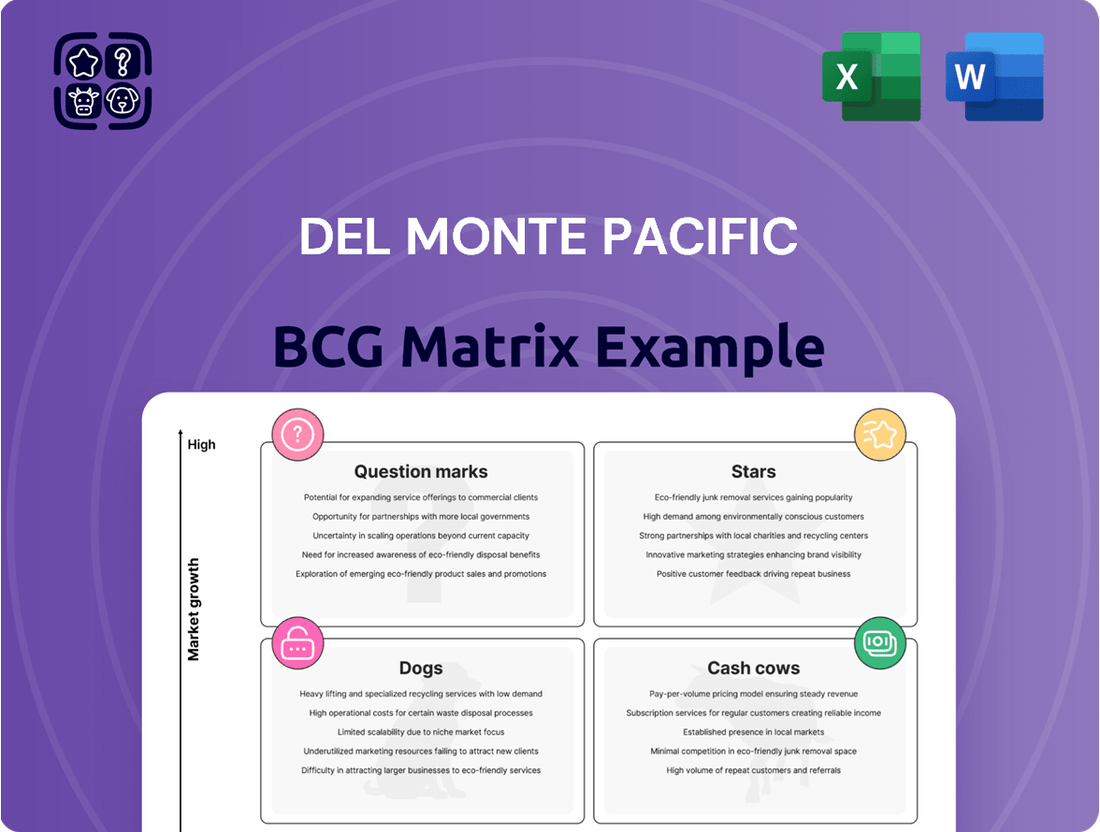

Del Monte Pacific Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Del Monte Pacific Bundle

Del Monte Pacific's product portfolio is a dynamic landscape, with some brands likely shining as Stars and others potentially needing a strategic refresh. Understanding their position within the BCG Matrix is crucial for informed decision-making.

This preview offers a glimpse into Del Monte Pacific's market standing. Purchase the full BCG Matrix report to unlock detailed quadrant placements, identify key growth drivers and resource drains, and gain actionable insights to optimize your investment strategy.

Don't miss out on the complete strategic picture. Get the full Del Monte Pacific BCG Matrix today and equip yourself with the knowledge to navigate market complexities and drive superior business performance.

Stars

Del Monte Pacific's S&W Deluxe fresh pineapple exports are firmly positioned as a Star in its Business Portfolio. These premium pineapples are experiencing robust growth, particularly in rapidly expanding North Asian markets such as China, South Korea, and Japan. The company has seen substantial increases in both volume and market share for this product line, reflecting strong consumer demand for high-quality fresh produce.

Del Monte Philippines' Ready-to-Drink (RTD) juice line, featuring 100% Pineapple Juice, Fruity Zing, and Fit 'n Right Green Apple, is a strong performer in the rapidly expanding Philippine RTD juice market. These products are not only bolstering Del Monte's market share but are also key contributors to incremental sales growth.

Joyba Bubble Tea in the US is a rising star within Del Monte Pacific's portfolio. This innovative beverage has seen significant expansion, with Del Monte Foods, Inc. (DMFI) broadening its nationwide distribution. This rapid market penetration underscores Joyba's strong growth trajectory.

The increasing sales figures for Joyba Bubble Tea solidify its position as a Star in the BCG Matrix. Continued investment is crucial to capitalize on this momentum and secure a larger share of the burgeoning bubble tea market. For instance, the US ready-to-drink tea market alone was valued at approximately $8.7 billion in 2023 and is projected to grow, providing a fertile ground for Joyba's expansion.

Del Monte Philippines Packaged Mixed Fruits (Today's Mixed Fruits)

Del Monte Philippines' Packaged Mixed Fruits, specifically brands like Today's Mixed Fruits, is a standout Star in the company's BCG Matrix. The Philippine market for packaged mixed fruits is experiencing robust growth, and Del Monte has successfully captured and expanded its share within this expanding segment. This strong performance is driven by consistent consumer demand and effective marketing strategies.

The brand's position as a Star is further solidified by its ability to leverage the growing market. Del Monte's strategic promotions have been instrumental in maintaining and increasing its market leadership. This indicates a healthy product with significant potential for continued investment and growth.

- Market Share: Del Monte holds a significant and growing market share in the Philippine packaged mixed fruits category.

- Market Growth: The category itself is demonstrating a positive growth trajectory, indicating strong consumer demand.

- Strategic Position: The brand benefits from strategic promotional activities that reinforce its leading position.

- Investment Potential: As a Star, Del Monte's mixed fruits are well-positioned for continued investment to sustain and enhance its market dominance.

Del Monte Foodservice and E-commerce Channels (US)

Del Monte's foodservice and e-commerce channels in the US have emerged as significant growth drivers, demonstrating the most robust expansion in recent quarters for Del Monte Foods, Inc. (DMFI). These channels are pivotal for broadening product reach and boosting sales.

While these avenues offer substantial growth potential, their precise market share within these often fragmented segments is still evolving. Continued strategic investment is essential to fully capitalize on the high growth trajectory observed in these areas.

- E-commerce Growth: Del Monte's online sales have experienced a notable uplift, reflecting broader consumer trends towards digital purchasing.

- Foodservice Expansion: The foodservice sector, encompassing restaurants and institutions, has also contributed significantly to DMFI's recent revenue gains.

- Strategic Focus: Del Monte Pacific is prioritizing these channels to capture emerging market opportunities and diversify its distribution network.

Del Monte's S&W Deluxe fresh pineapple exports are a prime example of a Star, showing high growth in markets like China and South Korea. The Philippine RTD juice line, including 100% Pineapple Juice, also shines as a Star due to strong sales and market share gains in a growing segment. Joyba Bubble Tea in the US is another Star, rapidly expanding its distribution nationwide, capitalizing on the booming ready-to-drink tea market, which was valued at approximately $8.7 billion in 2023.

Del Monte Philippines' Packaged Mixed Fruits, like Today's Mixed Fruits, are also Stars, benefiting from robust market growth and strategic promotions that solidify their leadership. Furthermore, Del Monte's US foodservice and e-commerce channels are emerging Stars, demonstrating significant recent expansion and representing key growth drivers for Del Monte Foods, Inc. (DMFI).

| Product/Channel | Market Growth | Market Share | Key Markets | Status |

|---|---|---|---|---|

| S&W Deluxe Fresh Pineapple | High | Growing | China, South Korea, Japan | Star |

| Philippine RTD Juice | High | Growing | Philippines | Star |

| Joyba Bubble Tea (US) | High | Expanding | USA | Star |

| Packaged Mixed Fruits (PH) | High | Significant & Growing | Philippines | Star |

| US Foodservice & E-commerce | High | Evolving | USA | Star |

What is included in the product

This BCG Matrix analysis categorizes Del Monte Pacific's product portfolio into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations on investment, holding, or divestment for each business unit.

A clear Del Monte Pacific BCG Matrix provides instant clarity on portfolio performance, alleviating the pain of strategic uncertainty.

Cash Cows

Del Monte Philippines' packaged pineapple segment is a classic Cash Cow within Del Monte Pacific's business portfolio. The company commands a substantial portion of the Philippine market for canned and packaged pineapple products.

Despite potentially moderate overall category growth, Del Monte's strong brand recognition and effective distribution, especially with its popular multipack stand-up pouches, ensure steady sales volume. This consistent demand translates into reliable cash generation for the company.

Investment in this segment is strategic, focusing on maintaining operational efficiency and defending its leading market position rather than pursuing rapid expansion. For instance, in fiscal year 2024, Del Monte Pacific reported robust performance in its Philippines operations, underscoring the stability of its packaged pineapple business.

Del Monte Philippines Tomato Sauce continues to dominate the Philippine market, even as the overall category experiences a slowdown. Its enduring brand loyalty and consistent sales, bolstered by strategic value offerings and engaging marketing initiatives, translate into robust profit margins and a dependable stream of cash.

This product is a quintessential Cash Cow for Del Monte Pacific, reliably generating the financial resources needed to fuel investments in other business segments. For instance, in 2023, Del Monte Philippines reported a net sales growth of 10% year-on-year for its branded business, with sauces and condiments being a significant contributor.

Del Monte Philippines' Spaghetti Sauce stands as a prime example of a Cash Cow within the company's portfolio. The Philippine spaghetti sauce market saw robust volume growth, and Del Monte consistently held its top position, particularly during the crucial Christmas season. This dominance is fueled by the brand's strong equity and its strategic value pack options, which solidify its high market share and its capacity to generate substantial cash.

Del Monte Philippines Tomato Paste

Del Monte Philippines' Tomato Paste is a classic Cash Cow within the Del Monte Pacific portfolio. The company has solidified its leadership in this segment, with its volume outpacing the broader market's growth.

While facing some pressure from lower-priced regional competitors, Del Monte's commanding market share in tomato paste continues to generate substantial and consistent cash flow. This product line benefits from a mature but still expanding market, making it a reliable source of earnings for the company.

- Dominant Market Share: Del Monte Philippines holds a leading position in the tomato paste category, ensuring strong brand loyalty and consistent demand.

- Volume Growth: The brand's volume expansion outpaces the overall category growth, indicating increasing market penetration and consumer preference.

- Cash Generation: Despite competitive pressures, the product's established presence and market leadership translate into robust cash generation, funding other business ventures.

- Mature Yet Growing Segment: Operating in a mature market that still exhibits growth potential provides a stable yet expanding revenue stream.

Del Monte USA Canned Vegetable Business

Del Monte USA's canned vegetable business is a prime example of a Cash Cow within Del Monte Pacific's portfolio. The company holds a commanding market share in this segment within the United States, a testament to its enduring brand recognition and extensive distribution network.

Despite the broader canned vegetable market potentially being mature or seeing modest declines, Del Monte's established position allows it to consistently generate significant sales and cash flow. This stability is a hallmark of a Cash Cow, where the primary objective is to maintain operations efficiently and capitalize on existing market strength.

- Market Share: Del Monte USA is a leader in the US canned vegetable market.

- Cash Generation: The business consistently produces strong cash flow despite market maturity.

- Strategic Focus: Emphasis is on operational efficiency and leveraging brand dominance.

- Financial Performance: In fiscal year 2023, Del Monte Pacific reported that its US operations, which include the canned vegetable segment, contributed significantly to overall revenue and profitability. While specific segment breakdown for canned vegetables isn't always granularly disclosed, the category remains a stable contributor.

Del Monte Philippines' packaged pineapple segment continues to be a robust Cash Cow, leveraging its dominant market share and strong brand equity. The company's strategic focus on operational efficiency and maintaining its leading position ensures a steady generation of cash, as evidenced by the Philippines operations' strong performance in fiscal year 2024.

The Philippines tomato sauce and spaghetti sauce segments are quintessential Cash Cows, characterized by enduring brand loyalty and consistent sales, even in a slowing market. These segments, contributing significantly to branded business growth, reliably generate substantial cash flow to support other ventures.

Del Monte Philippines' tomato paste business solidifies its Cash Cow status with market-leading volume growth and a commanding share. Despite competitive pressures, its established presence in a mature yet expanding market provides a dependable source of earnings.

Del Monte USA's canned vegetable business remains a significant Cash Cow, benefiting from a commanding market share and extensive distribution. This segment consistently generates strong cash flow, with US operations contributing notably to overall profitability in fiscal year 2023.

| Business Segment | Market Position | Cash Generation | Strategic Focus |

|---|---|---|---|

| Philippines Packaged Pineapple | Dominant | Steady and Reliable | Maintain Efficiency, Defend Share |

| Philippines Tomato Sauce | Dominant | Robust and Dependable | Maintain Loyalty, Value Offerings |

| Philippines Spaghetti Sauce | Leading | Substantial | Leverage Brand Equity, Value Packs |

| Philippines Tomato Paste | Leading | Substantial and Consistent | Market Penetration, Competitive Pricing |

| USA Canned Vegetables | Commanding | Strong | Operational Efficiency, Brand Dominance |

Preview = Final Product

Del Monte Pacific BCG Matrix

The BCG Matrix analysis of Del Monte Pacific you are currently previewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive document, devoid of watermarks or demo content, offers a clear strategic overview of Del Monte Pacific's product portfolio, ready for your immediate use in business planning and decision-making.

Dogs

Del Monte Foods, Inc. (DMFI), the US arm, faced substantial net losses in fiscal year 2024, a trend anticipated to persist into FY2025. This financial strain is attributed to elevated inventory expenses, inefficient operating costs, and a rise in interest payments, impacting its overall profitability.

The company is actively implementing strategic realignments, including a pivot away from co-pack offerings with lower profit margins and efforts to decrease inventory levels. Furthermore, DMFI is consolidating its manufacturing operations, signaling a move towards greater efficiency and cost reduction in its US business.

These strategic maneuvers highlight DMFI's position as a low-growth, low-profitability segment that consumes resources from the parent company. Consequently, Del Monte Pacific is exploring measures such as asset divestitures and workforce adjustments to mitigate these financial pressures.

Del Monte USA Canned Fruit currently occupies a Dogs position within the Del Monte Pacific BCG Matrix. The U.S. canned fruit market has been struggling, showing declining trends. This challenging environment, coupled with Del Monte's reduced market share due to strategic shifts in trade promotion to improve profitability, has solidified its weak standing.

Despite holding the second-largest market share in the U.S. canned fruit sector, the overall category decline and the erosion of Del Monte's own market share are critical indicators. In 2024, the U.S. canned fruit market continued its downward trajectory, with sales volume decreasing by approximately 3.5% compared to the previous year, according to industry reports. This places the segment in a difficult spot, necessitating a serious evaluation for potential divestiture or a substantial strategic overhaul to reverse its fortunes.

Del Monte USA Fruit Cup Snacks are currently positioned in the Dog quadrant of the BCG Matrix. This segment, much like the broader canned fruit market in the US, is encountering significant headwinds, leading to a contraction in demand.

Del Monte's market share within the fruit cup snacks category has seen a noticeable decline. This erosion of market position is partly attributed to the company's strategic decision to scale back trade promotions, a move that has diminished its competitive edge in a challenging retail environment.

With the US fruit cup snacks market showing signs of stagnation or decline, and Del Monte experiencing a reduction in its market share, this business unit exhibits the classic characteristics of a Dog. Its low growth potential and weak competitive position necessitate careful management and potentially a re-evaluation of its strategic role within the company's portfolio.

Fiesta Fruit Cocktail (Philippines)

Fiesta Fruit Cocktail in the Philippines is currently positioned as a Dog within Del Monte Pacific's product portfolio. Despite the overall growth in the mixed fruits category, this specific product faces challenges in expanding its market share. This indicates a mature or declining market segment for Fiesta Fruit Cocktail, necessitating a strategic review of its future.

The performance of Fiesta Fruit Cocktail reflects a broader market dynamic where consumer preferences or competitive pressures are impacting its growth trajectory. In 2024, the Philippine canned fruit market, while generally stable, has seen shifts in demand towards newer or more innovative offerings, leaving established products like Fiesta Fruit Cocktail struggling to maintain relevance.

- Market Position: Fiesta Fruit Cocktail is identified as a Dog in the Philippine market.

- Growth Challenges: The product is experiencing difficulties in growing its market share within the mixed fruits category.

- Strategic Implication: This Dog status suggests a need for potential divestment, repositioning, or a significant reduction in investment.

- 2024 Context: The Philippine canned fruit sector in 2024 shows a trend where established products may be outpaced by newer entrants or changing consumer tastes.

Traditional Canned Juices (Philippines)

Del Monte Pacific's traditional canned juices in the Philippines are facing significant headwinds. This segment is characterized by declining sales, largely due to increased competition from more affordable ready-to-drink (RTD) PET juices. The shift in consumer preference towards the convenience and lower price point of PET packaging has eroded the market share of canned juices.

This trend places traditional canned juices squarely in the Dog category of the BCG Matrix. The market for this format is either stagnant or shrinking, making it a low-priority investment area for Del Monte Pacific. For instance, while the overall Philippine beverage market saw growth in 2023, the specific segment of traditional canned juices has been contracting.

- Declining Market Share: Increased competition from lower-priced PET alternatives has directly impacted the market share of traditional canned juices.

- Low Growth/Declining Sales: The segment is experiencing a downward trend in sales volume and value.

- Strategic Challenge: Del Monte Pacific must decide whether to divest, harvest, or attempt a turnaround for this underperforming product line.

Del Monte USA Canned Fruit and Fruit Cup Snacks are firmly in the Dog quadrant, reflecting a struggling US market with declining sales. Despite holding significant market share, the overall category shrinkage and Del Monte's own market share erosion, partly due to reduced trade promotions, solidify this position. For instance, the US canned fruit market saw about a 3.5% volume decrease in 2024, underscoring the challenges.

Fiesta Fruit Cocktail in the Philippines and Del Monte's traditional canned juices also fall into the Dog category. Fiesta Fruit Cocktail faces competition and shifting consumer tastes in a stable but evolving market. Traditional canned juices are losing ground to more affordable PET alternatives, with the segment contracting even as the broader Philippine beverage market grew in 2023.

| Product Segment | BCG Quadrant | Key Challenges | 2024/Recent Data Insight |

|---|---|---|---|

| Del Monte USA Canned Fruit | Dog | Category decline, reduced market share | US canned fruit market volume down ~3.5% in 2024 |

| Del Monte USA Fruit Cup Snacks | Dog | Market stagnation/decline, reduced market share | Impacted by scaled-back trade promotions |

| Fiesta Fruit Cocktail (Philippines) | Dog | Competition, changing consumer preferences | Philippine canned fruit market sees shifts towards newer offerings |

| Del Monte Traditional Canned Juices (Philippines) | Dog | Competition from PET juices, declining sales | PET juice growth outpaces canned juice contraction |

Question Marks

Del Monte Foods, Inc. (DMFI) is strategically introducing new spicy canned vegetable products, including Mexican Style Street Corn and Southern Style Whole Green Beans. These innovative offerings are gaining traction with key customers and expanding their retail presence. This move directly addresses the increasing consumer appetite for ethnic and globally inspired flavors, signaling a promising, high-growth segment within the canned vegetable market.

Despite their positive initial reception and alignment with market trends, these new spicy products currently represent a low market share. As such, they are categorized as Question Marks in the BCG matrix. Significant investment will be necessary to nurture these products and propel them towards becoming Stars, capitalizing on the burgeoning demand for spicy and international taste profiles in the US market.

Del Monte Bubble Fruit Gels, a recent introduction by Del Monte Foods, Inc. (DMFI), is actively working to establish its distribution network in the US market. This product appears to be aiming for a younger audience and taps into the increasing popularity of fruit snacks offering unique textures.

Given its novelty, Del Monte Bubble Fruit Gels likely holds a small market share currently but possesses significant growth potential within the dynamic snack sector. This places it squarely in the Question Mark category of the BCG matrix, signifying its potential to become a star if market acceptance and distribution continue to expand.

Del Monte Heart Smart with Reducol in the Philippines is positioned as a Question Mark within the BCG Matrix. This functional beverage taps into the burgeoning consumer demand for health and wellness products, offering a clinically proven benefit of lowering cholesterol.

The company's strategy to build awareness for Heart Smart with Reducol highlights its potential. However, its current market penetration and share are likely modest, reflecting its status as a product with high growth prospects but not yet established market dominance.

S&W Salted Egg Cookies (Hong Kong & Macau)

The S&W Salted Egg Cookies, launched in Hong Kong and Macau in January 2025, mark Del Monte Pacific's strategic move into the premium snack category, aiming to leverage the S&W brand equity in a novel product offering. This product is positioned as a Question Mark within the BCG matrix due to its recent introduction into a potentially high-growth, yet unproven, market segment.

The salted egg flavor profile has seen significant traction in Asian snack markets, with a projected compound annual growth rate (CAGR) of 8.5% for the savory snack segment in the Asia-Pacific region through 2027, indicating substantial potential for S&W Salted Egg Cookies. However, as a new entrant, its current market share is negligible, necessitating significant investment to capture consumer attention and build brand loyalty in a competitive landscape.

- Brand Extension: S&W Salted Egg Cookies represent a diversification of the S&W brand beyond its core fruit and culinary products, entering the lucrative snack market.

- Market Entry: The product's debut in January 2025 in Hong Kong and Macau signifies a new venture into an emerging consumer trend for premium, uniquely flavored snacks.

- Growth Potential: The snack market in these regions shows robust growth, with the premium segment expected to expand, offering high potential for the cookies if market acceptance is achieved.

- Investment Needs: As a Question Mark, the product requires substantial marketing and distribution investment to establish a foothold and convert potential into market share, with initial sales figures yet to be fully assessed.

Del Monte Zero® Pineapple

Del Monte Zero® Pineapple represents a strategic move by Del Monte Pacific, positioning itself within the growing demand for sustainable and health-conscious food options. This product is classified as a Question Mark in the BCG Matrix due to its current low market share within the overall pineapple category, despite its innovative carbon-neutral approach.

The company's investment in Del Monte Zero® Pineapple is driven by significant market trends. For instance, a 2024 Nielsen report indicated that 73% of global consumers are willing to change their consumption habits to reduce their environmental impact. This aligns perfectly with the premium positioning of Del Monte Zero® Pineapple, targeting a segment of consumers who prioritize environmental responsibility.

- Sustainability Focus: Del Monte Zero® Pineapple is carbon-neutral, appealing to the 60% of consumers who, according to a 2024 Deloitte survey, actively seek out sustainable brands.

- Niche Market Appeal: While not yet a dominant player, its premium health and eco-friendly attributes cater to a growing niche, suggesting potential for future market penetration.

- High Growth Potential: The increasing consumer consciousness around environmental impact and health provides a strong foundation for this product to evolve from a Question Mark into a Star with strategic marketing and distribution efforts.

Question Marks in Del Monte Pacific's portfolio represent products with low market share but high growth potential, requiring careful strategic consideration. These are typically new product launches or those entering emerging markets where significant investment is needed to gain traction and potentially become future Stars. The company must decide whether to invest heavily to increase market share or divest if the potential is not realized.

Del Monte Foods' spicy canned vegetables and Bubble Fruit Gels are prime examples of Question Marks, tapping into evolving consumer tastes for ethnic flavors and unique snack textures respectively. Similarly, Del Monte Heart Smart with Reducol in the Philippines targets the growing health and wellness trend, while S&W Salted Egg Cookies in Asia aim for the premium snack segment. Del Monte Zero® Pineapple, with its carbon-neutral focus, appeals to environmentally conscious consumers, all needing strategic support to grow.

| Product | Market Share | Market Growth | BCG Category | Strategic Implication |

| Spicy Canned Vegetables | Low | High | Question Mark | Invest for growth, capitalize on flavor trends. |

| Bubble Fruit Gels | Low | High | Question Mark | Build distribution, target younger consumers. |

| Heart Smart with Reducol (PH) | Low | High | Question Mark | Increase awareness for health benefits. |

| S&W Salted Egg Cookies (HK/Macau) | Negligible | High (Savory Snacks Asia-Pacific) | Question Mark | Significant marketing investment needed. |

| Del Monte Zero® Pineapple | Low | High (Sustainability focus) | Question Mark | Leverage eco-conscious consumer demand. |

BCG Matrix Data Sources

Our Del Monte Pacific BCG Matrix leverages comprehensive data from annual reports, market share analyses, and consumer trend research to accurately position each product category.