Del Monte Pacific Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Del Monte Pacific Bundle

Del Monte Pacific faces significant buyer power due to the widespread availability of canned and fresh produce, potentially squeezing profit margins. Intense rivalry among established players and the looming threat of new entrants further shape its competitive landscape. Understanding these forces is crucial for navigating the dynamic food industry.

Ready to move beyond the basics? Get a full strategic breakdown of Del Monte Pacific’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Del Monte Pacific's reliance on specific agricultural inputs, particularly pineapples like the C74 variety, means a concentrated supplier base can wield considerable power. This limited pool of growers or regions can significantly influence both the price and availability of crucial raw materials.

For instance, Del Monte Pacific faced challenges in FY2024 stemming from the low productivity of its C74 pineapple variety. This directly affected the company's costs and overall profitability, highlighting the impact of supply-side issues from a concentrated agricultural input market.

Input cost volatility is a significant factor impacting the bargaining power of suppliers in the food and beverage sector. Fluctuations in the prices of essential raw materials like fruits, vegetables, and packaging directly affect a company's profitability. For instance, Del Monte Pacific experienced a decline in its gross margin during FY2024, partly attributed to inventory costs in the US and a reduced pineapple supply in Asia, highlighting its exposure to these price swings.

Supplier switching costs can significantly impact Del Monte Pacific's bargaining power. Establishing new relationships for specialized agricultural products, like their C74 fruit variety, involves substantial expenses related to quality assurance, supply chain adjustments, and existing contracts. This makes it difficult for Del Monte to switch suppliers even if prices rise, as demonstrated by their ongoing efforts to restore plantation productivity for this specific fruit over the next two years.

Forward Integration Threat

The threat of forward integration by suppliers, while not a dominant force for raw agricultural inputs, could shift bargaining power. Imagine large-scale growers or cooperatives deciding to move into processing and packaging their produce. This would place them in direct competition with companies like Del Monte Pacific, allowing them to capture more of the value chain themselves.

For example, if a major pineapple cooperative in the Philippines, which supplies a significant portion of Del Monte Pacific's raw materials, were to invest in canning and bottling facilities, they would gain considerable leverage. This move would directly challenge Del Monte Pacific's existing operations and market position. Del Monte Pacific's strong brand recognition and extensive distribution channels do provide a degree of insulation against such direct competitive threats from its suppliers.

- Forward Integration Threat: Large-scale growers or cooperatives could integrate forward into processing and packaging, directly competing with Del Monte Pacific and increasing their own bargaining power.

- Value Chain Control: Such integration would allow suppliers to control more of the value chain, from farm to finished product.

- Brand and Distribution as Defense: Del Monte Pacific's established brand equity and robust distribution network offer a buffer against this potential supplier power increase.

Uniqueness of Inputs

The uniqueness of inputs can significantly influence supplier bargaining power. If Del Monte Pacific relies on specific, hard-to-find agricultural ingredients or proprietary processing techniques sourced from particular suppliers, those suppliers gain leverage. This is especially true if these inputs are critical to maintaining the distinct quality and appeal of Del Monte Pacific's established brands, such as Del Monte, S&W, Contadina, and College Inn.

For instance, a supplier providing a unique variety of pineapple for Del Monte's premium canned fruit or a specialized tomato strain for Contadina pasta sauces could command higher prices or more favorable terms. This dependence on specialized inputs limits Del Monte Pacific's ability to switch suppliers easily without impacting product consistency or cost structure. In 2023, Del Monte Pacific reported that its cost of sales increased by 1.8% to $1.73 billion, partly reflecting fluctuations in raw material costs which can be influenced by supplier uniqueness.

The bargaining power of suppliers is amplified when they offer inputs that are not readily available from alternative sources. This scarcity, coupled with the essential nature of the input to Del Monte Pacific's product differentiation, allows suppliers to negotiate from a position of strength.

- Limited Availability: Suppliers with unique or patented agricultural inputs hold greater power.

- Brand Dependence: If specific inputs are crucial for brand identity and quality perception, suppliers gain leverage.

- Switching Costs: High costs or disruptions associated with changing suppliers for specialized inputs increase supplier power.

- 2023 Performance Impact: Rising raw material costs, potentially linked to unique inputs, contributed to a 1.8% increase in Del Monte Pacific's cost of sales in 2023.

Del Monte Pacific's suppliers, particularly those providing specialized agricultural inputs like the C74 pineapple variety, can exert significant bargaining power due to a concentrated supply base and high switching costs.

Input cost volatility, as seen in FY2024 with reduced pineapple supply impacting margins, directly benefits suppliers who can leverage these price swings.

The threat of forward integration by key suppliers, while not currently dominant, represents a potential future shift where suppliers could capture more value, impacting Del Monte Pacific's market position.

Uniqueness of inputs, critical for maintaining brand quality for products like Del Monte and Contadina, further strengthens supplier leverage, as evidenced by the 1.8% rise in Del Monte Pacific's cost of sales in 2023 due to raw material cost fluctuations.

| Factor | Impact on Del Monte Pacific | Supporting Data (FY2023/2024) |

|---|---|---|

| Concentrated Supply Base | Limited options increase supplier leverage. | Reliance on specific pineapple varieties like C74. |

| Switching Costs | High costs for specialized inputs restrict supplier changes. | Efforts to restore C74 productivity over two years. |

| Input Cost Volatility | Suppliers benefit from price fluctuations. | Reduced pineapple supply impacted FY2024 margins. |

| Uniqueness of Inputs | Critical inputs for brand differentiation grant supplier power. | Cost of sales rose 1.8% in 2023 partly due to raw material costs. |

What is included in the product

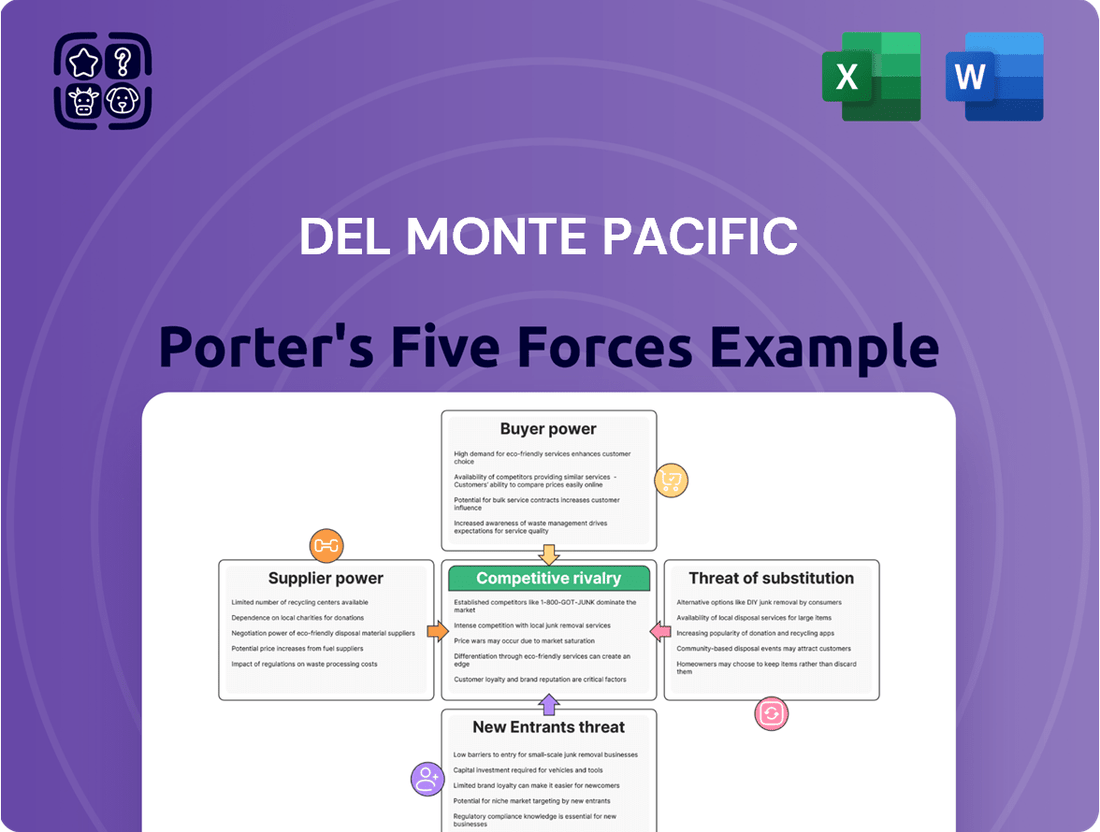

Del Monte Pacific's Porter's Five Forces analysis reveals the intense competition, significant buyer power, and moderate threat of new entrants in the global food and beverage industry.

Instantly identify and mitigate competitive threats with a visual breakdown of Del Monte Pacific's industry landscape.

Customers Bargaining Power

Consumers in the packaged food and beverage sector, especially in the Asia Pacific region, are showing a growing preference for affordability. This price sensitivity is particularly pronounced in the mass-market segments, where value for money is a key purchasing driver.

Del Monte Pacific's product portfolio, like many others in the industry, contends with the presence of private label brands and other more budget-friendly alternatives. This competitive landscape can exert downward pressure on pricing strategies and, consequently, impact profit margins for companies like Del Monte Pacific.

For instance, in 2024, reports indicated that private label brands in several Asian markets saw a significant increase in market share, often driven by their lower price points compared to established national brands. This trend directly reflects the heightened price sensitivity among a substantial portion of the consumer base.

The bargaining power of customers is significantly influenced by the availability of substitutes. Consumers today have a vast array of food and beverage choices, from fresh produce and other packaged brands to preparing meals at home. This broad spectrum of alternatives means customers can easily switch away from Del Monte Pacific products if they are not satisfied with price, quality, or variety.

In 2024, this dynamic is particularly evident. For instance, Del Monte Pacific's performance in certain segments, such as packaged fruits in the United States, has faced headwinds. This is partly due to evolving consumer preferences and dietary habits, leading to a decline in demand for these specific categories as consumers opt for fresher or different types of food options, thereby exercising their power through substitution.

Major retailers and supermarket chains, like Walmart and Kroger in the US, hold substantial sway over Del Monte Pacific. Their sheer size means they buy in massive quantities, giving them leverage to negotiate better prices and terms. For instance, in 2024, these large chains continued to demand significant promotional allowances from CPG companies like Del Monte to secure prime shelf placement and feature in weekly flyers, directly impacting Del Monte's gross margins.

Information Availability and Brand Loyalty

Consumers now have unprecedented access to information regarding product ingredients, nutritional content, and sourcing practices. This transparency significantly influences their purchasing decisions, empowering them to make more informed choices. For Del Monte Pacific, this means that while its heritage brands carry significant recognition, cultivating and maintaining strong brand loyalty is paramount. This is especially true given the increasing consumer focus on health and wellness trends, which can easily sway purchasing habits away from established brands if transparency and perceived value are not consistently met.

Del Monte Pacific's ability to leverage its brand equity in this environment is key. For instance, in 2024, the global packaged food market saw continued growth, with consumers actively seeking out brands that align with their values, including health and sustainability. Del Monte Pacific's financial reports for the fiscal year ending March 31, 2024, indicated a revenue of $2.4 billion, underscoring the scale of its operations and the importance of customer perception.

- Increased Consumer Information: Greater availability of data on ingredients, nutrition, and origin empowers buyers.

- Brand Loyalty as a Counterbalance: Maintaining strong customer attachment is vital to mitigate buyer power.

- Health and Wellness Trends: Shifting consumer preferences towards healthier options necessitate adaptation.

- Del Monte Pacific's 2024 Revenue: The company reported $2.4 billion in revenue for the fiscal year ending March 31, 2024, highlighting its market presence.

Changing Consumer Preferences

Consumers are increasingly prioritizing health and wellness, a trend that can significantly impact demand for traditional packaged foods. This shift means companies like Del Monte Pacific must actively respond to evolving tastes.

Sustainability is also a major driver, with consumers showing a preference for brands that demonstrate environmental responsibility. This includes everything from sourcing to packaging, influencing purchasing decisions.

Specific dietary trends, such as plant-based eating or reduced sugar intake, further fragment the market. Del Monte Pacific’s strategic moves, like introducing Joyba bubble tea and expanding flavor profiles, directly address these evolving consumer demands to maintain and grow market share.

- Evolving Health Consciousness: A growing segment of consumers actively seeks out healthier options, impacting demand for conventionally processed foods.

- Sustainability as a Key Factor: Environmental concerns are influencing purchasing decisions, favoring brands with strong eco-friendly practices.

- Dietary Trend Adoption: The rise of niche diets and ingredient preferences necessitates product diversification and innovation.

- Del Monte Pacific's Response: Investments in products like Joyba and new flavor development are crucial for adapting to these changing consumer preferences and driving future growth.

The bargaining power of customers for Del Monte Pacific is substantial, driven by price sensitivity, the availability of numerous substitutes, and the increasing power of large retailers. Consumers in 2024 are highly attuned to value, readily switching to private labels or more affordable alternatives, as evidenced by the growing market share of these brands in Asia. This price pressure directly impacts Del Monte Pacific's profitability.

Furthermore, the proliferation of information empowers consumers to make more informed choices, demanding transparency in ingredients and sourcing. Del Monte Pacific's ability to maintain brand loyalty amidst these trends, coupled with its reported $2.4 billion revenue for the fiscal year ending March 31, 2024, highlights the critical need to consistently deliver on perceived value and evolving health and wellness preferences.

| Factor | Impact on Del Monte Pacific | 2024 Data/Observation |

|---|---|---|

| Price Sensitivity | High | Increased market share for private labels in Asia due to lower price points. |

| Availability of Substitutes | High | Consumers opting for fresh produce or alternative brands, impacting demand for certain packaged fruit categories. |

| Retailer Power | High | Major retailers demanding promotional allowances for shelf placement and advertising. |

| Consumer Information & Trends | Growing | Emphasis on health, wellness, and sustainability influencing purchasing decisions. |

Preview Before You Purchase

Del Monte Pacific Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Del Monte Pacific, detailing the competitive landscape and strategic implications for the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Rivalry Among Competitors

The branded food and beverage sector, especially in key markets like the Philippines, the United States, and the broader Asia-Pacific region, is highly fragmented. Del Monte Pacific faces a crowded landscape populated by numerous local and international competitors, creating a fiercely competitive environment.

This intense rivalry stems from the presence of a wide array of players, ranging from global giants with extensive resources to smaller, specialized brands that cater to specific consumer preferences. For instance, in the Philippines, Del Monte Pacific competes with established local players and international brands vying for market share in categories like canned fruits and beverages.

In 2024, the global food and beverage market continued to see robust activity, with companies like Nestlé, PepsiCo, and Unilever maintaining significant market presence alongside regional players. Del Monte Pacific’s competitive set includes these large multinationals as well as numerous smaller, agile companies that can quickly adapt to changing consumer tastes, intensifying the pressure on market share and pricing.

The Asia Pacific food and beverage market is showing promising growth, but the traditional packaged fruit and vegetable segments are expected to see more moderate expansion. This slower growth rate intensifies competition as companies vie for a larger piece of the market pie.

When growth is less robust, businesses often resort to more aggressive pricing and marketing tactics to capture consumer attention and sales. This can put pressure on margins for all players, including Del Monte Pacific.

Del Monte Pacific, like many in the food processing sector, contends with substantial fixed costs tied to its extensive manufacturing facilities, advanced machinery, and broad distribution infrastructure. These investments necessitate high operational output to achieve economies of scale and cover overhead, creating a strong incentive to maintain production levels even when market demand fluctuates.

This inherent cost structure can intensify competitive rivalry. When demand slackens, companies may resort to aggressive pricing strategies to fill excess capacity and avoid underutilization penalties. For instance, in 2023, the global food processing industry faced challenges with rising input costs, which, combined with potential overcapacity in certain segments, could have pressured margins and fueled price competition among key players like Del Monte Pacific.

Brand Differentiation and Marketing Intensity

Competitors in the food and beverage industry frequently leverage strong brand differentiation, extensive advertising, and targeted promotional activities to capture and retain consumer attention. This intense focus on marketing is crucial for standing out in a crowded marketplace.

Del Monte Pacific actively invests in robust marketing campaigns and the consistent introduction of new products. These strategic efforts are designed to solidify its market leadership position and to expand its share of the market in the face of vigorous competition from its rivals.

- Brand Differentiation: Competitors heavily invest in making their brands unique and memorable to consumers.

- Marketing Intensity: Advertising spend and promotional activities are significant drivers of market share.

- Del Monte Pacific's Strategy: The company counters this by launching new products and running impactful campaigns.

- Market Share Goals: These initiatives aim to maintain leadership and grow market share against competitors.

Strategic Alliances and Acquisitions

Strategic alliances and acquisitions are pivotal in the food and beverage sector, allowing companies to bolster their competitive standing. Del Monte Pacific's situation, particularly the Chapter 11 filing of its US subsidiary in 2024 and the subsequent exploration of asset sales, underscores the intense pressure to adapt. This move indicates a strategic re-evaluation aimed at navigating a highly competitive market and potentially shedding underperforming assets to improve overall financial health.

These corporate maneuvers are driven by a desire to consolidate market share, acquire innovative technologies, or broaden product offerings. In 2023, the global food and beverage M&A market saw continued activity, with companies seeking scale and efficiency. Del Monte Pacific's strategic adjustments are a direct response to these industry dynamics, aiming to streamline operations and enhance its competitive edge in a market characterized by consolidation and evolving consumer preferences.

- Market Consolidation: Companies are actively merging or acquiring rivals to gain a larger market share and achieve economies of scale.

- Technological Advancement: Acquisitions can provide access to new processing technologies, packaging innovations, or digital platforms that enhance efficiency and product appeal.

- Portfolio Expansion: Strategic alliances and M&A are used to diversify product lines, entering new categories or strengthening existing ones to meet varied consumer demands.

- Financial Restructuring: In challenging periods, asset sales or divestitures, as considered by Del Monte Pacific, can be crucial for financial recovery and strategic refocusing.

Competitive rivalry is a significant force for Del Monte Pacific, operating in a fragmented global food and beverage market. The intense competition stems from a diverse range of players, from multinational giants to niche brands, all vying for consumer attention and market share, especially in key regions like the Philippines and the US. In 2024, companies like Nestlé and PepsiCo continued to dominate, while smaller, agile competitors also posed a threat by quickly adapting to changing tastes.

The pressure is amplified by slower growth in traditional packaged fruit and vegetable segments, leading to more aggressive pricing and marketing tactics. Del Monte Pacific's substantial fixed costs in manufacturing and distribution also incentivize high production, potentially fueling price competition during demand downturns. For instance, rising input costs in 2023 could have squeezed margins industry-wide.

Brand differentiation and marketing intensity are crucial. Del Monte Pacific counters this through new product launches and robust campaigns to maintain its market position. The industry also sees ongoing consolidation through mergers and acquisitions, as evidenced by Del Monte Pacific's 2024 Chapter 11 filing for its US subsidiary and subsequent asset sale considerations, aimed at financial recovery and strategic refocusing in a dynamic market.

SSubstitutes Threaten

Consumers can easily switch from Del Monte's packaged fruits and vegetables to fresh produce, which is often seen as a healthier and more natural option. This shift is particularly noticeable as health and wellness trends continue to gain momentum, directly challenging Del Monte Pacific's core packaged goods business.

For instance, the global fresh fruit and vegetables market was valued at approximately $1.1 trillion in 2023 and is projected to grow, indicating a strong consumer preference for fresh alternatives. This presents a significant threat to packaged food companies like Del Monte Pacific, as consumers increasingly prioritize perceived naturalness and freshness in their diets.

The rising tide of home cooking, significantly boosted by meal kit services and accessible online recipes, presents a notable threat. Consumers are increasingly empowered to create meals from scratch, directly diminishing their need for pre-packaged foods and ingredients. This shift can siphon demand away from Del Monte Pacific's core offerings in culinary sauces, condiments, and other packaged food items.

Del Monte Pacific faces a significant threat from a wide range of substitute beverage options. These include readily available choices like plain water, fresh fruit juices, various dairy products, and a growing segment of other ready-to-drink beverages, such as teas and coffees. The sheer volume and accessibility of these alternatives can draw consumers away from Del Monte's offerings.

The beverage market is also highly dynamic, with constant innovation introducing new functional beverages and plant-based alternatives. For instance, the global plant-based milk market was valued at approximately USD 11.9 billion in 2023 and is projected to grow significantly, presenting a direct substitute for traditional dairy-based beverages and potentially impacting demand for other prepared drinks. This continuous emergence of novel products creates an ongoing challenge for Del Monte to maintain market share and consumer loyalty.

Private Label and Generic Brands

Supermarkets and retailers frequently introduce their own private label or generic versions of packaged foods and beverages, often at a more attractive price point. These offerings directly compete with established brands, drawing in consumers who prioritize cost savings and potentially chipping away at market share. For instance, in 2024, private label sales in the U.S. grocery sector continued their upward trend, capturing approximately 19% of total sales, a figure that has steadily grown over the past decade.

These lower-priced alternatives act as potent substitutes, especially for consumers who are less brand-loyal or more sensitive to price fluctuations. This pressure forces established brands like Del Monte to either compete on price, potentially impacting margins, or to focus on differentiation through quality, innovation, or brand perception. The increasing sophistication of private label products, with many now offering comparable quality to national brands, further intensifies this threat.

- Private Label Growth: In 2023, private label sales in the U.S. reached over $200 billion, indicating a significant competitive force.

- Price Sensitivity: A substantial portion of consumers, particularly in inflationary environments, actively seek out private label options to manage household budgets.

- Market Share Erosion: The availability of cheaper substitutes directly challenges the pricing power and market share of premium brands.

- Brand Differentiation: Companies like Del Monte must continually invest in marketing and product development to justify their price premium over private label competitors.

Shifting Dietary Trends

The rise of plant-based diets, low-sugar, and low-carb lifestyles presents a significant threat of substitution for Del Monte Pacific. Consumers increasingly seek fresh produce or specialized products that cater to these specific health preferences, potentially bypassing traditional canned and packaged fruit and vegetable offerings. For instance, the global plant-based food market was valued at approximately $27.0 billion in 2023 and is projected to grow substantially, indicating a clear shift in consumer demand that could impact sales of conventional processed foods.

This dietary evolution means consumers might opt for fresh, whole fruits and vegetables directly from grocery stores or seek out innovative plant-based alternatives that offer convenience and perceived health benefits. Del Monte's reliance on processed and canned goods could be challenged as consumers prioritize less processed, more natural food sources. By 2024, it's estimated that a significant portion of the population actively incorporates or considers plant-based eating, a trend that directly substitutes demand for many of Del Monte's core products.

The threat is amplified by the growing availability and marketing of these alternative food categories. Companies specializing in fresh produce delivery services or innovative plant-based meal solutions are directly competing for consumer spending.

- Dietary Shift: Growing adoption of plant-based, low-sugar, and low-carb diets.

- Consumer Preference: Consumers seek alternative food sources aligning with health trends.

- Market Impact: Potential move away from traditional packaged fruit and vegetable products.

- Market Growth: Global plant-based food market projected for significant growth, indicating strong substitution trends.

The threat of substitutes for Del Monte Pacific is substantial, stemming from readily available fresh produce, increasing home cooking trends, diverse beverage alternatives, private label products, and evolving dietary preferences like plant-based eating.

Consumers are increasingly opting for fresh fruits and vegetables, viewing them as healthier alternatives to packaged goods. For instance, the global fresh produce market continues to expand, indicating a strong preference for natural options. This trend directly challenges Del Monte's packaged offerings.

The rise of home cooking and meal kits empowers consumers to prepare meals from scratch, reducing reliance on pre-packaged ingredients. Furthermore, the beverage market offers a vast array of substitutes, including water, fresh juices, and innovative ready-to-drink options. For example, the plant-based milk market alone was valued at nearly $12 billion in 2023, showcasing significant consumer shifts.

Private label brands, often priced lower, also pose a threat, with U.S. grocery private label sales capturing around 19% of the market in 2024. This price sensitivity, coupled with a growing demand for plant-based and health-conscious foods, means Del Monte must continually innovate and differentiate to maintain its market position.

| Substitute Category | Key Driver | Impact on Del Monte | 2023/2024 Data Point |

|---|---|---|---|

| Fresh Produce | Health & Wellness Trends | Direct competition for fruit & vegetable consumption | Global fresh produce market valued at ~$1.1 trillion (2023) |

| Home Cooking & Meal Kits | Convenience & Control | Reduced demand for packaged ingredients | Significant growth in meal kit subscriptions |

| Beverage Alternatives | Variety & Health Trends | Competition for beverage market share | Plant-based milk market valued at ~$11.9 billion (2023) |

| Private Label Products | Price Sensitivity | Pressure on pricing and market share | Private label sales ~19% of U.S. grocery market (2024) |

| Plant-Based & Health Diets | Dietary Evolution | Shift away from traditional processed foods | Global plant-based food market valued at ~$27.0 billion (2023) |

Entrants Threaten

Entering the branded food and beverage sector, particularly on a global scale similar to Del Monte Pacific, demands significant financial outlay. This includes investments in state-of-the-art manufacturing plants, robust supply chain networks, and extensive marketing campaigns to build brand recognition.

For instance, establishing a new global food processing operation could easily cost hundreds of millions of dollars. This substantial capital requirement acts as a significant deterrent, effectively raising the barrier to entry for many aspiring competitors looking to challenge established players like Del Monte Pacific.

Del Monte Pacific enjoys a significant advantage due to its deeply ingrained brand loyalty and a robust distribution network across its primary markets, including the Philippines, the United States, and the broader Asia-Pacific region. This established presence makes it difficult for newcomers to gain traction.

Building comparable brand recognition and securing widespread, efficient distribution channels would demand substantial capital investment and considerable time for any new competitor attempting to enter Del Monte Pacific's established markets.

The threat of new entrants regarding access to raw materials and supply chains for Del Monte Pacific is moderate. Establishing reliable access to high-quality agricultural inputs like pineapples and other fruits requires significant upfront investment in land, cultivation, and supplier relationships, which can be a barrier. For instance, in 2023, Del Monte Pacific reported its revenue from agriculture and food processing segments, highlighting the capital-intensive nature of securing these raw materials.

Regulatory Hurdles and Food Safety Standards

The food and beverage sector, including companies like Del Monte Pacific, faces significant barriers to entry due to rigorous regulatory requirements. These include strict food safety standards, detailed labeling laws, and comprehensive quality control measures that new companies must meticulously adhere to.

Navigating this complex web of regulations is not only costly but also incredibly time-consuming. For instance, obtaining necessary certifications and ensuring compliance with varying international food laws can demand substantial investment in research, legal counsel, and operational adjustments, effectively deterring potential new competitors.

- Significant Capital Investment: New entrants need to invest heavily in facilities, equipment, and processes that meet stringent food safety and quality standards, such as HACCP or ISO certifications.

- Complex Compliance Landscape: Adhering to diverse national and international regulations for ingredients, processing, packaging, and labeling requires specialized expertise and ongoing monitoring.

- Brand Reputation and Trust: Established players like Del Monte Pacific benefit from decades of building consumer trust in their product safety and quality, a reputation that new entrants struggle to replicate quickly.

- Supply Chain Scrutiny: Regulators closely examine the entire food supply chain, from sourcing raw materials to final distribution, adding another layer of complexity and cost for newcomers.

Retaliation by Incumbents

Established players like Del Monte Pacific can strongly retaliate against new entrants. They possess significant market power and financial muscle, allowing them to deploy aggressive pricing, boost marketing spend, or accelerate product development. For instance, in 2024, Del Monte Pacific reported robust revenue growth, indicating their capacity to absorb short-term margin pressures from competitive responses.

This retaliation makes it exceedingly difficult for newcomers to establish a market presence. New entrants face the daunting task of competing against well-entrenched brands with loyal customer bases and extensive distribution networks. The threat of incumbents using their scale to undercut prices or flood the market with promotions can quickly erode a new competitor's profitability and market share.

- Incumbent Retaliation: Established firms can engage in price wars, increased advertising, or product differentiation to deter new entrants.

- Financial Strength: Companies like Del Monte Pacific have the financial resources to sustain aggressive competitive tactics.

- Market Power: Existing market share and brand loyalty provide incumbents with significant advantages against newcomers.

- Barriers to Entry: Incumbent reactions create substantial barriers, making it costly and risky for new companies to enter and survive.

The threat of new entrants in the branded food and beverage sector, particularly for a global player like Del Monte Pacific, is generally considered moderate to high. Significant capital is required for manufacturing, distribution, and marketing, with new global operations potentially costing hundreds of millions of dollars.

New entrants must also navigate complex regulatory environments, including stringent food safety standards and labeling laws, which demand substantial investment and time for compliance. For instance, obtaining necessary certifications can be a costly and lengthy process.

Established brands like Del Monte Pacific benefit from strong brand loyalty and extensive distribution networks, making it challenging for newcomers to gain market share. Building comparable brand recognition and securing efficient distribution channels would require considerable time and capital investment.

Incumbents can also retaliate aggressively through price wars or increased marketing, leveraging their financial strength. Del Monte Pacific's reported revenue growth in 2024 indicates its capacity to absorb such competitive pressures.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Del Monte Pacific leverages a comprehensive dataset including Del Monte Pacific's annual reports and SEC filings, alongside industry-specific market research from firms like Euromonitor and IBISWorld. We also incorporate macroeconomic data from sources such as the World Bank and government agricultural statistics to provide a robust understanding of the competitive landscape.