Dental Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dental Bundle

The Dental Porter's Five Forces Analysis reveals a complex competitive landscape, highlighting the bargaining power of both suppliers and buyers within the industry.

Understanding the threat of new entrants and the intensity of rivalry among existing dental providers is crucial for any player looking to succeed.

Furthermore, the analysis delves into the critical threat of substitutes, examining how alternative healthcare solutions might impact the dental market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dental’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for specialized dental equipment, materials, and technology often features a concentrated supplier base. This concentration can grant a few key players substantial leverage, enabling them to dictate terms and pricing. For instance, in 2024, the global dental equipment market, valued at over $9 billion, is dominated by a handful of major manufacturers for high-end imaging and treatment units.

Dentalcorp's considerable scale of operations, however, provides a counterbalancing advantage. By aggregating demand across its extensive network of dental practices, Dentalcorp can leverage bulk purchasing power. This allows for more favorable negotiation terms with suppliers, potentially reducing costs for essential supplies and equipment, which is a critical factor in managing operational expenses.

Furthermore, strategic partnerships are instrumental in navigating supplier power. Dentalcorp's collaboration with companies like VideaHealth for AI-driven diagnostic solutions exemplifies an approach to integrating critical technologies. Such alliances can foster deeper relationships with key technology providers, potentially leading to more collaborative development and more predictable supply chains, thereby mitigating the risk of unchecked supplier influence.

Suppliers offering unique or specialized inputs, such as patented dental materials or advanced diagnostic equipment, often wield significant bargaining power. This is because alternatives are scarce, making it difficult for buyers to switch without incurring substantial costs or compromising on quality. For instance, companies like Dentalcorp, which prioritize clinical excellence, are inherently reliant on these specialized inputs, giving their suppliers leverage.

The Canadian dental equipment market, projected for growth, sees established players like 3M and Dentsply Sirona maintaining dominant positions. Their strong market presence and proprietary technologies allow them to influence pricing and terms, directly impacting companies that depend on their specialized offerings.

Individual dental practices within a large network like dentalcorp may encounter significant switching costs when changing core suppliers for equipment or laboratory services. These costs can include the expense of new equipment installation, staff retraining for new systems and processes, and potential disruptions to patient care during the transition. For instance, a practice switching its primary dental chair manufacturer might need to invest in new specialized tools and retrain its entire clinical team on its operation and maintenance.

Despite these individual practice-level costs, dentalcorp's centralized management structure is designed to mitigate these challenges. By acting as a single entity, dentalcorp can negotiate more favorable terms with suppliers and potentially absorb some of the transition costs or offer standardized training programs. This collective bargaining power, derived from the aggregated demand of numerous practices, can significantly reduce the perceived switching costs for individual members of the network when dealing with their suppliers.

Forward Integration Threat by Suppliers

While less common, a significant threat from suppliers is their potential for forward integration. Imagine a large dental supply manufacturer deciding to buy up dental practices. This would allow them to control both the supply of materials and the demand for them. For example, a company like Henry Schein, a major distributor of dental products and services, could theoretically expand into owning and operating dental clinics.

However, the sheer operational complexity of managing a network of dental practices, similar to a large consolidator like dentalcorp, often acts as a deterrent for traditional manufacturers. The core competencies required for manufacturing high-quality dental materials are vastly different from those needed for efficient patient care and practice management. This operational hurdle makes widespread forward integration by suppliers a less likely, though not impossible, scenario.

The more immediate and prevalent risk associated with supplier bargaining power remains price increases. In 2024, many dental practices continued to face rising costs for essential supplies, driven by factors such as supply chain disruptions and inflation. For instance, the cost of composite resins and anesthetic agents saw noticeable increases throughout the year.

- Forward Integration Threat: Suppliers acquiring dental practices.

- Operational Hurdles: Complexity deters manufacturers from running clinics.

- Primary Risk: Increased prices for essential dental goods.

- 2024 Impact: Dental practices experienced rising costs for materials.

Availability of Substitutes for Suppliers' Products

The availability of substitutes significantly impacts supplier bargaining power in the dental industry. For common consumables like gloves, masks, or basic composite fillings, numerous manufacturers exist, leading to intense competition. This saturation means dental practices can easily switch suppliers if prices rise or quality falters, thereby diminishing the power of individual suppliers in these segments. For example, the global dental consumables market, valued at approximately USD 35 billion in 2023, features a wide array of providers for these everyday items.

However, the landscape shifts dramatically when considering specialized or technologically advanced products. For cutting-edge dental technologies such as AI-powered diagnostic software, advanced CAD/CAM milling machines, or novel biomaterials for regenerative dentistry, the number of highly capable suppliers is far more limited. This scarcity grants these specialized suppliers considerably more leverage. In 2024, the dental technology market, particularly segments like AI in dentistry, is experiencing rapid growth, with fewer than a handful of dominant players offering truly differentiated solutions, allowing them to command higher prices and dictate terms.

- High availability of substitutes for basic dental supplies like gloves and basic fillings reduces supplier power.

- Limited number of suppliers for advanced dental technologies such as AI diagnostics and 3D printing increases their bargaining power.

- The global dental consumables market's size (approx. USD 35 billion in 2023) highlights competition among many suppliers for common items.

- Dominance by a few key players in niche technology markets in 2024 enables them to exert greater influence.

The bargaining power of suppliers in the dental sector is influenced by the concentration of their market and the uniqueness of their offerings. When few suppliers dominate, especially for specialized equipment or materials, they can significantly dictate pricing and terms. For example, in 2024, the high-value dental imaging equipment market is largely controlled by a small number of manufacturers, impacting cost structures for practices.

| Factor | Impact on Supplier Power | Example (2024 Data) |

|---|---|---|

| Supplier Concentration | High power with few dominant players | Dominant manufacturers in dental imaging equipment market |

| Uniqueness of Inputs | High power for specialized/patented items | Providers of novel biomaterials or AI diagnostic solutions |

| Availability of Substitutes | Low power for commoditized consumables | Multiple providers for gloves, masks, basic composites |

| Switching Costs for Buyers | High costs increase supplier leverage | Transitioning core dental chair manufacturers |

| Threat of Forward Integration | Potential for suppliers to enter buyer markets | Large distributors acquiring dental practices (theoretically) |

What is included in the product

This analysis dissects the competitive landscape for dental practices by examining the intensity of rivalry, the bargaining power of suppliers and buyers, the threat of new entrants, and the availability of substitutes.

Effortlessly identify and prioritize competitive threats with clear visualizations of each Porter's Five Forces component.

Gain immediate clarity on strategic positioning by instantly seeing how each force impacts your dental practice.

Customers Bargaining Power

The bargaining power of customers in the dental industry, particularly for a company like Dentalcorp, is significantly diminished due to a highly fragmented customer base. Individual patients seeking essential dental services typically lack the collective leverage to negotiate prices. The Canadian dental market itself is robust, with strong patient demand, underscoring the general inability of individual consumers to exert significant downward price pressure.

Patients' willingness to pay for dental services is often tied to their budget and how much their insurance covers. For procedures that aren't strictly necessary, like cosmetic treatments, price becomes a bigger consideration. In 2024, the introduction of the Canadian Dental Care Plan (CDCP) is a significant development, aiming to make dental care more affordable for millions of Canadians. This plan is expected to increase demand for services it covers, potentially shifting some of the bargaining power towards consumers who now have better access and financial support.

The digital age has significantly amplified the bargaining power of customers, particularly in the dental sector. Patients now have unprecedented access to information online, allowing them to easily compare services, pricing, and even the credentials of dentists. For instance, review sites and online directories provide a wealth of patient feedback, making it simpler than ever for individuals to shop around. This transparency forces providers to be more competitive.

Dentalcorp's strategic focus on patient-centered care and robust digital platforms directly addresses this shift. By enhancing communication channels and offering greater convenience, they aim to foster stronger patient relationships. In 2024, many dental practices are investing in patient portals and telehealth options to improve accessibility and satisfaction, recognizing that informed and satisfied patients are more likely to remain loyal, thereby mitigating some of this customer power.

Low Switching Costs for Patients

Patients typically encounter minimal costs when switching dental providers. This ease of transition empowers them to seek alternatives if they are unhappy with the quality of care or the pricing structure. For instance, in 2024, the average cost of a routine dental check-up remained relatively stable across the industry, meaning price alone isn't a significant barrier to switching.

Dentalcorp actively works to mitigate this customer power by cultivating loyalty through several key strategies. Their approach centers on delivering a uniformly high standard of care across all their clinics, fostering a sense of trust and reliability for patients. This consistency aims to reduce the perceived risk associated with trying a new provider.

Furthermore, Dentalcorp emphasizes integrated care pathways, ensuring a seamless experience for patients needing various dental services. This holistic approach, combined with a focus on an overall enhanced patient experience, encourages retention. For example, patient satisfaction surveys from late 2024 indicated that convenience and a positive overall experience were significant factors in patient loyalty, often outweighing minor price differences.

- Low Switching Costs: Patients can easily move between dental practices with little financial or logistical burden.

- Price Sensitivity: The consistent pricing of routine procedures in 2024 means patients are more likely to consider cost when choosing a dentist.

- Dentalcorp's Strategy: Focus on consistent quality, integrated care, and superior patient experience to build loyalty.

- Patient Loyalty Factors: Convenience and positive overall experience significantly influence patient retention, as seen in late 2024 data.

Impact of Preventative Care and Wellness Trends

The increasing focus on preventative care and wellness is a significant factor impacting the bargaining power of customers in the dental industry. As patients become more proactive about their oral health, they tend to seek out services that promote long-term well-being. This shift can lead to a greater demand for regular check-ups and cleanings, fostering more consistent patient relationships.

This trend directly supports dentalcorp's strategic objective of enhancing patient outcomes and improving the overall dental experience. By emphasizing preventative measures, dental practices can build stronger patient loyalty, reducing the likelihood of patients seeking care solely based on price or immediate need. For instance, studies indicate a growing patient willingness to invest in preventative services, with a significant portion of dental spending in 2024 being allocated to routine care rather than emergency treatments.

- Shift to Recurring Revenue: Preventative care fosters predictable, recurring visits, strengthening the customer relationship.

- Value-Based Purchasing: Patients prioritizing long-term health are more likely to choose providers based on quality and outcomes, not just cost.

- Reduced Demand for Episodic Care: A healthier patient base naturally reduces the need for urgent, potentially higher-margin, emergency services.

- Increased Patient Engagement: Wellness trends encourage patients to actively participate in their oral health management, leading to greater satisfaction and retention.

The bargaining power of customers in the dental sector is generally low due to a fragmented patient base and the essential nature of many dental services. However, factors like price sensitivity for non-essential procedures and the ease of switching providers do offer some leverage. The Canadian Dental Care Plan's 2024 rollout is expected to boost patient access and potentially increase their influence by enabling more informed choices and price comparisons.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance/Data |

|---|---|---|

| Customer Fragmentation | Low | Individual patients lack collective negotiation power. |

| Switching Costs | Low | Minimal financial or logistical barriers to changing dentists. |

| Price Sensitivity (Non-Essential) | Moderate | Cosmetic procedures are more influenced by price than emergencies. |

| Information Access | Moderate | Online reviews and price comparison tools empower informed decisions. |

| Canadian Dental Care Plan (CDCP) | Increasing | Introduced in 2024, it aims to improve affordability and access, potentially shifting some power. |

What You See Is What You Get

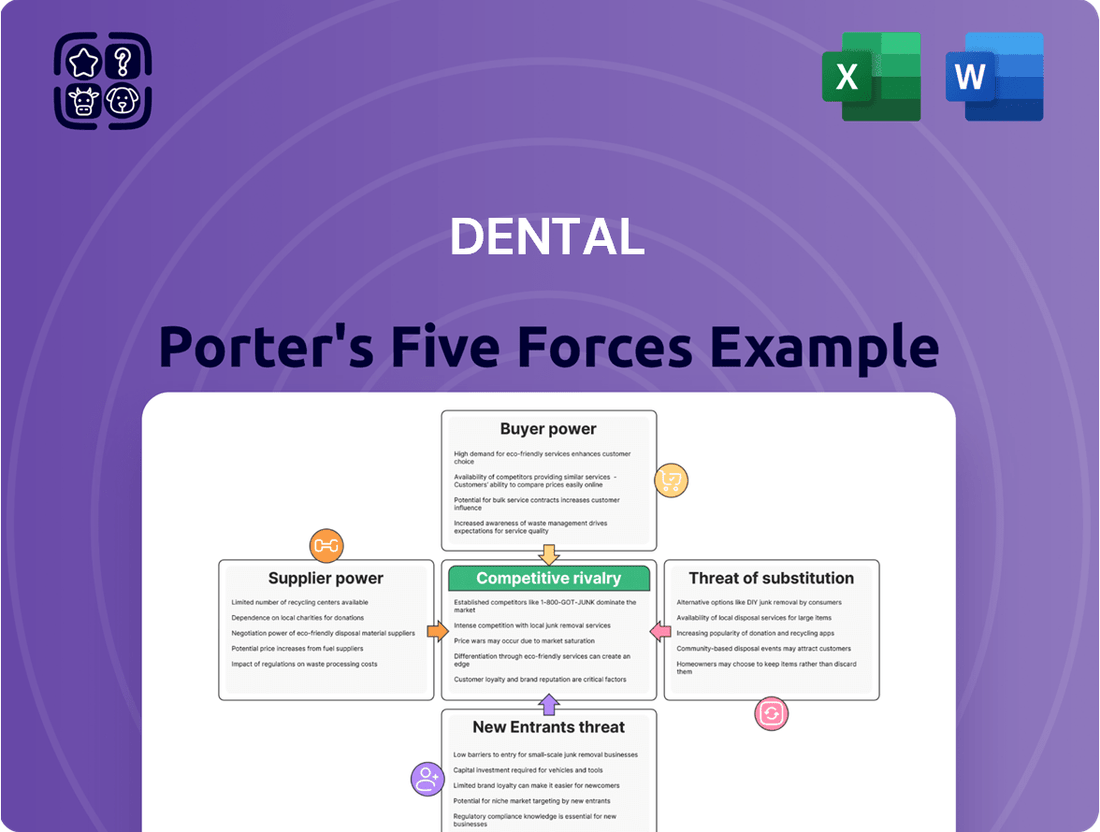

Dental Porter's Five Forces Analysis

This preview shows the exact, comprehensive Five Forces Analysis for the dental industry that you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, professionally written document detailing the competitive landscape, including supplier power, buyer power, threat of new entrants, threat of substitutes, and industry rivalry. Once you complete your purchase, you’ll get instant access to this exact file, fully formatted and ready to inform your strategic decisions. No mockups, no samples; the document you see here is precisely what you’ll be able to download and utilize to understand the forces shaping the dental market.

Rivalry Among Competitors

The Canadian dental market is characterized by significant fragmentation, with numerous independent dental practices forming the backbone of the industry. This widespread presence of smaller entities fosters a highly competitive environment.

However, Dental Service Organizations (DSOs), such as dentalcorp, are actively pursuing growth strategies, including aggressive expansion and practice acquisitions. This consolidation trend is beginning to reshape the competitive landscape.

This dynamic means that both independent practices and emerging DSOs are engaged in intense competition, not only for securing new patients but also for acquiring existing dental practices to expand their reach and market share.

Dentalcorp's aggressive expansion through acquisitions, particularly its significant investments and projected growth into 2025, directly fuels competitive rivalry. As Canada's largest dental network, Dentalcorp's strategy of acquiring numerous practices intensifies the competition for desirable clinics and skilled dental professionals across the market.

Dentalcorp's competitive advantage stems from its ability to offer extensive management and operational support to dental practices. This allows dentists to concentrate solely on providing patient care, a significant draw compared to independent practices burdened with administrative tasks.

By consolidating resources and operations, Dentalcorp achieves considerable economies of scale. This model directly contrasts with smaller, standalone dental offices that cannot leverage similar efficiencies.

The company's scale also enables it to negotiate better terms with suppliers for equipment and consumables, further reducing costs for its affiliated practices. For instance, in 2024, Dentalcorp reported that its network practices saw an average reduction of 7% in supply costs compared to industry benchmarks for independent clinics.

This robust support system, encompassing everything from marketing and HR to billing and IT, creates a strong barrier to entry for new competitors and enhances the loyalty of existing practice owners within its network.

Price Competition and Service Offerings

Competitive rivalry within the dental industry extends beyond just price wars. While clinics do compete on cost, a significant portion of this rivalry centers on the differentiation of service offerings, the integration of advanced technology, and the overall patient experience. For instance, Dentalcorp is actively investing in artificial intelligence and other state-of-the-art technologies to not only streamline operations but also to elevate the quality and scope of services provided to patients.

This strategic focus on technology and service breadth is a key differentiator in a crowded market. In 2024, the dental industry saw continued investment in digital dentistry, with a growing number of practices adopting technologies like CAD/CAM systems for same-day crowns and intraoral scanners for more comfortable impressions. This technological advancement directly impacts service delivery and patient satisfaction, creating a competitive edge.

- Service Breadth: Clinics are differentiating by offering a wider range of specialized services, from cosmetic dentistry to orthodontics and implants.

- Technological Integration: Investment in AI for diagnostics, robotic assistance in procedures, and advanced imaging technologies are becoming crucial competitive factors.

- Patient Experience: Focus on comfort, convenience (e.g., online booking, virtual consultations), and personalized care significantly influences patient loyalty and clinic choice.

- Data Utilization: Clinics leveraging patient data for personalized treatment plans and improved efficiency gain a competitive advantage.

Regulatory and Policy Changes

Regulatory shifts, such as the introduction of programs like the Canadian Dental Care Plan (CDCP), directly influence the competitive environment for dental practices and Dental Support Organizations (DSOs). The CDCP, launched in 2024, aims to make dental care more accessible, potentially increasing patient volume but also introducing new reimbursement structures and compliance requirements that all providers must navigate.

Changes in tax regulations, including Investment Tax Credits (ITCs) for clean technology or other business investments, can also reshape competitive advantages by altering capital expenditure decisions and operational costs for DSOs. For instance, a DSO's ability to leverage these credits could influence its capacity for expansion or technological upgrades, thereby impacting its market position relative to smaller, independent practices.

These evolving policy landscapes create both opportunities and challenges. For example, expanded public coverage might drive demand, but also necessitate adjustments in service delivery and pricing strategies. Understanding and adapting to these regulatory changes is crucial for maintaining a competitive edge in the dental sector.

- Canadian Dental Care Plan (CDCP) rollout began in 2024, impacting reimbursement models.

- Investment Tax Credits (ITCs) can alter capital investment strategies for DSOs.

- Policy changes create new competitive pressures and potential market expansion.

- Adaptability to new regulations is key for maintaining operational competitiveness.

Competitive rivalry in the Canadian dental market is intense, driven by a fragmented landscape of independent practices and the consolidation efforts of Dental Service Organizations (DSOs) like Dentalcorp. This rivalry is fought not just on price but also on service differentiation, technological adoption, and patient experience. Dentalcorp's aggressive acquisition strategy, aiming for significant growth by 2025, heightens this competition for both practices and talent, while its operational efficiencies and economies of scale offer a distinct advantage over smaller, independent clinics.

| Factor | Impact on Rivalry | Example/Data (2024) |

|---|---|---|

| Market Fragmentation | High rivalry among numerous independent practices | Significant number of solo practices across Canada |

| DSO Consolidation | Increased competition due to DSOs acquiring practices | Dentalcorp's aggressive expansion strategy |

| Service Differentiation | Competition on specialized services, technology, and patient experience | Investment in AI diagnostics and digital dentistry |

| Economies of Scale | DSOs achieve cost advantages, impacting smaller practices | Dentalcorp practices saw a 7% reduction in supply costs |

SSubstitutes Threaten

For minor oral health concerns, individuals might turn to readily available home remedies or over-the-counter (OTC) products. These can act as substitutes for professional dental visits, especially for those seeking cost-effective solutions. For instance, many consumers utilize OTC pain relievers for toothaches or mouthwash for bad breath, bypassing a dentist for minor discomforts.

However, the efficacy of these substitutes is limited, particularly for more serious dental issues like cavities or gum disease. A 2023 survey indicated that only about 45% of people in the US visit the dentist annually, suggesting a significant portion may be relying on self-care for a range of problems. These home-based approaches cannot address the underlying causes of dental decay or infection and lack the diagnostic capabilities of a trained dental professional.

For very minor oral discomfort, some patients might turn to a general medical practitioner instead of a dentist. This represents a potential substitute, though it's quite limited. For instance, a 2023 survey indicated that only about 5% of individuals experiencing mild toothaches sought care from their primary care physician.

General practitioners simply lack the specialized training and diagnostic tools necessary for effective dental care. While they can address some basic infections, they cannot perform procedures like fillings or extractions, which are common dental needs. This limitation significantly restricts their ability to truly substitute for dental services, especially for anything beyond the most superficial issues.

A significant threat comes from patients delaying or avoiding dental treatment altogether. This often stems from high costs, dental anxiety, or simply a lack of understanding about the importance of regular care. When treatment is postponed, minor issues can escalate into more serious and expensive problems.

The introduction of the Canadian Dental Care Plan in 2024 is designed to address some of these cost concerns. By potentially lowering out-of-pocket expenses for eligible Canadians, this initiative could encourage more people to seek timely dental care, thus mitigating the threat of delayed treatment.

For instance, a 2023 survey indicated that over 40% of Canadians reported foregoing dental care due to cost. The Canadian Dental Care Plan, with an initial investment of $928 million for 2024-25, aims to make dental services more accessible, potentially shifting patient behavior away from avoidance.

Alternative Healthcare Providers

While not direct replacements for dentists, other oral health professionals can fulfill certain needs, potentially impacting a dental practice. Denturists, for instance, specialize in crafting and fitting dentures, a specific service that might otherwise be handled by a general dentist. Similarly, oral hygienists are crucial for routine cleanings and preventative care.

However, these professionals often function within the established dental framework, typically referring patients to dentists for more complex procedures or diagnoses. The market for these specialized services is relatively small compared to the broad range of treatments a dentist offers. For example, in 2024, the demand for dentures, while significant for certain demographics, still represents a fraction of the overall dental services market. Data from 2023 indicated that while the global dentures market was valued at approximately $2.6 billion, the broader dental services market is in the hundreds of billions.

- Denturists: Specialize in dentures, a niche service.

- Oral Hygienists: Provide preventative care and cleanings.

- Referral Network: Often work within the dental ecosystem, referring complex cases to dentists.

- Market Size: Denture market is a small segment of the overall dental services industry.

Emerging Technologies for Self-Diagnosis/Monitoring

Emerging technologies for self-diagnosis and monitoring pose a potential threat to traditional dental services. Future advancements in personal diagnostic tools, like smart toothbrushes or at-home saliva testing kits, could enable individuals to track certain oral health indicators independently. For instance, by 2024, the global dental diagnostics market, which includes these nascent technologies, was projected to reach significant figures, indicating growing investment in this area. However, these innovations are more likely to act as complementary aids rather than direct replacements for professional dental care.

While these devices can offer preliminary insights, they lack the comprehensive diagnostic capabilities and treatment planning expertise of a qualified dentist. A 2023 survey indicated that while consumer interest in at-home oral health monitoring is rising, the majority of respondents still prioritize professional cleanings and check-ups for overall oral wellness. The complexity of diagnosing conditions like periodontal disease or early-stage cavities requires advanced imaging and clinical judgment that current self-monitoring technologies cannot replicate.

The threat of substitutes, in this context, is moderate. These technologies could potentially reduce the frequency of routine check-ups for very low-risk patients, but they do not eliminate the fundamental need for professional intervention, especially for preventative care and treatment of existing issues. The market for professional dental services remains robust due to the irreplaceable nature of many dental procedures.

- Market Growth: The global dental diagnostics market is experiencing growth, signaling increased development in self-monitoring technologies.

- Consumer Interest: Consumer interest in at-home oral health monitoring is on the rise, indicating potential adoption of these tools.

- Limitations of Technology: Current self-diagnostic tools cannot replace the comprehensive capabilities and clinical judgment of dental professionals.

- Complementary Role: These technologies are expected to supplement, not substitute, professional dental services, particularly for complex diagnoses and treatments.

The threat of substitutes in the dental industry is primarily from readily available home remedies, over-the-counter products, and delayed treatment due to cost. While these can address minor discomforts, they cannot replace professional diagnosis and treatment for more serious oral health issues.

Emerging self-monitoring technologies, like smart toothbrushes, offer preliminary insights but lack the comprehensive capabilities of dentists. The Canadian Dental Care Plan, launched in 2024 with an initial investment of $928 million for 2024-25, aims to mitigate the threat of treatment avoidance due to cost by increasing accessibility to dental services.

While specialists like denturists and hygienists provide specific services, they often operate within the broader dental framework, referring complex cases to dentists. The market for these specialized services is considerably smaller than the overall dental services market, which was valued in the hundreds of billions in 2023.

The threat of substitutes is considered moderate, as current alternatives and emerging technologies are unlikely to fully replace the need for professional dental intervention, particularly for preventative care and complex treatments.

| Substitute Category | Examples | Impact on Dental Services | Data Point (2023/2024) |

|---|---|---|---|

| Home Remedies/OTC | Pain relievers, mouthwash | Addresses minor discomfort, bypasses dentists for minor issues | 45% of US adults visit the dentist annually, suggesting reliance on self-care for some issues. |

| Delayed Treatment | Postponing dental visits | Minor issues escalate, leading to more complex and costly problems | Over 40% of Canadians reported foregoing dental care due to cost prior to the 2024 plan. |

| Self-Monitoring Tech | Smart toothbrushes, saliva tests | Offers preliminary insights, but lacks comprehensive diagnostic capabilities | Consumer interest in at-home oral health monitoring is rising. |

| Specialized Professionals | Denturists, oral hygienists | Fulfills specific needs, often within the dental ecosystem | Global dentures market valued at ~$2.6 billion (2023), a fraction of the broader dental services market. |

Entrants Threaten

Starting an independent dental practice in 2024 demands significant upfront capital. Dentists looking to open their own clinic face substantial costs for high-quality dental chairs, X-ray machines, sterilization equipment, and practice management software. The total investment can easily range from $300,000 to over $500,000, depending on location and the sophistication of the technology chosen.

This high capital requirement acts as a considerable barrier for new entrants. For many dentists, the sheer financial outlay for establishing a fully equipped, compliant practice can be daunting. This financial hurdle makes the Dental Support Organization (DSO) model, which allows dentists to partner with existing infrastructure and share overhead costs, a more accessible and appealing pathway for many practitioners entering the market.

New entrants into the dental services market in Canada face significant regulatory hurdles and licensing requirements. Obtaining the necessary provincial and federal healthcare licenses is a complex and time-consuming process, demanding adherence to strict standards. For example, the Canadian Dental Care Plan (CDCP) mandates that participating dentists must be licensed and in good standing with their respective provincial regulatory bodies, adding another layer of compliance.

Established dental networks like dentalcorp possess a significant advantage through strong brand recognition and deeply ingrained patient trust, hurdles that new entrants find arduous to surmount. This loyalty is quantifiable, evidenced by dentalcorp's impressive recurring patient visit rate, a testament to their established reputation and quality of care.

Access to Talent and Skilled Professionals

The dental industry is experiencing significant staffing challenges, particularly with shortages of dental hygienists and other essential professionals. This scarcity directly impacts new entrants, making it harder for them to attract and retain the skilled talent needed to establish and grow their practices. For instance, a 2023 report indicated a projected shortage of over 10,000 dental hygienists in the coming years across North America, a trend that continued into early 2024.

Established networks, like Dentalcorp, can leverage their existing resources and brand recognition to attract professionals. This can create a competitive disadvantage for new dental practices attempting to build their teams from scratch. The ability to offer competitive compensation, benefits, and professional development opportunities is crucial, and larger, established entities often have an edge in these areas.

The threat of new entrants is amplified by this talent acquisition hurdle. New practices may struggle to offer the same level of job security or advanced training opportunities as larger, more established groups. By mid-2024, many dental recruitment firms reported an increase in demand for experienced hygienists, with salaries for these roles seeing an upward trend of 5-10% year-over-year.

- Talent Shortages: Difficulty in finding and keeping skilled dental professionals like hygienists and assistants.

- Competitive Recruitment: New practices face challenges competing with established players for talent.

- Retention Issues: High turnover can be a significant problem for new entrants without strong employer branding.

- Impact on Growth: Inability to secure adequate staffing directly hinders the expansion and operational capacity of new dental businesses.

Consolidation Trend and Acquisition by DSOs

The Canadian dental market is experiencing significant consolidation, with Dental Support Organizations (DSOs) actively acquiring independent practices. For instance, dentalcorp, a prominent player, has been instrumental in this trend, acquiring numerous practices. This consolidation directly impacts the threat of new entrants by diminishing the availability of attractive, established practices for acquisition.

This reduction in available targets makes it considerably more difficult for new individual practitioners or smaller DSOs to enter the market through acquisition. Consequently, the multiples paid for these practices are increasing, raising the barrier to entry. Emerging players must therefore consider more challenging organic growth strategies or face significantly higher costs for market entry.

- Market Consolidation: DSOs like dentalcorp are actively acquiring independent dental practices across Canada.

- Reduced Acquisition Pool: This activity shrinks the number of desirable practices available for new entrants.

- Increased Entry Costs: Acquisition multiples are rising, making it more expensive for new players to enter.

- Challenging Organic Growth: The competitive landscape makes organic expansion a more difficult path for new entrants.

The threat of new entrants in the dental sector is moderated by substantial capital requirements, with new practices needing upwards of $300,000 to $500,000 for equipment alone in 2024. Regulatory compliance, such as meeting the standards for the Canadian Dental Care Plan, adds another layer of complexity and cost. Furthermore, intense competition for skilled staff, particularly dental hygienists, with reported shortages and salary increases of 5-10% year-over-year in early 2024, strains new businesses. Finally, market consolidation, with DSOs like dentalcorp acquiring practices, reduces acquisition opportunities and increases entry costs, pushing potential new entrants towards more challenging organic growth strategies.

| Barrier | Description | Impact on New Entrants | 2024 Data/Trend |

|---|---|---|---|

| Capital Requirements | High costs for equipment, technology, and setup. | Significant upfront investment needed. | $300,000 - $500,000+ for a new practice. |

| Regulatory Compliance | Licensing, accreditation, and adherence to healthcare plans. | Time-consuming and complex process. | Canadian Dental Care Plan (CDCP) mandates provincial licensing. |

| Talent Acquisition | Shortages of skilled dental professionals. | Difficulty in hiring and retaining staff. | Projected shortage of 10,000+ dental hygienists; 5-10% salary increase for hygienists. |

| Market Consolidation | Acquisition of independent practices by DSOs. | Reduced availability of acquisition targets; increased entry costs. | DSOs actively acquiring practices, raising acquisition multiples. |

Porter's Five Forces Analysis Data Sources

Our Dental Porter's Five Forces analysis is built upon a foundation of diverse data sources, including industry-specific market research reports, government health statistics, and dental practice financial statements. This blend ensures a comprehensive understanding of market dynamics and competitive pressures.