DaVita Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DaVita Bundle

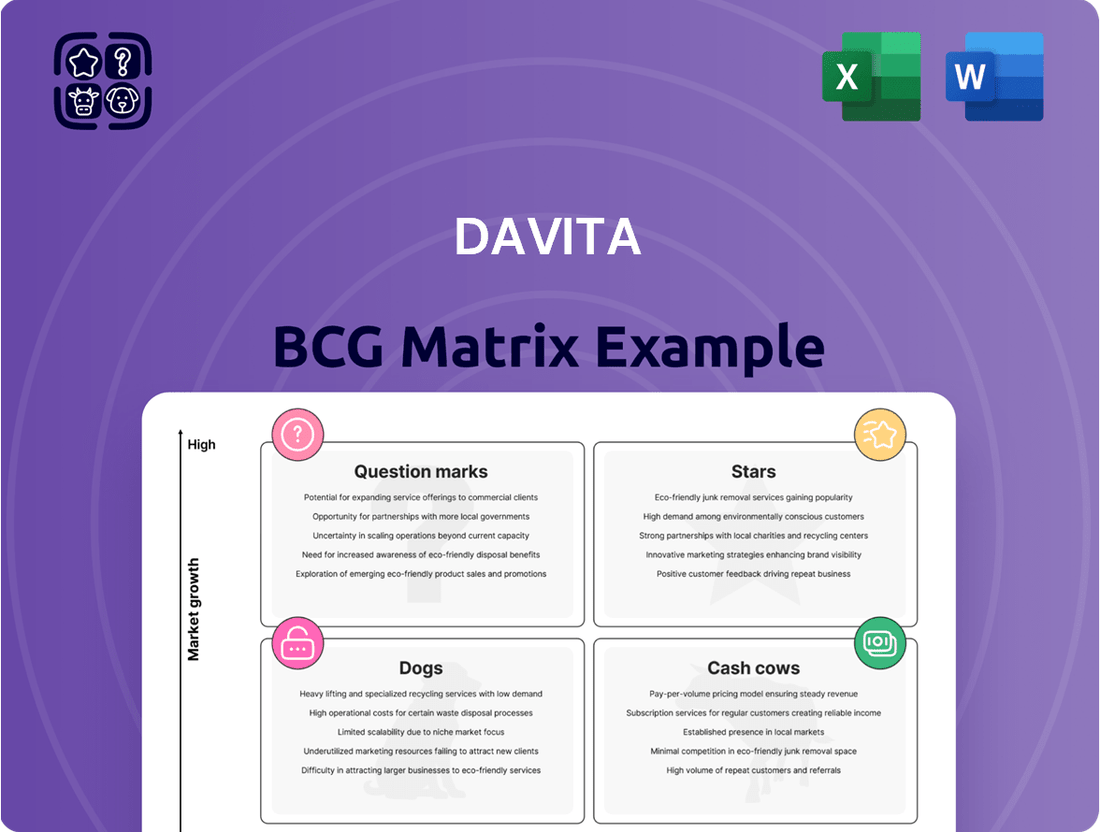

Unlock the strategic potential of DaVita's product portfolio with a glimpse into its BCG Matrix. See which services are driving growth and which might need a second look.

For a comprehensive understanding of DaVita's market position, including detailed quadrant analysis and actionable insights, purchase the full BCG Matrix report. It's your key to informed investment and strategic resource allocation.

Stars

DaVita's aggressive push into Latin America, including acquisitions in Chile, Ecuador, Brazil, and Colombia, has solidified its position as the dominant dialysis provider in the region. This strategic expansion, particularly through acquiring assets from Fresenius Medical Care, targets growth in markets with significant unmet needs as the U.S. market shows signs of maturity.

DaVita's Integrated Kidney Care (IKC) programs represent a strategic focus on value-based care, aiming to manage kidney disease comprehensively. These initiatives are positioned as a significant growth driver, emphasizing improved patient outcomes and reduced healthcare costs through proactive interventions.

In 2024, DaVita continued to expand its IKC offerings, participating in various Medicare and commercial value-based payment models. These programs are designed to lower hospital readmission rates and emergency room visits for kidney patients, which are critical metrics in demonstrating the effectiveness of integrated care. For instance, IKC models often target a reduction in hospitalizations by a certain percentage compared to traditional fee-for-service models.

Home Dialysis Solutions, encompassing both peritoneal dialysis and home hemodialysis, is a burgeoning area for DaVita, reflecting a significant growth opportunity. This trend is fueled by patients valuing the autonomy and comfort of treatment at home, alongside advancements in technology that enhance patient care and enable remote oversight.

The market for home dialysis is expanding rapidly, with projections indicating continued strong growth. For instance, the global home dialysis market was valued at approximately $10.5 billion in 2023 and is expected to reach over $20 billion by 2030, demonstrating a compound annual growth rate of around 10%.

Technological Innovation in Kidney Care

DaVita is actively investing in technological innovation to lead kidney care delivery. This includes AI-driven predictive analytics for early disease detection and connected cyclers enabling remote patient monitoring. These advancements aim to improve operational efficiency and patient outcomes.

These technological investments are crucial for DaVita's strategic positioning. For instance, their focus on tele-nephrology tools can expand access to specialized care, particularly in underserved areas. This proactive approach to innovation is a key differentiator in the evolving healthcare landscape.

DaVita's commitment to technology is reflected in its financial strategies. While specific investment figures for 2024 in these areas are not yet fully disclosed, the company's historical emphasis on R&D and digital transformation signals continued significant allocation. For example, in 2023, DaVita reported a substantial portion of its capital expenditures directed towards technology and facility upgrades, a trend expected to continue.

- AI-driven predictive analytics for early identification of patients at risk of kidney disease progression.

- Connected cyclers allowing for remote monitoring of dialysis treatments, improving patient safety and convenience.

- Tele-nephrology platforms to enhance access to specialist consultations and chronic care management.

- Digital tools aimed at streamlining administrative processes and improving overall care coordination.

Strategic Partnerships and Collaborations

DaVita actively cultivates strategic partnerships to bolster its position in the kidney care market. Collaborations with nephrologists are crucial for implementing value-based care models, aiming to improve patient outcomes and manage costs effectively. For instance, DaVita's focus on physician alignment has been a cornerstone of its strategy, seeking to integrate care pathways and enhance patient satisfaction.

Further expanding its influence, DaVita partners with organizations like the American Diabetes Association. These alliances focus on critical areas such as diabetes education and prevention, recognizing the strong link between diabetes and kidney disease. Such partnerships not only broaden DaVita's reach but also contribute to a more holistic approach to kidney health, driving innovation and market penetration.

These strategic alliances are vital for DaVita's growth and market standing, allowing it to tap into new patient populations and enhance its service offerings. Key aspects of these collaborations include:

- Nephrologist Alignment: Strengthening relationships with physicians to drive quality and efficiency in care delivery.

- Disease Prevention Initiatives: Partnering with health organizations to address the root causes of kidney disease, like diabetes.

- Innovation in Care Models: Collaborating to develop and implement new, patient-centric care approaches.

- Market Expansion: Leveraging partnerships to increase DaVita's presence and impact across the kidney care continuum.

DaVita's Integrated Kidney Care (IKC) programs are positioned as Stars in the BCG matrix due to their strong growth potential and current market leadership. These initiatives focus on value-based care, aiming to manage kidney disease comprehensively and improve patient outcomes. The company's expansion of IKC offerings in 2024, participating in various Medicare and commercial value-based payment models, underscores this Star status. These programs are designed to reduce hospital readmissions and emergency room visits, critical metrics for success in the evolving healthcare landscape.

What is included in the product

The DaVita BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions.

A clear DaVita BCG Matrix visually categorizes renal care services, easing strategic decision-making.

Cash Cows

DaVita's U.S. in-center hemodialysis services are a classic Cash Cow. This segment commands a substantial market share, around 35%, within a mature and stable industry. The consistent demand for life-sustaining ESRD treatments ensures a steady and significant cash flow for the company.

DaVita's established patient base, exceeding 280,000 individuals, coupled with its extensive network of over 2,600 U.S. outpatient dialysis centers, firmly positions it as a Cash Cow. This robust infrastructure ensures a consistent and predictable revenue stream, a hallmark of mature, high-market-share businesses.

The sheer scale of DaVita's operations translates into significant operational efficiencies and strong brand loyalty. In 2024, DaVita continued to leverage this established presence, demonstrating its ability to generate substantial and stable cash flows from its core dialysis services.

DaVita's long-standing reimbursement models, primarily driven by Medicare, create a predictable and steady revenue stream. This stability is a key characteristic of its Cash Cow business.

For instance, in 2023, Medicare accounted for approximately 70% of DaVita's total revenue, underscoring the reliance on this foundational payment system. While policy discussions are ongoing, the core structure of dialysis reimbursement has remained largely consistent, offering a reliable foundation for cash generation.

Operational Efficiencies and Cost Management

DaVita's commitment to operational efficiencies and stringent cost management is a cornerstone of its success, particularly within its Cash Cow quadrant of the BCG Matrix. By focusing on optimizing patient care delivery and controlling general and administrative (G&A) expenses, the company consistently achieves robust profit margins.

Despite facing headwinds such as supply chain volatility, DaVita has showcased resilience, maintaining strong financial performance. This ability to navigate challenges while keeping costs in check is crucial for its Cash Cow status, ensuring a steady stream of profits.

- Focus on Patient Care Cost Optimization: DaVita actively seeks ways to manage the costs associated with providing dialysis treatment, a core service.

- G&A Expense Control: The company diligently works to keep its overhead and administrative costs lean, contributing to profitability.

- Resilience Amidst Disruptions: Even with supply chain issues impacting the healthcare sector, DaVita has managed to sustain its financial strength.

- Healthy Profit Margins: These operational and cost-management efforts directly translate into healthy profit margins, a hallmark of a Cash Cow.

Share Repurchase Programs

DaVita's consistent share repurchase programs underscore its robust free cash flow generation, a hallmark of a mature Cash Cow. In 2023, the company repurchased approximately $1.1 billion of its common stock, signaling a strong commitment to shareholder value. This strategic move not only reduces the number of outstanding shares but also enhances earnings per share (EPS), a key indicator of financial strength in established businesses.

- Share Repurchases: DaVita actively engages in share repurchase programs, a common strategy for Cash Cows.

- Shareholder Value: These buybacks demonstrate DaVita's commitment to returning capital to its investors.

- EPS Enhancement: Reducing outstanding shares can lead to higher earnings per share, improving key financial metrics.

- Financial Health Signal: Consistent buybacks often signal confidence in the company's future cash flows and overall financial stability.

DaVita's U.S. in-center hemodialysis operations are a prime example of a Cash Cow. This segment benefits from a dominant market share within a stable, mature industry. The consistent demand for essential dialysis treatments ensures a reliable and substantial cash flow for the company, further solidified by its extensive network of over 2,600 U.S. centers and a patient base exceeding 280,000 individuals.

The company's strong financial performance in 2023, with Medicare accounting for approximately 70% of its revenue, highlights the predictable income streams from its core services. DaVita's focus on operational efficiencies and cost management, particularly in G&A expenses, contributes to healthy profit margins, a key characteristic of its Cash Cow status. This stability is further evidenced by its active share repurchase programs, which in 2023 amounted to roughly $1.1 billion, demonstrating a strong ability to generate and return free cash flow to shareholders.

| Segment | Market Share | Industry Maturity | Cash Flow Generation | Key Driver |

| U.S. In-Center Hemodialysis | ~35% | Mature | High & Stable | Consistent Patient Demand & Reimbursement |

| Patient Base | >280,000 | N/A | Predictable Revenue | Established Relationships |

| Center Network | >2,600 | N/A | Operational Efficiency | Economies of Scale |

| Medicare Reimbursement | ~70% of Revenue (2023) | Stable | Reliable Income | Government Payer Stability |

| Share Repurchases (2023) | ~$1.1 Billion | N/A | Shareholder Value | Strong Free Cash Flow |

Full Transparency, Always

DaVita BCG Matrix

The DaVita BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means you'll get the complete analysis, ready for strategic application, without any alterations or hidden elements.

Rest assured, the DaVita BCG Matrix you're examining is the final, unwatermarked report you will download upon completing your purchase. It's been meticulously prepared to provide actionable insights for your business strategy.

What you see here is the actual DaVita BCG Matrix document that will be delivered to you after purchase, ensuring you receive the exact strategic tool you need. This preview guarantees no surprises and immediate usability for your planning needs.

This preview accurately represents the DaVita BCG Matrix you will acquire after your purchase, offering a complete and professionally designed analysis. You can confidently expect the same high-quality, ready-to-use document.

Dogs

Some of DaVita's U.S. dialysis centers might be classified as Dogs in a BCG Matrix analysis. This is because they could be situated in areas with slow population growth or where competition is particularly fierce, resulting in reduced patient numbers and less profit. For instance, DaVita has been actively engaged in reviewing and closing underperforming facilities as part of its ongoing strategic adjustments.

Legacy IT systems at DaVita, if not modernized, could be categorized as Dogs in a BCG Matrix analysis. These systems, often characterized by outdated technology and limited functionality, may require substantial maintenance and support costs without contributing to significant revenue growth or market share expansion. For instance, in 2024, many healthcare providers continued to grapple with the expense of maintaining aging electronic health record systems, which, while functional, lacked the advanced analytics and interoperability of newer platforms.

In DaVita's BCG Matrix, certain specialized ancillary services with low market share and limited growth potential would fall into the 'Dogs' category. These might be services that don't strongly support the company's core integrated kidney care strategy and struggle to generate significant returns, making continued investment questionable.

For instance, imagine a niche diagnostic service DaVita offers that serves a very small patient subset and faces intense competition from specialized labs. If this service's revenue contribution remains minimal, perhaps less than 0.5% of DaVita's total revenue, and its growth rate is projected to be below 2% annually, it would likely be classified as a 'Dog.' Such services might be candidates for divestiture or strategic pruning to focus resources on more promising areas.

Geographical Locations with Limited Growth Potential

DaVita's geographical locations with limited growth potential, often termed Dogs in the BCG Matrix, represent international operations in specific regions that are not demonstrating anticipated growth or profitability. These areas might require disproportionate resources without yielding sufficient returns, impacting overall company performance.

For instance, DaVita's presence in certain European markets, where healthcare reimbursement models are complex and patient volumes have stagnated, could be categorized as Dogs. Despite initial investments in clinics and infrastructure, these regions may not be showing the expected revenue growth or market share expansion.

Consider the following:

- Stagnant Market Share: DaVita's market share in some non-core international markets has remained flat or declined, indicating a lack of competitive advantage or market penetration.

- Low Profitability: Operations in these identified regions may be yielding low profit margins or even operating at a loss, due to factors like intense competition or unfavorable regulatory environments.

- Resource Drain: Continued investment in these underperforming areas diverts capital and management attention that could be better allocated to high-growth potential markets or strategic initiatives.

Non-Core Business Ventures

Non-core business ventures within DaVita, identified as Dogs in the BCG Matrix, represent initiatives that haven't gained substantial market traction or proven their future potential. These ventures are consuming valuable resources without a clear path to profitability or significant growth.

For instance, DaVita's exploration into certain ancillary health services or technology pilots that failed to scale or demonstrate a strong return on investment would fall into this category. In 2023, DaVita reported significant investments in innovation, with some of these early-stage projects not yet yielding the expected market acceptance.

- Resource Drain: Ventures with low market share and low growth prospects, such as unproven telehealth platforms or niche patient engagement tools that haven't attracted a critical mass of users.

- Divestiture Candidates: Businesses that consistently underperform, like a small, specialized medical equipment line DaVita might have acquired but which failed to compete effectively.

- Strategic Re-evaluation: Pilot programs in new geographic markets or service lines that did not meet initial adoption targets, indicating a need for discontinuation or a significant pivot.

DaVita's certain U.S. dialysis centers in mature or highly competitive markets, showing low patient growth and profitability, can be classified as Dogs. These facilities may require significant operational adjustments or even closure to reallocate resources effectively. For example, DaVita has historically closed underperforming clinics to streamline operations.

Legacy IT infrastructure within DaVita, if not updated, represents potential Dogs. These systems, costly to maintain and lacking modern capabilities, hinder efficiency and innovation. In 2024, the healthcare sector continued to invest in IT modernization to address the challenges of outdated systems.

Specialized, low-demand ancillary services that DaVita offers, with minimal market share and growth, are categorized as Dogs. These services may drain resources without contributing significantly to the company's core strategy or overall profitability.

DaVita's ventures into non-core or unproven markets, which have failed to gain traction or demonstrate a clear path to profitability, are also considered Dogs. These initiatives consume capital and management focus that could be better directed toward more promising areas.

Question Marks

Emerging value-based care models beyond Integrated Kidney Care (IKC) represent the question marks in DaVita's strategic portfolio. These innovative approaches, often still in their infancy with evolving reimbursement pathways, hold significant growth potential but currently possess low market share and unproven profitability.

For instance, DaVita's continued exploration into bundled payment models for specific chronic conditions beyond kidney disease, or advanced telehealth integration for remote patient monitoring, fit this category. While these initiatives aim to improve patient outcomes and reduce overall healthcare costs, their financial viability and widespread adoption are still being determined. As of early 2024, the Centers for Medicare & Medicaid Services (CMS) continues to refine and expand various value-based purchasing programs, offering both opportunities and uncertainties for these nascent models.

Investments in novel medications and therapies designed to slow the progression of chronic kidney disease (CKD) before it reaches end-stage renal disease (ESRD) represent a promising area within the DaVita BCG Matrix, likely categorized as a 'Question Mark'. These advanced therapies, such as SGLT2 inhibitors and GLP-1 receptor agonists, show significant potential for slowing disease progression, with studies in 2024 continuing to demonstrate their efficacy. For instance, data from ongoing clinical trials in 2024 have indicated a substantial reduction in kidney function decline for patients treated with these agents compared to placebo groups.

While the clinical promise is high, the market adoption and long-term financial returns for these advanced therapies are still in their nascent stages of development. The high cost of these innovative treatments and the need for extensive patient and physician education contribute to this evolving market landscape. As more data emerges and reimbursement models stabilize throughout 2024 and into 2025, their position in the market will become clearer, potentially shifting them towards a 'Star' if adoption accelerates and clinical outcomes are consistently positive.

Wearable or portable dialysis devices are a burgeoning area in healthcare technology, poised for significant growth as innovation continues. This segment represents a high-growth market with a relatively low current market share, making it an attractive, albeit uncertain, investment. DaVita's potential entry or expansion into this space would position these ventures as Question Marks within its BCG Matrix.

The market for wearable dialysis technology is still in its developmental stages, facing challenges in regulatory approval, cost-effectiveness, and widespread patient and clinician adoption. Despite these hurdles, projections indicate substantial future demand, with some analysts estimating the global wearable dialysis market to reach several billion dollars by the late 2020s. For instance, advancements in miniaturization and battery life are key drivers, with companies actively investing in R&D to overcome current limitations.

Expansion into New International Markets Beyond Current Acquisitions

Further expansion into entirely new international markets, beyond DaVita's recent Latin American acquisitions, would place its dialysis services in the Stars quadrant of the BCG Matrix. These ventures carry high growth potential but also significant risks and uncertainties regarding market penetration, regulatory hurdles, and profitability.

For instance, entering a market like Southeast Asia, with a growing middle class and increasing prevalence of chronic kidney disease, presents a substantial opportunity. However, navigating diverse healthcare systems and local competition requires careful strategic planning. DaVita's ability to leverage its existing expertise in patient care and operational efficiency will be crucial for success in these nascent markets.

- High Growth Potential: Emerging economies often exhibit higher GDP growth rates and increasing demand for healthcare services, including dialysis.

- Significant Risks: Unfamiliar regulatory environments, political instability, and cultural differences can pose considerable challenges to market entry and sustained operations.

- Investment Requirements: Establishing new facilities and building brand recognition in untapped markets necessitates substantial capital investment.

- Competitive Landscape: Understanding and differentiating from local providers or other multinational players is key to gaining market share.

AI-Driven Diagnostics and Predictive Analytics for Early CKD

AI-driven diagnostics and predictive analytics for early Chronic Kidney Disease (CKD) detection represent a significant 'Question Mark' for DaVita. While the potential for early intervention and improved patient outcomes is vast, this area demands considerable upfront investment in research, development, and data infrastructure. The market for such advanced diagnostic tools is still maturing, requiring DaVita to navigate complex regulatory pathways and demonstrate clear clinical and economic value to gain widespread adoption.

- Growth Potential: Early CKD detection can shift treatment paradigms, potentially reducing the need for costly dialysis later on.

- Investment Needs: Developing sophisticated AI algorithms and validating them requires substantial financial commitment. For instance, the global AI in healthcare market was valued at approximately $15.1 billion in 2023 and is projected to grow significantly, indicating the scale of investment needed.

- Regulatory Hurdles: Gaining approval for AI-driven medical diagnostics involves rigorous testing and adherence to stringent healthcare regulations, which can be time-consuming and expensive.

- Market Penetration: Establishing a strong market presence requires convincing healthcare providers of the accuracy and reliability of these new diagnostic methods amidst existing diagnostic workflows.

DaVita's investment in novel, early-stage kidney disease therapies and technologies, such as advanced pharmaceuticals slowing CKD progression or wearable dialysis devices, are prime examples of its Question Marks. These ventures offer substantial future growth but currently have low market share and unproven profitability, requiring significant investment and facing market uncertainties.

The potential for AI-driven early CKD detection also falls into this category, demanding upfront investment in R&D and data infrastructure. While the market for these advanced diagnostic tools is maturing, DaVita must navigate regulatory pathways and demonstrate clear value for widespread adoption.

Emerging value-based care models beyond current offerings and expansion into less-penetrated international markets also represent DaVita's Question Marks. These areas present high growth potential but are accompanied by significant risks, investment requirements, and competitive challenges.

| Category | Growth Potential | Market Share | Investment Needs | Key Uncertainties |

|---|---|---|---|---|

| Novel CKD Therapies | High | Low | High | Reimbursement, Adoption |

| Wearable Dialysis Devices | Very High | Very Low | Very High | Regulatory Approval, Cost-Effectiveness |

| AI-Driven CKD Detection | High | Low | High | Validation, Integration |

| New International Markets | High | Low | High | Regulatory, Competition |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.