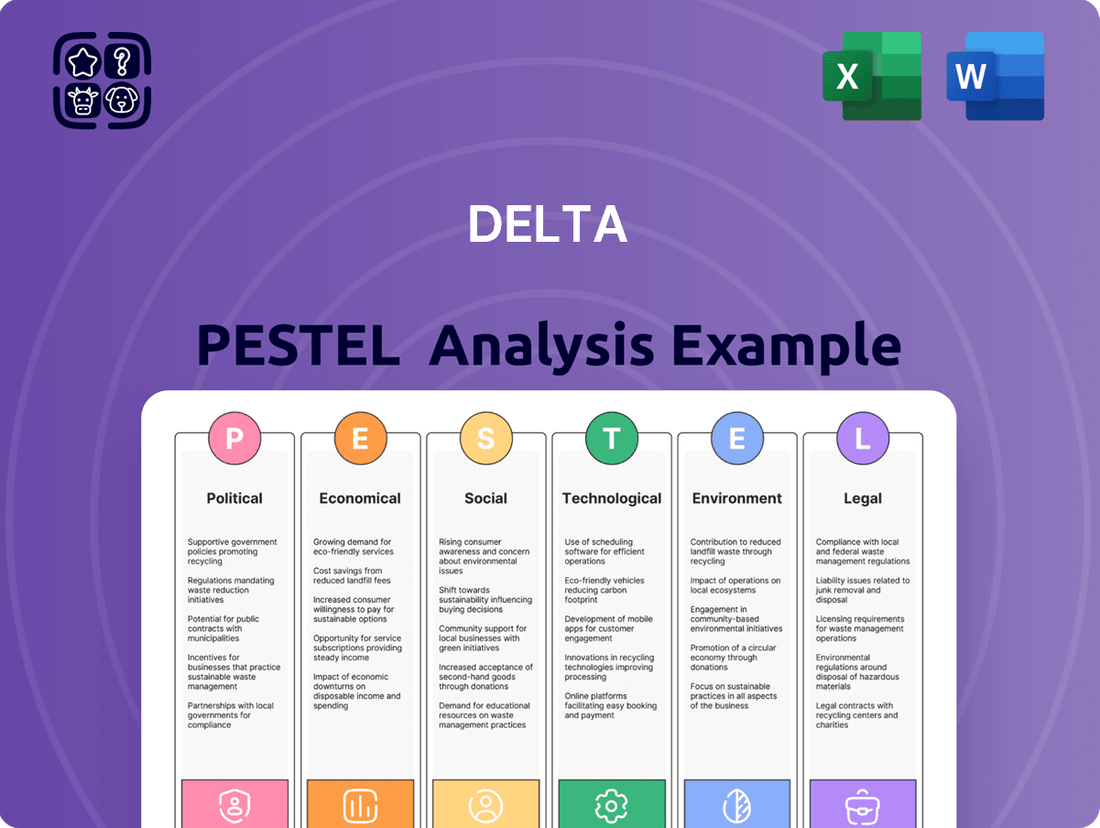

Delta PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Bundle

Uncover the critical external forces shaping Delta's future with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are influencing the airline's operations and strategic direction. This expertly crafted report offers actionable insights to help you navigate market complexities and identify opportunities. Strengthen your business strategy by leveraging this in-depth analysis. Download the full version now for immediate access to vital market intelligence.

Political factors

The Indian government, at both central and state levels, maintains a stringent regulatory framework for the gaming and casino sector. This oversight directly influences operational strategies and revenue streams for companies like Delta Corp.

A pivotal recent development is the imposition of a 28% Goods and Services Tax (GST) applied to the full face value of bets in online gaming and casinos. This tax measure, implemented in late 2023, represents a substantial increase from previous tax structures and has a direct impact on profitability.

For Delta Corp, these tax policies are critical. The company’s financial performance and operational models are significantly affected by the GST, particularly as discussions continue regarding its potential retrospective application from the initial implementation date.

Gambling is regulated at the state level in India, creating a patchwork of rules that differ from one region to another. This means Delta Corp's operational landscape is heavily influenced by the specific policies of each state it operates in.

Delta Corp's primary base is Goa, where offshore casino licenses have seen extensions. However, there's a clear indication that these operations are slated for relocation, adding an element of uncertainty to its long-term presence there. This relocation is a direct response to policy shifts and the evolving regulatory environment.

Any adjustments to Goa's gambling policies, whether favorable or restrictive, could have a substantial impact on Delta Corp's business. Furthermore, the prospect of other Indian states either opening their doors to the gaming industry or tightening existing regulations presents both opportunities for expansion and risks to its current stability.

The GST Council's decision to impose a 28% Goods and Services Tax on the full face value of bets in online gaming, effective from October 1, 2023, has significantly impacted Delta Corp's operational landscape. This move has necessitated a strategic reassessment of its online gaming ventures, potentially delaying or altering expansion plans.

Furthermore, the Supreme Court's ongoing deliberation on the retrospective application of this 28% GST rate introduces substantial financial uncertainty for Delta Corp. The outcome of this hearing could result in significant retrospective liabilities, impacting the company's financial health and future investment capacity.

Government Support for Tourism and Hospitality

The Indian government has been actively promoting tourism and hospitality, which can create a more favorable environment for companies like Delta Corp. For instance, in the Union Budget 2023-24, there was a significant increase in capital expenditure, with a substantial portion allocated to infrastructure development. This includes potential upgrades to transportation networks and other public amenities that enhance the overall travel experience, indirectly benefiting integrated resorts.

These government initiatives, while broad, can translate into tangible benefits for Delta Corp's operations. Increased budget allocations for tourism infrastructure can lead to better connectivity and accessibility to popular destinations where Delta Corp has a presence. Furthermore, granting infrastructure status to hotels can encourage investment and development in the hospitality sector, potentially leading to increased demand for entertainment and gaming services offered by Delta Corp.

A thriving broader hospitality sector naturally supports ancillary industries. As more tourists visit India and spend on accommodation and dining, there's a ripple effect that can boost demand for entertainment options, including casinos. This creates a positive ecosystem for integrated resorts that combine gaming with hospitality, dining, and entertainment. For example, the Indian government's vision to make India a global tourism hub by 2047, supported by policies aimed at ease of travel and enhanced visitor experience, bodes well for such businesses.

- Increased Capital Expenditure: The Union Budget 2023-24 saw a 33% increase in capital expenditure to ₹10 lakh crore, much of which is directed towards infrastructure that supports tourism.

- Tourism Promotion Schemes: Various central and state government schemes aim to boost domestic and international tourism, leading to higher footfalls in tourist destinations.

- Focus on Connectivity: Investments in airports, highways, and railways improve accessibility to regions where Delta Corp operates, making it easier for visitors to reach their properties.

- Hospitality Sector Growth: Government recognition and support for the hospitality sector encourage new developments and upgrades, increasing overall capacity and service quality.

Anti-Gambling Sentiments and Social Pressure

Growing public and political unease regarding gambling activities is a significant political factor for companies like Delta Corp. This sentiment, often stemming from concerns about addiction and social costs, can translate into stricter regulations or even outright prohibitions in specific jurisdictions.

While Delta Corp currently operates within legal frameworks, persistent negative public perception could prompt governments to consider more restrictive policies. This might manifest as increased taxes on gaming revenue, tighter licensing requirements, or limitations on advertising and promotional activities. For instance, in late 2023, discussions in certain Indian states intensified around the potential for increased taxation on online gaming revenue, directly impacting the profitability of companies in this sector.

- Public Opinion: Surveys in 2024 indicate a growing segment of the population in key markets expressing concern over the expansion of legal gambling.

- Policy Scrutiny: Several legislative bodies are actively reviewing existing gambling laws, with a focus on consumer protection and revenue generation.

- Advocacy Groups: Anti-gambling advocacy groups are becoming more vocal, influencing public discourse and lobbying for policy changes.

Government policies heavily influence Delta Corp's operations, particularly the 28% GST on gross betting value introduced in late 2023. This tax significantly impacts profitability and strategic planning, with ongoing debates about its retrospective application adding financial uncertainty.

State-level gambling regulations create a complex operational environment for Delta Corp, as seen with Goa's casino licensing extensions and planned offshore relocation. Policy shifts in any state present both opportunities for expansion and risks to existing stability.

Government promotion of tourism and hospitality, evidenced by increased capital expenditure in the 2023-24 budget (₹10 lakh crore), indirectly benefits Delta Corp by improving infrastructure and accessibility to its properties.

Growing public and political concern over gambling can lead to stricter regulations or increased taxation, as observed in late 2023 discussions regarding online gaming revenue. This sentiment poses a risk to the sector's long-term growth and profitability.

What is included in the product

This comprehensive PESTLE analysis delves into the external macro-environmental forces influencing Delta, examining Political, Economic, Social, Technological, Environmental, and Legal factors to uncover strategic opportunities and potential threats.

Offers a structured approach to identify and understand external factors impacting a business, thereby alleviating the pain of navigating an uncertain market landscape.

Economic factors

Disposable income is a significant driver for discretionary spending, and for companies like Delta, this translates directly into demand for their services. As incomes rise, consumers have more money left over after essential expenses, which they can allocate to leisure activities such as casino gaming and hospitality.

India's burgeoning middle class is a key demographic here. With more disposable income, this group is increasingly seeking out entertainment and travel experiences. This trend is further supported by strong economic growth projections for India. For instance, the International Monetary Fund (IMF) projected India's GDP growth at 6.8% for 2024, signaling a healthy economic environment conducive to increased consumer spending.

Delta Corp's performance is intrinsically linked to tourism, particularly in Goa, its primary operational hub. Early 2025 data indicates robust growth in domestic tourist numbers visiting Goa, signaling a positive trend for local demand at Delta's establishments.

However, a noted dip in international tourist arrivals in the same period presents a challenge, potentially dampening overall footfall to its casino and hospitality ventures. This mixed trend underscores the critical need for a balanced recovery in both domestic and international travel segments to bolster Delta Corp's revenue streams.

The Goods and Services Tax (GST) at 28% on the full face value of bets has been a significant hurdle for Delta Corp, especially impacting its online gaming operations. This hefty tax has directly reduced the revenue generated from these betting activities.

Consequently, Delta Corp reported a substantial drop in its revenue from operations for the fiscal year ending March 31, 2024. For instance, the company's revenue from its online skill gaming business saw a significant decline, directly attributable to the increased tax liability.

This tax regime change has compelled Delta Corp to re-evaluate its business strategies and potentially adjust its pricing or operational models to mitigate the impact on profitability. The company is actively exploring ways to navigate this challenging tax environment.

The profitability of the online gaming segment has been squeezed due to the 28% GST, leading to a considerable dent in the company's overall financial performance. This has necessitated a strategic pivot to ensure long-term sustainability.

Inflation and Operational Costs

Inflationary pressures are a significant concern for Delta Corp, directly impacting its operational costs. Rising prices for utilities, supplies, and labor can erode profit margins. For instance, the U.S. Consumer Price Index (CPI) saw an increase, indicating broader inflationary trends that affect businesses across sectors.

Managing these escalating costs is crucial for Delta Corp's profitability. Higher wages to retain staff and increased energy expenses for its casino vessels and hotels are direct consequences. The company must find ways to absorb or pass on these increased costs while remaining competitive.

- Rising Utility Costs: Energy prices, a key component of operational expenses for hotels and vessels, have seen notable fluctuations.

- Wage Inflation: The labor market continues to experience upward pressure on wages as companies compete for talent.

- Supply Chain Costs: The cost of goods and services, from food and beverages to maintenance supplies, remains sensitive to inflationary trends.

- Impact on Profit Margins: Delta Corp must carefully manage these cost increases to protect its profitability in a competitive landscape.

Investment and Expansion Capital

Delta Corp's ambitious expansion, including new offshore casino vessels and hotel developments, necessitates significant investment. For instance, the company has earmarked substantial capital for these ventures, aiming to boost annual turnover. Access to robust investment and expansion capital is therefore paramount for realizing these growth objectives.

Economic stability directly influences the availability and cost of this capital. In 2024, global economic uncertainty, including inflation and interest rate fluctuations, could pose challenges to securing affordable financing. Delta Corp's ability to attract investors and secure loans at favorable terms will be a key determinant of its expansion success.

- Delta Corp's capital expenditure plans for new projects are estimated to be in the hundreds of millions of dollars for the 2024-2025 fiscal year.

- Access to credit markets and investor confidence are critical for funding these large-scale developments.

- Interest rate environments in major economies will directly impact the cost of borrowing for Delta Corp's expansion capital needs.

- Economic growth forecasts for key markets will influence investor appetite for new hospitality and gaming ventures.

Economic factors significantly shape Delta Corp's operating environment. Rising disposable incomes, particularly within India's growing middle class, fuel demand for leisure and hospitality services, a trend supported by strong GDP growth projections, with India's GDP forecast at 6.8% for 2024 by the IMF. Conversely, inflationary pressures increase operational costs for utilities, wages, and supplies, impacting profit margins.

The imposition of a 28% GST on online gaming has severely affected Delta Corp's revenue from this segment, forcing strategic re-evaluations. Access to capital for expansion projects, estimated in the hundreds of millions for 2024-2025, is also influenced by economic stability and interest rate environments.

| Economic Factor | Impact on Delta Corp | Supporting Data (2024-2025) |

| Disposable Income & GDP Growth | Increased demand for leisure & hospitality | India's projected GDP growth: 6.8% (IMF, 2024) |

| GST on Online Gaming | Reduced revenue and profitability in online segment | 28% GST on full face value of bets |

| Inflationary Pressures | Increased operational costs (utilities, wages, supplies) | Broad inflationary trends impacting various business expenses |

| Capital Expenditure Needs | Requires access to financing for expansion | Hundreds of millions USD planned for 2024-2025 projects |

What You See Is What You Get

Delta PESTLE Analysis

The preview you see here is the exact Delta PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Delta Airlines. You can confidently assess the detailed insights and strategic considerations presented. What you're previewing here is the actual file, offering a complete and actionable analysis.

Sociological factors

Modern Indian lifestyles are increasingly embracing leisure and entertainment, fueling demand for diverse offerings like integrated resorts and online gaming. This shift is evident as discretionary spending on entertainment continues to rise, with projections indicating significant growth in the digital entertainment sector.

Delta Corp's strategic expansion into online skill gaming directly addresses these evolving preferences. By tapping into the digital entertainment landscape, the company is aligning with the habits of India's young, tech-savvy demographic, a segment that prioritizes convenience and interactive experiences.

The online gaming market in India saw substantial growth, with reports from 2023-2024 highlighting millions of active users engaging in various skill-based games. This surge in participation underscores the societal acceptance and growing popularity of digital entertainment platforms.

Public perception of gambling in India is a complex tapestry woven with cultural norms, moral beliefs, and evolving societal attitudes. Despite the gaming industry's significant growth, particularly in sectors like online gaming and skill-based contests, traditional views on gambling persist, creating a sensitive environment for companies like Delta Corp.

Navigating these diverse societal views is crucial for Delta Corp's long-term success. The company's commitment to responsible gaming initiatives, such as setting spending limits and providing self-exclusion options, plays a vital role in fostering broader social acceptance and mitigating potential backlash. This approach aims to position gaming as a form of entertainment rather than a vice.

The Indian online skill gaming sector alone was projected to reach $2.2 billion by 2023, indicating a growing acceptance of certain forms of gaming. However, the distinction between skill-based games and games of chance remains a key point of public discourse, directly impacting the regulatory landscape and consumer sentiment towards companies operating in the broader gaming space.

India's youthful population, with a median age around 28 years as of recent estimates, is a significant driver for online skill gaming. This demographic, coupled with a rapidly expanding internet user base—projected to exceed 900 million by 2025—and over 600 million smartphone users, creates a fertile ground for platforms like Delta Corp's Adda52.

The increasing digital savviness and preference for online entertainment among younger Indians directly translates to higher engagement and sustained growth for skill-based gaming. This trend is further bolstered by growing disposable incomes in urban centers, allowing more young individuals to participate in these digital activities.

The sheer volume of this demographic is a key asset; with over 50% of India's population under 25, the potential market for online gaming is immense. This youth bulge represents a consistent influx of new users, eager to adopt and engage with digital platforms that offer both entertainment and intellectual challenge.

Employment Generation and Local Community Impact

Delta Corp's significant presence in regions like Goa and Sikkim through its land-based casinos and hotels acts as a major engine for job creation. In fiscal year 2024, the company reported employing a substantial number of individuals across its hospitality and gaming operations, directly contributing to local economies. This employment generation fosters goodwill and strengthens the company's social license to operate within these communities.

The economic ripple effect extends beyond direct employment, supporting local suppliers and ancillary businesses. For instance, Delta Corp's procurement practices often prioritize local vendors, further embedding its operations within the community fabric. This mutual benefit cultivates a positive perception, enhancing social capital and potentially easing regulatory navigation.

- Employment: Delta Corp's operations in Goa and Sikkim provide direct employment to thousands of local residents.

- Economic Contribution: The company's presence stimulates local economies through wages, procurement, and tourism spending.

- Social Acceptance: Positive employment impact contributes to community acceptance and support for Delta Corp's ventures.

- Skills Development: Operations often lead to the development of new skills within the local workforce, enhancing employability.

Responsible Gaming and Corporate Social Responsibility (CSR)

Societal expectations are increasingly pushing companies like Delta Corp to prioritize responsible gaming. This means implementing strong measures to protect players and prevent problem gambling, a trend that gained significant traction in 2024. Failure to do so can lead to reputational damage and regulatory scrutiny.

Corporate Social Responsibility (CSR) initiatives, particularly those focused on ethical operations and community well-being, are becoming crucial for long-term business sustainability. Delta Corp's engagement in such activities, like promoting safer gaming environments, can significantly bolster its public image and appeal to a wider customer base. For instance, by 2025, a significant portion of consumers are expected to factor a company's social impact into their purchasing decisions.

The growing awareness of potential social issues linked to the gaming industry means that proactive measures are no longer optional but essential. Companies that demonstrate a commitment to responsible practices often see improved customer loyalty and a stronger brand reputation. This focus on responsible gaming is a key differentiator in the evolving market landscape, with many industry players actively investing in player protection technologies and education programs in 2024-2025.

- Growing Consumer Demand: By 2025, over 60% of consumers are expected to consider a company's social responsibility when making purchasing decisions.

- Reputational Enhancement: Robust responsible gaming policies can improve Delta Corp's brand image, attracting socially conscious customers and investors.

- Risk Mitigation: Proactive engagement in CSR and responsible gaming helps mitigate potential regulatory penalties and negative publicity.

- Industry Trend: Leading gaming operators are increasingly investing in player support services and educational campaigns to foster a culture of responsible play.

Societal attitudes towards leisure and entertainment are shifting, with a notable rise in discretionary spending on experiences like online gaming and hospitality. This trend is particularly pronounced among India's younger demographic, who are increasingly tech-savvy and drawn to interactive digital platforms. Delta Corp's strategic focus on online skill gaming, such as its Adda52 platform, directly aligns with these evolving consumer preferences, tapping into a market segment that values convenience and engagement.

The company's physical presence, especially in regions like Goa, contributes significantly to local economies through job creation and support for ancillary businesses. This socio-economic impact fosters positive community relations and enhances Delta Corp's social license to operate. By 2025, consumer decisions are increasingly influenced by a company's social responsibility, making ethical operations and community well-being crucial for sustained success.

Public perception of gambling remains complex, with a persistent tension between traditional views and the growing acceptance of skill-based gaming. Delta Corp's commitment to responsible gaming initiatives, including player protection measures, is vital for navigating this sensitive environment and building broader social acceptance. Industry reports from 2024 highlight a significant investment by leading operators in player support, indicating a sector-wide trend towards prioritizing responsible play.

| Sociological Factor | Impact on Delta Corp | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Changing Lifestyles & Leisure Preferences | Increased demand for entertainment and gaming offerings. | Growing discretionary spending on leisure; rise in digital entertainment consumption. |

| Demographic Shift (Youthful Population) | Large, tech-savvy customer base for online skill gaming. | India's median age around 28; over 50% of population under 25; projected 900M+ internet users by 2025. |

| Public Perception of Gaming | Need for careful navigation due to mixed societal views. | Growing acceptance of skill-based games vs. traditional views on chance; importance of responsible gaming discourse. |

| Corporate Social Responsibility (CSR) Expectations | Enhanced brand reputation and social license through ethical practices. | By 2025, >60% consumers consider CSR in purchasing; proactive responsible gaming measures mitigate risk. |

Technological factors

The online gaming sector is experiencing a technological surge, with platforms continually improving graphics, user interfaces, and mobile compatibility. This rapid evolution directly affects Delta Corp's skill gaming operations, demanding constant innovation to stay competitive and keep users engaged. For instance, the global online gaming market was valued at an estimated USD 229.5 billion in 2023 and is projected to grow significantly, highlighting the importance of technological adoption for companies like Delta Corp.

Delta Corp's online gaming and digital payment operations are highly susceptible to cyber threats. As of 2024, the global cost of cybercrime is projected to reach $10.5 trillion annually, highlighting the significant financial and reputational risks. Protecting sensitive user data and ensuring secure transaction processing are critical for maintaining customer confidence and adhering to increasingly stringent data privacy laws, such as GDPR and the upcoming comprehensive privacy legislation in various jurisdictions by 2025.

The Indian digital payment landscape has seen explosive growth, with UPI transactions alone projected to reach 100 billion in FY2024-25, according to government estimates. This widespread adoption directly benefits online gaming and casino platforms like Delta Corp by simplifying financial interactions for a vast user base. The convenience offered by systems like UPI and various e-wallets streamlines deposits and withdrawals, significantly enhancing the accessibility of Delta's services.

Delta Corp's strategic integration of these digital payment gateways is crucial for user retention and acquisition. In 2023, over 75% of online transactions in India were conducted digitally, highlighting a clear consumer preference for cashless methods. This trend empowers Delta to cater to a digitally native audience, reducing friction in the customer journey and potentially boosting transaction volumes for its gaming and casino offerings.

Use of Data Analytics for Customer Experience

Delta Corp is increasingly leveraging data analytics to understand its customers better, aiming to enhance their overall experience. By analyzing gaming patterns and preferences, the company can tailor its offerings. This approach is crucial in a competitive market where personalized engagement drives loyalty.

The insights gained from data analytics allow for more effective marketing campaigns and improved customer service. For instance, identifying popular game types or peak engagement times helps optimize resource allocation and promotional strategies. This data-driven approach is becoming a standard for customer-centric businesses.

Delta Corp's investment in data analytics supports a more dynamic and responsive business model. In 2024, the gaming industry saw a significant rise in personalized digital experiences, with companies reporting improved customer retention rates of up to 15% through targeted strategies. This trend is expected to continue, making data analytics a key technological driver for Delta Corp’s success.

- Personalized Offers: Data analytics enables Delta Corp to deliver customized promotions and bonuses based on individual player behavior, increasing engagement.

- Optimized Game Portfolio: By analyzing which games are most popular and how players interact with them, Delta Corp can refine its game selection and development.

- Enhanced Customer Service: Real-time data on customer interactions allows for quicker and more effective resolution of issues, improving overall satisfaction.

- Predictive Analytics: Understanding trends and player churn through data can help Delta Corp proactively implement retention strategies.

Innovation in Gaming Technology (e.g., VR/AR)

The integration of Virtual Reality (VR) and Augmented Reality (AR) into the gaming sector presents a significant technological shift. These immersive technologies are poised to redefine player engagement, offering experiences far beyond traditional formats. For instance, the global VR in gaming market was valued at approximately USD 6.7 billion in 2023 and is projected to grow substantially, reaching an estimated USD 31.2 billion by 2030, according to recent market analyses.

Delta Corp could leverage these advancements to create novel entertainment offerings, potentially revitalizing its casino and online gaming segments. Early adoption of VR/AR could provide a competitive edge, attracting a new demographic of tech-savvy gamers. This technological evolution could lead to entirely new revenue streams and enhanced customer loyalty.

- VR/AR Market Growth: The VR in gaming market is expected to surge, indicating strong consumer interest and investment potential.

- Immersive Experiences: These technologies promise deeper player immersion, transforming how games are played and perceived.

- Competitive Advantage: Early adoption by Delta Corp could differentiate its offerings in a crowded market.

- New Revenue Streams: VR/AR integration opens avenues for innovative game development and monetization strategies.

Technological advancements are reshaping the gaming landscape, with continuous improvements in graphics, user interfaces, and mobile compatibility. For Delta Corp, this necessitates ongoing innovation to maintain competitiveness and user engagement in its skill gaming operations. The global online gaming market, valued at an estimated USD 229.5 billion in 2023, underscores the critical role of technological adoption.

Cybersecurity is paramount, especially with the projected global cost of cybercrime reaching $10.5 trillion annually by 2024. Protecting user data and ensuring secure transactions are vital for Delta Corp to maintain customer trust and comply with evolving data privacy regulations expected by 2025.

The rapid growth of digital payments, with Indian UPI transactions alone projected to hit 100 billion in FY2024-25, offers significant opportunities for Delta Corp. This trend simplifies financial interactions for a broad user base, enhancing the accessibility of its gaming and casino services.

Delta Corp's strategic use of data analytics is key to understanding customer behavior and personalizing experiences. In 2024, the gaming industry saw personalized digital experiences improve customer retention by up to 15%, a trend expected to continue. This data-driven approach is crucial for Delta Corp's success.

| Technology Area | Impact on Delta Corp | Key Data/Projections |

|---|---|---|

| Online Gaming Platforms | Requires constant innovation in graphics and user experience. | Global online gaming market: USD 229.5 billion (2023), significant growth projected. |

| Cybersecurity | Essential for protecting data and maintaining customer trust. | Global cost of cybercrime: $10.5 trillion annually (projected 2024). |

| Digital Payments | Simplifies transactions and enhances accessibility for users. | Indian UPI transactions: 100 billion projected (FY2024-25). |

| Data Analytics | Drives personalized experiences and improves customer retention. | Personalized experiences increased customer retention by up to 15% (2024). |

| VR/AR | Offers potential for new, immersive entertainment experiences. | VR in gaming market: USD 6.7 billion (2023), projected to reach USD 31.2 billion by 2030. |

Legal factors

Delta Corp operates within India's intricate gambling and gaming legal landscape, where states hold significant regulatory power. This necessitates meticulous adherence to diverse state-specific laws, which often differentiate between games of skill and chance, impacting operational allowances and tax structures. For instance, while some states permit a broader range of gaming activities, others impose stricter controls or outright bans, requiring Delta Corp to tailor its business model and licensing strategies accordingly.

Navigating these varied state regulations is crucial for Delta Corp's land-based casinos and its burgeoning online gaming platforms. Compliance with licensing requirements, including obtaining permits and adhering to operational guidelines, forms a core part of its legal strategy. As of early 2024, discussions around a potential unified Goods and Services Tax (GST) on online gaming continue, with proposals suggesting a 28% GST on the full value of bets placed, a move that could significantly alter the financial dynamics of the online gaming sector.

The Goods and Services Tax (GST) framework significantly impacts Delta Corp, particularly with the imposition of a 28% GST on the full face value of bets for online gaming and casinos, effective from October 2023. This change presents a substantial legal and financial hurdle for the company.

Delta Corp has been compelled to adapt its operational strategies and business model in response to this new tax regime. The company is actively navigating the complexities arising from this regulation, which could influence its revenue streams and profitability.

Furthermore, Delta Corp faces potential retrospective tax demands, a situation that is currently under review and subject to ongoing rulings from the Supreme Court. The outcome of these legal proceedings will be critical in determining the company's financial liabilities and future operational landscape.

Delta Corp, as a major player in the casino and gaming industry, faces significant legal scrutiny under Anti-Money Laundering (AML) regulations. These rules are designed to curb illicit financial activities, making compliance a non-negotiable aspect of operations. Failure to adhere to these stringent requirements, which include robust transaction monitoring and meticulous record-keeping, can result in substantial fines and reputational damage.

In 2024, the global push for stricter financial crime prevention intensified, with regulatory bodies worldwide enhancing their oversight of the gaming sector. For instance, in India, where Delta Corp operates, the Prevention of Money Laundering Act (PMLA) mandates rigorous Know Your Customer (KYC) procedures and the reporting of suspicious transactions above certain thresholds. The Financial Intelligence Unit-India (FIU-IND) regularly updates its guidelines, requiring operators to implement sophisticated systems to detect and report potential money laundering activities, with penalties for non-compliance potentially reaching millions of dollars in fines.

Data Protection and Privacy Laws

Delta Corp's online operations in India necessitate strict adherence to the Digital Personal Data Protection Act, 2023. This legislation mandates robust data protection and privacy measures for the secure handling and storage of user information collected through its platforms. Compliance involves transparent data collection practices, obtaining explicit user consent for processing, and ensuring data minimization, aligning with the Act's principles.

Key aspects of Delta Corp's legal obligations under India's data protection framework include:

- Data Consent: Obtaining clear and informed consent from users before collecting or processing their personal data, as stipulated by the DPDP Act.

- Data Security: Implementing appropriate technical and organizational measures to protect user data from unauthorized access, disclosure, alteration, or destruction.

- Data Breach Notification: Establishing protocols for promptly notifying affected individuals and the relevant regulatory authority in the event of a data breach.

- Cross-Border Data Transfer: Adhering to regulations concerning the transfer of personal data outside of India, ensuring such transfers meet prescribed standards.

Intellectual Property Rights

Delta Corp's online gaming platforms and proprietary software are safeguarded by robust intellectual property (IP) rights. This legal framework is crucial for protecting its innovative game development and unique user experiences from unauthorized duplication and exploitation. For instance, in 2024, the global online gaming market saw significant investment in IP protection, with companies allocating an estimated 15% of their R&D budgets to secure patents and copyrights.

Implementing stringent legal measures to prevent infringement is paramount for maintaining Delta Corp's competitive edge. This includes actively monitoring for and pursuing legal action against entities that attempt to replicate its software or gaming concepts. The company's commitment to IP integrity directly influences its long-term viability and ability to attract and retain customers in a crowded digital entertainment landscape.

- Copyright Protection: Safeguarding the unique code and creative assets of Delta Corp's games.

- Patent Filings: Protecting novel gaming mechanics or technologies developed by the company.

- Trademark Enforcement: Ensuring brand identity and preventing confusion with competitor offerings.

- Legal Defense: Proactively defending against infringement claims and pursuing litigation when necessary.

Delta Corp faces a complex legal environment in India, particularly concerning taxation and regulatory compliance for its gaming operations. The imposition of a 28% GST on the full value of bets for online gaming and casinos, effective October 2023, significantly impacts its financial strategy, while ongoing discussions around potential retrospective tax demands add further uncertainty. The company must navigate these evolving tax laws and potential disputes to ensure its long-term financial stability and operational continuity.

Anti-Money Laundering (AML) regulations, including India's Prevention of Money Laundering Act (PMLA), impose strict Know Your Customer (KYC) and suspicious transaction reporting requirements on Delta Corp. In 2024, enhanced global financial crime prevention measures mean increased oversight for the gaming sector, with significant penalties for non-compliance. Adhering to these mandates is crucial to avoid substantial fines and reputational damage.

Data privacy is paramount under India's Digital Personal Data Protection Act, 2023, requiring Delta Corp to implement robust measures for handling user information on its online platforms. This includes obtaining explicit consent, ensuring data security, and establishing breach notification protocols. Failure to comply with these data protection mandates can lead to legal repercussions.

Intellectual property (IP) protection is vital for Delta Corp's competitive edge, safeguarding its game development and user experiences. In 2024, the industry's focus on IP security means companies allocate substantial R&D budgets to patents and copyrights. Delta Corp actively pursues legal action against infringement to maintain its market position and protect its innovations.

| Legal Aspect | Key Regulation/Action | Impact on Delta Corp | Data Point/Year |

|---|---|---|---|

| Taxation | 28% GST on online gaming bets | Increased operational cost, potential revenue impact | Effective October 2023 |

| Financial Crime | PMLA & AML regulations | Mandatory KYC, transaction monitoring, reporting | Enhanced global focus in 2024 |

| Data Privacy | Digital Personal Data Protection Act, 2023 | Strict data handling, consent, security protocols | Mandatory compliance |

| Intellectual Property | Copyright, Patent, Trademark laws | Protection of game development, competitive advantage | 15% of R&D budget allocated to IP protection globally (Industry Trend) |

Environmental factors

Delta Corp, as a major player in the integrated resorts and hotels sector, is experiencing significant stakeholder pressure to embed robust sustainability practices. This includes a strong focus on improving energy efficiency, which is critical given the energy-intensive nature of hospitality operations. For instance, many leading hotel chains are targeting reductions of 20-30% in energy consumption by 2030 through smart building technologies and renewable energy adoption.

Water conservation is another key environmental factor. Hotels can implement low-flow fixtures, rainwater harvesting systems, and greywater recycling, aiming to reduce water usage by up to 25% per guest. Meeting these targets not only supports environmental goals but also leads to substantial cost savings on utility bills, a crucial consideration for profitability.

Effective waste management is also paramount, with an emphasis on reducing single-use plastics and increasing recycling rates. The hospitality industry is increasingly moving towards circular economy principles, aiming to divert 70-80% of operational waste from landfills by 2030. These initiatives are vital for enhancing Delta Corp's brand reputation and ensuring compliance with evolving environmental regulations.

Goa, a vital hub for Delta Corp's operations, faces significant environmental challenges due to climate change. Rising sea levels and increasingly frequent extreme weather events pose a direct threat to the coastal tourism infrastructure, potentially impacting visitor numbers and the overall appeal of the region.

The potential for coastal erosion, intensified by rising sea levels, could damage or destroy existing hotels, resorts, and casinos, necessitating costly repairs or relocation efforts. For instance, studies indicate that parts of Goa's coastline could experience substantial erosion in the coming decades, directly affecting properties built close to the shore.

Furthermore, an increase in the frequency and intensity of monsoons or cyclones could lead to operational disruptions, cancellations, and damage to property, impacting revenue streams. The economic implications are substantial, as tourism is a major contributor to Goa's GDP, and disruptions directly affect the profitability of companies like Delta Corp.

Delta Corp must proactively assess these long-term environmental risks, developing robust mitigation strategies. This includes investing in climate-resilient infrastructure and exploring diversification of its offerings to reduce reliance on climate-sensitive coastal tourism, ensuring business continuity in the face of these evolving environmental factors.

Delta Corp must navigate a complex web of environmental regulations governing its physical assets, from waste management and pollution control to land usage. Non-compliance can lead to significant financial penalties, legal battles, and severe damage to its brand image.

For instance, in India, where Delta Corp operates significantly, the Ministry of Environment, Forest and Climate Change continually updates environmental protection laws. As of early 2024, stricter emission norms for industries and enhanced waste management protocols are being enforced, requiring substantial investment in upgrading facilities and operational processes to meet these evolving standards.

Corporate Social Responsibility (CSR) and Eco-tourism

Delta Corp's engagement in environmental Corporate Social Responsibility (CSR), particularly through eco-tourism initiatives, is increasingly vital. This strategy directly addresses growing consumer demand for sustainable and responsible travel options, potentially enhancing Delta's brand reputation. For instance, in 2024, the global eco-tourism market was valued at approximately $180 billion, with projections indicating continued robust growth.

Furthermore, supporting local conservation efforts can diversify Goa's tourism appeal beyond its traditional beach-focused offerings. This diversification can lead to more resilient tourism revenue streams. Data from early 2025 suggests that destinations with strong eco-tourism components saw a 15% increase in visitor spending compared to purely conventional tourist spots.

- Enhanced Brand Image: CSR activities, especially those promoting eco-tourism, can significantly boost Delta Corp's public perception and appeal to environmentally conscious travelers.

- Market Diversification: Investing in eco-tourism helps broaden Goa's tourist offerings, reducing reliance on seasonal beach tourism and attracting a wider demographic.

- Consumer Alignment: With a growing global emphasis on sustainability, Delta's proactive approach aligns with evolving consumer preferences, potentially driving higher customer loyalty and engagement.

- Economic Impact: Successful eco-tourism ventures can contribute to local economies through job creation in conservation, guiding, and community-based tourism enterprises.

Resource Management (Water, Energy)

Delta Corp's extensive hospitality footprint demands a keen focus on resource management, particularly water and energy. Efficiently managing these crucial elements directly impacts operational costs and the company's commitment to sustainability. For instance, in 2024, the hospitality sector globally saw energy costs rise, with many businesses exploring renewable sources and conservation strategies to mitigate these increases.

Implementing advanced technologies and best practices for water and energy conservation can yield significant financial benefits. These initiatives not only reduce utility bills but also enhance Delta Corp's reputation as an environmentally responsible operator. Studies from 2024 indicated that hotels prioritizing water efficiency could reduce consumption by up to 20%, leading to substantial savings.

- Water Conservation: Exploring low-flow fixtures, rainwater harvesting, and smart irrigation systems across properties.

- Energy Efficiency: Investing in LED lighting, energy-efficient appliances, and smart building management systems.

- Renewable Energy Adoption: Evaluating the feasibility of solar power installations for hotels and resorts.

- Waste Heat Recovery: Investigating opportunities to capture and reuse waste heat from kitchens and laundry services.

Delta Corp faces increasing pressure to adopt sustainable practices, particularly concerning energy and water usage. For instance, many hotel chains aimed for 20-30% energy reduction by 2030. Water conservation efforts, like low-flow fixtures, could cut usage by up to 25% per guest, boosting profitability and environmental credentials.

Climate change poses a direct threat to Delta Corp's coastal operations in Goa. Rising sea levels and extreme weather events can lead to coastal erosion, property damage, and operational disruptions, impacting revenue. Proactive measures like investing in resilient infrastructure are crucial for business continuity.

Stringent environmental regulations, such as stricter emission norms and enhanced waste management protocols enforced in India as of early 2024, necessitate significant investment in facility upgrades. Non-compliance can result in substantial financial penalties and reputational damage for Delta Corp.

Investing in eco-tourism initiatives is vital for Delta Corp, aligning with growing consumer demand for sustainable travel. The global eco-tourism market, valued at approximately $180 billion in 2024, is projected for continued growth, enhancing brand image and diversifying market appeal.

| Environmental Factor | Delta Corp's Focus | Industry Trend/Data (2024/2025) |

|---|---|---|

| Energy Efficiency | Improving energy consumption in operations | Global hotel sector exploring renewables and conservation due to rising energy costs. |

| Water Conservation | Reducing water usage across properties | Hotels prioritizing water efficiency could reduce consumption by up to 20% (2024 data). |

| Waste Management | Minimizing waste, reducing single-use plastics | Hospitality aiming to divert 70-80% of waste from landfills by 2030. |

| Climate Change Impact | Mitigating risks to coastal assets in Goa | Coastal erosion and extreme weather events pose threats to tourism infrastructure. |

| Regulatory Compliance | Adhering to evolving environmental laws | Stricter emission and waste management norms enforced in India (early 2024). |

| Eco-Tourism | Developing sustainable tourism offerings | Global eco-tourism market valued at ~$180 billion (2024), showing strong growth. |

PESTLE Analysis Data Sources

Our Delta PESTLE Analysis is constructed using a robust blend of official government statistics, reputable financial news outlets, and comprehensive market research reports. This ensures that every factor, from political stability to technological advancements, is informed by verifiable data.