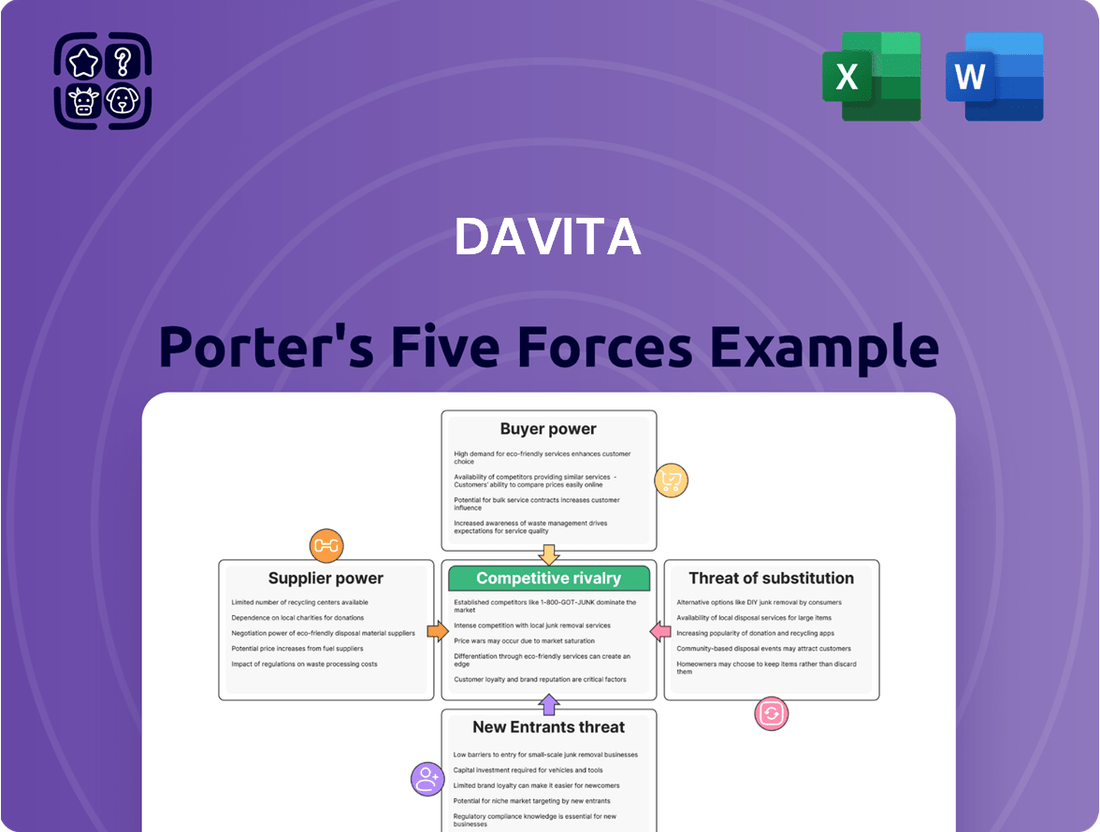

DaVita Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DaVita Bundle

DaVita's competitive landscape is shaped by powerful forces, from the intense rivalry among existing dialysis providers to the significant bargaining power of both suppliers and buyers. Understanding these dynamics is crucial for any stakeholder looking to navigate this complex market.

The complete report reveals the real forces shaping DaVita’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The dialysis sector depends on a select group of specialized suppliers for critical items like dialysis machines, water purification systems, dialyzers, and essential pharmaceuticals. This limited supplier pool grants these vendors considerable influence, as DaVita and its competitors have few other options, increasing their reliance on these crucial suppliers.

DaVita faces significant supplier bargaining power due to high switching costs for essential dialysis equipment and consumables. Transitioning to a new supplier often necessitates substantial investments in staff retraining, system recalibration, and integration processes. These disruptions can potentially impact patient care continuity, making it difficult and expensive for DaVita to change providers.

DaVita's reliance on specialized medical equipment and pharmaceuticals means suppliers often wield significant power. Many of these suppliers hold patents and proprietary technologies for advanced dialysis machines and critical drugs. This intellectual property limits DaVita's options for sourcing, as it restricts access to generic or alternative products, thereby enhancing the suppliers' leverage and their capacity to set higher prices.

Importance of Supplier Inputs to Quality of Care

The quality and reliability of the supplies DaVita uses are absolutely crucial for the safety and effectiveness of dialysis treatments. Think about it – if the equipment or medications aren't top-notch, patient outcomes can really suffer.

Because DaVita places such a high priority on providing excellent patient care, they're not going to cut corners on the quality of their suppliers, even if it means paying a bit more. This dedication to quality actually gives their suppliers more leverage.

For instance, in 2023, DaVita reported that its cost of goods sold, which includes many supplier inputs, was approximately $5.6 billion. This significant expenditure underscores the importance of these relationships and the potential power suppliers hold.

- Criticality of Supplies: Dialysis requires specialized equipment, dialyzers, and pharmaceuticals, making supplier reliability paramount.

- Quality Over Cost: DaVita's focus on patient safety means they are less price-sensitive when sourcing essential medical supplies.

- Supplier Dependence: A disruption in the supply chain for critical components could directly impact DaVita's ability to provide continuous care.

Limited Backward Integration Potential

DaVita, a major player in kidney care services, faces a significant challenge due to its limited potential for backward integration. This means DaVita cannot easily produce its own essential dialysis equipment or pharmaceuticals. For instance, the complex manufacturing processes and substantial capital required to produce dialysis machines or specialized drugs are often beyond the scope of a service-focused company like DaVita. This inherent limitation directly strengthens the bargaining power of its suppliers, as DaVita remains dependent on them for critical inputs.

The specialized nature of dialysis equipment, requiring advanced engineering and regulatory approvals, further complicates any backward integration efforts. Similarly, the pharmaceutical sector involves rigorous research, development, and manufacturing standards. These barriers mean DaVita must rely on external manufacturers who possess the necessary expertise and infrastructure. In 2024, the global dialysis equipment market was valued at approximately $15 billion, highlighting the scale of investment and specialized knowledge required to compete in this segment.

- Limited Control Over Supply Chain: DaVita's inability to backward integrate restricts its control over the quality, cost, and availability of essential dialysis supplies.

- Supplier Dependence: The high capital and technical barriers to entry in manufacturing dialysis equipment and pharmaceuticals solidify DaVita's reliance on a concentrated group of external suppliers.

- Cost Implications: This dependence can lead to higher input costs for DaVita, as suppliers can leverage their market position to negotiate favorable terms, impacting DaVita's overall profitability.

The bargaining power of suppliers for DaVita is substantial, primarily due to the specialized nature of the products and the limited number of capable manufacturers. This dependence means suppliers can often dictate terms, impacting DaVita's operational costs and strategic flexibility.

| Factor | Impact on DaVita | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Supplier Concentration | Few specialized suppliers for critical equipment and pharmaceuticals. | Global dialysis equipment market estimated at $15 billion in 2024, dominated by a few key players. |

| Switching Costs | High costs associated with retraining, system integration, and potential patient care disruption. | Significant capital investment required for new equipment integration. |

| Product Differentiation & Patents | Suppliers hold patents on advanced technology and critical drugs. | Proprietary technologies limit access to generic alternatives. |

| Criticality of Supplies | Uninterrupted supply of high-quality consumables is vital for patient safety. | DaVita's cost of goods sold was approximately $5.6 billion in 2023, highlighting supplier input costs. |

What is included in the product

This analysis meticulously examines the five forces impacting DaVita's dialysis services industry, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the presence of substitutes.

Easily identify and quantify competitive pressures, allowing for proactive strategy adjustments to mitigate threats.

Customers Bargaining Power

While individual patients have limited direct bargaining power due to the critical nature of dialysis, DaVita's customer base is highly fragmented, comprising numerous individual patients. This fragmentation means no single patient can significantly influence pricing or terms.

The essential and often urgent need for dialysis treatment generally restricts a patient's ability to negotiate prices or service conditions with providers like DaVita. Patients are typically focused on accessing care rather than leveraging purchasing power.

Government payers like Medicare and Medicaid wield considerable influence over DaVita's revenue, as a substantial portion of its income is derived from these programs. The Centers for Medicare & Medicaid Services (CMS), in particular, sets the reimbursement rates for End-Stage Renal Disease (ESRD) services, giving it significant bargaining power due to its vast patient base and regulatory oversight. This directly affects how much DaVita earns per treatment. For instance, CMS announced a finalized base rate increase to $273.82 for Calendar Year 2025, a slight adjustment from prior periods.

Private insurers and managed care organizations are a key customer group for DaVita. Their growing enrollment of patients with end-stage renal disease (ESRD), especially through Medicare Advantage, gives them considerable power to negotiate better pricing and contract terms. This leverage stems from their focus on cost management and the push towards value-based care models.

Patient Choice and Provider Network Restrictions

Patient choice in dialysis providers, while present, is often constrained. Factors like geographic location, established physician relationships, and the specific medical needs of the patient can significantly narrow down available options. For instance, a patient requiring specialized care might have fewer viable choices compared to someone with a less complex condition.

However, the evolving landscape of healthcare, particularly the push towards value-based care and integrated kidney care initiatives, is beginning to shift some power towards patients. These models emphasize coordinated care, potentially giving patients more leverage in selecting providers who offer a more holistic and efficient treatment plan. By 2024, many integrated care models are showing promise in improving patient outcomes and satisfaction, suggesting a growing influence for informed patient decisions.

- Geographic Limitations: Patients are often restricted to dialysis centers within a manageable travel distance, especially given the frequency of treatments.

- Physician Network Restrictions: Insurance plans and physician referrals can steer patients towards specific dialysis providers, limiting their direct choice.

- Condition Severity: Patients with more complex medical needs may require specialized facilities or equipment, further reducing their provider options.

- Emerging Patient Influence: Value-based care and integrated kidney care programs are empowering patients by offering more coordinated and potentially patient-centric treatment pathways.

Growing Trend of Home Dialysis

The growing trend of home dialysis, encompassing both hemodialysis and peritoneal dialysis, is a significant factor influencing the bargaining power of customers in the renal care sector. As more patients opt for the convenience and flexibility of at-home treatments, they gain leverage over traditional in-center providers.

This shift empowers patients, as they have viable alternatives to facility-based care. For instance, the number of patients utilizing home dialysis modalities has seen consistent growth. In 2023, home dialysis accounted for approximately 20% of all dialysis treatments in the United States, a figure projected to continue its upward trajectory through 2024 and beyond.

- Increased Patient Choice: The proliferation of home dialysis technologies and support services expands patient options beyond traditional dialysis centers.

- Demand for Flexibility: Patients seeking greater control over their treatment schedules and environments are more likely to choose home-based care, pressuring centers to offer more accommodating services.

- Cost Considerations: While not always cheaper, the perceived value and convenience of home dialysis can shift patient preferences, potentially impacting the pricing power of large providers.

- Technological Advancements: Innovations in portable dialysis machines and remote monitoring systems further enhance the feasibility and appeal of home dialysis, reinforcing patient bargaining power.

While individual patients have limited bargaining power due to the critical nature of dialysis, government payers and private insurers represent significant customer groups for DaVita. These entities, particularly Medicare and Medicaid, set reimbursement rates, influencing DaVita's revenue. For example, CMS finalized a base rate increase to $273.82 for Calendar Year 2025.

The growing adoption of home dialysis, projected to continue its growth through 2024, also empowers patients by offering alternatives to traditional centers, increasing their leverage for flexibility and potentially influencing service terms.

| Customer Segment | Bargaining Power | Key Factors |

| Individual Patients | Low | Critical need, geographic limitations, physician referrals, condition severity |

| Government Payers (e.g., Medicare, Medicaid) | High | Setting reimbursement rates, vast patient base, regulatory oversight |

| Private Insurers/Managed Care | Moderate to High | Growing enrollment (Medicare Advantage), focus on cost management, value-based care push |

| Home Dialysis Patients | Increasing | Availability of alternatives, demand for flexibility, technological advancements |

Full Version Awaits

DaVita Porter's Five Forces Analysis

This preview shows the exact DaVita Porter's Five Forces analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape within the kidney dialysis industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. This document is fully formatted and ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

The U.S. dialysis market is a tight race, with DaVita and Fresenius Medical Care holding the lion's share. This duopoly means the competition is fierce, as both giants battle for patients, prime locations, and the best deals with insurance providers. In 2023, DaVita operated over 3,100 dialysis centers in the U.S., while Fresenius Medical Care had a significant presence as well, underscoring their combined market dominance.

DaVita, like other dialysis providers, faces intense rivalry due to high fixed costs. The substantial investments in dialysis centers, specialized equipment, and skilled nursing personnel create a significant overhead burden. This necessitates high capacity utilization to achieve profitability, fueling aggressive competition among providers.

To offset these substantial fixed costs, dialysis centers strive for high patient volumes. This drive to fill available capacity often leads to competitive pricing strategies or a focus on patient acquisition, intensifying the rivalry. For instance, in 2024, the average dialysis center operates with a considerable percentage of its capacity needing to be filled to break even.

Competitive rivalry in the dialysis sector significantly transcends mere pricing strategies, with clinical outcomes and the overall quality of care emerging as paramount differentiators. DaVita, for instance, actively highlights its established leadership in clinical quality and ongoing innovation within the industry.

Providers like DaVita distinguish themselves by focusing on patient satisfaction scores, demonstrating measurable reductions in hospitalization rates, and achieving improved mortality statistics. These metrics are not just benchmarks; they are critical determinants influencing patient and payer decisions when selecting a dialysis provider.

For example, DaVita reported a 14.7% lower mortality rate for its patients compared to the national average in 2023, a key indicator of their commitment to superior care. This focus on tangible results directly impacts market share and patient loyalty, intensifying the competitive landscape beyond cost considerations.

Expansion into Integrated Kidney Care and Value-Based Models

DaVita and Fresenius Medical Care are intensifying their rivalry by aggressively pursuing integrated kidney care (IKC) and value-based care (VBC) models. This strategic shift moves competition beyond traditional dialysis services to encompass the entire spectrum of kidney disease management, from early intervention to post-transplant care.

This expansion into IKC and VBC aims to improve patient outcomes and lower healthcare costs by coordinating care across different providers and settings. For instance, DaVita's Kidney Care Connections program and Fresenius's value-based agreements highlight their commitment to this evolving landscape.

- DaVita's Kidney Care Connections: Focuses on managing patients with chronic kidney disease (CKD) before they require dialysis, aiming to slow disease progression and improve overall health.

- Fresenius Medical Care's VBC Initiatives: Engages in partnerships and direct contracting with payers to manage kidney patients under capitated payment models, rewarding better outcomes and cost efficiency.

- Market Growth in VBC for Kidney Care: The Centers for Medicare & Medicaid Services (CMS) has been a key driver, with programs like the Kidney Care Choices (KCC) model encouraging providers to adopt VBC. In 2023, approximately 30% of Medicare beneficiaries with CKD were enrolled in some form of value-based payment arrangement, a figure expected to rise.

Geographic Market Saturation and Consolidation

In some mature markets, DaVita faces intense competition due to the saturation of dialysis centers, directly impacting its ability to attract and retain patients. This saturation fuels a fierce rivalry for the existing patient base, often leading to price pressures and increased marketing efforts.

This competitive landscape often spurs consolidation within the industry. Companies like DaVita engage in mergers and acquisitions to achieve economies of scale, enhance operational efficiencies, and broaden their geographic footprint. For instance, by the end of 2023, the U.S. dialysis market saw continued M&A activity, with providers aiming to secure larger market shares in increasingly crowded regions.

- Market Saturation: Mature markets often exhibit a high density of dialysis facilities, intensifying competition for patients.

- Consolidation Drivers: Saturation encourages mergers and acquisitions as companies seek to gain market share and operational efficiencies.

- Regional Expansion: Consolidation allows companies to strengthen their presence and competitive position within specific geographic areas.

- Efficiency Gains: Merging operations can lead to cost savings through shared resources and optimized patient care delivery.

The competitive rivalry in the dialysis sector is exceptionally high, largely due to the market's duopolistic nature dominated by DaVita and Fresenius Medical Care. This intense competition is further fueled by high fixed costs inherent in operating dialysis centers, pushing providers to maximize patient volumes and capacity utilization. The battle for patients, locations, and favorable payer contracts is constant, with both companies investing heavily in clinical quality and patient satisfaction to differentiate themselves.

The strategic shift towards integrated kidney care and value-based care models intensifies this rivalry, as companies like DaVita compete on the comprehensive management of kidney disease, not just dialysis services. This evolution is supported by government initiatives like CMS's Kidney Care Choices model, which incentivizes better patient outcomes and cost efficiency. In 2023, a significant portion of Medicare beneficiaries with CKD were already in value-based arrangements, highlighting the growing importance of this competitive front.

Market saturation in certain regions exacerbates competitive pressures, leading to consolidation through mergers and acquisitions as companies like DaVita seek economies of scale and broader geographic reach. This pursuit of efficiency and market share is a direct response to the crowded competitive landscape, where even minor gains in patient retention or acquisition can significantly impact profitability.

| Metric | DaVita (2023) | Fresenius Medical Care (2023) | Industry Trend |

|---|---|---|---|

| U.S. Centers | ~3,100+ | Significant Presence | Stable to Moderate Growth |

| Mortality Rate vs. National Avg. | 14.7% Lower | Competitive | Focus on Improvement |

| Value-Based Care Enrollment (Medicare CKD) | Increasing | Increasing | ~30% in 2023, growing |

SSubstitutes Threaten

Kidney transplantation stands as the most effective long-term solution for end-stage renal disease, offering a pathway to a cure and a significantly enhanced quality of life over continuous dialysis. This procedure directly challenges the necessity of ongoing dialysis treatments.

Despite challenges like donor scarcity and the inherent complexities of surgery, transplant success rates continue to climb. In 2023, the United Network for Organ Sharing (UNOS) reported over 25,000 kidney transplants performed in the United States, a testament to the growing viability of this treatment. These advancements, coupled with concerted efforts to boost organ donation, present a substantial and increasing substitute threat to traditional dialysis providers.

Advances in preventive care and early detection of chronic kidney disease (CKD) are emerging as significant substitutes for traditional dialysis treatments. These innovations can slow or even halt the progression of kidney disease, potentially reducing the long-term reliance on dialysis. For instance, new diagnostic tools and pharmaceutical interventions targeting earlier stages of CKD, which saw significant development in 2024, offer a pathway to manage the condition without immediate need for dialysis.

The development of novel therapies, such as wearable artificial kidneys, bioengineered kidneys, and xenotransplantation, represents a future, albeit currently limited, substitute threat for DaVita. While still in various stages of research and development, these innovations could fundamentally alter the landscape of kidney failure treatment, potentially reducing reliance on traditional dialysis. For instance, advancements in bioengineered kidneys, aiming for functional organ replacements, could one day offer a more permanent solution than current dialysis methods.

Pharmaceutical Advancements

Pharmaceutical advancements, especially in areas like chronic kidney disease (CKD) treatment, present a significant threat of substitutes for dialysis providers like DaVita. New medications, such as GLP-1 receptor agonists, are showing promise in slowing or even reversing the progression of CKD. This means fewer patients might reach the stage where dialysis becomes the primary treatment option.

These innovative drugs act as direct substitutes by addressing the root causes or slowing the deterioration of kidney function. For instance, research in 2024 continues to explore the efficacy of these therapies in managing diabetic nephropathy, a leading cause of kidney failure. If these treatments become widely adopted and prove effective in preventing or delaying the need for dialysis, they could substantially reduce DaVita's patient base.

- New Medications: GLP-1 agonists and other novel therapies are being investigated for their potential to manage CKD progression.

- Reduced Dialysis Demand: Successful pharmaceutical interventions could decrease the number of patients requiring dialysis.

- Market Shift: A shift towards preventative and disease-modifying treatments could alter the competitive landscape for dialysis services.

Lifestyle Modifications and Dietary Management

For individuals in the earlier stages of kidney disease, lifestyle modifications and diligent dietary management can significantly postpone the necessity of dialysis. This self-management, coupled with strict adherence to medical recommendations, acts as a form of substitution by delaying the demand for DaVita's core services. For instance, in 2024, studies highlighted that proactive management of hypertension and diabetes, key drivers of kidney disease progression, could reduce the incidence of end-stage renal disease (ESRD) by up to 30% in at-risk populations.

These lifestyle changes, while not a direct replacement for the treatment of ESRD, effectively reduce the pool of patients who will eventually require DaVita's dialysis treatments. The emphasis on patient empowerment through education and support for dietary adherence, such as low-sodium and low-potassium diets, presents a viable alternative pathway for managing kidney health. In 2023, patient adherence programs focusing on these modifications saw a measurable impact, with participants showing slower rates of kidney function decline compared to control groups.

- Delayed Dialysis Need: Rigorous lifestyle and dietary changes can significantly push back the requirement for dialysis in early-stage kidney disease patients.

- Self-Management as Substitution: Effective self-care and medical adherence can act as a substitute by reducing the immediate need for DaVita's services.

- Impact of Hypertension/Diabetes Control: Proactive management of these conditions in 2024 showed potential to reduce ESRD incidence by up to 30% in at-risk groups.

- Dietary Adherence Programs: Patient support for specific diets in 2023 demonstrated slower kidney function decline in participants.

The threat of substitutes for DaVita's dialysis services is substantial and multifaceted. Kidney transplantation, while facing donor scarcity, saw over 25,000 procedures in the US in 2023, directly reducing the need for ongoing dialysis. Furthermore, advancements in preventive care and pharmaceuticals, like GLP-1 agonists showing promise in slowing CKD progression in 2024, aim to keep patients from reaching end-stage renal disease, thereby lessening demand for dialysis.

| Substitute Type | Description | 2023/2024 Impact/Potential |

| Kidney Transplantation | Offers a potential cure, reducing long-term dialysis reliance. | Over 25,000 US transplants in 2023. |

| Preventive Care & Lifestyle | Slowing CKD progression through diet, exercise, and managing comorbidities. | Potential to reduce ESRD incidence by up to 30% in at-risk groups (2024 studies). |

| Novel Therapies | Wearable artificial kidneys, bioengineered kidneys, xenotransplantation. | Emerging technologies with long-term potential to disrupt dialysis market. |

| Pharmaceuticals | Medications slowing CKD progression (e.g., GLP-1 agonists). | Research in 2024 shows promise in delaying dialysis need. |

Entrants Threaten

Establishing and operating a dialysis center network demands significant upfront capital. This includes substantial investment in specialized medical equipment, often costing millions per facility, alongside real estate acquisition or leasing and essential infrastructure development. For instance, building a new dialysis clinic can range from $2 million to $5 million or more, depending on size and location.

This considerable financial outlay acts as a formidable barrier, effectively deterring many potential new entrants who may lack the necessary resources or access to substantial funding. The sheer scale of investment required means only well-capitalized organizations can realistically consider entering the market, thereby limiting the threat of new competitors.

The kidney care industry faces substantial barriers to entry due to extensive regulatory requirements and compliance demands. Government bodies, such as the Centers for Medicare & Medicaid Services (CMS) in the United States, impose rigorous standards on everything from patient care quality to facility operations and reimbursement processes.

Navigating this complex web of regulations requires significant expertise and investment, acting as a formidable deterrent for potential new entrants. For instance, in 2024, dialysis providers must adhere to updated conditions for coverage and quality reporting measures, which can be costly and time-consuming to implement.

The dialysis industry demands a highly specialized workforce, encompassing nephrologists, nurses, and patient care technicians. This need for expertise creates a significant barrier for new companies looking to enter the market.

Recruiting and retaining this skilled labor is a substantial hurdle, particularly given the ongoing healthcare staffing shortages reported across the sector. For instance, in 2024, many healthcare systems continued to grapple with nurse shortages, impacting the availability of qualified personnel for new dialysis centers.

Established Brand Reputation and Patient Trust

DaVita's deeply entrenched brand reputation and the significant trust it has cultivated with patients present a formidable barrier to new entrants. Building comparable credibility in the sensitive field of kidney care, where patient loyalty is paramount, requires substantial time and consistent quality of service.

New competitors would struggle to replicate DaVita's established patient relationships and the confidence patients place in its long-standing presence. This ingrained trust, developed over decades of operation, makes it challenging for newcomers to attract and retain patients, who often prioritize familiarity and proven care models.

Consider these points regarding established brand reputation:

- Patient Loyalty: DaVita's established network fosters strong patient loyalty, making it difficult for new entrants to gain market share.

- Brand Recognition: Decades of operation have cemented DaVita's brand recognition, a significant advantage over nascent competitors.

- Trust Factor: Patients in kidney care often prioritize providers with a proven track record, a trust factor new entrants would need years to build.

Payer Relationships and Network Access

The dialysis industry presents a significant barrier to entry due to the intricate web of payer relationships. Securing contracts with major government programs like Medicare and Medicaid, along with numerous private insurers, is paramount for any dialysis provider's financial survival. For instance, in 2023, Medicare covered approximately 42% of dialysis patients in the U.S., highlighting its critical role.

DaVita, as an established leader, has cultivated deep, long-standing relationships with these payers. This translates into preferred network access and more favorable reimbursement rates, which are difficult for newcomers to replicate. These established connections are not easily bypassed, creating a substantial hurdle for new entrants attempting to gain traction and secure adequate patient volume.

The difficulty in achieving favorable reimbursement terms is a direct consequence of these entrenched payer relationships. New entrants often face lower initial reimbursement rates, impacting their ability to compete on price or invest in necessary infrastructure and services. This disparity in reimbursement can significantly hinder a new provider's growth and sustainability in the competitive dialysis market.

- Payer Dependence: Dialysis providers heavily rely on reimbursement from government and private insurance.

- Established Relationships: DaVita's long-standing contracts provide a competitive advantage.

- Network Access: Preferred provider status with insurers limits patient access for new entrants.

- Reimbursement Disparity: Newcomers struggle to secure favorable payment terms compared to incumbents.

The threat of new entrants in the dialysis market is generally low, primarily due to substantial barriers. These include the immense capital required for facility setup and equipment, stringent regulatory compliance, the need for specialized medical staff, and the difficulty in establishing strong payer relationships and patient trust. For instance, in 2024, the ongoing demand for skilled nurses in healthcare, including dialysis, continues to exacerbate staffing challenges for any new provider attempting to enter the market.

These factors collectively create a high barrier, limiting the number of potential competitors capable of entering and sustaining operations. DaVita's established infrastructure, brand recognition, and existing payer contracts further solidify this advantage, making it challenging for newcomers to gain a foothold and compete effectively.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/Recent) |

|---|---|---|---|

| Capital Requirements | High upfront investment for facilities and specialized equipment. | Deters those without significant funding. | New clinic construction costs can range from $2 million to $5 million+. |

| Regulatory Hurdles | Complex compliance with CMS and other health bodies. | Requires expertise and resources to navigate. | Adherence to updated 2024 conditions for coverage and quality reporting. |

| Workforce Specialization | Need for nephrologists, specialized nurses, and technicians. | Difficult to recruit and retain due to shortages. | Continued healthcare staffing shortages impacting availability of qualified personnel. |

| Payer Relationships | Securing favorable contracts with Medicare, Medicaid, and private insurers. | Incumbents have established, advantageous reimbursement rates. | Medicare's significant coverage (approx. 42% of US dialysis patients in 2023) highlights payer importance. |

| Brand Reputation & Trust | Cultivating patient loyalty and confidence in a sensitive field. | Newcomers struggle to build credibility and attract patients. | Long-standing patient relationships are difficult to replicate. |

Porter's Five Forces Analysis Data Sources

Our DaVita Porter's Five Forces analysis is built upon a foundation of comprehensive data, including DaVita's annual reports and SEC filings, industry-specific market research from firms like IBISWorld, and insights from healthcare consulting groups.