global revenue in 2024 saw significant contributions from its integrated communications services, reflecting the stability of these offerings.

- Stable Client Demand: Public relations and corporate communications are ongoing necessities for most businesses, ensuring a consistent client base.

- Recurring Revenue: Many engagements in this sector are retainer-based or involve long-term partnerships, creating predictable income.

- Foundational Importance: Effective communication is critical for brand reputation and crisis management, making it a non-negotiable expense for clients.

- Profitability: Dentsu's established expertise and global reach allow for efficient service delivery, contributing to healthy profit margins in this segment.

Foundational Data & Analytics Consulting

Dentsu's foundational data and analytics consulting services are likely a significant Cash Cow within the group. These services are critical for understanding consumer behavior and campaign effectiveness, making them indispensable to many clients' marketing efforts. In 2024, Dentsu's focus on data-driven insights continued to be a core differentiator.

These essential services, while perhaps not experiencing explosive growth, generate stable and predictable revenue streams. Their integral nature to client strategies and Dentsu's deep-seated expertise ensure consistent demand. For instance, Dentsu Aegis Network reported strong performance in its data and analytics capabilities, contributing to overall revenue stability.

- Core Services: Data strategy, analytics, insights generation, and measurement solutions.

- Market Position: High market share within Dentsu's existing client base due to essential integration.

- Revenue Generation: Consistent and stable income due to the foundational nature of these services.

- Growth Driver: While not high-growth, they enable and support growth in other Dentsu service areas.

Dentsu's global media networks, such as Carat, dentsuX, and iProspect, are indeed cash cows for the group. These established brands leverage vast client portfolios and operational synergies across numerous global markets, ensuring consistent revenue streams. While growth in some mature markets might be moderate, the sheer scale and deep-rooted client relationships of these networks translate into stable and predictable earnings. For instance, Dentsu reported a 7.5% organic growth in its Media segment for the first quarter of 2024, underscoring its continued strength and ability to generate substantial cash flow.

| Segment | BCG Category | Key Characteristics | Financial Indicator (Illustrative) |

|---|---|---|---|

| Global Media Networks | Cash Cow | Established brands, large client base, operational synergies | Q1 2024 Organic Growth: 7.5% (Media Segment) |

| Integrated Marketing Communications (IMC) | Cash Cow | Long-standing client relationships, recurring revenue from major brands | Consistent high-margin revenue contribution |

| Public Relations & Corporate Communications | Cash Cow | Essential services, retainer-based models, stable demand | Significant contribution to overall revenue stability in 2024 |

| Data & Analytics Consulting | Cash Cow | Indispensable for clients, deep expertise, stable demand | Strong performance in data capabilities, contributing to revenue stability |

Preview = Final Product

Dentsu Group BCG Matrix

The Dentsu Group BCG Matrix preview you're examining is the identical, complete document you will receive immediately after purchase. This means the strategic analysis, detailed quadrant breakdowns, and actionable insights are all present and ready for your use, without any alterations or missing sections.

Dogs

Traditional print and radio advertising services are positioned as Dogs in the Dentsu Group BCG Matrix. Dentsu's internal market forecasts highlight a persistent and substantial decline in these sectors, reflecting a shrinking overall market size.

As these markets contract, Dentsu's share within them is also likely eroding, transforming these segments into cash traps that drain resources with minimal returns. Consequently, these areas are prime candidates for divestiture or a significant scaling back of investment to reallocate capital to more promising growth areas.

Dentsu's Customer Experience Management (CXM) operations in the Americas and APAC, particularly in Australia, have been navigating a difficult landscape. These regions have seen organic declines, a direct result of clients scaling back on substantial transformational projects.

This pullback has impacted Dentsu's market share and led to negative growth within its CXM segments in these areas. For instance, in 2023, Dentsu reported that its Americas segment saw a net sales decline, with CXM being a contributing factor to this underperformance.

Dentsu's international creative agencies, like Dentsu Creative, have faced headwinds, including leadership instability and a muted global presence. This suggests a low market share in key international markets, hindering their ability to drive significant growth beyond Japan.

These units may be classified as Dogs in the BCG matrix, indicating they are consuming resources without generating substantial returns. For instance, in 2023, Dentsu's International Business segment, which encompasses these creative units, saw a reported operating loss, underscoring the challenges in achieving profitability and market penetration.

Non-Core or Redundant Business Units from Acquisitions

Dentsu Group is actively reviewing its portfolio, particularly those acquired businesses that haven't met expectations. This strategic reassessment is a key part of their 'One Dentsu' initiative aimed at streamlining operations and enhancing overall efficiency.

Some acquired units, despite initial strategic intent, have struggled to integrate or maintain market relevance. These underperforming segments often exhibit low growth rates and a declining market share, making them candidates for divestiture or restructuring.

- Underperforming Acquired Units: Dentsu has identified specific acquired businesses that are not contributing significantly to overall growth or profitability.

- Integration Challenges: Several units face difficulties in integrating with Dentsu's core operations, leading to inefficiencies and a dilution of market focus.

- Market Relevance Decline: Some acquired businesses have seen their market relevance diminish due to evolving industry trends or increased competition.

- Restructuring Impact: As of early 2024, Dentsu's restructuring efforts are expected to address these non-core units, potentially leading to divestments or significant operational changes.

Outdated or Less Differentiated Digital Display Advertising

Outdated or less differentiated digital display advertising represents a challenge for Dentsu Group within the broader digital advertising landscape. While the digital ad market continues its upward trajectory, certain segments of display advertising have become highly commoditized. This means there's less unique value proposition, leading to increased competition and potentially thinner profit margins for Dentsu in these specific areas.

In these less differentiated digital display segments, Dentsu likely holds a relatively low market share. The intense competition from numerous players, many offering similar services, limits growth potential. For instance, in 2023, the global digital advertising market reached an estimated $607.5 billion, but the growth in programmatic display, a segment prone to commoditization, is expected to moderate compared to more innovative areas like connected TV or retail media.

- Low Market Share: Dentsu's position in highly commoditized display ad formats may be modest due to widespread availability of similar services from competitors.

- Limited Growth Potential: As these segments mature and become less innovative, the opportunities for significant expansion and revenue growth diminish.

- Intense Competition: The barrier to entry for basic digital display advertising is low, leading to a crowded marketplace where differentiation is difficult.

- Pressure on Profit Margins: Commoditization often leads to price wars, squeezing the profitability of Dentsu's offerings in these specific sub-segments.

Dentsu's traditional advertising services, such as print and radio, are firmly in the Dog category due to declining market relevance and shrinking revenues. These legacy businesses are characterized by low market share and minimal growth prospects, demanding careful resource allocation to avoid becoming cash drains.

Furthermore, certain Customer Experience Management (CXM) operations in the Americas and APAC, particularly in Australia, have experienced organic declines. This underperformance stems from clients reducing spending on large-scale transformation projects, impacting Dentsu's market share in these regions negatively.

International creative agencies, like Dentsu Creative, also face challenges, exhibiting low market share in key global markets and struggling with profitability. This situation, coupled with underperforming acquired units that haven't integrated well or maintained market relevance, places them squarely in the Dog quadrant.

Highly commoditized digital display advertising segments represent another area where Dentsu likely holds a low market share. Intense competition and a lack of differentiation in these mature digital ad formats limit growth potential and put pressure on profit margins.

| Business Segment | BCG Category | Market Trend | Dentsu's Position | Outlook |

|---|---|---|---|---|

| Traditional Advertising (Print, Radio) | Dogs | Declining | Low Market Share | Divestiture or scaling back |

| CXM (Americas, APAC ex. Australia) | Dogs | Stagnant/Declining | Eroding Market Share | Restructuring or divestiture |

| International Creative Agencies | Dogs | Mixed/Challenged | Low Market Share | Strategic review, potential divestment |

| Commoditized Digital Display Ads | Dogs | Mature/Slowing Growth | Low Market Share | Focus on differentiation or exit |

Question Marks

Dentsu's early-stage AI-powered content creation tools and virtual influencer capabilities are positioned as Question Marks in the BCG matrix. While the AI-driven creative market is experiencing rapid growth, with projections indicating a significant expansion in the coming years, Dentsu's current market share in this nascent segment is relatively small. For example, the global AI in marketing market was valued at approximately $15.9 billion in 2023 and is expected to grow substantially, but Dentsu's specific penetration within AI content creation tools is still developing.

Dentsu Ventures, Dentsu Group's corporate venture capital arm, actively invests in early-stage startups, specifically at the seed and Series A rounds. Their focus is on innovative marketing and communication technologies, identifying ventures with significant growth potential but currently small market shares.

These investments align with the characteristics of "Question Marks" in the BCG matrix, signifying high-risk, high-reward opportunities. For instance, in 2023, Dentsu Ventures announced investments in several promising tech startups, though specific financial figures for these early-stage companies are typically not publicly disclosed.

Dentsu's commitment to sustainable marketing, highlighted by its 'Sustainable Marketing Academy,' positions it to capitalize on a rapidly expanding market. This focus aims to empower consumers with choices that align with environmental and social responsibility.

While Dentsu is actively developing these specialized solutions, its current market share in this niche is likely modest. Significant investment will be crucial for scaling these offerings and achieving widespread adoption within the industry. For instance, in 2024, the global market for sustainable marketing is projected to see substantial growth, with many companies allocating increased budgets to ESG-aligned campaigns.

Expansion into Nascent Digital Ecosystems (e.g., Metaverse, Web3 Advertising)

Dentsu is actively investing in and exploring new advertising frontiers within nascent digital ecosystems like the metaverse and Web3. These are high-risk, high-reward areas with significant growth potential, though Dentsu's current footprint is understandably small.

The company's strategy involves substantial upfront investment and dedicated development to establish a meaningful presence. For instance, the global metaverse market is projected to reach $800 billion by 2024, according to some industry estimates, highlighting the scale of opportunity. Dentsu's participation aims to capture a share of this expanding digital advertising spend.

- Market Exploration: Dentsu's engagement in the metaverse and Web3 represents a strategic move into uncharted advertising territories.

- Investment and Development: Significant capital and resources are being allocated to build capabilities and secure market share in these emerging sectors.

- Growth Potential: These digital ecosystems offer substantial, albeit speculative, growth opportunities for advertising revenue.

- Current Market Share: Dentsu's current share in these nascent markets is minimal, underscoring the need for aggressive development and investment.

Targeted Regional Growth Initiatives in Challenging International Markets

Dentsu Group's strategy for challenging international markets, particularly in APAC and the Americas, involves focused growth initiatives. These efforts are designed to revitalize performance in specific high-potential sub-segments where the company is currently underrepresented.

These targeted initiatives are positioned to capitalize on emerging opportunities, acknowledging that initial investments will be necessary to build market share from a lower base. For instance, in 2023, Dentsu reported a 1.8% organic revenue decline in its Americas segment, highlighting the need for strategic adjustments.

- Targeted Digital Transformation Services: Focusing on specific industries within APAC that show strong digital adoption rates.

- Data-Driven Marketing Solutions: Implementing tailored campaigns in the Americas that leverage localized consumer data.

- Acquisition of Niche Technology Firms: Strategic M&A to bolster capabilities in underserved but growing markets.

- Partnerships with Local Innovators: Collaborating with regional tech startups to enhance service offerings and market penetration.

Question Marks in Dentsu's BCG matrix represent areas with high growth potential but currently low market share, demanding significant investment to determine future success. These segments, like early-stage AI content creation and emerging digital ecosystems, are crucial for Dentsu's long-term strategy, requiring careful resource allocation and market development. The company's venture capital arm actively seeks out these high-risk, high-reward opportunities, aiming to nurture future market leaders.

Dentsu's strategic focus on nascent markets like AI-driven content creation and the metaverse exemplifies its Question Mark positioning. The global AI in marketing market is projected to expand significantly, with estimates suggesting a substantial increase from its 2023 valuation of approximately $15.9 billion. Similarly, the metaverse market, with some projections placing its value at $800 billion by 2024, represents a vast, albeit speculative, opportunity. Dentsu's investments in these areas, though currently yielding small market shares, are designed to capture future growth.

| Area of Focus | Market Growth Potential | Dentsu's Current Market Share | Strategic Action |

|---|---|---|---|

| AI-Powered Content Creation | High (Global AI in marketing market valued at ~$15.9B in 2023, with strong growth expected) | Low (Nascent segment, developing capabilities) | Investment in R&D, strategic partnerships, talent acquisition |

| Metaverse & Web3 Advertising | Very High (Projected market value of $800B by 2024 in some estimates) | Minimal (Early stages of development and adoption) | Exploration, platform development, pilot programs |

| Sustainable Marketing Solutions | High (Increasing consumer and corporate demand for ESG-aligned campaigns) | Modest (Niche market, requiring scaling) | Development of specialized services, 'Sustainable Marketing Academy' |

| Challenging International Markets (e.g., Americas) | Moderate to High (Targeted sub-segments with growth potential) | Low to Moderate (Underrepresented in specific high-potential areas) | Focused growth initiatives, data-driven strategies, potential M&A |

BCG Matrix Data Sources

Our Dentsu Group BCG Matrix is built on comprehensive market data, integrating financial reports, industry growth rates, and competitor analysis to provide a clear strategic overview.