Dell Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Technologies Bundle

A Porter's Five Forces analysis of Dell Technologies reveals a complex competitive landscape. The threat of new entrants is moderate, given the capital intensity and established brand loyalty in the tech sector. Buyer power, particularly from large enterprise clients, is significant, influencing pricing and customization.

The bargaining power of suppliers is also a key consideration, especially for critical components like semiconductors. Substitute products, such as cloud-based services and custom-built solutions, present a constant challenge to Dell's traditional hardware offerings.

Rivalry among existing competitors is intense, with major players like HP and Lenovo vying for market share through innovation and aggressive pricing. Understanding these dynamics is crucial for any stakeholder in the IT industry.

The complete report reveals the real forces shaping Dell Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dell Technologies faces a significant bargaining power of suppliers due to the high concentration of key component providers. For instance, critical semiconductors often come from a small group of manufacturers like Intel and AMD, granting them considerable influence over pricing and supply terms, particularly for advanced or specialized chips.

This reliance on a few dominant suppliers means Dell has less room to negotiate favorable conditions. The leverage held by these component makers can directly impact Dell's cost of goods sold and its ability to secure necessary inventory, especially during periods of high demand or supply chain disruptions.

Recognizing this vulnerability, Dell has been actively pursuing strategies to diversify its supplier base. A notable move includes efforts to shift chip production away from China, with plans to have such manufacturing located elsewhere by 2024, aiming to reduce dependence on any single region or supplier group.

High switching costs for certain components significantly bolster supplier bargaining power. For Dell Technologies, replacing a key component supplier isn't a simple swap; it often necessitates extensive product redesigns, rigorous re-certifications, and a complete overhaul of supply chain logistics.

This complexity grants considerable leverage to suppliers providing proprietary or deeply integrated technologies. The substantial investment in time and resources, often ranging from 12 to 18 months to implement component substitutions, underscores the difficulty and expense involved in changing suppliers, thereby strengthening the hand of existing providers.

If a supplier can realistically enter Dell's market and offer integrated solutions, their bargaining power significantly increases. This potential for forward integration, while less common for highly specialized components in the tech industry, means suppliers could directly challenge Dell in certain product segments or service offerings.

Dell's substantial market share and purchasing volume, exceeding $88 billion in revenue for fiscal year 2024, generally allows it to negotiate favorable terms and maintain robust relationships, mitigating some supplier leverage. However, for critical or unique components, a supplier's ability to consider forward integration remains a potent threat.

Importance of the component to Dell's product differentiation

For cutting-edge products like AI servers, where performance heavily depends on advanced GPUs, suppliers like Nvidia hold significant bargaining power. Dell's strategic partnerships, such as with Nvidia for its AI Factory, are vital for securing both supply and technological leadership in this rapidly evolving market.

The importance of these components to Dell's product differentiation is immense; without access to top-tier GPUs, Dell would struggle to offer the high-performance solutions demanded by its enterprise and AI-focused clientele.

- Nvidia's Dominance: Nvidia held an estimated 80% market share in discrete GPUs for data centers as of early 2024, giving it considerable leverage over buyers like Dell.

- AI Server Demand: The global AI server market was projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 30% from 2023 to 2030, increasing demand for critical components.

- Strategic Partnerships: Dell's collaboration with Nvidia is a prime example of how companies attempt to mitigate supplier power through deep integration and co-development.

Global supply chain disruptions and geopolitical factors

Global supply chain disruptions and geopolitical tensions, such as the ongoing US-China tech trade dynamics, continue to exert pressure on component availability and pricing. This environment inherently strengthens the bargaining power of suppliers, as they can leverage limited supply to command higher costs for essential parts. For instance, the semiconductor shortage that extended into 2023 significantly impacted the tech industry, forcing companies like Dell to pay premium prices for critical components.

Dell Technologies has been actively working to mitigate these risks by implementing strategies focused on supply chain resilience. This includes diversifying its manufacturing and assembly operations beyond traditional hubs, a move that aims to reduce reliance on single geographic regions and minimize exposure to geopolitical instability. This proactive approach allows Dell to better navigate the fluctuating costs and availability dictated by powerful suppliers.

- Increased Component Costs: Ongoing supply chain issues mean suppliers can charge more for semiconductors and other critical parts, directly impacting Dell's cost of goods sold.

- Geopolitical Leverage: Trade disputes and tariffs can restrict supply from certain regions, giving suppliers in unaffected or favored areas greater pricing power.

- Diversification Efforts: Dell's investment in supply chain resilience, including exploring alternative sourcing and manufacturing locations, is a direct response to enhance its negotiating position against suppliers.

- Supplier Consolidation: In certain specialized component markets, a limited number of suppliers can dominate, consolidating their bargaining power and ability to dictate terms.

Dell Technologies faces considerable bargaining power from its suppliers, particularly for critical components like advanced semiconductors. This is amplified by the concentration of key manufacturers, such as Intel and AMD, in the CPU market, and Nvidia's dominance in AI-accelerating GPUs. For example, Nvidia held approximately 80% of the discrete GPU market for data centers in early 2024, a position that grants them significant pricing and supply leverage.

The high costs and complexity associated with switching suppliers, often requiring 12-18 months for redesign and recertification, further solidify supplier influence. While Dell's substantial revenue, exceeding $88 billion in fiscal year 2024, provides some negotiating strength, it's often insufficient for unique or cutting-edge components where suppliers can exert considerable power.

Geopolitical tensions and supply chain disruptions, exacerbated by events like the ongoing US-China tech trade dynamics, have further empowered suppliers by limiting availability and driving up prices, as seen with semiconductor shortages extending into 2023.

| Component Category | Key Suppliers | Estimated Supplier Market Share (Early 2024) | Impact on Dell |

|---|---|---|---|

| CPUs | Intel, AMD | High concentration, specific shares vary by segment | Pricing and supply terms for core processing units |

| Data Center GPUs (AI) | Nvidia | ~80% | Critical for AI server performance and availability; high leverage |

| Memory (RAM/SSD) | Samsung, SK Hynix, Micron | Oligopolistic market structure | Influences cost of goods sold, inventory levels |

What is included in the product

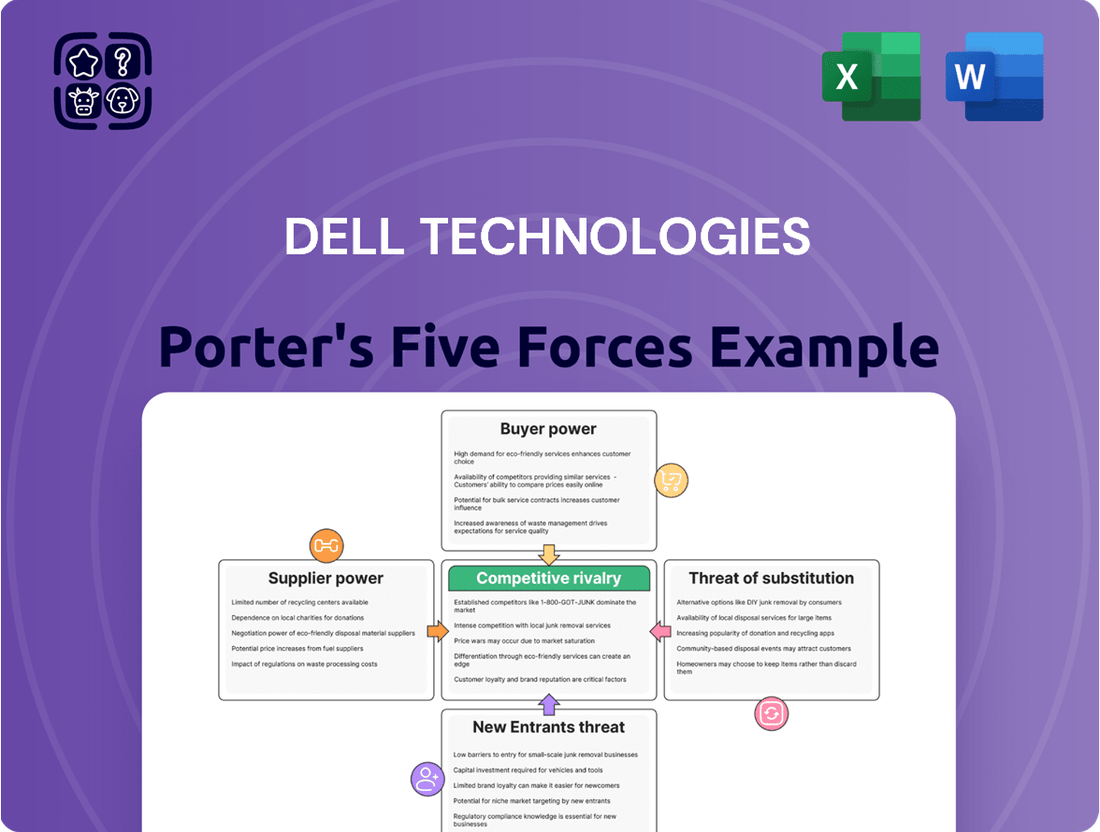

This analysis dissects the competitive forces impacting Dell Technologies, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position and profitability.

Instantly identify competitive pressures with a visually intuitive breakdown of each force—streamlining strategic analysis for Dell Technologies.

Customers Bargaining Power

Dell's diverse customer base, ranging from individual consumers to large enterprises and public sector organizations, significantly influences its bargaining power. For instance, in 2024, Dell's consumer and small business segments often exhibit a high degree of price sensitivity, actively seeking competitive deals and discounts, which can exert downward pressure on pricing.

Conversely, large enterprise clients, while still mindful of cost, frequently place greater emphasis on factors such as product reliability, extensive customization options, and robust support services. This segment's willingness to pay a premium for these value-added attributes can temper their price-bargaining power, providing Dell with more flexibility in its pricing strategies.

Customers seeking client solutions, like laptops and desktops, have a wealth of options available from major players such as HP, Lenovo, and Apple. Similarly, businesses looking for IT infrastructure, including servers and storage, can choose from numerous providers beyond Dell. This vast selection significantly amplifies customer bargaining power, compelling Dell to continuously offer competitive pricing, innovative features, and superior service to retain its market share.

Dell's direct sales model is a significant advantage, allowing it to directly engage with customers and gather valuable insights. This direct connection fosters strong relationships, enabling Dell to understand customer needs intimately.

By collecting extensive customer data, Dell can meticulously tailor its product offerings and develop customized solutions. This personalization enhances customer satisfaction and loyalty, making them less inclined to switch to competitors purely on price considerations.

In 2023, Dell reported that its direct sales model contributed to a significant portion of its revenue, underscoring its effectiveness in building customer loyalty and reducing price sensitivity.

Large enterprise customers have significant volume-based leverage

Large enterprise customers wield considerable influence due to their substantial purchasing volumes. This allows them to negotiate favorable terms, including significant volume discounts, extended payment schedules, and tailored support packages. Dell Technologies actively acknowledges this leverage by offering tiered pricing and volume-based incentives to its enterprise clientele.

For instance, in fiscal year 2024, Dell reported that its commercial segment, which largely comprises enterprise clients, accounted for a significant portion of its total revenue, underscoring the importance of these relationships. The ability of these large buyers to commit to high-volume purchases directly impacts Dell's revenue streams and market share, thereby enhancing their bargaining power.

- Volume Discounts: Enterprises can secure lower per-unit costs for hardware, software, and services through large-scale orders.

- Customized Agreements: Negotiating specific service level agreements (SLAs) and support structures to meet unique operational needs.

- Extended Payment Terms: Influencing cash flow by securing longer periods to remit payments for substantial purchases.

- Demand Shaping: Large orders can influence Dell's product development roadmaps and feature prioritization.

Growing adoption of 'as-a-service' and subscription models

The growing adoption of as-a-service and subscription models, exemplified by Dell APEX, fundamentally alters customer relationships. Instead of discrete transactions, Dell engages in ongoing service provision, which can shift the balance of power. While longer-term commitments might seem to reduce customer leverage, the inherent flexibility and potential ease of switching providers in a subscription landscape can empower customers if contract terms are not sufficiently lock-in. This evolving model means Dell must continually demonstrate value to retain its customer base.

- Dell APEX adoption: Dell Technologies is actively pushing its APEX portfolio, which offers IT infrastructure and services on a consumption basis. This shift caters to a market increasingly favoring operational expenditure (OpEx) over capital expenditure (CapEx).

- Subscription benefits: For customers, these models offer scalability, predictable costs, and access to the latest technology without large upfront investments. This can increase their willingness to explore alternatives if pricing or service levels are not competitive.

- Switching costs: The bargaining power is influenced by the switching costs associated with migrating data and applications from one as-a-service provider to another. Lower switching costs tend to give customers more leverage.

- Contractual flexibility: The terms within subscription contracts, such as termination clauses and service level agreements (SLAs), play a crucial role in determining customer bargaining power. Flexible contracts empower customers more than rigid, long-term commitments.

Customers wield significant bargaining power in the IT hardware and services market due to the availability of numerous alternatives. This forces Dell to remain competitive on pricing and innovation. For instance, in 2024, the intense competition among PC manufacturers like HP, Lenovo, and Apple means consumers can easily compare specifications and prices, driving down margins for all players.

Large enterprise customers, in particular, leverage their substantial purchasing volumes to negotiate favorable terms, including volume discounts and customized support agreements. In fiscal year 2024, Dell's commercial segment, comprising these large clients, was a key revenue driver, highlighting their influence. The shift towards as-a-service models, like Dell APEX, also impacts this power, as flexibility and ease of switching can empower customers if contracts are not sufficiently restrictive.

| Customer Segment | Bargaining Power Factors | Impact on Dell |

|---|---|---|

| Individual Consumers & SMBs | Price sensitivity, availability of alternatives | Downward pressure on pricing, need for competitive offerings |

| Large Enterprises | High purchase volume, need for reliability & customization | Negotiation leverage for discounts, tailored SLAs, influencing product roadmaps |

| As-a-Service Clients | Subscription flexibility, switching costs, contract terms | Requires continuous value demonstration, focus on service quality and contract flexibility |

Preview the Actual Deliverable

Dell Technologies Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Dell Technologies, detailing the intensity of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It offers a comprehensive strategic overview of Dell's market landscape. This analysis is professionally written and fully formatted, providing actionable insights into the forces shaping Dell's industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

The PC market is incredibly competitive, with Dell's Client Solutions Group (CSG) going head-to-head with giants like Lenovo, HP, and Apple. This intense rivalry puts constant pressure on pricing and demands a relentless pace of innovation to stay ahead. Dell, while a major player with a substantial market share, operates within a mature industry segment where differentiation is key.

In 2023, the global PC market shipments saw a decline, underscoring the challenging environment. However, Dell maintained its position among the top vendors. For instance, in Q4 2023, Dell was a significant contributor to the overall PC market, demonstrating its ability to compete despite market headwinds.

Dell's Infrastructure Solutions Group (ISG) faces intense competition from established giants like Hewlett Packard Enterprise (HPE) and IBM, alongside the growing influence of cloud hyperscalers such as Amazon Web Services (AWS) and Microsoft Azure. This rivalry spans servers, storage, and networking solutions, with each competitor vying for market share by emphasizing performance, reliability, and scalability.

The battleground is increasingly defined by the ability to support complex hybrid cloud environments and the burgeoning demand for AI-specific workloads. For instance, in Q1 2024, Dell reported ISG revenue of $9.0 billion, showcasing the significant market size and the stakes involved in this competitive landscape.

The pressure from cloud providers is particularly acute, as they offer integrated, highly scalable infrastructure services that can be a compelling alternative to on-premises solutions for many businesses. This dynamic forces traditional hardware vendors like Dell to constantly innovate and offer flexible, integrated solutions to remain competitive.

Customer loyalty can be fluid, making product differentiation and customer service crucial. Factors like price, technological innovation, and the ease of integration into existing IT ecosystems heavily influence purchasing decisions, intensifying the rivalry.

Innovation and technological advancements are crucial battlegrounds for Dell. To stay ahead, Dell is heavily investing in areas like AI-powered PCs and servers, alongside robust multi-cloud solutions. This focus on cutting-edge technology is vital to differentiate itself in a crowded market.

The pace of technological change is relentless, demanding continuous research and development. For instance, the global AI market is projected to reach hundreds of billions of dollars by 2024, a significant growth driver that Dell must tap into. Failing to keep up with rivals and emerging trends in areas like quantum computing or advanced cybersecurity could severely impact Dell's market position.

Global reach and diversified product portfolio

Dell Technologies benefits significantly from its extensive global reach and a highly diversified product portfolio that spans client solutions, infrastructure, and services. This broad offering allows Dell to serve a wide array of customer needs across different industries and geographies, creating a strong competitive moat. Its presence in over 180 countries means it can tap into various markets, buffering against regional economic downturns.

This diversification is a key strength, as it helps to smooth out revenue streams. When one segment, like consumer PCs, experiences a slowdown, strong performance in areas such as enterprise servers or cloud solutions can compensate. For instance, in fiscal year 2024, Dell reported net revenue of $88.4 billion, with its Infrastructure Solutions Group (ISG) seeing revenue grow by 8% year-over-year, showcasing the benefit of its diversified business model.

- Global Presence: Operates in over 180 countries, allowing access to diverse markets and customer bases.

- Diversified Portfolio: Offers solutions across client devices, infrastructure (servers, storage, networking), and services.

- Risk Mitigation: Diversification reduces reliance on any single product category or geographic region, enhancing stability.

- Financial Resilience: Fiscal year 2024 saw $88.4 billion in net revenue, with ISG revenue up 8%, demonstrating the strength of its varied offerings.

Strategic partnerships and ecosystem development

Dell's competitive rivalry is significantly shaped by its strategic partnerships and its focus on ecosystem development. Collaborations with key technology leaders such as Nvidia, Intel, and AMD are absolutely vital. These alliances allow Dell to co-engineer cutting-edge solutions and speed up the introduction of advanced technologies, particularly in the rapidly growing field of artificial intelligence.

These deep-seated partnerships are more than just supply agreements; they are strategic imperatives. They enable Dell to differentiate its product portfolio by integrating the latest innovations from its partners, thereby securing a strong foothold in the dynamic and ever-evolving technology ecosystem. This proactive approach to collaboration is a cornerstone of Dell's strategy to maintain its competitive edge.

- Nvidia Partnership: Dell's integration of Nvidia's AI accelerators and software platforms, like CUDA, into its servers and workstations is a prime example of co-engineering. This allows for optimized performance in AI workloads.

- Intel Collaboration: Dell consistently features Intel's latest processors in its product lines, benefiting from joint development efforts to ensure optimal compatibility and performance for enterprise computing needs.

- AMD Integration: Dell has expanded its use of AMD processors, particularly in its server and workstation offerings, leveraging AMD's growing market share and competitive CPU/GPU technologies.

- Ecosystem Impact: These partnerships foster a robust ecosystem around Dell's hardware, encouraging third-party software and solution providers to build and optimize their offerings for Dell platforms.

Dell faces intense competition across its business segments, particularly from established tech giants and emerging cloud providers. In the PC market, rivals like Lenovo and HP constantly vie for market share, pushing Dell to innovate rapidly. Similarly, its infrastructure solutions group competes fiercely with companies such as HPE and IBM, as well as cloud giants like AWS and Microsoft Azure, who offer compelling alternative infrastructure services. This dynamic environment necessitates continuous investment in R&D and strategic partnerships to maintain a competitive edge, especially as the demand for AI-specific solutions escalates.

| Competitor | Key Market Segment | Dell's Competitive Action |

| Lenovo | PCs, Servers | Focus on AI-powered PCs, hybrid cloud solutions |

| HP Inc. | PCs | Emphasis on innovation and differentiated product features |

| Hewlett Packard Enterprise (HPE) | Servers, Storage, Networking | Strengthening hybrid cloud and edge computing offerings |

| IBM | Servers, Software, Services | Leveraging AI and hybrid cloud capabilities |

| Amazon Web Services (AWS) | Cloud Infrastructure | Offering scalable, integrated cloud solutions as an alternative |

| Microsoft Azure | Cloud Infrastructure | Providing comprehensive cloud services and hybrid solutions |

SSubstitutes Threaten

The increasing adoption of public and hybrid cloud solutions, encompassing Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS), presents a significant threat of substitution for Dell's traditional on-premises hardware and software offerings. This shift means that businesses can increasingly access computing power and software without purchasing and maintaining their own physical infrastructure, directly impacting Dell's core business model.

Enterprises are demonstrably reallocating their IT budgets towards these flexible and scalable cloud services. For instance, a significant portion of IT spending in 2024 is directed towards cloud adoption, with many organizations prioritizing cloud migration. This trend directly erodes the demand for Dell's on-premises servers, storage, and networking equipment as companies opt for subscription-based cloud alternatives.

The as-a-service model, in particular, offers advantages like reduced upfront capital expenditure and greater agility, making it an attractive substitute for businesses that previously relied on Dell's hardware. This competitive pressure from cloud providers compels Dell to adapt its strategy to include cloud-centric solutions and services to remain relevant.

The rise of software-defined infrastructure (SDI) and virtualization presents a significant threat of substitutes for Dell's traditional hardware offerings. These technologies allow for the abstraction and pooling of IT resources, meaning functionality previously tied to specific physical hardware can now be delivered through software. This can lead to lower capital expenditure for customers, as they may not need to purchase as much dedicated hardware.

For instance, advancements in software-defined networking (SDN) and software-defined storage (SDS) enable greater flexibility and automation, often at a lower cost point than proprietary hardware solutions. Virtualization technologies further consolidate workloads onto fewer physical servers, directly impacting the demand for individual server units. This shift means customers can achieve greater agility and efficiency without necessarily buying more physical infrastructure from traditional vendors.

Dell Technologies is actively addressing this substitution threat with its APEX portfolio, which offers as-a-service solutions. APEX aims to provide the benefits of cloud-like consumption models for infrastructure, including hardware, while abstracting away much of the underlying complexity. This strategy allows Dell to compete by offering flexible, consumption-based services rather than just selling physical hardware, thereby mitigating the impact of software-defined and virtualized substitutes.

The proliferation of strong open-source software and hardware designs presents a significant threat of substitution for Dell. These alternatives often come at a much lower cost, making them particularly attractive to small businesses and for niche applications where specialized, proprietary solutions are not strictly necessary. For instance, Linux distributions continue to gain market share in server environments, directly competing with Dell's Windows-based offerings. This trend can accelerate the commoditization of certain IT infrastructure components, forcing Dell to contend with heightened price sensitivity among its customer base.

Refurbished or used IT equipment market

The burgeoning market for refurbished and used IT equipment poses a significant threat of substitutes for Dell Technologies. This segment is fueled by both economic pressures and a growing emphasis on environmental sustainability, offering compelling alternatives for budget-conscious consumers and businesses. For instance, the global IT asset disposition market, which includes the resale of used equipment, was valued at approximately $16.5 billion in 2023 and is projected to grow substantially in the coming years. This trend directly impacts Dell's ability to capture sales of new hardware, particularly within its consumer and small-to-medium business (SMB) customer bases, where price sensitivity is often higher.

Dell's direct competition comes from specialized refurbishers and even larger enterprises reselling their retired assets. This market provides lower entry costs for users needing functional technology without the premium associated with brand-new devices. This creates a price ceiling for new Dell products, as customers can opt for a certified refurbished Dell laptop or desktop at a significantly reduced cost. The increasing availability and quality of these secondary market products mean customers perceive them as viable substitutes for purchasing new.

- Growing Refurbished Market: The global market for refurbished electronics, including IT equipment, has seen robust growth, driven by cost-effectiveness and environmental concerns.

- Cost Savings for Consumers/SMBs: Refurbished Dell products offer a substantial price advantage, making them attractive alternatives for individuals and smaller businesses with limited IT budgets.

- Sustainability Drivers: Increased consumer and corporate focus on sustainability encourages the adoption of refurbished equipment as a more environmentally friendly choice.

- Impact on New Sales: The availability of lower-cost refurbished options can divert potential customers away from purchasing new Dell hardware, potentially impacting revenue and market share, especially in price-sensitive segments.

Shift to mobile devices and other computing paradigms

The growing prevalence of smartphones and tablets as primary computing devices presents a significant threat of substitution for Dell's traditional PC business. As consumers and businesses increasingly rely on these mobile platforms for communication, content consumption, and even productivity tasks, the demand for traditional desktops and laptops may diminish. This shift affects Dell's core revenue streams, pushing the company to adapt its product offerings and marketing strategies.

Dell's strategic response involves innovation aimed at making PCs more relevant in this evolving landscape. For instance, the company is focusing on AI-powered PCs, designed to offer enhanced performance, personalized experiences, and greater efficiency. These advancements aim to differentiate Dell's products and cater to changing user expectations, bridging the gap between traditional computing and the convenience offered by mobile devices.

- Mobile Computing Dominance: In 2024, smartphone shipments are projected to exceed 1.2 billion units globally, underscoring their widespread adoption for various computing needs.

- Tablet Market Share: Tablets continue to capture a significant portion of the portable computing market, often serving as a direct substitute for laptops in specific use cases.

- Dell's AI Integration: Dell has been actively promoting its AI-ready PCs, aiming to leverage artificial intelligence to enhance user experience and productivity, thereby competing with the inherent advantages of mobile devices.

- Shifting Consumer Preferences: Consumer surveys in late 2023 and early 2024 indicate a growing preference for integrated ecosystems where mobile devices serve as the central hub for many daily digital activities.

The rise of cloud computing, particularly Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS), directly challenges Dell's traditional on-premises hardware sales. Businesses are increasingly opting for the flexibility and scalability of cloud solutions, which can perform similar functions to Dell's physical servers and storage. For example, IT spending on cloud services is projected to continue its upward trajectory throughout 2024, with many organizations prioritizing cloud migration over on-premises investments.

Software-defined infrastructure (SDI) and virtualization also act as significant substitutes. These technologies abstract IT resources, allowing functionality to be delivered via software rather than dedicated hardware. This can reduce the need for customers to purchase new physical equipment from vendors like Dell. Advancements in areas like software-defined storage (SDS) offer cost-effective and agile alternatives.

The increasing availability and acceptance of refurbished and used IT equipment present another substitution threat. Driven by cost savings and sustainability initiatives, this market provides a lower-cost entry point for essential computing needs. The global IT asset disposition market, encompassing resale, was valued around $16.5 billion in 2023, indicating substantial customer preference for these alternatives.

Furthermore, the growing dominance of smartphones and tablets as primary computing devices poses a threat to Dell's personal computer (PC) business. These mobile platforms are increasingly used for productivity tasks, reducing reliance on traditional laptops and desktops. In 2024, global smartphone shipments are expected to surpass 1.2 billion units, highlighting their pervasive role.

Entrants Threaten

The IT hardware and solutions sector, where Dell Technologies operates, presents substantial barriers to new entrants, primarily due to high capital requirements. Establishing a competitive presence necessitates massive upfront investments in research and development, sophisticated manufacturing facilities, and extensive global distribution and service networks. For instance, companies venturing into this space need to consider the costs associated with advanced semiconductor fabrication, complex supply chain logistics, and the development of cutting-edge technologies.

Dell's established economies of scale provide a significant advantage, making it exceedingly difficult for newcomers to compete on cost. By producing in high volumes, Dell can achieve lower per-unit production costs through bulk purchasing of components and optimized manufacturing processes. In 2023, the global IT hardware market was valued in the hundreds of billions of dollars, indicating the sheer scale of investment required to even gain a foothold. New entrants would struggle to match Dell's existing cost efficiencies, which are built over decades of operation and market presence.

Dell Technologies benefits from significant brand loyalty, especially within the enterprise sector. This deep-seated customer trust, cultivated over years of reliable service and support, creates a substantial barrier for any new competitor aiming to gain market share. For instance, in 2024, Dell continued to see strong renewal rates for its managed services, a testament to these established relationships.

The company's direct sales model further solidifies these bonds. By engaging directly with clients, Dell understands and addresses their specific needs, fostering a customer-centric approach that breeds loyalty. This personalized engagement is challenging for new entrants to replicate, especially without an existing track record and established communication channels.

Dell's intricate global supply chain and distribution networks present a significant barrier to new entrants. Building a system that efficiently sources components, manufactures, handles logistics, and provides after-sales support for IT hardware on a global scale is a monumental undertaking. For instance, in 2023, Dell managed inventory valued at over $8 billion, a testament to the scale of its operations.

Intellectual property and technological barriers

Dell's extensive patent portfolio, encompassing its hardware, software, and intricate manufacturing techniques, acts as a significant intellectual property barrier. This robust protection makes it challenging for new entrants to replicate Dell's offerings without infringing on existing patents. For instance, in 2024, Dell continued to actively file new patents, particularly in areas like AI-accelerated computing and advanced cybersecurity solutions, further solidifying its technological moat.

The relentless speed of technological advancement also presents a formidable hurdle for potential competitors. Keeping pace with Dell's continuous innovation requires substantial investment in research and development, a capital commitment that can be prohibitive for newcomers. This dynamic environment means that emerging companies not only need to match current offerings but also anticipate and develop next-generation technologies to gain traction.

- Dell's patent portfolio protects its product designs, software functionalities, and manufacturing processes.

- Intellectual property barriers deter new entrants by requiring them to navigate or circumvent existing patents.

- Rapid technological innovation necessitates significant R&D investment, raising the cost of entry.

- New patent filings in 2024 focused on AI and cybersecurity, reinforcing Dell's competitive edge.

Regulatory hurdles and compliance costs

The technology sector, including companies like Dell, faces significant regulatory challenges that act as a barrier to new entrants. For instance, evolving data privacy laws like the GDPR and CCPA impose strict requirements on data handling and security, necessitating substantial investment in compliance infrastructure. In 2024, the ongoing global discussions around AI governance and ethical data usage are likely to introduce even more complex compliance frameworks, requiring new players to dedicate resources to understanding and adhering to these mandates before even launching their products.

These regulatory hurdles directly translate into increased operational costs and a longer time-to-market for potential competitors. New entrants must not only develop innovative technology but also ensure it meets stringent cybersecurity standards, environmental regulations concerning electronic waste, and potentially sector-specific certifications. For example, achieving compliance with various international data localization laws can add millions in legal and operational expenses, a cost that established players like Dell have already absorbed over time.

- Data Privacy Regulations: Compliance with laws like GDPR and CCPA requires significant investment in secure data handling practices.

- Cybersecurity Standards: Meeting evolving global cybersecurity mandates is crucial and costly for new technology firms.

- Environmental Compliance: Regulations on e-waste and product lifecycle management add to the operational burden.

- Time-to-Market Delays: Navigating complex regulatory approval processes can significantly extend the launch timeline for new entrants.

The threat of new entrants in the IT hardware and solutions sector, where Dell operates, is generally low. High capital requirements for R&D, manufacturing, and global distribution networks create substantial entry barriers. For instance, building advanced semiconductor fabrication facilities can cost billions of dollars, a cost that is prohibitive for most new companies.

Dell's established economies of scale significantly reduce its per-unit costs, making it difficult for newcomers to compete on price. In 2023, the global IT hardware market reached hundreds of billions, highlighting the scale needed to be competitive. New entrants also face challenges in matching Dell's brand loyalty and direct sales model, which foster strong customer relationships.

Dell's extensive patent portfolio, particularly in areas like AI and cybersecurity, further deters new entrants by protecting its technological innovations. For example, Dell's continued patent filings in 2024 reinforce its competitive technological moat. Navigating complex global regulations, such as data privacy laws, also adds significant compliance costs and time-to-market delays for potential competitors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dell Technologies is built upon a foundation of diverse and credible data sources, including Dell's own annual reports and SEC filings, as well as industry-specific market research reports from firms like Gartner and IDC. We also integrate macroeconomic data and analyst forecasts to provide a comprehensive view of the competitive landscape.