Dell Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Technologies Bundle

Curious about Dell Technologies' strategic product portfolio? This preview offers a glimpse into how their offerings might be categorized within the BCG Matrix – understanding whether they're Stars, Cash Cows, Dogs, or Question Marks is crucial for any investor or strategist.

Don't miss out on the full picture! Purchase the complete Dell Technologies BCG Matrix report to unlock detailed quadrant placements, data-driven insights, and actionable recommendations.

Gain a competitive edge by understanding precisely where Dell's products stand in their respective markets. This comprehensive report is your shortcut to clarity and informed decision-making.

Get instant access to a ready-to-use strategic tool that reveals which of Dell's products are market leaders and where capital should be allocated next.

Invest in strategic clarity and purchase the full BCG Matrix today to empower your planning and drive success.

Stars

Dell's AI-optimized servers, especially the PowerEdge XE series, are firmly positioned as Stars in the BCG Matrix. The market for AI infrastructure is booming, driven by the widespread adoption of generative AI and high-performance computing. Dell has publicly shared that its AI server backlog reached an impressive $2 billion in early 2024, underscoring the immense demand. This segment also saw substantial year-over-year revenue growth, exceeding 40% in the fourth quarter of fiscal year 2024, highlighting their strong market position and rapid expansion.

Dell's NativeEdge platform is a cornerstone of its comprehensive edge computing solutions. This market is booming, with projections indicating significant growth as businesses prioritize localized data processing for immediate insights and operational improvements. By 2024, the global edge computing market was valued at over $17 billion, and it's expected to reach over $60 billion by 2028, demonstrating its rapid expansion. Dell is actively cultivating a robust ecosystem and embedding artificial intelligence into its edge solutions, aiming to secure a substantial portion of this expanding market.

Dell's Precision workstations, particularly those engineered for AI and machine learning, are a strong contender in the high-end commercial segment. These machines are built for demanding tasks like complex AI model training and high-fidelity content creation, areas experiencing significant growth.

The demand for specialized hardware capable of handling AI workloads is rapidly increasing, driven by advancements in artificial intelligence and the need for powerful computing. In 2024, the global AI hardware market, which includes workstations, saw substantial investment and expansion. Dell's strategy to integrate cutting-edge professional GPUs and NPUs positions them well to capture a significant share of this burgeoning market.

Advanced Cybersecurity Services (Managed Detection and Response)

Dell Technologies' advanced cybersecurity services, especially its Managed Detection and Response (MDR) offerings, are firmly positioned as a Star in the BCG Matrix. This segment benefits from a rapidly expanding market, driven by the relentless surge in sophisticated cyber threats such as ransomware. In 2024, the global cybersecurity market was projected to reach over $200 billion, with MDR services being a significant growth driver.

Dell's strategic integration with leading platforms like Microsoft Defender XDR significantly bolsters its capabilities, enabling superior threat detection, rapid response, and efficient recovery for enterprises. This addresses a critical and escalating need within the business landscape, where organizations are increasingly outsourcing their security operations to specialized providers. Dell's commitment to enhancing its cybersecurity portfolio, including its MDR services, is solidifying its competitive edge in this high-growth sector.

- Market Growth: The cybersecurity market, particularly MDR, is experiencing robust expansion due to increasing cyberattack sophistication and frequency.

- Dell's Strengths: Dell's MDR services leverage advanced technologies and integrations, such as with Microsoft Defender XDR, for comprehensive threat management.

- Customer Needs: Enterprises require sophisticated, always-on security solutions to combat evolving threats, a need Dell's MDR directly addresses.

- Competitive Position: Dell is actively strengthening its market position in cybersecurity, recognizing it as a key growth area.

Dell AI Factory Solutions

Dell's AI Factory Solutions are positioned as Stars in the BCG Matrix. This is due to their comprehensive nature, encompassing Dell's robust infrastructure, specialized solutions, and expert services, all meticulously optimized for demanding AI workloads. This strategic offering frequently leverages key partnerships, such as the collaboration with NVIDIA, to deliver cutting-edge capabilities.

The market for integrated AI solutions within enterprises is experiencing explosive growth, and Dell's AI Factory directly addresses this critical demand. For example, in 2024, the global AI market size was projected to reach over $200 billion, with enterprise AI solutions being a significant driver of this expansion.

- Dell's AI Factory integrates hardware, software, and services for AI development.

- Partnerships, like the one with NVIDIA, are key to its AI capabilities.

- The enterprise AI market is experiencing rapid growth, fueling the Star status.

- Dell aims to simplify AI deployment for businesses.

Dell's AI Factory Solutions are firmly positioned as Stars, reflecting their comprehensive approach to AI development. This integrated offering combines robust infrastructure, specialized solutions, and expert services, often enhanced by key partnerships like the one with NVIDIA. The enterprise AI market is experiencing significant expansion, with projections for 2024 placing its global market size at over $200 billion, a substantial portion of which Dell's AI Factory is poised to capture.

| Product/Service | BCG Matrix Category | Key Growth Drivers | Dell's Competitive Advantage |

| AI-Optimized Servers (PowerEdge XE) | Star | Generative AI adoption, HPC demand | $2 billion AI backlog (early 2024), >40% Q4 FY24 revenue growth |

| NativeEdge Platform (Edge Computing) | Star | Localized data processing needs | Ecosystem development, AI integration in edge |

| Precision Workstations (AI/ML) | Star | Demand for AI model training, content creation | Integration of professional GPUs and NPUs |

| Managed Detection and Response (MDR) | Star | Sophisticated cyber threats, outsourcing security | Integration with Microsoft Defender XDR |

| AI Factory Solutions | Star | Demand for integrated enterprise AI | Partnerships (e.g., NVIDIA), comprehensive offering |

What is included in the product

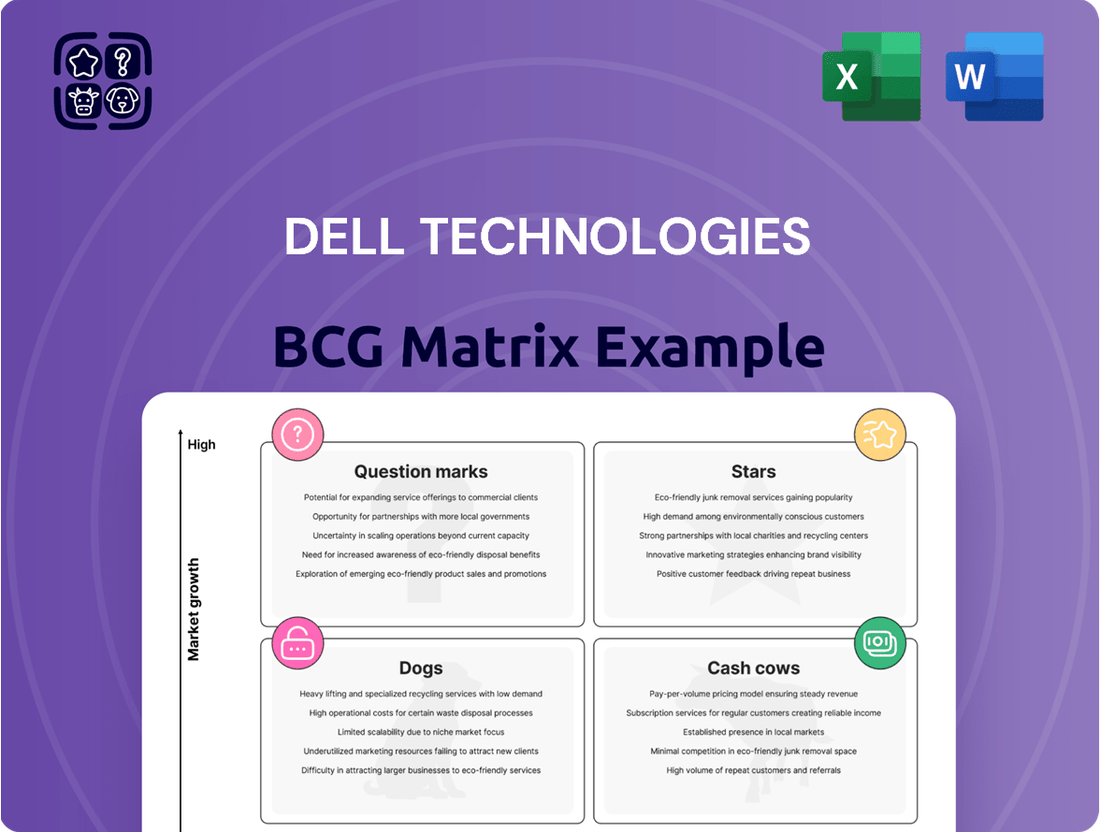

Dell Technologies BCG Matrix analyzes its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

Dell Technologies BCG Matrix offers a clear, visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Dell's Latitude and OptiPlex lines are quintessential cash cows. Despite a mature PC market, Dell consistently holds a significant share in commercial client devices, translating into reliable revenue and profit streams. These business-focused machines are crucial for corporate operations, offering stable cash flow with minimal need for aggressive marketing thanks to strong brand recognition and customer loyalty.

Dell's PowerStore and PowerMax represent the bedrock of its enterprise storage offerings, acting as significant cash cows within the company's portfolio. These solutions command a substantial market share in the well-established data center storage market, a testament to their enduring reliability and performance. For instance, Dell Technologies consistently reports strong revenue contributions from its infrastructure solutions, with enterprise storage being a key component, underpinning its financial stability.

These mature products are instrumental in generating consistent and substantial revenue streams, primarily driven by ongoing sales and lucrative support and maintenance contracts. While the overall market growth for traditional storage might not mirror that of cutting-edge technologies, the sheer volume and the sticky nature of these customer relationships ensure robust profit margins and predictable cash flow for Dell.

Dell's core server and networking hardware, distinct from their AI-focused offerings, firmly sits within the Cash Cow quadrant of the BCG Matrix. These are the workhorses of enterprise data centers, essential for everyday operations and consistently generating substantial revenue for Dell. While the growth trajectory might not match the explosive demand for AI-specific hardware, their market penetration and ongoing demand ensure steady profitability.

Despite the buzz around AI, traditional server and networking solutions remain critical infrastructure for businesses worldwide. Dell's robust market share in this segment, which stood at approximately 16.4% in the global server market during the first quarter of 2024, underscores its position as a reliable revenue generator. This foundational business provides the consistent cash flow needed to invest in newer, high-growth areas.

IT Consulting and Deployment Services

Dell Technologies' IT consulting and deployment services function as a strong Cash Cow within its portfolio. These services capitalize on Dell's comprehensive product offerings and extensive technical know-how, consistently generating substantial, high-margin revenue by supporting enterprise clients. The ongoing reliance of businesses on Dell for critical implementation and integration projects ensures a steady and predictable cash flow from a market that, while mature, remains indispensable.

These services are a significant contributor to Dell's financial stability, reflecting the ongoing demand for expert IT support. For instance, in fiscal year 2024, Dell reported substantial revenue from its Infrastructure Solutions Group (ISG), which includes these services, indicating their continued market relevance and profitability.

- Stable Revenue Streams: The consulting and deployment segments provide predictable income due to long-term enterprise contracts.

- High Profit Margins: Leveraging existing product ecosystems and specialized expertise allows for attractive profit margins.

- Market Maturity: While the market for these services is established, the continuous need for IT modernization and integration sustains demand.

- Customer Reliance: Businesses depend on Dell's end-to-end solutions, solidifying the position of these services as a reliable cash generator.

Dell Financial Services

Dell Financial Services (DFS) operates as a classic Cash Cow within Dell Technologies' BCG Matrix. DFS primarily offers leasing and financing solutions for Dell's extensive range of products and services, a model that has proven highly effective in driving sales across the company's portfolio. This segment plays a crucial role in making Dell's technology more accessible to a wider customer base, thereby fostering customer loyalty and encouraging repeat business. The predictable revenue streams generated by DFS, primarily through interest and lease payments, solidify its position as a stable, low-growth contributor in the mature financial services market.

The strategic importance of DFS is underscored by its ability to act as a sales enabler for Dell's core hardware and software offerings. By removing financial barriers, DFS directly influences purchasing decisions, particularly for businesses and institutions that benefit from predictable payment structures. This financial arm not only smooths out cash flow for customers but also provides Dell with a consistent and reliable income stream, essential for funding research and development into newer, high-growth areas.

- DFS generates consistent revenue through interest and lease payments from customers financing Dell products.

- This segment supports sales across Dell's entire product portfolio, enhancing customer affordability.

- DFS operates in a well-established financial services market, characterized by predictable, low-growth revenue.

- The financial services division contributes to customer loyalty by offering flexible payment solutions.

Dell's Latitude and OptiPlex product lines are prime examples of cash cows. These established commercial PC lines consistently generate steady revenue, benefiting from a mature market and strong brand loyalty, which translates into predictable profitability with minimal need for aggressive marketing spend.

Dell's PowerStore and PowerMax storage solutions are significant cash cows, holding strong positions in the mature data center storage market. Their reliability and performance ensure consistent revenue contributions, a key factor in Dell's overall financial stability.

Core server and networking hardware, excluding AI-specific offerings, are also cash cows for Dell. With a substantial market share, such as approximately 16.4% in the global server market in Q1 2024, these products provide foundational, predictable cash flow essential for investing in growth areas.

Dell's IT consulting and deployment services are strong cash cows, leveraging existing product expertise to generate high-margin revenue. These services are crucial for enterprise clients, ensuring a steady and predictable cash flow from a mature but indispensable market.

Dell Financial Services (DFS) acts as a classic cash cow by providing leasing and financing for Dell products, driving sales and customer loyalty. This segment offers predictable revenue through interest and lease payments in a low-growth, established financial services market.

| Product/Service Category | BCG Matrix Quadrant | Key Characteristics | Supporting Data/Observations (as of mid-2024) |

| Latitude & OptiPlex PCs | Cash Cow | Mature market, strong brand loyalty, consistent revenue generation. | Significant share in commercial client devices, stable profitability. |

| PowerStore & PowerMax Storage | Cash Cow | Established data center storage market, reliable and high-performing. | Substantial market share, consistent revenue contribution to Infrastructure Solutions Group (ISG). |

| Core Servers & Networking Hardware | Cash Cow | Essential enterprise infrastructure, steady profitability. | ~16.4% global server market share (Q1 2024), foundational revenue generator. |

| IT Consulting & Deployment Services | Cash Cow | High-margin, leverages existing product ecosystem, stable demand. | Significant revenue contributor to ISG, driven by ongoing IT modernization needs. |

| Dell Financial Services (DFS) | Cash Cow | Sales enabler, predictable revenue from financing. | Drives sales across portfolio, smooths customer cash flow, consistent income stream. |

What You’re Viewing Is Included

Dell Technologies BCG Matrix

The Dell Technologies BCG Matrix you are previewing is the identical, complete document you will receive immediately after your purchase. Rest assured, this is not a sample or a demo; it's the fully formatted, professionally analyzed report ready for your strategic decision-making. You’ll gain access to the same in-depth insights and actionable data that will empower your business planning.

Dogs

Older consumer PC models, like legacy Inspiron and XPS lines that lack advanced AI features, can be categorized as Dogs in Dell Technologies' BCG Matrix.

The consumer PC market is intensely competitive, often leading to price wars, which further erodes the already lower margins of these aging products. Demand for these devices is generally declining as consumers seek newer technology.

Dell's consumer revenue experienced a notable decline in the fiscal year 2024, with a reported decrease in net revenue for the Consumer segment. This suggests that older product lines, which may not offer the latest innovations, could be consuming resources without generating substantial returns, fitting the profile of a Dog.

Certain niche or discontinued peripheral products, like older monitor models or basic keyboards, often land in the Dogs quadrant of the BCG Matrix. These items typically have a very small slice of the market and operate in markets that aren't growing, or are even shrinking. For instance, sales of CRT monitors, a classic Dog product, plummeted by over 99% by the early 2000s as LCD technology took over.

Products in this category usually contribute minimal profit and can even drain resources. Think about the cost of maintaining inventory for a model that hasn't sold in years or the support calls for obsolete hardware. In 2024, companies are increasingly shedding such products to streamline operations and focus on higher-growth areas, a trend evident in the shrinking accessory segments for many tech giants.

Outdated data protection appliances, such as older versions of Dell's PowerProtect DD series that haven't been upgraded, can be found in the Dogs quadrant of the BCG Matrix. These devices, while functional, are often surpassed by newer, more efficient, and cyber-resilient solutions, leading to lower demand. For instance, while Dell's overall data protection revenue grew significantly, these legacy systems represent a shrinking portion of that growth, potentially requiring more support than they generate in new sales.

Non-Strategic Software Acquisitions (if any, that haven't scaled)

Dell Technologies has historically acquired companies to bolster its software capabilities, but not all have scaled as anticipated. For instance, if Dell acquired a niche data analytics platform in 2022 that struggled to gain significant market share against established giants like Microsoft or SAP by mid-2024, it might be categorized here. Such an acquisition, especially if operating in a low-growth segment with minimal integration into Dell's broader solutions portfolio, could represent a non-strategic asset.

These underperforming software assets can become a drain on resources. For example, if a 2023 acquisition of a cloud management tool showed less than 5% year-over-year revenue growth in its specific market segment by early 2024, and Dell's market share in that niche remained below 3%, it might be a candidate for this category. Continued investment without a clear path to market leadership or significant synergy with Dell's core infrastructure and services business would likely yield diminishing returns.

- Potential Cash Traps: Assets requiring ongoing investment without proportional revenue growth or strategic alignment risk becoming financial burdens.

- Low Market Traction: Acquisitions in niche software markets where Dell has struggled to achieve significant market penetration, perhaps holding less than a 5% market share by Q2 2024.

- Integration Challenges: Software products that have not been effectively integrated into Dell's primary offerings, limiting their ability to leverage the company's broader customer base and sales channels.

- Diminishing Returns: Continued funding for software in low-growth or highly competitive niches where Dell lacks a competitive advantage is unlikely to generate substantial returns on investment.

Generic, Low-Margin Networking Components

Generic, low-margin networking components would likely fall into the Dogs category of the Dell Technologies BCG Matrix. These are products that operate in slow-growing markets and hold a small market share. Think of basic network switches or cables that aren't part of a larger, proprietary ecosystem. The market for these components is often saturated, with many suppliers offering similar products, leading to price wars and thin profit margins. For instance, in 2024, the global Ethernet switch market, while substantial, sees intense competition in the lower-end, generic segments, impacting profitability for vendors not offering specialized or integrated solutions.

- Low Market Share: These components often struggle to gain significant traction against larger, more integrated offerings.

- Limited Growth Potential: The markets for highly commoditized networking parts tend to expand slowly, if at all.

- Intense Competition: Numerous vendors compete on price rather than innovation for these basic items.

- Low Profitability: The combination of high competition and lack of differentiation results in minimal profit contributions.

These are products with low market share in slow-growing industries. Dell's older, less innovative consumer PCs, like certain legacy Inspiron models, fit this description. The intense competition in the PC market, especially for older devices, often leads to price wars, further squeezing already thin margins. Dell's fiscal year 2024 saw a notable decrease in consumer revenue, indicating these aging product lines may be consuming resources without delivering substantial returns.

| Product Category | Market Share | Growth Rate | Profitability | Strategic Fit |

|---|---|---|---|---|

| Legacy Consumer PCs (e.g., older Inspiron) | Low | Declining | Low/Negative | Poor |

| Discontinued Peripherals (e.g., older monitors) | Very Low | Shrinking | Negligible | None |

| Outdated Data Protection Appliances | Shrinking Segment | Low | Below Average | Needs Modernization |

| Underperforming Acquired Software | Low (<5% share) | Low (<5% growth) | Minimal | Questionable |

| Generic Networking Components | Low | Slow | Low | Limited |

Question Marks

Dell's new AI-powered PCs, equipped with Neural Processing Units (NPUs), are positioned to capitalize on the burgeoning AI PC market. This segment is experiencing rapid growth, fueled by expectations of a significant refresh cycle driven by artificial intelligence capabilities. For instance, industry analysts projected the AI PC market to reach nearly $100 billion by 2027, indicating substantial future potential.

Currently, Dell's AI PCs are in a developing phase, meaning their market share and broad consumer adoption are still taking shape. This places them in a position analogous to a Question Mark in the BCG matrix, signifying high potential but also uncertainty. Dell is making substantial investments in research and development, alongside marketing efforts, to establish a strong foothold in this emerging category.

While the long-term outlook for AI PCs is promising, these investments currently represent a significant cash outflow. The substantial R&D and marketing spend are necessary to cultivate demand and refine product offerings in a market that is still defining itself. Dell's strategy aims to transform these AI PCs into future Stars, but the immediate financial outlay requires careful management given the unproven nature of widespread returns at this stage.

Dell's APEX as-a-Service offerings, especially those targeting multicloud and AI operations like APEX AIOps SaaS, represent emerging cloud services. These are positioned as potential Stars within Dell's BCG Matrix, given the rapid growth of the as-a-Service market. However, Dell is actively developing these offerings and seeking broader customer adoption to compete with established hyperscale cloud providers.

Significant investment is necessary for Dell to capture substantial market share in this competitive space and demonstrate the long-term profitability of its APEX as-a-Service solutions. For example, the global public cloud services market was projected to reach $679 billion in 2024, indicating the immense opportunity but also the scale of competition Dell faces.

Dell Technologies' ventures into specialized AI/ML software platforms, while not as dominant as its infrastructure leadership, represent a strategic play in a burgeoning market. These platforms are crucial for unlocking the full potential of AI, offering tailored solutions for specific industries or tasks. For instance, in 2024, the global AI software market was projected to reach significant growth, with specialized platforms forming a substantial portion of this expansion.

While Dell's core strength lies in providing the robust hardware infrastructure that powers AI, its position in the broader AI software ecosystem is still evolving. Developing unique value propositions in this space demands considerable investment in research and development to create differentiated offerings that can effectively compete. This is particularly true as the AI software landscape is characterized by rapid innovation and intense competition from established tech giants and agile startups alike.

The high-growth nature of specialized AI/ML software means that substantial capital outlay is necessary to foster innovation and establish a competitive edge. Companies like Dell must continuously invest in talent, cutting-edge technology, and strategic partnerships to build sophisticated platforms. These platforms are designed to address complex challenges, from drug discovery to predictive maintenance, thereby creating new revenue streams and solidifying market presence in the advanced technology sector.

GenAI Solutions with Specific Partner Integrations (e.g., Hugging Face, Meta Llama)

Dell Technologies is actively developing Generative AI solutions, with notable integrations with partners like Hugging Face and Meta's Llama 3 models. This places these offerings in a rapidly expanding market where Dell's specific share at this application layer is still solidifying.

Significant investment is crucial for Dell to foster adoption and clearly illustrate the tangible benefits of these GenAI solutions. The potential upside is substantial, with the possibility of these ventures becoming market leaders, or Stars, in the BCG matrix if they achieve widespread success.

- Dell's strategic partnerships with Hugging Face and Meta (Llama 3) are key to its GenAI solution development.

- The GenAI market is experiencing rapid growth, indicating high potential but also early-stage market penetration for Dell's specific offerings.

- Substantial investment is necessary to drive adoption and demonstrate clear value propositions for these new GenAI solutions.

- Successful market penetration could elevate these GenAI initiatives to 'Star' status within Dell's portfolio.

Emerging Immersive Technologies (XR/Holographic solutions)

Dell's exploration into emerging immersive technologies like XR and holographic solutions positions them in a category that, while currently speculative, holds significant future growth potential. This segment can be viewed as a question mark in a BCG matrix context, characterized by low current market share but high anticipated growth.

Dell has demonstrated interest in this space through various initiatives, including concept devices and partnerships that hint at future product development. For instance, the market for AR/VR hardware, a key component of XR, was projected to reach over $30 billion globally by 2024, indicating substantial, albeit nascent, market opportunity.

- Market Entry: Dell's involvement is in the early stages, with a focus on research and development to understand user adoption and technological feasibility.

- Low Market Share: As a developing market, Dell's current share in dedicated XR/holographic hardware is minimal, but this is typical for question mark products.

- High Growth Potential: The broader immersive technology market is expected to expand rapidly, driven by advancements in computing power, display technology, and software applications across various industries, including gaming, education, and enterprise collaboration.

- R&D Investment: Significant investment in research and development is crucial for Dell to navigate this evolving landscape, refine its offerings, and establish a competitive presence.

Dell's AI PCs represent a significant new venture, currently classified as Question Marks in the BCG matrix. This means they operate in a high-growth market but have a low market share, requiring substantial investment to capture future potential. Dell is investing heavily in R&D and marketing to establish a presence in this rapidly evolving sector.

The success of these AI PCs hinges on Dell's ability to convert these initial investments into market leadership. Given the projected growth of the AI PC market, which analysts anticipated could reach nearly $100 billion by 2027, these Question Marks have the potential to become lucrative Stars if Dell can effectively navigate the competitive landscape and drive consumer adoption.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.