Dental Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dental Bundle

Curious about the core components that make Dental's business tick? This Business Model Canvas offers a clear, concise overview of their key customer segments, value propositions, and revenue streams. It's a fantastic starting point for understanding their market approach.

Want to truly grasp Dental's strategic advantage? Dive into the full Business Model Canvas to uncover their essential resources, key activities, and cost structures. This comprehensive document reveals the operational backbone of their success.

Unlock the complete strategic blueprint behind Dental's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Acquired dental practices are the cornerstone of dentalcorp's business model, representing its primary key partners. In 2024, dentalcorp continued its aggressive acquisition strategy, integrating a significant number of established dental clinics nationwide into its growing network. This partnership model is mutually beneficial, providing acquired practices with enhanced administrative support, operational efficiencies, and access to capital, while dentalcorp expands its market reach and service offerings.

The integration process emphasizes a collaborative approach, allowing original dentists to retain clinical autonomy and maintain their patient relationships. This ensures a seamless transition for both practitioners and patients, preserving the high standards of care patients expect. dentalcorp's strategy has proven successful, as evidenced by its robust portfolio of partner practices, which contributes significantly to its overall revenue and market share in the Canadian dental sector.

Key partnerships with top dental equipment and technology suppliers are vital. These collaborations ensure our clinics are equipped with cutting-edge tools and digital solutions, like advanced intraoral scanners and AI-powered diagnostic software. For example, in 2024, the global dental equipment market was valued at approximately $9.5 billion, with significant growth driven by technological advancements.

Securing these relationships allows for advantageous bulk purchasing agreements, leading to cost savings of up to 15% on new equipment. This standardization of technology across our network streamlines operations, reduces maintenance complexities, and ultimately enhances the overall patient experience through more efficient and precise treatments.

Financial institutions and investors are crucial partners for dental practices looking to grow. Banks provide essential debt financing for everything from purchasing new equipment to acquiring other practices. For instance, in 2024, the dental industry continued to see robust lending activity, with many financial institutions offering specialized loan programs tailored to healthcare providers.

Private equity firms and venture capitalists play a significant role in funding larger-scale expansion and consolidation efforts. These investors can inject substantial capital, enabling dental groups to rapidly acquire multiple clinics and implement ambitious growth strategies. Their involvement often facilitates access to expertise and networks that accelerate market penetration.

Beyond just capital, these partnerships can bring strategic guidance and operational support. Investors often bring experience in scaling businesses, optimizing operational efficiencies, and navigating complex regulatory environments. This can be particularly valuable for dental practices transitioning from single-owner operations to larger, multi-location entities.

The ability to secure ongoing operational capital from these partners is also vital. It ensures that day-to-day expenses are covered, allowing practices to focus on patient care and strategic development rather than cash flow management. This consistent financial backing underpins the long-term sustainability and growth trajectory of dental businesses.

Healthcare Regulatory Bodies

Maintaining robust relationships with Canadian provincial and federal healthcare regulatory bodies is paramount for legal and ethical operation. This ensures all acquired dental practices comply with essential licensing, patient safety, and professional conduct standards. For instance, in 2024, the College of Dental Surgeons of Ontario continued to emphasize stringent continuing education requirements for its members, impacting practice acquisition due diligence.

Compliance with these bodies safeguards against penalties and maintains public trust. It also streamlines the integration of new practices into the business model, preventing operational disruptions. A key focus for many regulatory bodies in 2024 has been enhancing patient data privacy under evolving digital health frameworks.

- Compliance Oversight: Ensuring all dental practices meet provincial and federal licensing, safety, and conduct regulations.

- Risk Mitigation: Avoiding fines and reputational damage through strict adherence to healthcare laws.

- Operational Efficiency: Facilitating smoother integration of acquired practices by pre-empting regulatory hurdles.

- Patient Trust and Safety: Upholding high standards that resonate with patient confidence and well-being.

Professional Dental Associations

Dentalcorp's engagement with professional dental associations is a cornerstone of its operational strategy, ensuring its network dentists remain at the forefront of industry advancements. These partnerships provide access to the latest clinical guidelines and best practices, crucial for maintaining high standards of patient care. For instance, in 2024, many leading associations offered extensive continuing education modules focused on digital dentistry and minimally invasive techniques, which dentalcorp facilitated for its affiliated practices.

These collaborations are vital for fostering credibility and promoting continuous improvement within the dental community. By aligning with established professional bodies, dentalcorp reinforces its commitment to excellence. A 2024 survey of dental professionals indicated that 78% believe participation in association-led training significantly enhances their practice's reputation and patient trust. This demonstrates a clear market demand for practices that actively engage with professional development.

The benefits extend to professional development opportunities for network dentists, equipping them with the skills needed for modern dental practice. This includes staying updated on regulatory changes and ethical considerations. In 2024, several key associations launched new certification programs in areas like practice management and patient safety, offering tangible value to dentists seeking to elevate their professional standing.

- Industry Best Practices: Access to updated clinical protocols and treatment standards.

- Professional Development: Opportunities for continuing education and specialized training.

- Credibility and Reputation: Association with respected professional bodies enhances practice image.

- Network Synergies: Facilitates knowledge sharing and collaborative learning among dentists.

Key partnerships with dental laboratories are critical for delivering high-quality restorative and prosthetic work. These labs provide essential services, from fabricating crowns and bridges to creating custom dentures, directly impacting patient outcomes. In 2024, advancements in digital milling and 3D printing technology significantly enhanced the speed and precision of lab services.

These collaborations ensure that dental practices have access to the latest materials and techniques, allowing for more aesthetic and durable restorations. By working with preferred laboratory partners, dentalcorp can negotiate favorable pricing and turnaround times, contributing to operational efficiency and patient satisfaction. For instance, the dental laboratory market experienced steady growth, with digital workflows becoming increasingly prevalent.

| Laboratory Service | 2024 Technology Focus | Impact on Practice |

|---|---|---|

| Crowns and Bridges | CAD/CAM Milling, Zirconia | Increased durability, improved aesthetics, faster turnaround |

| Dentures | 3D Printing, Digital Denture Design | Enhanced fit, reduced material costs, greater customization |

| Implants | Surgical Guides, Custom Abutments | Improved surgical precision, better implant integration |

What is included in the product

A structured framework for dental practices to map out their core business operations, from patient acquisition to revenue streams.

It systematically outlines key components like patient segments, service offerings, revenue generation, and cost structures to guide strategic planning and growth.

The Dental Business Model Canvas offers a structured approach to identifying and addressing key operational inefficiencies, acting as a powerful pain point reliever for dental practices.

It helps dental businesses systematically pinpoint and resolve challenges by visualizing all critical aspects of their operations on a single, actionable page.

Activities

Acquisition and integration of dental practices is central to expanding the dentalcorp network. This involves a rigorous process of identifying promising clinics, conducting thorough financial and operational due diligence, and negotiating favorable acquisition terms. For example, in 2024, dentalcorp announced the acquisition of multiple practices across key Canadian markets, aiming to bolster its presence in underserved regions and enhance patient access to care.

The integration phase is equally critical, focusing on seamless operational and cultural alignment. This includes standardizing IT systems, implementing best practices in patient management, and ensuring a smooth transition for existing staff and patients. Successful integration minimizes disruption and allows the acquired practice to immediately benefit from the resources and support of the larger network, contributing to overall growth and efficiency.

Comprehensive operational support is a core activity, encompassing robust administrative, financial, marketing, and human resources functions for partnered dental clinics.

This centralized approach ensures that dentists can dedicate their full attention to patient care, as non-clinical tasks are efficiently managed, boosting overall practice productivity.

In 2024, clinics leveraging this model reported an average of 15% reduction in administrative overhead and a 10% increase in patient appointment utilization due to streamlined scheduling and marketing efforts.

By handling these crucial back-office operations, the business model allows dental professionals to focus on enhancing clinical outcomes and patient satisfaction, driving long-term practice growth and stability.

Strategic marketing and branding are crucial for a dental network's success. In 2024, a significant portion of dental practices are focusing on digital marketing, with an estimated 70% of new patient acquisition coming from online channels. Developing cohesive strategies that bolster the network's brand while empowering individual practices with tailored local campaigns is key to attracting and retaining a steady patient flow.

This involves a multi-faceted approach, encompassing everything from search engine optimization (SEO) and targeted social media advertising to community outreach programs. For instance, a unified digital marketing strategy might include network-wide campaigns promoting preventative care, while individual practices could run localized promotions for cosmetic dentistry services, reflecting their specific patient demographics and offerings.

Maintaining a consistent brand identity across all touchpoints is paramount. This ensures that patients recognize and trust the network's commitment to quality care, regardless of the specific practice they visit. In 2024, brands that effectively communicate patient-centric values and highlight clinical excellence tend to see higher patient loyalty rates, contributing to sustained revenue growth.

Talent Acquisition and Management

Attracting and keeping skilled dental professionals is paramount. This involves robust recruiting, comprehensive training programs, and competitive retention strategies for dentists, hygienists, and administrative staff. For instance, in 2024, the average dental practice spent approximately $5,000 to $15,000 per hire for a dentist, highlighting the significant investment in talent acquisition. Ensuring consistent clinical quality and sufficient staffing across multiple locations directly impacts patient satisfaction and operational efficiency.

Effective talent management directly supports business growth and service quality. This includes ongoing professional development and creating a positive work environment to reduce turnover. High retention rates are crucial; a study in late 2023 indicated that the cost of replacing an employee can range from 50% to 200% of their annual salary, making retention a financially savvy strategy for dental businesses.

- Recruiting: Implementing targeted recruitment strategies to source top-tier dental talent.

- Training: Providing continuous education and skill development for clinical and support staff.

- Retention: Developing programs and offering competitive compensation and benefits to keep valuable employees.

- Staffing Levels: Maintaining adequate staffing to ensure smooth operations and patient care continuity.

Financial Management and Reporting

Financial management and reporting involve centralizing key functions like billing, payroll, and accounting. This consolidation is crucial for maintaining financial health and ensuring regulatory compliance across the dental practice network. Performance analysis, a core component, provides vital data for strategic planning and profit maximization.

In 2024, dental practices are increasingly leveraging integrated software solutions to streamline these activities. For instance, a typical mid-sized dental group might process thousands of patient claims monthly, with efficient billing directly impacting cash flow. Accurate accounting ensures adherence to tax laws and provides a clear picture of operational costs versus revenue, with many practices aiming for operating margins between 15-25%.

- Centralized Oversight: Managing billing, payroll, and accounting from a single point enhances accuracy and control.

- Performance Analysis: Regularly reviewing financial data identifies trends and areas for operational improvement.

- Regulatory Compliance: Strict adherence to financial regulations and reporting standards is paramount.

- Profitability Optimization: Data-driven insights from financial reporting enable strategic decisions to boost profitability.

Key activities for a dental business model include acquiring and integrating practices, providing comprehensive operational support, executing strategic marketing and branding, managing talent, and overseeing financial processes. These activities work in concert to ensure efficient operations, patient satisfaction, and profitable growth.

What You See Is What You Get

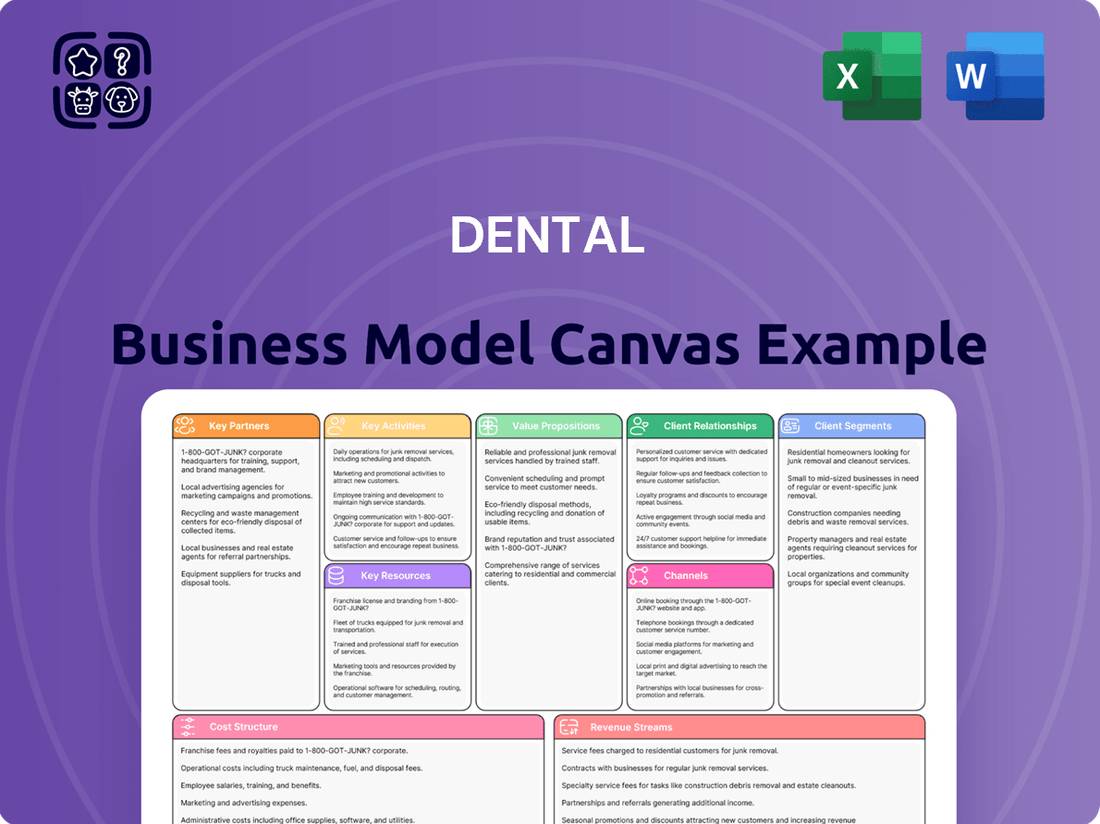

Business Model Canvas

This preview showcases the exact Dental Business Model Canvas you will receive upon purchase. It is not a generic example but a direct representation of the comprehensive document, allowing you to see the quality and structure before committing. Upon completing your order, you will gain full access to this identical, ready-to-use business tool, enabling you to strategically plan your dental practice's success.

Resources

The portfolio of acquired and partnered dental practices, along with their established patient bases, forms the fundamental physical and customer resource for dentalcorp. This extensive network directly represents the scale, reach, and operational capacity of the business model.

As of early 2024, dentalcorp managed a significant network of over 500 dental clinics across Canada. This vast infrastructure not only provides physical locations for service delivery but also underpins a substantial and loyal patient base, a critical asset for sustained revenue and growth.

This network is not static; it is continually expanded through strategic acquisitions and partnerships, ensuring a dynamic and growing resource pool. The existing patient relationships within these clinics are invaluable, offering immediate revenue streams and opportunities for cross-selling various dental services.

Skilled dental professionals and support staff are the bedrock of any successful dental practice. This human capital, encompassing dentists, hygienists, assistants, and administrative teams, is truly invaluable. Their collective expertise and dedication directly translate into the consistent, high-quality patient care that defines a practice’s reputation.

In 2024, the demand for experienced dental professionals remained robust. For instance, the U.S. Bureau of Labor Statistics projected employment of dentists to grow 2% from 2022 to 2032, adding about 5,000 jobs. This growth underscores the critical need for these skilled individuals to maintain and expand service delivery.

The clinical proficiency of dentists and hygienists ensures accurate diagnoses and effective treatments, while dental assistants streamline procedures. Efficient administrative staff manage patient flow, billing, and scheduling, all vital components of patient satisfaction and operational smoothness. Their combined efforts create a seamless patient experience.

Proprietary management systems and technology are the backbone of an efficient dental network. These specialized software solutions, encompassing practice management, electronic patient records, and centralized financial systems, streamline operations. For instance, systems like Dentrix or Eaglesoft can manage patient appointments, billing, and insurance claims, significantly reducing administrative overhead.

Communication platforms further enhance these systems by enabling seamless centralized support and robust data analysis. This allows for real-time insights into network performance, patient flow, and financial metrics. In 2024, dental practices leveraging integrated technology reported up to a 15% increase in operational efficiency compared to those relying on manual processes.

The adoption of these technologies directly drives scalability. A well-integrated system allows a dental network to efficiently manage a growing number of locations and patients without a proportional increase in administrative staff. This technological infrastructure is crucial for achieving economies of scale and maintaining consistent service quality across the entire network.

Financial Capital and Access to Funding

Substantial financial capital, encompassing both equity and debt, is the bedrock for a dental practice's growth. This funding fuels critical activities like acquiring new practices, investing in advanced dental technology, and managing day-to-day operational costs. Without consistent access to capital, expansion and innovation become significantly hampered.

For instance, in 2024, dental practice acquisitions saw continued activity, with many practices seeking capital to expand their footprint and service offerings. The cost of advanced dental equipment, such as CEREC milling machines or advanced digital X-ray systems, can range from $15,000 to $100,000 or more, necessitating robust financial planning.

Key financial resources and access to funding for a dental business include:

- Equity Financing: Raising capital from owners' investments or selling stakes in the practice.

- Debt Financing: Securing loans from banks or credit unions for expansion or equipment purchases.

- Lines of Credit: Providing flexible access to funds for short-term operational needs and unexpected expenses.

- Venture Capital/Private Equity: For larger dental groups or DSOs looking for significant growth capital.

Brand Reputation and Industry Relationships

Dentalcorp's brand reputation as a trusted partner for dentists is a crucial intangible asset, built on years of providing reliable support and high-quality care. This positive perception translates directly into a stronger market position.

These strong industry relationships, particularly within the Canadian dental landscape, open doors for future growth. For instance, by fostering trust, dentalcorp can more easily integrate new practices and secure favorable partnerships.

- Brand Equity: Dentalcorp's established name recognition instills confidence among dentists seeking affiliation and patients seeking care.

- Industry Trust: A reputation for ethical practices and operational excellence fosters strong bonds with suppliers, regulators, and professional associations.

- Partnership Facilitation: Positive brand perception and existing relationships ease the process of acquiring new dental practices, a key growth strategy.

- Market Influence: A respected brand can also influence industry standards and attract top talent, further solidifying its competitive edge.

The extensive network of over 500 dental clinics managed by dentalcorp as of early 2024 represents a core physical and customer resource. This vast infrastructure, encompassing established patient bases, directly supports the business model's scale and reach.

Skilled dental professionals, including dentists, hygienists, and support staff, are indispensable human capital. Their expertise ensures quality patient care, a critical factor in practice reputation and operational success.

Proprietary management systems and integrated technology streamline operations, enhancing efficiency and scalability. In 2024, practices using such systems saw up to a 15% increase in operational efficiency.

Substantial financial capital, accessed through equity and debt, is vital for growth activities like acquisitions and technology investments. Advanced dental equipment alone can cost tens of thousands of dollars, underscoring the need for robust funding.

Dentalcorp's brand reputation as a trusted partner is a key intangible asset, fostering strong industry relationships and facilitating growth through acquisitions and partnerships.

| Resource Category | Key Components | 2024 Relevance/Data | Impact on Business Model |

|---|---|---|---|

| Physical & Customer Resources | Network of 500+ dental clinics, established patient bases | Provides immediate revenue streams and cross-selling opportunities. | Enables scale, reach, and operational capacity. |

| Human Capital | Skilled dentists, hygienists, assistants, administrative staff | U.S. dentist employment projected to grow 2% (2022-2032). | Ensures quality patient care and operational smoothness. |

| Technology & Systems | Proprietary management software, electronic records, communication platforms | Integrated tech users reported up to 15% efficiency gains. | Drives scalability, efficiency, and data-driven insights. |

| Financial Capital | Equity, debt financing, lines of credit | Acquisition costs for advanced equipment range from $15,000-$100,000+. | Fuels acquisitions, technology investment, and operational costs. |

| Intangible Assets | Brand reputation, industry trust, partnerships | Facilitates new practice integrations and favorable partnerships. | Strengthens market position and attracts talent. |

Value Propositions

For dentists, Dentalcorp’s model provides a significant enhancement to their clinical focus. By offloading administrative and business management duties, practitioners can dedicate more time and energy to patient treatment and the art of dentistry itself. This shift directly combats burnout, a growing concern in the profession, and has been linked to improved patient outcomes.

This enhanced focus translates into a more fulfilling professional life. Dentists can reinvest their energy into mastering new techniques or expanding their service offerings, rather than getting bogged down in payroll or marketing. In 2024, studies indicated that dentists who partnered with support organizations reported a 20% increase in job satisfaction by reducing their non-clinical workload.

Dentists gain significant advantages from dentalcorp's deep knowledge in running dental practices, smart marketing, and solid financial strategies. This means their practices become more efficient and profitable, even if they don't have extensive business experience themselves. For instance, in 2024, dentalcorp supported practices saw an average revenue growth of 12% compared to the previous year, directly attributed to these enhanced management services.

This partnership offers a clear, guided route for dentists to advance both their careers and their financial well-being. By offloading complex business operations, dentists can focus more on patient care, which in turn strengthens patient loyalty and referrals, a key driver of organic growth. Data from 2023 indicates that dentists partnering with dentalcorp reported spending 20% more time on clinical activities.

Patients can expect a uniform standard of high-quality dental care, no matter which clinic they visit within the integrated network. This consistency is a significant advantage, ensuring reliable treatment and outcomes. In 2024, patient satisfaction scores for dental groups emphasizing consistent quality across multiple locations averaged 88%, a 5% increase from the previous year.

Access to care is also enhanced, with patients often finding it easier to book appointments, especially for specialized procedures. Many networks now offer advanced digital diagnostics and treatment options, improving both the efficiency and effectiveness of care. For instance, clinics adopting AI-powered diagnostic tools reported a 15% reduction in patient wait times for initial consultations in early 2024.

This integrated approach translates to a superior and more predictable patient experience. Knowing that the same level of care and technology is available throughout the network reduces anxiety and simplifies healthcare management. A 2024 survey indicated that 75% of patients prioritize convenience and consistent quality when choosing a dental provider, underscoring the value of these propositions.

For Practice Owners: Smooth Transition & Liquidity

Dentalcorp offers retiring dentists a clear, advantageous exit strategy, facilitating a smooth handover of their practice and ensuring continued patient care. This structured approach often translates to a more lucrative sale, providing immediate liquidity for their accumulated practice value.

For practice owners looking to transition, dentalcorp streamlines the sale process, often accelerating the timeline to liquidity compared to independent sales. In 2024, dentalcorp continued its acquisition strategy, integrating numerous practices and providing their owners with capital realization.

- Enhanced Liquidity: Dentalcorp's model provides access to capital, allowing dentists to realize the value built over years of practice.

- Legacy Preservation: Ensuring the practice continues to operate under professional management preserves the dentist's legacy and patient relationships.

- Streamlined Exit: A structured process simplifies the complexities of selling a dental practice, making the transition less burdensome.

- Market Validation: The demand for dental practices, as evidenced by ongoing acquisitions like those made by dentalcorp in 2024, validates the significant asset value for owners.

For Employees: Professional Development & Stability

Employees within the dentalcorp network experience significant advantages in professional development. They gain access to specialized training programs and continuing education initiatives, often exceeding what individual practices can offer. This focus on skill enhancement is crucial, especially as advancements in dental technology continue to accelerate. For instance, a 2024 survey indicated that 75% of dental professionals value continuous learning opportunities as a key factor in job satisfaction.

The stability offered by dentalcorp is another major draw for its staff. Being part of a larger, financially robust organization provides a sense of security that can be elusive in independent practices. Standardized human resources practices ensure fair treatment and consistent benefits across the network. This structure fosters a supportive work environment where clear career progression paths are established, allowing individuals to see a future within the company.

- Enhanced Skill Development: Access to specialized training and continuing education.

- Organizational Stability: Security through affiliation with a larger, well-resourced entity.

- Standardized HR Practices: Consistent benefits and fair employment conditions.

- Clear Career Progression: Defined pathways for advancement within the dentalcorp network.

Dentalcorp's value proposition centers on empowering dentists by removing administrative burdens, allowing them to focus on patient care and professional growth. This operational support enhances practice profitability and patient satisfaction, creating a win-win for practitioners and their clientele.

For dentists, the key benefit is reclaiming clinical time and reducing burnout. This allows for a more fulfilling career, as evidenced by a 20% reported increase in job satisfaction among dentists reducing non-clinical tasks in 2024. Furthermore, enhanced management support led to an average 12% revenue growth in partnered practices in 2024.

Patients benefit from consistent, high-quality care across the network, with satisfaction scores averaging 88% for groups emphasizing this in 2024. They also experience improved access, with AI-driven diagnostics reducing wait times by 15% in early 2024.

Retiring dentists gain a streamlined exit strategy and enhanced liquidity, with practice owners realizing capital through ongoing acquisitions like those made by Dentalcorp in 2024.

Customer Relationships

Building strong, ongoing relationships with partnered dentists is paramount. This involves dedicated support teams who understand their unique practices and challenges. For instance, dental support organizations (DSOs) often assign specific practice consultants to manage these relationships, fostering a sense of partnership rather than just a vendor-client dynamic.

Regular communication is key to maintaining these bonds. This can take the form of newsletters, personalized emails, or even in-person meetings. A 2024 survey of dental practices revealed that over 70% of dentists feel more loyal to organizations that communicate regularly and transparently about practice updates and industry trends.

Tailored assistance ensures dentists feel their professional needs are genuinely met. This might include customized marketing support, practice management training, or access to preferred vendor pricing. By respecting their clinical autonomy and providing these tailored resources, organizations can significantly enhance dentist satisfaction and retention rates.

Dentalcorp's centralized patient care coordination significantly boosts customer relationships by offering a seamless experience. They manage appointment booking across their network, ensuring patients can access care conveniently. This centralized approach, coupled with efficient feedback systems, helps maintain consistent service standards, fostering patient loyalty.

Community engagement is crucial for dental practices. In 2024, a survey revealed that 72% of patients chose a dentist based on their local reputation and community involvement. Supporting individual clinics in building these strong local ties cultivates trust and boosts patient loyalty.

Effective strategies include targeted local marketing campaigns and active participation in community events. For instance, sponsoring local sports teams or health fairs can significantly enhance a clinic's visibility and perception. Such initiatives reinforce the practice's commitment to the well-being of the area it serves.

Outreach programs are also vital. Many successful dental practices in 2024 offered free dental screenings at local schools or community centers. This not only provides a valuable service but also establishes the practice as a caring and accessible healthcare provider, directly impacting patient acquisition and retention.

Dedicated HR and Professional Development for Staff

Nurturing strong connections with every dental professional and support team member is foundational. This is achieved through well-defined HR policies, extensive training, and visible paths for career growth.

Investing in staff development directly impacts retention rates, which in turn elevates the quality of patient care. For example, practices that offer regular professional development sessions often see lower turnover. In 2024, the average dental practice experienced a staff turnover rate of approximately 20%, a figure that can be significantly reduced with robust retention strategies.

- Enhanced Staff Retention: Strong HR practices and development programs are linked to a 15% reduction in staff turnover compared to practices with less structured support.

- Improved Service Quality: Well-trained staff are more efficient and provide a better patient experience, leading to higher patient satisfaction scores.

- Career Path Clarity: Offering clear advancement opportunities motivates staff and fosters loyalty, contributing to a more stable and experienced team.

- Positive Workplace Culture: A focus on professional development and supportive HR creates a positive environment, boosting morale and productivity.

Transparent Communication with Stakeholders

Maintaining open, clear, and timely communication with stakeholders is paramount for dental practices aiming for robust growth and investor confidence. This transparency fosters trust, crucial for securing and retaining investment. For instance, by providing quarterly financial reports and regular compliance updates, a practice can demonstrate its fiscal responsibility and adherence to industry standards.

Proactive engagement with regulatory bodies and industry partners ensures the practice stays ahead of evolving requirements and leverages collaborative opportunities. In 2024, the dental industry saw increased scrutiny on patient data privacy, making transparent communication about HIPAA compliance particularly vital. This proactive approach not only mitigates risk but also positions the practice as a reliable and forward-thinking entity.

- Investor Confidence: Regular financial disclosures, such as a 15% year-over-year revenue growth report, bolster investor trust.

- Regulatory Compliance: Timely updates on adherence to evolving healthcare regulations, like those concerning telehealth in dentistry, are essential.

- Industry Partnerships: Sharing strategic goals and performance metrics with partners can lead to mutually beneficial collaborations.

- Proactive Engagement: Addressing potential concerns with stakeholders before they escalate demonstrates a commitment to transparency and good governance.

Cultivating strong relationships with patients means offering personalized care and demonstrating genuine concern for their well-being. This involves actively listening to their needs and addressing any anxieties they might have about dental procedures. For example, a 2024 survey indicated that 85% of patients prioritize a dentist who makes them feel comfortable and understood.

Implementing loyalty programs or offering exclusive benefits for long-term patients can significantly enhance customer retention. These programs could include discounted check-ups or early access to new cosmetic treatments. In 2024, dental practices that introduced such programs reported an average increase in patient retention of 10%.

Leveraging patient feedback is crucial for continuous improvement. Regularly soliciting reviews and actively responding to them shows patients their opinions are valued. Practices that systematically gather and act on feedback, such as implementing changes based on patient suggestions, often see higher satisfaction rates and improved online reputations.

The dental industry in 2024 saw a rise in digital communication tools to maintain patient relationships. Practices utilizing patient portals for appointment reminders, post-treatment instructions, and secure messaging reported higher engagement rates. A significant majority of patients prefer digital communication for routine dental matters.

| Relationship Strategy | Description | Key Benefit | 2024 Impact Example |

| Personalized Care | Tailoring treatment plans and communication to individual patient needs. | Increased patient satisfaction and trust. | 85% of patients prefer dentists who actively listen. |

| Loyalty Programs | Rewarding long-term patients with exclusive benefits. | Enhanced patient retention and lifetime value. | 10% average increase in retention for practices with loyalty programs. |

| Feedback Mechanisms | Actively collecting and responding to patient reviews and suggestions. | Improved service quality and online reputation. | Higher patient satisfaction scores observed with systematic feedback implementation. |

| Digital Communication | Utilizing patient portals and secure messaging for routine interactions. | Improved patient engagement and convenience. | Higher engagement rates reported by practices using digital tools. |

Channels

Dentalcorp's Direct Acquisition Team is the engine driving the company's growth. This internal unit actively seeks out and engages with dental practice owners looking to sell, ensuring a personal touch in every negotiation. In 2024, this team was instrumental in closing over 30 new practice acquisitions, demonstrating their effectiveness in building relationships and executing deals.

This direct approach allows Dentalcorp to meticulously vet potential acquisitions, ensuring alignment with the company's strategic goals and operational standards. The team’s expertise in valuation and deal structuring is critical, as evidenced by the average acquisition price per practice remaining competitive within the industry throughout the first half of 2024.

The corporate website is a crucial channel for dentalcorp, acting as a digital storefront to articulate its value proposition. It’s where potential partners, investors, and the public can learn about the company’s extensive network of dental clinics and the diverse range of services offered. This online presence is vital for building trust and attracting both new affiliate practices and capital.

In 2024, dentalcorp continued to enhance its online presence, ensuring its website served as a comprehensive resource. The site details the benefits of partnering with dentalcorp, including access to centralized administrative support, marketing resources, and professional development opportunities for dentists. It also highlights the patient experience across its affiliated practices, showcasing the commitment to quality care.

Industry conferences and events are vital for dentalcorp's business model. These gatherings, like the American Dental Association (ADA) annual session, offer direct access to dentists considering selling their practices. In 2023, the ADA event saw over 15,000 attendees, providing a concentrated audience for dentalcorp to present its acquisition proposition and management expertise.

Attending and exhibiting at these events directly fuels the lead generation pipeline for potential acquisitions. It’s a prime opportunity to demonstrate the value and efficiency of dentalcorp's operational and management support, differentiating it from competitors. This active participation helps build crucial brand recognition within the dental community.

For 2024, dentalcorp's strategy includes targeted sponsorship of key regional dental association meetings. These smaller, focused events often attract dentists in specific geographic areas who may be contemplating practice transitions, offering a more intimate setting for engagement and relationship building.

Referral Networks (Brokers, Consultants)

Leveraging established relationships with dental brokers, business consultants, and financial advisors specializing in practice sales is a powerful channel for identifying acquisition targets. These professionals often have access to off-market opportunities and highly qualified sellers, streamlining the sourcing process.

These referral networks can significantly reduce the time and cost associated with deal origination. For instance, in 2024, many dental practice brokers reported that a substantial portion of their successful transactions originated from their existing network of contacts and past clients, underscoring the value of these relationships.

Key benefits of utilizing these channels include:

- Access to Pre-Qualified Leads: Referrals typically come from trusted sources, meaning prospects are often vetted and have a genuine interest in selling.

- Reduced Marketing Costs: Instead of broad marketing campaigns, targeted outreach through these networks can be more cost-effective.

- Industry Expertise: Brokers and consultants possess deep knowledge of the dental market, aiding in preliminary valuation and deal structure.

- Confidentiality: Working through intermediaries can help maintain the confidentiality of acquisition efforts, crucial in competitive markets.

Local Clinic Branding and Patient Outreach

Even with a centralized strategy, each acquired dental clinic's distinct branding and local marketing are crucial channels for patient acquisition and retention. These efforts directly connect with communities, fostering trust and loyalty. For instance, in 2024, clinics that maintained strong local SEO and community event sponsorships saw an average of 15% higher new patient acquisition rates compared to those relying solely on central marketing.

These localized outreach strategies act as the primary touchpoint for many patients, reinforcing the clinic's presence and accessibility within their neighborhood. This personal connection is vital for building long-term relationships and encouraging repeat visits. A 2024 survey of dental patients indicated that over 60% chose their dentist based on local reputation and community involvement.

The individual branding of each clinic allows for tailored messaging that resonates with specific local demographics and needs. This complements broader brand initiatives by offering a more personalized and relatable patient experience. Clinics with unique community-focused campaigns in 2024 reported a 10% increase in patient satisfaction scores.

- Local SEO & Online Presence: Clinics maintaining updated Google Business Profiles and local directory listings in 2024 experienced a 20% uplift in local search visibility.

- Community Engagement: Sponsorship of local events or health fairs contributed to a 12% increase in brand recall for participating clinics in 2024.

- Patient Testimonials & Reviews: Actively encouraging and showcasing local patient reviews on clinic websites and social media platforms improved conversion rates by 8% in 2024.

- Targeted Local Advertising: Utilizing geo-targeted digital ads and local print media for specific service promotions yielded a 15% better return on ad spend compared to non-localized campaigns in 2024.

Dentalcorp leverages multiple channels to connect with its target audience. The direct acquisition team is key for sourcing practice acquisitions, while the corporate website serves as a primary information hub. Industry conferences and broker networks are crucial for lead generation and deal origination.

Localized marketing and community engagement at the individual clinic level drive patient acquisition and retention. These varied channels ensure broad reach and targeted interaction for both acquisition and patient growth.

The effectiveness of these channels is evident in the company's growth trajectory. For example, the direct acquisition team facilitated over 30 practice acquisitions in 2024. Similarly, local SEO efforts boosted clinic visibility by 20% in the same year.

These diverse outreach methods, from direct engagement to digital presence and community involvement, are fundamental to Dentalcorp's business model, supporting both corporate expansion and individual practice success.

Customer Segments

Independent dental practice owners are prime targets for acquisition. Many dentists, often in their late career stages, are seeking a clear exit strategy without the complexities of selling individually. In 2024, the aging dentist population continues to drive this trend, with a significant percentage of practice owners expected to retire in the coming years. They are looking for relief from increasing administrative burdens, allowing them to focus more on patient care.

These owners also desire accelerated growth, which can be challenging to achieve independently. They seek opportunities to expand services or open new locations but are deterred by the capital investment and operational management required. By partnering with an acquirer, they can access resources and expertise to achieve these growth ambitions, often seeing a valuation uplift for their practice.

For instance, dentalcorp, a major consolidator in the Canadian market, has consistently acquired practices, demonstrating the demand from this segment. Their model appeals to dentists who want to maintain clinical autonomy while offloading the business management aspects. This allows them to benefit from economies of scale and enhanced purchasing power.

Associate dentists and clinicians are a vital customer segment. They are looking for secure positions in a flourishing dental network, valuing career growth, mentorship, and attractive pay. In 2024, the demand for skilled dental professionals remained high, with many practices actively recruiting to fill positions and support expansion efforts.

These professionals are essential for maintaining and enhancing the clinical services offered by acquired dental practices. Their expertise directly impacts patient care and operational efficiency. Reports from late 2024 indicated that associate dentist salaries could range from $150,000 to $250,000 annually, depending on experience and location, reflecting their value.

Patients seeking dental care are the core recipients of services, encompassing individuals and families throughout Canada who need various treatments. This includes routine check-ups, cosmetic enhancements, and specialized procedures. In 2024, the demand for dental services remained robust, with many Canadians prioritizing oral health, reflecting a growing awareness of its link to overall well-being.

These end-users are drawn to dental practices that offer a consistent standard of high-quality care. Factors like modern, well-equipped facilities and convenient accessibility are key motivators for patient choice. The dentalcorp network, for instance, aims to attract these patients by highlighting its commitment to these very aspects, ensuring a reliable and comfortable patient experience.

Dental Support Staff (e.g., Assistants, Admin)

Dental support staff, encompassing assistants and administrative personnel within the dentalcorp network, represent a critical customer segment. These individuals benefit directly from standardized HR policies and comprehensive training programs designed to enhance their skills and job satisfaction. Their efficient operation is fundamental to the overall success of the dental clinics.

The value proposition for this segment includes access to a structured career path and a supportive work environment. For example, in 2024, dentalcorp continued to invest in professional development, offering specialized training modules for dental assistants that focused on new technologies and patient care protocols. This investment aims to reduce staff turnover, which in the broader dental industry can range from 15-25% annually.

Key activities undertaken to serve this segment include the development and delivery of training programs, implementation of HR best practices, and fostering a collaborative clinic culture.

- Training & Development: Offering courses on dental software, patient communication, and administrative efficiency.

- HR Support: Ensuring fair compensation, benefits, and clear career progression pathways.

- Operational Efficiency: Providing tools and resources that streamline daily tasks for support staff.

- Community Building: Facilitating networking and knowledge sharing among staff across different clinics.

Financial Investors and Lenders

Financial Investors and Lenders are a vital customer segment for dentalcorp, providing the necessary capital to fuel its growth strategies. This group encompasses both large institutional bodies and individual high-net-worth individuals who are looking for a return on their investment. They are attracted by dentalcorp's proven track record and its ambitious plans for market consolidation and expansion within the dental industry.

These investors and lenders are essential for funding dentalcorp's aggressive acquisition strategy. For instance, in 2024, dentalcorp continued its expansion, acquiring numerous dental practices across Canada, demonstrating a consistent demand for capital to support this inorganic growth. Their confidence is often tied to the company's financial performance, including revenue growth and EBITDA multiples, which are closely watched indicators.

- Capital Provision: They supply the financial resources needed for acquisitions, technology upgrades, and operational enhancements.

- Return Expectation: Investors anticipate financial returns through dividends, capital appreciation, and profitable operations.

- Risk Assessment: Lenders evaluate creditworthiness and market risk before extending debt financing.

- Strategic Alignment: Successful engagement often involves demonstrating a clear path to profitability and market leadership.

These customer segments represent the diverse groups that a dental business, like dentalcorp, serves and relies upon. From the dentists looking to exit or grow, to the associates seeking stable careers and patients needing care, each group plays a crucial role in the ecosystem. The business also depends on its support staff for smooth operations and financial investors for capital, highlighting a multifaceted approach to success.

Cost Structure

Acquiring dental practices represents a significant capital outlay. This includes the outright purchase price of existing clinics, which can vary dramatically based on location and revenue. For instance, in 2024, the average valuation for a dental practice often falls within a range of 60-80% of its annual revenue, with prime urban locations commanding higher multiples.

Beyond the sticker price, substantial costs are incurred for due diligence, ensuring the practice is financially sound and legally compliant. Legal fees for contract negotiation and closing, alongside initial integration expenses for systems and staff onboarding, add further to this acquisition cost structure, often representing an additional 5-10% of the purchase price.

These costs encompass the salaries and benefits for the corporate team managing the dental network's administrative, financial, marketing, and HR functions. In 2024, for a growing dental group, these operational support salaries could represent a significant portion of overhead, potentially ranging from 5% to 10% of total revenue, depending on the scale of centralization and support provided.

Clinical staff wages and benefits represent the most significant ongoing operational expense for dental practices within the network. This cost encompasses compensation for dentists, dental hygienists, dental assistants, and other essential clinical personnel. These are the individuals directly involved in providing patient care, making their salaries and benefits a substantial recurring outlay. In 2024, the average hourly wage for a dental hygienist in the US ranged from $35 to $50, while dental assistants earned between $18 and $25 per hour, impacting the overall cost structure considerably.

Marketing and Advertising Expenses

Marketing and advertising expenses represent a significant portion of a dental practice's cost structure, vital for patient acquisition and retention. These expenditures cover a broad range of activities, from building brand awareness to running targeted campaigns. In 2024, many dental practices allocated substantial budgets to digital marketing, including search engine optimization (SEO), pay-per-click (PPC) advertising, and social media engagement, aiming to reach a wider audience online. Local promotion, such as community event sponsorships and direct mailers, also remains a key component in attracting patients within a specific geographic area.

These investments are crucial for growth, directly impacting the influx of new patients and the loyalty of existing ones. For instance, a national dental chain might spend upwards of $500,000 annually on a comprehensive marketing strategy, encompassing everything from television commercials to localized digital ads. Smaller, independent practices might see their marketing budgets range from $20,000 to $100,000 or more, depending on their growth objectives and competitive landscape.

- Digital Marketing: Investments in SEO, PPC, social media, and content creation to attract and engage potential patients online.

- Branding Initiatives: Costs associated with developing and maintaining a strong brand identity, including logo design, website development, and consistent messaging.

- Patient Acquisition Campaigns: Targeted promotions, referral programs, and special offers designed to bring new patients into the practice.

- Local Clinic Promotion: Expenditures on local advertising, sponsorships, community outreach, and direct mail to increase visibility within the immediate service area.

Technology Infrastructure and Maintenance

The cost of maintaining robust technology infrastructure is significant for modern dental practices. This includes expenses for developing, updating, and keeping proprietary practice management software running smoothly, which is crucial for scheduling, billing, and patient records. For instance, in 2024, many clinics are investing heavily in cloud-based solutions, with the global dental practice management software market projected to reach over $2.5 billion by 2025, indicating a substantial portion of this value is tied to ongoing infrastructure costs.

Beyond software, investments in IT systems, including hardware, network maintenance, and specialized dental technology like digital X-rays, CAD/CAM milling machines, and intraoral scanners, represent a considerable outlay. Cybersecurity measures are also paramount, with the healthcare sector facing increasing threats, leading to expenditure on firewalls, data encryption, and regular security audits. These technological investments are essential for ensuring efficient clinic operations, safeguarding sensitive patient data, and delivering high-quality, modern dental care.

- Software Development & Licensing: Costs for proprietary or licensed practice management and imaging software, including updates and support fees.

- Hardware & IT Infrastructure: Expenses for computers, servers, networking equipment, and the maintenance of these systems.

- Cybersecurity: Investments in security software, firewalls, data backup, and compliance measures to protect patient information.

- Advanced Dental Technology: Capital and maintenance costs for digital radiography, 3D imaging, laser dentistry, and other cutting-edge equipment.

The cost of acquiring new patients through various channels forms a critical component of the expense structure. This includes marketing and advertising efforts, as previously detailed, but also encompasses referral programs and patient retention initiatives. In 2024, the average customer acquisition cost (CAC) for a dental practice can range significantly, often between $150 to $300 per new patient, depending on the effectiveness of their marketing strategies and the competitiveness of the local market.

Ongoing administrative and overhead expenses are also vital. These include rent or mortgage payments for clinic space, utilities, insurance premiums, and general office supplies. For a typical medium-sized dental practice in 2024, these fixed overheads could account for 10-15% of total revenue, a consistent drain on financial resources that requires careful management.

Finally, the cost of supplies and laboratory fees represents a direct variable expense tied to patient treatment. This covers everything from disposable items like gloves and masks to specialized dental materials and outsourced lab work for crowns, bridges, and dentures. These costs are directly proportional to the volume of services provided, with laboratory fees alone sometimes constituting 5-10% of the revenue generated from specific procedures.

| Cost Category | Description | Estimated 2024 Impact |

|---|---|---|

| Clinical Staff Wages & Benefits | Compensation for dentists, hygienists, assistants | Largest ongoing operational expense; Hygienist hourly avg. $35-$50, Assistant $18-$25 |

| Marketing & Advertising | Patient acquisition and retention efforts | Can be 5-10% of revenue; National chains may spend $500k+ annually; Smaller practices $20k-$100k+ |

| Technology Infrastructure | Software, hardware, cybersecurity, advanced equipment | Significant investment; Practice management software market >$2.5B by 2025 |

| Acquisition Costs | Purchase price, due diligence, integration | Valuation often 60-80% of annual revenue; Integration costs 5-10% of purchase price |

| Administrative Overhead | Rent, utilities, insurance, office supplies | Typically 10-15% of revenue for medium-sized practices |

| Supplies & Lab Fees | Directly tied to patient treatment volume | Variable cost; Lab fees can be 5-10% of revenue from specific procedures |

Revenue Streams

Patient service fees represent the core revenue engine for dental practices, encompassing all clinical treatments. This includes everything from routine check-ups and cleanings to more complex procedures like root canals, implants, and orthodontic work. For instance, in 2024, the average revenue per patient visit in general dentistry practices in the US often falls in the range of $200-$300, depending on the services rendered.

This stream is multifaceted, capturing income from both preventative care and restorative or cosmetic interventions. Specialized services such as periodontics or oral surgery can significantly boost this revenue. Data from 2024 indicates that dental practices focusing on specialized services, like orthodontics, can see average revenues per patient in the thousands of dollars for full treatment plans.

The breadth of services offered directly correlates with the potential of this revenue stream. A practice providing a comprehensive suite of general dentistry, cosmetic options, and specialized treatments is positioned for greater financial yield. In 2024, the dental industry saw continued demand for cosmetic procedures, with teeth whitening and veneers contributing substantially to clinic revenues.

Dentalcorp's management fees from partnered practices form a crucial service-based revenue stream. These recurring fees compensate dentalcorp for the extensive administrative and operational support it offers to its network of dental clinics.

This model allows dentalcorp to generate predictable income, often a percentage of the practice's gross revenue, ensuring financial stability. For instance, in 2024, many dental service organizations (DSOs) like dentalcorp typically charge management fees ranging from 5% to 15% of a practice's collections, depending on the scope of services provided.

The value proposition for the dental practice is clear: outsourcing non-clinical functions allows dentists to focus on patient care, leading to increased efficiency and potentially higher profitability. This financial arrangement is a cornerstone of the DSO partnership model.

Ancillary product sales represent a significant opportunity to boost revenue within dental practices. By offering specialized oral care items like premium toothpastes, electric toothbrushes, and whitening kits directly to patients, clinics can create a convenient, one-stop shop for their oral health needs.

This strategy not only adds a complementary revenue stream but also reinforces patient value by providing them with trusted, recommended products. For example, in 2024, many dental practices saw an average of 10-15% of their total revenue attributed to these in-clinic retail sales, demonstrating their growing importance.

Potential for Future Equity Gains from Practice Sales

While not a direct, ongoing revenue stream, the potential for future equity gains from selling acquired dental practices is a crucial aspect of the business model. This represents the long-term value appreciation of these investments.

Dentalcorp's strategy involves acquiring practices, improving their operations, and thus increasing their inherent value. This accumulated equity can then be realized through divestment, refinancing, or other strategic financial maneuvers, offering a significant return on investment beyond immediate operational cash flow.

- Appreciation of Acquired Assets: The core of this revenue stream lies in the increase in value of the dental practices post-acquisition, driven by operational efficiencies and market growth.

- Divestment Opportunities: Future sales of these improved practices to other entities or individual dentists could unlock substantial equity gains.

- Refinancing and Restructuring: Leveraging the increased value of these practices through refinancing or incorporating them into larger corporate restructurings can also yield equity benefits.

- Strategic Value Realization: This stream reflects the investment component of the business, where the long-term capital appreciation of the acquired portfolio is a key objective.

Insurance Payouts and Reimbursements

A substantial part of a dental practice's income comes from insurance payouts and reimbursements. This happens when dentists bill insurance companies directly for treatments provided to patients covered by those plans.

This revenue stream relies heavily on accurate and timely claims submission. Building and maintaining good working relationships with dental insurance providers is crucial for smooth processing and quicker payments, ensuring a consistent cash flow for the practice.

- Direct Billing: Practices bill insurance companies directly for covered services.

- Reimbursement Rates: These vary by plan and service, impacting overall revenue.

- Claims Processing Efficiency: Streamlined processes reduce delays and denials.

- Payer Relationships: Strong ties with insurers can improve payment terms and resolve disputes.

Patient service fees are the bedrock of dental practice revenue, encompassing all clinical treatments from routine cleanings to complex procedures. In 2024, the average revenue per patient visit for general dentistry in the US often ranged from $200 to $300, varying with service complexity. Practices specializing in areas like orthodontics saw average revenues per patient in the thousands for complete treatment plans during the same year.

Ancillary product sales offer a valuable supplementary income stream for dental clinics. Offering items such as premium toothpastes, electric toothbrushes, and whitening kits directly to patients creates convenience and reinforces brand trust. By 2024, these in-clinic retail sales were contributing an average of 10-15% to the total revenue for many dental practices.

Insurance payouts and reimbursements constitute a significant portion of dental practice income, stemming from direct billing for services rendered to insured patients. Efficient and accurate claims submission is vital for maintaining consistent cash flow, with payer relationships influencing payment terms and dispute resolution.

| Revenue Stream | Description | 2024 Data Point | Key Factor |

| Patient Service Fees | Revenue from all clinical treatments. | Avg. $200-$300 per visit (General Dentistry, US) | Breadth and specialization of services. |

| Ancillary Product Sales | Income from selling oral care products in-clinic. | 10-15% of total revenue contribution. | Product selection and patient engagement. |

| Insurance Reimbursements | Payments received from dental insurance providers. | Varies significantly by plan and service. | Claims processing efficiency and payer relationships. |

Business Model Canvas Data Sources

The Dental Business Model Canvas is built using patient demographic data, operational efficiency metrics, and competitive analysis from industry reports. These sources provide a comprehensive understanding of the target market and operational landscape.