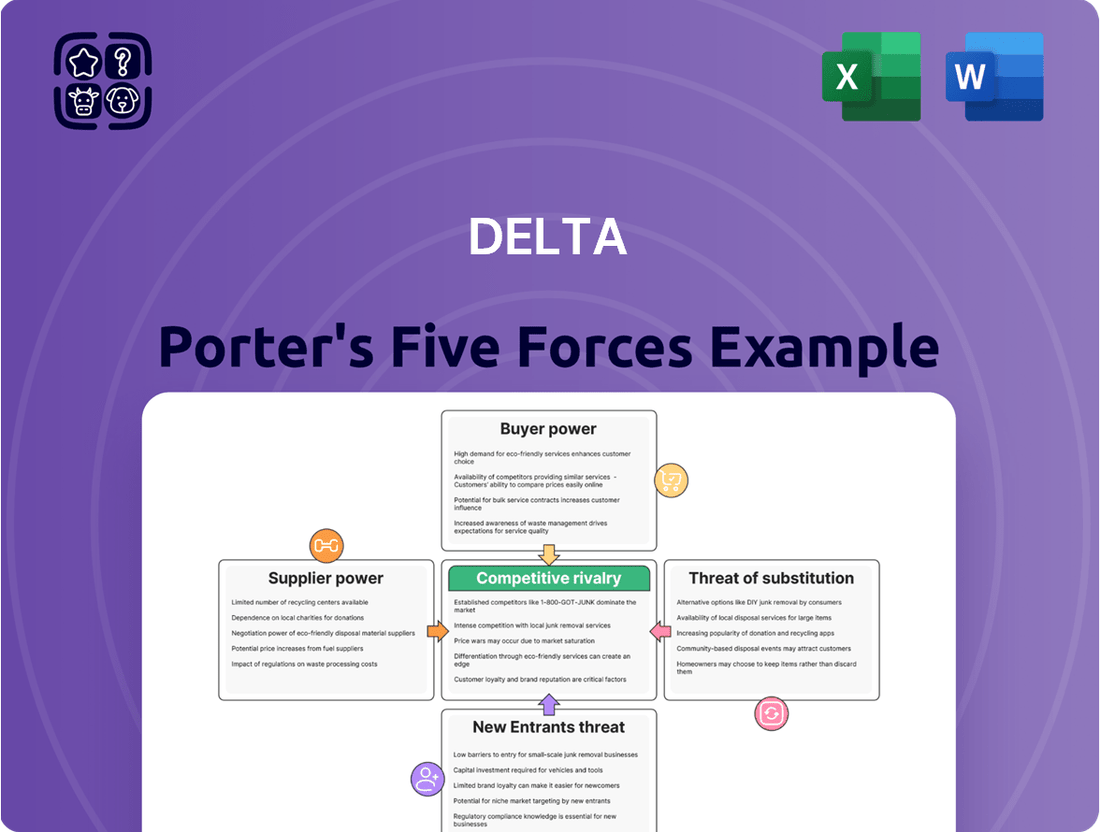

Delta Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Bundle

Delta's competitive landscape is shaped by powerful forces, from the intense rivalry among airlines to the significant bargaining power of its customers. Understanding these dynamics is crucial for any stakeholder in the aviation industry.

The threat of new entrants, while moderated by high startup costs, still presents a potential challenge, while the bargaining power of suppliers, particularly for fuel and aircraft, can significantly impact Delta's profitability.

Furthermore, the availability of substitute services, such as high-speed rail or virtual meetings, adds another layer of complexity to Delta's market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Delta’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Delta Corp's reliance on a small number of specialized suppliers for critical components like advanced casino gaming software and bespoke luxury hotel furnishings significantly strengthens supplier bargaining power. For instance, the gaming technology sector often sees a few dominant players providing proprietary systems, making it difficult for casino operators to find readily available alternatives. This situation can lead to suppliers dictating terms, especially when their technology is integral to the operational efficiency and customer experience of the casino.

The scarcity of these niche suppliers, particularly for highly specialized casino equipment or unique hospitality supplies, grants them considerable leverage. If Delta Corp requires very specific, custom-built gaming machines or high-end, imported decor for its premium hotel suites, the pool of suitable providers shrinks considerably. This limited choice empowers those few suppliers to command higher prices and more favorable payment terms.

Furthermore, this supplier power is often magnified by high switching costs. Integrating new gaming software can be a complex and time-consuming process, involving significant IT investment and potential disruption to ongoing operations. Similarly, contractual obligations with existing suppliers for specialized equipment or long-term supply agreements can make it prohibitively expensive or impractical to change providers, further entrenching the supplier's advantageous position.

The government acts as a crucial supplier in the gaming sector by issuing and renewing essential licenses. Delta Corp's reliance on these licenses, particularly in regulated Indian states like Goa and Sikkim, underscores the significant bargaining power held by regulatory bodies. For instance, any adjustments to licensing fees or operational mandates by these authorities directly influence Delta Corp's financial performance and operational stability.

The availability of skilled talent, crucial for roles like casino managers, croupiers, IT specialists for online gaming, and hospitality staff, directly impacts supplier power. A tight labor market for these specialized positions can empower employees to negotiate for higher wages and improved benefits, consequently raising Delta Corp's operational expenses.

For instance, in 2024, the Indian gaming industry, including hospitality sectors, faced challenges in retaining specialized IT professionals due to global demand. Reports indicated salary increases of up to 15% for experienced cybersecurity experts in the tech sector, a trend likely mirrored in the gaming industry for its online platforms.

This scarcity of uniquely qualified personnel, especially those with specific gaming certifications or extensive sector experience, grants employees significant leverage. They can effectively act as powerful suppliers, dictating terms that influence Delta Corp's cost structure and operational efficiency.

Infrastructure and Technology Providers

Providers of essential IT infrastructure, cybersecurity, and payment gateways hold significant bargaining power for Delta Corp's online operations. The reliance on these services for reliability, scalability, and security means that established providers with deep integration capabilities can command stronger terms. For instance, a major cloud provider's pricing structure or a critical payment gateway's transaction fees can directly impact Delta Corp's profitability.

The critical nature of these technological services means that switching costs can be substantial, further bolstering supplier leverage. Companies like Amazon Web Services (AWS) or Microsoft Azure, which form the backbone of many online platforms, often have pricing power due to their market dominance and the complexity of migrating large datasets and applications. In 2024, the global cloud computing market was projected to reach over $600 billion, highlighting the scale and influence of these infrastructure providers.

- Criticality of Services: Reliable IT infrastructure, cybersecurity, and payment gateways are non-negotiable for Delta Corp's online gaming platforms.

- Supplier Concentration: While the market has multiple players, specialized and high-performance providers often face less competition, increasing their leverage.

- Integration and Switching Costs: Deep integration of a supplier's technology into Delta Corp's systems makes switching difficult and expensive.

- Impact on Operations: Disruptions or cost increases from these suppliers can directly affect Delta Corp's service availability and profit margins.

Landlords and Real Estate Owners for Physical Locations

For its physical land-based casinos and integrated resorts, Delta Corp's reliance on real estate is a critical factor. The availability and cost of prime locations, particularly in sought-after tourist destinations such as Goa, can significantly bolster the bargaining power of landlords and real estate owners. This dependence can constrain Delta Corp's operational flexibility.

The lengthy commitments involved in long-term leases and the substantial capital expenditure required for developing new properties further amplify the bargaining leverage of property owners. These factors limit Delta Corp's alternatives, increasing its reliance on existing property arrangements and potentially impacting its cost structure and expansion plans. For instance, in 2024, real estate prices in prime Indian tourist locations continued to show a steady upward trend, with rental yields in popular areas like Goa averaging between 3-5% annually, depending on the specific location and property type.

- High dependence on prime locations: Delta Corp's operational success is tied to its access to high-footfall areas, giving property owners in these zones considerable negotiating power.

- Leasehold vs. Freehold: The structure of land acquisition, whether through long-term leases or freehold ownership, directly influences the ongoing bargaining power of landlords.

- Property development costs: The significant investment needed to establish new casino and resort facilities makes switching locations or renegotiating terms with existing landlords a complex and costly endeavor.

- Market trends in 2024: Reports indicated continued demand for commercial and hospitality real estate in India's tourism hotspots, suggesting sustained pressure on rental costs and lease terms for businesses like Delta Corp.

Suppliers hold significant bargaining power when they are concentrated, provide critical inputs, or have high switching costs for the buyer. For Delta Corp, this is evident with specialized gaming software providers and providers of essential IT infrastructure. The limited number of providers for proprietary gaming systems and critical cloud services means these suppliers can dictate terms, impacting Delta Corp's operational costs and innovation capabilities. In 2024, the global market for specialized gaming software was dominated by a few key players, allowing them to maintain premium pricing.

The scarcity of unique talent, like experienced casino managers or cybersecurity experts, also empowers employees to act as powerful suppliers, negotiating for higher wages and benefits. This was particularly noticeable in 2024, with reports of up to 15% salary increases for IT professionals in high-demand sectors. Furthermore, prime real estate in tourist hotspots like Goa, with rental yields averaging 3-5% in 2024, gives property owners considerable leverage over Delta Corp's physical operations.

| Factor | Impact on Delta Corp | Supporting Data/Trend (2024) |

|---|---|---|

| Supplier Concentration (Gaming Software) | Dictates terms, higher pricing | Dominant players in specialized gaming software market |

| Talent Scarcity (IT/Gaming Mgmt) | Increased wage demands, higher operational costs | Up to 15% salary increase for IT professionals in demand |

| Real Estate Availability (Prime Locations) | Higher lease costs, limited flexibility | 3-5% average annual rental yields in Goa |

| Critical IT Infrastructure Providers | Pricing power due to market dominance | Global cloud computing market exceeding $600 billion |

What is included in the product

This analysis unpacks the competitive forces shaping Delta's industry, examining threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the availability of substitutes.

Quickly identify and mitigate competitive threats by visualizing the intensity of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

Delta Corp's customer base is incredibly diverse, ranging from high-net-worth individuals who patronize its upscale casinos to casual users engaging with its online skill gaming platforms. This segmentation directly influences their bargaining power.

High rollers, due to their significant spending, often possess individual leverage to negotiate for exclusive perks and personalized offers. This can translate into tailored benefits that reduce the effective price they pay.

Conversely, online gamers, while individually less powerful, exhibit a higher degree of price sensitivity and are readily attracted to promotional deals and discounts. Their collective volume, however, grants them considerable market influence.

For instance, in 2024, the online gaming sector, a key area for Delta Corp, saw intense competition with numerous platforms offering welcome bonuses and loyalty programs, highlighting the power of price-sensitive players to drive competitive pricing strategies.

In the online skill gaming sector, including popular games like poker and rummy, customers generally encounter low switching costs. This means players can readily transition from one gaming platform to another without facing significant financial or practical barriers. This ease of movement directly impacts the bargaining power of customers, as they have ample choices.

The Indian market, in particular, has seen a significant rise in the number of online gaming applications and websites. This saturation provides consumers with a wide array of options, allowing them to select platforms based on various competitive factors such as more favorable odds, attractive bonuses, superior user interface, or a broader selection of games. For companies like Delta Corp, this translates into increased pressure to maintain competitive pricing and compelling promotional offers to retain their customer base.

This heightened customer power necessitates that Delta Corp consistently evaluates and enhances its product offerings and marketing strategies. For instance, a report from January 2024 indicated that the Indian online gaming market was projected to reach $3.76 billion by 2030, highlighting the intense competition and the importance of customer retention. Companies must therefore focus on delivering superior value and experience to stand out.

Recent regulatory shifts, like the 28% Goods and Services Tax (GST) on gross deposits in the online gaming sector, significantly influence how customers spend and behave. This added cost can make online gaming less appealing, potentially leading players to reduce their engagement or seek out less regulated alternatives.

The heightened taxation directly increases customer price sensitivity. When the perceived value for money diminishes, customers become more aware of costs and are more likely to seek out better deals or alternative entertainment options. This can shift the balance of power towards the customer.

In 2023, the Indian online gaming industry saw a substantial impact from the GST announcement, with many platforms adjusting their pricing models or facing reduced player activity. For example, some reports indicated a noticeable dip in transaction volumes on certain platforms following the implementation of the new tax structure.

When customers are more sensitive to price and value due to regulatory impositions, their collective bargaining power grows. They can exert pressure on businesses by choosing to spend less, switch to competitors, or demand better terms, forcing companies to adapt their strategies to retain their customer base.

Information Availability and Price Transparency

Customers today, particularly in the online gaming sector, benefit from an unprecedented amount of readily accessible information. This includes detailed comparisons of various gaming platforms, different game mechanics, payout percentages, and current promotional deals. For instance, by July 2025, the global online gaming market was projected to reach over $110 billion, fueled by this very accessibility.

Review sites, online forums, and social media platforms have become powerful tools for consumers, allowing for effortless comparison shopping. This ease of comparison directly translates to increased price transparency, giving customers the upper hand in selecting the most financially beneficial offers available. This environment makes it harder for companies to maintain customer loyalty solely on price.

The abundance of information significantly reduces customer switching costs and strengthens their overall bargaining power. Customers can easily identify and move to competitors offering better value, forcing businesses to compete more aggressively on price and service. By 2024, the average online gamer in many developed nations could compare dozens of platforms within minutes, a stark contrast to earlier eras.

- Information Accessibility: Detailed platform, game, and payout data is widely available.

- Price Transparency: Online resources enable easy comparison of offers, driving down prices.

- Reduced Loyalty: Customers are less tied to specific platforms due to easy switching.

- Empowered Consumers: Increased information grants customers greater leverage in negotiations.

Limited Alternatives for Premium Land-Based Casino Experience

For those seeking a premium, integrated land-based casino and hospitality experience, Delta Corp, a dominant player in Goa and Sikkim, experiences limited customer bargaining power. The unique fusion of luxurious accommodations, diverse entertainment options, and sophisticated gaming environments establishes a significant barrier for new entrants. This scarcity of comparable offerings in the market restricts customer choices, thereby diminishing their individual leverage when selecting a high-end, all-encompassing resort experience. For instance, in 2023, the Indian gaming and hospitality sector saw continued growth, with integrated resorts commanding premium pricing due to their exclusive nature.

- Limited Direct Competition: Delta Corp's established presence in key regions like Goa provides a distinct advantage.

- High Barrier to Entry: Replicating the full spectrum of gaming, hospitality, and entertainment requires substantial capital and operational expertise.

- Customer Loyalty & Experience: The integrated nature of the experience fosters customer loyalty, reducing price sensitivity.

- Niche Market Appeal: This premium segment caters to a specific customer base less likely to compromise on quality for cost savings.

Customer bargaining power for Delta Corp is a mixed bag, heavily influenced by the specific segment. In online gaming, low switching costs and abundant information empower customers, driving price competition. Conversely, Delta Corp's premium, integrated resort offerings in Goa and Sikkim face customers with significantly less bargaining power due to limited comparable alternatives and high barriers to entry.

The intense competition in the online gaming space, with platforms offering numerous bonuses and loyalty programs, means customers can easily shift their spending. This price sensitivity was particularly evident in 2023 following the introduction of a 28% GST on online gaming deposits, which increased customer awareness of costs and the search for better value.

| Customer Segment | Bargaining Power Factors | Impact on Delta Corp | Key Data Point (2024) |

| Online Gamers | Low switching costs, high information availability, price sensitivity | Pressure on pricing, need for promotions, customer retention challenges | Online gaming market projected to reach $3.76 billion by 2030 (Jan 2024 report) |

| Premium Hospitality Patrons (Goa/Sikkim) | Limited direct competition, high entry barriers, strong brand loyalty | Higher pricing power, less susceptibility to price wars, stable revenue streams | Indian gaming and hospitality sector continued growth in 2023, with integrated resorts commanding premium pricing. |

Full Version Awaits

Delta Porter's Five Forces Analysis

The document you see here is your complete Delta Porter's Five Forces Analysis, providing a thorough examination of the competitive landscape. You're previewing the final version—precisely the same document that will be available to you instantly after buying, offering actionable insights into industry structure and profitability. This detailed analysis, covering threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry among existing competitors, is ready for your immediate use. No mockups, no samples. The document you see here is exactly what you’ll be able to download after payment, empowering your strategic decision-making.

Rivalry Among Competitors

The Indian gaming and hospitality sector, especially online, is incredibly competitive. Delta Corp, a leader in physical casinos, finds its online skill gaming platforms like Adda52 up against strong rivals. Companies such as WinZO, MPL, GamesKraft, and Junglee Games are significant players in this space.

This crowded market demands constant innovation and robust marketing from Delta Corp to maintain its edge. The presence of numerous established firms and the rapid growth of online platforms mean that staying ahead requires a dynamic strategy, especially as the digital gaming market continues to expand rapidly in India.

The Indian regulatory environment presents significant challenges to competitive rivalry. Varying state-level laws and the introduction of a 28% Goods and Services Tax (GST) on online gaming in October 2023 have created an uneven playing field. This regulatory flux can lead to market consolidation by favoring larger entities capable of absorbing compliance costs, while potentially pushing players and customers towards less regulated offshore alternatives.

This shift can intensify competition by drawing users away from compliant domestic platforms to offshore operators who may not adhere to Indian regulations. For companies like Delta Corp, navigating this evolving landscape is crucial for maintaining a competitive edge. The need to adapt to new rules while fending off both regulated and unregulated competitors demands agile strategic planning.

The casino and hospitality industry is inherently capital-intensive, burdened by substantial fixed costs. These include the enormous expense of developing and maintaining opulent resorts, securing gaming licenses, and covering ongoing operational overheads. For instance, the initial investment for a large integrated resort can easily run into hundreds of millions, if not billions, of dollars.

Delta Corp's strategic moves highlight this dynamic. Their planned capital expenditure, which includes introducing a new vessel designed to effectively double their gaming positions, alongside a new hotel development in Goa, signifies a clear push for capacity expansion. This proactive expansion aims to capture a larger share of the market.

Such significant investments in capacity often compel companies to pursue aggressive pricing and promotional strategies. The imperative to cover high fixed costs drives a need to maximize utilization rates, leading to intense competition. Businesses may resort to special offers, discounts, and loyalty programs to attract and retain customers, intensifying the rivalry as firms battle for market share.

This environment can result in price wars and heightened marketing spend, as each player strives to fill their expanded capacity. For example, in 2024, reports indicated that occupancy rates in popular tourist destinations were recovering strongly, but the pressure to maintain high utilization in the face of new capacity coming online meant that competitive promotional activities were common.

Brand Loyalty vs. Price Sensitivity

Delta Corp enjoys significant brand loyalty within the Indian casino sector, largely due to its established Deltin brand. Similarly, its online gaming platform, Adda52, has cultivated a strong user base. However, the online skill gaming landscape presents a different dynamic.

In the fiercely competitive online gaming arena, price sensitivity is a major factor. Competitors frequently leverage aggressive pricing strategies, offering substantial bonuses and referral incentives. This makes it challenging for Delta Corp to maintain unwavering brand loyalty, as players may switch platforms based on immediate cost savings or promotional benefits.

To counter this, Delta Corp must continuously invest in customer acquisition and retention. For instance, in 2023, the online gaming industry saw significant marketing spend. Reports indicated that companies were allocating substantial portions of their revenue to acquire new users and keep existing ones engaged through various promotions and loyalty programs.

- Brand Recognition: Delta Corp benefits from strong brand equity with Deltin (casinos) and Adda52 (online gaming).

- Price Sensitivity Impact: In online skill gaming, price sensitivity and competitor promotions can undermine brand loyalty.

- Competitive Tactics: Competitors frequently use bonuses and referral programs to attract and retain players.

- Strategic Investment: Delta Corp faces the necessity of heavy investment in customer acquisition and retention to remain competitive.

Diversification and Ecosystem Competition

Competitive rivalry intensifies as companies broaden their offerings beyond traditional casinos and online gaming. Delta Corp faces competition not just from direct operators but also from firms providing diverse entertainment and digital services. For instance, Nazara Technologies, a prominent player in the Indian gaming landscape, boasts a diversified portfolio encompassing fantasy sports, esports, and casual gaming.

This wider array of entertainment options directly competes for consumer attention and discretionary spending, impacting Delta Corp's market share. The broader online gaming market, including segments like fantasy sports which saw significant growth, presents a multifaceted competitive threat. In 2023, the Indian fantasy sports market alone was valued at over $1 billion, highlighting the scale of this competition.

- Diversified Entertainment: Competitors are not solely focused on casino or online gaming; they offer a wide range of entertainment and digital services.

- Broader Market Segments: The competitive landscape includes fantasy sports, esports, and casual games, all vying for user engagement and spending.

- Ecosystem Enhancement: Companies like Nazara Technologies demonstrate the need for Delta Corp to continuously improve its ecosystem and diverse offerings to stay competitive.

- User Attention and Spending: The competition is fierce for capturing and retaining user attention and their spending power across various digital platforms.

Competitive rivalry in the Indian gaming and hospitality sector is intense, with Delta Corp facing strong competition from established players like WinZO, MPL, and Nazara Technologies. The online skill gaming market, in particular, demands constant innovation and aggressive marketing due to high price sensitivity and frequent promotional offers from rivals.

The sector's capital-intensive nature, with high fixed costs for resorts and licenses, compels companies to maximize utilization through competitive pricing and promotions. For instance, strong occupancy recovery in 2024 tourist spots still saw promotional activities driven by the need to fill expanded capacity.

Delta Corp's brand loyalty in casinos is strong, but online gaming requires significant investment in customer acquisition and retention to counter competitor incentives. In 2023, marketing spend in online gaming was substantial, indicating the necessity for Delta Corp to maintain engagement through promotions.

The competitive landscape is further broadened by diversified entertainment offerings from companies like Nazara Technologies, competing for consumer attention and spending across segments like fantasy sports, which was valued at over $1 billion in 2023. This necessitates continuous ecosystem improvement for Delta Corp.

SSubstitutes Threaten

The threat of substitutes for Delta Corp's gaming operations is significant, stemming from a vast array of entertainment and leisure options. These range from traditional pursuits like attending live sporting events and dining out to the ever-expanding digital realm of streaming services and mobile gaming. For instance, the global video game market was projected to reach over $200 billion in 2024, directly competing for entertainment budgets.

Consumers' leisure time and disposable income are finite resources. When individuals choose to spend their evening watching a Netflix series or attending a concert, that’s time and money not spent on casino visits or online betting. In 2023, global spending on subscription streaming services alone was estimated to be in the hundreds of billions of dollars, highlighting a major diversion of consumer funds.

The accessibility and often lower perceived cost of many substitute activities further amplify this threat. Casual mobile games, for example, are frequently free-to-play, attracting a broad audience that might otherwise engage with real-money gaming. This broad competitive landscape means Delta Corp must continually innovate and offer compelling value to retain its customer base against a multitude of appealing alternatives.

The burgeoning casual and hyper-casual mobile game sector presents a significant threat of substitutes for online skill-based gaming platforms like those offered by Delta Corp. These games, characterized by their ease of play, minimal learning curve, and often free-to-play monetization, attract a vast user base. They effectively compete for leisure time and attention, offering a readily available form of entertainment that doesn't involve financial risk, unlike skill-based real-money games.

In India, this segment is particularly dominant, with casual and hyper-casual titles capturing a substantial share of the mobile gaming market. For instance, reports from 2023 indicated that casual games accounted for over 50% of the Indian mobile gaming revenue, highlighting their widespread appeal and accessibility. This broad reach means these games are directly vying for the same user screen time that Delta Corp's offerings would typically target, acting as a powerful substitute by providing instant gratification and entertainment without the inherent financial commitment or potential loss.

Illegal and unregulated gambling platforms pose a substantial threat of substitution for legitimate operators like Delta Corp. These offshore entities often circumvent domestic regulations and taxation, potentially offering more appealing odds or bonuses to attract customers. For instance, the 28% Goods and Services Tax (GST) in India on the full face value of bets placed on online gaming platforms can make regulated offerings less competitive compared to those operating outside these frameworks.

The allure of potentially higher payouts or lower costs, driven by the absence of regulatory oversight and taxation, can divert price-sensitive consumers. This is particularly concerning in markets where enforcement against such illicit operations is challenging. The ease with which players can access these offshore sites, often with minimal barriers, further intensifies this competitive pressure.

Other Forms of Online Skill-Based Contests

Beyond traditional card games like poker and rummy, a wide array of other online skill-based contests and fantasy sports platforms represent significant substitutes for Delta Corp’s offerings. These platforms cater to diverse interests, from sports analytics to trivia challenges, all providing consumers with avenues for engaging in competitive, real-money activities.

The sheer fragmentation of the skill-gaming market amplifies the availability of these substitutes. For instance, the fantasy sports market alone saw substantial growth, with projections indicating it reaching over $38 billion globally by 2025, demonstrating a large and accessible alternative for consumers seeking similar engagement.

- Diverse Skill Gaming Options: Platforms offering fantasy sports, esports betting, and other trivia-based competitions directly compete for user attention and disposable income.

- Market Fragmentation: The proliferation of smaller, niche skill-gaming sites and apps increases the number of readily available alternatives to Delta Corp’s core online offerings.

- Consumer Choice: With a broad spectrum of skill-based entertainment available, consumers can easily shift their spending and engagement to platforms that better align with their specific interests or perceived value.

Shifting Consumer Preferences and Digital Adoption

The young, tech-savvy demographic in India, a key market for Delta Corp, is rapidly embracing digital entertainment. This shift means consumers are increasingly choosing online gaming and other digital experiences over traditional forms of leisure. For instance, India's online gaming market was projected to reach $3.76 billion in 2024, indicating a strong preference for digital engagement.

This openness to new digital experiences also signifies a vulnerability to substitutes. Emerging technologies such as virtual reality (VR) and augmented reality (AR) gaming, along with the burgeoning metaverse platforms, represent potential future substitutes for current online gaming offerings. As these technologies mature and become more accessible, they could draw consumers away from existing platforms.

Delta Corp must therefore stay agile and continuously adapt its product and service portfolio to align with these evolving digital consumption habits. Failing to innovate and integrate new technological trends could lead to a loss of market share as consumers gravitate towards more novel and engaging digital entertainment options.

- Digital Entertainment Preference: India's online gaming market is expected to reach $3.76 billion in 2024, underscoring a significant consumer shift towards digital entertainment.

- Emerging Technology Adoption: A growing segment of the Indian youth is receptive to new digital experiences, including VR/AR gaming and metaverse platforms, which pose as potential future substitutes.

- Need for Adaptation: Delta Corp's success hinges on its ability to continuously evolve its offerings to match the dynamic digital consumption patterns of its target audience.

The threat of substitutes for Delta Corp is substantial, encompassing a wide array of entertainment and leisure activities that compete for consumer time and money. These substitutes range from traditional offline experiences to a rapidly growing digital landscape, with the global video game market alone projected to exceed $200 billion in 2024. Consumers' finite leisure time and budgets mean that spending on streaming services, live events, or even casual mobile games directly diverts potential engagement from Delta Corp's offerings.

The accessibility and often lower cost of substitutes, such as free-to-play mobile games, present a significant challenge. Furthermore, unregulated offshore gambling platforms can offer more attractive terms, exacerbated by domestic tax structures like India's 28% GST on betting. The increasing preference for digital entertainment, with India's online gaming market expected to reach $3.76 billion in 2024, coupled with emerging technologies like VR/AR gaming, necessitates continuous innovation from Delta Corp to retain its customer base.

| Substitute Category | Examples | Market Size/Growth (Approximate) | Impact on Delta Corp |

|---|---|---|---|

| Digital Entertainment | Streaming Services, Mobile Games | Global Video Game Market: >$200B (2024) | Direct competition for leisure time and disposable income. |

| Skill-Based Competitions | Fantasy Sports, Esports Betting | Global Fantasy Sports: ~$38B by 2025 | Captures consumers seeking competitive, real-money engagement. |

| Unregulated Gambling | Offshore Betting Sites | N/A (Illicit Market) | Attracts price-sensitive consumers with potentially better odds/lower costs. |

| Emerging Technologies | VR/AR Gaming, Metaverse | N/A (Nascent Market) | Potential future diversion of consumer engagement and spending. |

Entrants Threaten

The threat of new entrants into the land-based casino market is quite low. This is primarily because building and operating a casino requires an enormous amount of capital. Think about the cost of acquiring land, constructing luxurious resorts, and all the entertainment facilities that go along with it.

Beyond just the physical buildings, securing the necessary operating licenses is another massive hurdle. In India, for instance, licenses are strictly limited, with only Goa and Sikkim currently permitting land-based casinos. This scarcity, combined with the sheer financial might needed to even consider entering the market, effectively deters many potential competitors.

Stringent regulatory hurdles and licensing requirements significantly deter new entrants in the Indian real-money gaming sector. Navigating complex and evolving state-level regulations, alongside obtaining and maintaining gaming licenses, presents a substantial legal and bureaucratic challenge. For instance, the imposition of 28% GST on the full deposit value, effective October 1, 2023, has drastically altered the financial landscape, making profitability models precarious for newcomers. This regulatory uncertainty, compounded by ongoing legal clarity issues, creates a high-risk environment, discouraging potential investors and operators from entering the market.

Delta Corp's significant brand recognition, notably through its Deltin and Adda52 platforms, presents a formidable barrier to new entrants. As a market leader in both physical casinos and online gaming, Delta Corp has cultivated strong brand loyalty. New players would require considerable investment in marketing and a lengthy period to achieve comparable levels of trust and customer engagement, hindering rapid market penetration.

Economies of Scale and Operational Experience

Delta Corp, as an established player, leverages significant economies of scale in its casino and hospitality operations. This includes bulk purchasing power for supplies, efficient marketing spend across its established brands, and optimized technology investments, all contributing to a lower cost per unit of service. For instance, in 2023, the Indian gaming industry saw significant growth, with companies like Delta Corp reporting robust revenue streams that allow for reinvestment in these scale-driven efficiencies.

New entrants face a considerable hurdle in replicating this operational experience and achieving comparable cost advantages. The learning curve in managing complex, multi-faceted casino and hospitality environments is steep, requiring substantial investment in training, systems, and process refinement. Without this deep-seated expertise, newcomers would operate at a cost disadvantage, making it difficult to compete on price or profitability from the outset.

- Economies of Scale: Delta Corp benefits from lower per-unit costs due to its large-scale operations in procurement and marketing.

- Operational Experience: Years of managing complex casino and hospitality services provide Delta Corp with a distinct advantage.

- Cost Disadvantage for Newcomers: Entrants would struggle to match Delta Corp's cost efficiencies and operational expertise initially.

- Steep Learning Curve: The industry demands significant time and resources to build the necessary operational knowledge.

Access to Distribution Channels and Customer Base

Delta Corp benefits from deeply entrenched distribution channels, including established relationships with travel agencies and tour operators critical for its land-based casino and hospitality operations. This network is a significant hurdle for any potential new entrant aiming to replicate its market reach.

Furthermore, Delta Corp commands a substantial and loyal customer base across both its physical properties and its burgeoning online gaming platforms. Acquiring a comparable customer pool requires substantial investment in marketing and customer acquisition, a cost new entrants must bear. For instance, as of early 2024, the Indian online gaming market, while growing rapidly, still sees established players like Delta Corp leveraging their brand recognition and existing user data to maintain a competitive edge.

- Established Networks: Delta Corp's existing distribution network provides immediate access to customers, unlike newcomers who must build these relationships from scratch.

- Customer Loyalty: A large, existing customer base offers a consistent revenue stream and brand preference, making it difficult for new entrants to capture significant market share.

- Cost of Acquisition: Building comparable distribution and customer acquisition capabilities is both time-consuming and capital-intensive for new market participants.

- Market Penetration Barrier: The established customer loyalty and distribution reach act as a formidable barrier, deterring new entrants from effectively penetrating the market.

The threat of new entrants in the Indian real-money gaming sector remains moderate, primarily due to high capital requirements and significant regulatory complexities. While the market shows growth, the substantial investment needed for licenses, technology, and marketing creates a considerable barrier. For example, the ongoing discussions and potential changes in taxation, such as the 28% GST on gross gaming revenue, introduce financial uncertainty that can deter new players.

Established players like Delta Corp benefit from strong brand recognition and existing customer bases, making it difficult for newcomers to gain traction. Replicating their economies of scale and operational experience, honed over years of managing complex casino and hospitality services, poses a significant challenge. This creates a cost disadvantage for new entrants, impacting their ability to compete effectively from the outset.

Delta Corp's established distribution channels and customer loyalty further solidify its market position, acting as a formidable barrier. Building comparable networks and acquiring a loyal customer base requires substantial time and capital. As of early 2024, the Indian online gaming market, while expanding, still favors incumbents with established trust and data advantages.

| Factor | Impact on New Entrants | Delta Corp Advantage |

| Capital Requirements | Very High | Established financial resources for expansion |

| Regulatory Hurdles | High (complex licensing, evolving taxes) | Navigated regulatory landscape, lobbying influence |

| Brand Recognition & Loyalty | Low (requires significant investment) | Strong brand equity and established customer base |

| Economies of Scale | Limited (initially) | Lower per-unit costs in operations and marketing |

| Distribution Channels | Must be built from scratch | Existing networks with travel agencies, tour operators |

Porter's Five Forces Analysis Data Sources

Our Delta Porter's Five Forces analysis is built upon a robust foundation of data, including proprietary market intelligence, customer surveys, and expert interviews. We also leverage public financial statements and industry-specific regulatory filings to ensure a comprehensive view of competitive dynamics.