DBM Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DBM Bundle

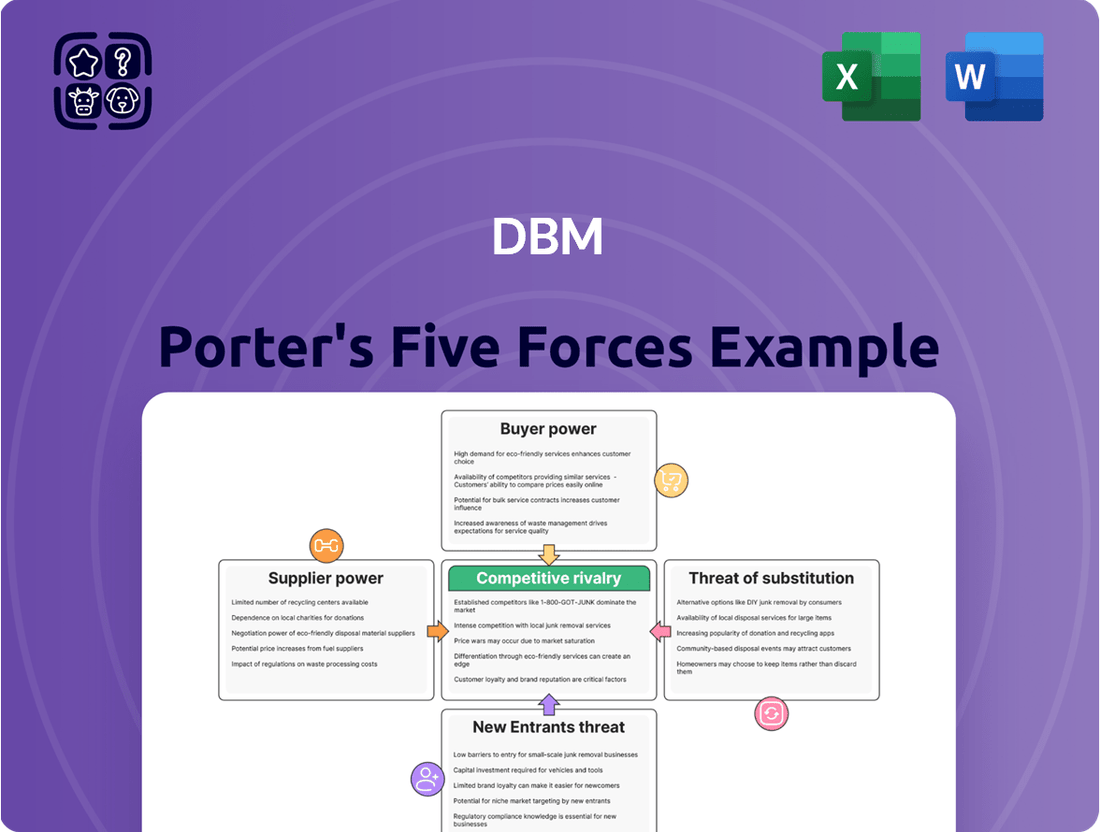

DBM's competitive landscape is shaped by significant buyer power and the constant threat of new entrants, impacting pricing and market share. Understanding these forces is crucial for strategic planning.

The complete Porter's Five Forces Analysis delves deeper, revealing the intensity of each force and its direct implications for DBM's profitability and long-term viability. Unlock actionable insights to navigate DBM's market effectively.

Suppliers Bargaining Power

The steel industry, a critical supplier for DBM Global, exhibits a concentrated market structure. Major players such as China Baowu Steel Group, ArcelorMittal, and Nucor Corporation hold substantial market share, enabling them to influence pricing and availability of primary steel.

This consolidation translates to fewer sourcing alternatives for DBM Global, potentially diminishing its bargaining power. For instance, in 2023, China Baowu Steel Group alone produced over 130 million metric tons of crude steel, highlighting the scale of these dominant entities and their capacity to dictate terms.

Suppliers' costs for essential inputs like iron ore, coking coal, and energy are highly susceptible to global market swings. These price fluctuations are directly transferred to downstream industries, such as steel fabricators. For instance, in 2024, steel prices demonstrated considerable volatility, a trend anticipated to persist into 2025. This instability is driven by a confluence of factors including ongoing geopolitical tensions, persistent supply chain disruptions, and inflationary pressures.

Ongoing global conflicts and lingering effects from the COVID-19 pandemic have significantly impacted the steel supply chain, leading to unpredictable risks and extended lead times. For DBM Global, this translates to increased costs and difficulties in obtaining necessary materials for its large-scale projects, potentially jeopardizing timelines.

Labor Shortages in Manufacturing and Fabrication

Skilled labor shortages are a significant concern across manufacturing and fabrication, including the crucial steel sector. This scarcity directly impacts suppliers, forcing them to increase wages and benefits to attract and retain talent, thereby driving up their operational costs.

These heightened labor expenses for suppliers translate into higher prices for fabricated steel products and raw materials. For DBM Global, this means potentially paying more for essential components, directly affecting its cost of goods sold and overall profitability.

- Skilled Labor Gap: In 2023, the U.S. manufacturing sector reported a shortage of 800,000 skilled workers, according to the Manufacturing Institute.

- Wage Inflation: Average hourly earnings in manufacturing saw a notable increase, reflecting the competitive labor market.

- Supplier Cost Pass-Through: Increased supplier labor costs are often passed on to buyers like DBM Global, impacting material acquisition expenses.

Sustainability and Green Steel Initiatives

The increasing focus on sustainability and the drive toward green steel production are compelling steel manufacturers to invest in novel, costlier technologies. This shift, aimed at curbing carbon emissions and adhering to more stringent environmental mandates, could elevate production expenses for suppliers. For DBM Global, this translates to a potential for increased input costs, impacting their overall profitability.

For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully phased in for reporting in 2023 and financial adjustments starting in 2026, is already influencing steel sourcing decisions. Companies like DBM Global may face higher prices from suppliers who are investing in cleaner production methods to comply with such regulations. In 2024, the global steel industry continues to grapple with the capital expenditures required for decarbonization, with estimates suggesting trillions of dollars needed worldwide by 2050.

- Increased Investment in Green Technologies: Steelmakers are channeling significant capital into technologies like hydrogen-based direct reduced iron (DRI) and carbon capture utilization and storage (CCUS).

- Rising Production Costs: The adoption of these advanced, environmentally friendly processes often leads to higher initial and operational costs for steel suppliers.

- Potential Price Hikes for DBM Global: Suppliers may pass on these increased costs to their customers, including DBM Global, affecting raw material pricing.

- Regulatory Compliance Pressure: Stricter environmental regulations globally are a key driver for these technological shifts, directly impacting supplier cost structures.

The bargaining power of suppliers in the steel industry, a key input for DBM Global, is significant due to market concentration and rising costs. Dominant players like China Baowu Steel Group, with over 130 million metric tons of crude steel production in 2023, can dictate terms. Volatile steel prices in 2024, influenced by geopolitical events and supply chain issues, further empower these suppliers.

Skilled labor shortages, impacting the manufacturing sector with 800,000 fewer workers in the U.S. in 2023, drive up supplier wages and consequently material costs for DBM Global. The global push for sustainability and green steel production necessitates costly technological investments, which suppliers are likely to pass on, potentially increasing DBM Global's input expenses.

| Factor | Impact on Suppliers | Implication for DBM Global |

|---|---|---|

| Market Concentration | Fewer sourcing options, pricing power | Reduced negotiation leverage, potentially higher prices |

| Input Cost Volatility (2024) | Increased raw material and energy expenses | Higher procurement costs for steel |

| Skilled Labor Shortages (2023 U.S. Mfg. deficit: 800,000) | Higher wage and benefit costs | Increased cost of fabricated steel products |

| Green Steel Investments | Capital expenditure for new technologies | Potential for increased input costs due to regulatory compliance |

What is included in the product

Analyzes the competitive intensity and profitability of DBM's industry by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and rivalry among existing competitors.

Effortlessly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

DBM Global’s focus on large-scale projects means its clients are often a select group of major developers and general contractors. These powerful customers, responsible for significant infrastructure and commercial builds, wield considerable influence. For instance, a single major project could represent a substantial portion of DBM’s annual revenue, giving these clients leverage to negotiate pricing and contract terms aggressively.

Once a steel fabrication and erection contract for a large, complex project is awarded and work commences, the costs and risks associated with switching suppliers become extremely high for the customer. This creates a degree of lock-in for DBM Global during the project lifecycle, reducing the customer's immediate bargaining power.

For instance, in 2024, major infrastructure projects often involve multi-year timelines and intricate logistical chains. If a customer were to switch steel fabricators mid-project, they would face significant delays, potential rework, and the need to re-qualify new suppliers, all of which translate into substantial financial penalties and operational disruptions.

Customers increasingly prioritize integrated solutions and specialized expertise, especially for complex projects. DBM Global's offering of design, detailing, fabrication, and erection under one roof caters to this demand, potentially lessening their focus on price alone.

For instance, in 2024, the construction industry saw a significant demand for streamlined project management, with clients willing to pay a premium for single-source providers who could demonstrate deep technical knowledge and project execution capabilities. This focus on a comprehensive, expert-driven approach can reduce the bargaining power of customers who might otherwise pit suppliers against each other solely on cost.

Price Sensitivity Driven by Overall Project Budgets

Even with the specialized nature of steel construction, customers, particularly those involved in large infrastructure and commercial projects, exhibit significant price sensitivity. This sensitivity is directly linked to their overall project budgets, which often have tight constraints.

For instance, in 2024, the construction industry faced ongoing material cost volatility. A report from the Bureau of Labor Statistics indicated that construction material costs, while showing some stabilization compared to earlier periods, remained elevated, influencing overall project economics. This pressure forces clients to scrutinize every cost component, including steel, to maintain financial viability.

- Price Sensitivity: Customers in large-scale projects are acutely aware of their total budget limitations.

- Cost Management: Fluctuations in steel prices, along with labor and other input costs, directly impact customer negotiation leverage.

- Budgetary Pressure: The need to control overall project expenditure compels customers to seek better pricing on steel to offset other rising costs.

Threat of Customer Backward Integration is Low

For DBM Global's highly specialized services, like design-assist, intricate fabrication, and sophisticated field erection, the likelihood of customers taking these functions in-house, known as backward integration, is quite minimal. The substantial capital outlay, the need for specialized machinery, and the requirement for a highly skilled labor force create significant hurdles for potential customer integration.

These barriers are particularly pronounced in industries where DBM Global operates, such as complex commercial and industrial construction. For instance, the advanced welding techniques and precision engineering demanded in many of DBM Global's projects are not easily replicated by general contractors or end-users.

- High Capital Investment: Setting up facilities for complex fabrication and erection requires millions in specialized equipment, making it prohibitive for most customers.

- Specialized Expertise: DBM Global employs engineers and fabricators with unique skill sets developed over years of experience in complex structural projects.

- Advanced Technology: The company utilizes sophisticated design software and fabrication machinery that are costly and require ongoing training to operate effectively.

DBM Global's customers, often major developers and general contractors on large projects, possess significant bargaining power due to the substantial revenue a single project can represent. This leverage allows them to negotiate pricing and terms aggressively, especially given the industry's inherent price sensitivity driven by budget constraints.

While switching costs are high once a project is underway, reducing immediate customer power, the ongoing pressure from material cost volatility, as seen in 2024 with elevated construction material prices according to the Bureau of Labor Statistics, reinforces customer focus on cost management and budget adherence.

Customers increasingly value integrated solutions and specialized expertise, which DBM Global offers. This focus on comprehensive service, rather than just price, can somewhat mitigate customer bargaining power, as clients in 2024 showed a willingness to pay a premium for streamlined project management and deep technical knowledge from single-source providers.

The high capital investment, specialized expertise, and advanced technology required for DBM Global's complex fabrication and erection services create substantial barriers to backward integration for customers, thereby limiting their potential to bring these functions in-house and reducing their overall bargaining leverage.

| Factor | Impact on Customer Bargaining Power | 2024 Context/Data |

|---|---|---|

| Project Size & Revenue Concentration | High leverage for customers on large projects | Single major project can be a significant portion of DBM's annual revenue. |

| Switching Costs (Post-Contract) | Lowers immediate bargaining power | High costs, delays, and re-qualification risks for mid-project supplier changes. |

| Demand for Integrated Solutions | Reduces price-only focus | Clients in 2024 sought single-source providers with technical expertise. |

| Barriers to Backward Integration | Limits customer leverage | Prohibitive capital, specialized skills, and advanced machinery required. |

| Price Sensitivity & Budgetary Pressure | Increases negotiation leverage | Elevated construction material costs in 2024 (BLS data) intensified scrutiny on steel pricing. |

Preview Before You Purchase

DBM Porter's Five Forces Analysis

This preview showcases the complete DBM Porter's Five Forces Analysis, demonstrating the exact document you will receive immediately after purchase. You're looking at the actual, professionally formatted analysis, ensuring no surprises or placeholder content. This is the full, ready-to-use document that will be available for instant download upon completing your transaction.

Rivalry Among Competitors

The North American structural steel fabrication market, while experiencing growth, is highly fragmented. This means there are numerous companies vying for business, from large national entities to smaller regional fabricators and erectors. DBM Global operates within this competitive arena, facing a wide array of rivals.

The construction and infrastructure sectors are experiencing robust growth, with projections indicating continued expansion through 2024 and 2025. This surge is fueled by increasing urbanization and substantial government investments in infrastructure development worldwide. For instance, global infrastructure spending was estimated to reach $4.1 trillion in 2024, a significant increase that benefits companies like DBM Global.

This market expansion offers a degree of relief from intense competitive rivalry by creating a larger pie for all participants. As demand for construction materials, including structural steel, escalates, there are more opportunities for DBM Global and its competitors to secure projects and increase sales volumes. This environment can temper aggressive price competition as the focus shifts towards fulfilling the growing demand.

DBM Global actively combats intense industry rivalry by offering a distinct suite of fully integrated steel construction services. This approach, encompassing design, fabrication, and erection, sets them apart from competitors focused on narrower service segments.

The company's strategic emphasis on complex, large-scale projects further insulates it from direct competition. These demanding undertakings often require specialized expertise and capabilities that fewer rivals can match, thereby reducing the intensity of direct competitive pressure.

For instance, DBM Global's involvement in projects like the Allegiant Stadium in Las Vegas, a highly complex structure, showcases their ability to handle intricate challenges. This specialization allows them to command a premium and differentiate themselves in a market often characterized by price-based competition.

Intense Competition on Price and Lead Times

Even with efforts to differentiate, the competitive landscape for DBM Global is marked by fierce rivalry, especially concerning pricing and project delivery timelines. Customers consistently prioritize cost-effectiveness and prompt project completion, putting pressure on all industry players.

DBM Global's capacity to navigate supply chain disruptions and ensure efficient project execution is paramount to retaining its competitive advantage in this demanding market. For instance, in 2024, the construction sector experienced an average project delay of 15%, highlighting the critical importance of timely delivery.

- Price Sensitivity: Customers frequently compare bids, making price a significant factor in contract awards.

- Lead Time Demands: The need for rapid project commencement and completion drives competition on scheduling.

- Supply Chain Resilience: Managing material costs and availability directly impacts pricing and lead times.

- Operational Efficiency: Streamlined project management is key to meeting customer expectations for speed and cost.

Technological Advancements and Automation Driving Efficiency

The metal fabrication sector is seeing a significant shift towards advanced automation, robotics, and digital tools such as AI and Building Information Modeling (BIM). These technologies are key drivers for improving precision and operational efficiency across the industry.

Companies like DBM Global, by embracing these technological innovations, are positioning themselves to achieve a distinct competitive edge. This advantage stems from their ability to enhance product quality, lower production costs, and ultimately speed up the delivery of projects.

- Increased Automation Adoption: The metal fabrication industry is increasingly integrating advanced automation and robotics, with a notable rise in adoption rates reported by industry surveys, indicating a strong trend towards efficiency gains.

- Digitalization Impact: Technologies like AI and BIM are transforming how metal fabrication projects are planned and executed, leading to better design accuracy and streamlined workflows.

- Competitive Advantage through Innovation: DBM Global's strategic investment in these cutting-edge technologies allows them to offer superior quality products at competitive prices, thereby outperforming rivals in project timelines and client satisfaction.

Competitive rivalry in the North American structural steel fabrication market is intense due to its fragmented nature, with numerous players competing for projects. DBM Global faces this challenge head-on by differentiating through integrated services and focusing on complex projects. Despite market growth, customer demands for cost-effectiveness and speed keep competitive pressures high, making operational efficiency and supply chain resilience crucial for success.

Technological adoption, particularly in automation and digital tools like BIM, is a key battleground. Companies leveraging these advancements gain a significant edge in quality, cost, and delivery times. For instance, the construction sector in 2024 saw an average project delay of 15%, underscoring the value of efficient execution.

| Key Competitive Factors | Impact on DBM Global | Industry Trend (2024) |

|---|---|---|

| Price Sensitivity | Drives need for cost-efficient operations | High; bid comparisons are common |

| Lead Time Demands | Requires streamlined project management | Critical; rapid project completion is valued |

| Technological Adoption (AI, BIM, Automation) | Offers differentiation and efficiency gains | Increasingly important for competitive advantage |

| Project Complexity Specialization | Reduces direct competition for large-scale projects | Growing demand for specialized capabilities |

SSubstitutes Threaten

The threat of substitutes for steel in construction is significant, as materials like concrete, engineered wood products such as Cross-Laminated Timber (CLT), and advanced composites offer compelling alternatives. These substitutes are gaining traction due to their varied advantages, including cost-effectiveness, lighter weight, and unique structural or aesthetic qualities.

In 2024, the global construction market saw continued growth in the adoption of sustainable and alternative materials. For instance, the engineered wood market, particularly CLT, experienced robust expansion, driven by its environmental benefits and rapid construction capabilities. This trend directly impacts steel demand by providing viable substitutes for various structural applications.

The construction industry is experiencing a pronounced shift towards sustainable materials, fueled by growing environmental awareness, increasingly stringent government regulations, and a rising client demand for eco-friendly buildings. This trend directly impacts the threat of substitutes, as alternative materials offer competitive advantages.

Materials such as bamboo, recycled steel, low-carbon concrete, and hempcrete are rapidly gaining market share. For instance, the global green building materials market was valued at approximately $254.7 billion in 2023 and is projected to reach $676.7 billion by 2030, exhibiting a compound annual growth rate of 15.1%. This growth signifies a substantial availability of viable alternatives to traditional construction inputs.

While steel is a powerhouse for high-rise buildings, industrial projects, and major infrastructure thanks to its immense strength and longevity, other materials often win out for different uses. For instance, wood remains a go-to for residential construction, offering a balance of cost and workability. Concrete also shines when it comes to foundations and intricate architectural designs.

Cost-Performance Trade-offs of Substitutes

The decision to adopt substitute materials often presents a complex interplay between cost savings, performance characteristics, and environmental considerations. While some alternatives may offer initial price advantages or lighter weight, they frequently fall short when matching the robust tensile strength, extensive span capabilities, or inherent fire resistance crucial for DBM Global's demanding, large-scale construction projects.

For example, while engineered wood products or advanced composites might be explored, their long-term durability and structural integrity under extreme loads or in challenging environmental conditions may not yet rival that of traditional steel. This necessitates a careful evaluation of the total lifecycle cost and performance, not just upfront material expenses.

- Cost vs. Performance: While alternatives like certain polymers or composites might reduce weight, they often come with higher initial costs or may not meet the stringent performance requirements for load-bearing applications in complex structures.

- Durability and Longevity: Steel's proven track record for enduring harsh conditions and its predictable performance over decades make it a preferred choice, whereas the long-term durability of many substitutes in large-scale infrastructure remains less established.

- Project-Specific Requirements: The unique demands of DBM Global's projects, such as extended spans or high-rise construction, often favor the inherent strength and structural reliability of steel over materials with potentially limited capabilities in these areas.

Hybrid Construction Approaches

The construction industry is seeing a rise in hybrid approaches, blending steel with materials like mass timber or advanced composites. This trend, while not a direct replacement for steel in all DBM Global's specialized projects, represents a subtle substitution by integrating alternative materials within steel frameworks. For instance, mass timber's growing popularity in mid-rise buildings, driven by sustainability goals, offers an alternative to traditional steel framing in certain applications.

Consider the growing use of cross-laminated timber (CLT) in commercial construction. In 2023, the global mass timber market was valued at approximately $1.2 billion and is projected to grow significantly. This expansion means that for projects where structural integrity can be met by these hybrid systems, the demand for pure steel might be indirectly impacted.

These hybrid constructions allow for optimized performance by combining material strengths, potentially reducing overall steel requirements for certain building components. For example, a project might utilize steel for primary load-bearing elements while employing mass timber for floor slabs and walls, thereby substituting some steel usage.

The threat of substitutes for DBM Global, therefore, lies not in a complete material replacement but in the increasing adoption of integrated solutions that reduce the overall reliance on steel in specific structural applications.

The threat of substitutes for steel in construction is growing, with materials like engineered wood, advanced composites, and low-carbon concrete offering viable alternatives. These substitutes are increasingly adopted due to their environmental benefits, lighter weight, and cost-effectiveness in specific applications.

In 2024, the global green building materials market continued its upward trajectory, projected to reach substantial figures, indicating a strong demand for alternatives to traditional materials like steel. This trend is driven by sustainability mandates and client preferences for eco-friendly construction solutions.

While steel remains dominant for high-strength, large-span projects, substitutes are carving out market share in residential and mid-rise construction. This shift is evident in the expanding mass timber market, which offers hybrid solutions that can reduce overall steel dependency.

| Material Substitute | Key Advantages | 2024 Market Trend/Data |

|---|---|---|

| Engineered Wood (e.g., CLT) | Sustainability, Lighter Weight, Faster Construction | Robust expansion in mid-rise and commercial projects. |

| Advanced Composites | High Strength-to-Weight Ratio, Corrosion Resistance | Increasing exploration for specialized structural components. |

| Low-Carbon Concrete | Reduced Environmental Impact, Versatility | Growing adoption driven by regulatory pressures and green building initiatives. |

| Bamboo | Rapid Renewability, Strength | Gaining traction in specific regions for structural and non-structural elements. |

Entrants Threaten

The steel fabrication and erection industry, particularly for large-scale projects, presents a formidable barrier to entry due to the immense capital required for facilities, specialized equipment, and advanced technology. DBM Global's operations, for instance, necessitate significant upfront investment in manufacturing plants and construction machinery, a cost that can easily run into tens or even hundreds of millions of dollars.

Established companies like DBM Global also leverage significant economies of scale. They can negotiate better prices for raw materials like steel due to bulk purchasing power and optimize their production processes for greater efficiency. For example, in 2023, the average cost of structural steel beams saw fluctuations, but large fabricators could mitigate these by securing long-term contracts, a feat difficult for newcomers to replicate, thus impacting their ability to compete on price.

DBM Global's core offerings, like design-assist, detailing, and advanced field erection, necessitate a high degree of specialized engineering and fabrication knowledge. This technical depth, coupled with the need for industry-recognized certifications and a proven safety track record, presents a substantial hurdle for potential new competitors.

For instance, in 2024, the structural steel detailing industry alone saw demand for highly skilled professionals, with many firms reporting backlogs due to a shortage of qualified personnel. Acquiring this level of expertise and the necessary accreditations is a time-consuming and capital-intensive process, effectively acting as a barrier to entry.

New companies face significant hurdles in accessing the extensive networks and established reputations that are crucial for landing large-scale project contracts. Securing work in commercial, industrial, and infrastructure sectors frequently hinges on pre-existing relationships with key players like major developers and general contractors, alongside a demonstrable history of successful project completion.

For instance, DBM Global's participation in high-profile projects such as JFK Terminal 6 and the JPMorgan Chase Headquarters underscores the value of its robust reputation and deeply integrated network. These are assets that new entrants would find exceptionally difficult and time-consuming to replicate, creating a substantial barrier to entry.

Skilled Labor Shortages

The construction and metal fabrication sectors are grappling with persistent shortages of skilled labor, impacting critical roles like welders, fabricators, and erectors. This scarcity presents a significant barrier for potential new entrants, as they would face considerable challenges in attracting and retaining the qualified workforce essential for operations. Consequently, these new businesses would likely incur higher recruitment costs and experience limitations in their production capacity.

The difficulty in securing a skilled workforce directly translates into increased operational expenses for newcomers. For instance, in 2024, the average hourly wage for a certified welder in the US hovered around $25-$30, with specialized skills commanding even higher rates. This escalating labor cost can significantly erode profit margins for new entrants, making it harder to compete with established firms that may have existing training programs or more favorable labor contracts.

- Skilled Labor Scarcity: Ongoing shortages in construction and metal fabrication limit new entrants' ability to build a competent workforce.

- Increased Recruitment Costs: New companies face higher expenses to attract and retain skilled tradespeople, impacting their initial capital outlay.

- Operational Capacity Constraints: A lack of available skilled workers directly restricts the scale and speed at which new entrants can operate and grow.

- Wage Inflation: Competition for a limited pool of skilled labor drives up wages, creating a cost disadvantage for new businesses.

Regulatory Hurdles and Safety Standards

The steel construction sector faces significant regulatory barriers that deter new entrants. Compliance with rigorous building codes, safety regulations, and environmental standards, especially for major infrastructure projects, demands substantial upfront investment. For instance, in 2024, the average cost for obtaining necessary permits and certifications for large-scale construction projects in the US could range from 5% to 15% of the total project value, a considerable hurdle for newcomers.

Navigating these complex requirements necessitates specialized expertise and a deep understanding of legal frameworks. New companies must allocate considerable resources to ensure adherence to safety protocols and environmental impact assessments. This added layer of complexity and cost directly impacts the profitability and feasibility of market entry, effectively raising the barrier for potential competitors.

- Stringent Building Codes: Adherence to codes like the International Building Code (IBC) requires significant design and material validation.

- Safety Regulations: Compliance with OSHA standards for steel erection, for example, mandates specific training and equipment, increasing operational costs.

- Environmental Standards: Meeting regulations related to emissions, waste management, and material sourcing adds further complexity and expense.

- Infrastructure Project Demands: Large projects often have unique, project-specific regulatory requirements that new entrants may not be equipped to handle initially.

The threat of new entrants in the steel fabrication and erection industry is significantly mitigated by high capital requirements and the need for specialized expertise. Established players like DBM Global benefit from economies of scale, bulk purchasing power, and established networks, making it difficult for newcomers to compete on price and secure large contracts. The industry also faces a persistent shortage of skilled labor, driving up recruitment costs and limiting operational capacity for new businesses.

| Factor | Impact on New Entrants | Example/Data Point (2024) |

| Capital Requirements | Very High | Initial investment in facilities and specialized equipment can reach tens to hundreds of millions of dollars. |

| Technical Expertise | High Barrier | Need for advanced engineering, detailing, and certifications; shortage of skilled detailers reported in 2024. |

| Economies of Scale | Significant Disadvantage | New entrants cannot match bulk purchasing power for materials like steel, impacting price competitiveness. |

| Skilled Labor Availability | Major Hurdle | Average welder wages around $25-$30/hour in 2024; competition for talent increases costs for newcomers. |

| Regulatory Compliance | Costly and Complex | Permit and certification costs can be 5-15% of project value; adherence to safety and environmental standards is demanding. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available financial statements, industry-specific market research reports, and government economic indicators. This ensures a comprehensive understanding of competitive intensity, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.