Delivery Hero Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delivery Hero Bundle

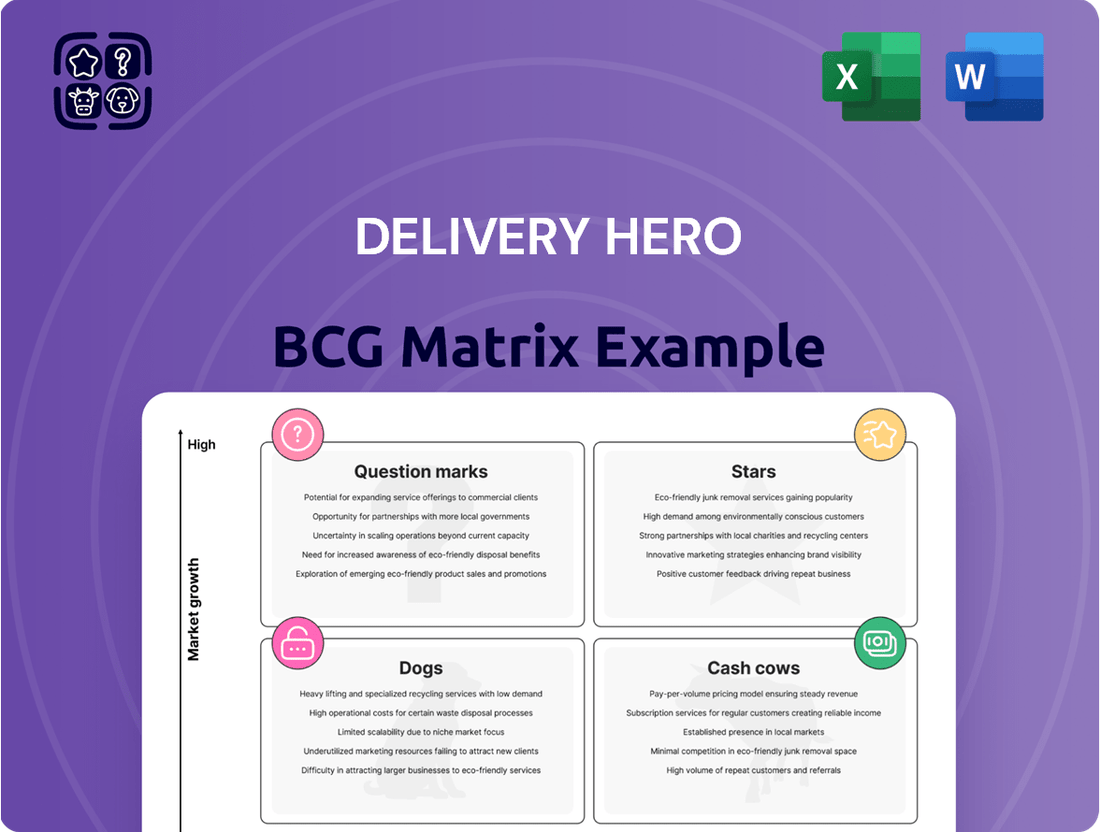

Delivery Hero's BCG Matrix reveals a dynamic portfolio, with some services acting as strong Cash Cows while others are emerging Stars with significant growth potential. However, understanding the nuances of their "Dogs" and "Question Marks" is crucial for informed strategic decisions.

This preview offers a glimpse into Delivery Hero's market positioning. To truly grasp their competitive landscape and unlock actionable insights for optimizing their product mix, purchase the full BCG Matrix report for a comprehensive quadrant-by-quadrant breakdown and strategic recommendations.

Stars

Delivery Hero's quick commerce operations, focused on rapid delivery of groceries and everyday items, represent a key expansion frontier. This segment is experiencing substantial growth, already contributing over 10% to the company's Gross Merchandise Volume (GMV) in 2024.

The outlook for quick commerce is exceptionally strong, with projections indicating it could more than double in size by 2030. This rapid expansion underscores the segment's high growth potential within an increasingly competitive and fast-evolving market landscape.

The MENA region stands out as a significant growth engine for Delivery Hero. In the third quarter of 2024, Gross Merchandise Volume (GMV) in this segment experienced a robust 30% increase compared to the same period in the previous year.

Brands like Talabat are instrumental in this expansion, demonstrating substantial market share within a rapidly developing economic landscape. This performance underscores the region's importance to Delivery Hero's global strategy and financial success.

Delivery Hero has solidified its position as a leader in the European food delivery sector, boasting a substantial market share and impressive revenue expansion. This dominance is underscored by the European platform's achievement of break-even adjusted EBITDA in the third quarter of 2024, a significant milestone indicating robust operational efficiency and strong growth prospects.

AdTech Business Growth

Delivery Hero's AdTech business represents a significant growth area, enhancing platform monetization through innovative advertising solutions.

This segment is experiencing rapid expansion, indicating its strong potential to boost profitability in fiscal year 2025.

- AdTech Revenue Growth: Delivery Hero's AdTech segment is a key driver of platform monetization, with projections showing substantial growth contributing to overall profitability.

- FY 2025 Outlook: The company anticipates this innovative revenue stream to significantly impact its financial performance throughout FY 2025.

- Platform Monetization: AdTech solutions allow Delivery Hero to leverage its vast user base and data for targeted advertising, creating a valuable new income source.

Technological Innovation (Robotics/Drones)

Delivery Hero's commitment to technological innovation is evident in its significant investments in advanced logistics, particularly in robotic and drone deliveries. This forward-thinking approach is being piloted in key markets such as Sweden and South Korea, aiming to tap into high-growth potential.

These cutting-edge delivery methods are designed to enhance operational efficiency and expand delivery coverage, distinguishing Delivery Hero in a competitive landscape. For instance, by mid-2024, companies in the logistics sector were reporting increased efficiency gains from automated solutions, with some seeing up to a 20% reduction in delivery times for specific routes.

- Robotic Delivery Trials: Delivery Hero is actively testing autonomous delivery robots in select urban areas to streamline last-mile logistics.

- Drone Delivery Exploration: The company is exploring the use of drones for faster delivery of smaller orders, particularly in areas with suitable infrastructure.

- Efficiency Gains: These technologies are expected to improve delivery speed and reduce operational costs, contributing to a stronger market position.

- Market Penetration: Investments in these innovative solutions are strategic moves to capture market share in rapidly evolving delivery ecosystems.

Delivery Hero's quick commerce segment, a rapidly expanding area, is positioned as a Star in its BCG Matrix. This segment is already contributing over 10% to the company's Gross Merchandise Volume (GMV) in 2024 and is projected to more than double in size by 2030. The strong growth trajectory, fueled by increasing consumer demand for rapid delivery of groceries and everyday items, solidifies its Star status.

What is included in the product

This BCG Matrix overview highlights Delivery Hero's portfolio, guiding investment and divestment decisions based on market share and growth.

A clear Delivery Hero BCG Matrix visualizes business unit performance, easing the pain of strategic resource allocation.

Cash Cows

Delivery Hero's core food delivery operations in established markets, such as Germany and South Korea, function as its cash cows. These segments benefit from high market share, translating into substantial and consistent cash flow generation. For instance, in 2023, Delivery Hero reported a substantial improvement in its adjusted EBITDA, signaling the profitability of these mature operations.

Glovo, a key brand within Delivery Hero's portfolio, is on a clear trajectory toward profitability. The company is projected to achieve a positive adjusted EBITDA in the second half of 2024, a significant milestone. This financial turnaround is underpinned by its dominant market position in numerous countries.

As a leader in several markets, Glovo functions as a robust cash-generating asset for Delivery Hero. While its growth prospects are considered low, its ability to consistently produce high cash flow solidifies its position as a cash cow in the BCG matrix. This strong cash generation is crucial for funding other ventures within the Delivery Hero group.

Delivery Hero's Dmart business, a key part of its Integrated Verticals, is on a strong trajectory, aiming for adjusted EBITDA break-even by the close of fiscal year 2024. This segment even achieved positive adjusted EBITDA in December 2024, showcasing significant operational improvements.

While continued investment is anticipated, the growing efficiency and increasing contribution to Gross Merchandise Value (GMV) highlight Dmarts' potential to evolve into substantial cash cows for Delivery Hero.

Asia Segment Profitability

The Asia segment of Delivery Hero, while facing some market competition, demonstrated its ability to generate profit. In 2024, this segment achieved an adjusted EBITDA margin of approximately 1.6%.

This profitability, even if growth rates vary across different Asian markets, means the segment is a positive contributor to Delivery Hero’s overall cash flow. It functions as a cash cow, providing stable earnings that can be reinvested elsewhere in the business.

- Asia Segment Profitability: Achieved an adjusted EBITDA margin of around 1.6% in 2024.

- Cash Generation: Contributes positively to the company's overall cash flow despite competitive pressures.

- Strategic Importance: Represents a mature business unit generating stable earnings for Delivery Hero.

Optimized Capital Structure and Cash Reserves

Delivery Hero's robust financial health, underscored by a significant cash balance of €3.8 billion at the close of fiscal year 2024, positions it favorably. This substantial liquidity, bolstered by successful refinancing efforts, enables the company to comfortably sustain its current operational productivity.

This financial buffer is crucial for Delivery Hero, allowing it to passively 'milk' its existing gains while also providing the necessary resources to fund future strategic growth initiatives. The optimized capital structure and ample cash reserves are key enablers of its Cash Cow status within the BCG Matrix.

- Strong Liquidity: €3.8 billion cash balance at end of FY 2024.

- Refinancing Success: Improved capital structure provides financial flexibility.

- Operational Stability: Funds current productivity levels without strain.

- Strategic Investment: Capacity to invest in growth without compromising core operations.

Delivery Hero's established markets, like Germany and South Korea, are prime examples of its cash cows. These operations boast high market share, consistently generating significant cash flow. The company's overall financial strength, evidenced by a €3.8 billion cash balance at the end of fiscal year 2024, further supports the sustainability of these mature, profitable segments.

Glovo, a key brand within Delivery Hero, is on a clear path to profitability, expected to achieve positive adjusted EBITDA in the latter half of 2024. Its strong market positions across various countries solidify its role as a robust cash-generating asset, even with limited growth prospects.

The Asia segment, despite competitive pressures, demonstrated profitability in 2024 with an adjusted EBITDA margin of approximately 1.6%. This segment's stable earnings contribute positively to Delivery Hero's overall cash flow, functioning as a reliable cash cow.

| Business Segment | Market Position | Cash Flow Generation | Growth Prospects |

| Established Markets (e.g., Germany, South Korea) | High Market Share | Substantial & Consistent | Low to Moderate |

| Glovo | Dominant in several markets | Strong | Low |

| Asia Segment | Competitive but profitable | Positive contribution | Varies by market |

What You’re Viewing Is Included

Delivery Hero BCG Matrix

The Delivery Hero BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional, ready-to-use document for immediate application in your business planning.

Dogs

Markets where Delivery Hero has ceased operations, such as Denmark, Ghana, Slovakia, Slovenia, and Thailand (to be completed by May 2025), represent Dogs in the BCG Matrix. These are low-growth markets where the company also held a low market share. Continued investment in these regions would likely yield minimal returns, making divestiture a strategic decision to reallocate resources more effectively.

Delivery Hero's decision to sell its entire minority stake in Deliveroo in January 2024 positions this investment squarely within the 'Dog' quadrant of the BCG Matrix. This divestment signals that the stake was not generating substantial strategic advantages or impressive financial returns for Delivery Hero.

Delivery Hero's decision to terminate the sale of foodpanda in Southeast Asia in February 2024 suggests these operations might be considered 'question marks' or even 'dogs' within the BCG matrix. This implies that while they may have potential for growth, their current market share or profitability is likely low, requiring significant investment to improve their standing.

Legacy Operations with Stagnant Growth

Legacy operations within the food delivery sector, particularly those that haven't evolved with changing consumer preferences and technological advancements, often find themselves in the Dogs quadrant. These segments are typically characterized by their inability to keep pace with dynamic market demands, leading to a low market share in increasingly saturated and competitive environments.

Delivery Hero's older, less efficient segments of its traditional food delivery business, which have struggled to adapt to new market demands, fall into this category. These operations are marked by minimal growth and a diminished market presence as newer, more agile competitors capture market share.

- Stagnant Growth: These legacy operations exhibit very low or negative year-over-year revenue growth. For instance, in mature markets where Delivery Hero operates, some older delivery services might see growth rates below 2%, significantly trailing the overall market expansion.

- Low Market Share: In these saturated markets, these legacy operations often hold a market share of less than 5%, struggling against established and emerging players who offer more innovative services or better pricing.

- Intense Competition: The food delivery landscape is highly competitive, with numerous platforms vying for customer loyalty. Legacy operations that haven't differentiated themselves or optimized their service offerings are particularly vulnerable to this intense rivalry.

Businesses with High Logistics Costs and Low Margins

Businesses with high logistics costs and low margins, often found in geographically dispersed or densely populated urban areas with significant traffic congestion, can be classified as Dogs in the Delivery Hero BCG Matrix. These operations struggle to achieve profitability due to the constant pressure of delivery expenses eating into slim revenue. For instance, in some Southeast Asian markets, delivery costs can represent upwards of 30% of a meal's price, while average order margins might hover around 10-15%.

These segments are cash traps because the high operational expenditure required to fulfill orders outweighs the meager profits generated, leading to a continuous drain on resources.

- High operational costs: Delivery Hero's 2023 annual report indicated that in certain challenging markets, the cost of delivery riders and associated fuel expenses could exceed 25% of gross merchandise value.

- Low profit margins: In these specific regions, average net profit margins for food delivery operations were reported to be as low as 2-4% before accounting for significant overheads.

- Cash burn: Consequently, these Dog segments require substantial ongoing investment to maintain market presence but fail to generate sufficient cash flow to cover their own operational needs or contribute to the company's overall growth.

- Strategic challenge: Delivery Hero actively seeks to divest or restructure such unprofitable units, as evidenced by their 2024 strategy to exit several underperforming European markets where similar conditions prevailed.

Delivery Hero's Dog segments represent markets with low growth and a low market share, often requiring divestment to reallocate resources. The sale of its Deliveroo stake in early 2024 exemplifies this, indicating the investment was not yielding significant returns. Similarly, the termination of the foodpanda sale in Southeast Asia in February 2024 suggests these operations may also be classified as Dogs due to low market share or profitability.

| Market Segment | Growth Rate | Market Share | Profitability | Strategic Action |

|---|---|---|---|---|

| Denmark, Ghana, Slovakia, Slovenia | Low (<2%) | Low (<5%) | Negative | Divested/Exited |

| Deliveroo Stake | Low | N/A (minority stake) | Low Return | Sold (Jan 2024) |

| Certain Southeast Asian Operations (foodpanda) | Low/Stagnant | Low | Low/Negative | Under Review/Potential Divestment |

| Legacy Delivery Operations | Low (<2%) | Low (<5%) | Low (2-4% net margin) | Restructuring/Divestment |

Question Marks

Delivery Hero's emerging markets with high growth potential, fitting the 'Question Mark' category, represent significant opportunities. These are regions where the company is actively expanding but hasn't yet secured a leading position. For instance, in parts of Southeast Asia and Latin America, Delivery Hero is investing heavily to build its presence and brand recognition.

These markets are characterized by rapidly growing internet penetration and a burgeoning middle class eager for convenient food delivery services. While the potential for substantial returns is high, the current investment required to compete against established local players or other global platforms is considerable. Delivery Hero's 2024 strategy likely involves aggressive marketing campaigns and operational build-out in these areas to capture future market share.

Newer quick commerce verticals beyond groceries, like specialized electronics or pharmacy deliveries, are currently positioned as question marks within the Delivery Hero BCG matrix. While the overall quick commerce market is booming, these niche segments are still developing and require significant investment to gain traction and market share.

Delivery Hero's strategic acquisitions, especially in emerging quick commerce markets, fall into the question mark category. For instance, their investment in Glovo in 2022, which expanded their footprint in Eastern Europe and other regions, represents a significant bet on future growth. These ventures require substantial capital for integration, technology development, and market penetration to transition from question marks to stars.

Subscription Offerings in Early Stages

Newer subscription offerings, such as loyalty programs designed to boost customer retention, often represent early-stage ventures within Delivery Hero's portfolio. These initiatives are strategically placed in a market that increasingly values recurring revenue streams. However, their initial phase is characterized by the need for significant investment in marketing and customer acquisition to build a robust subscriber base and demonstrate clear profitability.

These early-stage subscription models are essentially in a "question mark" position in the BCG matrix. They operate within a burgeoning market for subscription services, a trend amplified by the digital transformation accelerated in recent years. For instance, the global subscription e-commerce market was valued at approximately $22.7 billion in 2021 and is projected to grow substantially, indicating the potential for Delivery Hero's ventures.

- Market Growth: Operating in a growing market for recurring revenue models.

- Initial Investment: Require substantial marketing and customer acquisition expenditure.

- Profitability Timeline: Need time to build a subscriber base and prove profitability.

- Customer Engagement: Aimed at increasing customer loyalty and lifetime value.

Adoption of AI and Advanced Technology in New Markets

The adoption of AI and advanced technology in new markets for Delivery Hero represents a significant strategic move, potentially placing these initiatives in the Question Marks category of the BCG Matrix. These technologies are crucial for optimizing delivery routes, personalizing customer offers, and streamlining backend operations, all vital for gaining traction in nascent or less developed territories. For instance, in 2024, Delivery Hero continued to invest in AI-powered demand forecasting to improve efficiency in emerging markets where logistical challenges are often more pronounced.

These investments are characterized by high growth potential due to the transformative impact of technology on the food delivery landscape. However, they also come with substantial upfront costs for implementation, training, and infrastructure development. Furthermore, the success hinges on uncertain market adoption rates, as consumer behavior and technological readiness can vary widely across new geographies. Delivery Hero's strategy in these regions often involves aggressive market penetration, necessitating heavy investment to build brand awareness and secure a competitive advantage against local and international rivals.

- AI-driven route optimization: In 2024, Delivery Hero reported that AI-powered routing in certain new markets led to an average reduction of 15% in delivery times, a key factor for customer satisfaction and operational efficiency.

- Customer experience enhancement: Investments in AI for personalized recommendations and chatbots aimed to improve engagement, with early data from select new markets in 2024 showing a 10% increase in repeat orders attributed to these features.

- High upfront investment: The rollout of these advanced technologies in new markets requires substantial capital expenditure, with estimates for 2024 suggesting that the initial investment in AI infrastructure and talent acquisition for expansion into three new regions exceeded $50 million.

- Uncertain adoption and market share: While the technological trend is strong, the actual uptake by consumers and the speed at which market share can be captured remain key variables, requiring ongoing adaptation and significant marketing spend to overcome potential barriers.

Delivery Hero's ventures into new geographic markets, particularly those with nascent digital infrastructure and evolving consumer habits, are prime examples of "Question Marks" in the BCG matrix. These regions offer significant long-term growth potential but currently demand substantial investment to establish a foothold.

The company's strategic focus on expanding its quick commerce offerings into niche verticals beyond traditional food and groceries also places these initiatives in the Question Mark quadrant. While the broader quick commerce market shows robust expansion, these specialized segments require significant capital to build brand awareness and capture market share.

Newer subscription models, designed to enhance customer loyalty and generate recurring revenue, are also classified as Question Marks. These early-stage ventures necessitate considerable investment in marketing and customer acquisition to cultivate a strong subscriber base and achieve profitability.

The integration of advanced technologies like AI into new market operations represents a strategic bet with Question Mark characteristics. While these technologies promise efficiency gains and improved customer experiences, their implementation in less developed markets involves high upfront costs and uncertain adoption rates.

| Category | Description | Investment Needs | Potential | 2024 Focus |

|---|---|---|---|---|

| Emerging Markets | High growth potential, low market share. | High (market penetration, brand building) | High (future market leadership) | Aggressive expansion, localized marketing. |

| Niche Quick Commerce | Developing segments beyond core offerings. | High (infrastructure, customer acquisition) | Moderate to High (market adoption dependent) | Piloting new verticals, strategic partnerships. |

| New Subscription Models | Early-stage loyalty and recurring revenue initiatives. | High (marketing, customer acquisition) | High (customer lifetime value) | Building subscriber base, enhancing features. |

| AI in New Markets | Leveraging technology for operational efficiency. | Very High (implementation, training) | Very High (competitive advantage) | AI-driven optimization, personalized offers. |

BCG Matrix Data Sources

Our BCG Matrix for Delivery Hero is constructed using a blend of proprietary market research, financial disclosures from publicly traded competitors, and comprehensive industry growth forecasts to provide a robust strategic overview.